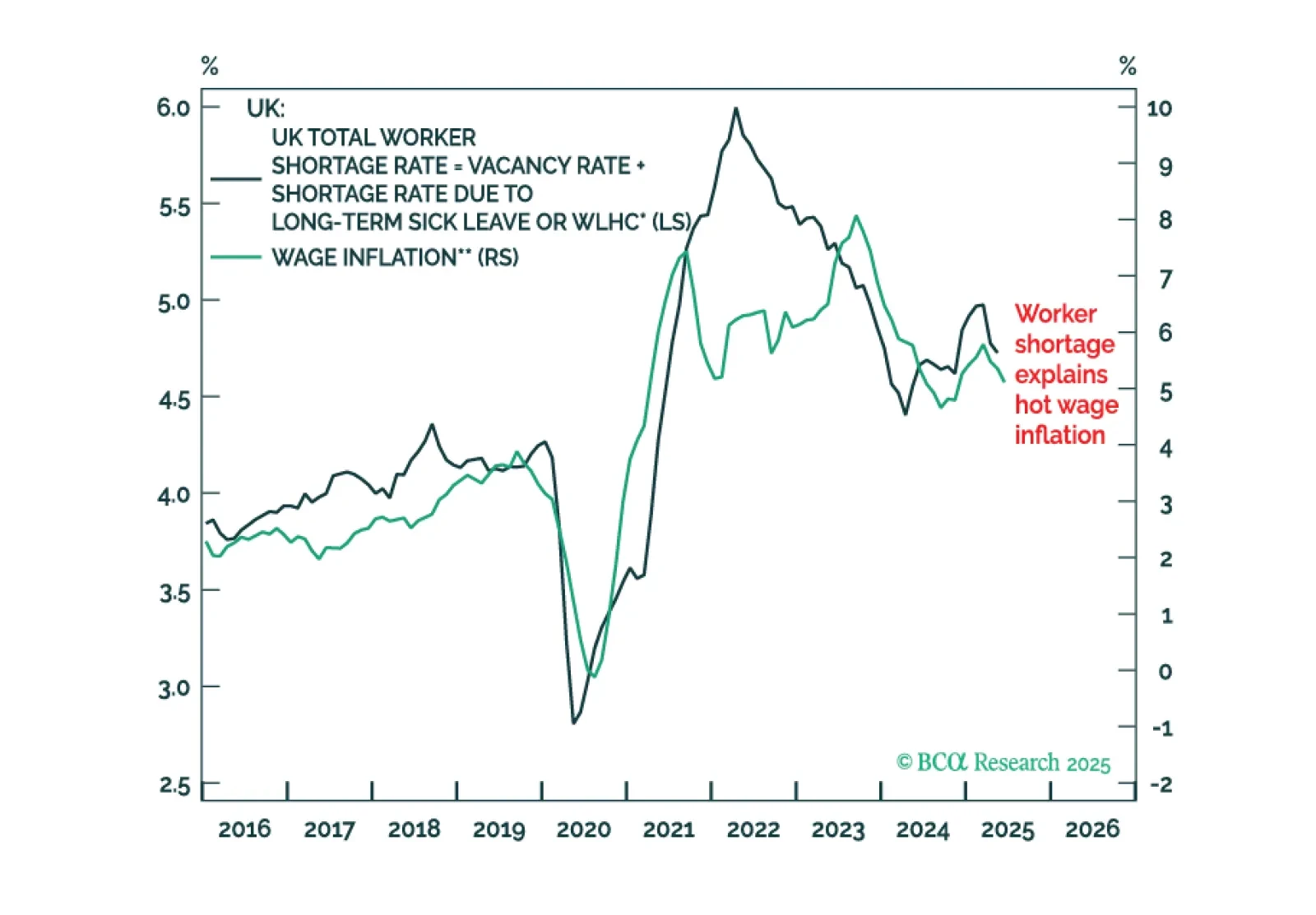

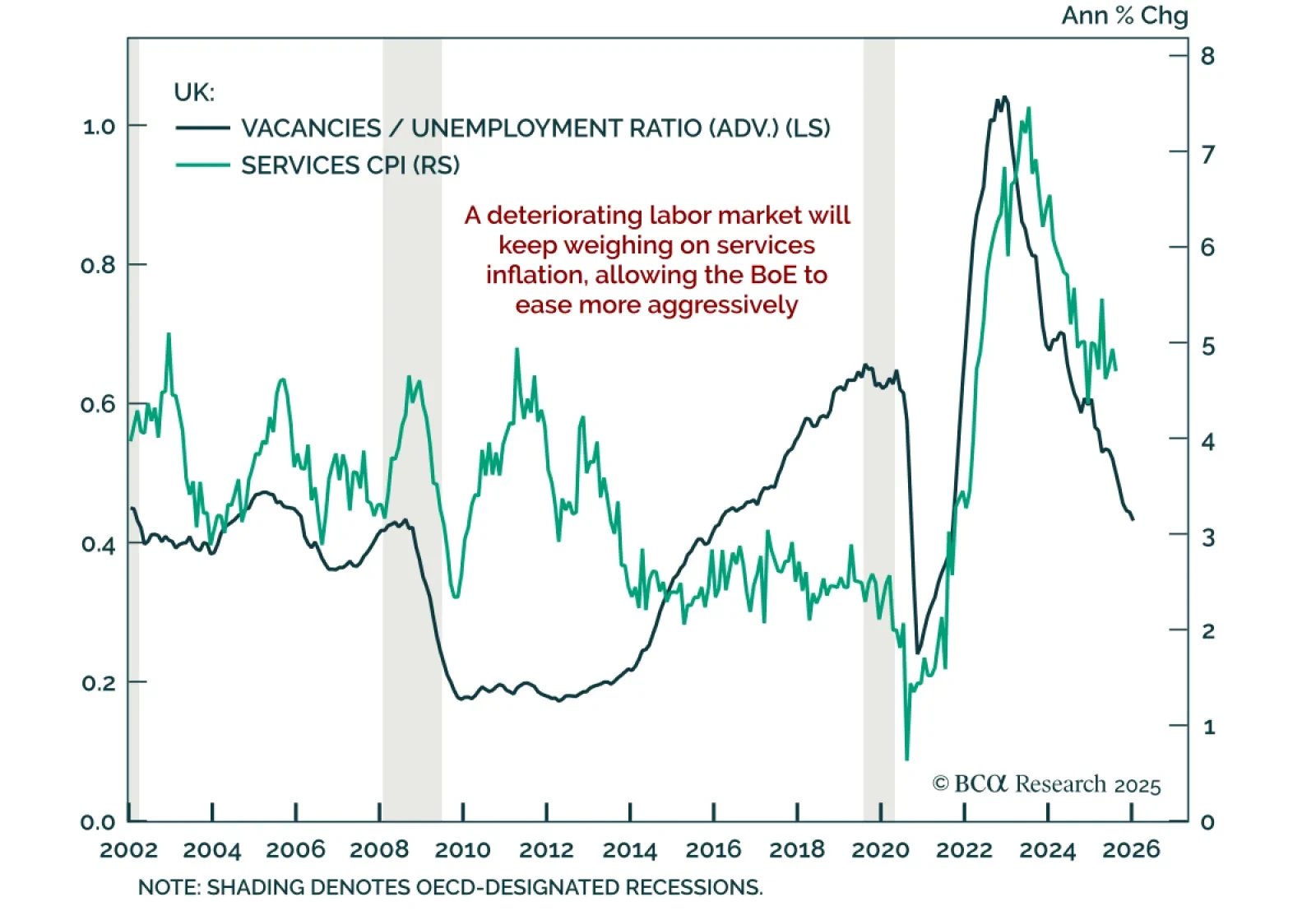

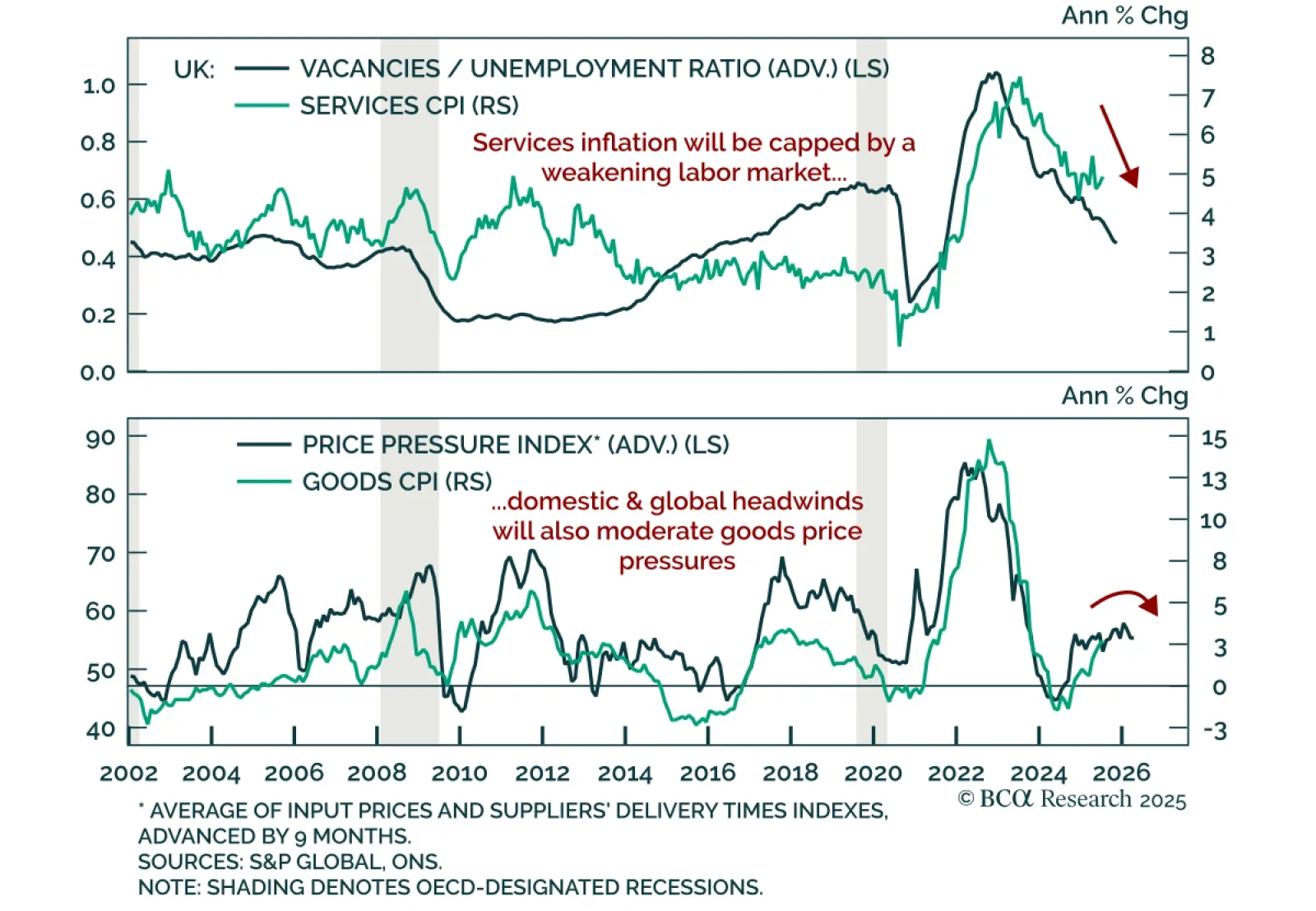

UK labor data weakened in August and September, reinforcing downside inflation risks and supporting overweight Gilts with 2s10s steepeners. Payrolls fell by 10k in September, while job vacancies continued to slide to cyclical lows as…

