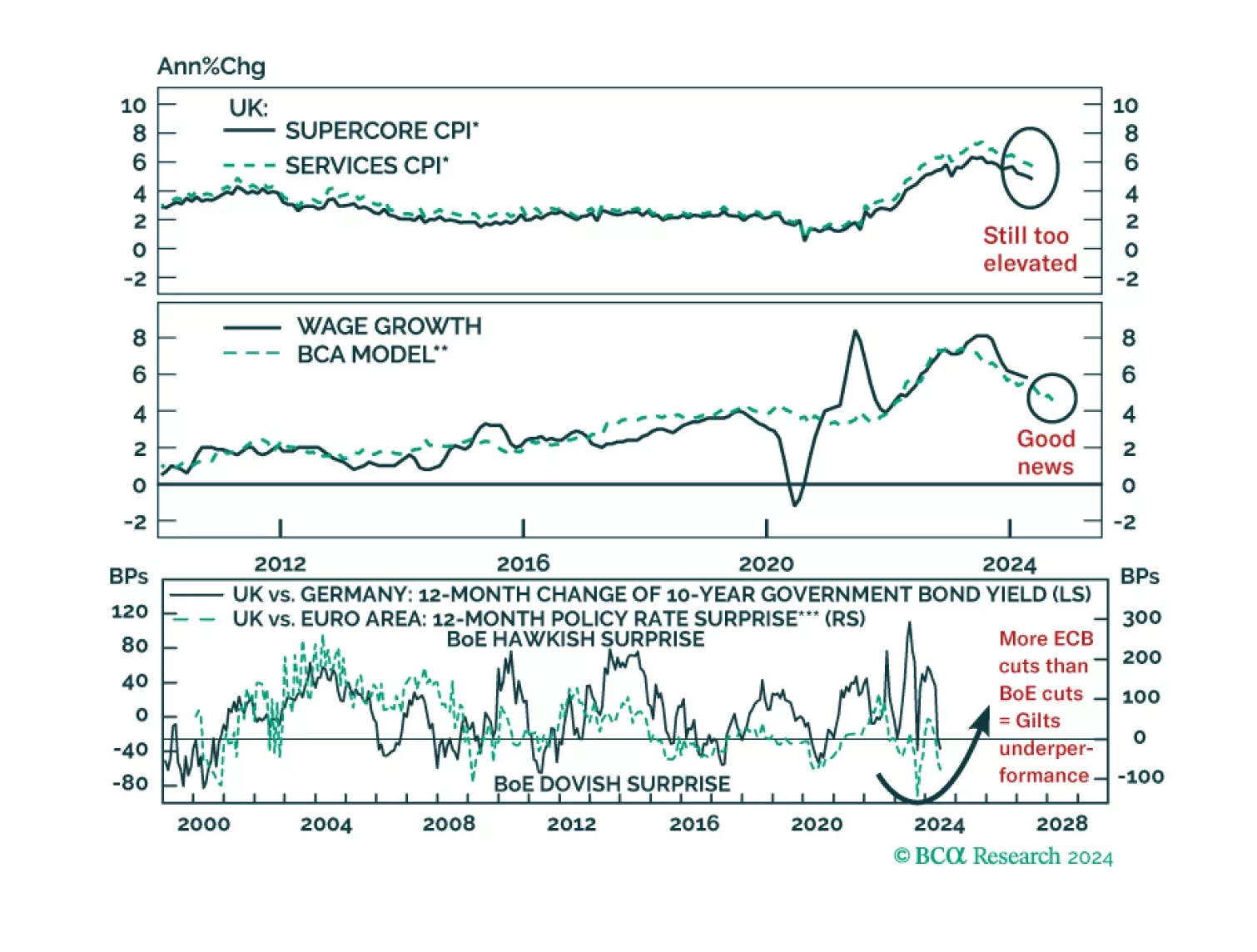

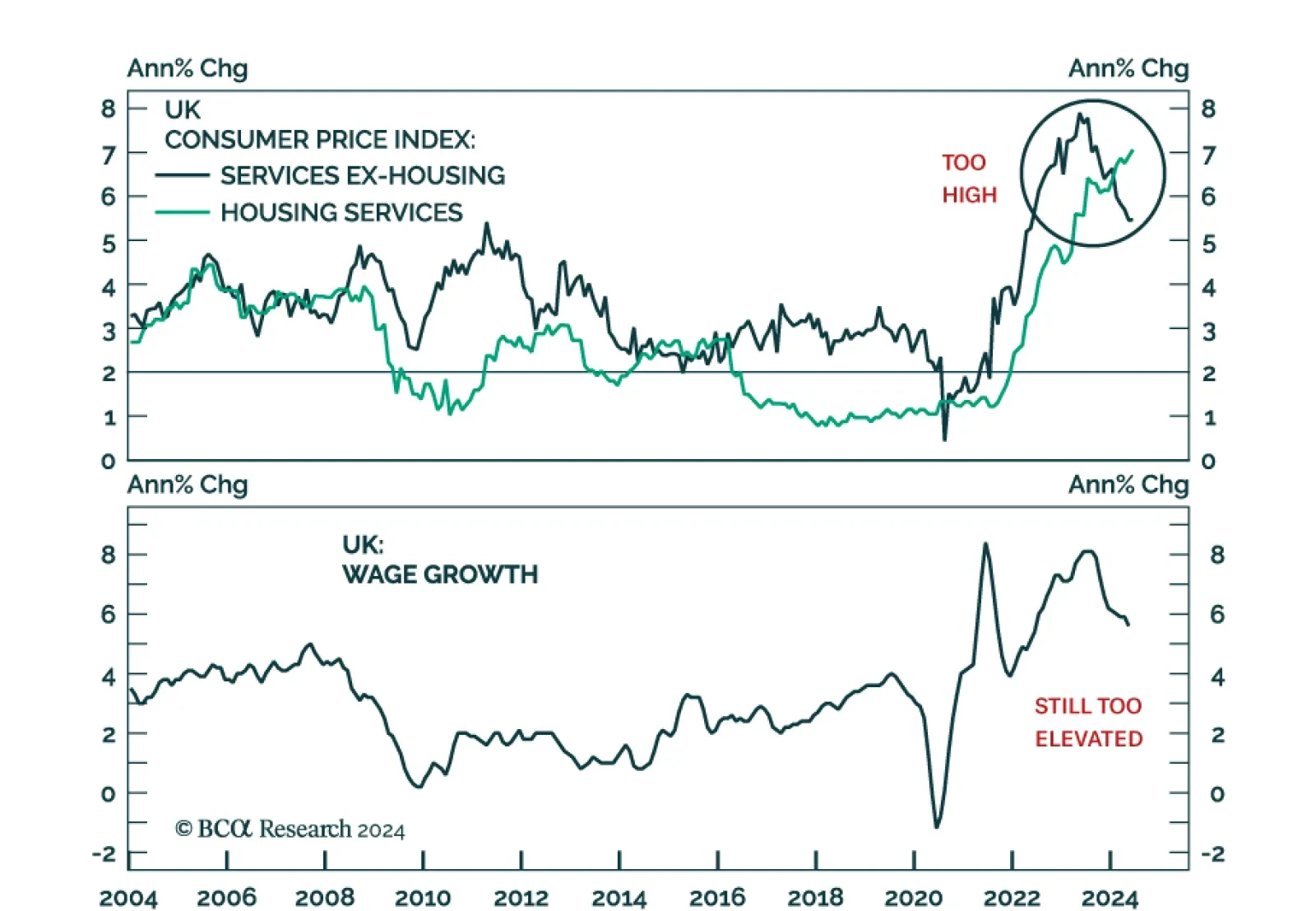

UK’s CPI growth stands right on the Bank of England’s (BoE) 2% target. However, services inflation remains sticky, growing at a constant 5.7% y/y in June. Moreover, the deceleration in wage growth remains insufficient…

