The Bank of England’s Monetary Policy Committee voted 5-4 in favor of maintaining its bank rate at 5.25% on Thursday. The four members that voted against the pause all preferred a 25-basis point rate increase. The tight…

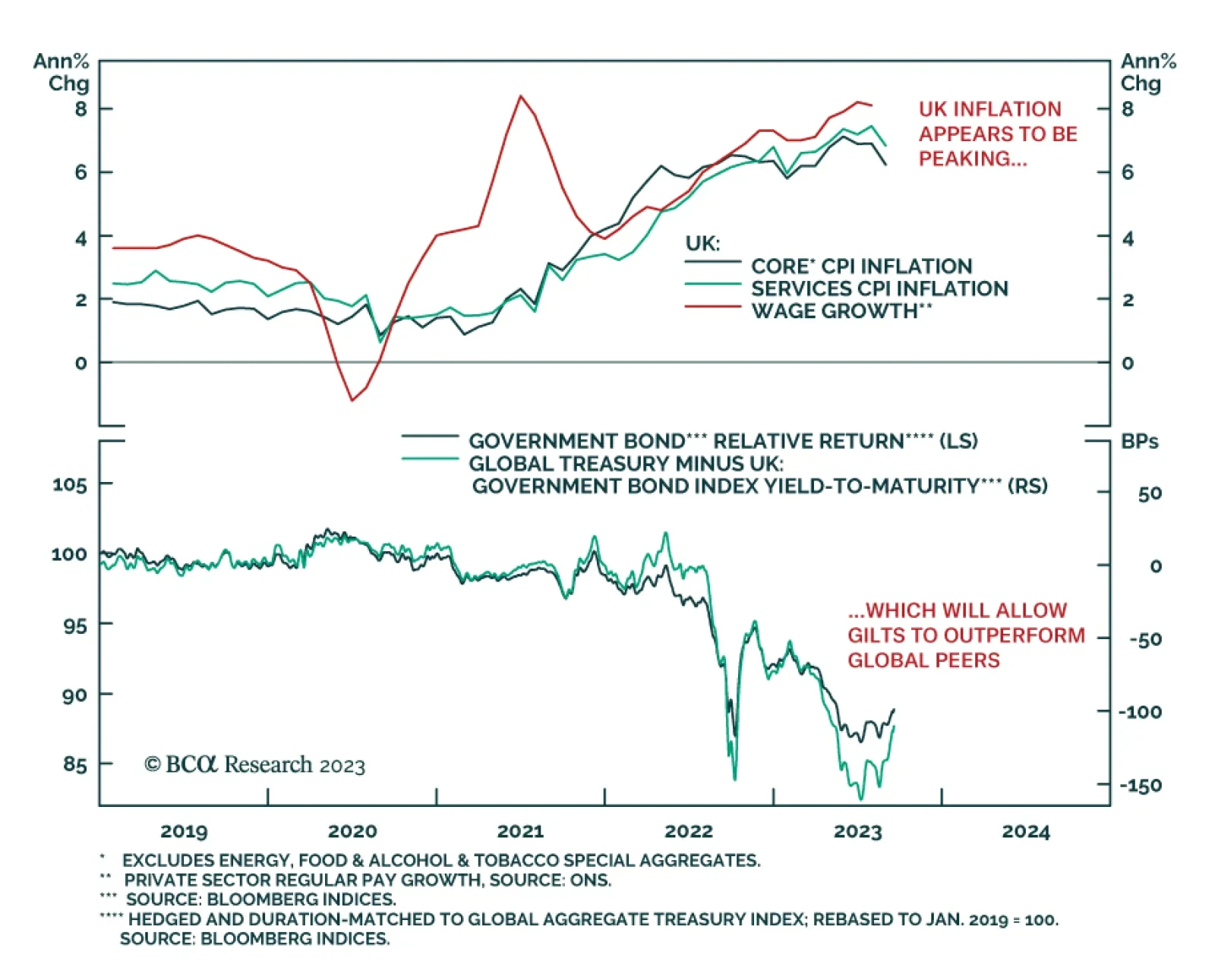

