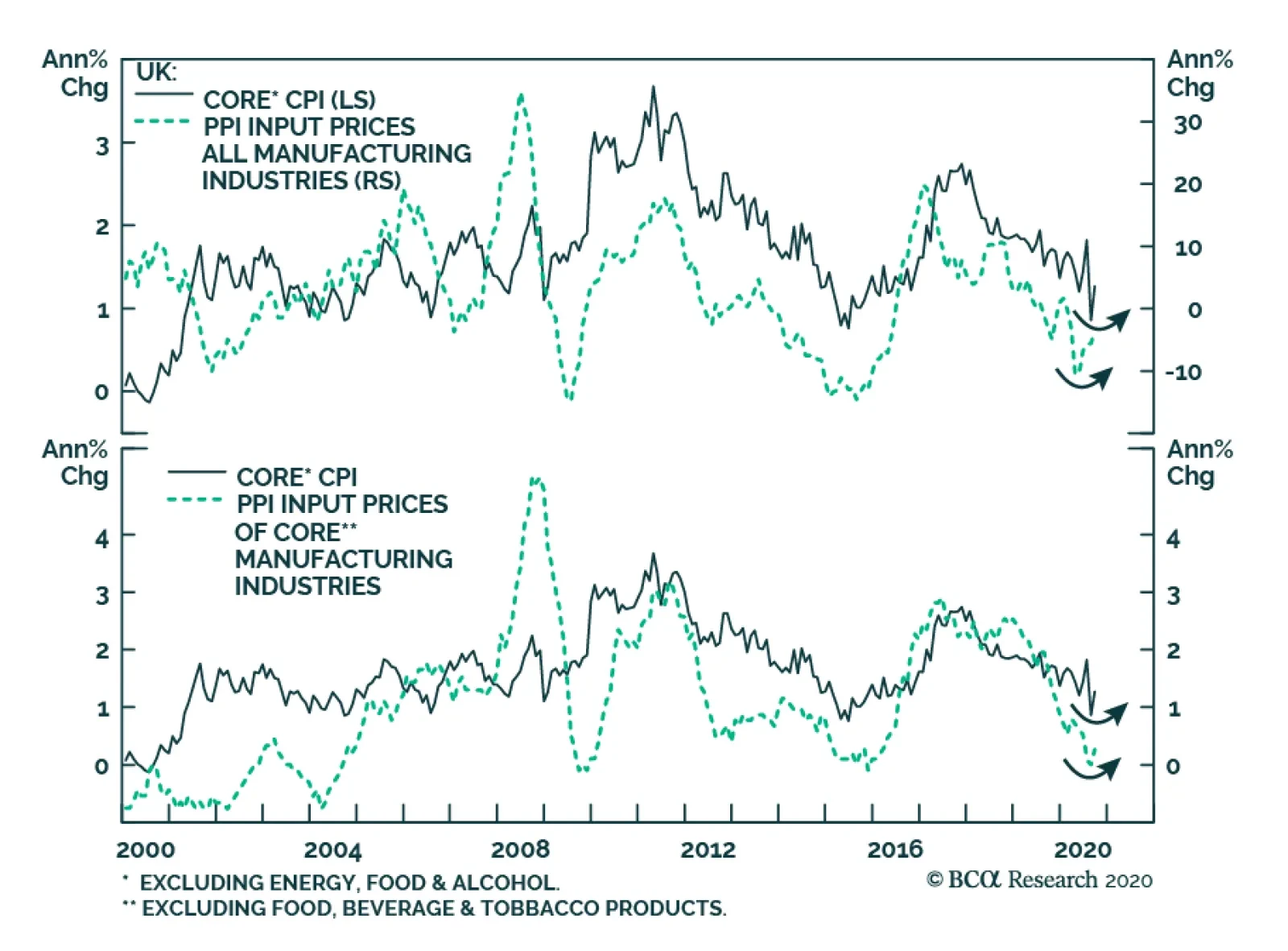

The various inflation indicators for the UK in September were a mixed bag. While Core CPI inflation hit expectations of 1.3% annually, the monthly headline CPI print hit 0.4%, below expectations of 0.5%. The most positive element…

