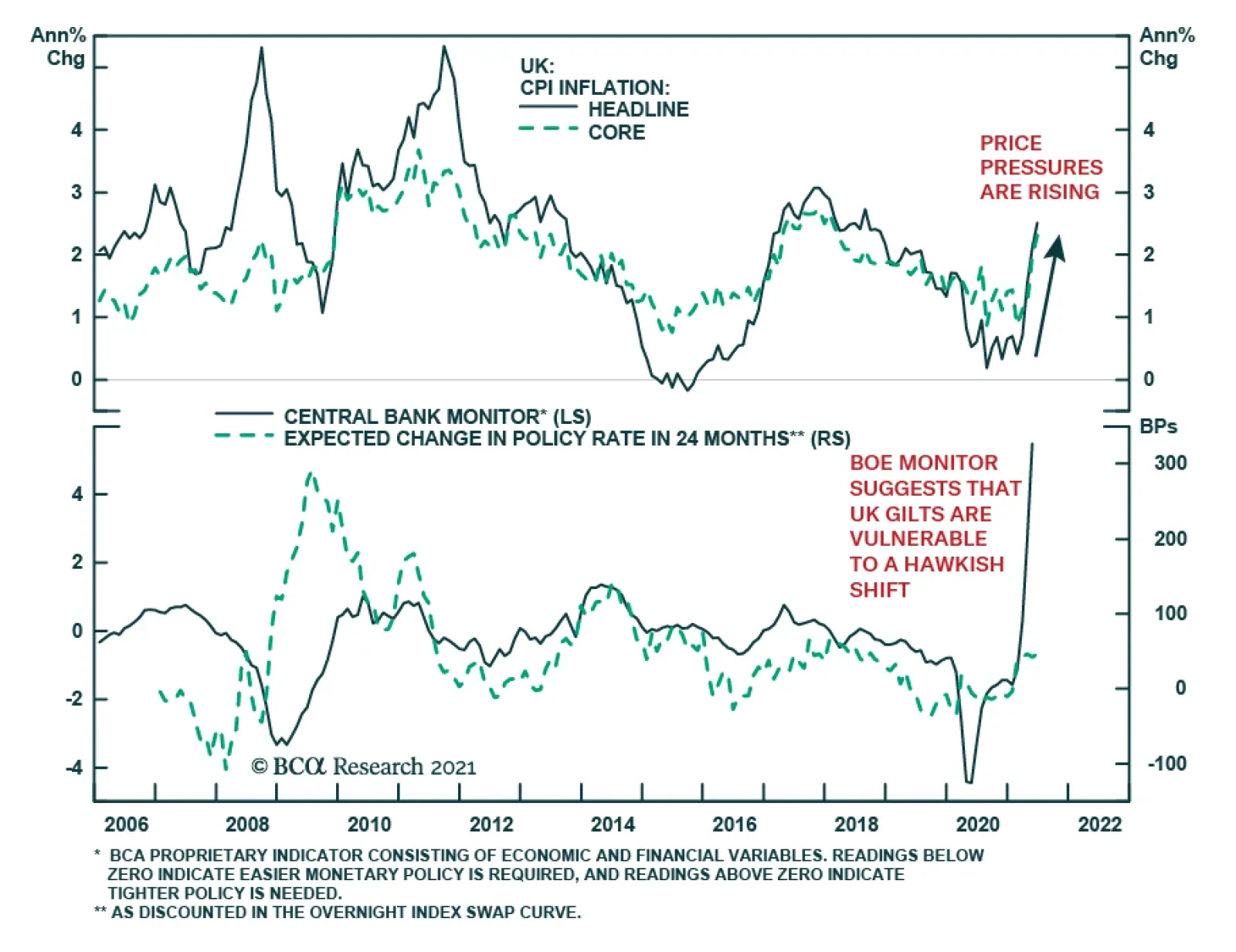

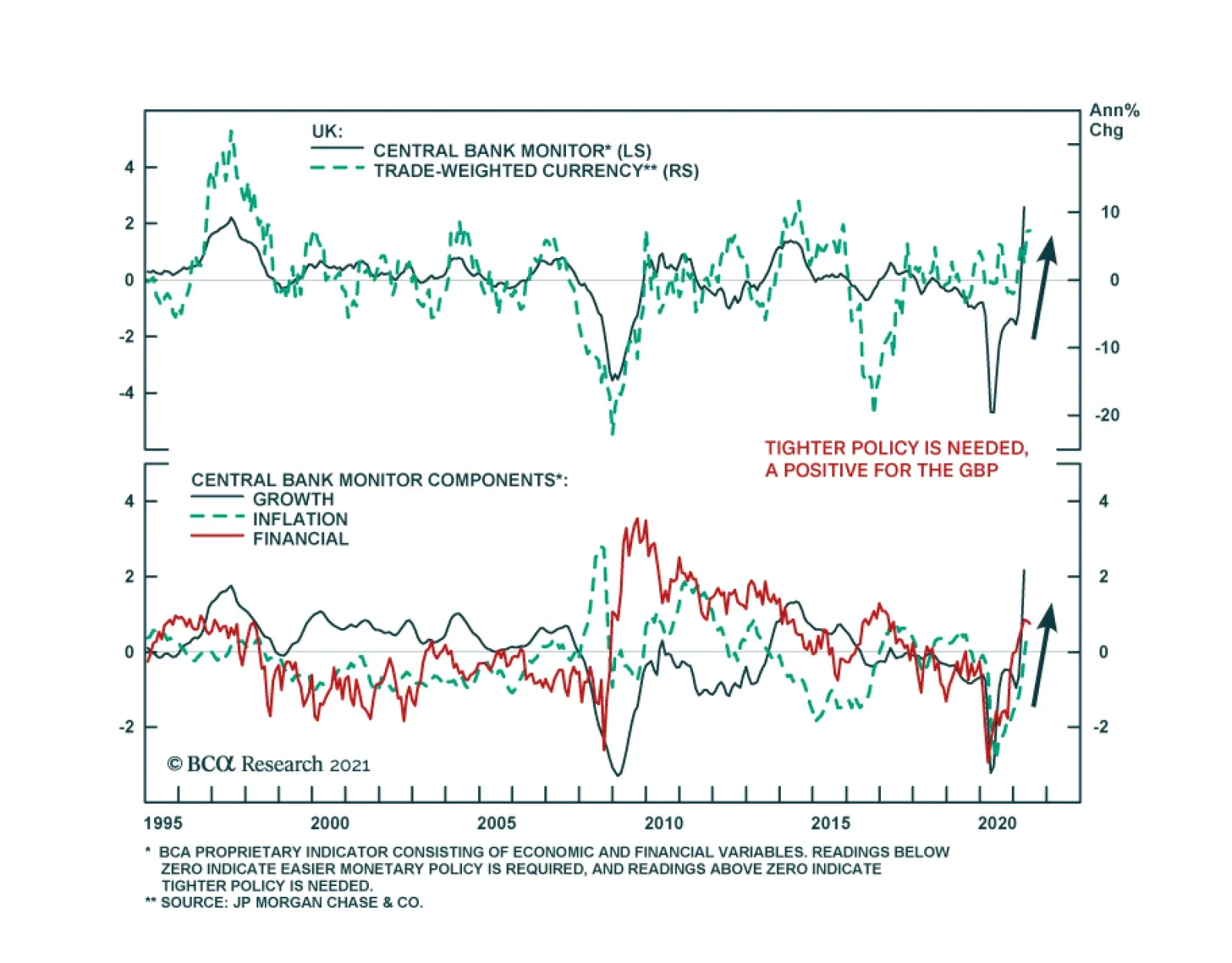

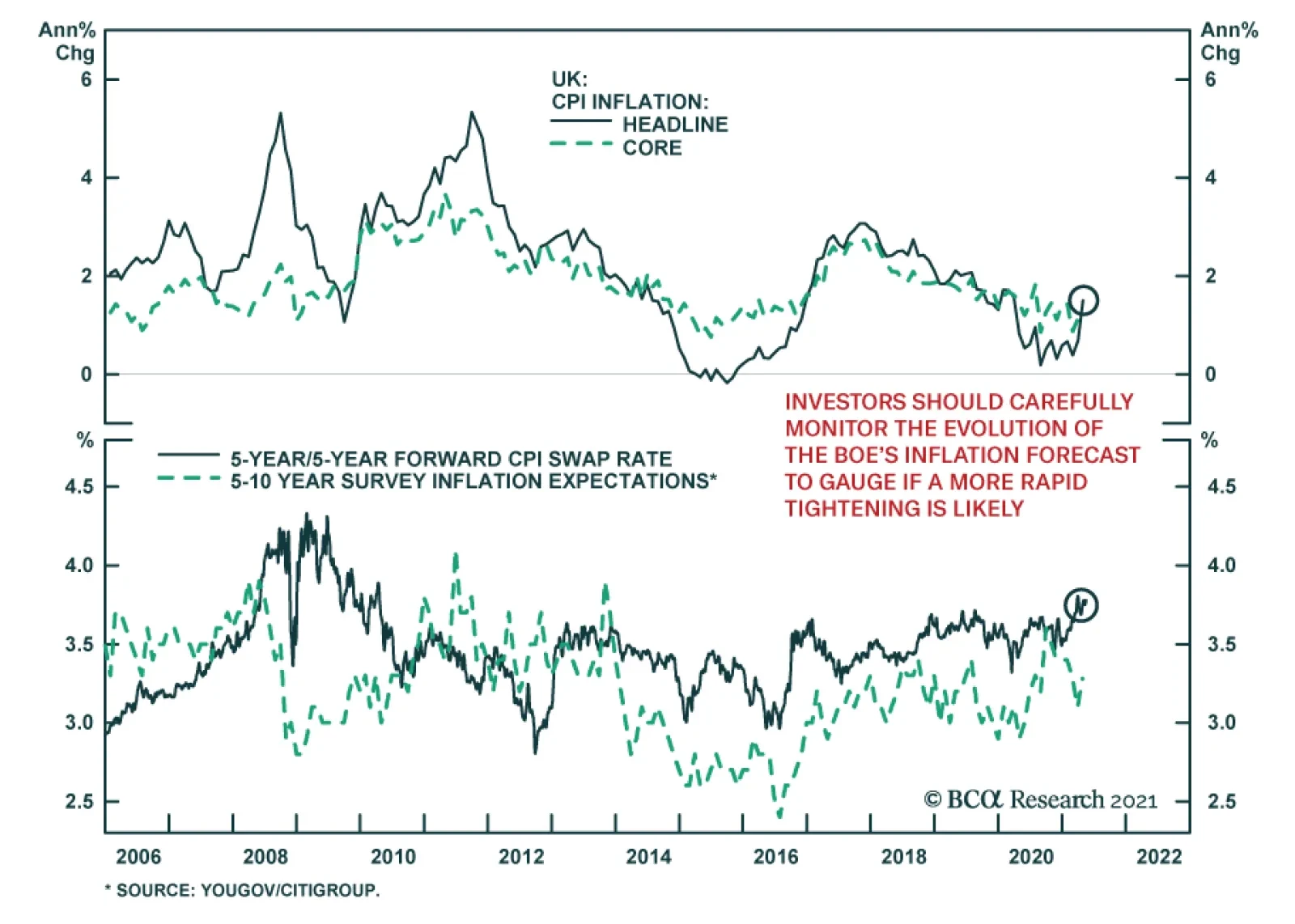

The UK’s various inflation indicators surprised to the upside in June. Headline CPI inflation rose to a 3-year high of 2.5% from 2.1%, above the anticipated 0.1pp increase. Similarly, at 2.3% y/y, core CPI inflation…

GFIS Model Bond Portfolio Q2/2021 Performance Review & Current Allocations: Hitting A Few Roadblocks

Highlights Q2/2021 Performance Breakdown: Our recommended model bond portfolio underperformed the custom benchmark index by -6bps during the second quarter of the year. Winners & Losers: The government bond side of the portfolio…

The Bank of England did not announce any policy changes following the conclusion of the MPC meeting on Thursday. Instead, the central bank now projects that inflation will “exceed 3% for a temporary period” – an…

Highlights The ongoing transition to a post-pandemic state and fiscal policy are either positive or net-neutral for risky asset prices. Fiscal thrust will turn to fiscal drag over the coming year, but the negative impact this will…

