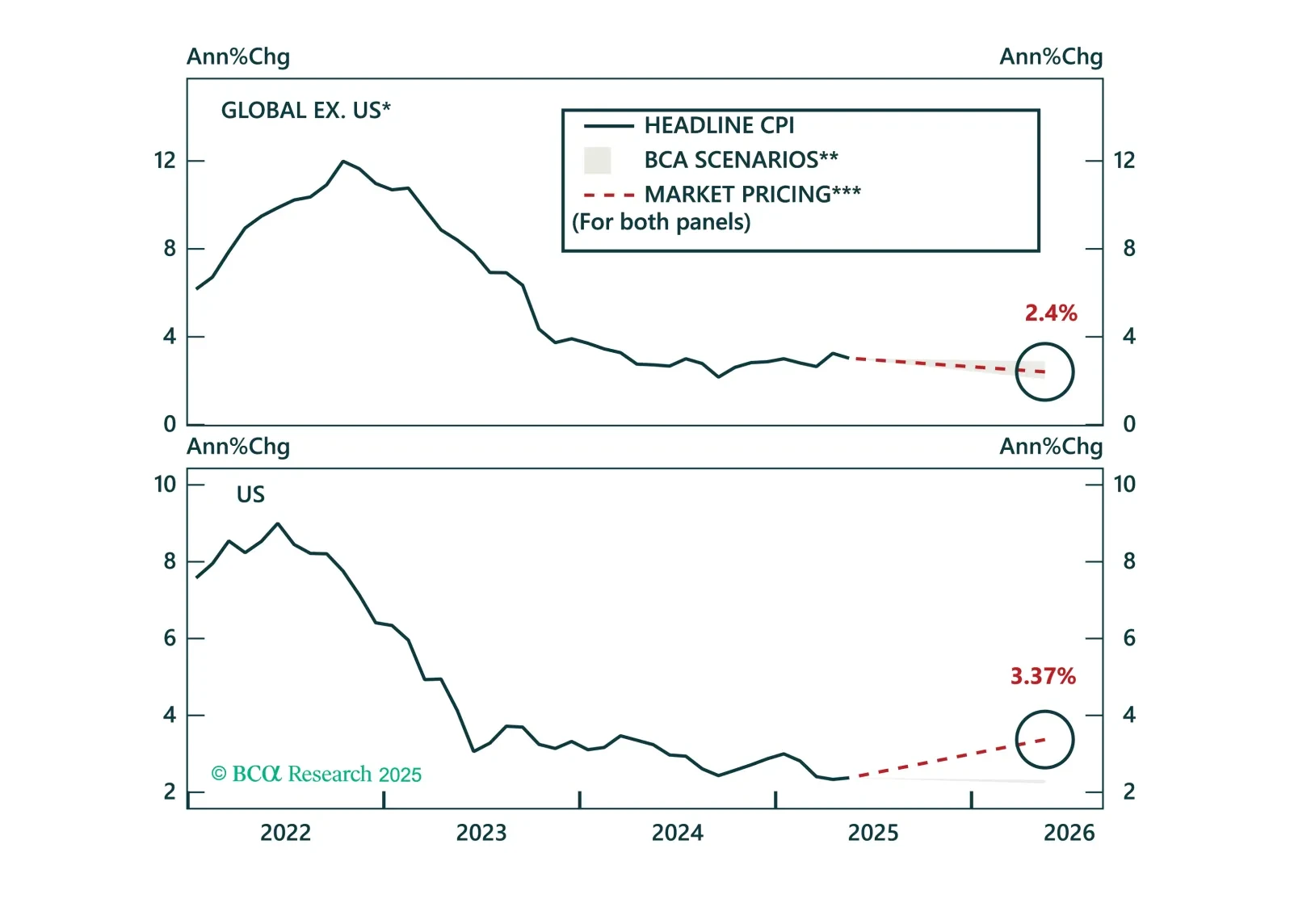

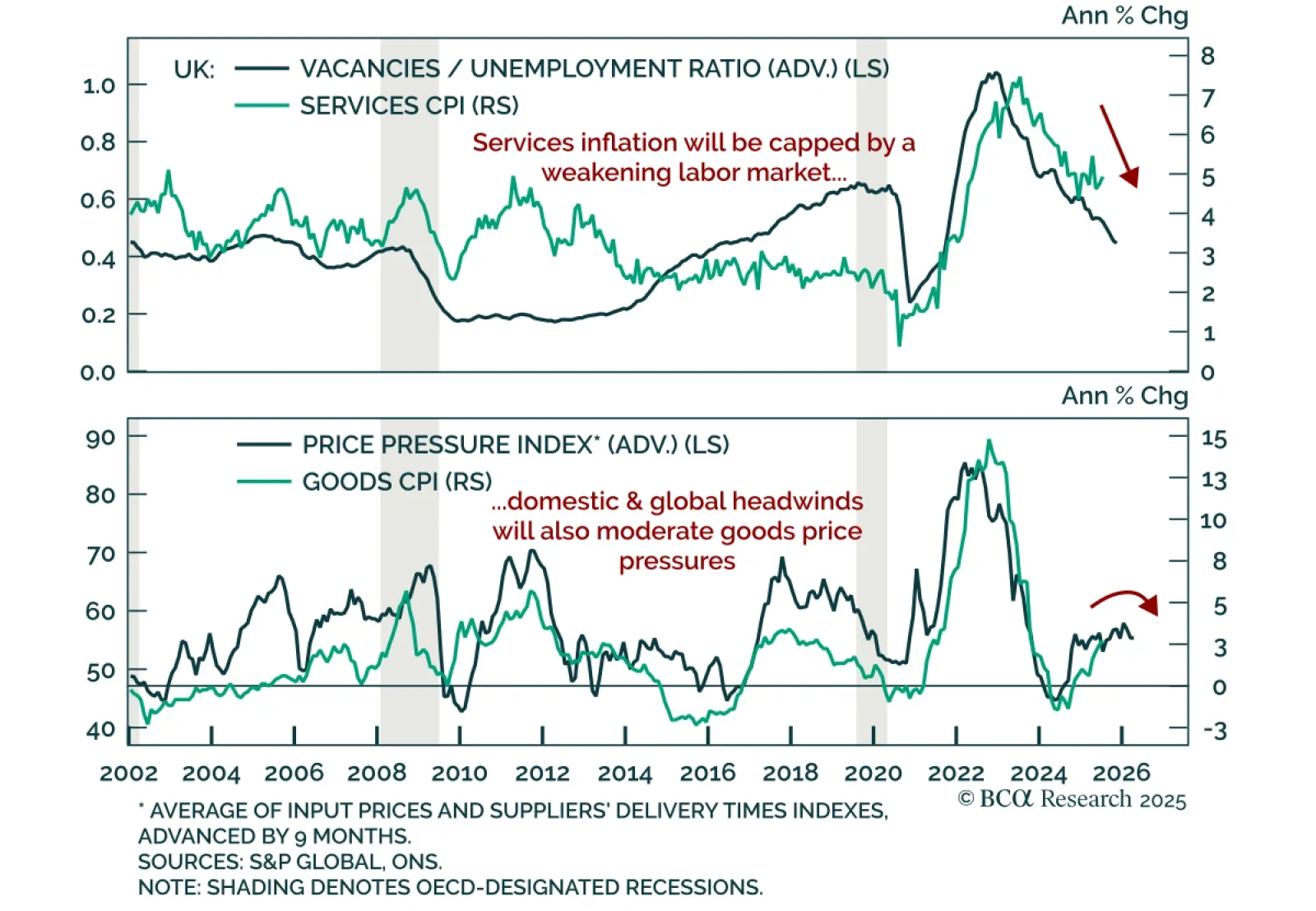

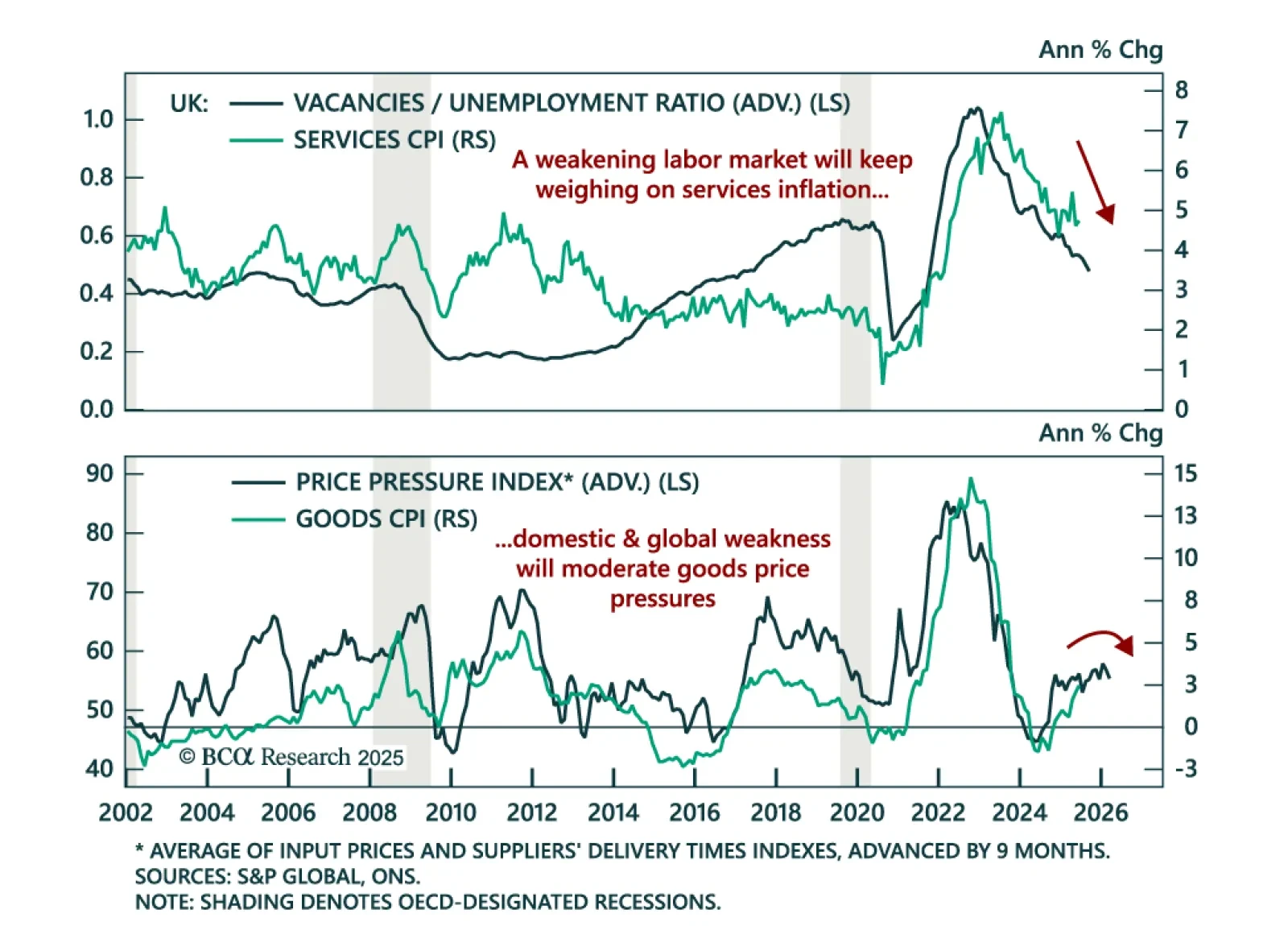

Hot July inflation does not alter the weakening UK backdrop, keeping Gilts attractive and GBP vulnerable. Headline CPI rose 0.1% m/m, lifting y/y inflation to 3.8% from 3.6%, while core ticked up to 3.8% from 3.7%. Services…

