Financial markets were taken on a wild ride between Wednesday and Friday of this week, with hugely important monetary policy meetings in the US, euro area and UK along with a rash of economic data. Despite all the news, noise and…

The ECB and the BoE provided a comforting signal to markets that the end of the respective tightening campaigns is coming before the summer. In the process, they are closing their hawkishness gap relative to the Fed.

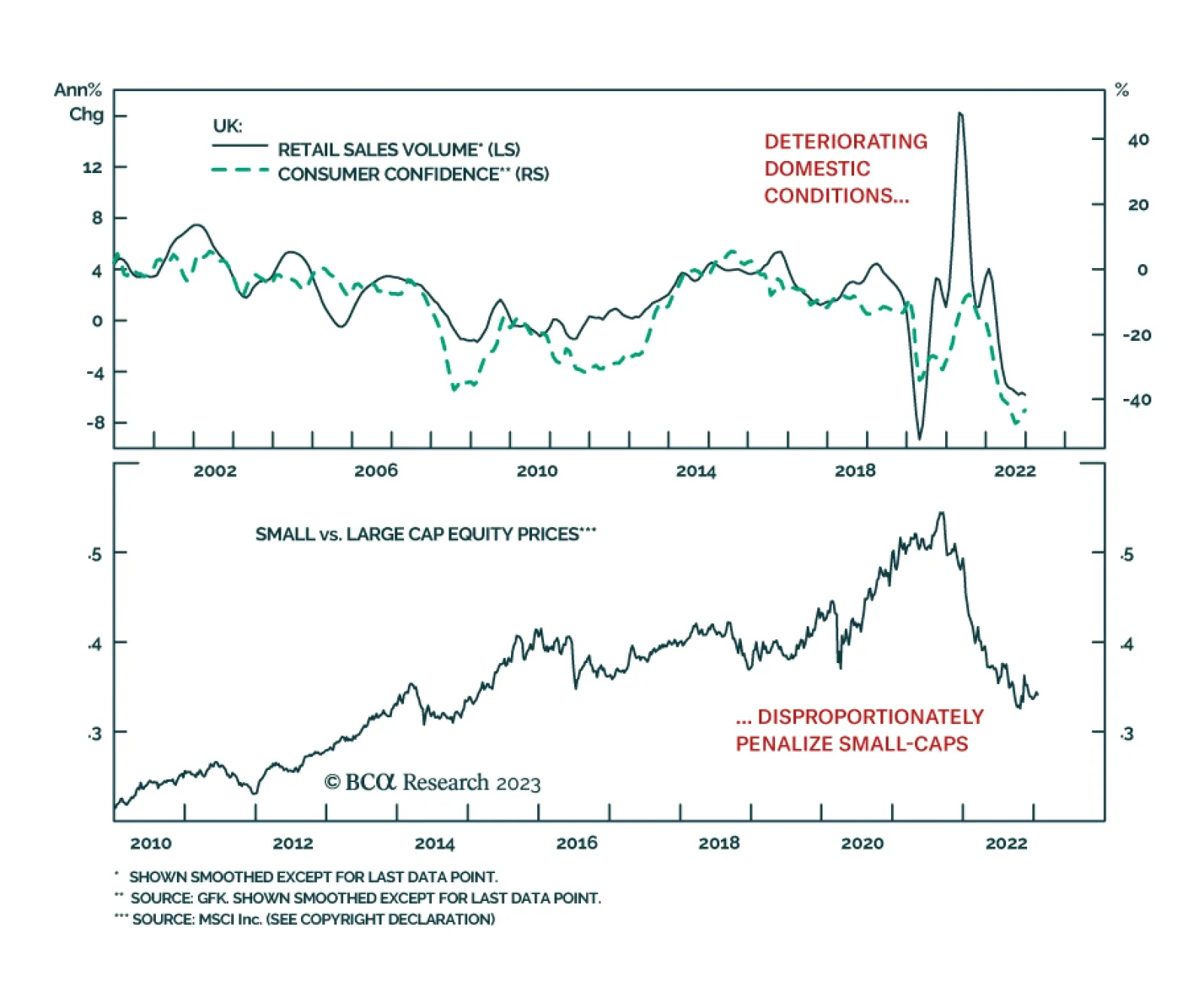

The volume of retail sales in the UK unexpectedly declined by 1.0% m/m (5.8% y/y) in December, disappointing expectations it would rebound following November’s 0.5% m/m contraction. Lower sales of cosmetics, sports…

While the housing downturn will be fairly mild in the US, it will be more severe abroad. Continue to favor bonds of countries whose housing fundamentals will limit rate hikes.