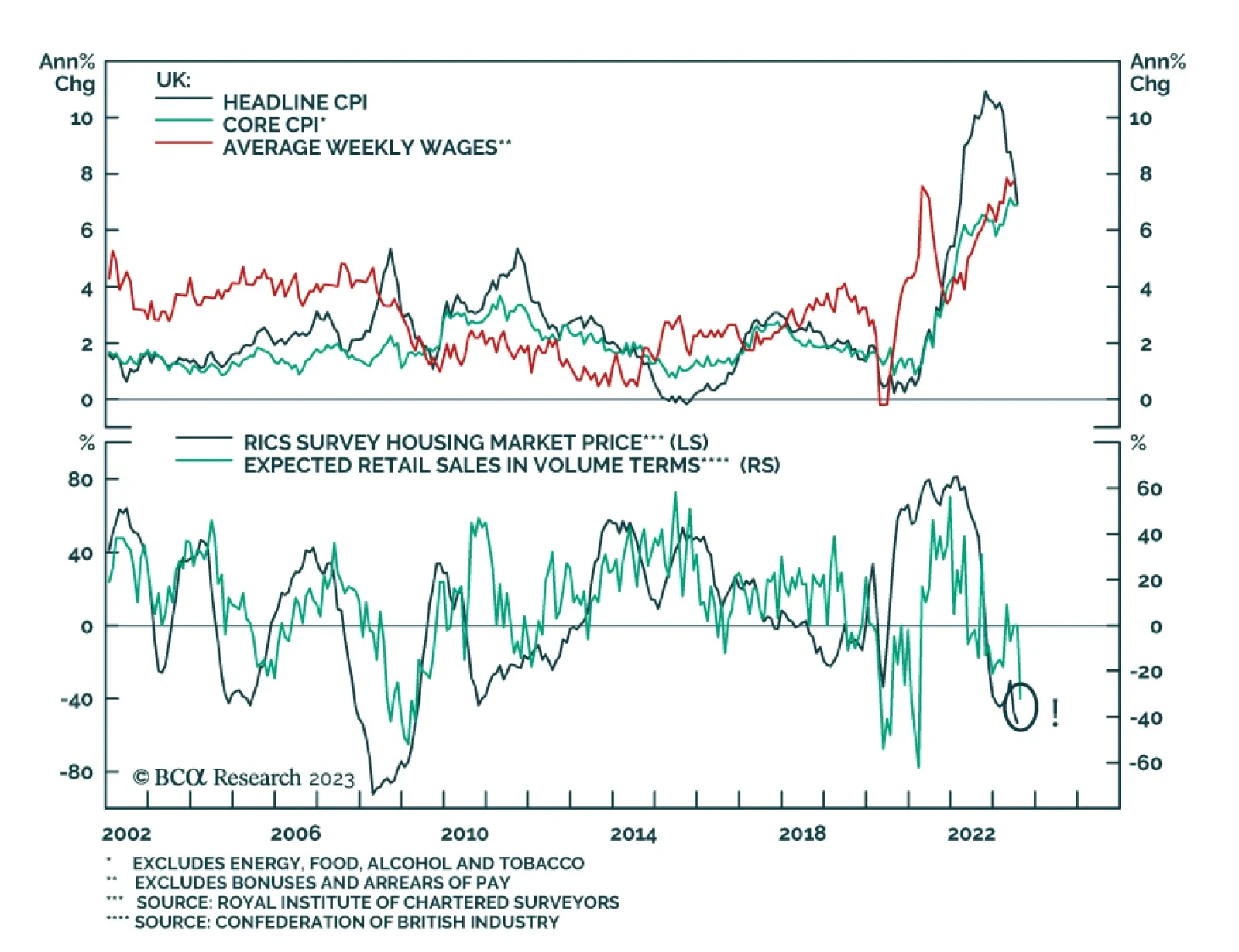

The August UK inflation report produced a large downside surprise. Headline CPI rose +0.3% month-on-month, versus expectations of a +0.7% increase. Year-over-year headline CPI inflation slowed to 6.7% from 6.8%, a sizeable miss…

