Highlights Global growth will remain above-trend in 2022, although with more divergence between regions than at any time during the pandemic (US strong, Europe steady, China slowing). Global inflation will transition from being driven…

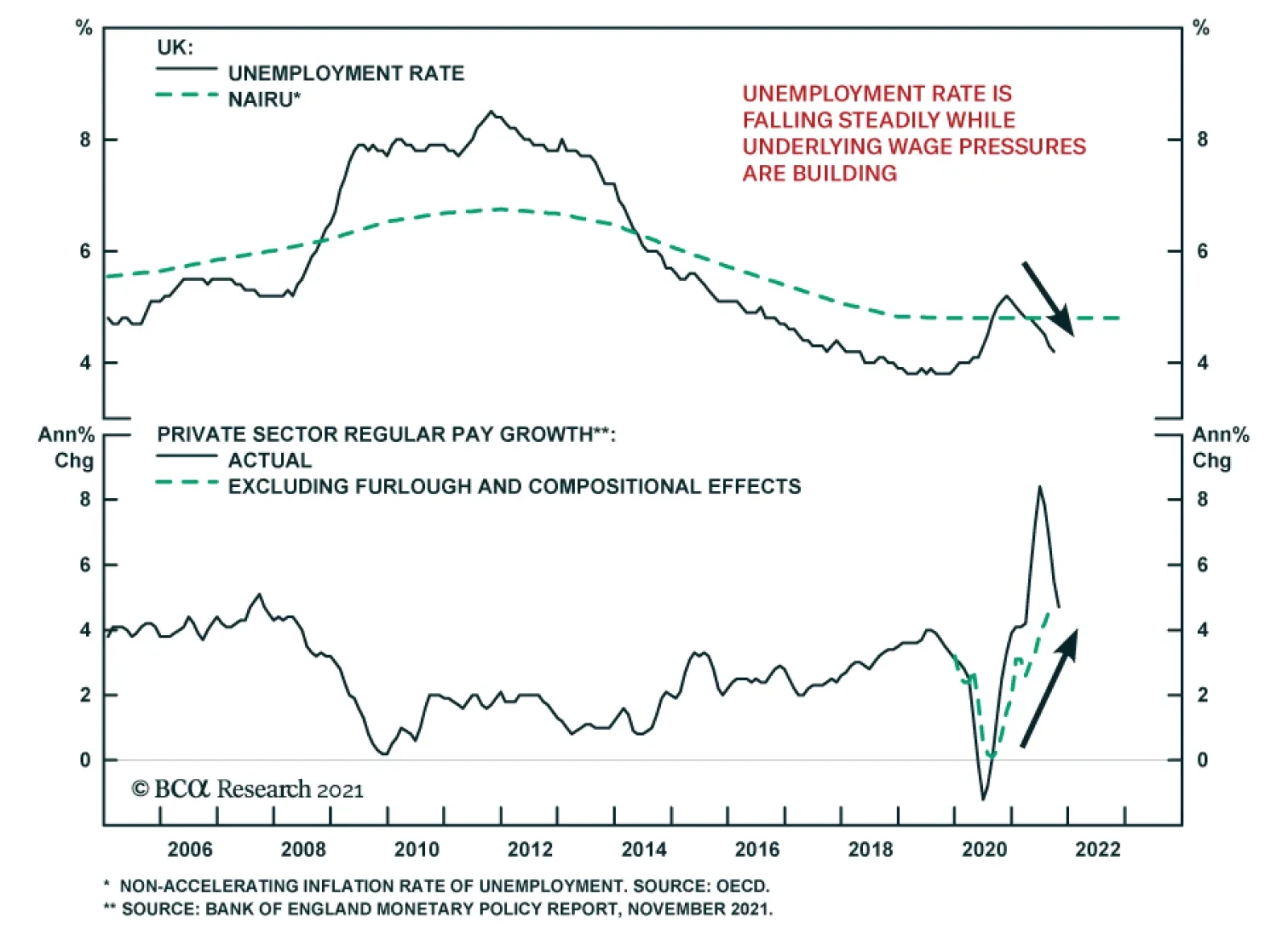