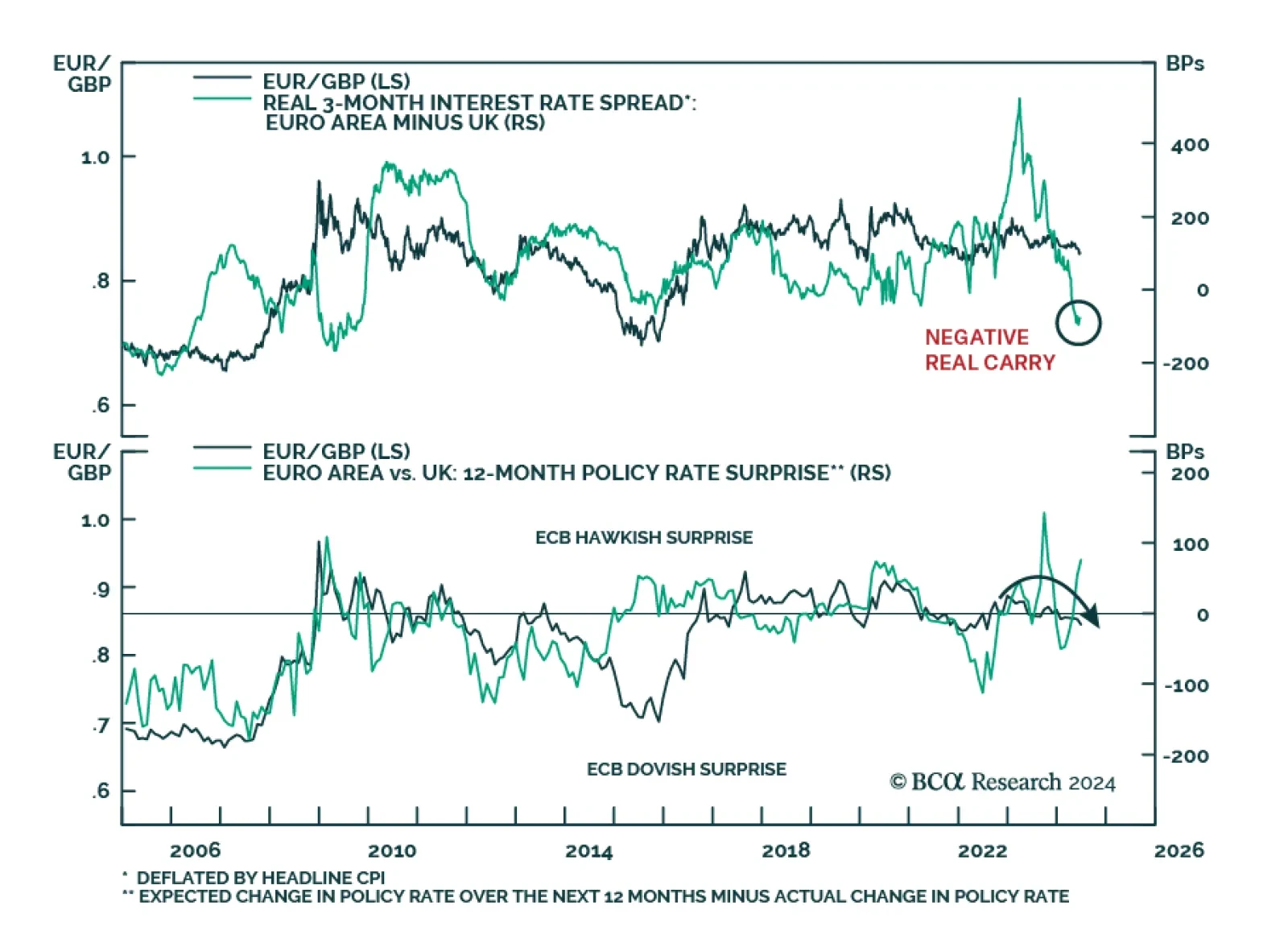

We review some of the key data releases this week that we find have an impact on our currency strategy. Long yen positions make sense today. Long sterling and the euro bets are more of a judgment call, and we will fade any strength…

The real threat to European equities is growth, not political risk. How low will Eurozone earnings fall during the coming recession and how much will equities decline in response?