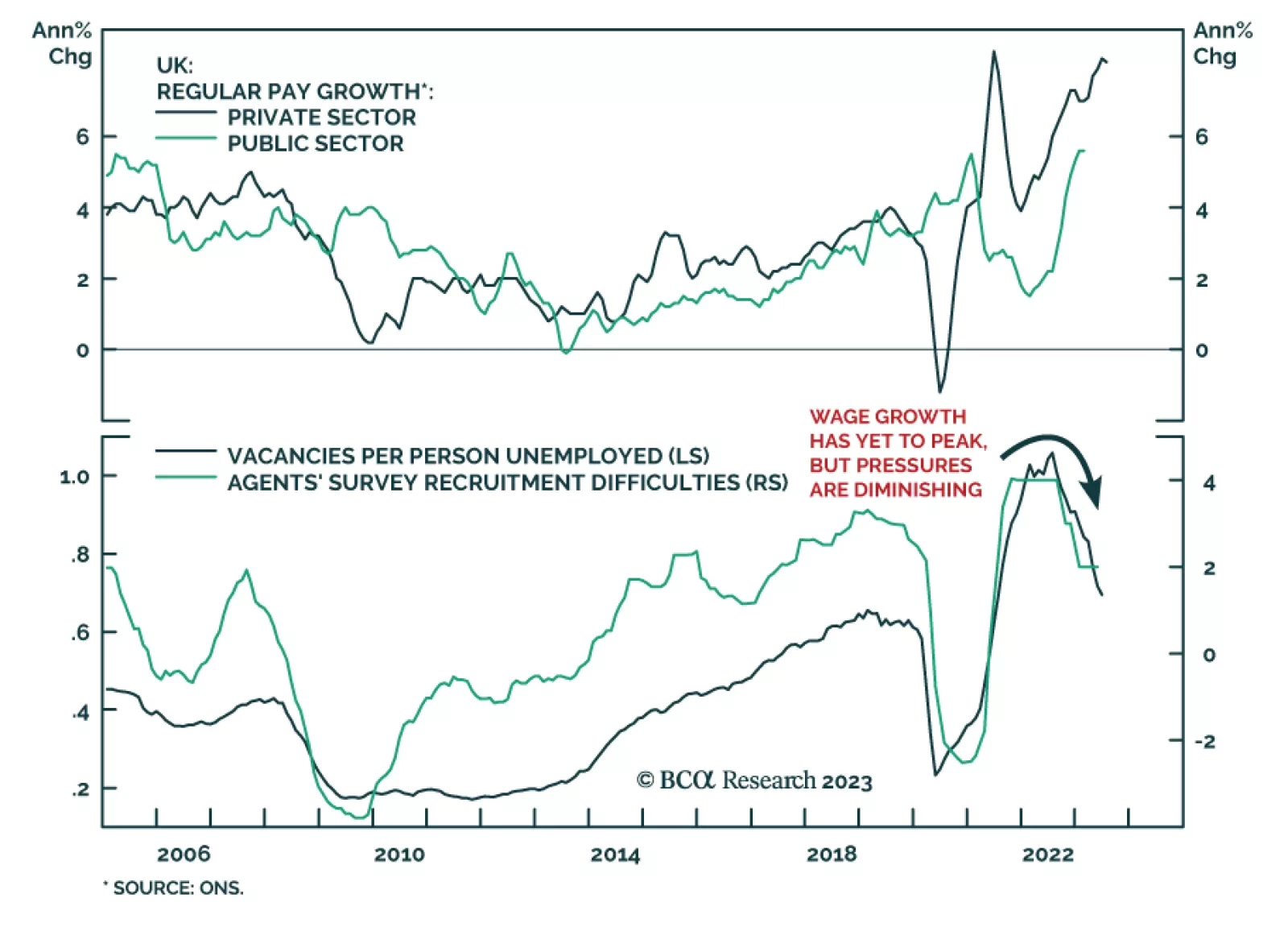

The latest UK labor market developments complicate the Bank of England’s task when it meets next week. The unemployment rate ticked up from 4.2% to 4.3% in the three months to July as employment fell by 207 thousand.…

