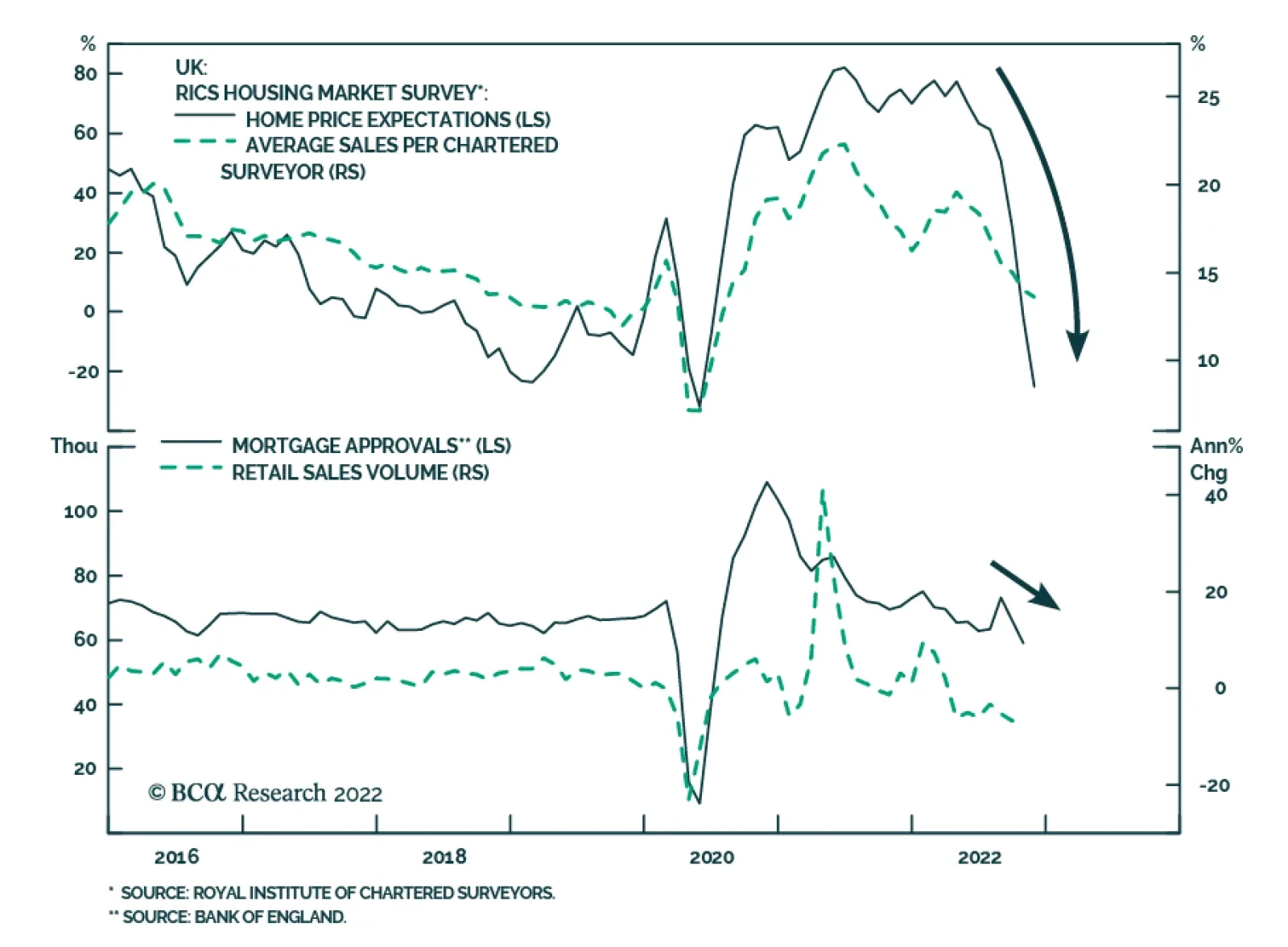

The UK Royal Institution of Chartered Surveyors’ (RICS) house price net balance – which is calculated as the difference between the share of property surveyors expecting house prices to increase and those that expect…

