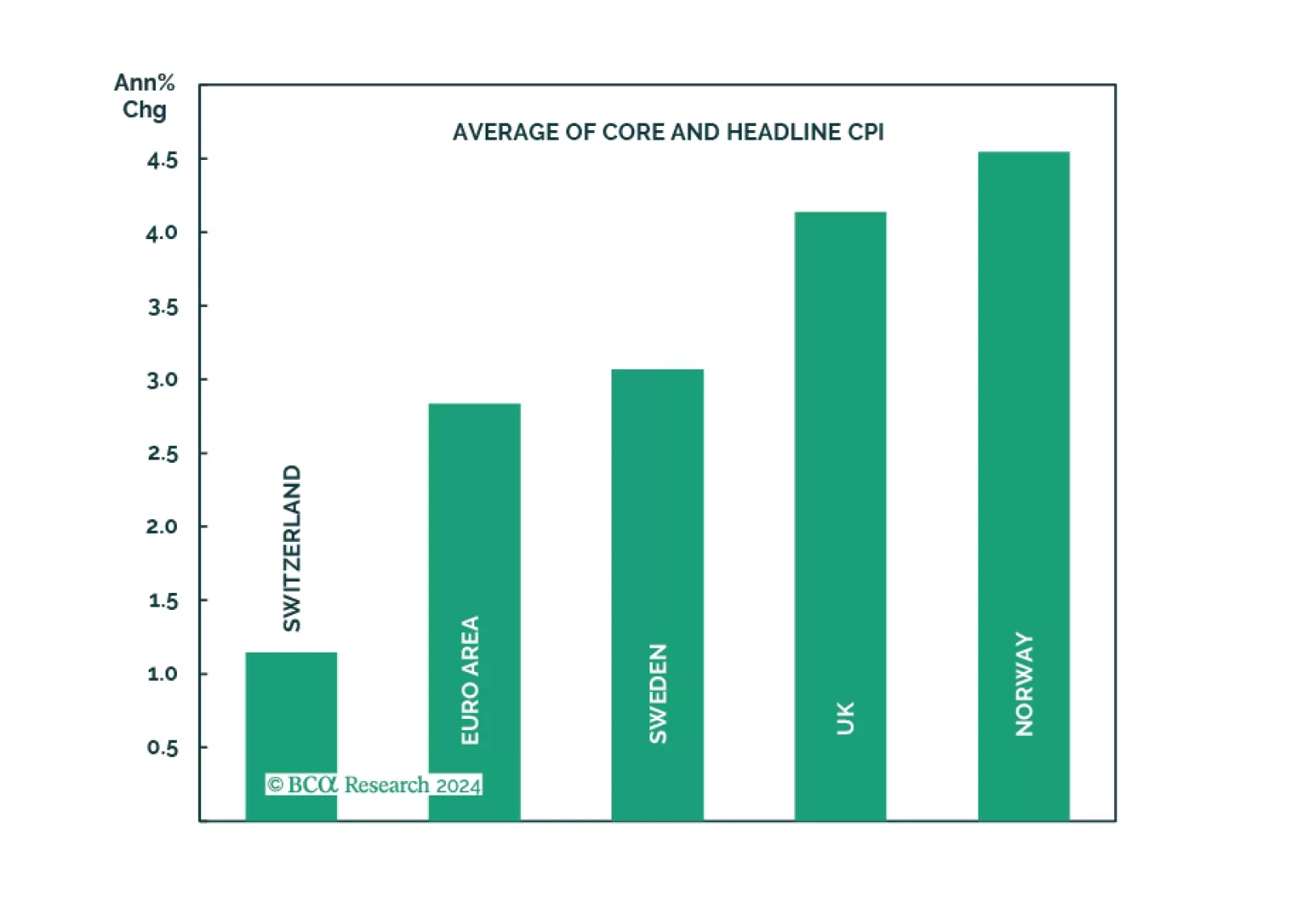

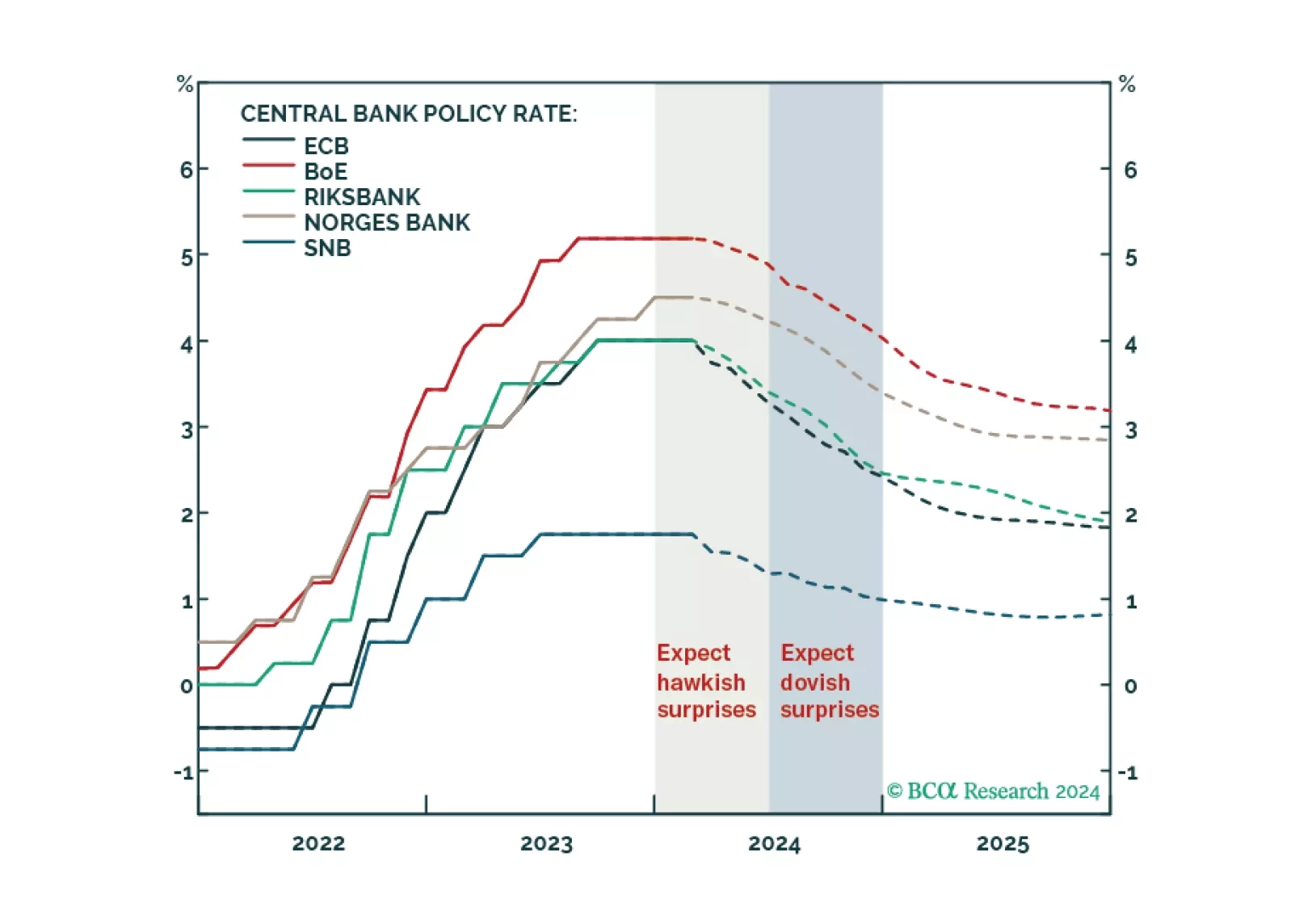

Does the recent surprise rate cut by the Swiss National Bank augur other dovish surprises among major central banks in Europe?

