The change in the BoE’s tone has likely altered the path for sterling. In this report, we explore if the BoE’s lens for monetary policy is justified, and provide some targets for the pound.

At 3.8%, the yield on 10-year UK Gilts is now back near where it was in early March. This marks a round-trip after the yield fell to as low as 3.3% in the weeks following the emergence of bank stress in the US and Europe.…

Macro and geopolitical risks may spoil the narrow window for a stock market rally before recessionary trends rise to the fore.

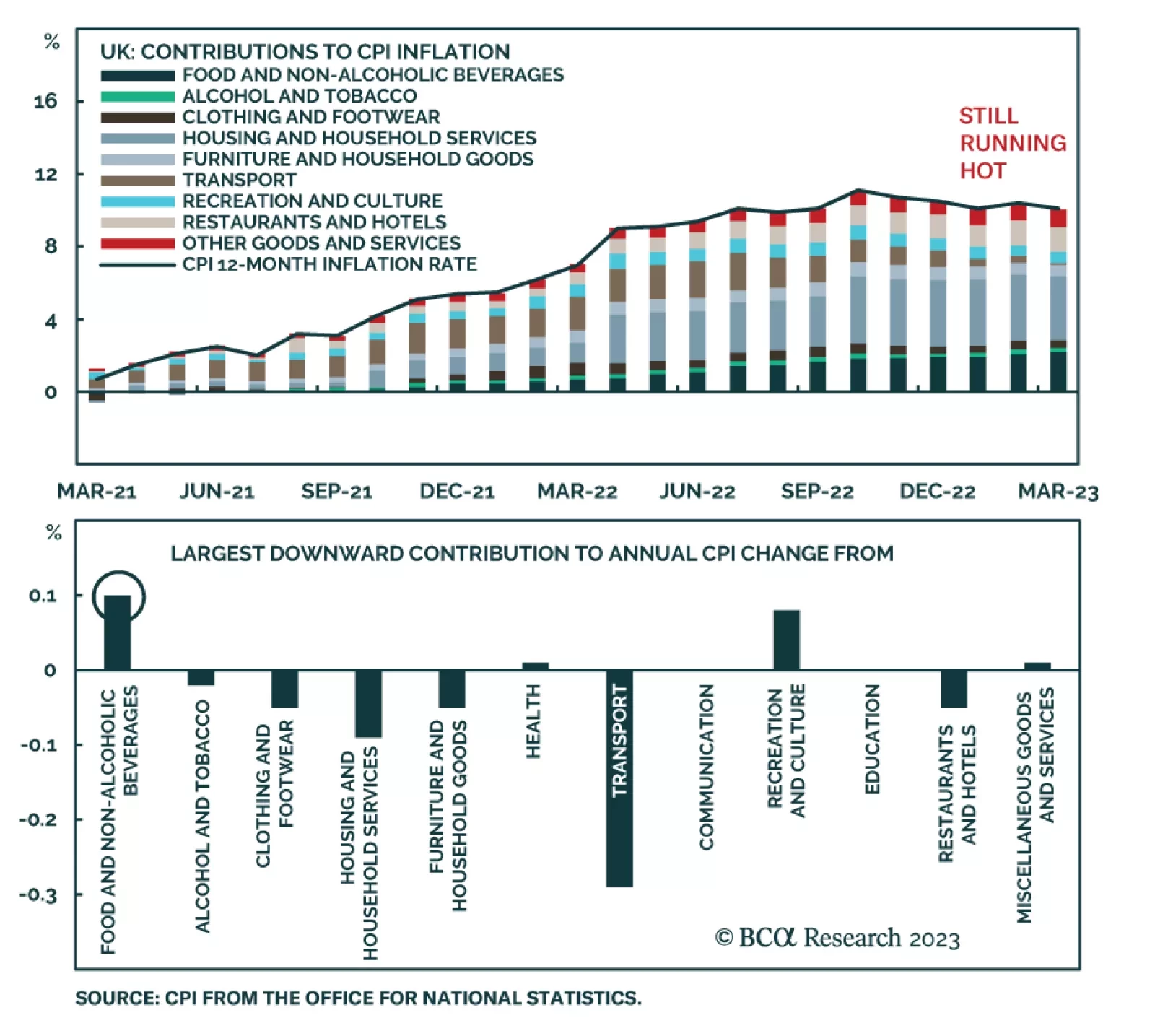

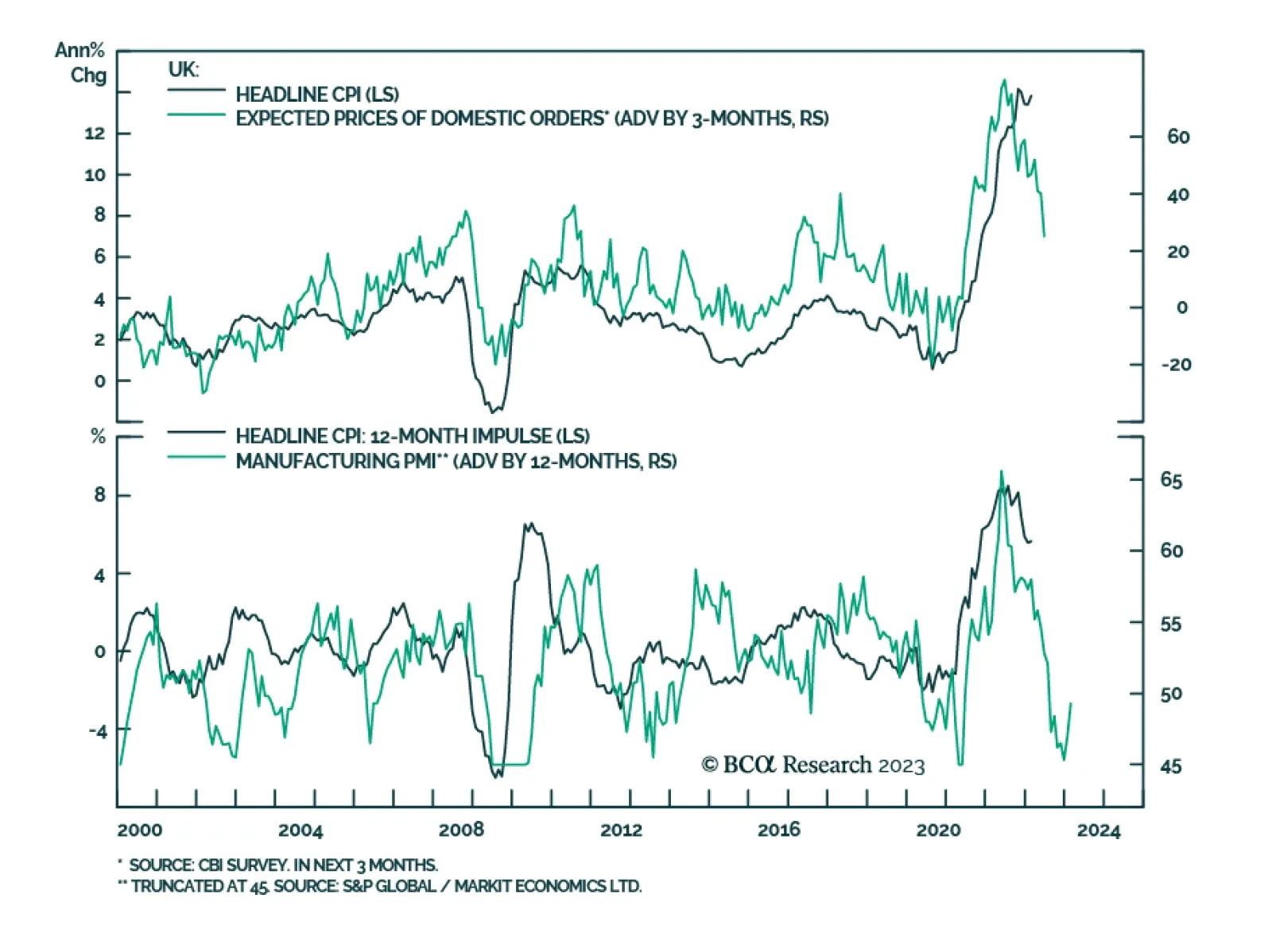

UK inflation came in hotter-than-anticipated in March. Headline inflation remained in double digits at 10.1% y/y, above expectations that it would recede from 10.4% y/y to 9.8% y/y. Similarly, the core index was unchanged at 6.2…

