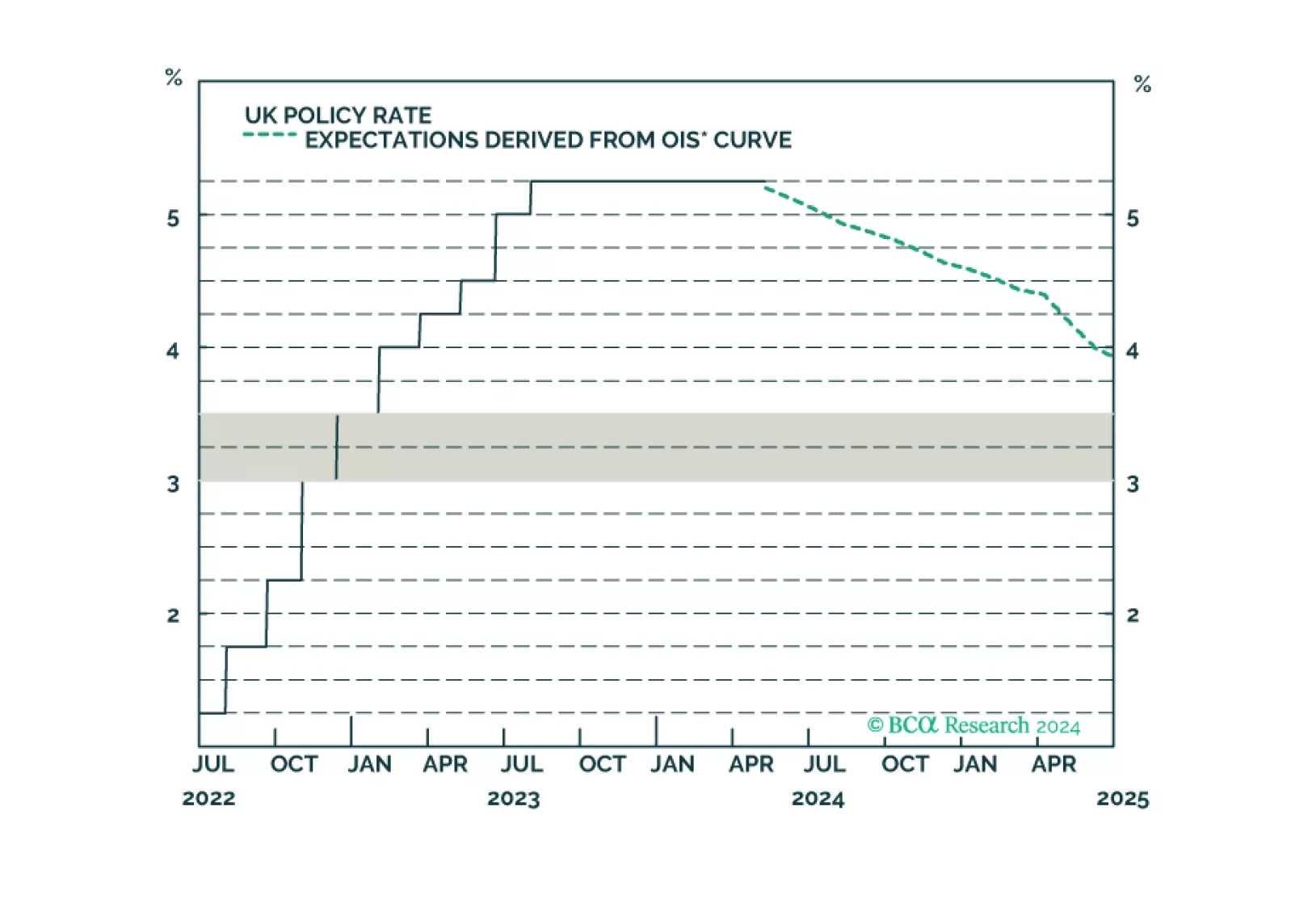

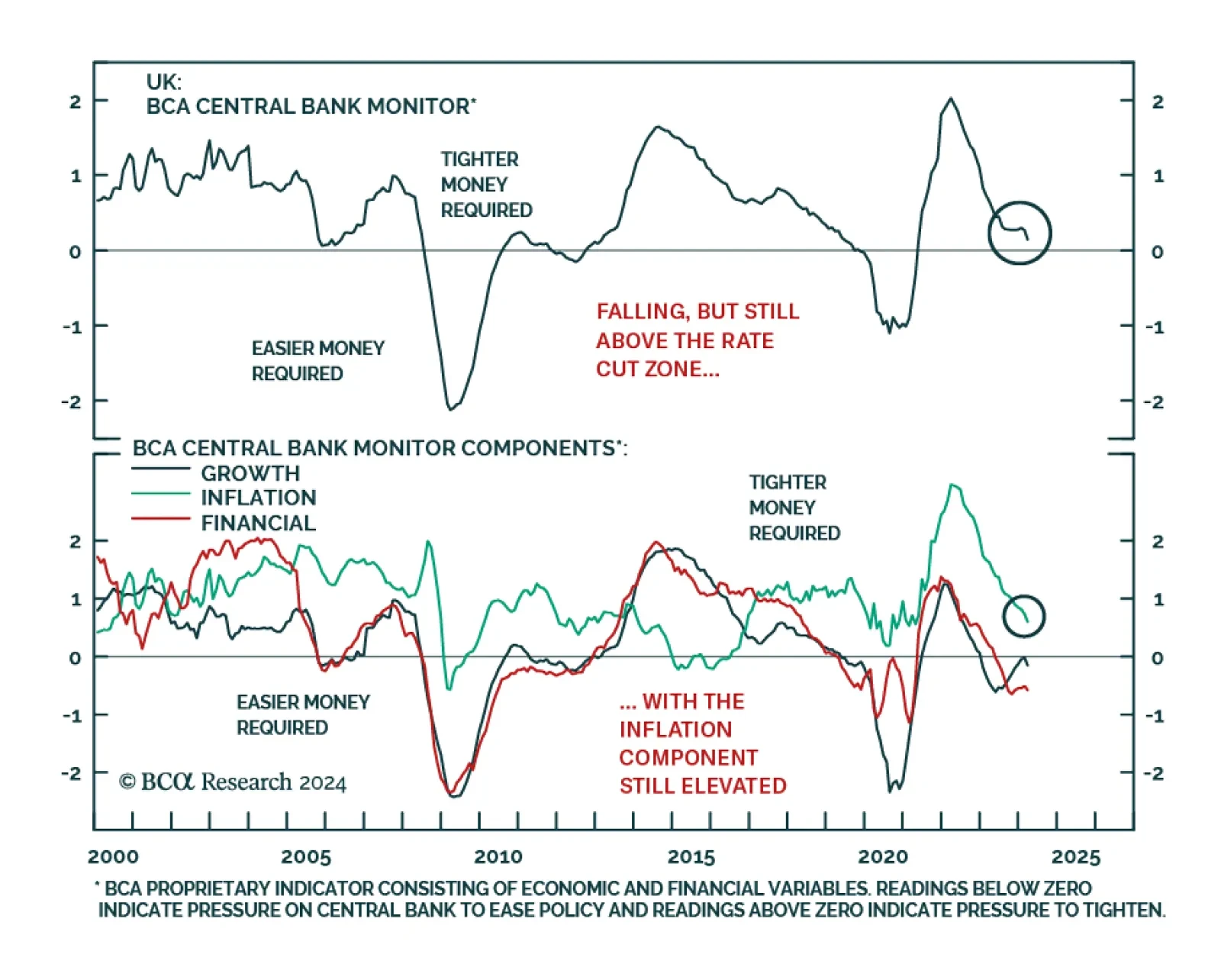

In a widely expected move, the Bank of England (BoE) maintained its policy rate at 5.25% in May. Nevertheless, two Committee Members voted in favor of cutting rates, one more than was anticipated. The tone of the report was…

An update to our views on UK rates and currency following today’s Bank of England meeting.

