We look at the implications a various European central bank meetings this week, for currency strategy.

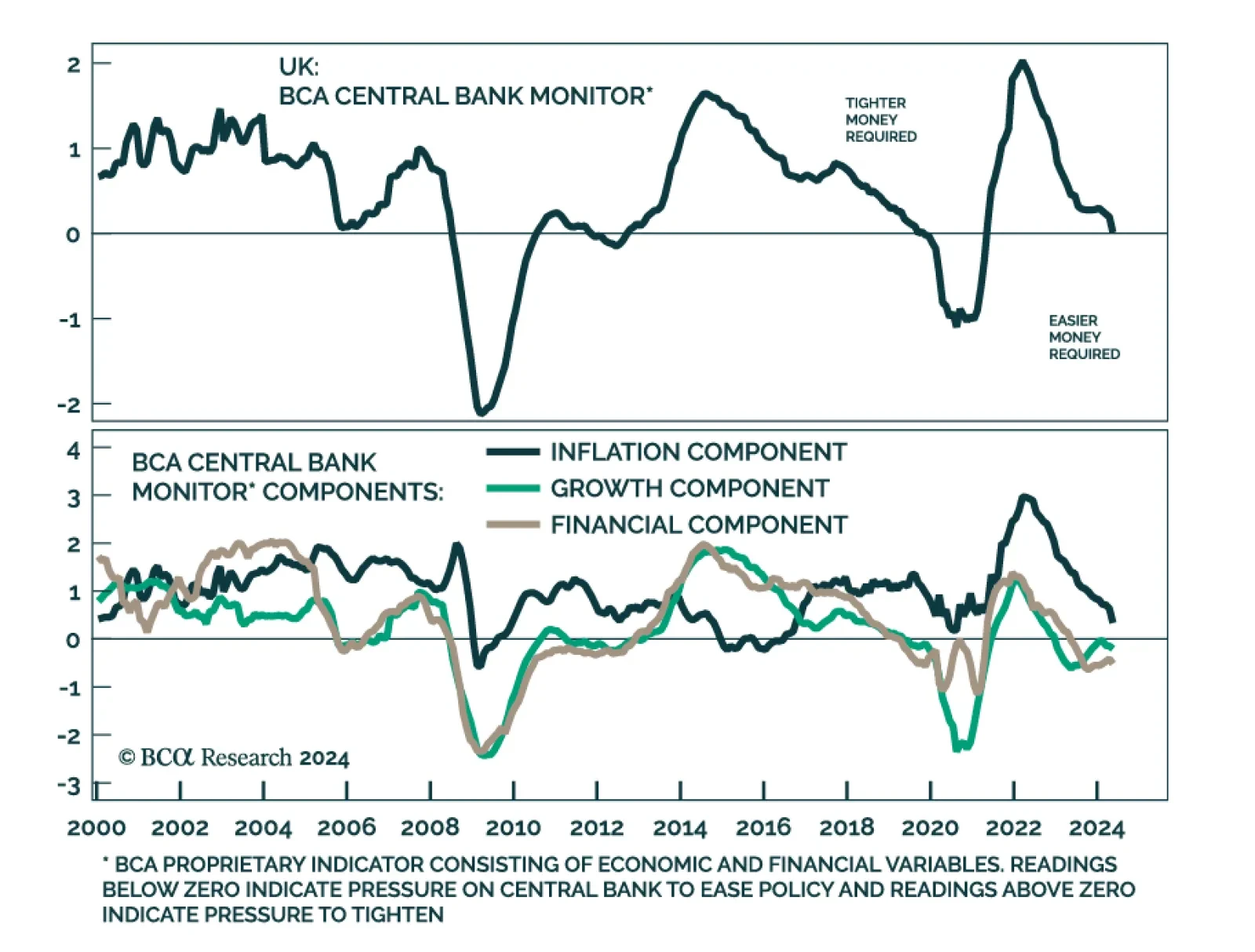

In a widely expected move, the Bank of England (BoE) kept its policy rate unchanged at 5.25% in June. Although MPC members voted seven-to-two in favor of not cutting rates, a tweak in communication noting that the decision was…