UK inflation was hotter-than-anticipated in February. Headline CPI inflation accelerated from 10.1% y/y to 10.4% y/y – surprising consensus estimates it would slow to 9.9% y/y. The monthly rate increased to 1.1% m/m,…

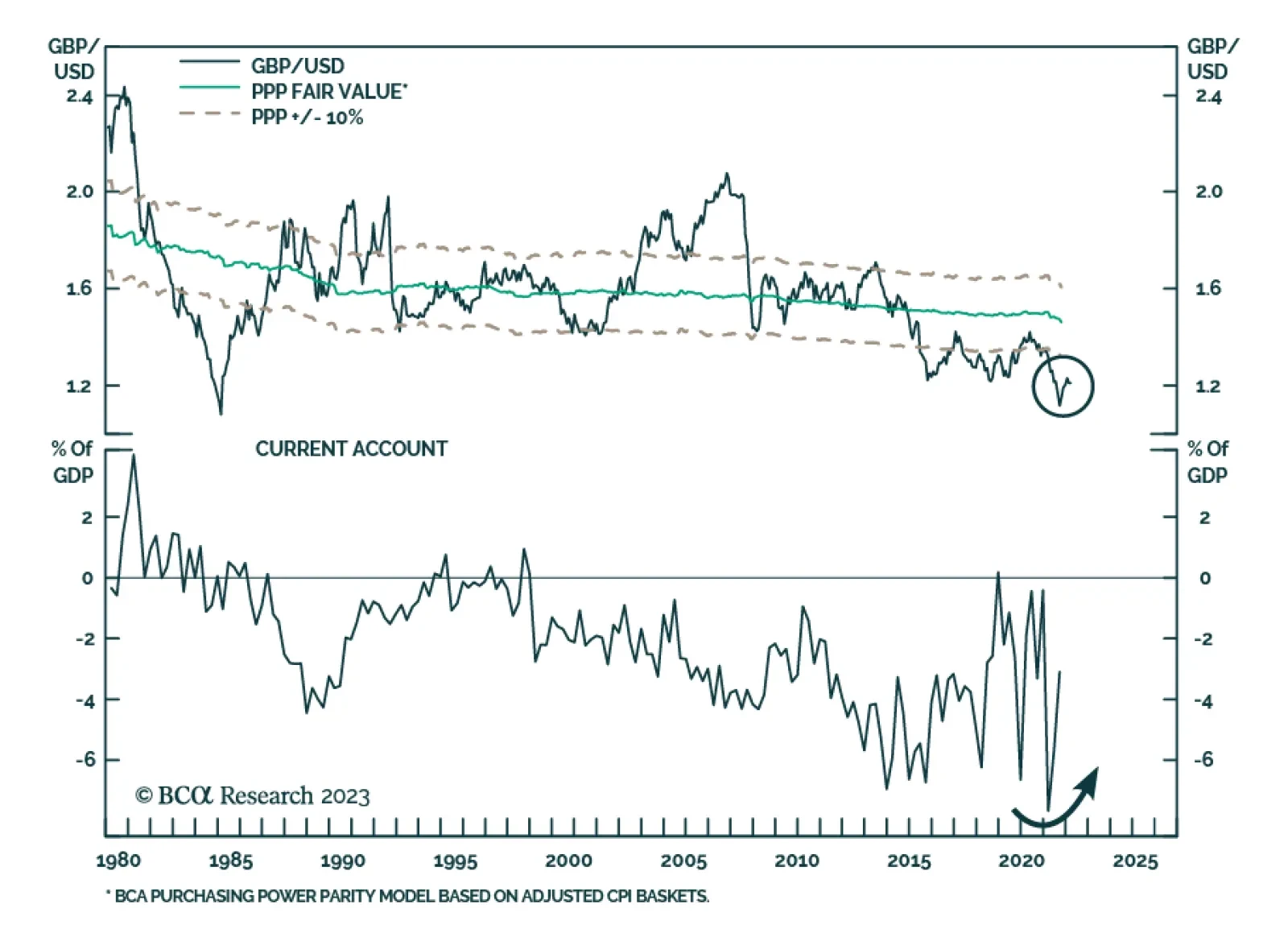

BCA Research’s European Investment Strategy service concludes that on a long-term basis, the pound is an attractive currency, but the near-term outlook is challenging. The long-term appeal of the GBP rests on three…