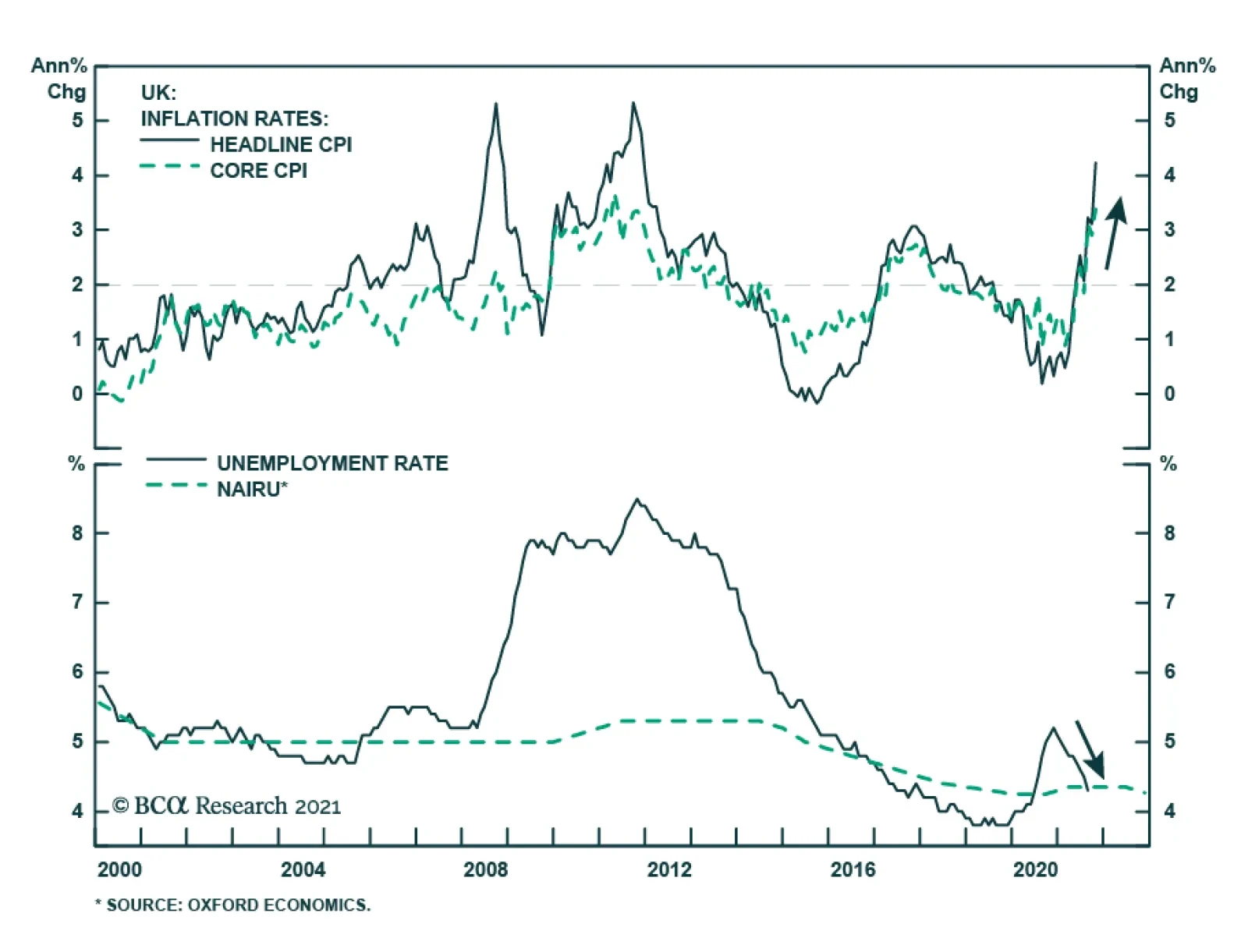

The UK labor market recovery appears to be withstanding the September expiry of the government’s Job Retention Scheme. The number of payrolled employees increased by 257 thousand in November to 29.4 million. This latest…

