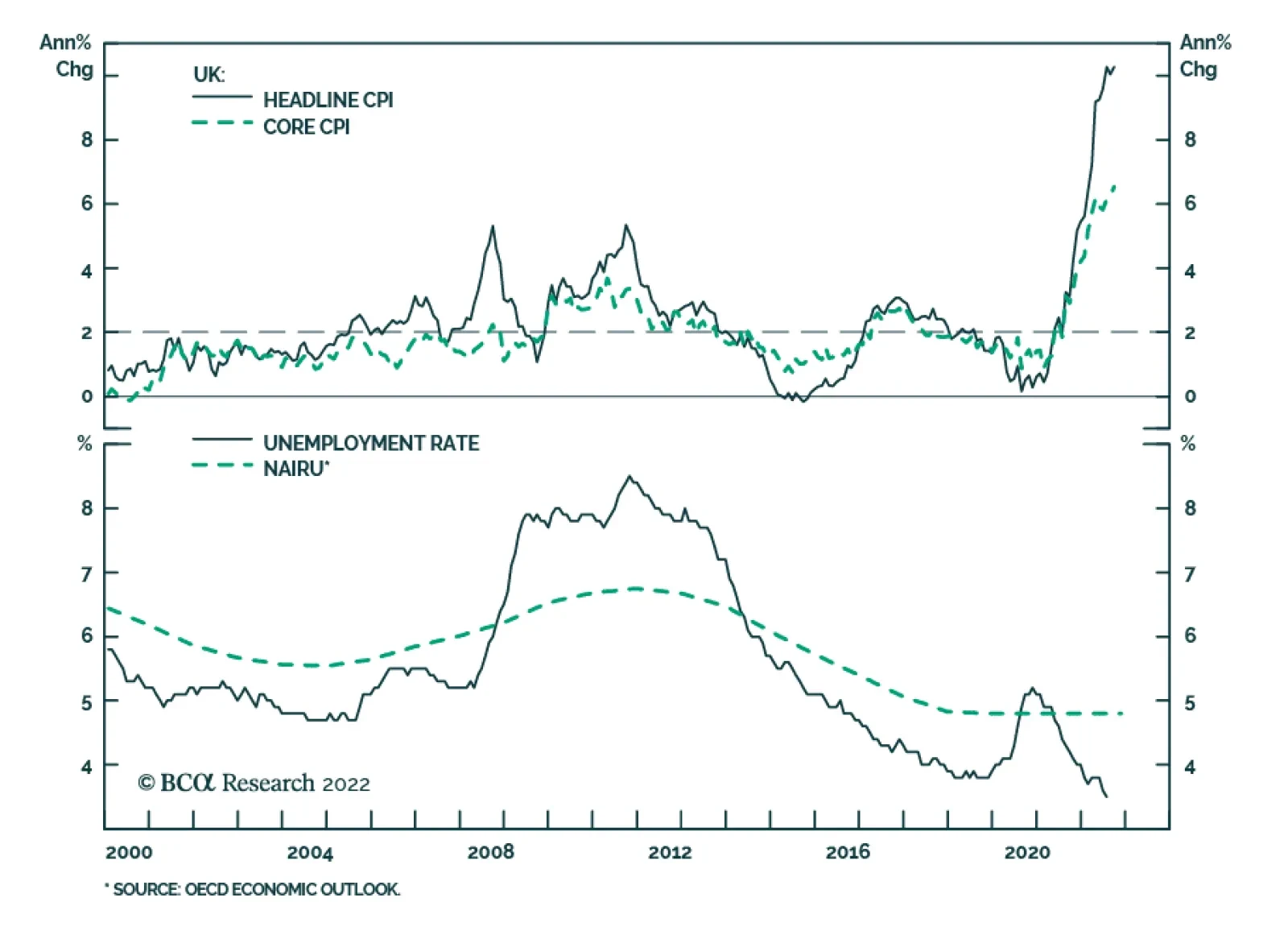

After moderating in August, UK CPI inflation firmed again in September, rising back up to its 40-year high of 10.1% y/y – slightly above expectations. Food and goods prices (particularly clothing and furniture &…