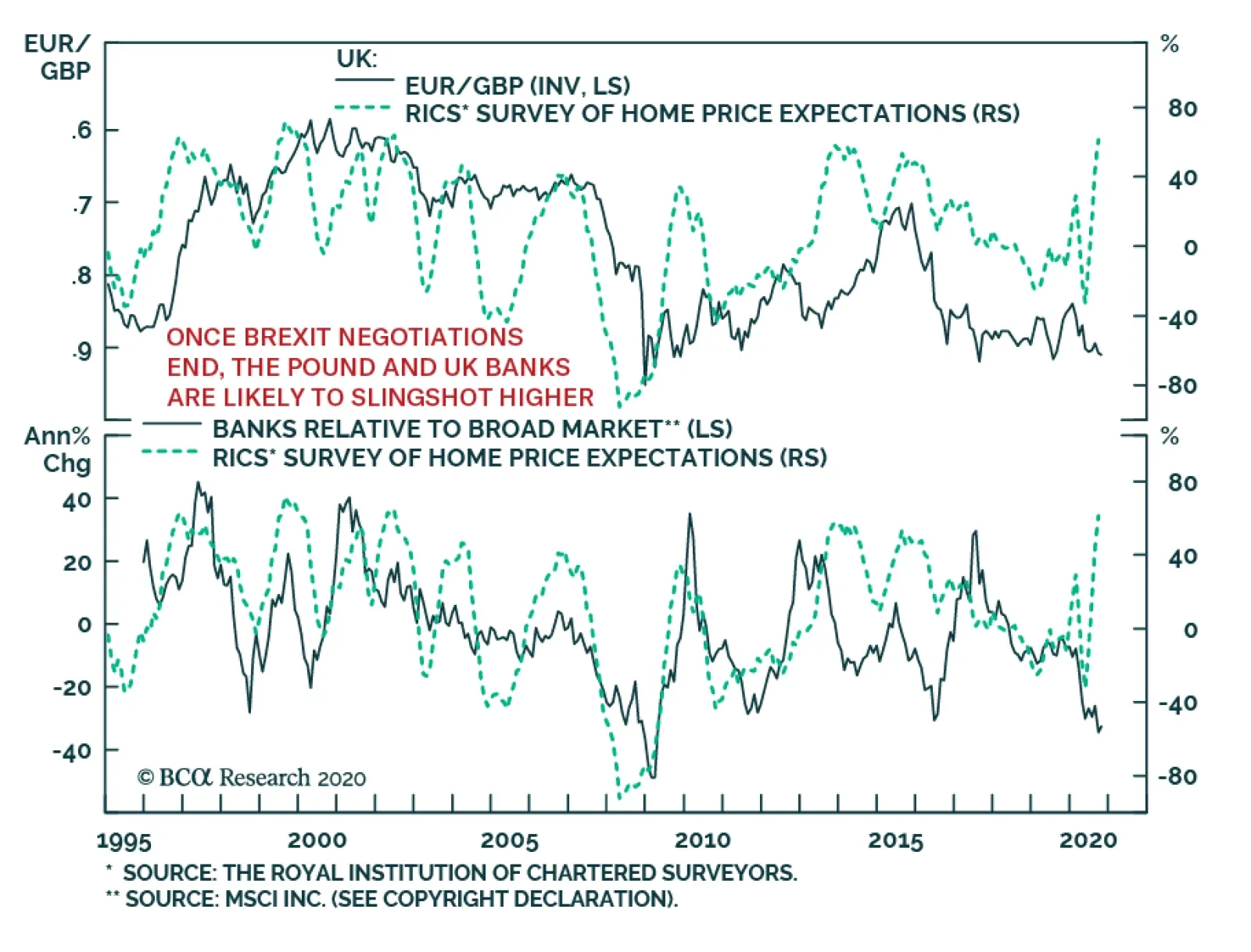

The UK’s RICS House Price Balance indicator surged to 61% in September, handily beating expectations of a decline to 40% from 44%. A strong RICS argues in favor of an acceleration in UK house price gains, which creates a…

Highlights The great political surprises of 2016 are approaching key deadlines on November 3 and December 31. Investors should not let Brexit take their eye off the US election. Globalization will retreat faster under Trump regardless…