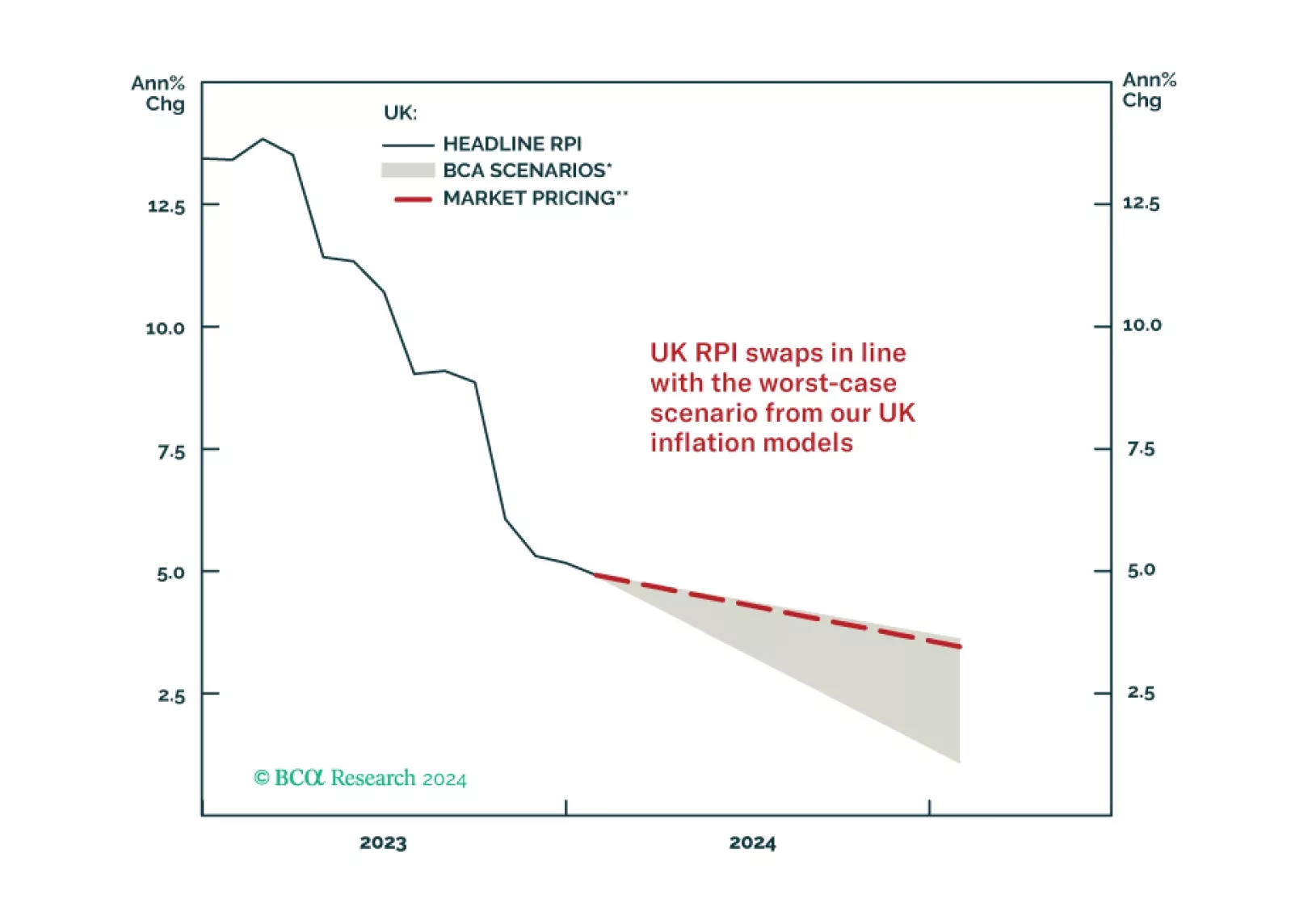

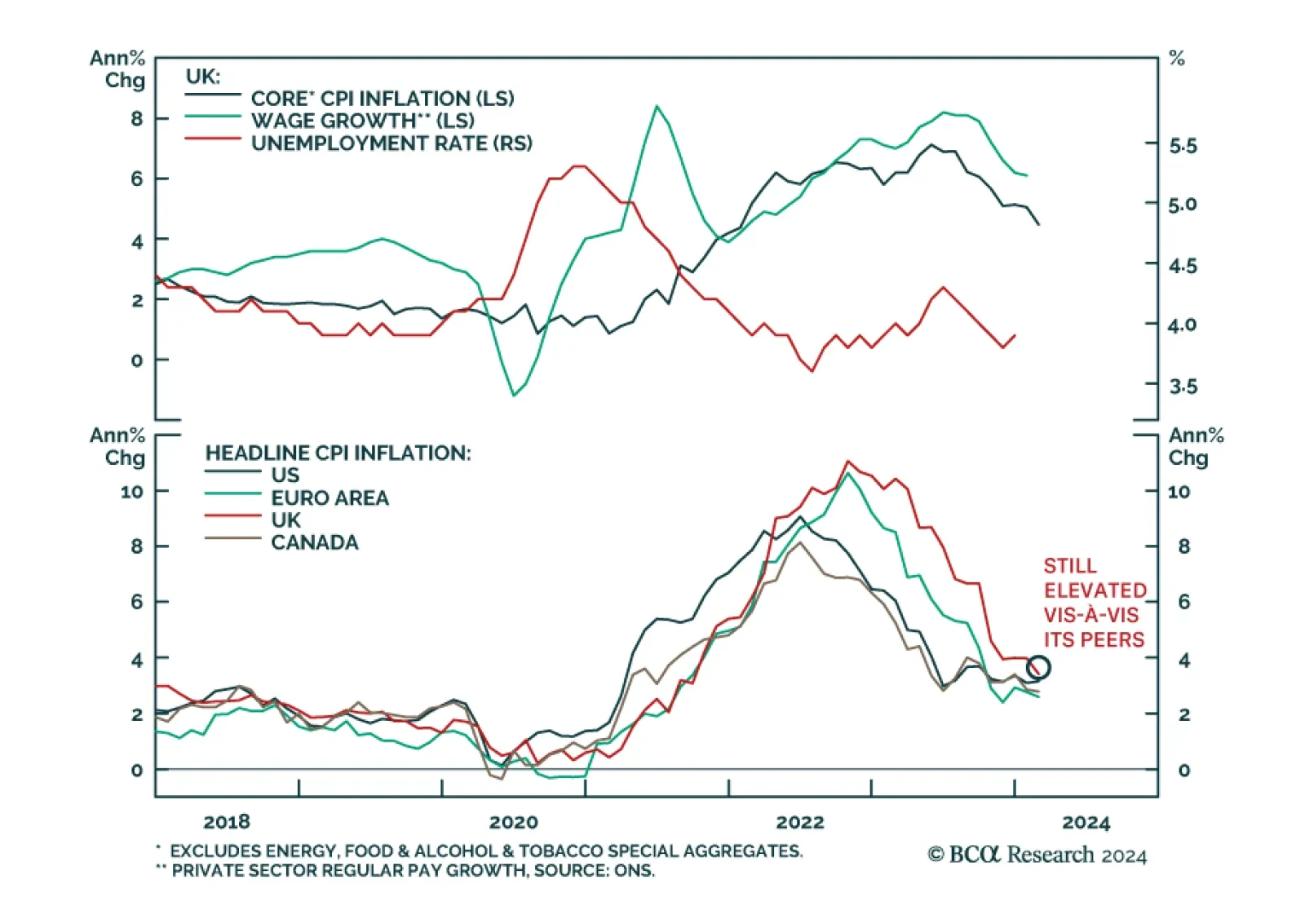

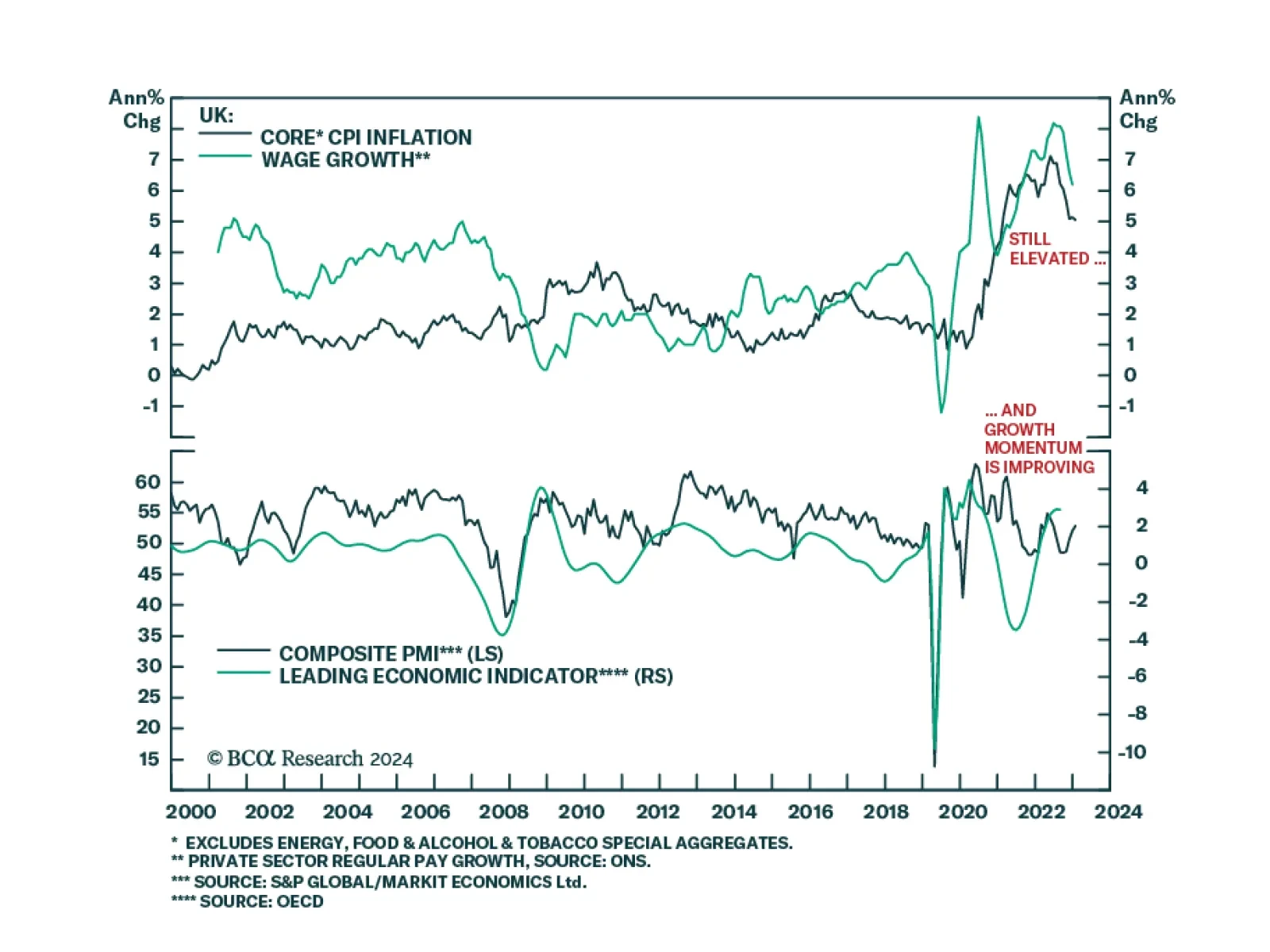

The UK CPI report showed inflation eased by more than anticipated in February. Headline CPI inflation dropped from 4.0% y/y to 3.4% y/y – below consensus estimates of 3.5% y/y and the weakest increase since September 2021.…