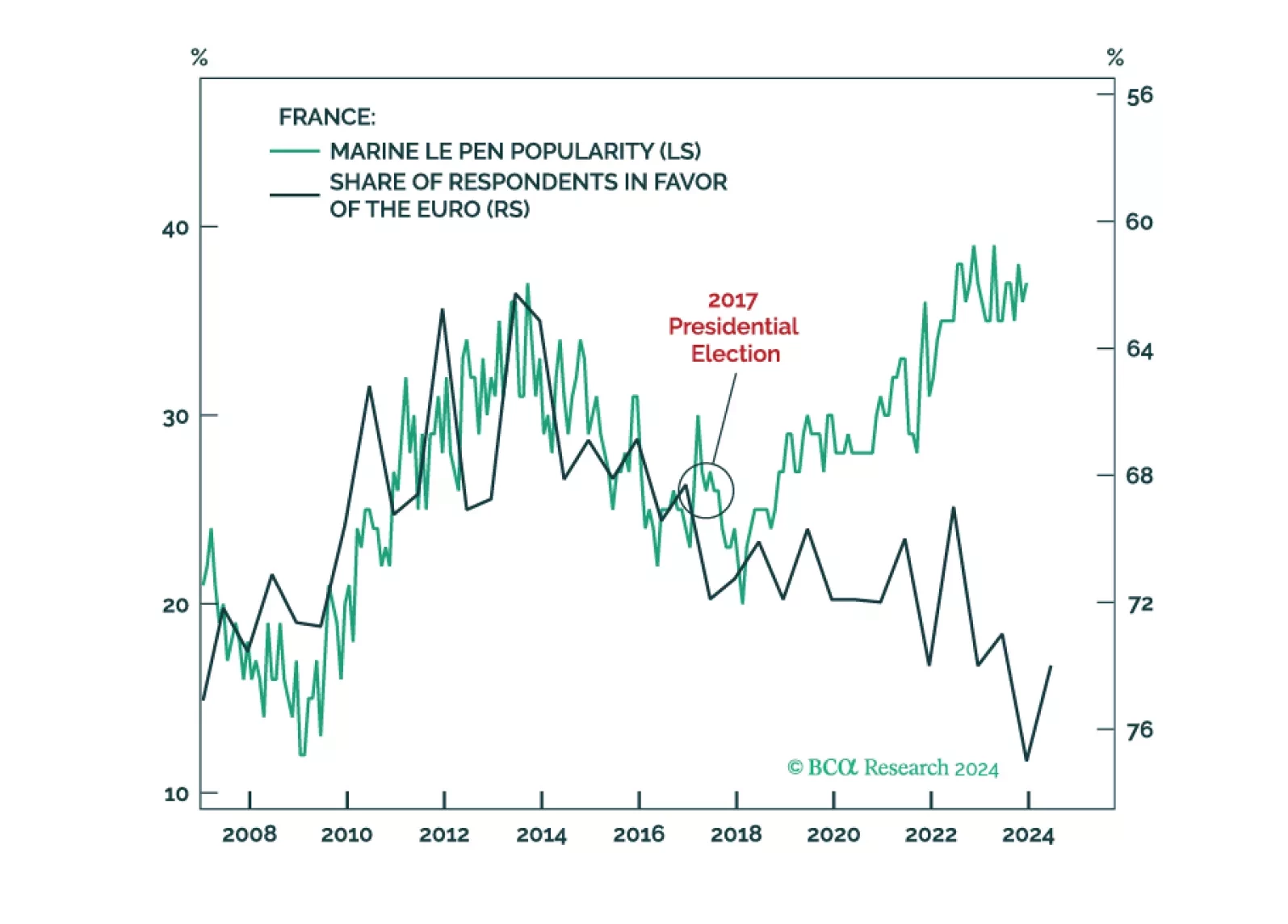

Investors in European sovereign bonds should find solace that continental voters are not turning away from support for EU integration. As such, populist parties are not really that “far” left or right. And as long as they want to…