In this, our final report of a tumultuous year, we summarize our policy outlook for the “Big 4” central banks – the Fed, the ECB, the Bank of England (BoE) and the BoJ – and the associated bond market implications for 2023.

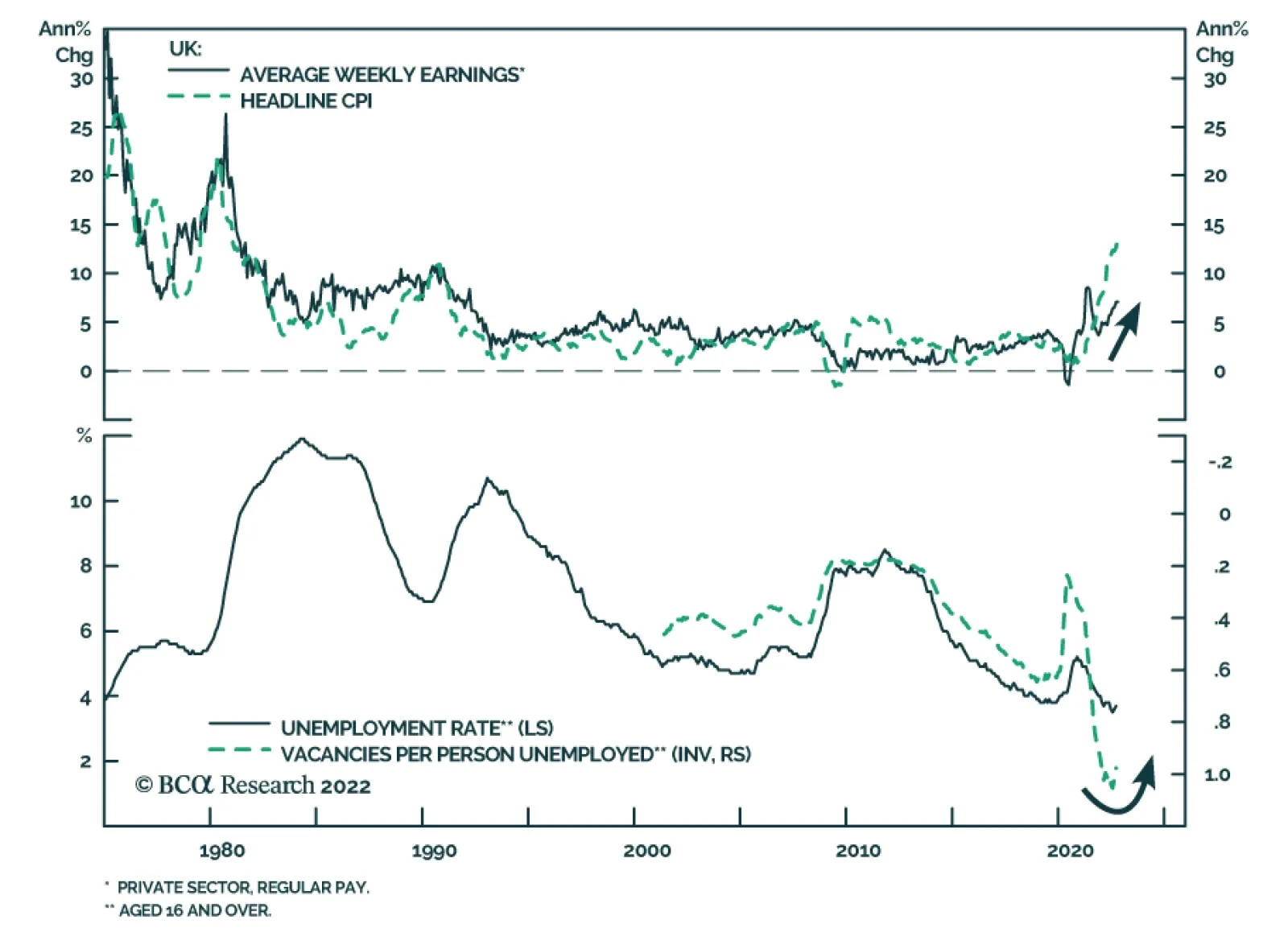

Conflicting forces are dominating the UK labor market. Data released on Tuesday revealed that the unemployment rate ticked up from 3.6% to 3.7% in the three months to October (the second consecutive increase), providing some…

In this Strategy Outlook, we present the major investment themes and views we see playing out next year and beyond.