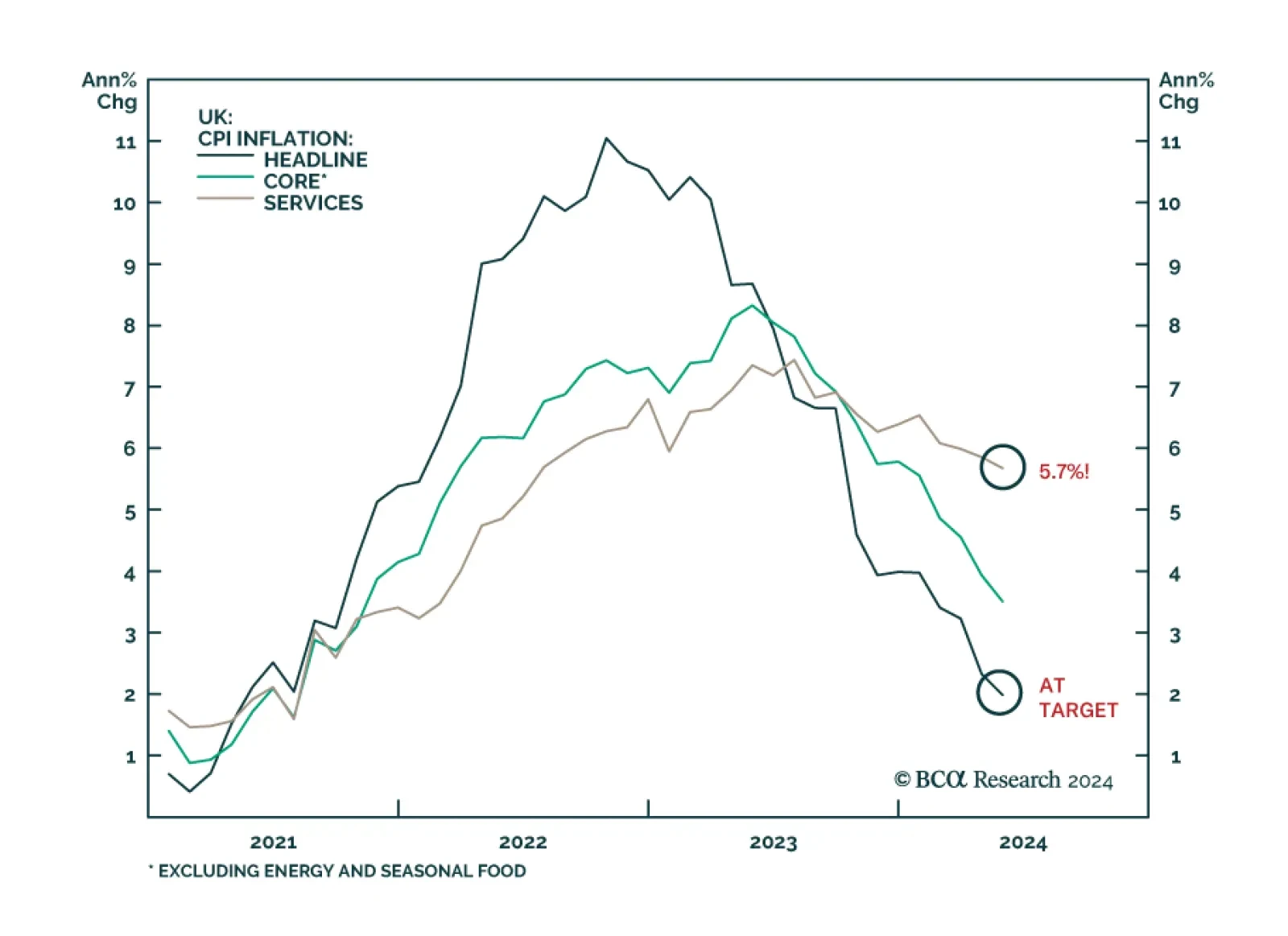

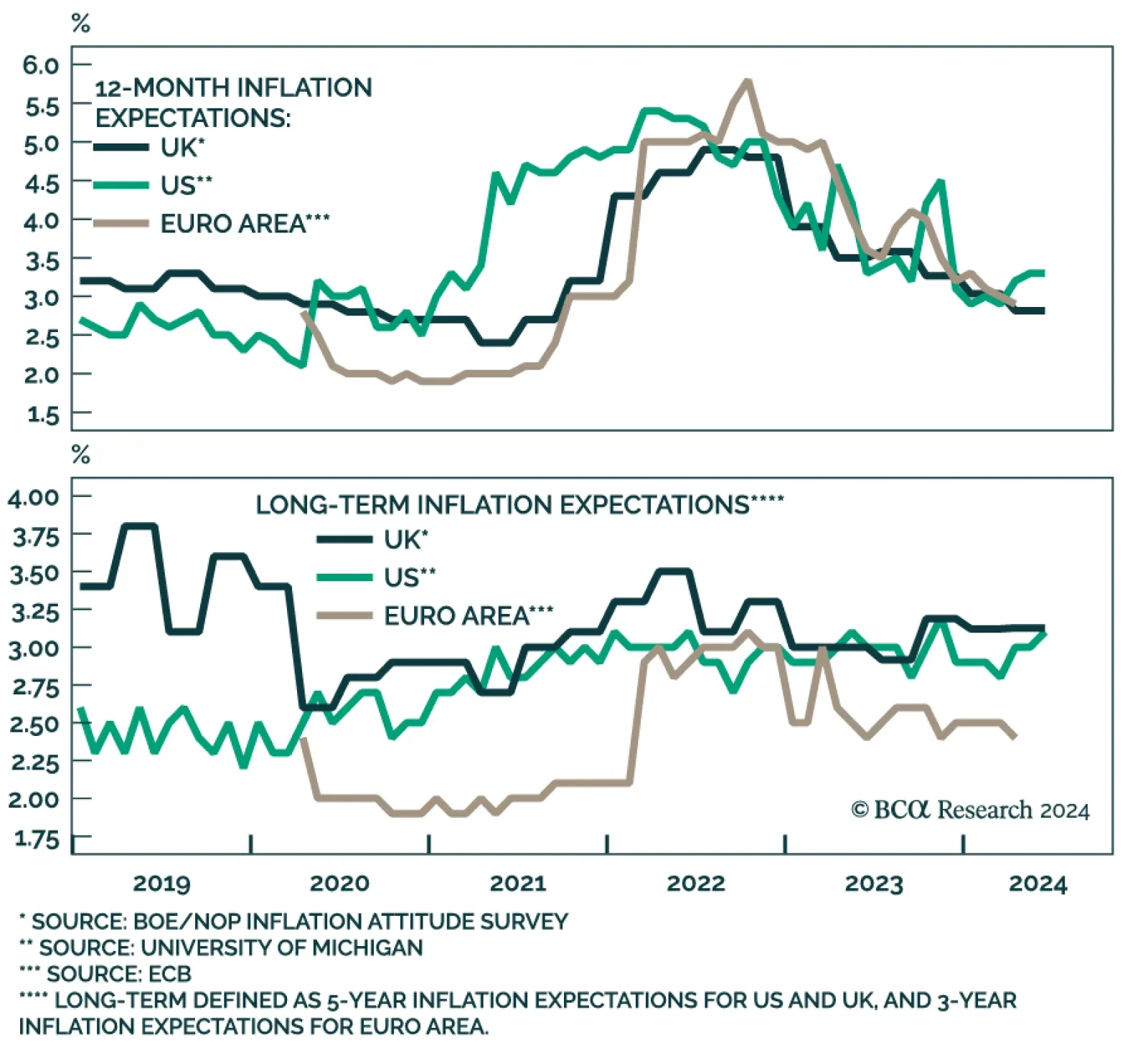

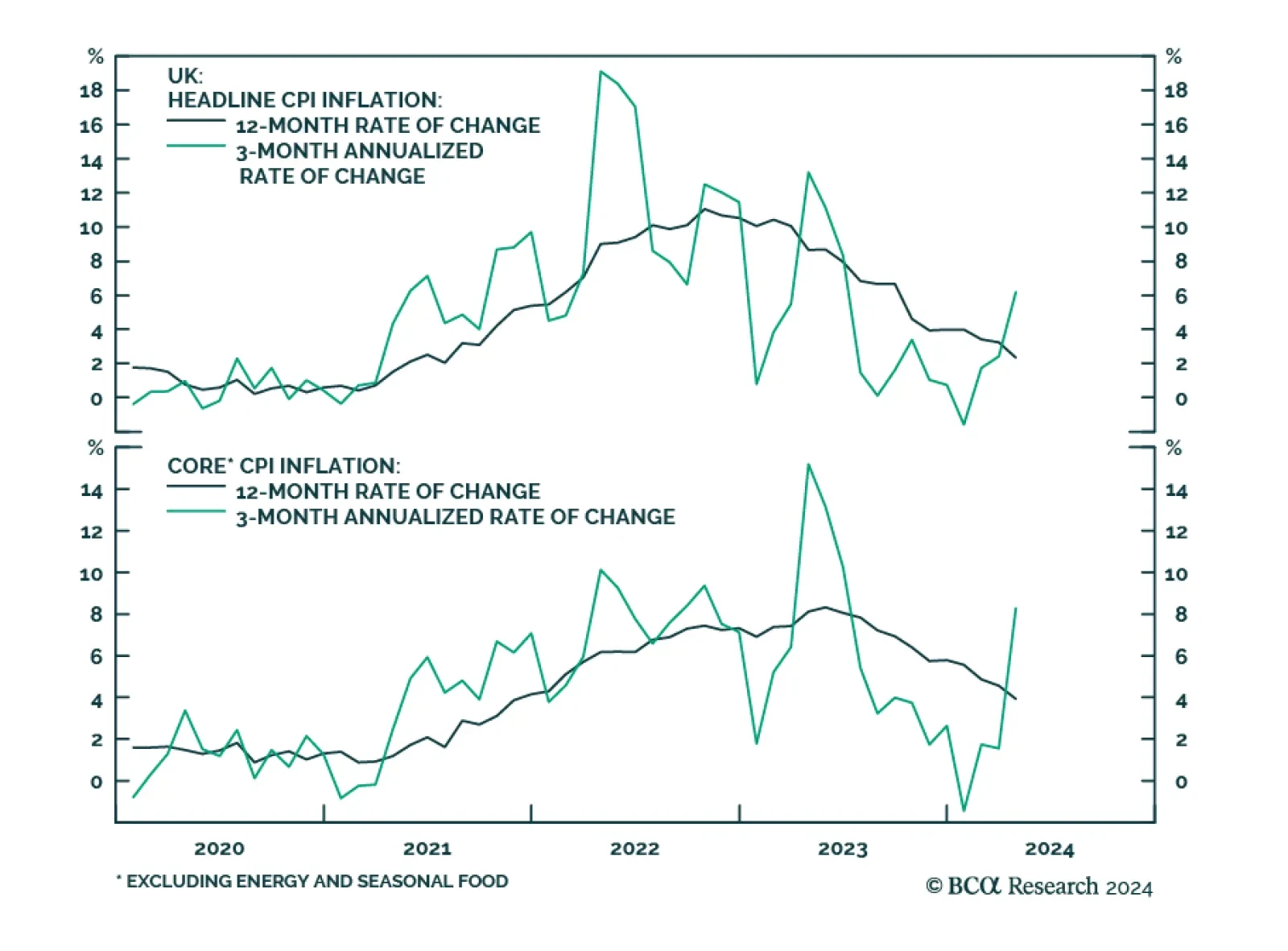

On the surface, UK inflation appears to be on the right track. The May CPI release came in broadly within expectations. Headline inflation eased from 2.3%y/y to 2.0%y/y – directly on the BoE’s target for the first…

According to BCA Research’s Global Investment Strategy service, aggressive fiscal stimulus and labor market flexibility contributed to the relative strength of the US consumer. However, adverse region-specific effects also…