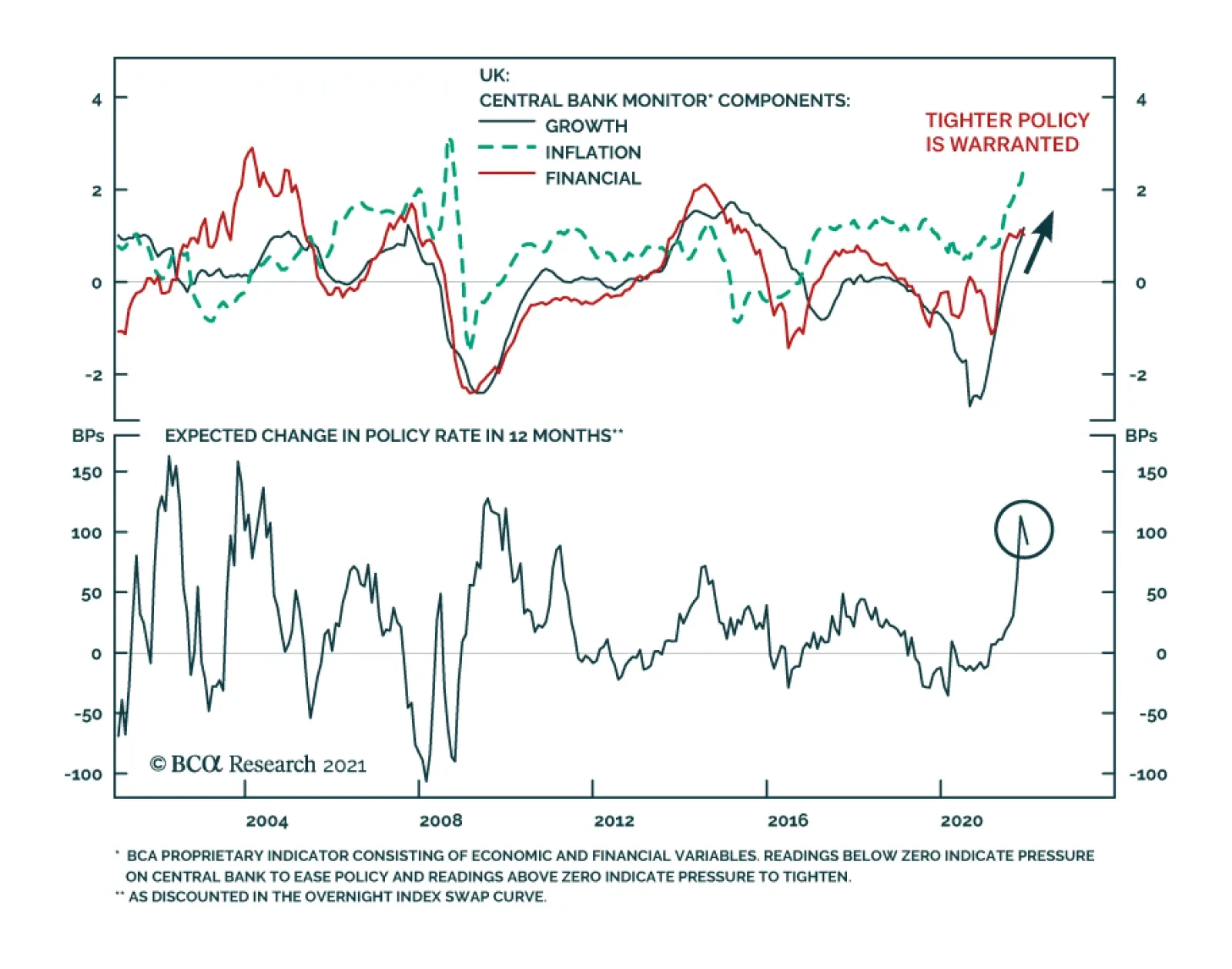

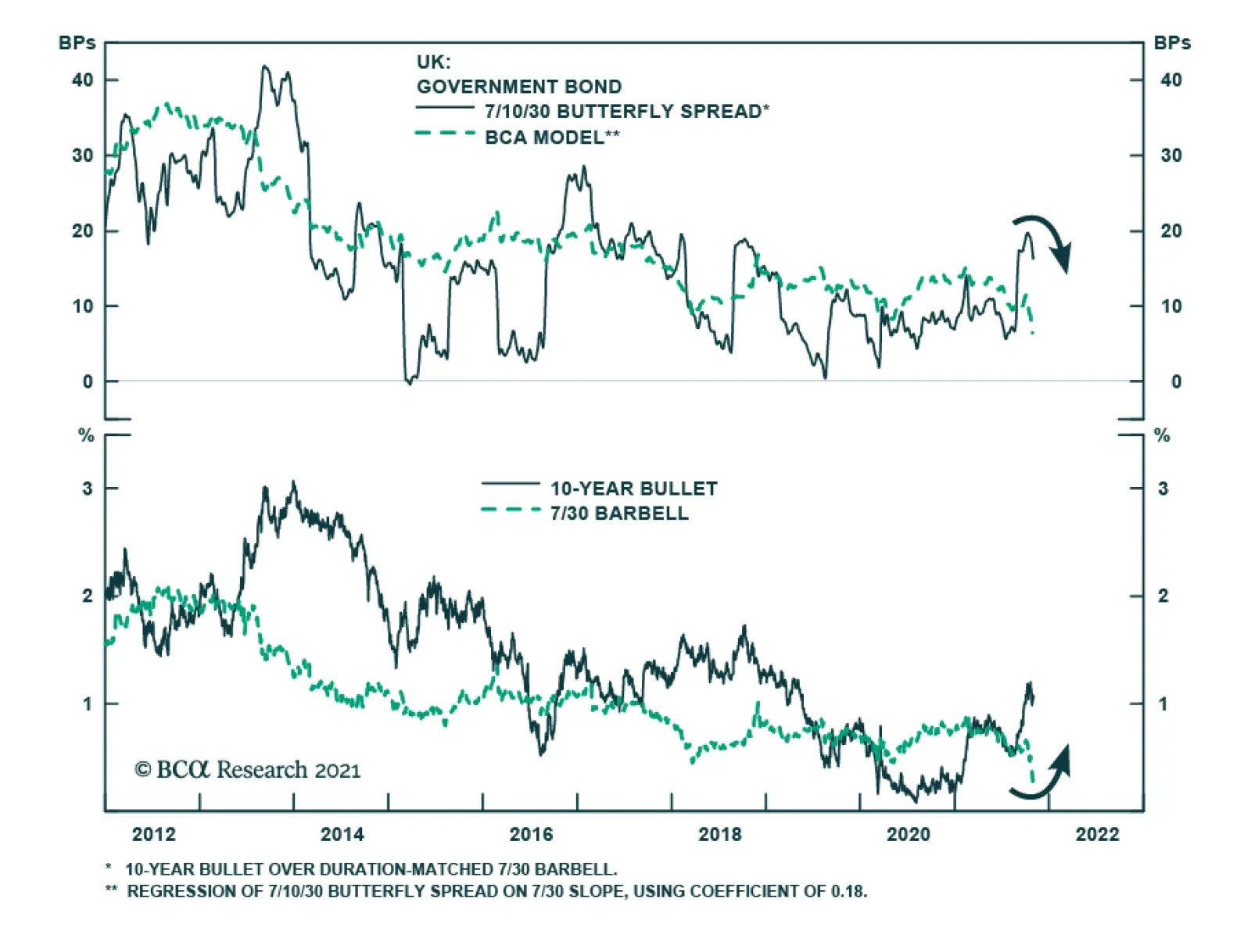

Market participants have been rolling back their rate hike expectations for the BoE. The emergence of the omicron variant and economic risks around tighter restrictions have only reinforced this trend. Meanwhile, UK Gilts have…