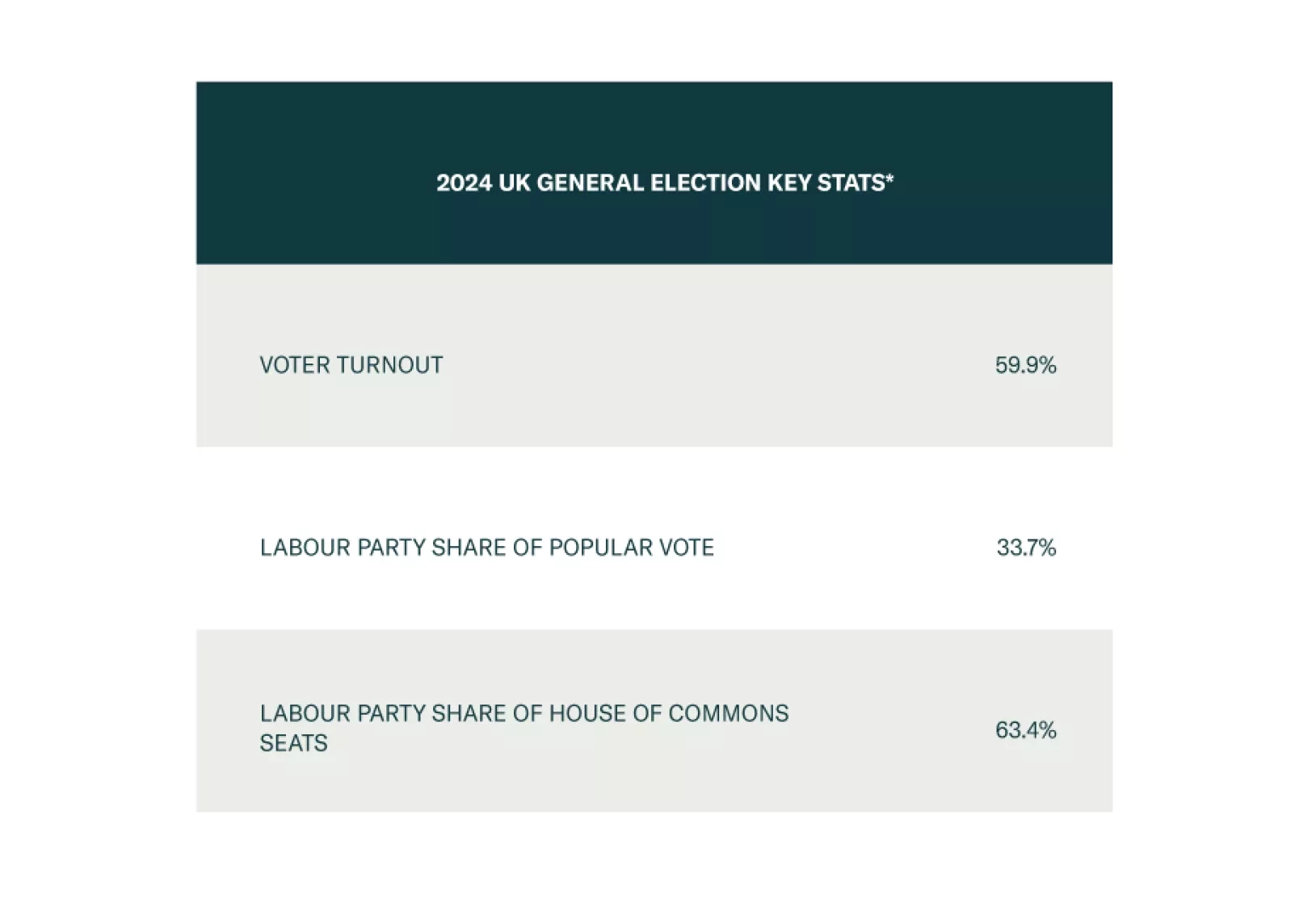

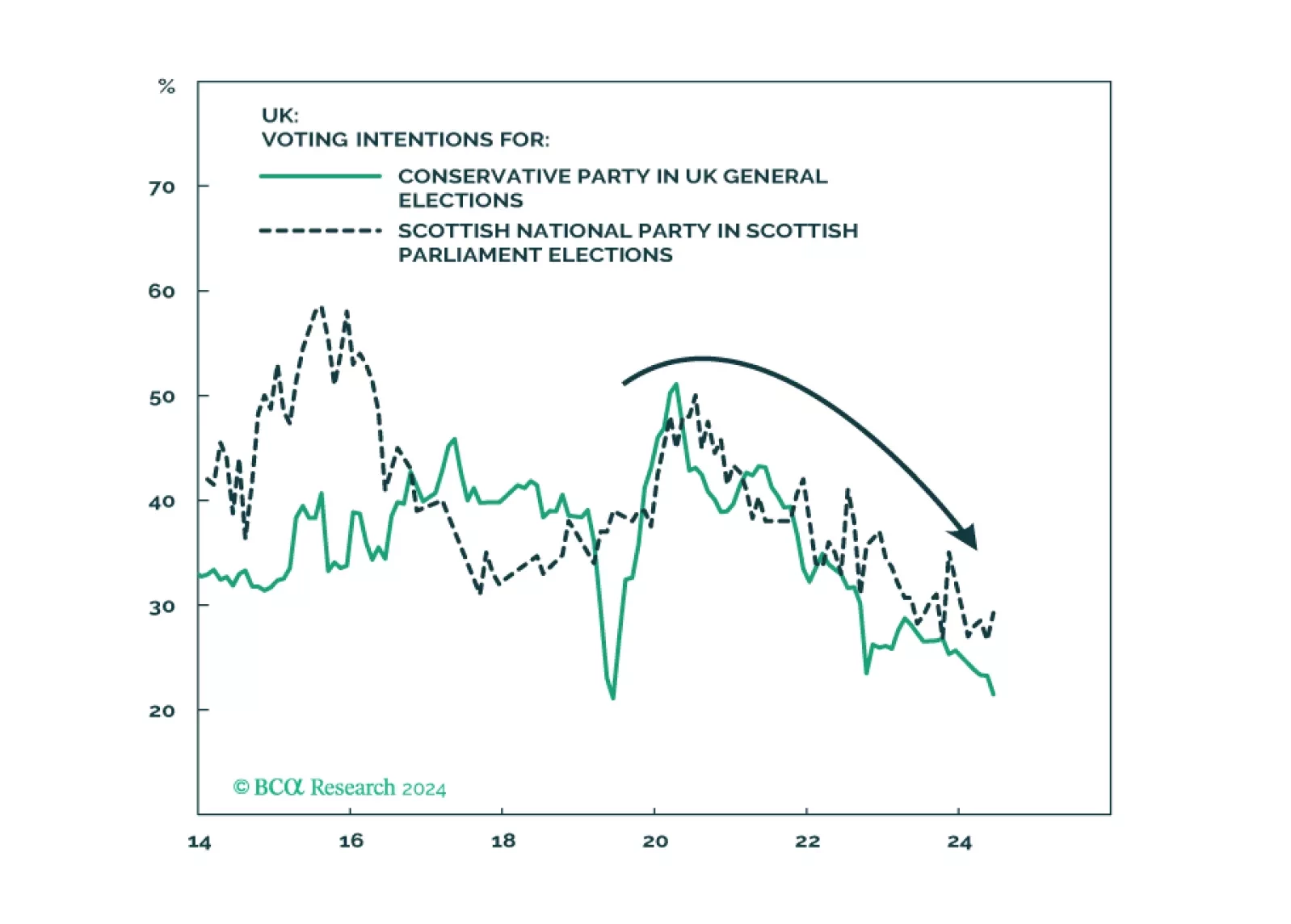

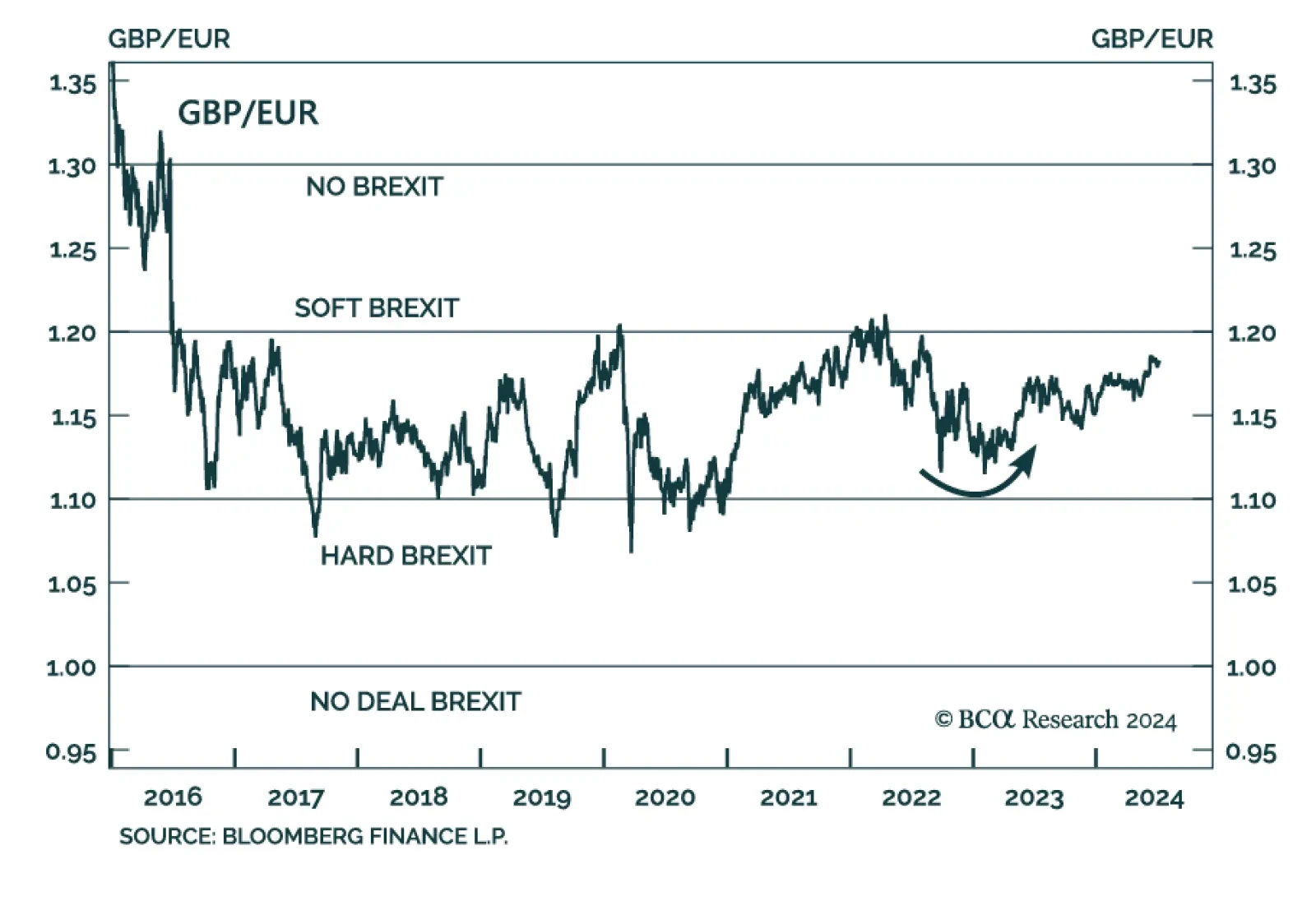

The Labour Party won the UK election, just as BCA Research’s Geopolitical Strategy service predicted back in 2022. However, this win is unlikely to rock the proverbial geopolitical boat. Popular enthusiasm for Sir Keir…

The new Labour government will have flexibility to respond to macro shocks, which is positive for the UK in general, namely GBP-EUR, and also gilts in absolute terms. But over the long run, tax hikes will likely surprise to the…

The consensus soft-landing narrative is wrong. The US will fall into a recession in late 2024 or early 2025. We were tactically bullish on stocks most of last year, turned neutral earlier this year, and are going underweight today.…

According to BCA Research’s European Investment Strategy service, the BoE will start cutting rates in September, but the pace of subsequent rate cuts will be modest until a recession engulfs Western economies in early 2025…

Is the BoE making a mistake moving toward rate cuts before the end of the summer? What would such a move mean for UK asset prices?