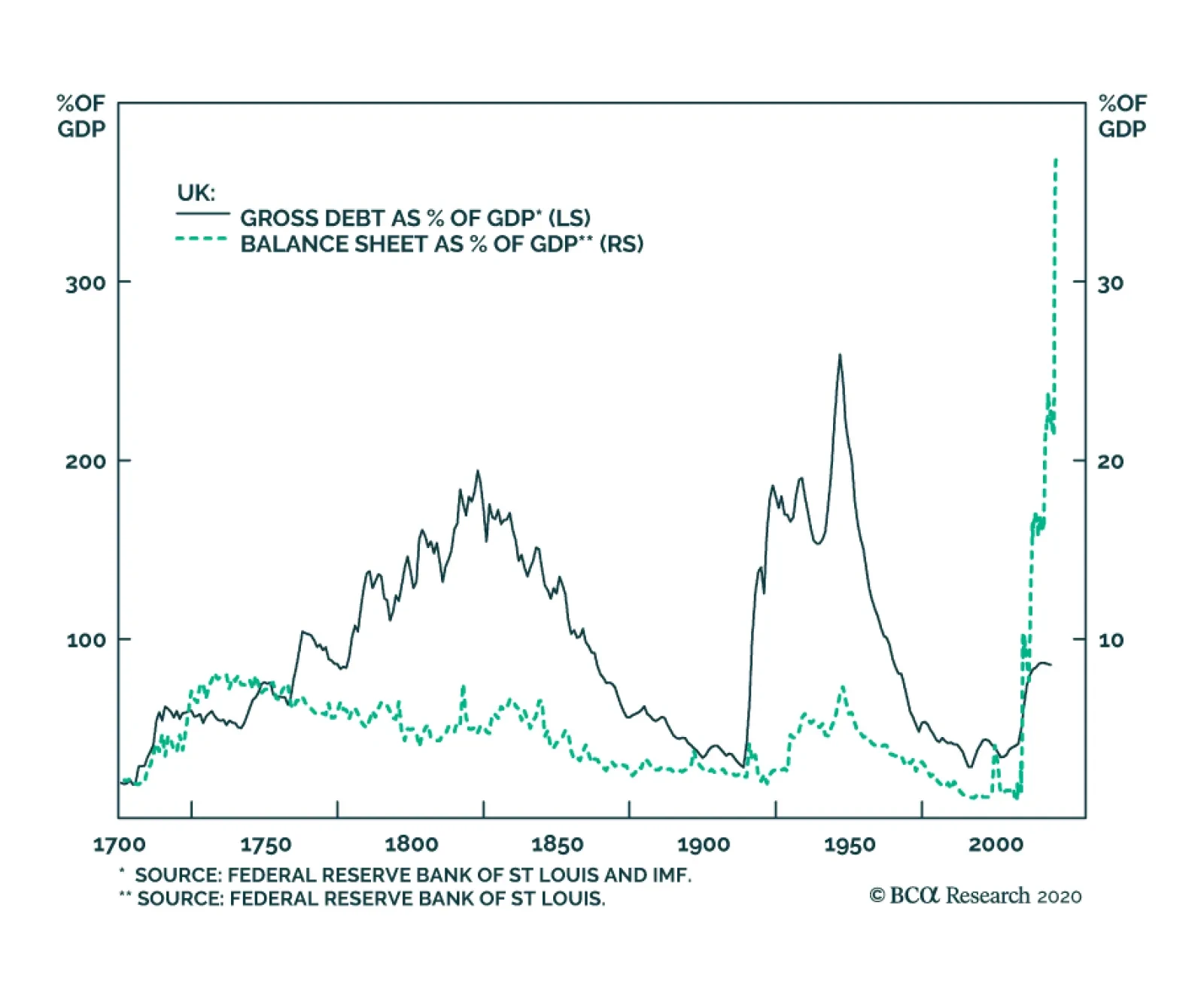

Highlights Rising Global Yields: The increased turbulence in global bond markets is part of the adjustment process to a more positive outlook for global economic growth. Rising real yields are now the main driver of nominal yield…

Highlights Market-based geopolitical analysis is about identifying upside as well as downside risk. So far this year upside risks include vaccine efficacy, coordinated monetary and fiscal stimulus, China’s avoidance of over-…