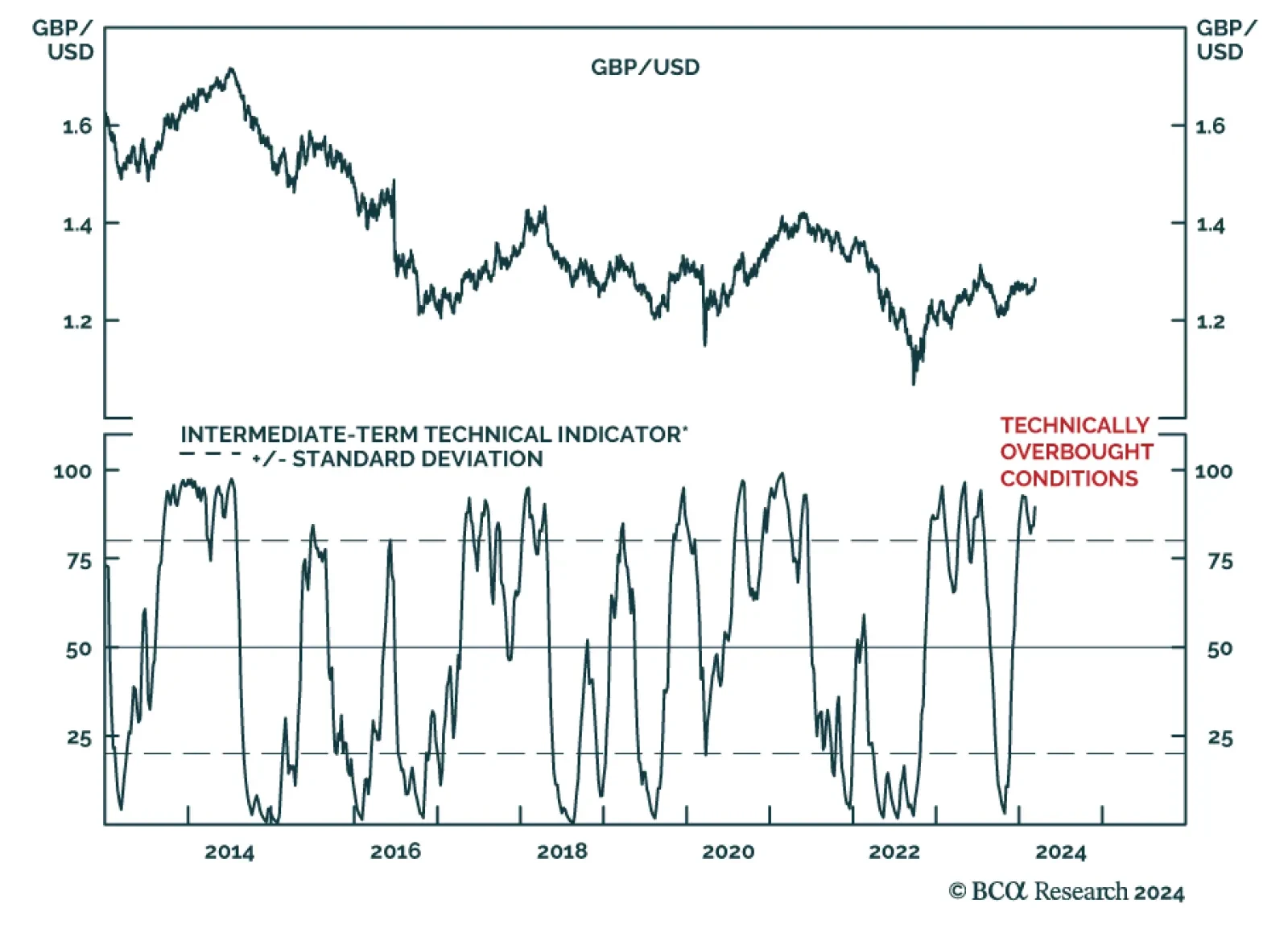

The British pound is the best performing G10 currency so far this year, gaining 0.7% vis-à-vis the US dollar. The outperformance of sterling over the past month coincides with an increase in Citigroup’s UK economic…