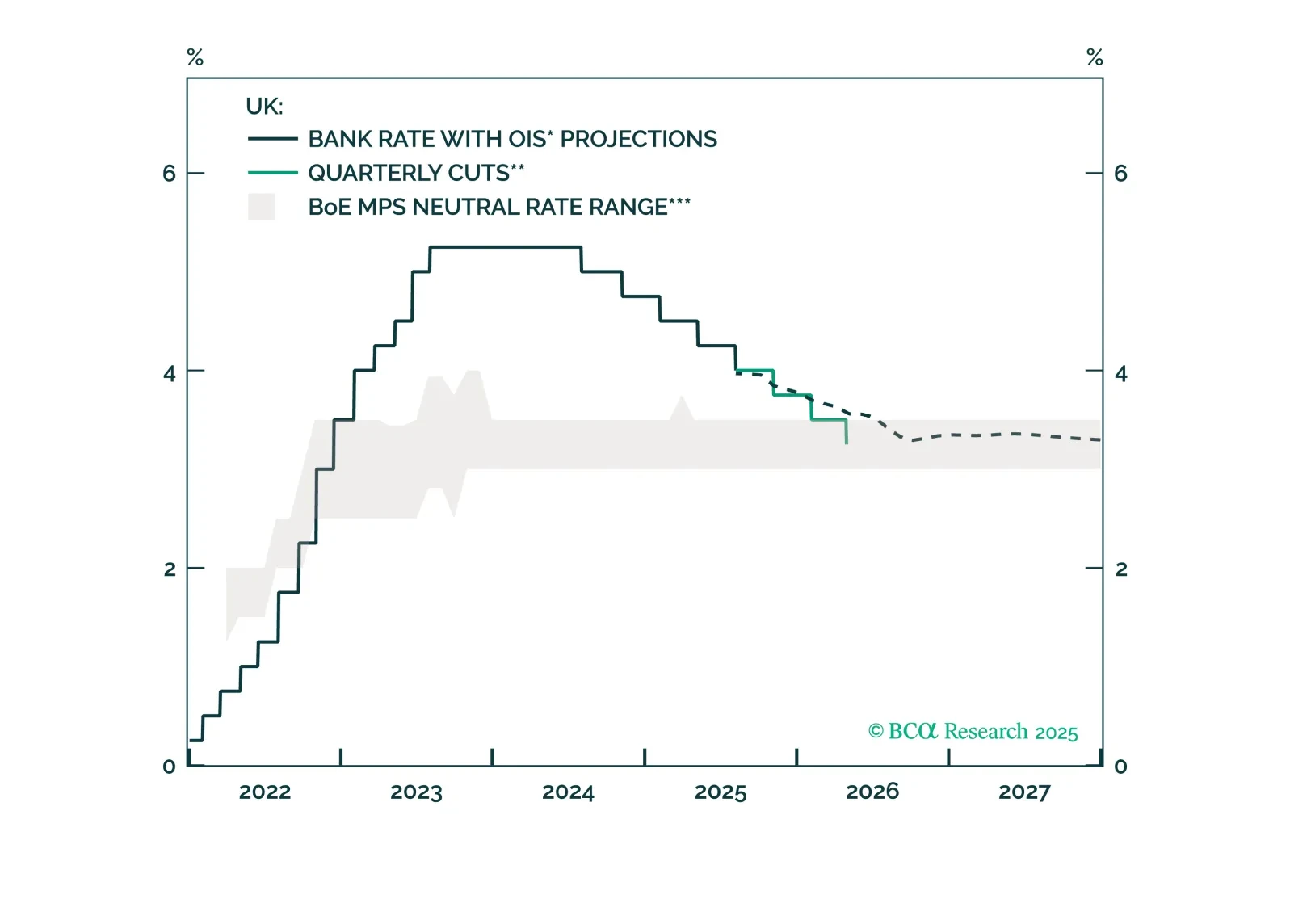

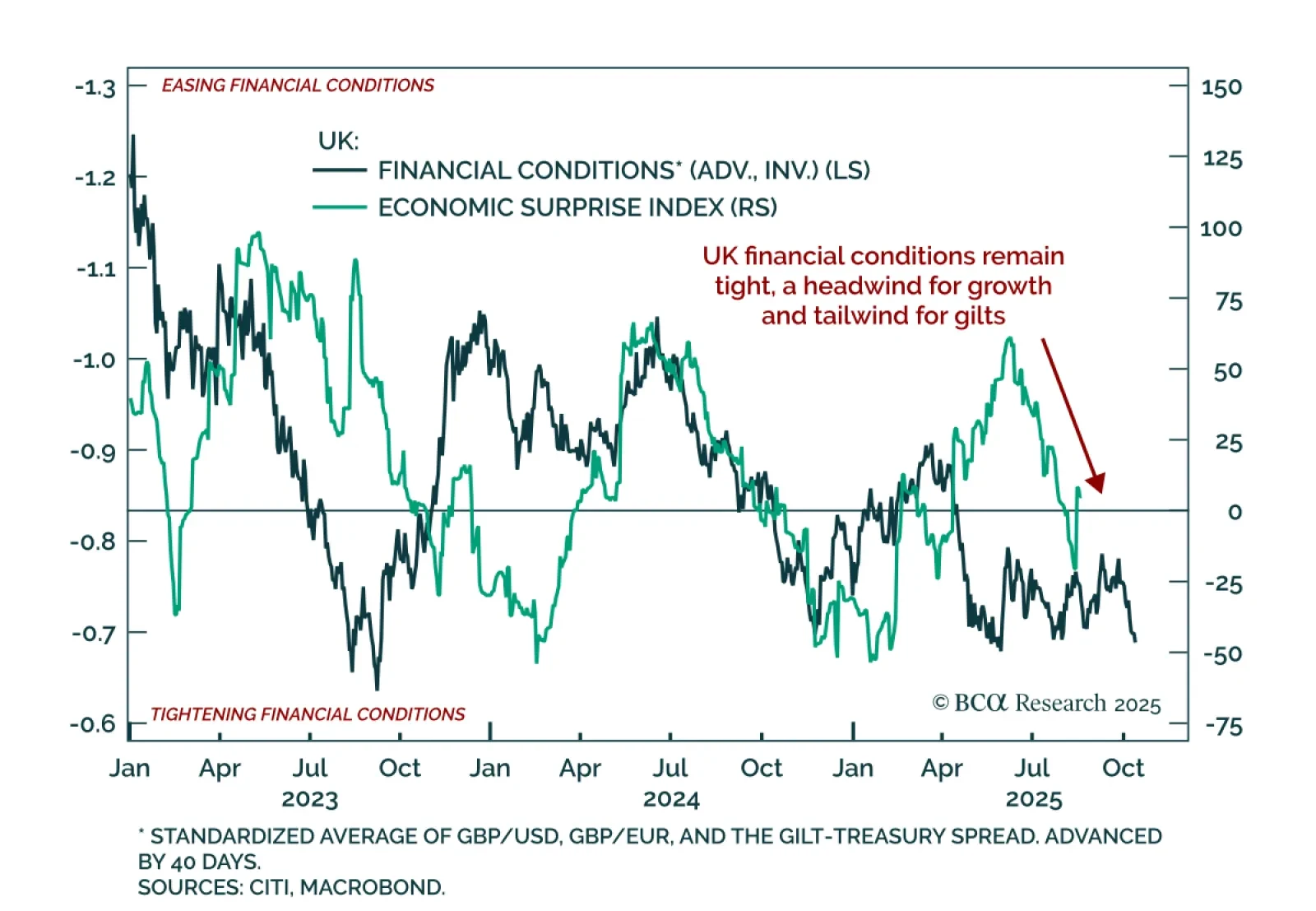

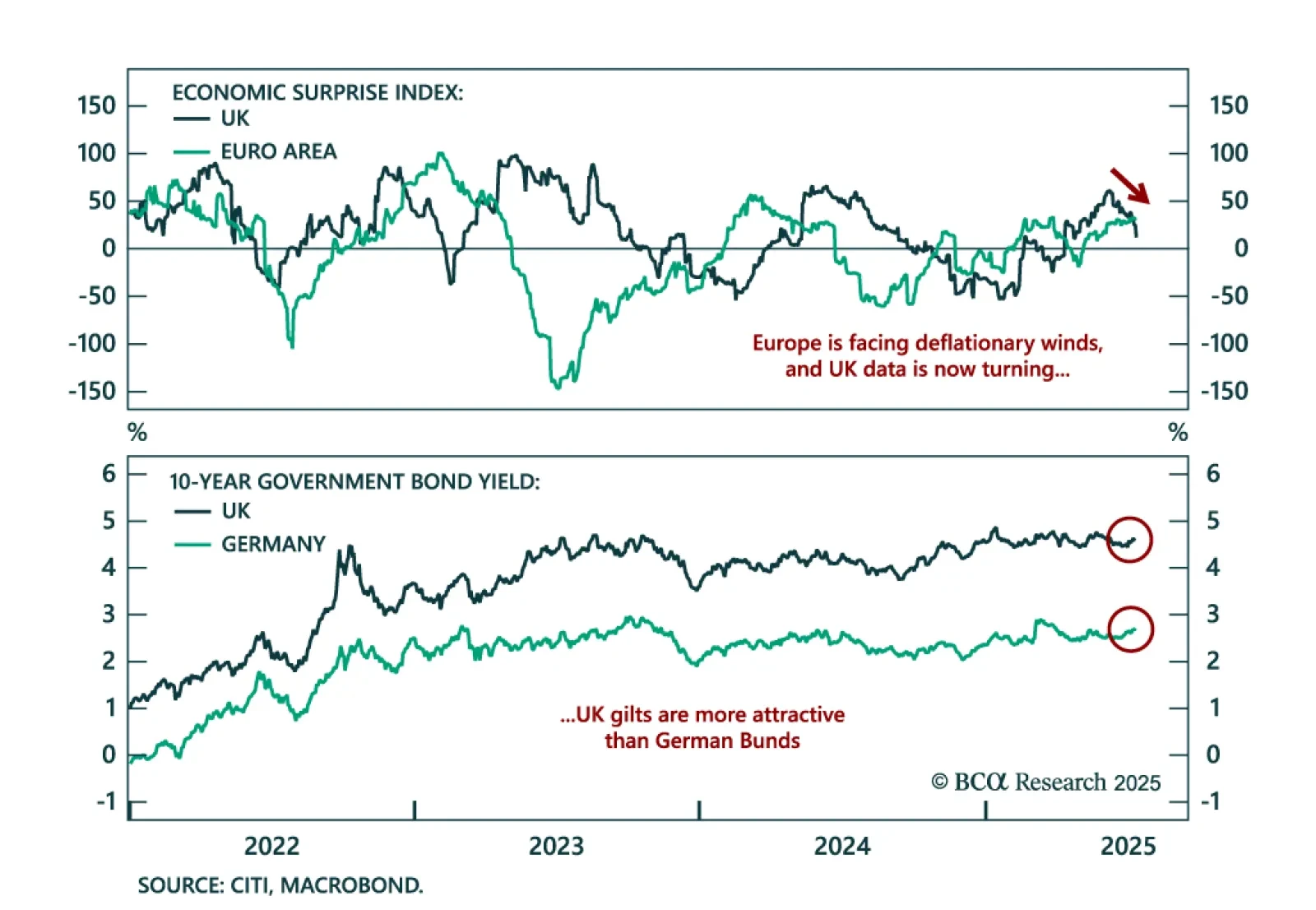

UK data momentum is fading, keeping Gilts attractive and GBP vulnerable. At 5.60%, 30-year Gilts trade at their highest yields since the late 1990s, reflecting persistent pressure on the long end across DMs. The Bank of England…

