UK gilts have sold off sharply over the past month, particularly at the short end of the yield curve. The two-year yield has risen by over 100bps since mid-May, while 10-year yields have increased by just over 70bps –…

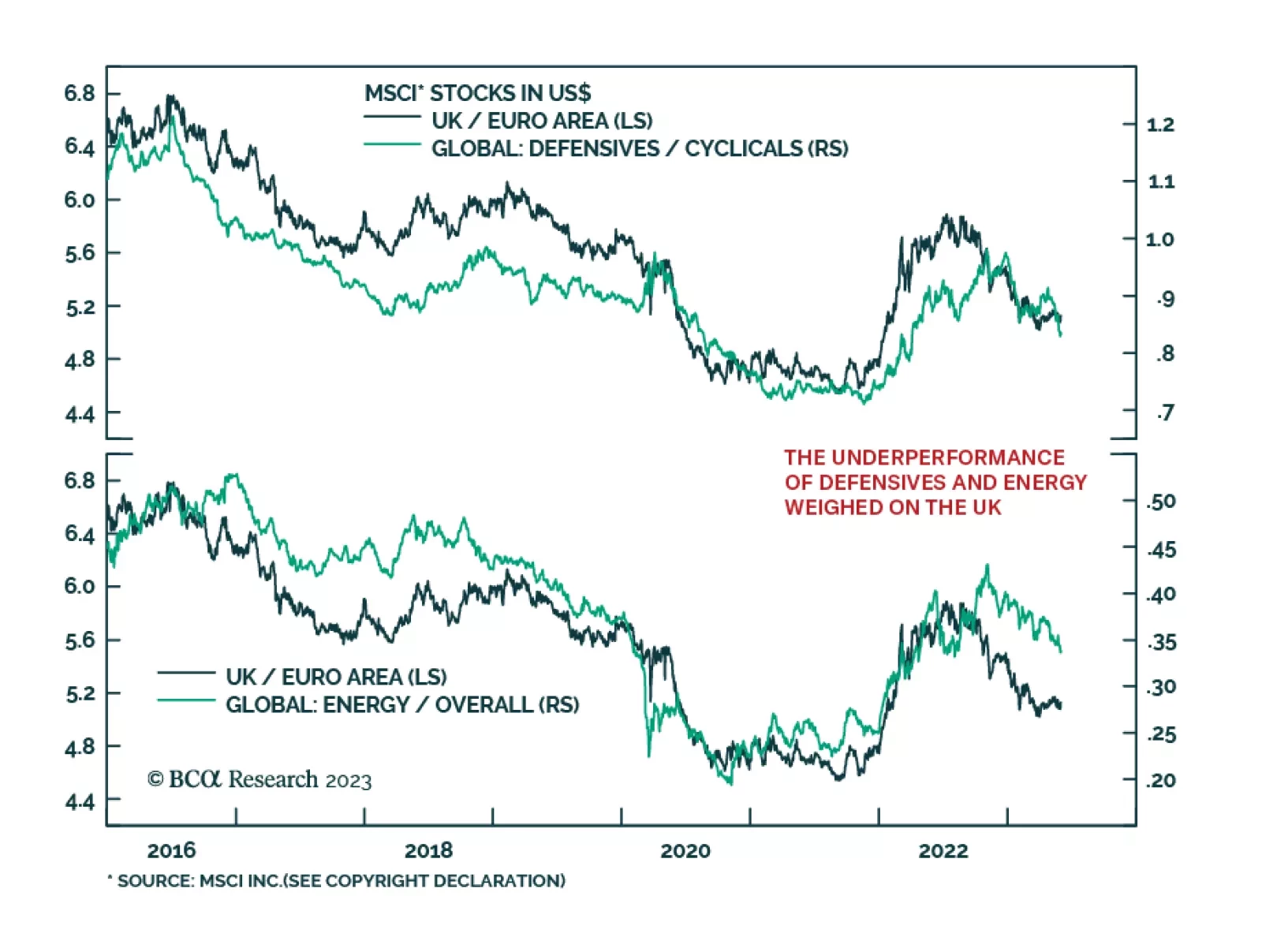

In our May In Review Insight, we showed that last month, UK stocks posted the lowest z-score among all major global equity markets, underperforming their Eurozone peers. What explains this relative weakness? The chart above…

In this report, we follow up on the upgrade to our US duration stance from last week with a review of our rates views and government bond allocations outside the US. We conclude that while we now find US Treasuries to be more…

In this Month-In-Review report, we go over the latest G10 data releases and rank currencies’ fundamental standing based on our updated macroeconomic model.