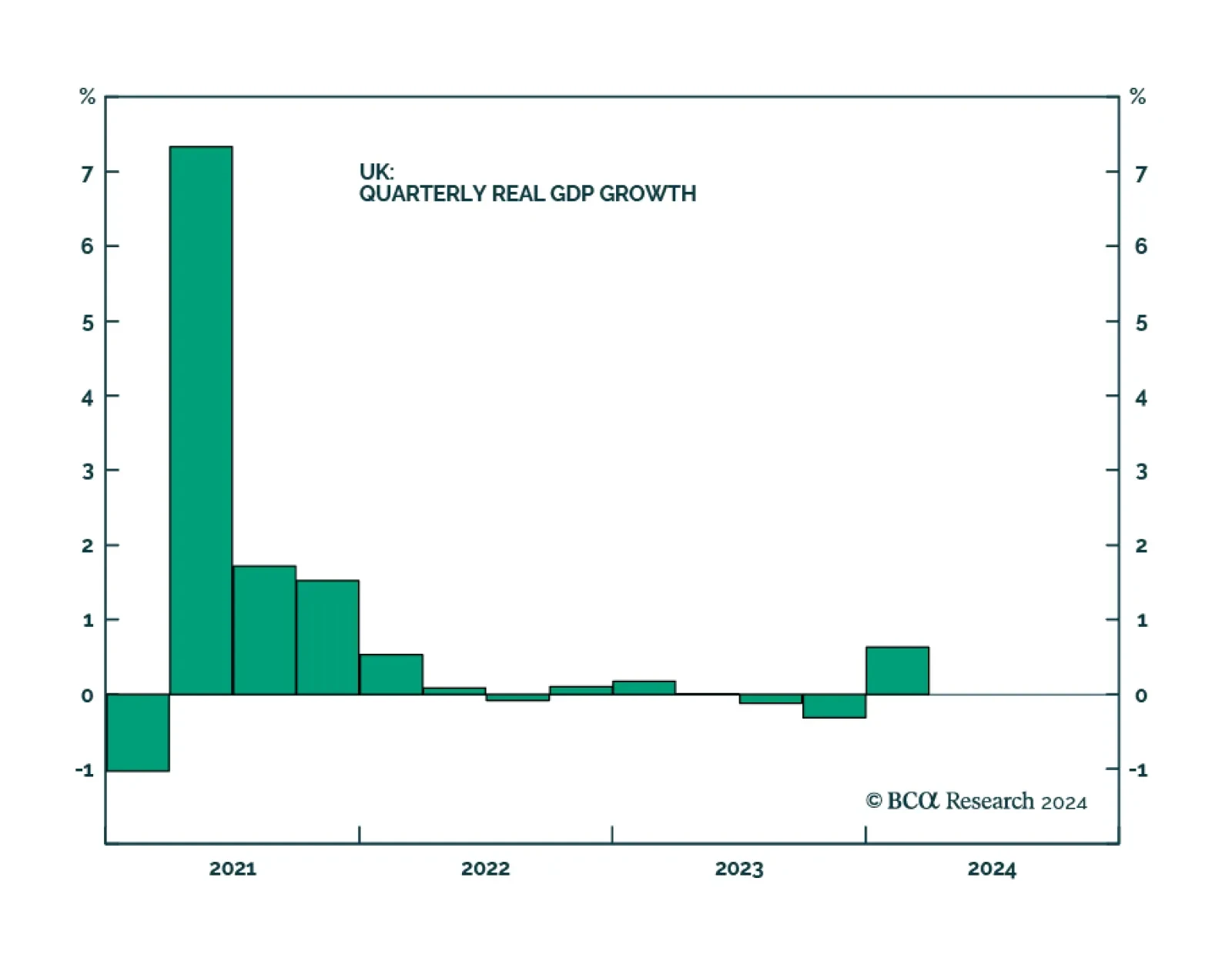

The BoE had to deal with a stagflationary headache in the second half of 2023. Inflation was stickier and growth was weaker in the UK than in many of its DM peers. This trend turned around earlier this year with a late-cycle…