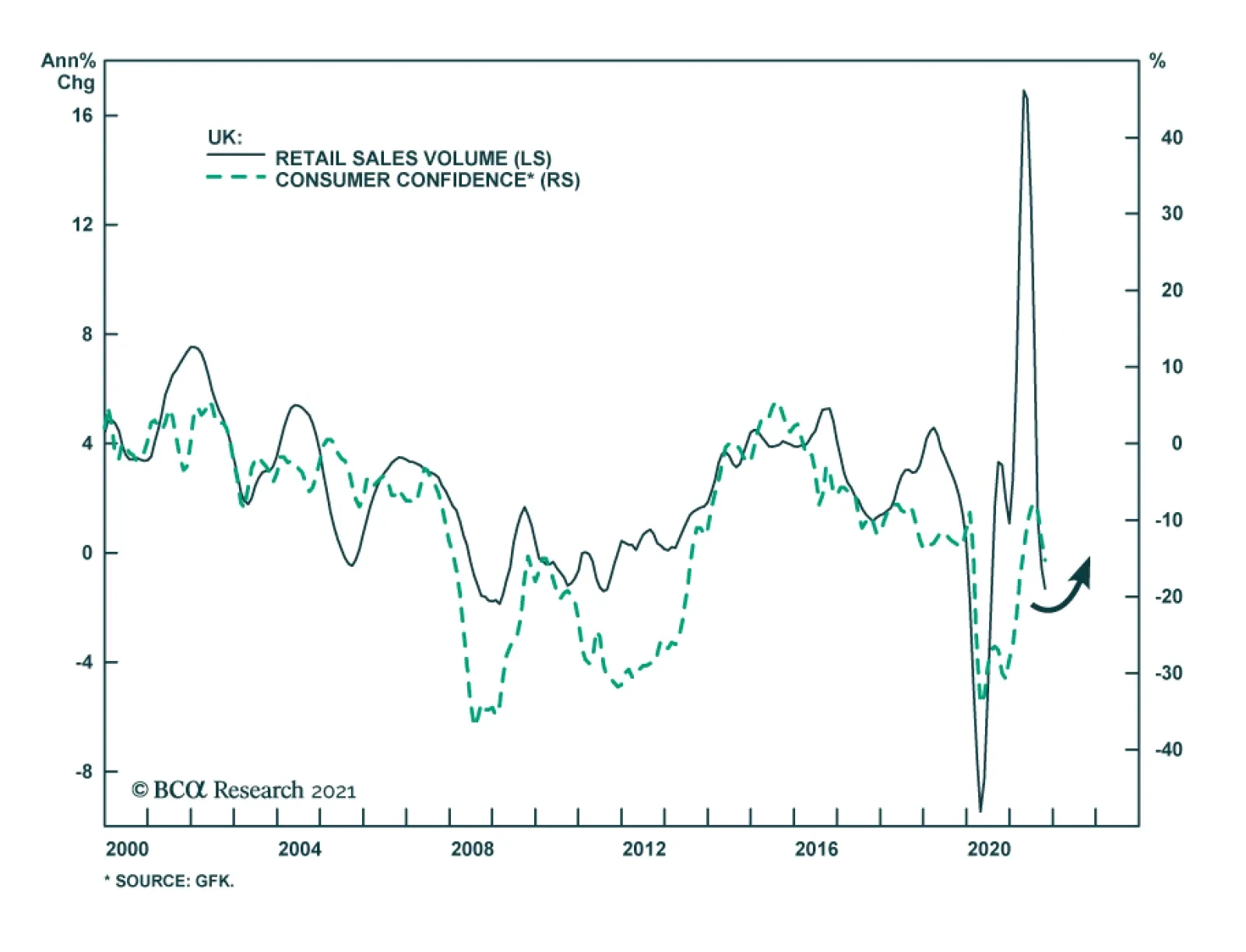

UK retail sales delivered a positive surprise in October. The headline index advanced 0.8% m/m, marking the first increase in six months and beating expectations of 0.5% m/m increase. Moreover, the GfK Consumer Confidence…

GBP has recently been outperforming. It is the only G10 currency to appreciate vis-à-vis the dollar over the past week which is a reversal of the downward trend from earlier this month. UK Gilt yields have also trended…

Dear Client, The next two BCA Research Global Fixed Income Strategy reports will be jointly published with other BCA services, which will impact the publishing dates. Our next report will be a joint Special Report on Australia,…