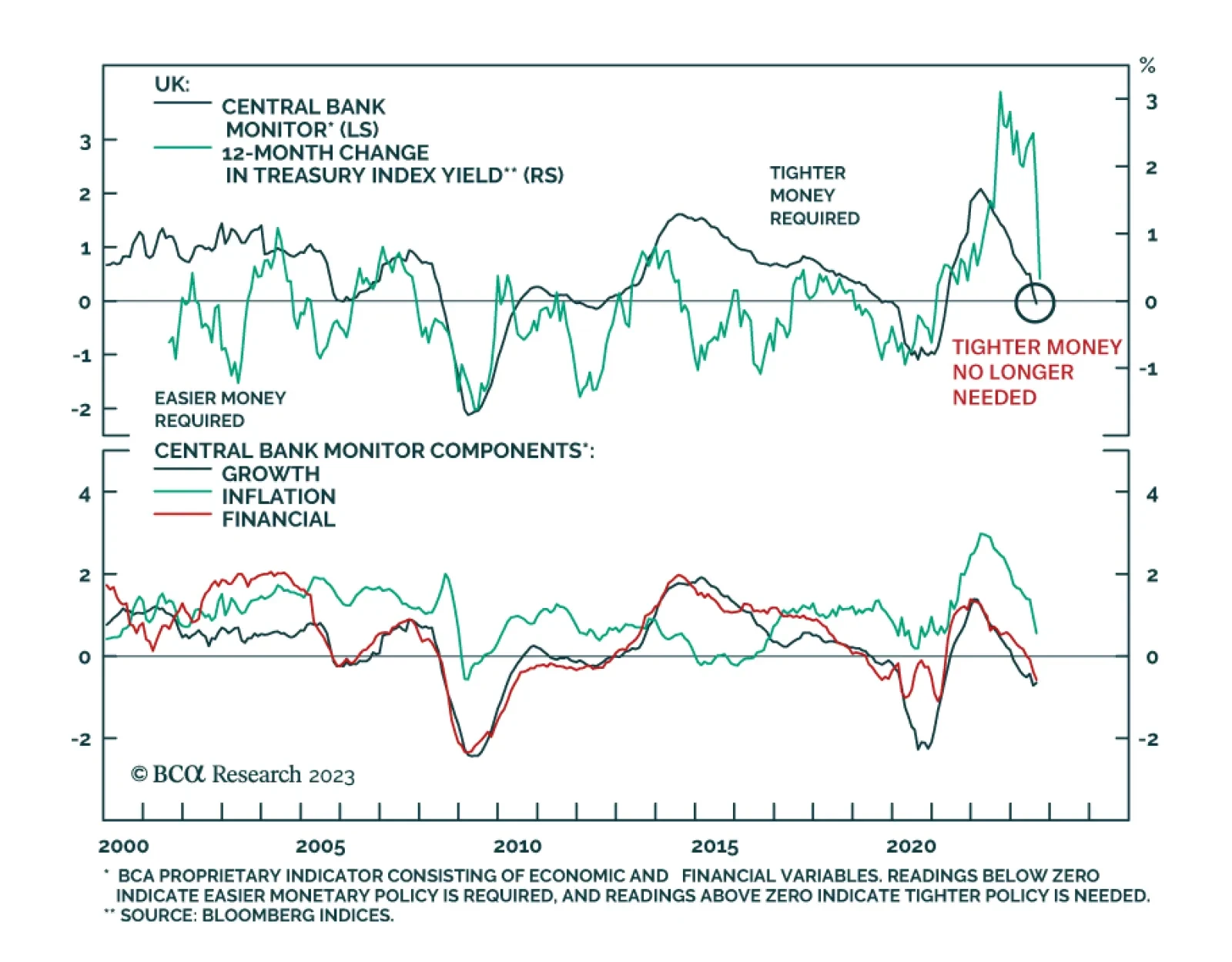

In this report, we assess the best opportunities in inflation-linked bonds in the major developed economies, based on trends in growth, inflation and the stance of monetary policies in each country. We conclude that the environment…