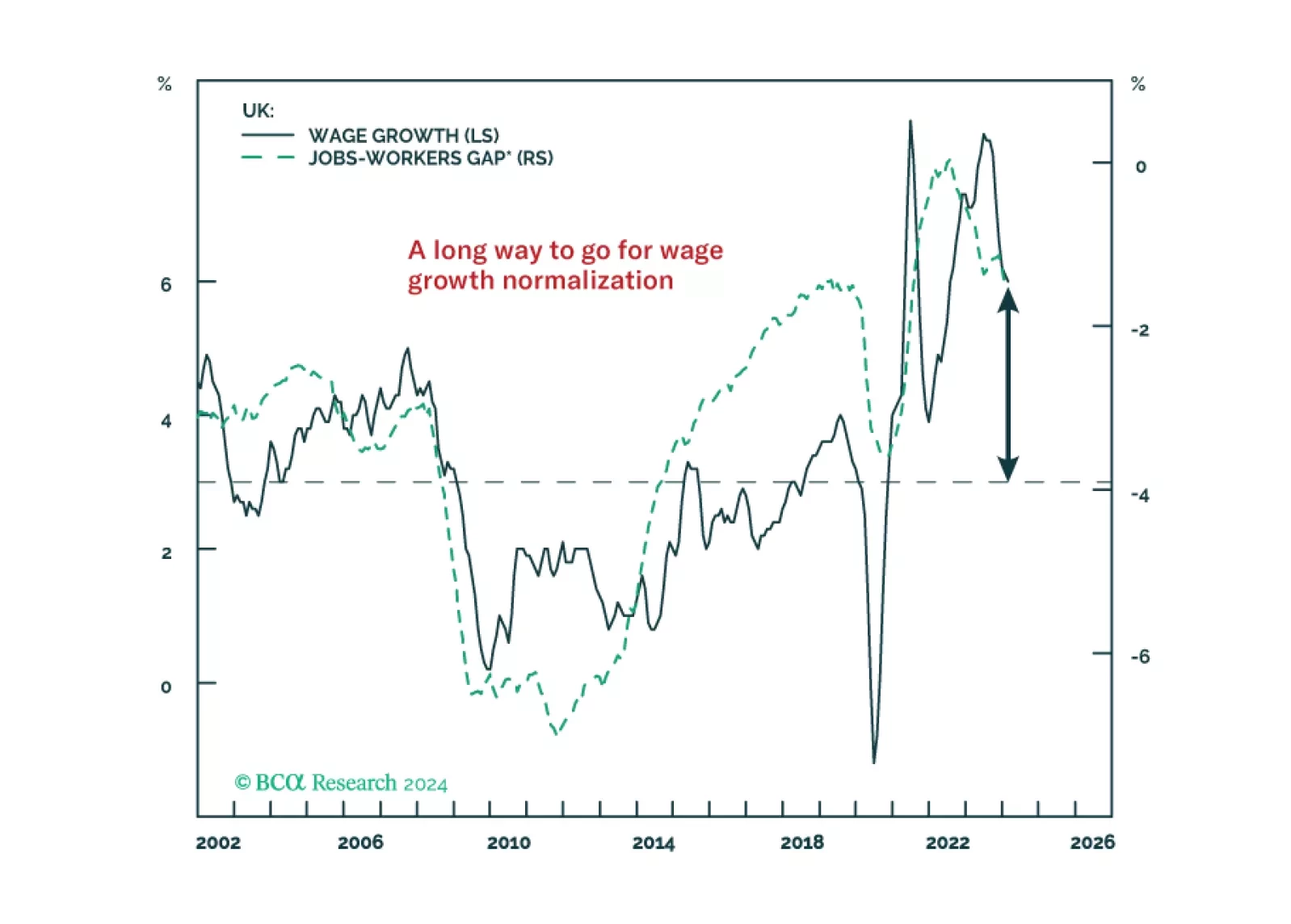

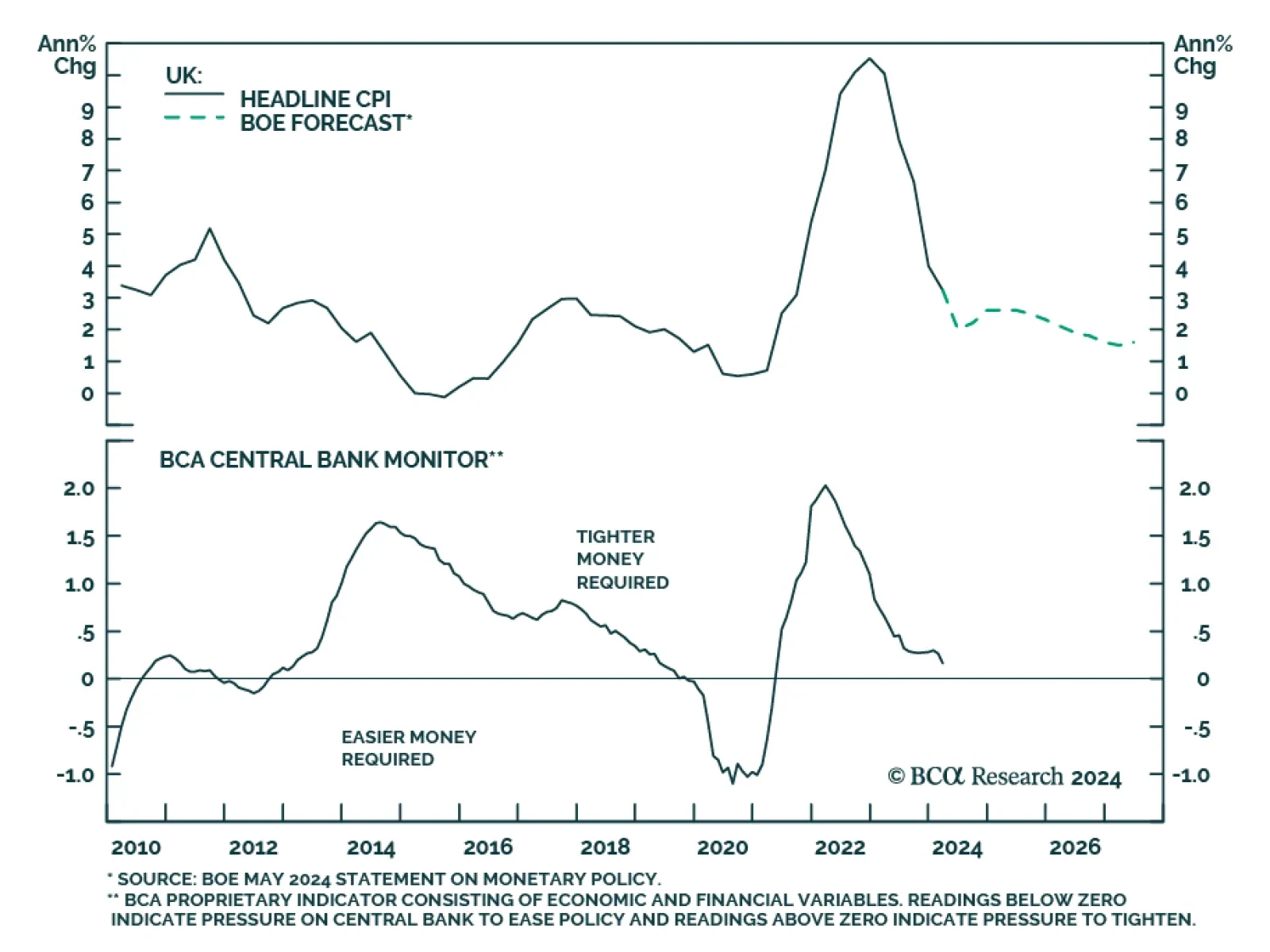

According to BCA Research’s Global Fixed Income Strategy service, a hard landing is the only way to solve the UK inflation problem. Sticky inflation and lingering inflation pressures have made the BoE’s job much…