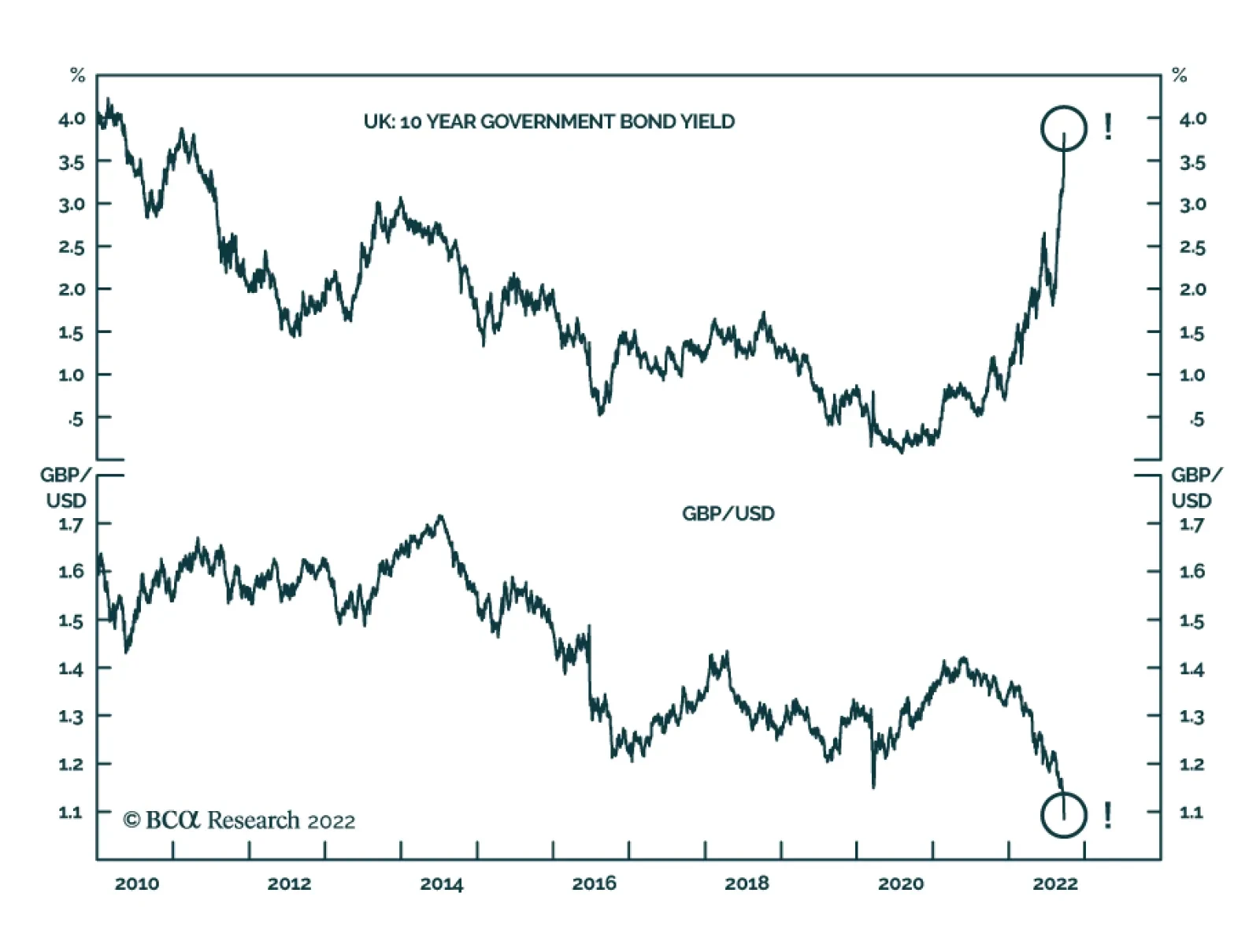

Is the US in a wage-price inflation spiral that could lead to more aggressive Fed rate hikes? Is it time to buy UK Gilts after a wild month of volatility? We answer "no" to both questions, as we discuss in this week’s report.

The ECB will continue to lift rates due to sticky inflation and a tight labor market. Will it be enough to push long-term German yields higher?