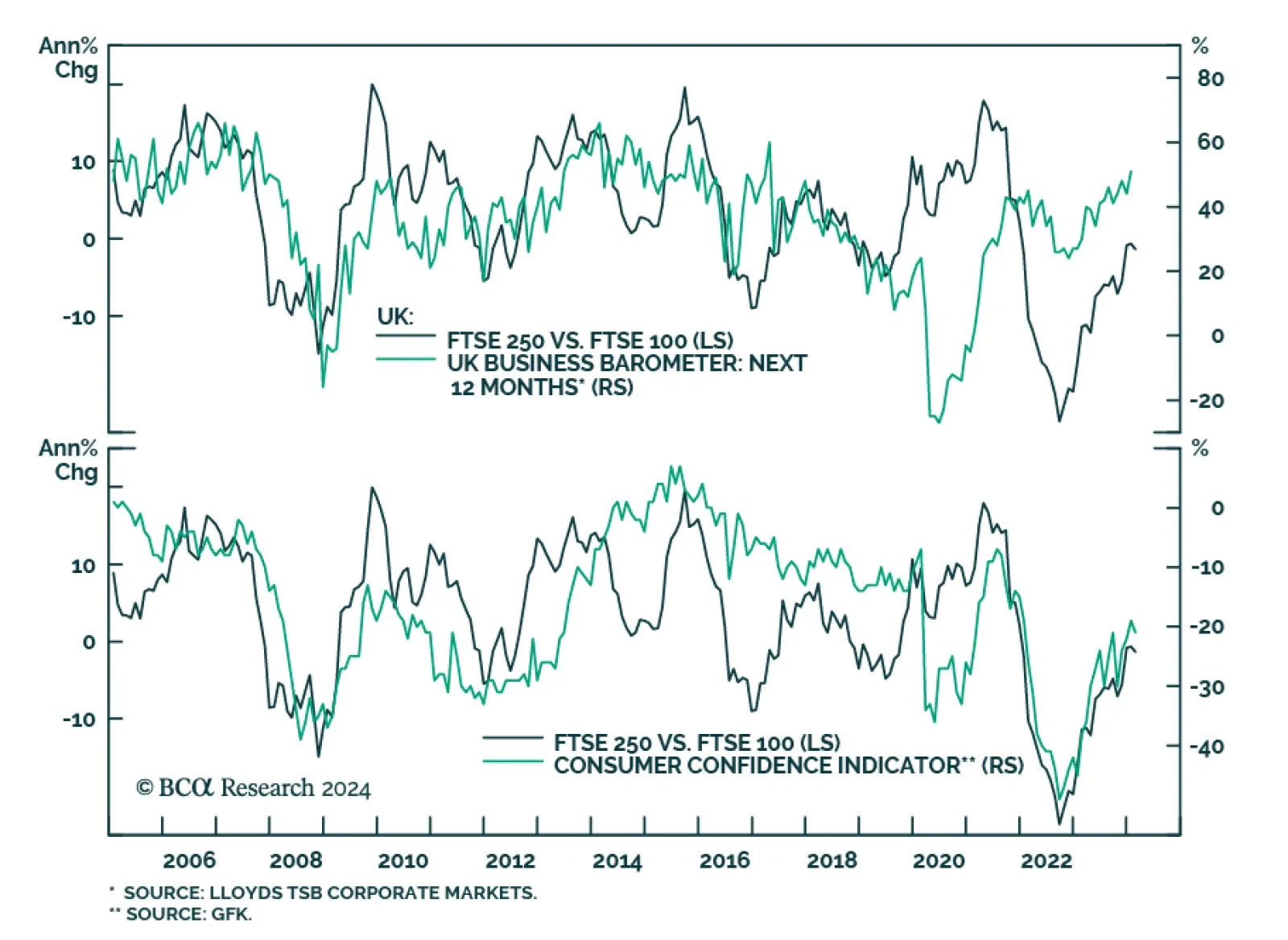

The FTSE 250 has been outperforming the FTSE 100 since late October 2023, with the former gaining 13.7% versus 3.9% in the case of the latter over this period. To the extent that UK small cap stocks are more exposed to…