Highlights For the month of February, our trading model recommends shorting the US dollar versus the euro and Swiss franc. While we agree a barbell strategy makes sense, we would rather hold the yen and the Scandinavian currencies.…

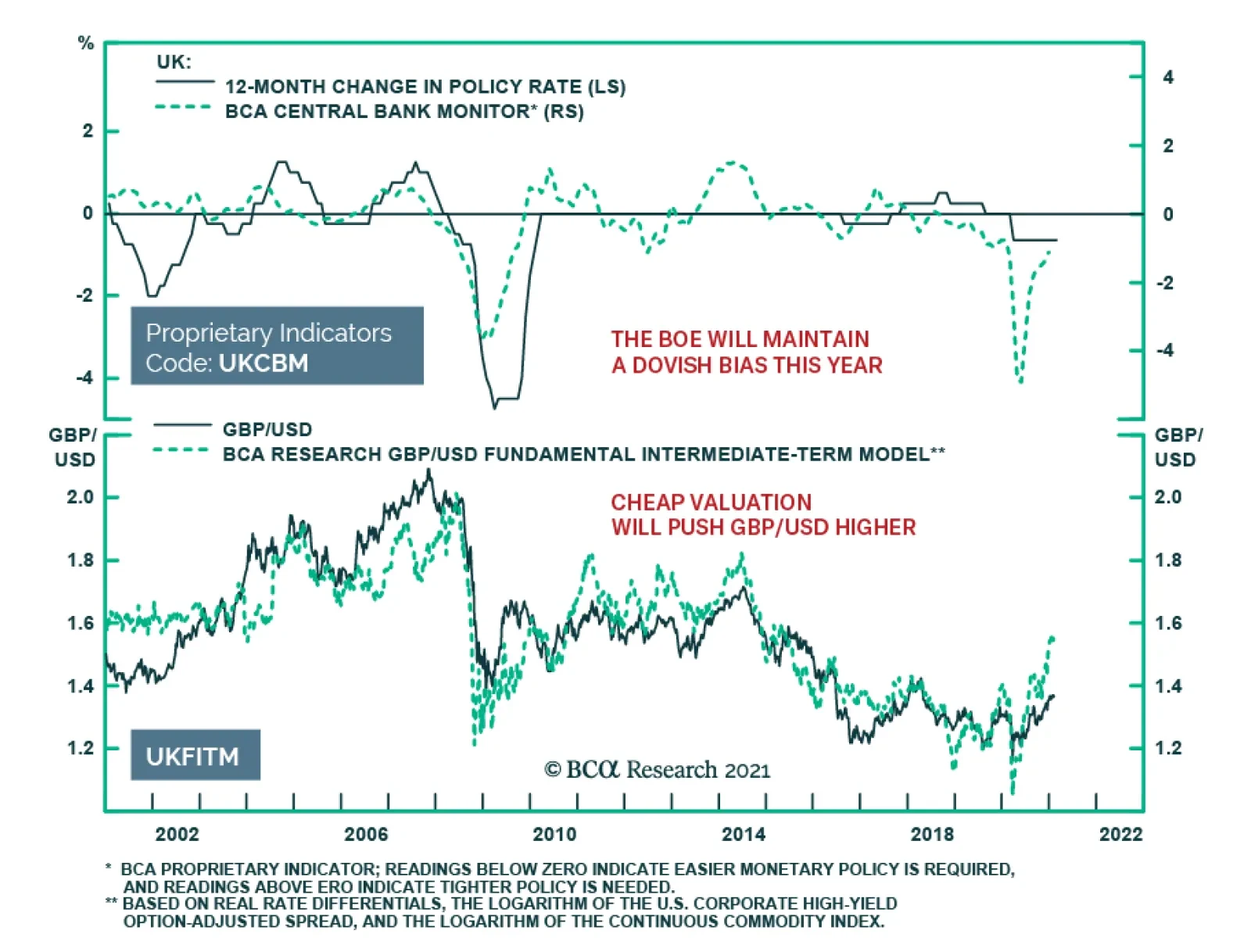

The Bank of England did not adjust monetary policy at the conclusion of its meeting on Thursday. The Bank Rate was maintained at 0.1% and its target stock of asset purchases was held at GBP 895 billion. Although the BoE revised…