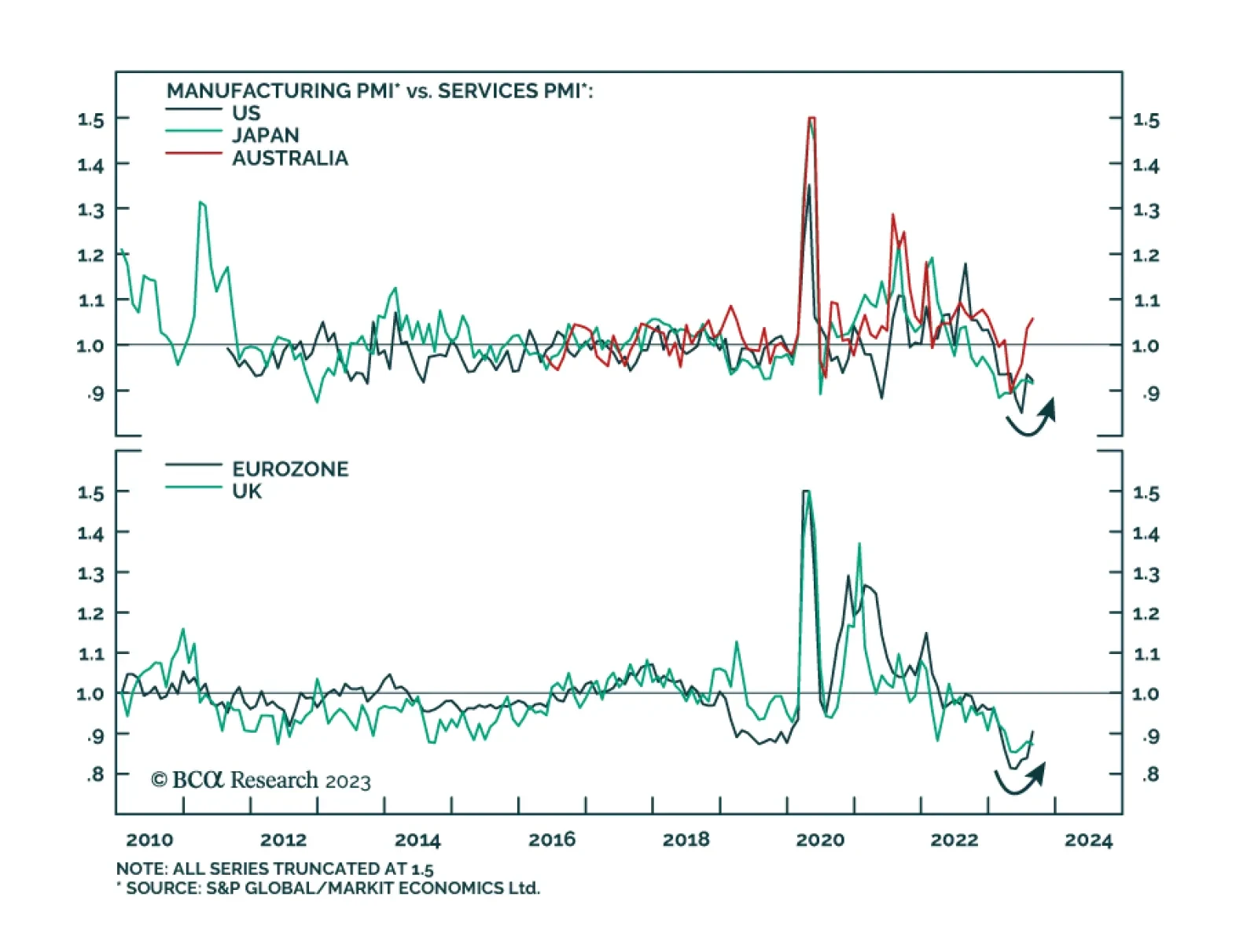

Yesterday we highlighted that the August update of the Philly Fed’s Nonmanufacturing Business Outlook survey sent a negative signal, with the New Orders, Sales, and Employment components all deteriorating. On Wednesday, the…

European yields are testing the upper end of their recent trading range. Is the European economic outlook consistent with an imminent breakout?