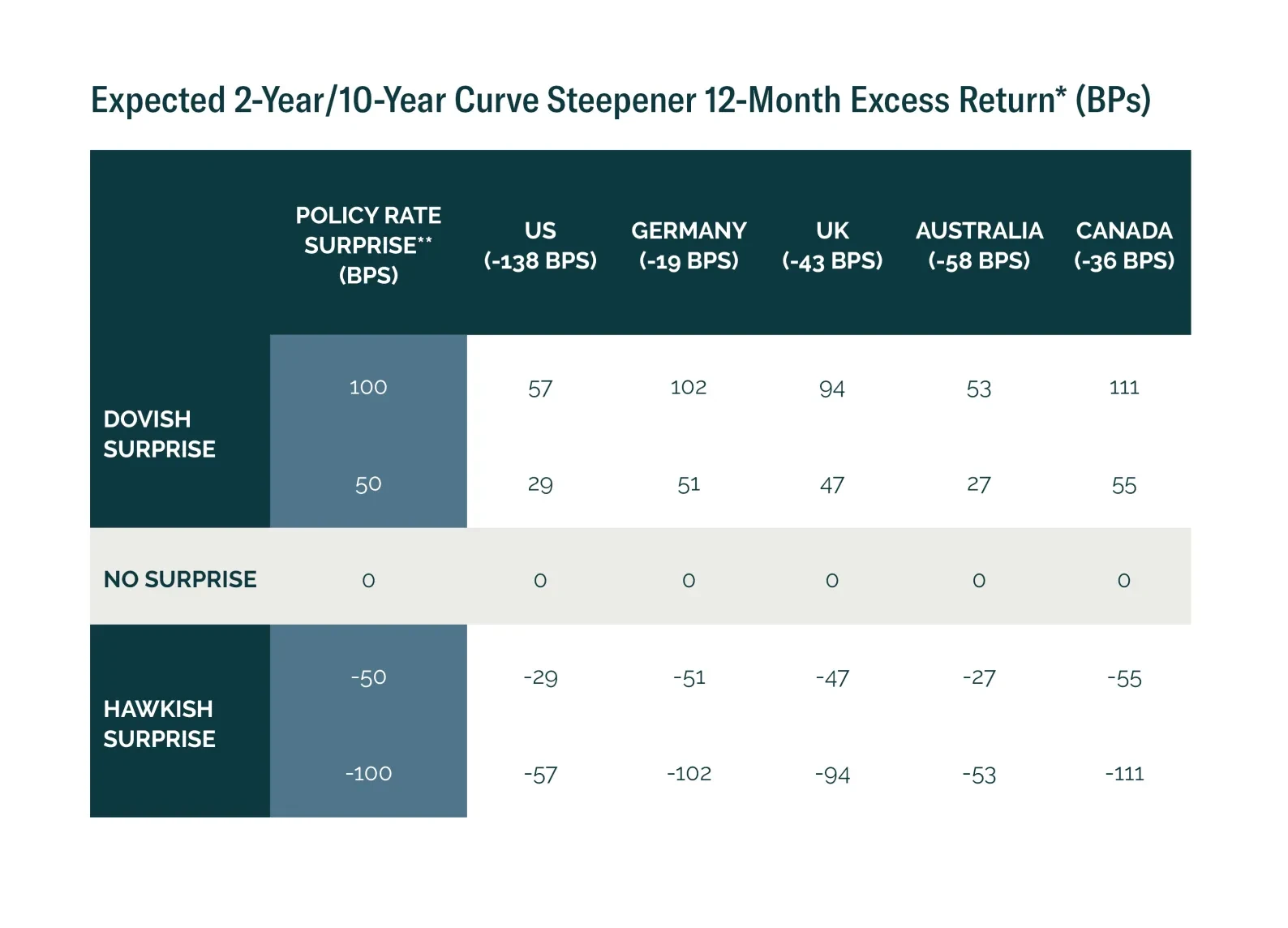

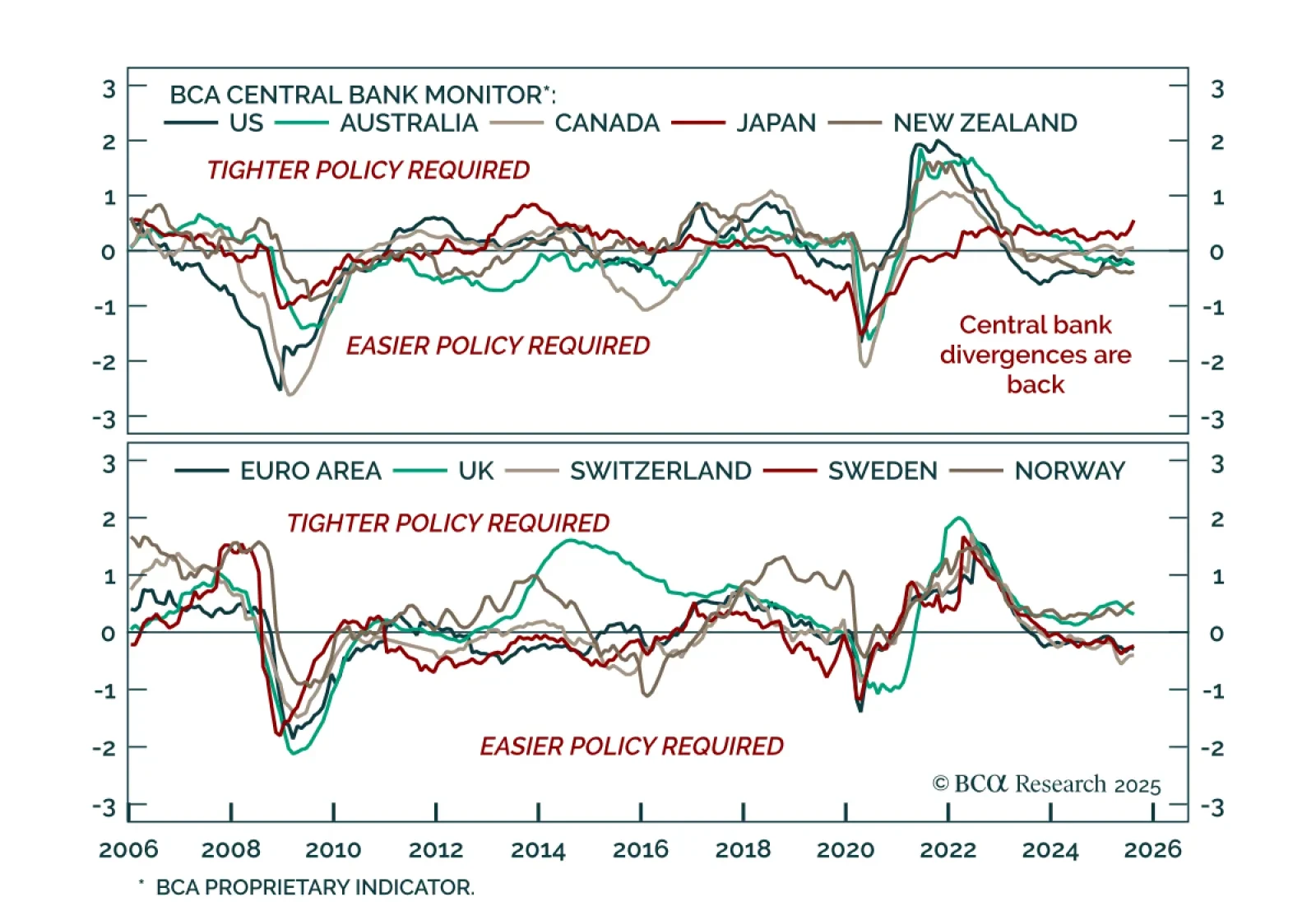

Despite concerns about fiscal sustainability, a rise in term premia, and attacks on central bank independence, monetary policy remains the primary driver of bond markets. In our Q3 Review & Outlook, we update our views and…