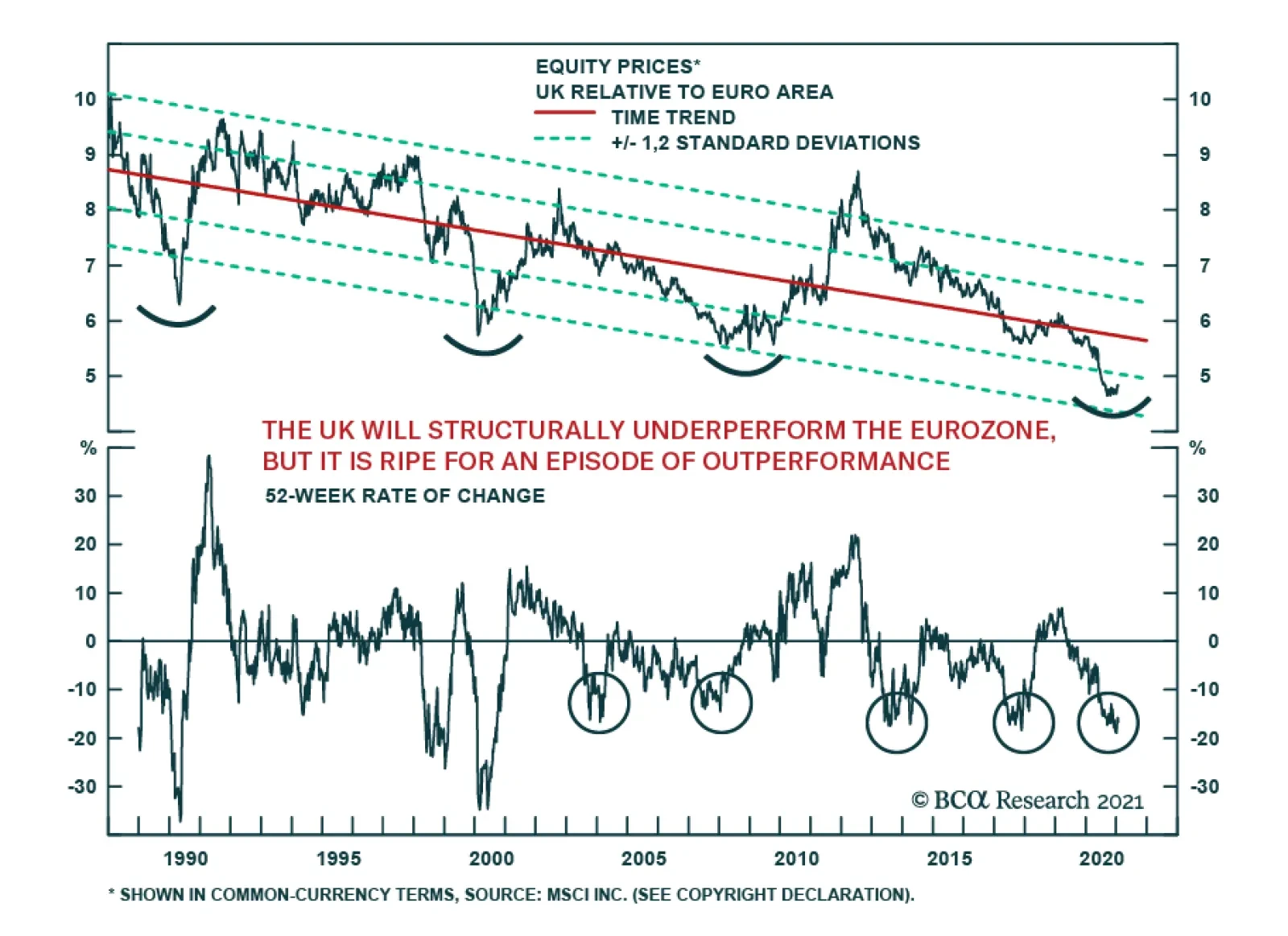

While it is well known that UK equities have been in a secular downtrend against the US, it is often less appreciated that they have greatly underperformed euro area stocks for the past 32 years. There is little reason to believe…