Despite a decline from 7.9% to 6.8% in July, the UK’s headline CPI surprised to the upside. The slowdown in headline CPI mostly reflects the deceleration in the annual inflation for housing, water, electricity, gas and…

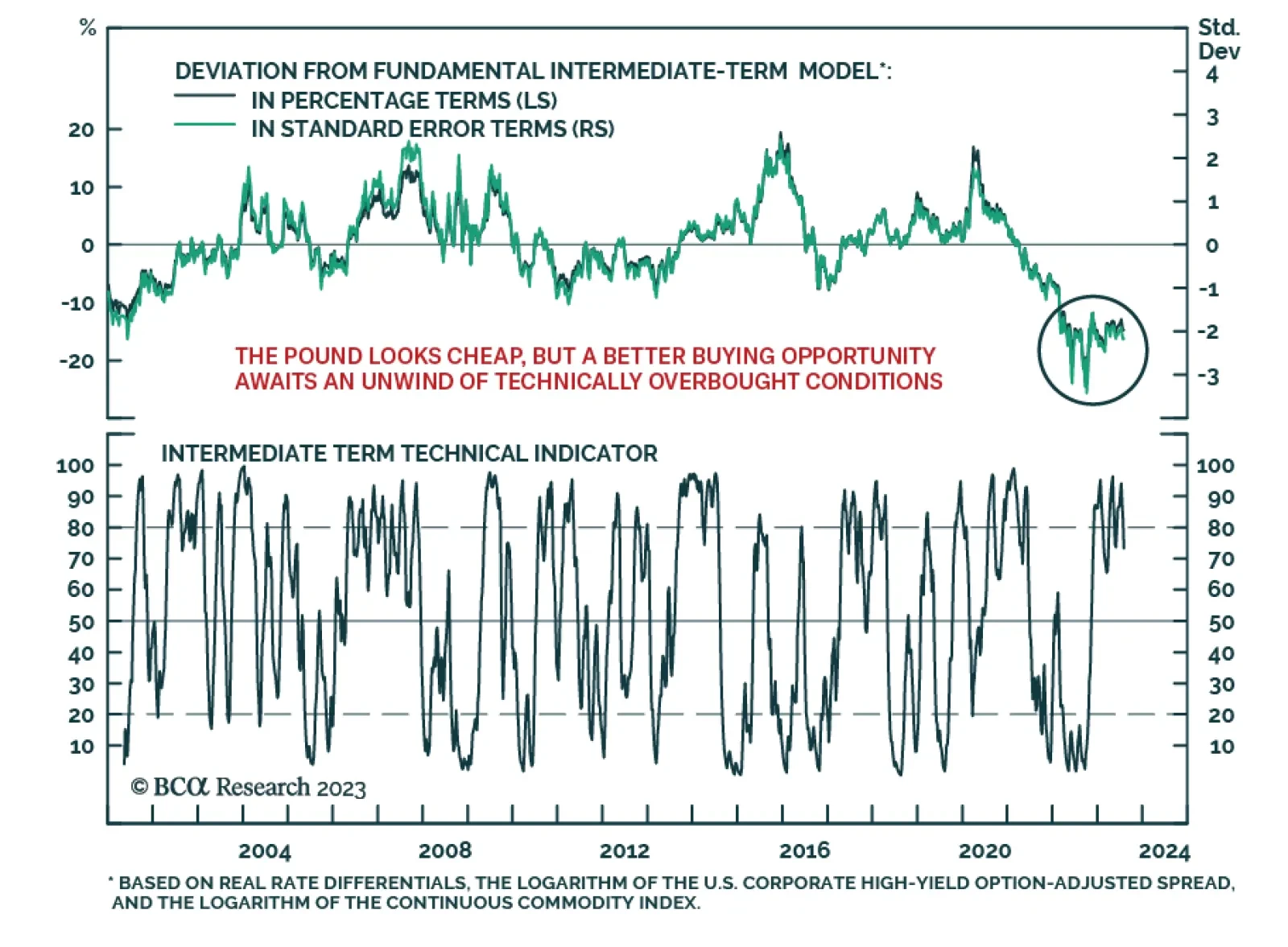

According to BCA Research’s Global Fixed Income and Foreign Exchange Strategy services, the British pound is overbought in the near-term and is at risk of a pullback on easing rate expectations, but this will represent a…