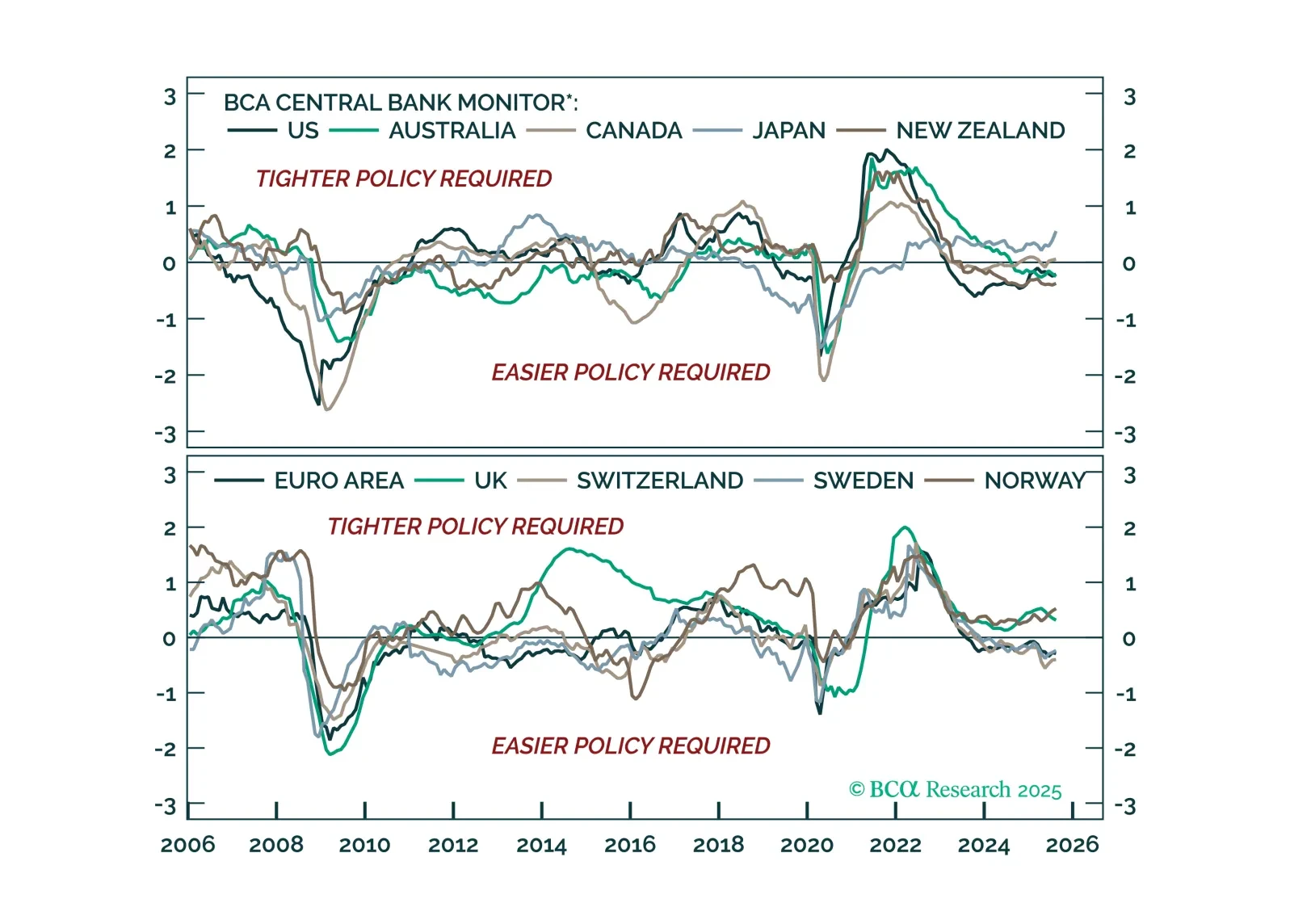

Our DM strategists recommend regional bond overweights in the UK, Canada, and Sweden, and express policy divergence through tactical FX trades: long USD, underweight GBP and SEK, and long JPY vs. EUR. Most G10 central banks are…