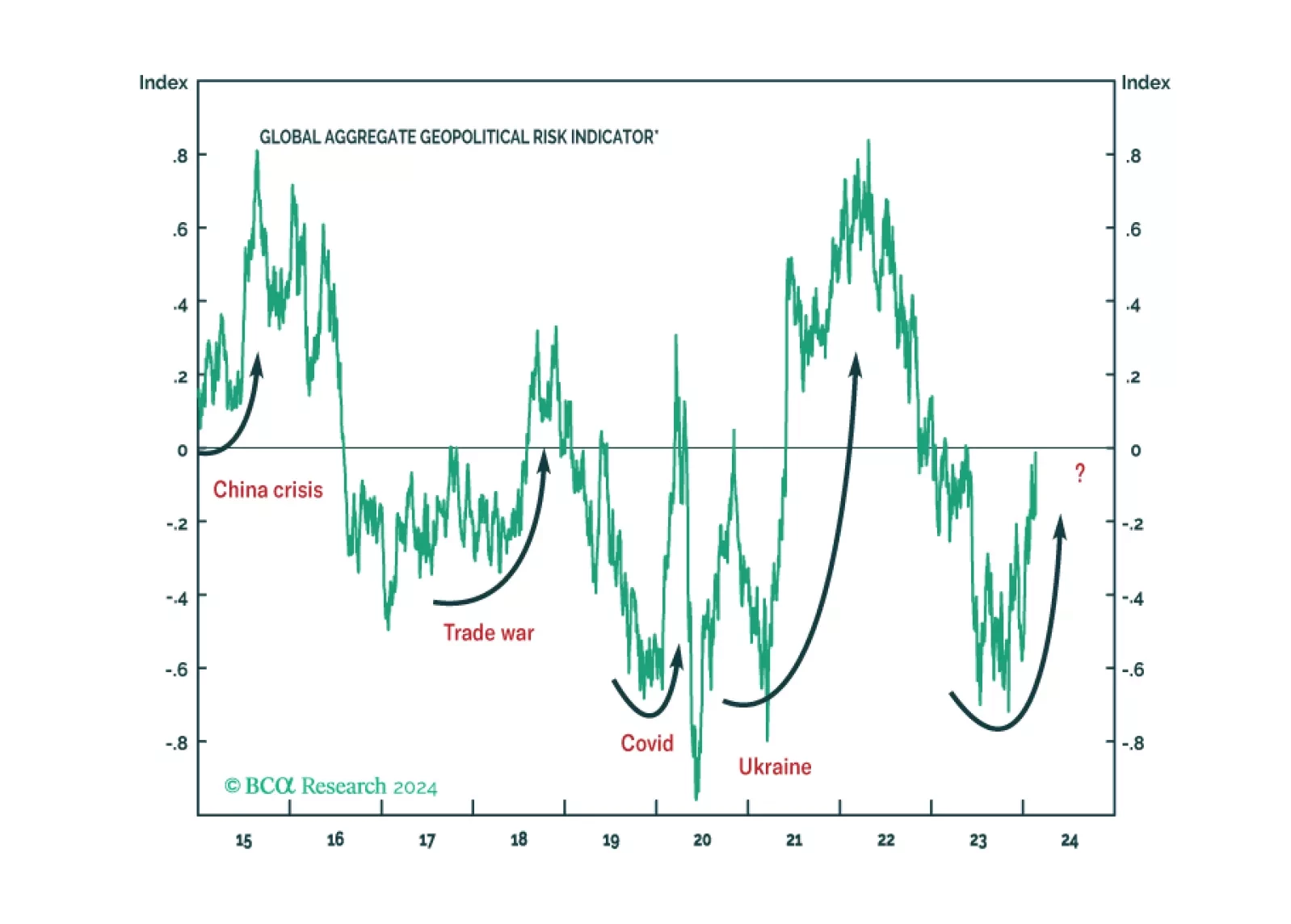

While 2024 will see various election risks, global geopolitical uncertainty is driven by the US election and its struggle with Russia, China, and Iran. The stock market can manage local domestic political risk. But it will correct…