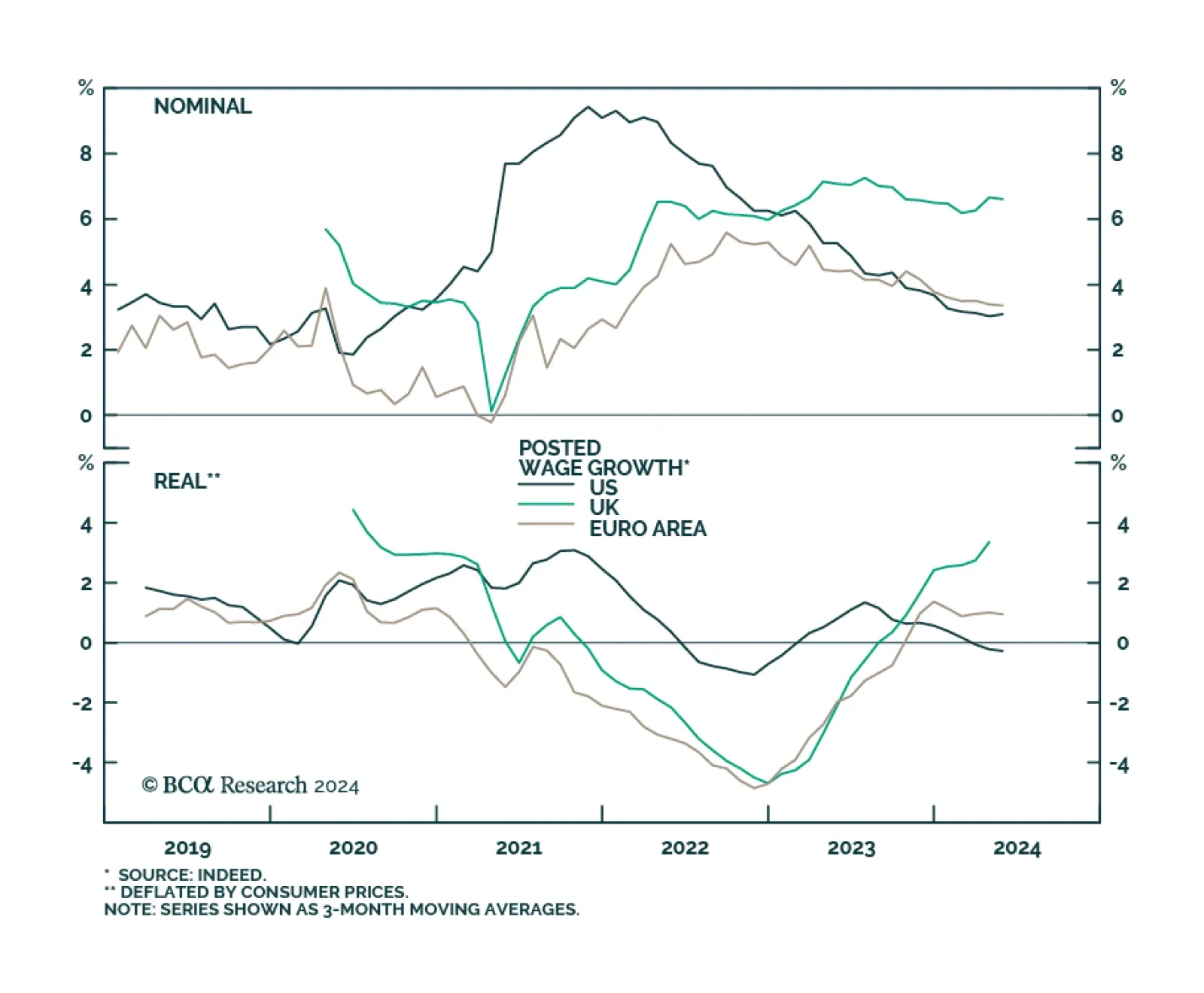

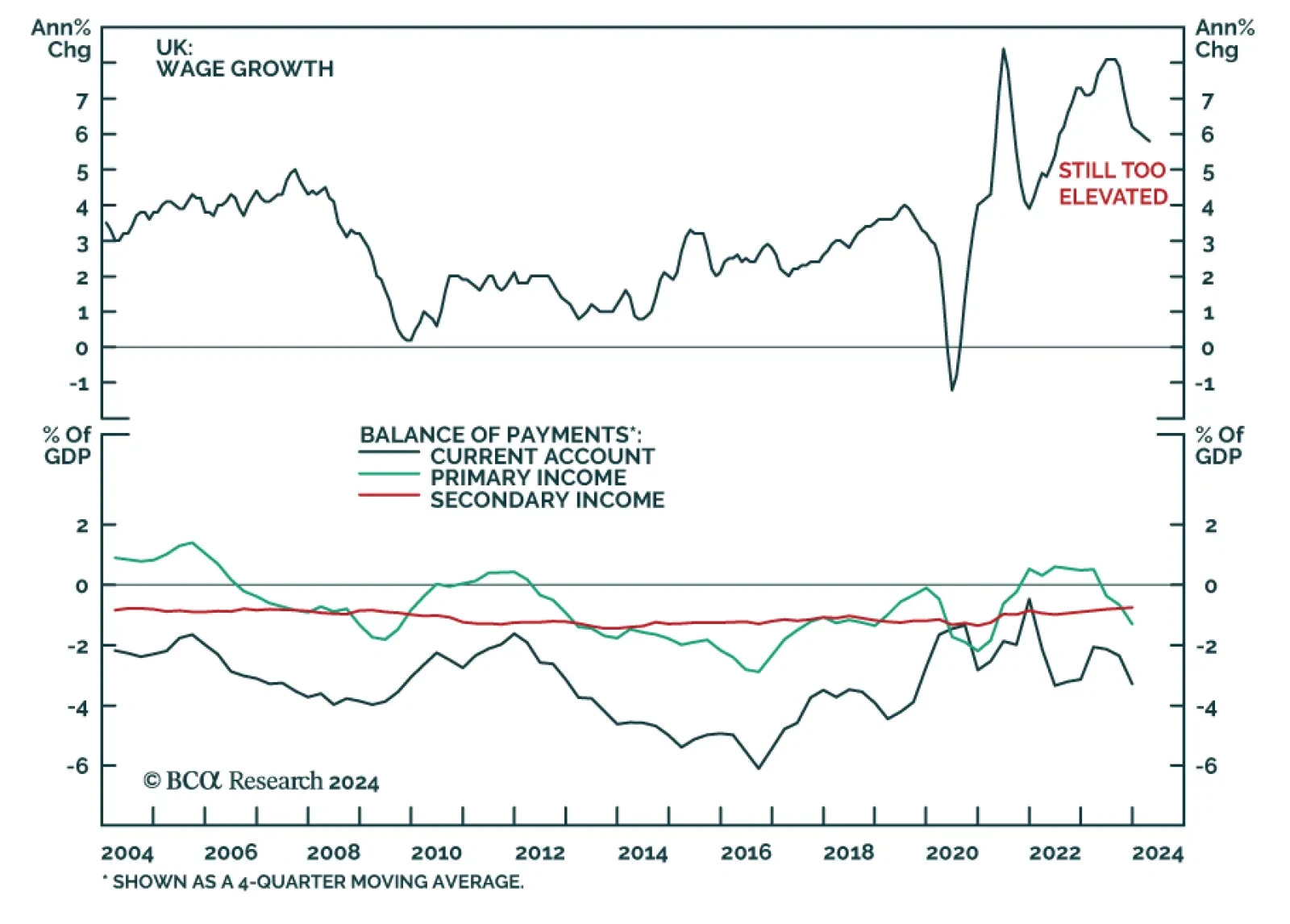

The UK unemployment rate surprised to the upside in the 3-month period ending in April, ticking up to 4.4% against expectations it would remain stable at March’s originally reported 4.3%. Concurrently, wage growth remains…