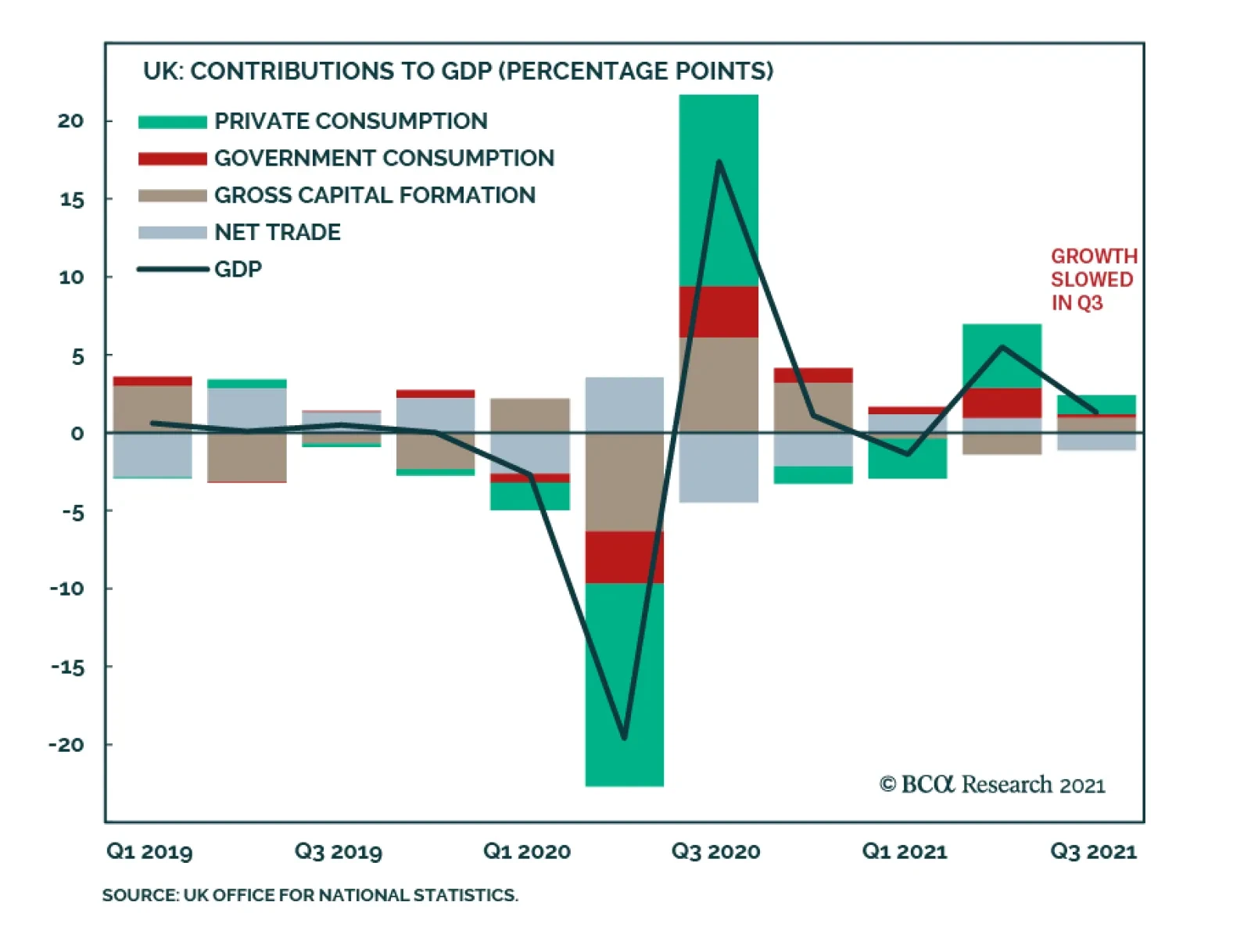

The UK economy decelerated in Q3 with the GDP print falling below expectations. Economic growth slowed from 5.5% to 1.3% q/q versus an anticipated 1.5% rate. Similarly, year-over-year growth moderated to 6.6% from 23.6%. However…

Highlights Fed/BoE: Both the Fed and the Bank of England found ways to talk down 2022 rate hike expectations discounted in US and UK bond markets. This is only a temporary reprieve, however, as the near-term uncertainties over the…

The Bank of England kept policy unchanged at its meeting on Thursday. The Monetary Policy Committee voted by a majority of 6-3 to maintain UK bond purchases and a majority of 7-2 to keep the Bank Rate at 0.1%. Governor Bailey…