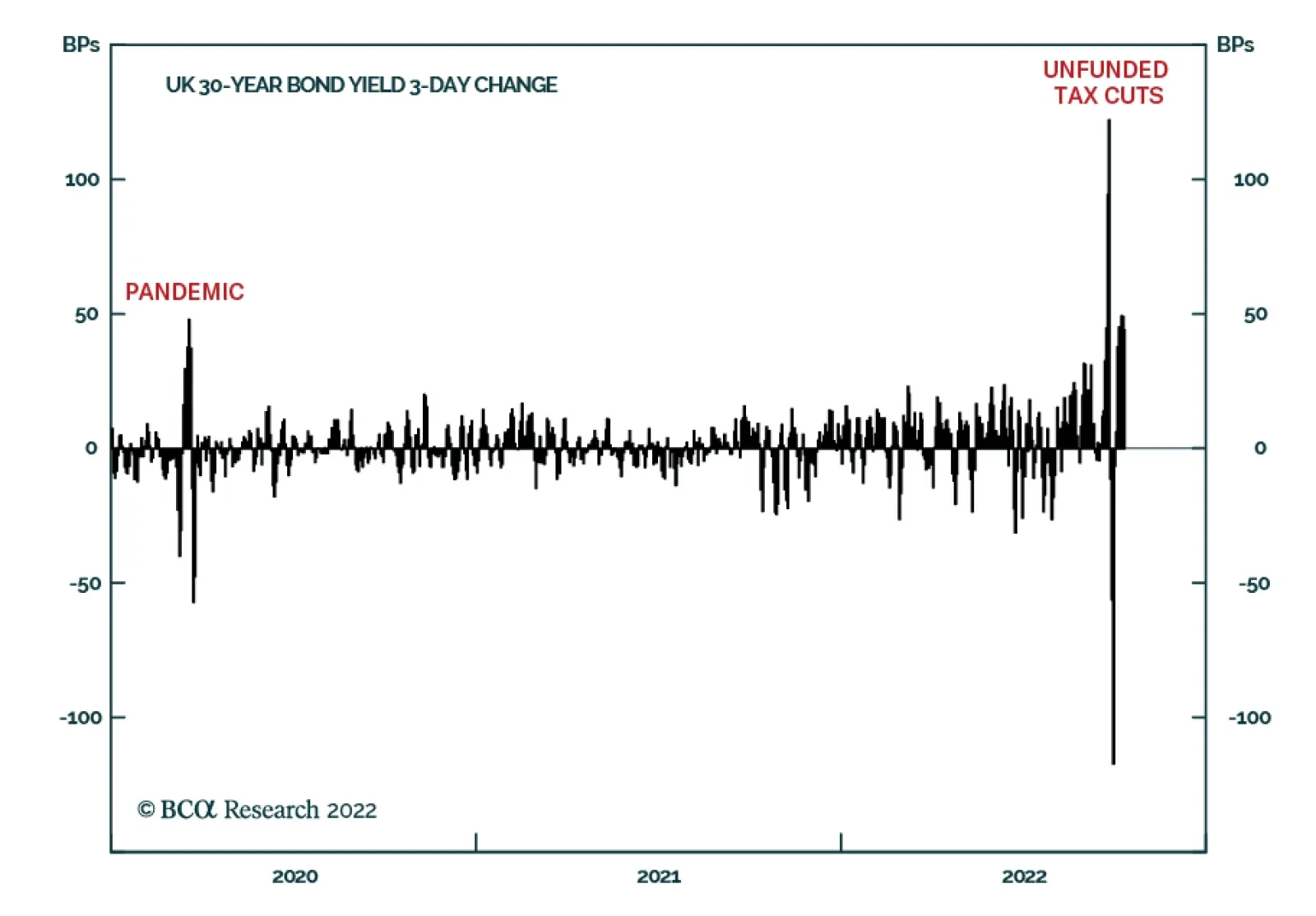

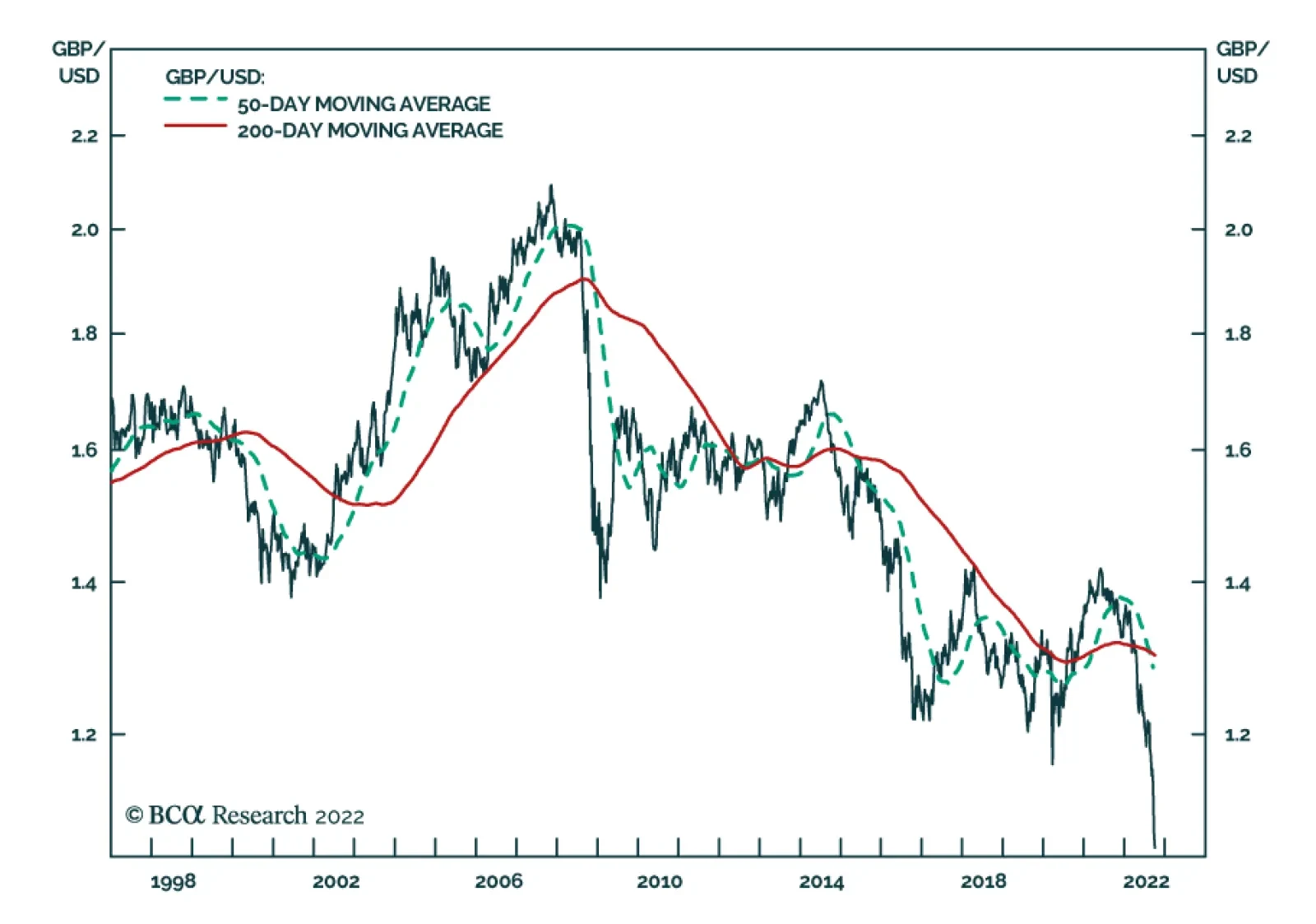

According to BCA Research’s Counterpoint service, the UK’s near death experience sends three salutary warnings to all investors. Warning 1: Beware ‘Hidden Leverage’ Hidden leverage is not unique…

Is the BoE’s emergency intervention in its bond market a British idiosyncrasy that global investors can ignore? No, the UK’s near death experience sends three salutary warnings, with implications for all investors.

This week’s Global Investment Strategy report titled Fourth Quarter 2022 Strategy Outlook: A Three-Act Play discusses the outlook for the global economy and financial markets for the rest of 2022 and beyond.

Executive Summary For the first time in a decade, it is much less attractive to buy than to rent a home. In both the UK and US, the mortgage rate is now almost double the average rental yield. To reset the equilibrium between buying…

Sterling collapsed to an all-time low in intra-day trading on Monday. The weakness follows UK Chancellor Kwasi Kwarteng’s Friday mini-budget announcement and weekend comments that more tax cuts are coming. The Bank of…

In its post-meeting statement on Thursday, the Bank of England highlighted that the MPC is prepared to “respond forcefully” to any changes to the inflationary outlook. On Friday, the new UK government unveiled a…