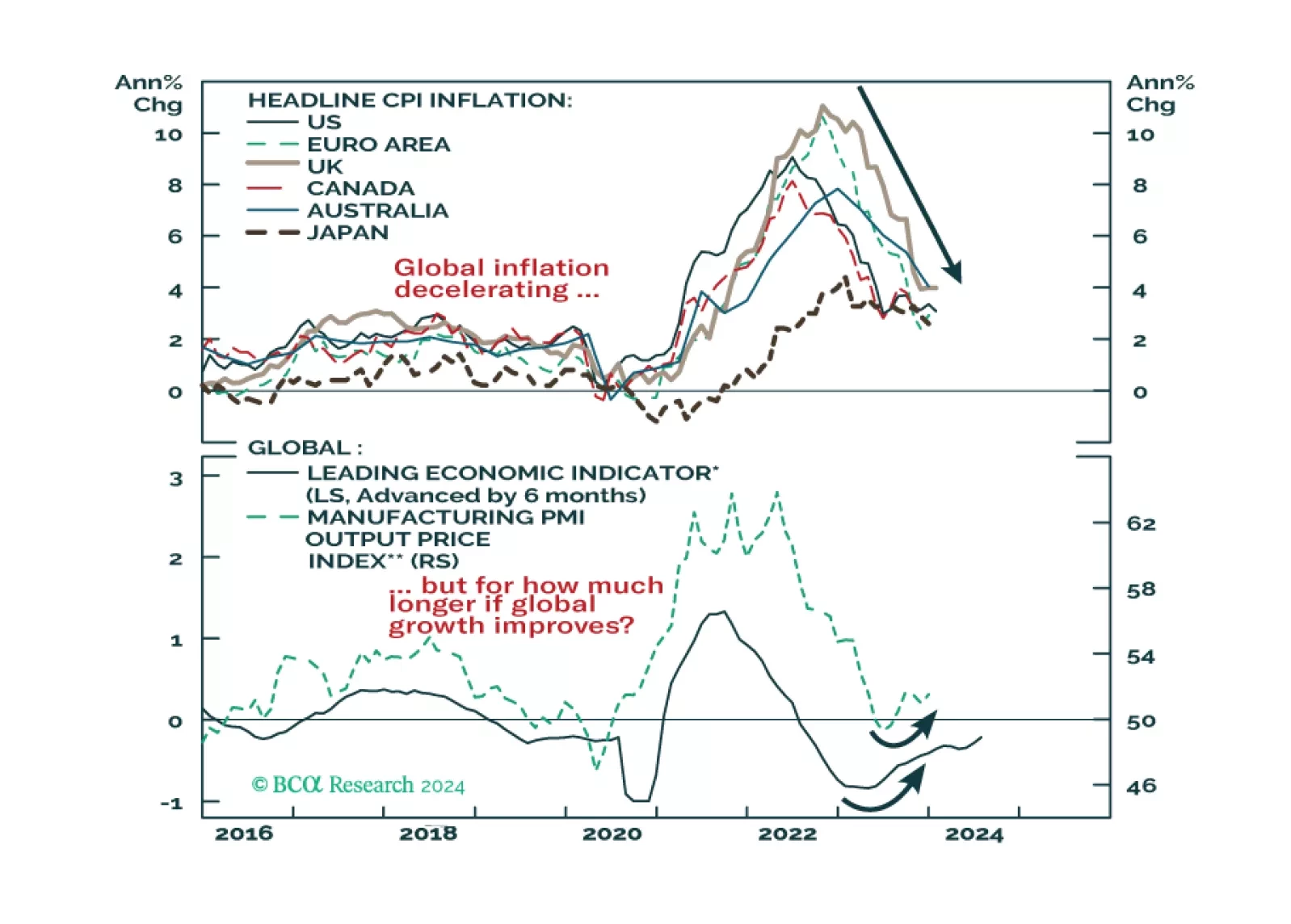

Could a second wave of global inflation be underway? The latest inflation prints in the US and UK showed upside surprises, while there is evidence of increased price pressures in global manufacturing. Combined with the improvements…