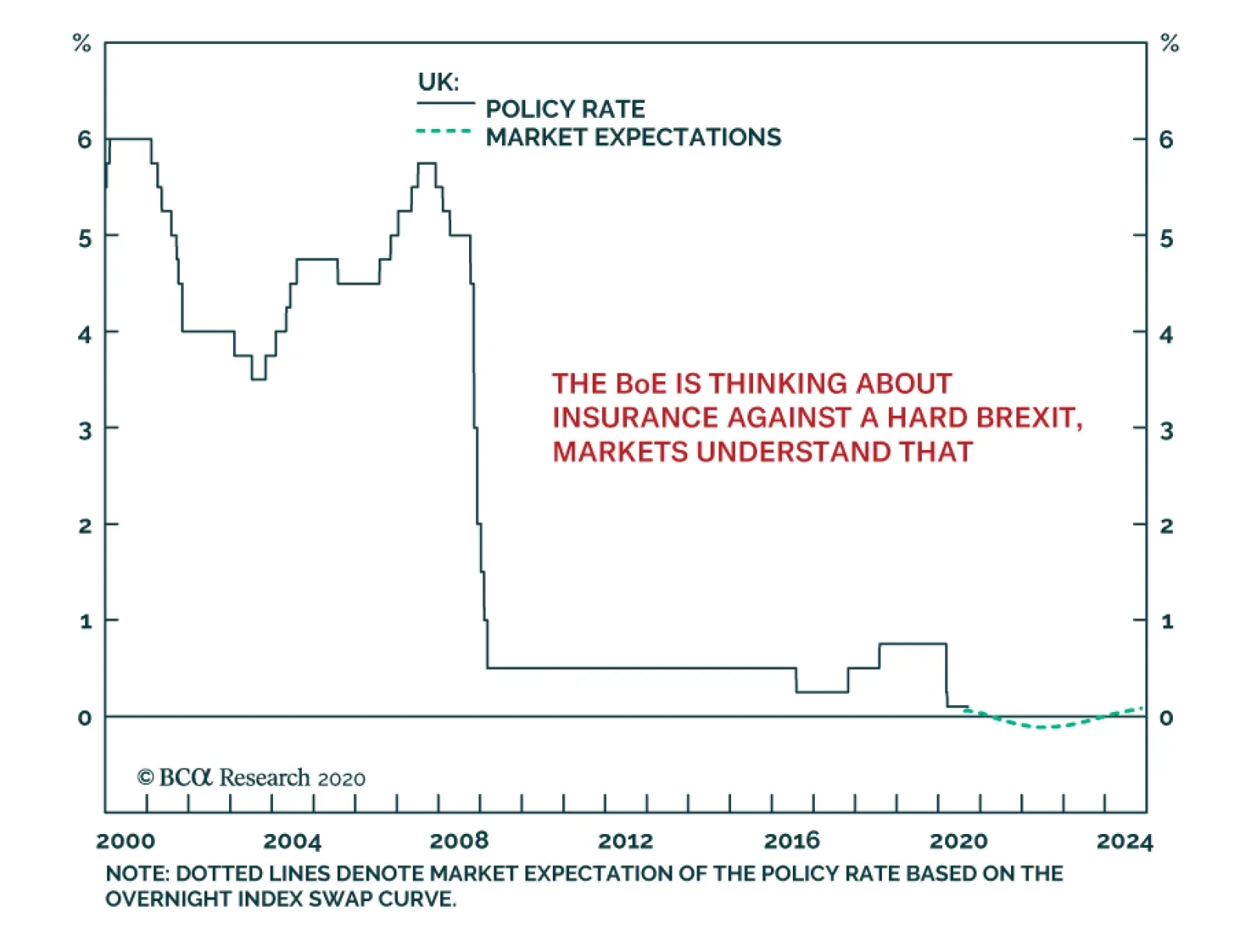

The Bank of England met yesterday and left policy unchanged. However, the meeting’s minutes revealed that the MPC is actively exploring the implementation of a negative Bank rate. So serious is the idea, the BoE is in talks…