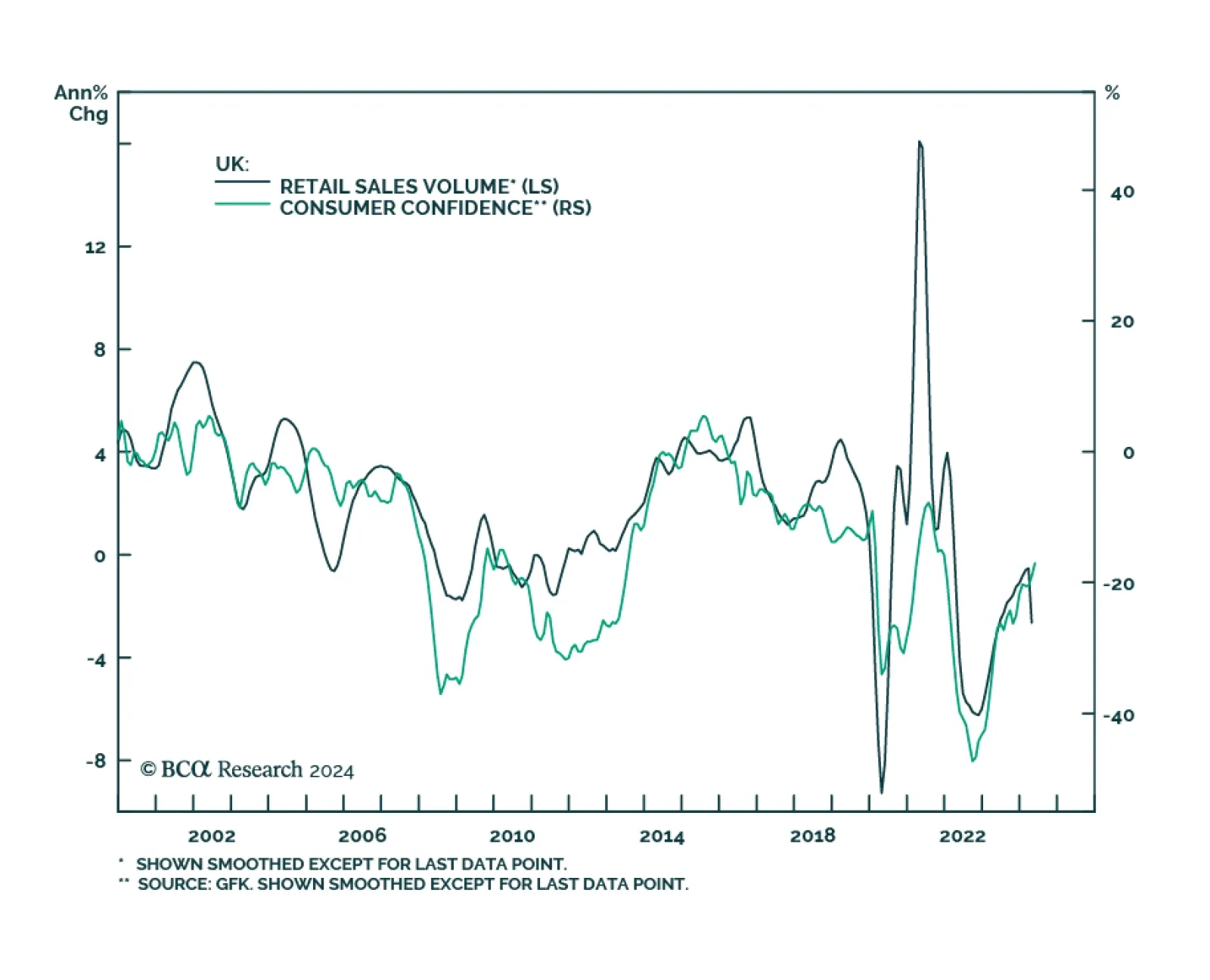

UK retail sales plunged 2.3% m/m in April from a downwardly revised 0.2% m/m contraction in March, significantly undershooting expectations of a 0.5% m/m decline. Household goods as well as clothing and footwear stores led the…

The UK CPI release surprised markets to the upside across the board on Wednesday. Headline CPI increased 2.3% year-on-year, above expectations of 2.1%. Core surprised to the upside as well, moderating from 4.2% to 3.9%y/y, less…

Preliminary GDP estimates suggest that the UK economy started growing again in Q1, thus exiting a technical recession in the past two quarters. Q1 growth came in at 0.6%, improving from a 0.3% contraction last quarter,…