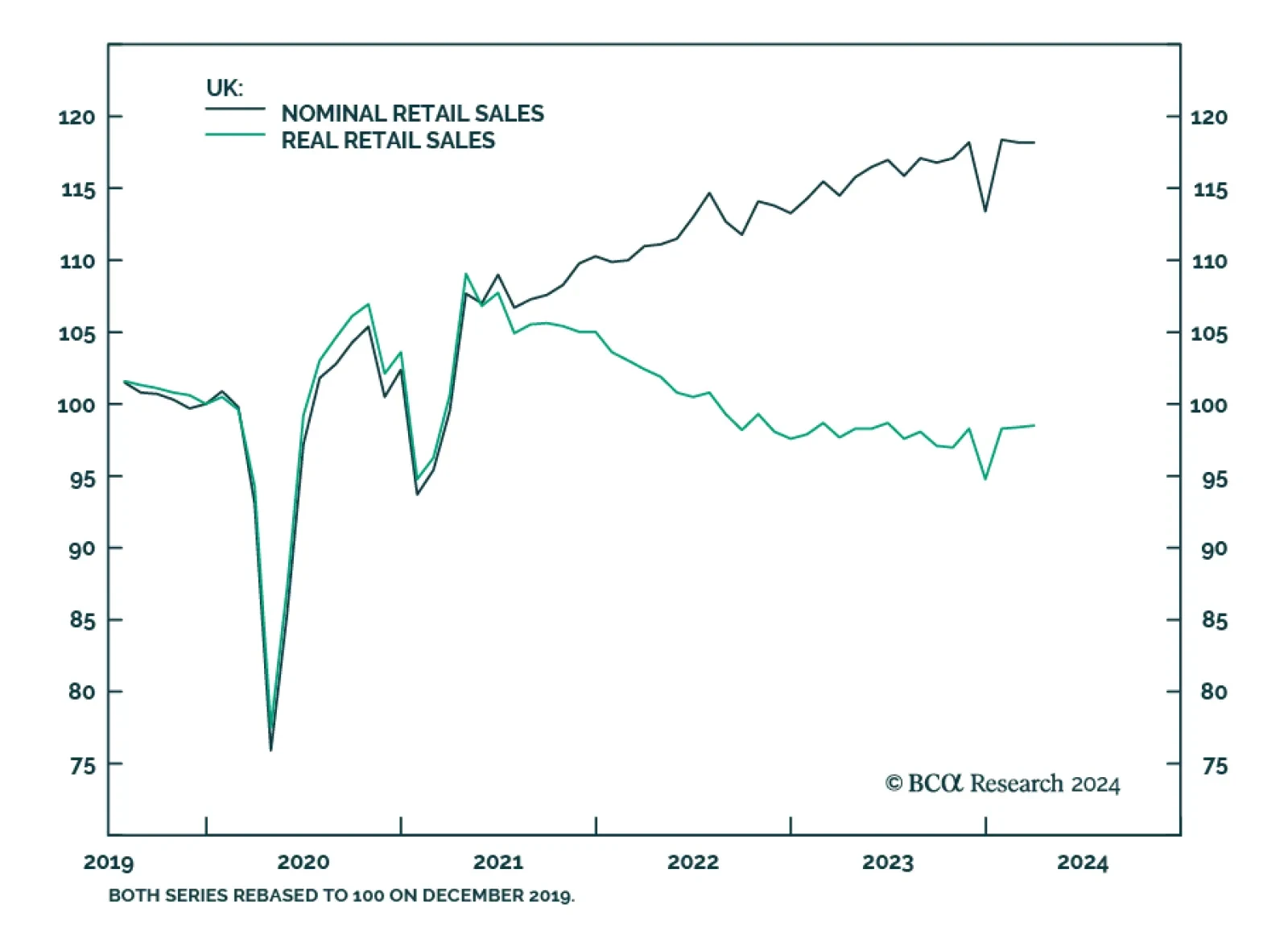

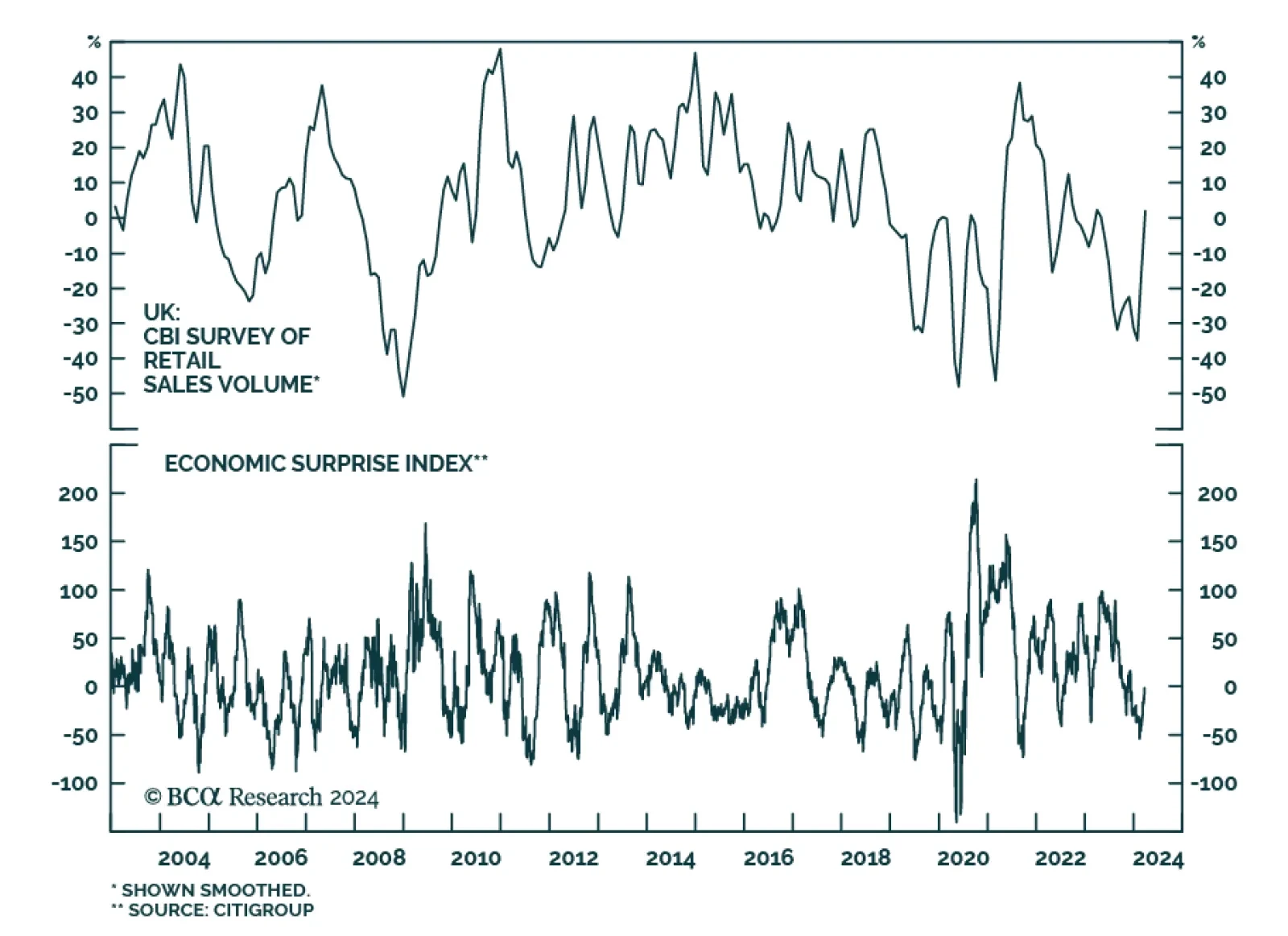

UK retail sales volumes were flat in March, a decrease from the 0.1% growth registered in February and disappointing expectations of a 0.3% m/m increase. The details were mixed, with automotive fuel and non-…