Highlights With a vaccine already rolling out in the UK and soon in the US, investors have reason to be optimistic about next year. Government bond yields are rising, cyclical equities are outperforming defensives, international stocks…

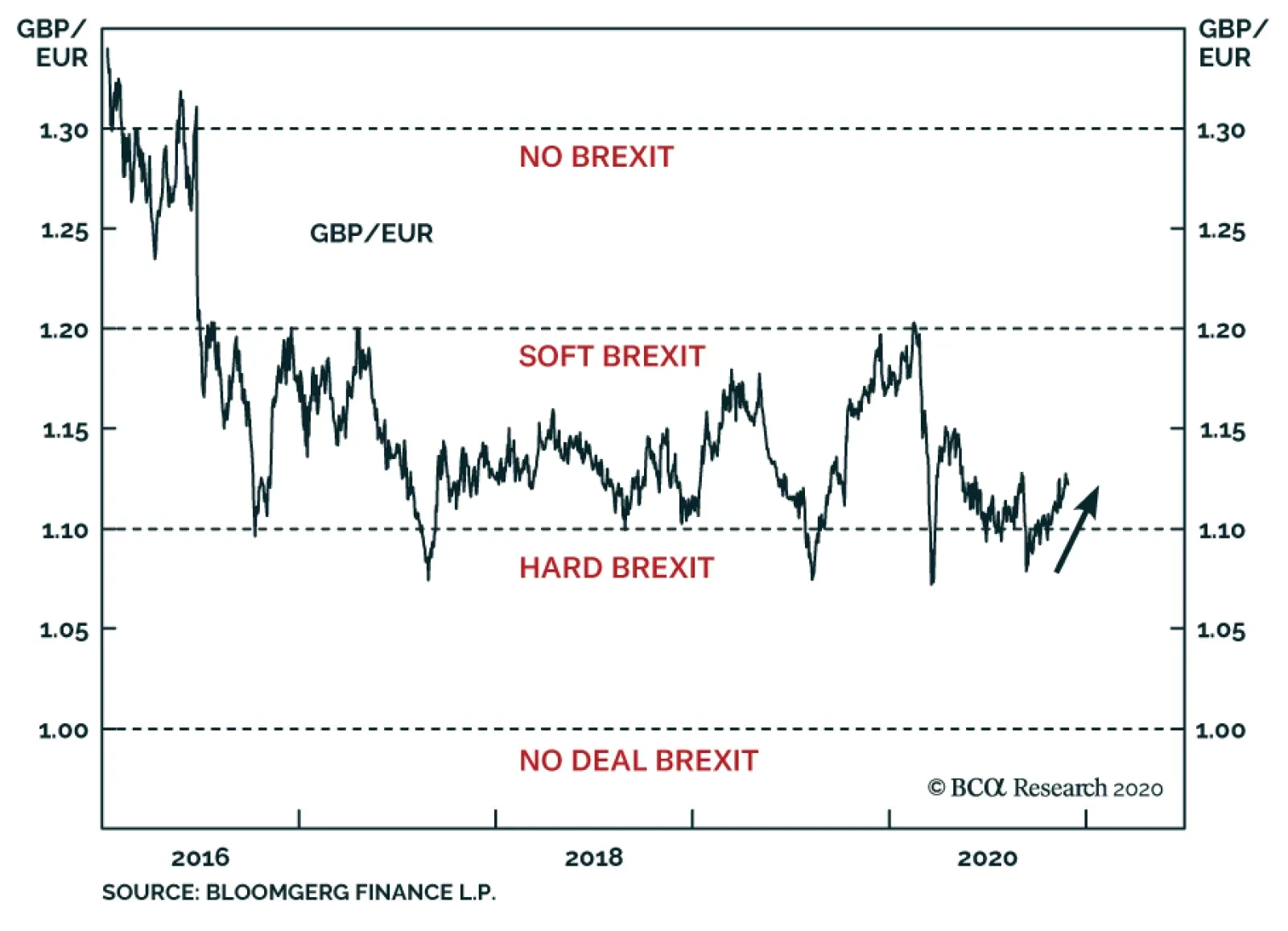

According to BCA Research's Geopolitical Strategy service, it is not too late to go long GBP-EUR. A near-term global risk-off move would work against this trade, but it is a strategic opportunity. The Brexit finale is…