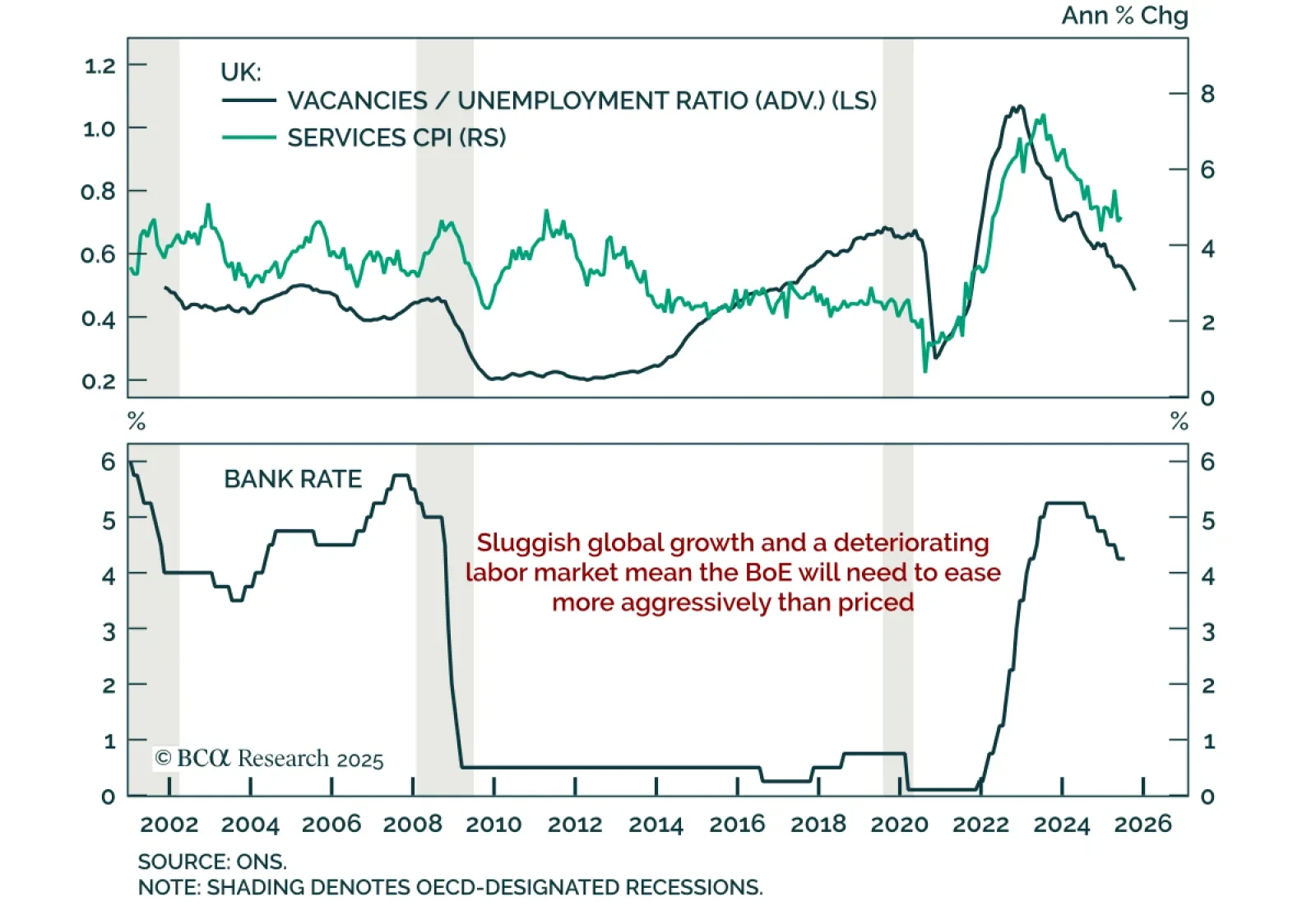

The BoE is easing, but risks falling behind. Labor and growth cracks are starting to emerge, and the Bank may soon be forced to move more decisively. This report outlines why gilts remain a buy and sterling’s path is diverging vs.…

The BoE delivered a narrow rate cut to 4%, but a divided vote and fading growth momentum suggest markets are underpricing further easing. Stay overweight UK Gilts. The 5-4 split reflected concerns among dissenters about a…