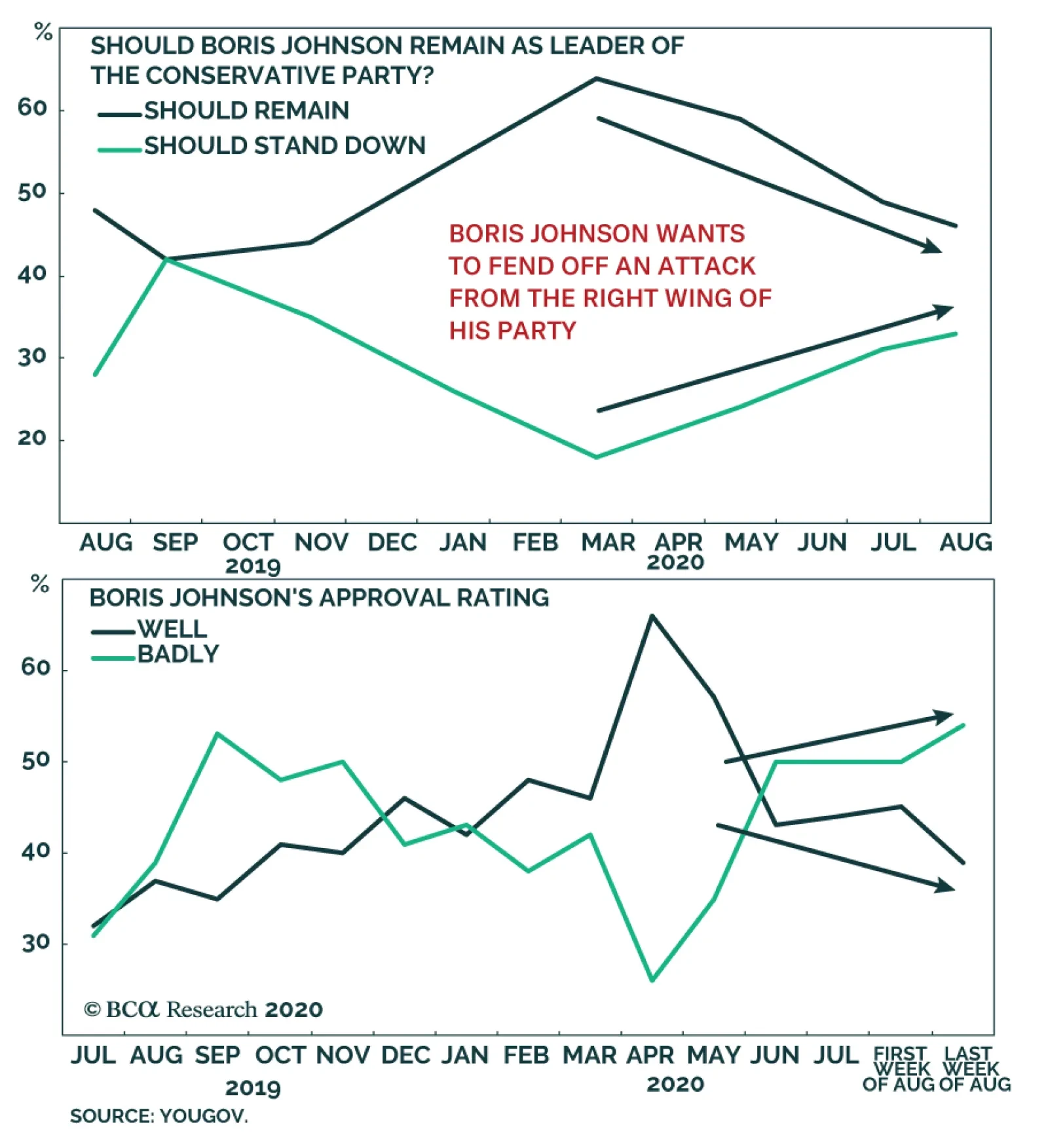

The UK is once again playing hardball with the EU. The proposed Internal Market Bill would violate the terms of the post-Brexit deal already agreed with the EU. If implemented, the UK seriously risks being treated as a trading…

Highlights We remain bearish on the US dollar over the next 12 months. The best vehicle to express this view continues to be the Scandinavian currencies (NOK and SEK). Precious metals remain a buy so long as the dollar faces downside…

To all clients, Next week, in lieu of publishing a regular report, I will be hosting a webcast on September 15th at 10 am EDT, discussing our latest views on global fixed income markets. Sign up details for the Webcast will…