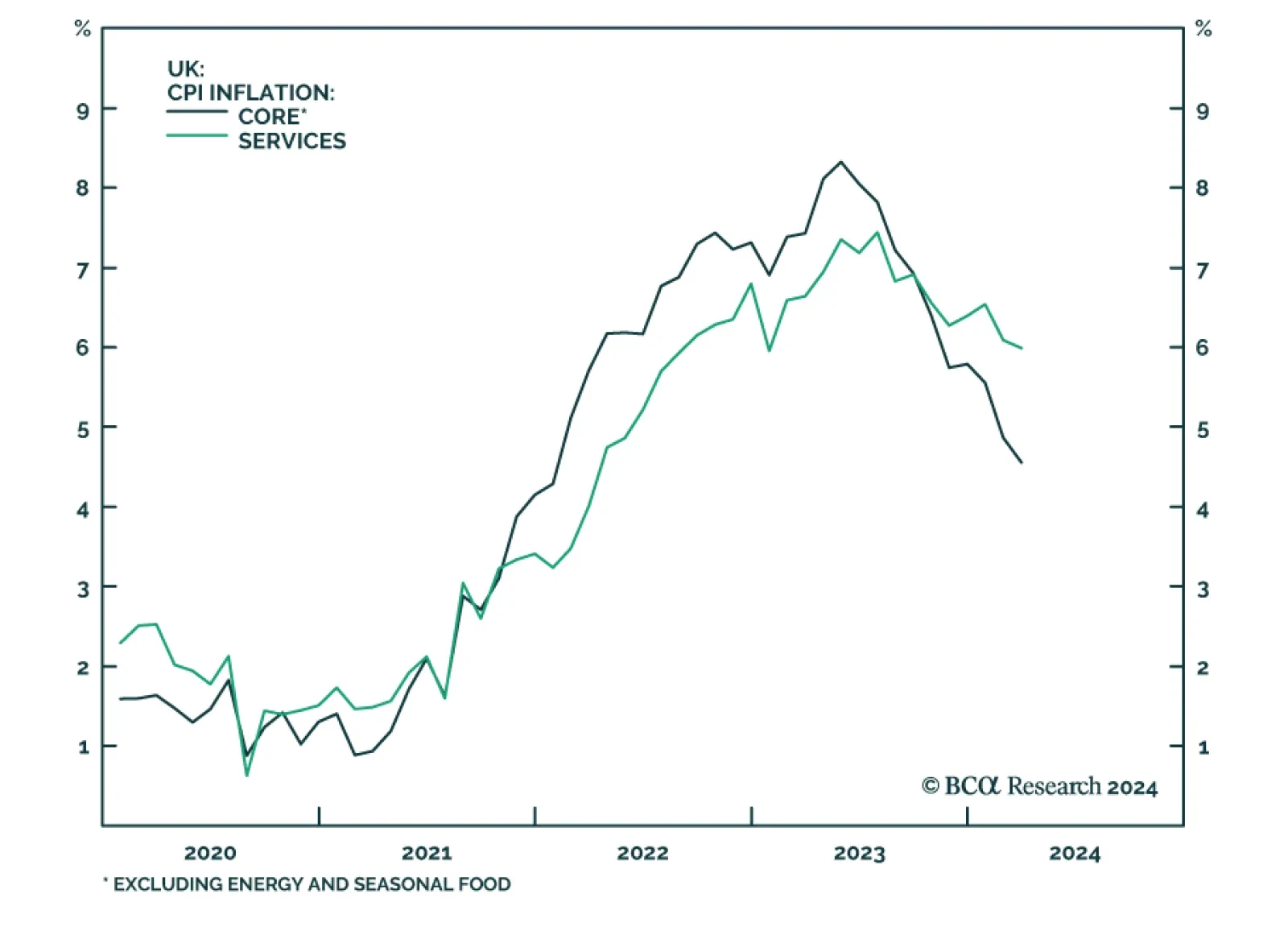

UK inflation came in hotter than expected in March. Headline CPI inflation was unchanged at 0.6% m/m – above expectations of a slowdown to 0.4% m/m. Moreover, while the headline and core measures both decelerated on an…