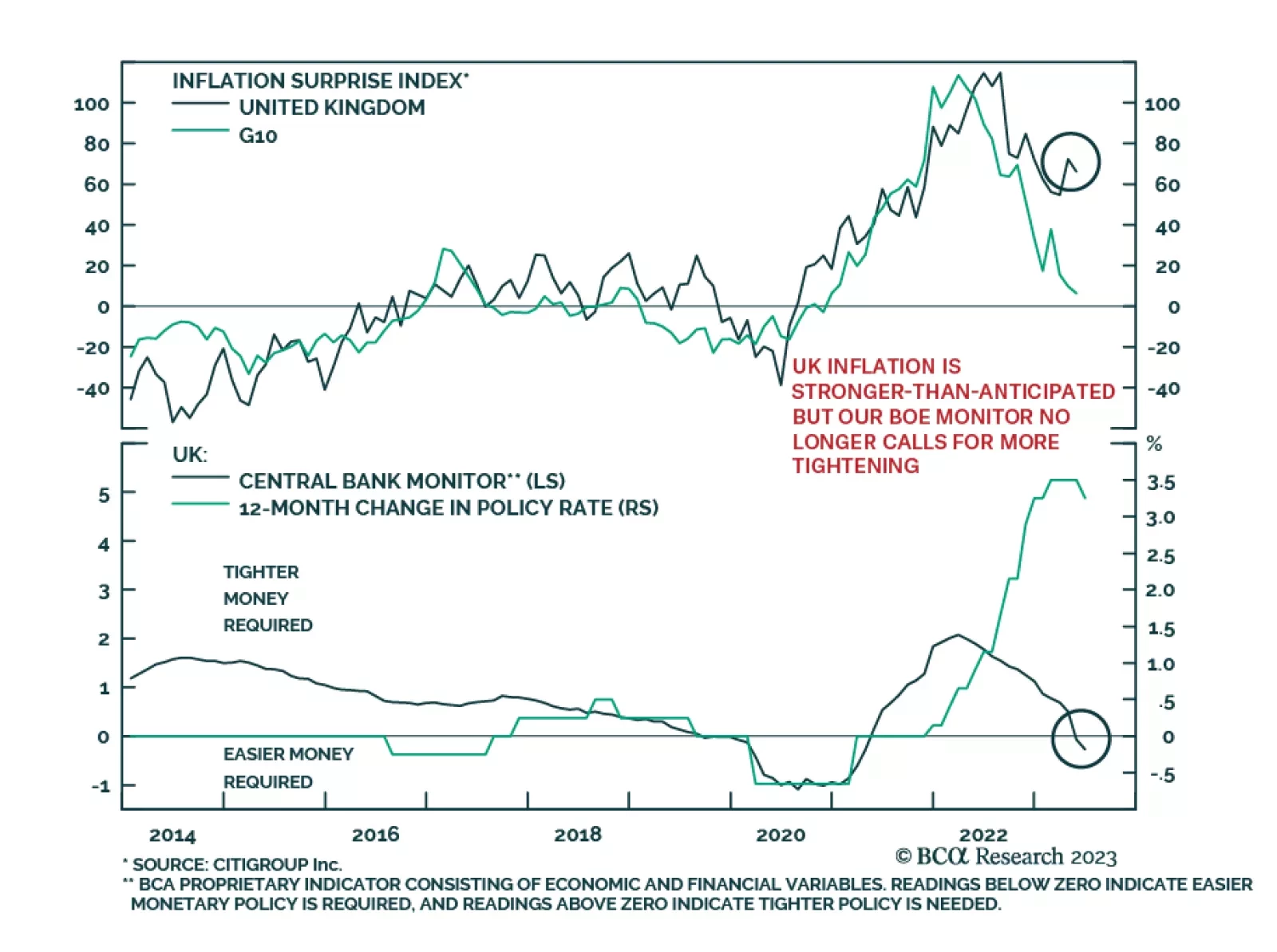

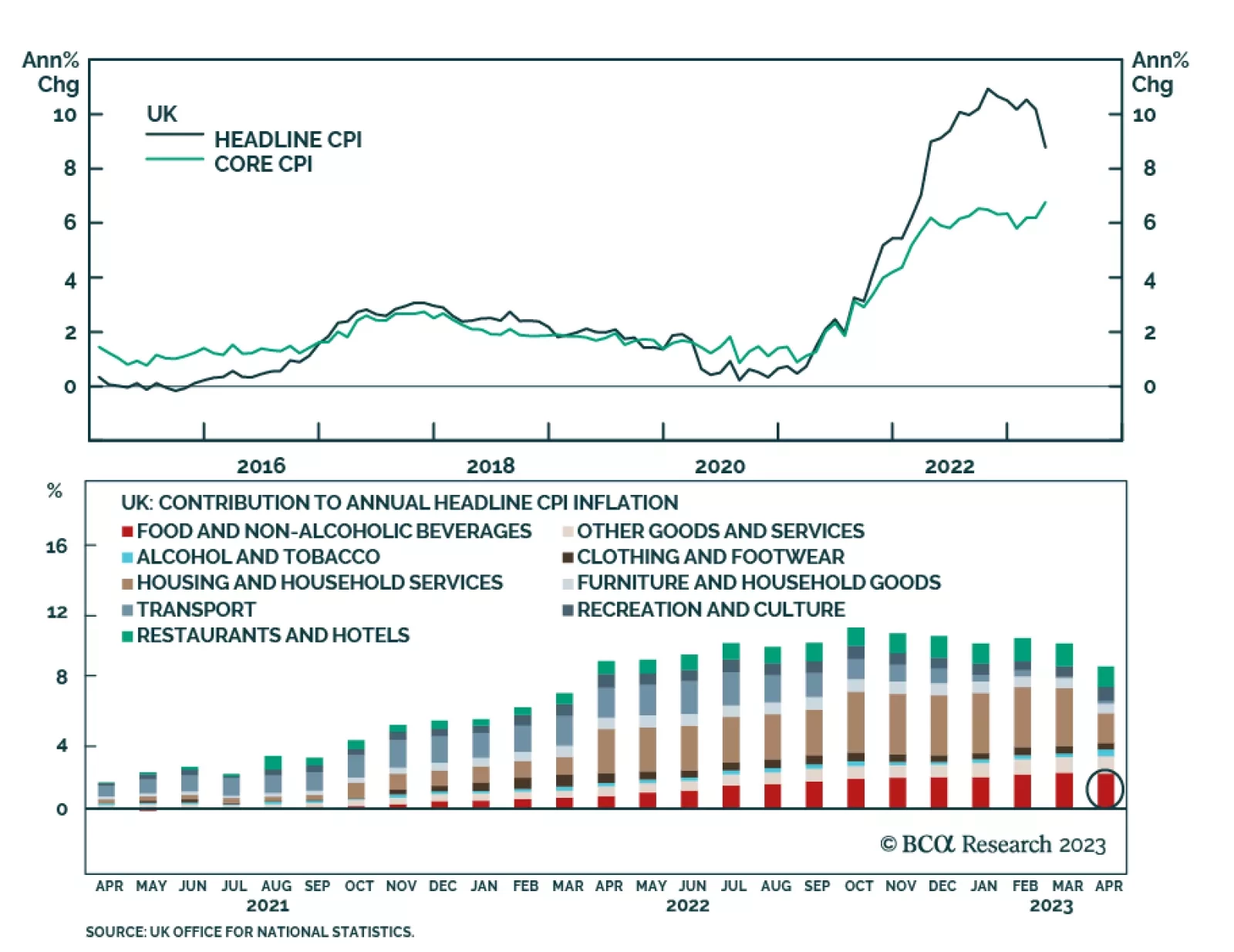

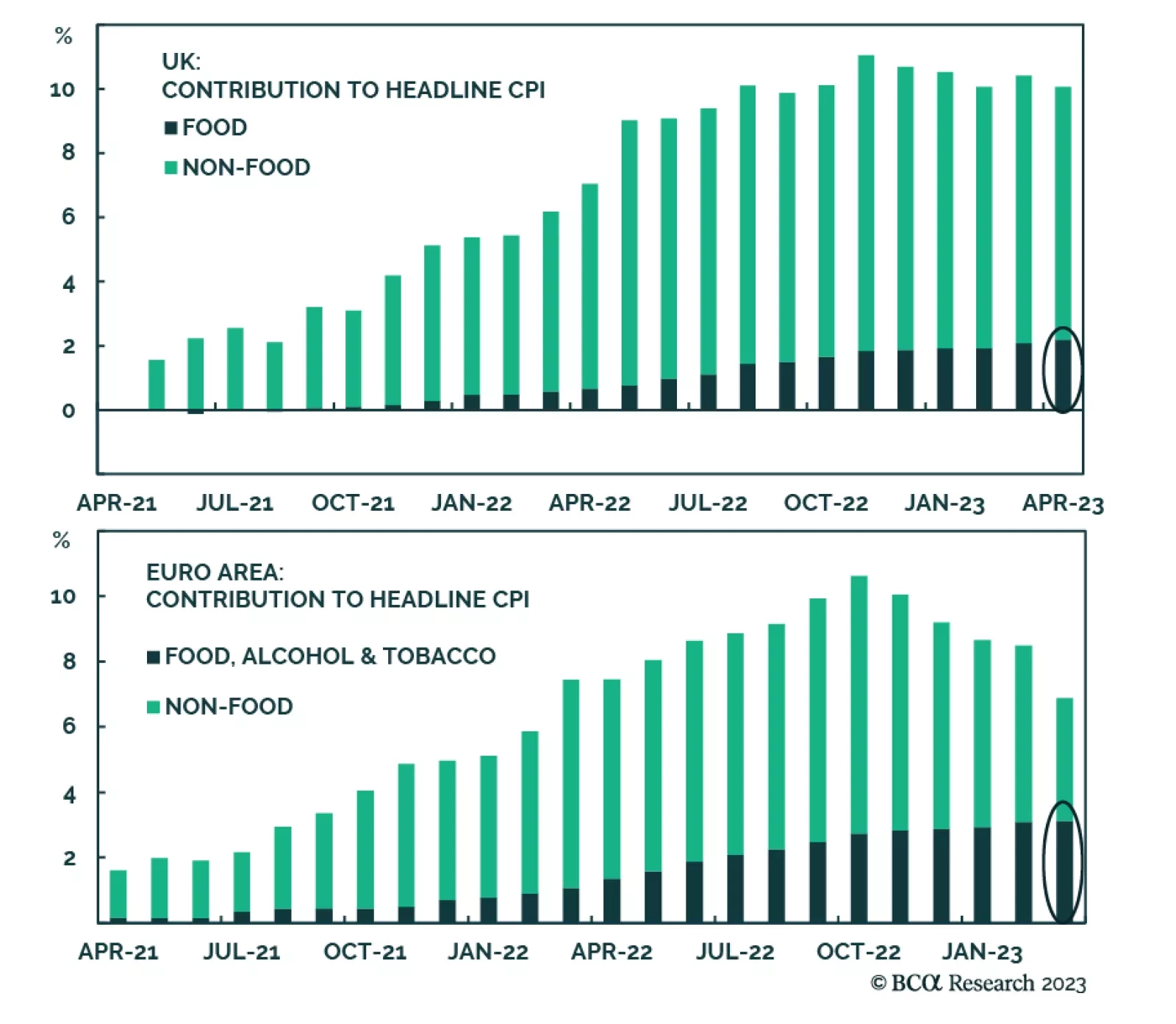

UK headline inflation fell by less than expected in April. The decline from 10.1% y/y to 8.7% y/y came above consensus estimates calling for a more pronounced drop to 8.2% y/y. And although the annual figure now stands at its…

A restrictive policy by the ECB and a weak manufacturing sector will create headwinds for European stocks this summer. How should investors position their portfolios in this context?