The UK inflation release for January came in slightly softer than anticipated. Both headline and core CPI were unchanged on year-over-year basis at 4.0% and 5.1%, respectively – below expectations of slight accelerations.…

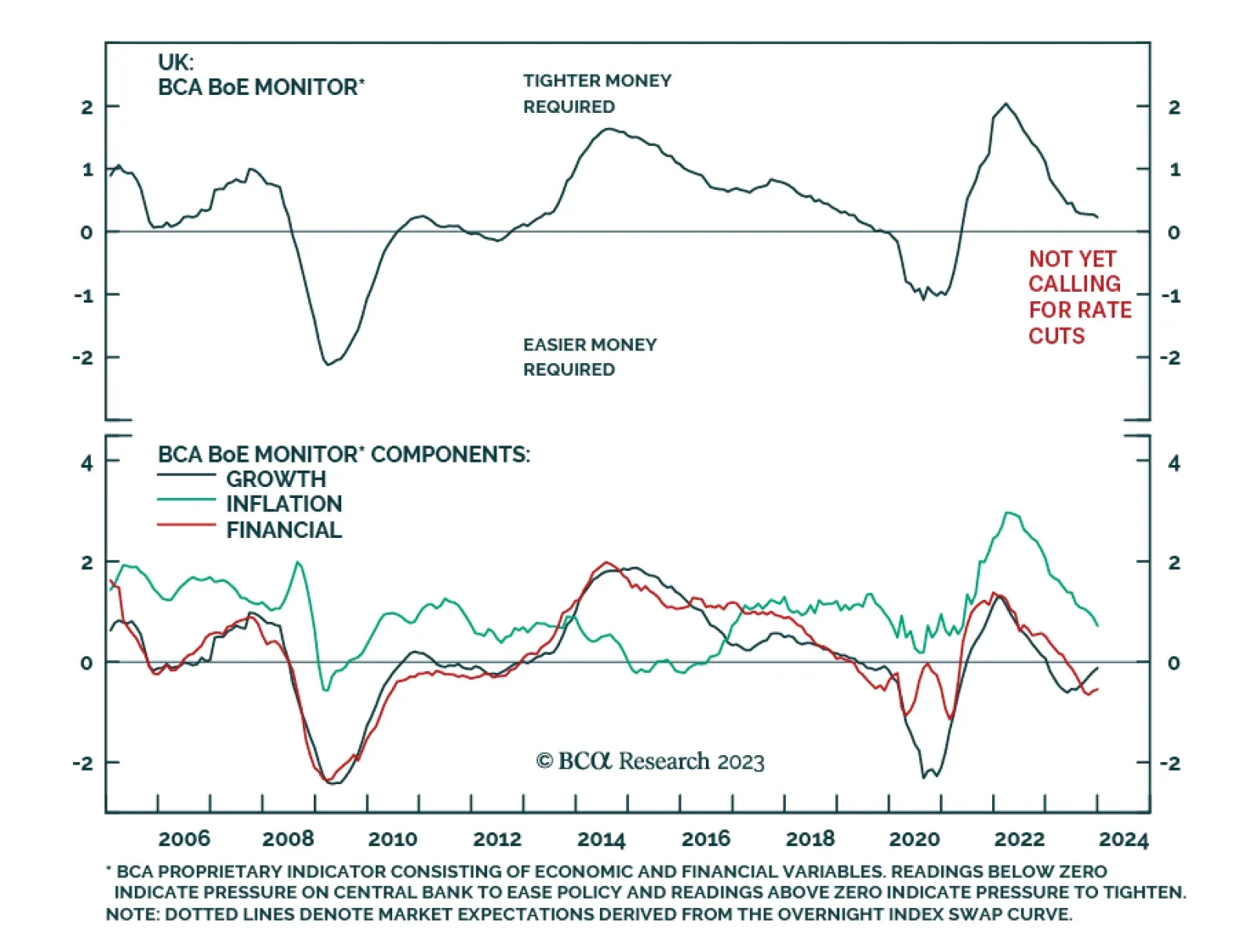

Our Central Bank Monitors support European central bankers’ decision to hold rates steady. Find out what it means for European fixed-income portfolio allocation.

As expected, the Bank of England voted to keep its bank rate unchanged at 5.25% on Thursday – maintaining policy on hold for the fourth consecutive meeting. Two of the nine MPC members voted in favor of a 25bps rise (one…