Highlights Negative Rates: The persistence of the COVID-19 pandemic is intensifying pressure on policymakers in many countries to provide more stimulus. The odds that a new central bank will join the negative policy interest rate club…

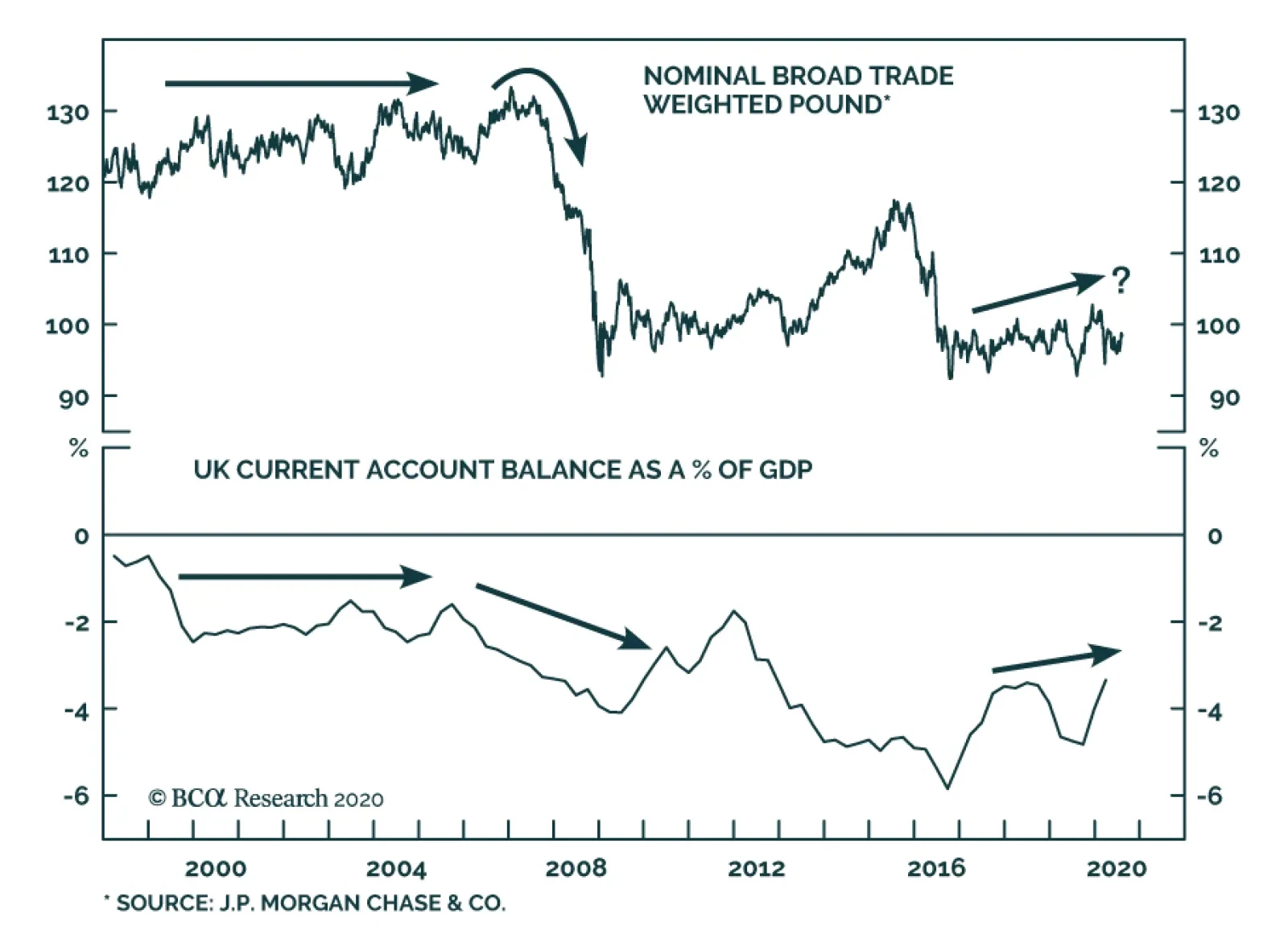

BCA Research's Foreign Exchange Strategy service continues to favor the British pound over the long term due to its cheap valuation. The key development in the UK’s balance-of-payment dynamics is that…