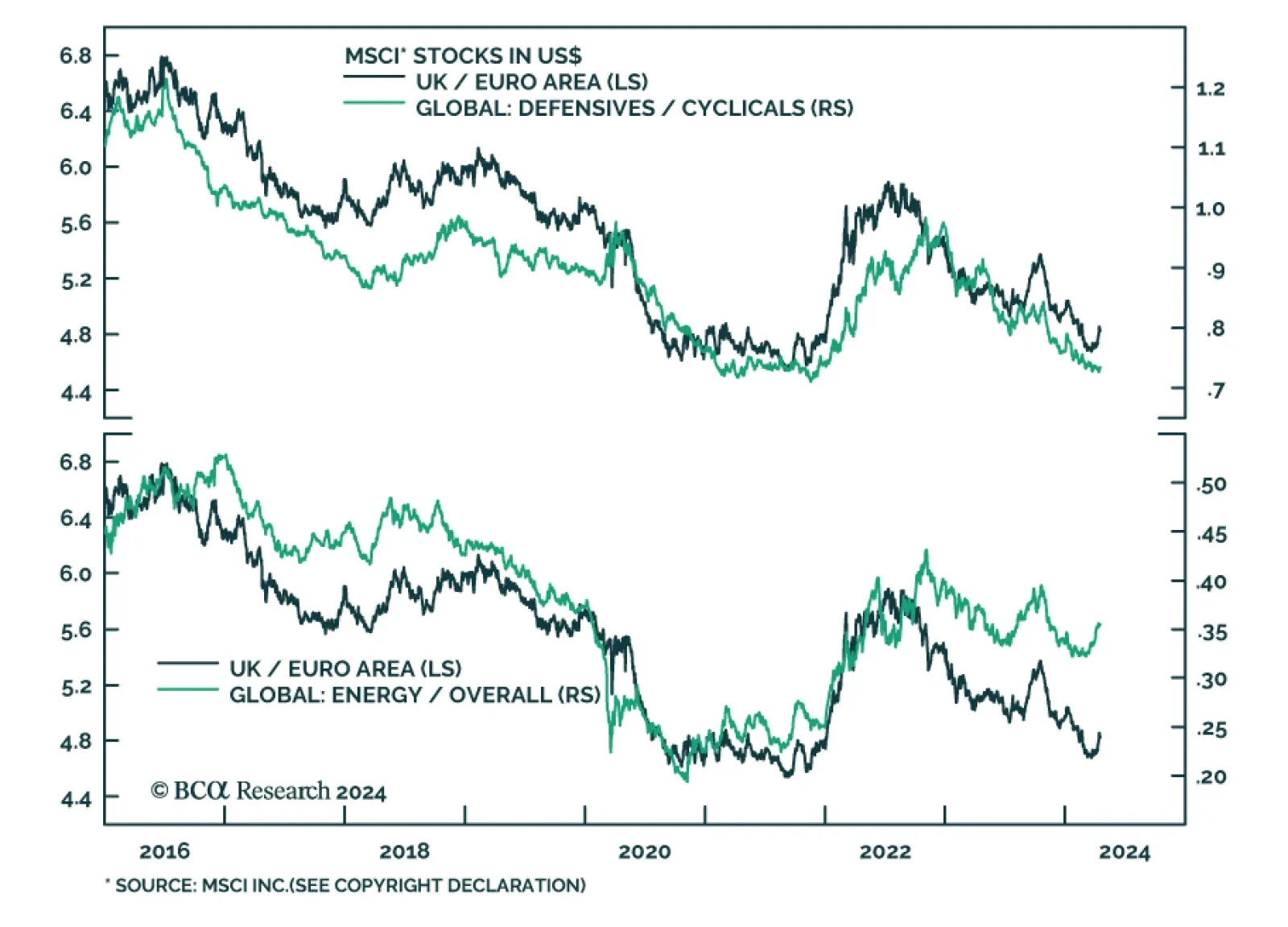

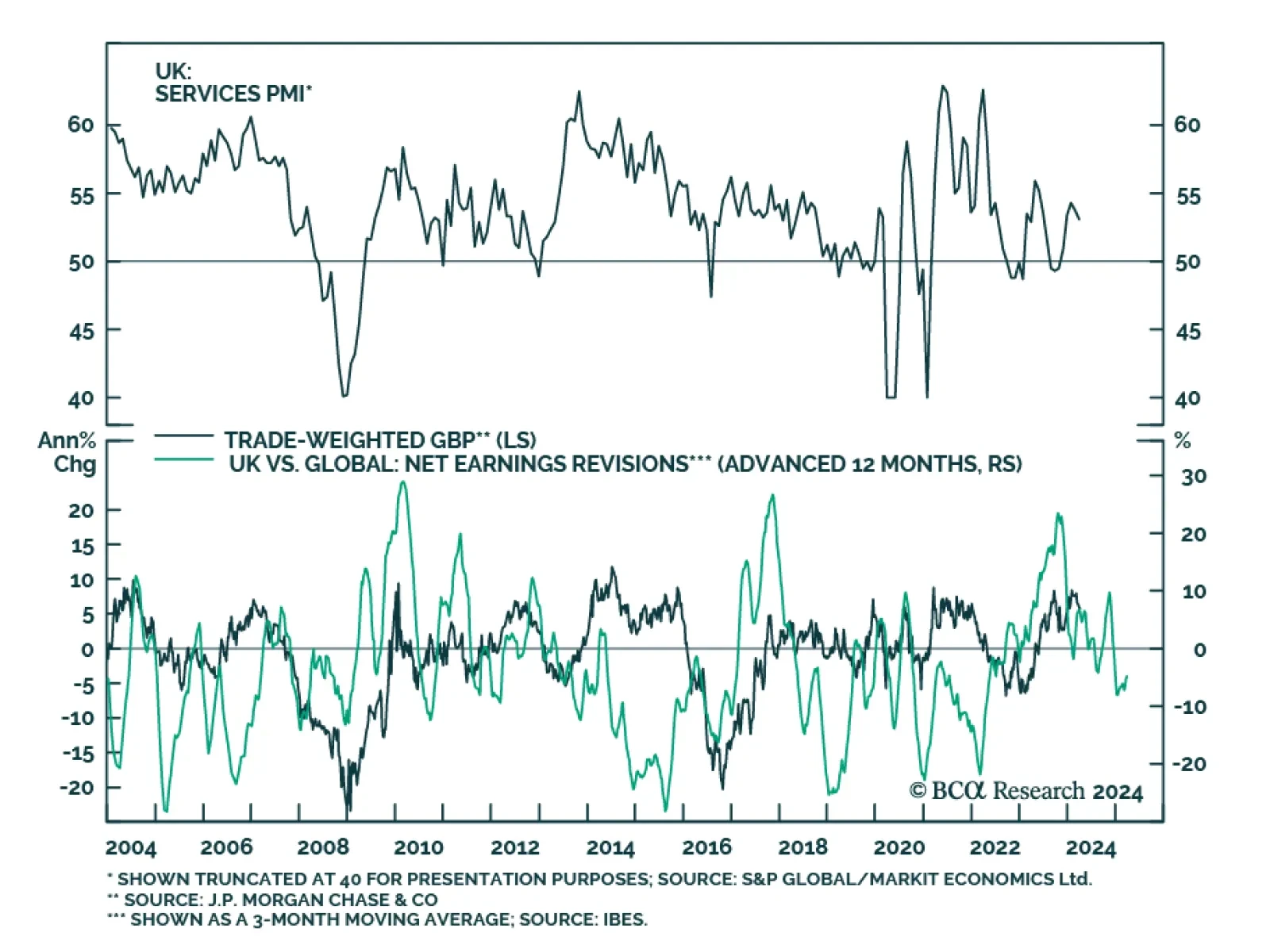

UK stocks posted one of the largest positive abnormal returns (z-score) among the major financial markets we tracked in March. The MSCI UK index has gained 2% relative to Eurozone stocks since late February. However, the…