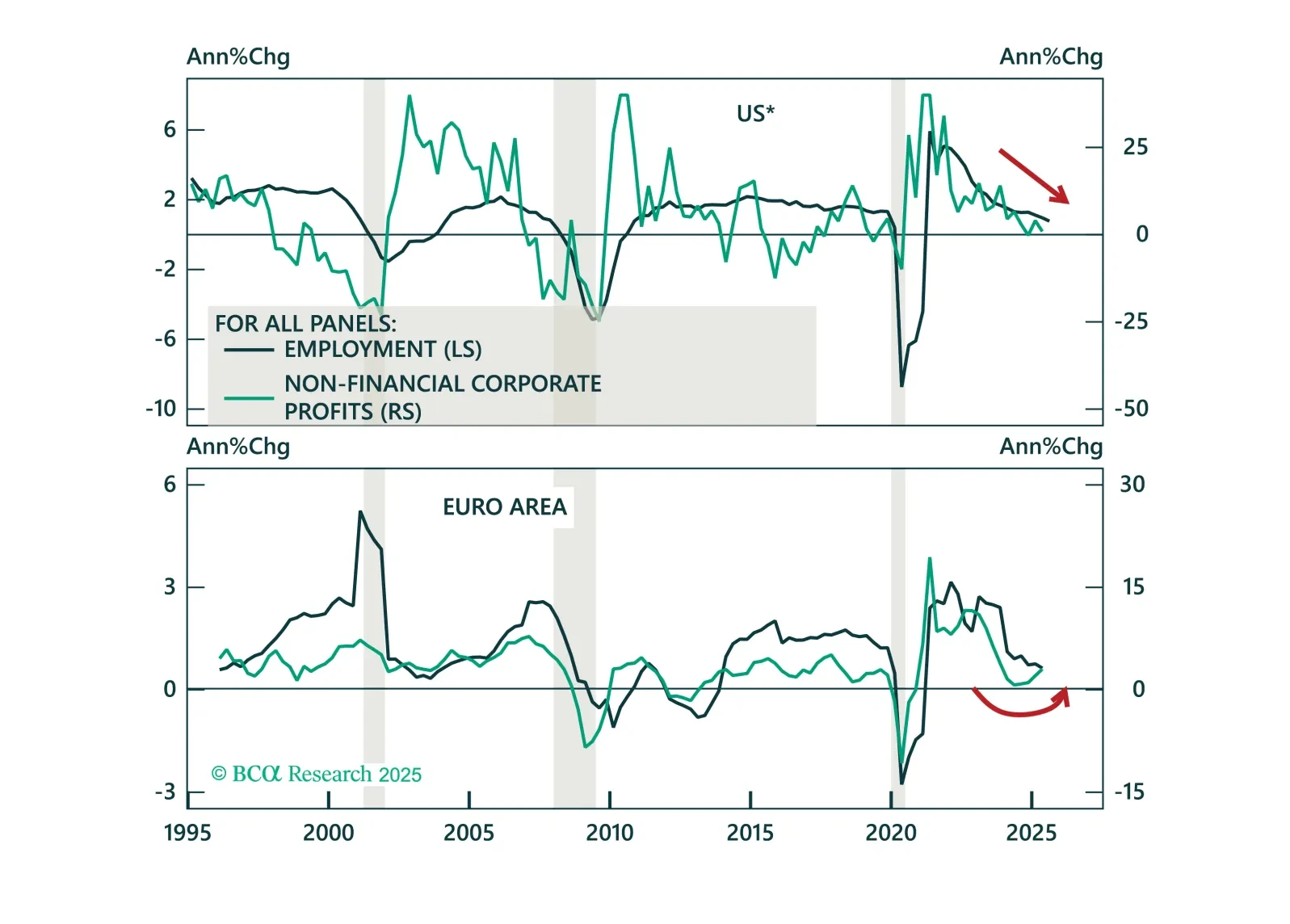

Monetary policy divergences are re-emerging. We rely on BCA’s Central Bank Monitor to assess the current policy stance of major central banks, and highlight the tactical opportunities across bond markets and currencies.