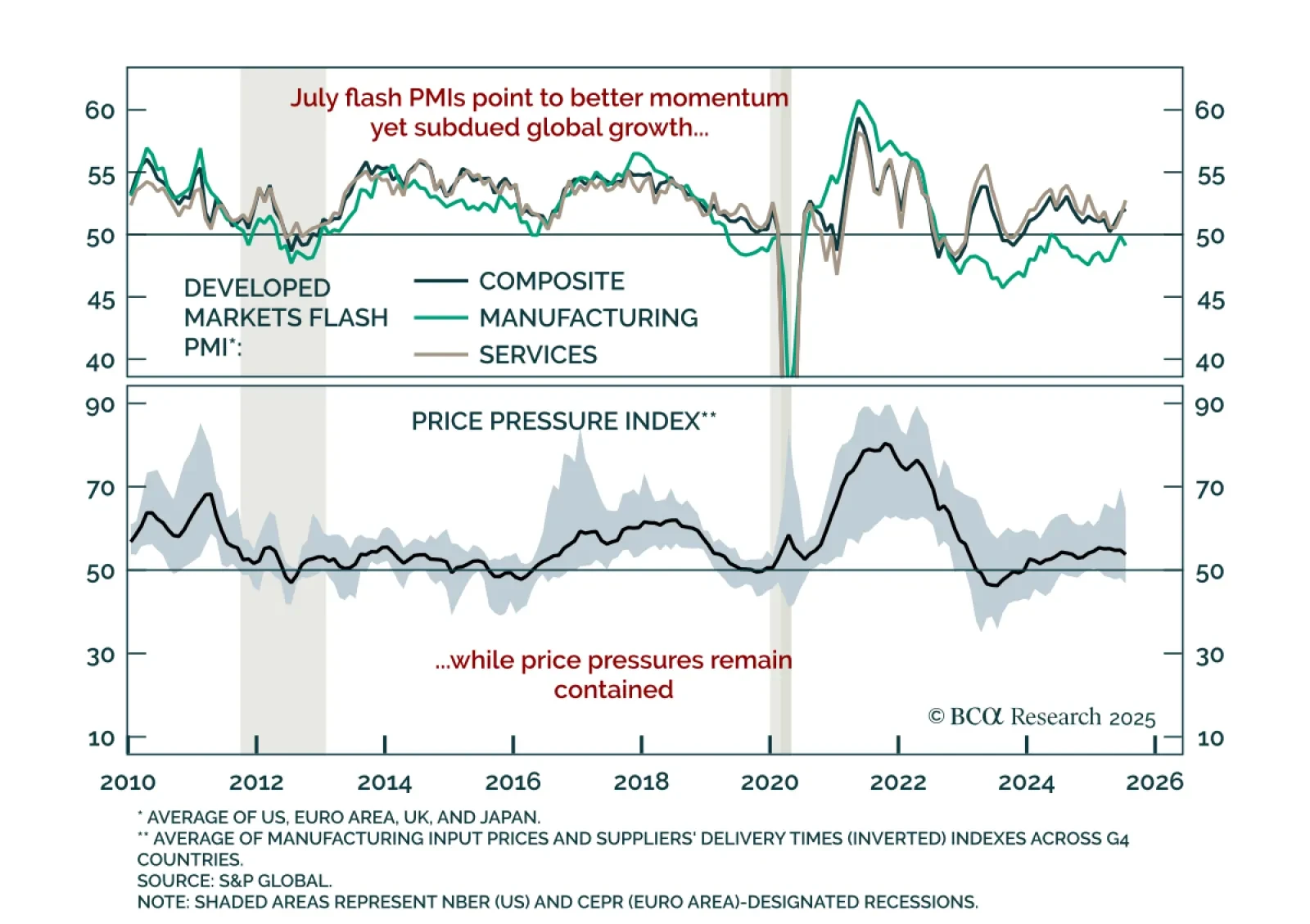

July DM flash PMIs point to improving global growth momentum led by services, but manufacturing remains weak and upside is limited, reinforcing our defensive stance. Services PMIs improved in the US, Europe, and Japan, but…

June UK CPI surprised to the upside, but weakening leading indicators point to disinflation ahead. Stay overweight Gilts. Headline inflation accelerated to 3.6% y/y from 3.4%, and core rose to 3.7% from 3.5%. Services inflation held…

Disinflation continues to unfold globally, and markets are finally catching up. Inflation expectations have broadly realigned with fundamentals, prompting us to shift our global ILB allocation to neutral. While tariff risks are…

UK growth data continues to disappoint, making the case for a Gilts overweight and a dovish BoE. May GDP fell 0.1% m/m, missing estimates and marking a consecutive monthly contraction after April’s 0.3% decline. Industrial and…

In this chartbook, we look at the balance of payments across DM and EM countries. The US does not fare well, but neither do a few other countries.

Acute geopolitical risks, like a massive oil shock, may be abating. But structural geopolitical risk remains high and could upset a blithe market. Cyclical economic risks are underrated as the US slows down and China continues to…