The final UK S&P Global Services and Composite PMIs for March were both revised down slightly from their flash estimates. While the report indicates that activity is still expanding, there has been a clear loss in momentum…

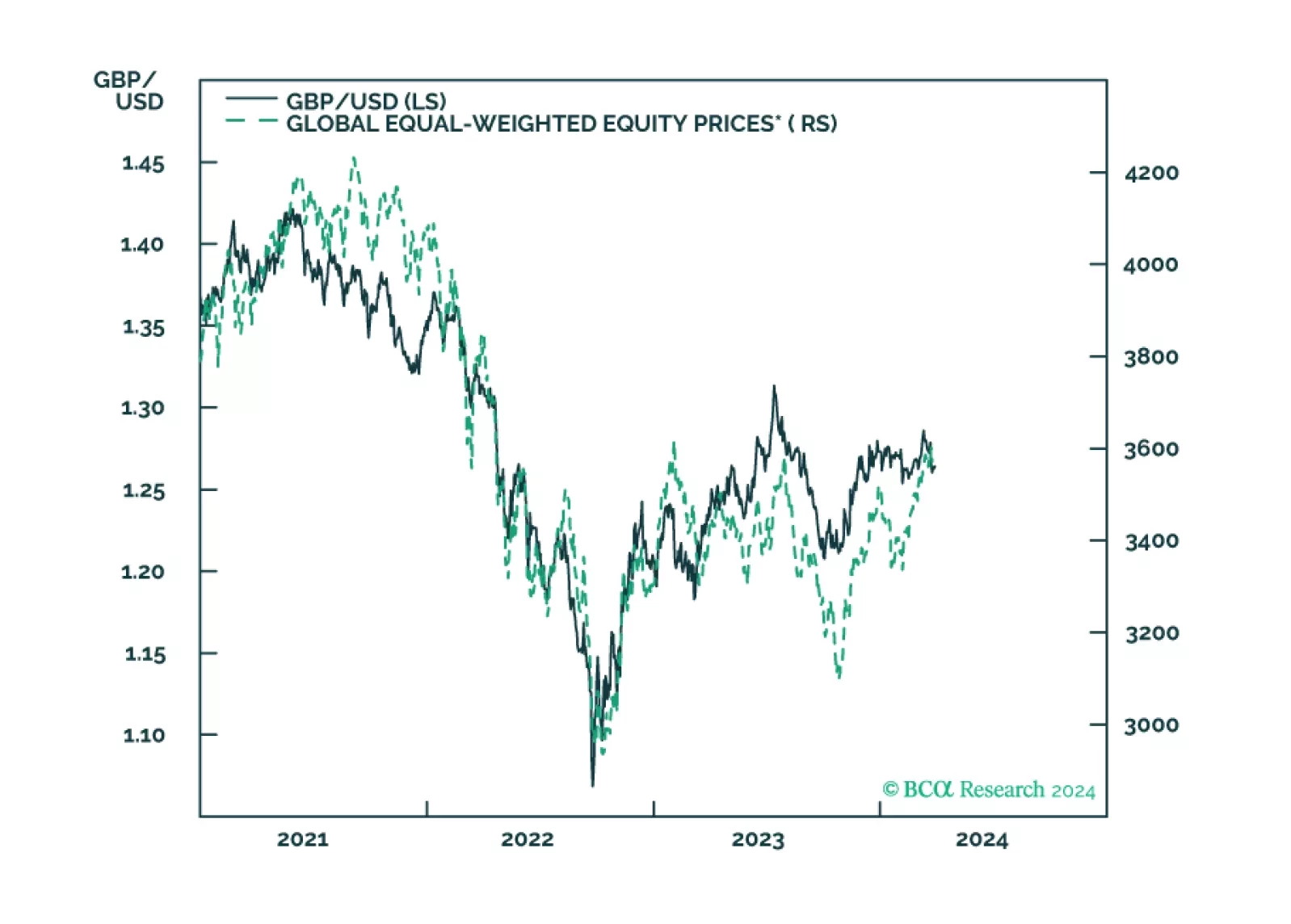

In this Insight, we discuss our rationale for a short sterling position.

The latest batch of economic data out of the UK suggests that economic conditions have recently stabilized. The flash Manufacturing PMI rose by a stronger-than-anticipated 2.4 points to a 20-month high of 49.9 in March –…