According to BCA Research's Foreign Exchange Strategy service, currency markets also continue to ignore the risks of a no-deal Brexit and the significant acceleration in the pace of COVID-19 infections. The Bank of England…

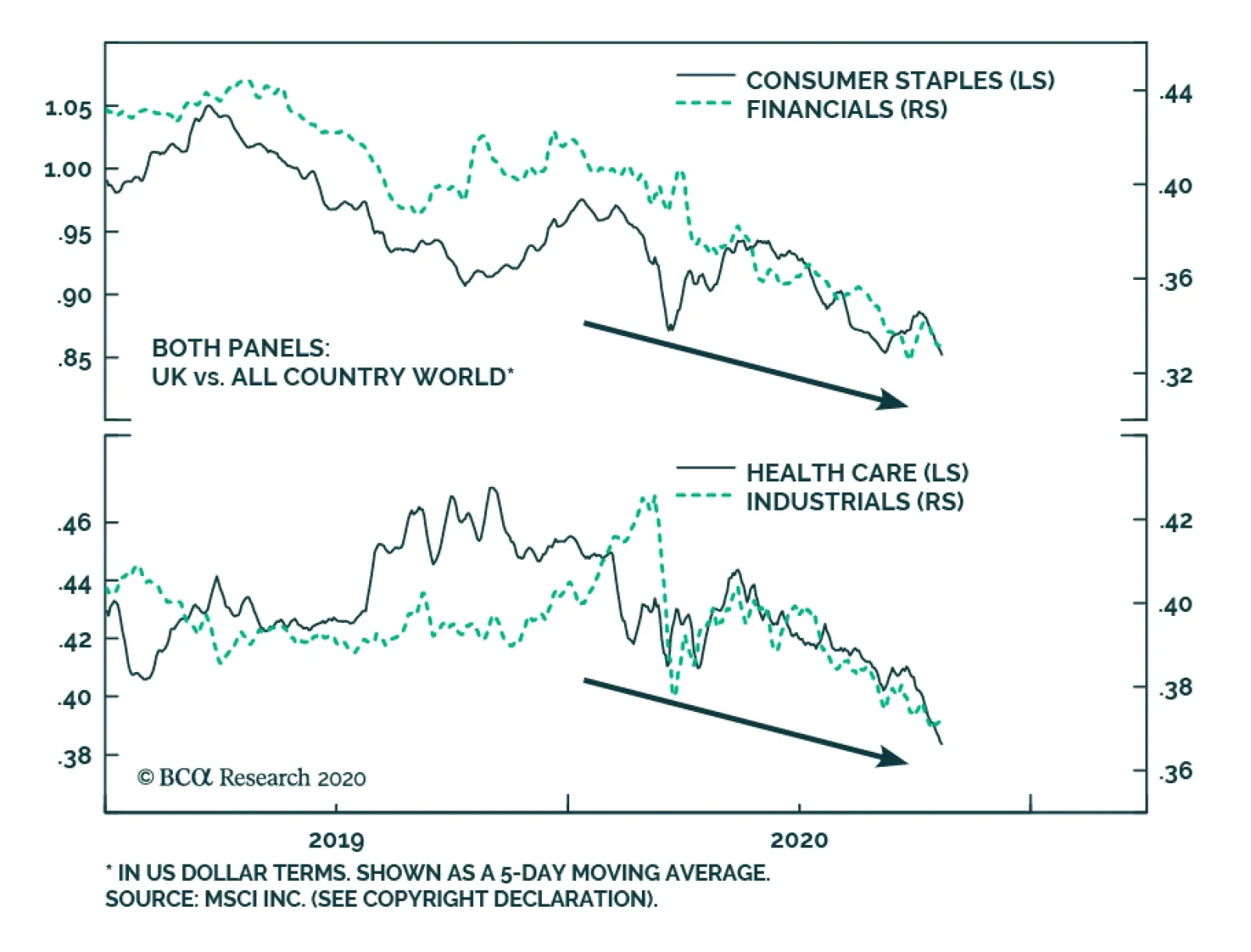

We noted in an Insight earlier this week that the performance of UK equities this year has been especially bad, in part due to the heavy tech underweight of the UK equity market. When analyzing regional equity performance,…