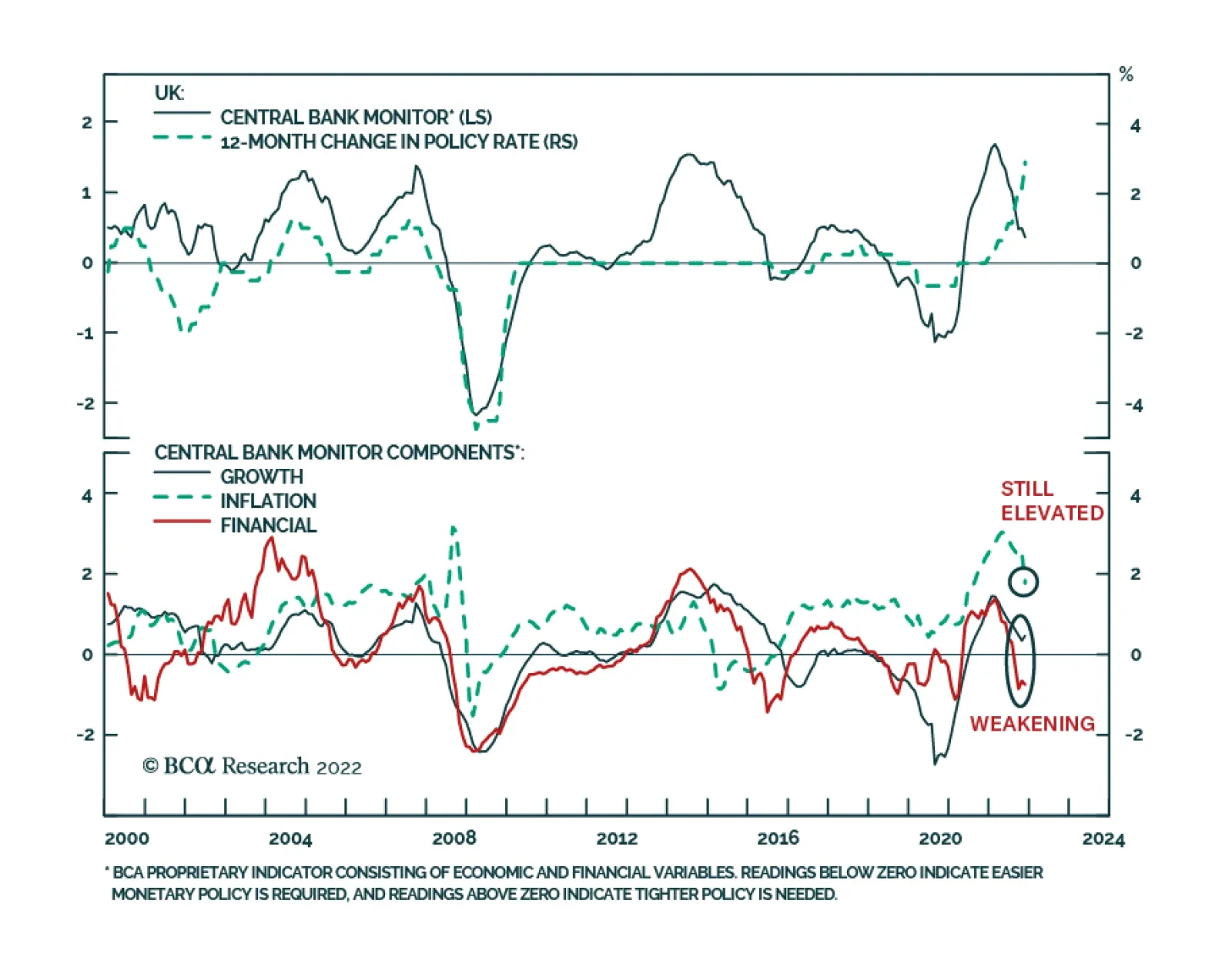

Price pressures remain intense in the UK. Headline CPI inflation jumped from 10.1% y/y to a 41-year high of 11.1% in October – surpassing expectations of a milder acceleration to 10.7%. Similarly, the month-on-month rate…