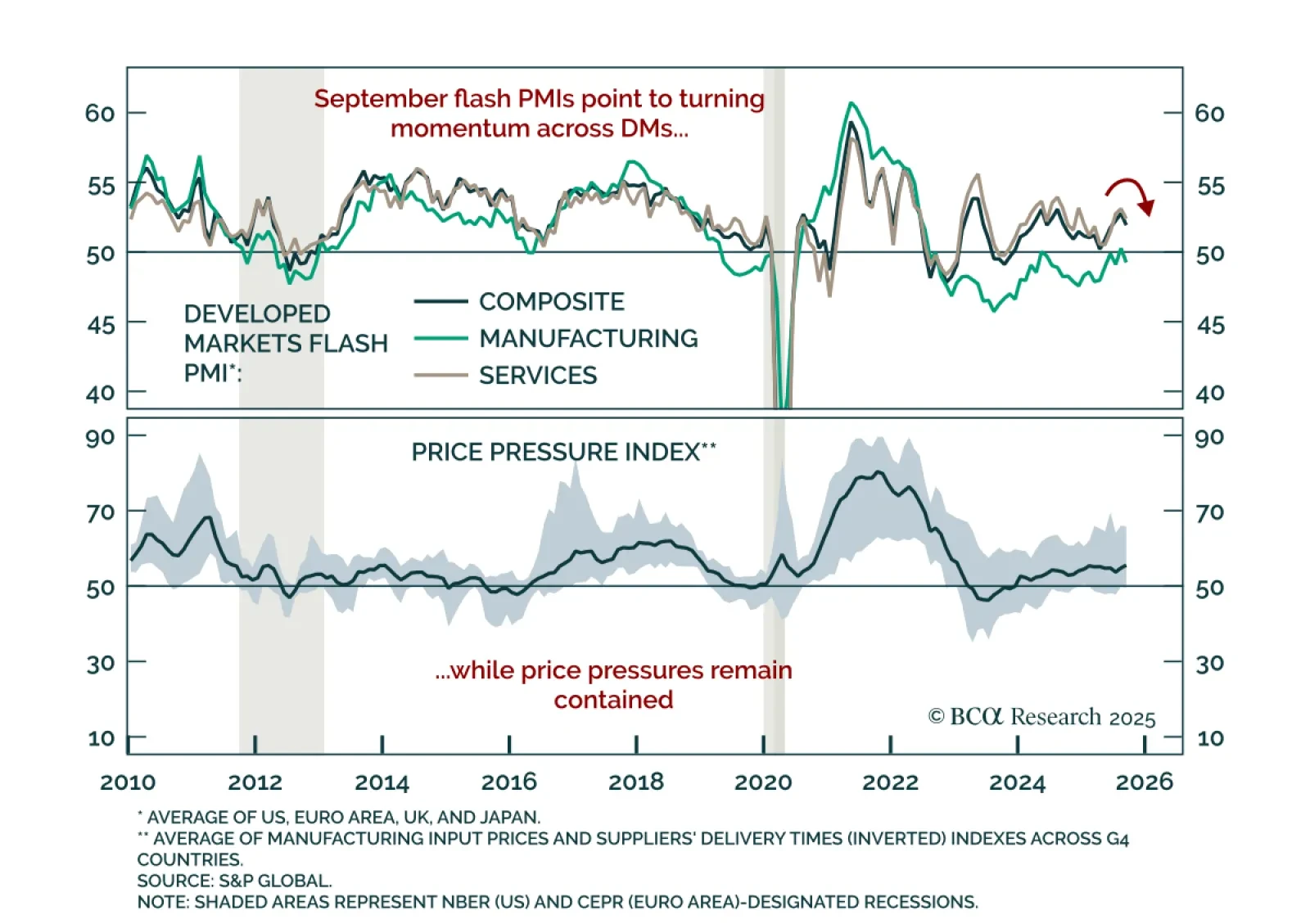

September flash PMIs show slowing global momentum, reinforcing US equity outperformance and underweights in industrial metals. The US composite slipped to 53.6 from 54.6, led by weaker manufacturing. Europe was mixed: Services…