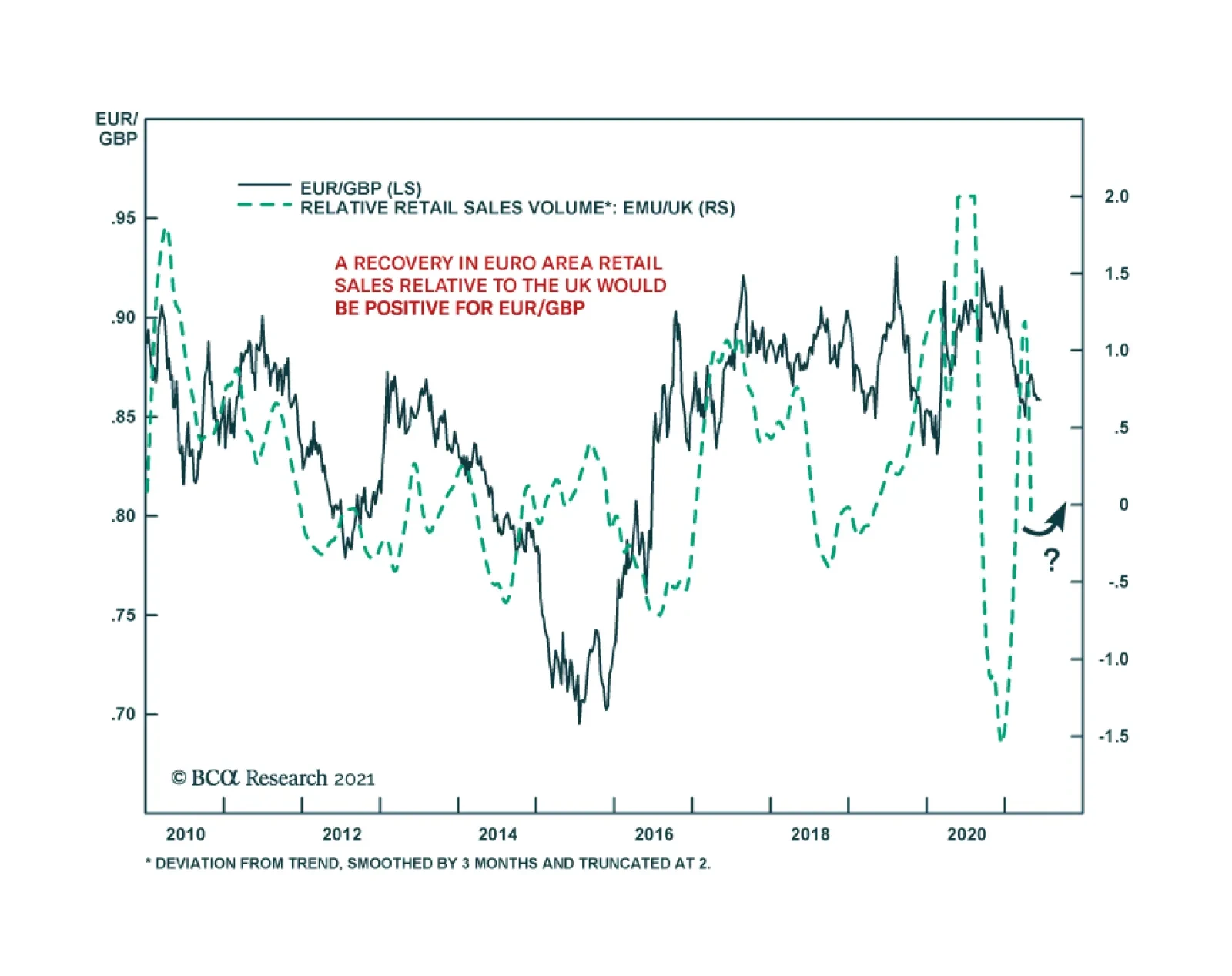

UK retail sales declined unexpectedly in May. The headline number fell 1.4% m/m following a 9.2% m/m jump in April, disappointing expectations of a deceleration to 1.5%. Similarly, sales excluding auto fuel were down 2.1% m/m…

Highlights Oil demand expectations remain high. Realized demand continues to disappoint. This means OPEC 2.0's production-management strategy – i.e., keeping the level of supply below demand – will continue to dictate…

UK inflation doubled in April, rising to the highest level since last March. The consumer price index increased to 1.5% y/y. The acceleration in the monthly pace to 0.6% m/m from 0.3% m/m suggests that more than just base effects…