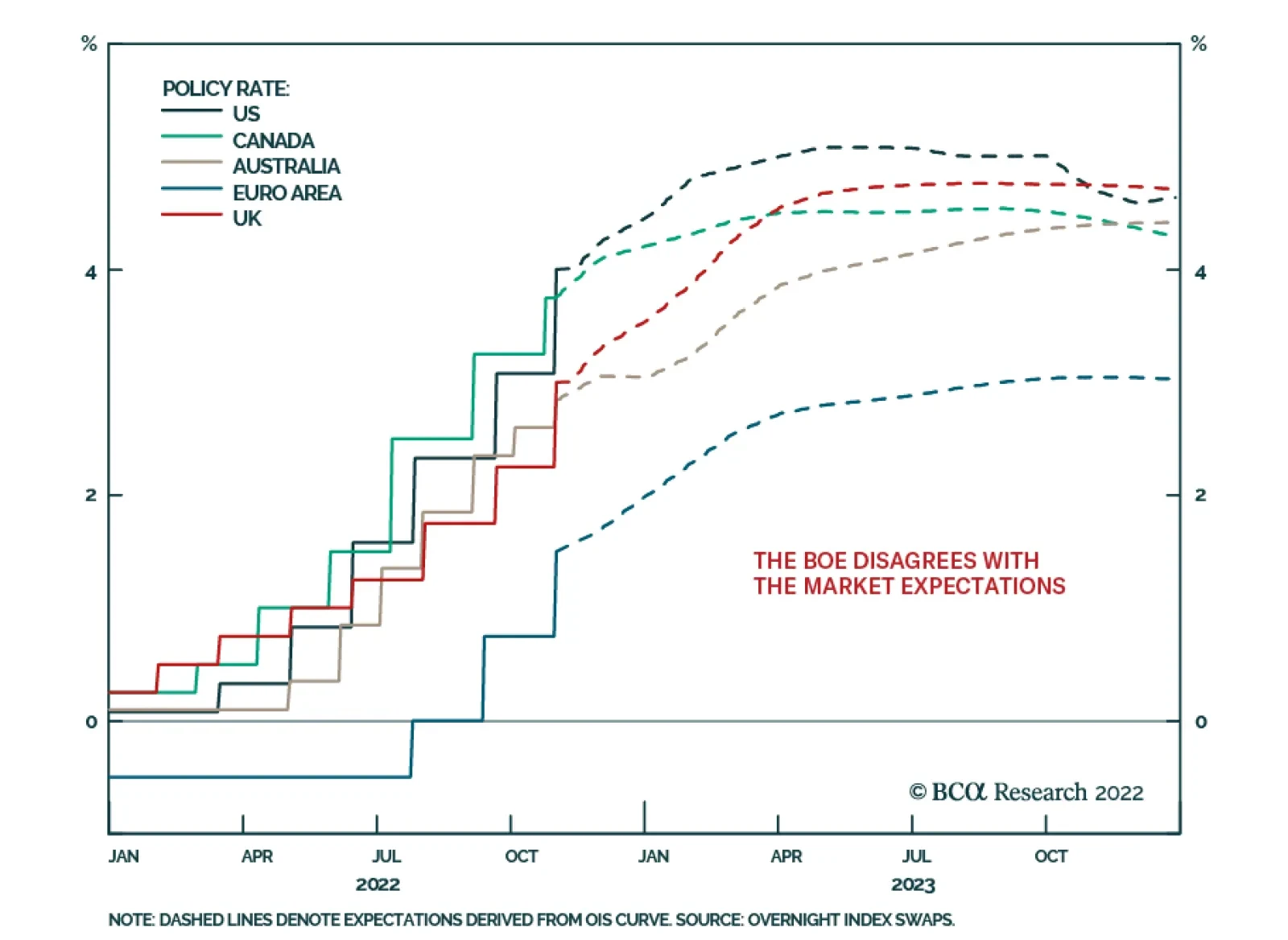

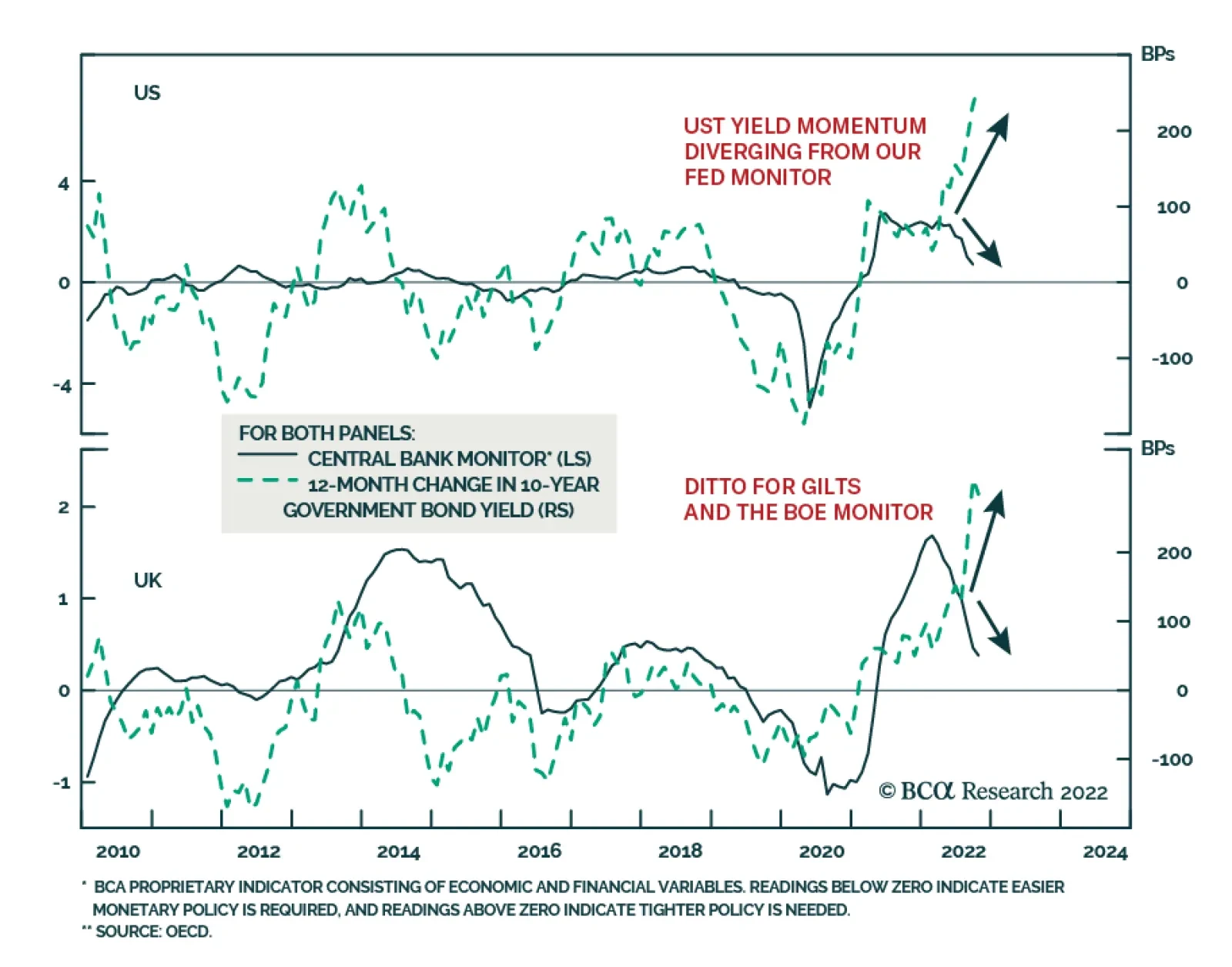

Central banker messaging after the latest rate hike announcements in the US, UK and Australia indicates a shift in focus from the pace of hikes to how high rates must rise to slow growth and bring down inflation. This represents the…

Europe is hampered by a lower trend growth rate, but has room to grow faster than the US over the next two years. How can investors profit from this outlook?