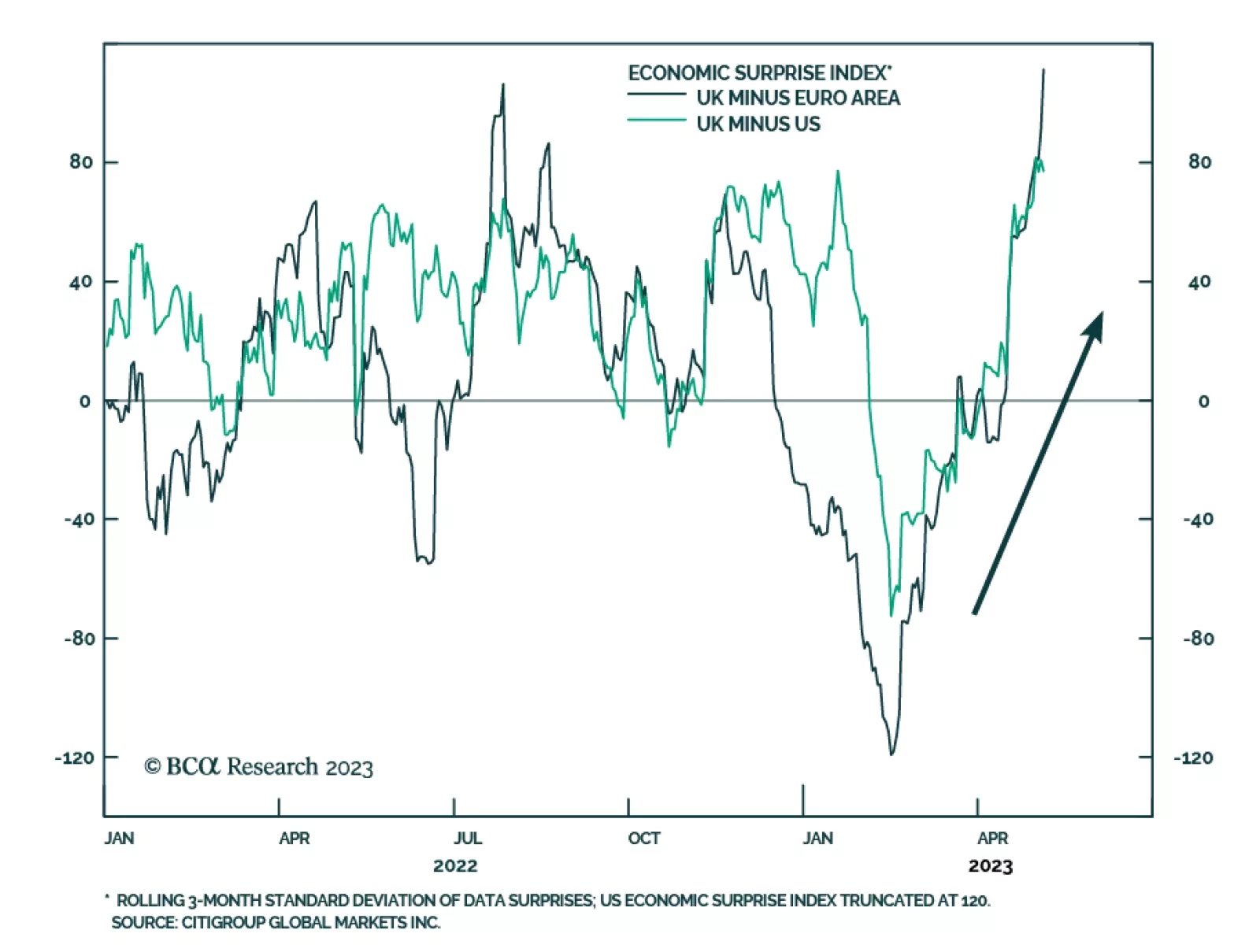

The UK economy is more resilient than was feared last year. While this will not help UK stocks, the Footsie’s long term prospects are appealing.

Great Power Rivalry is taking another leg up as Russia and China further align their geopolitical interests. Investors should stay long USD-CNY, favor defensives over cyclicals, and markets like North America and DM Europe that have…

Our Central Bank Monitors support the recent shift in tone from central bankers in Europe. Find out what it means for European fixed-income portfolio allocation.