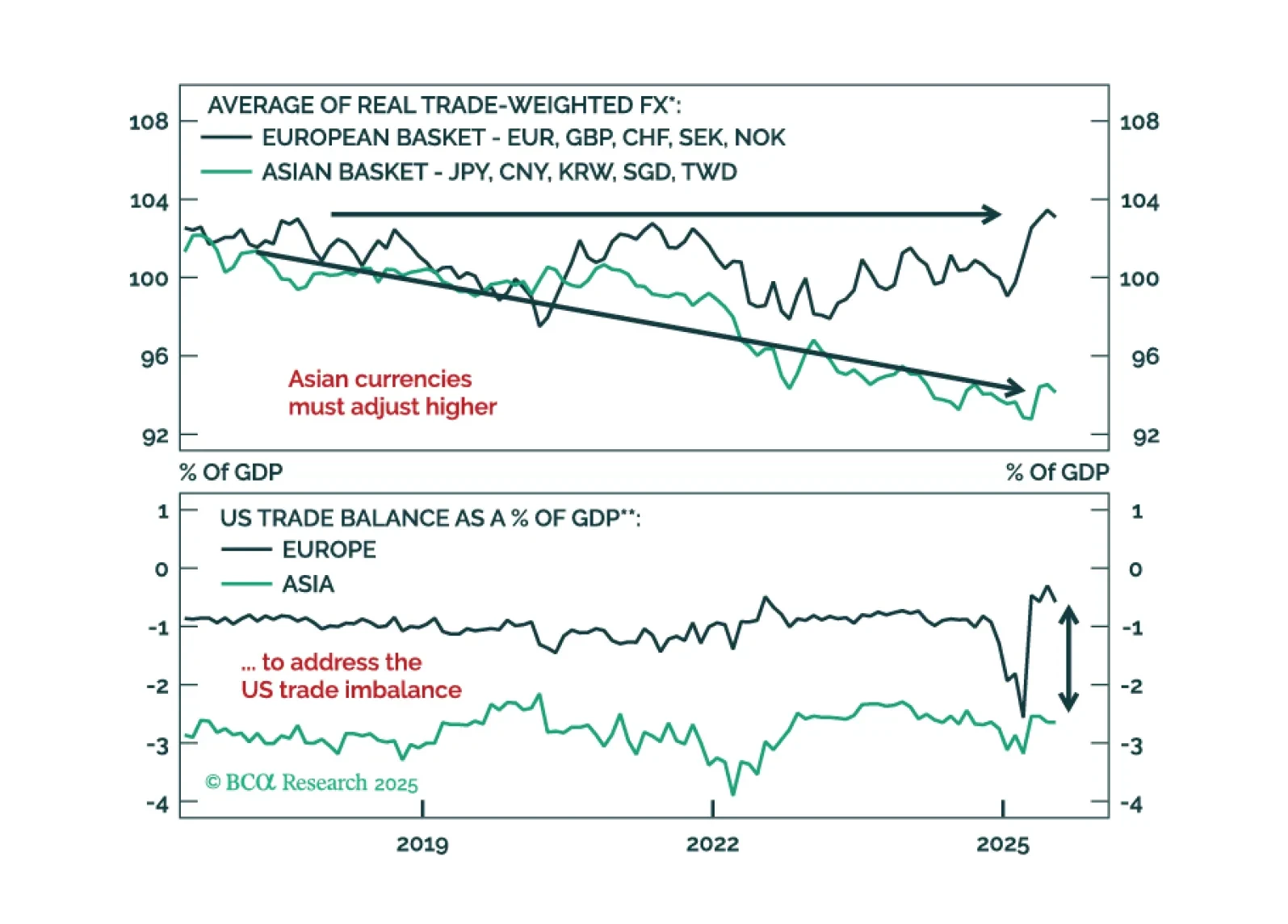

A fleeting greenback rally post Fed rate cut will offer a final chance to reset short dollar exposures. See why undervalued Asian FX are poised to lead the next leg lower in USD and how to position now.