As anticipated, the Bank of England raised the Bank Rate by 75bps to 3% on Thursday. The decision marks the largest interest rate hike in 33 years and brings the cost of borrowing to a 14-year high. Notably, seven of the nine MPC…

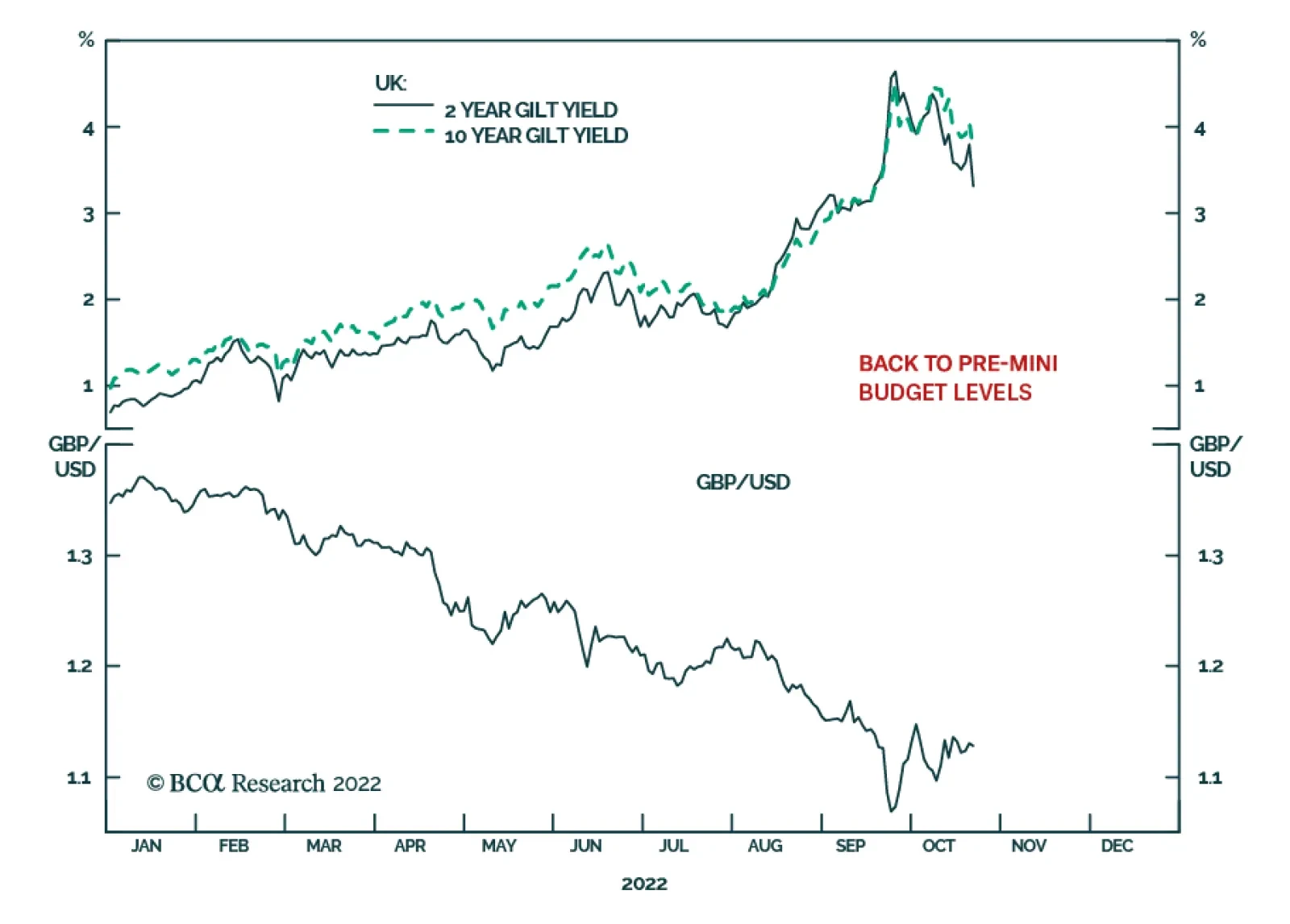

On Monday, UK Gilts rallied on news that former Chancellor of the Exchequer Rishi Sunak is the new leader of the Conservative Party. The 10-year yield fell by 31bps while the 2-year yield ended the day 24bps lower – levels…

BCA Research’s Global Fixed Income Strategy service continues to recommend underweight allocations to US Treasuries and UK Gilts in global bond portfolios, while targeting a below-benchmark overall global duration exposure…