In Thursday’s BoE meeting, policymakers highlighted that stronger-than-anticipated food price gains contributed to recent upside surprises in the UK’s inflation rate. Rapidly climbing food inflation hit a 19.6% y/y in…

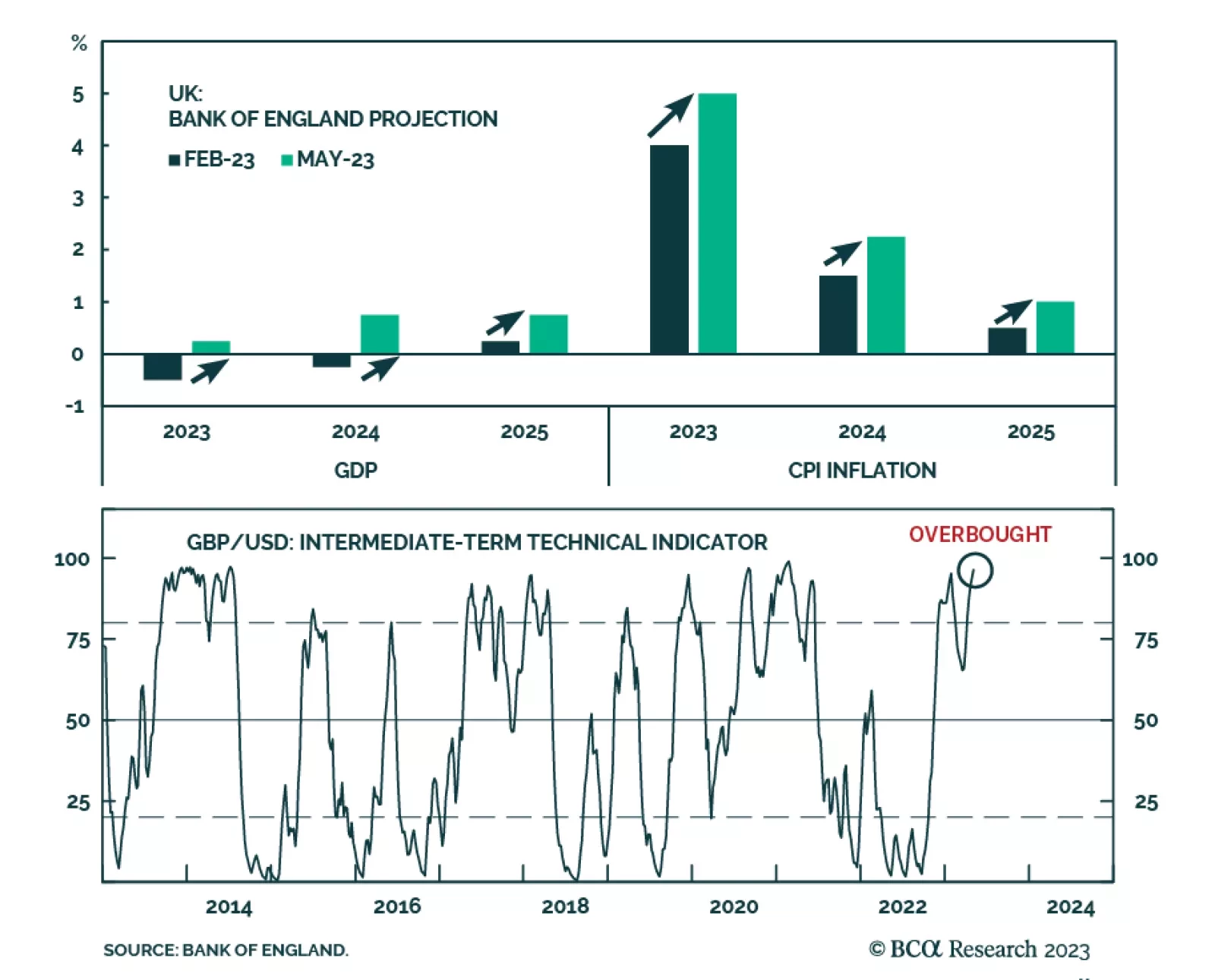

As expected, the Bank of England raised its bank rate by 25bps to 4.5% on Thursday, marking the 12th consecutive rise. Notably the updated projections show a significant improvement in the economic outlook. The upwards growth…

The change in the BoE’s tone has likely altered the path for sterling. In this report, we explore if the BoE’s lens for monetary policy is justified, and provide some targets for the pound.