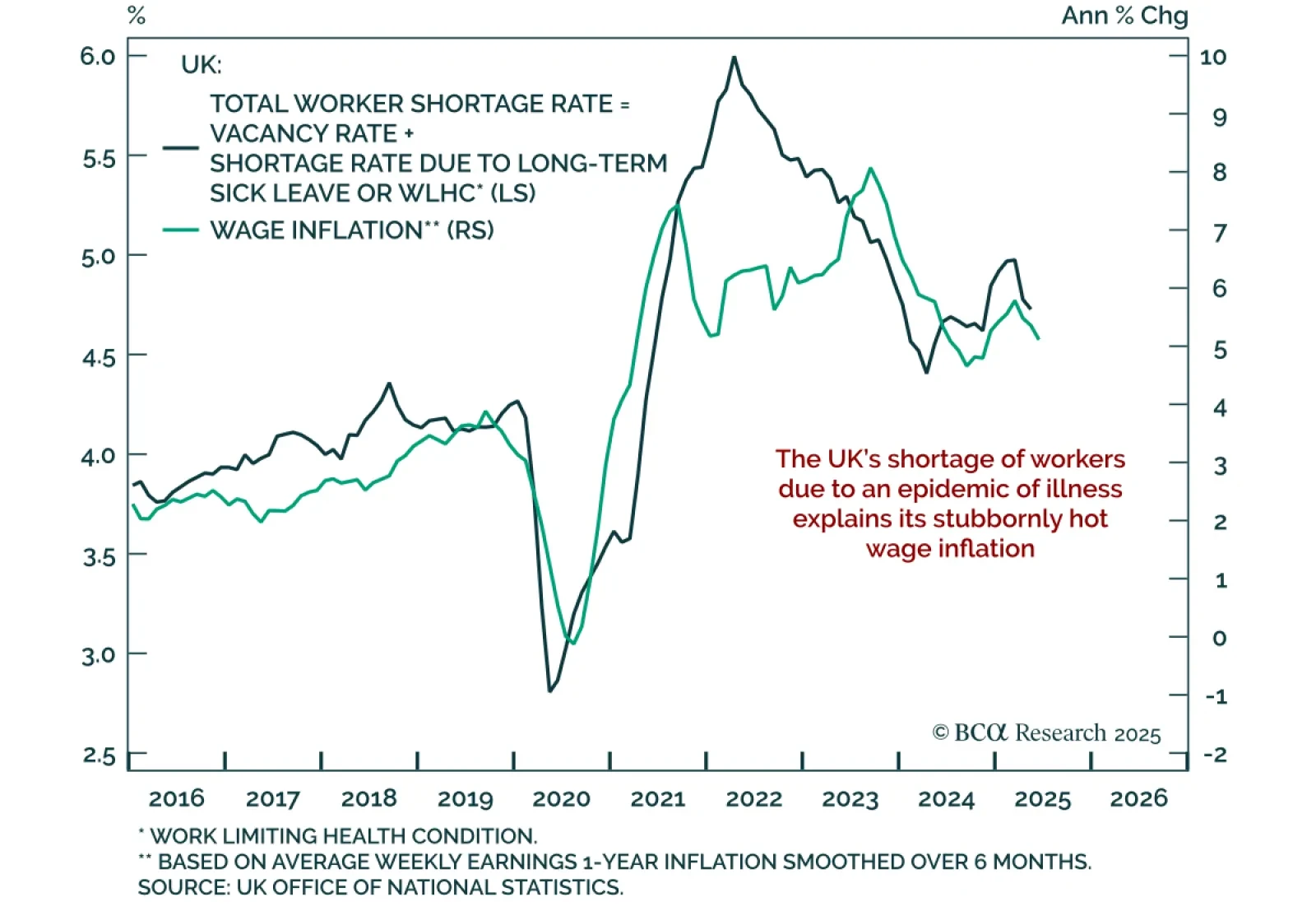

Our Counterpoint strategists recommend a structural overweight in GBP/USD and UK gilts relative to US Treasuries, and a tactical short in China’s CSI 300. Our colleagues argue a sharp rise in long-term sickness and disability has…

Hot July inflation does not alter the weakening UK backdrop, keeping Gilts attractive and GBP vulnerable. Headline CPI rose 0.1% m/m, lifting y/y inflation to 3.8% from 3.6%, while core ticked up to 3.8% from 3.7%. Services…