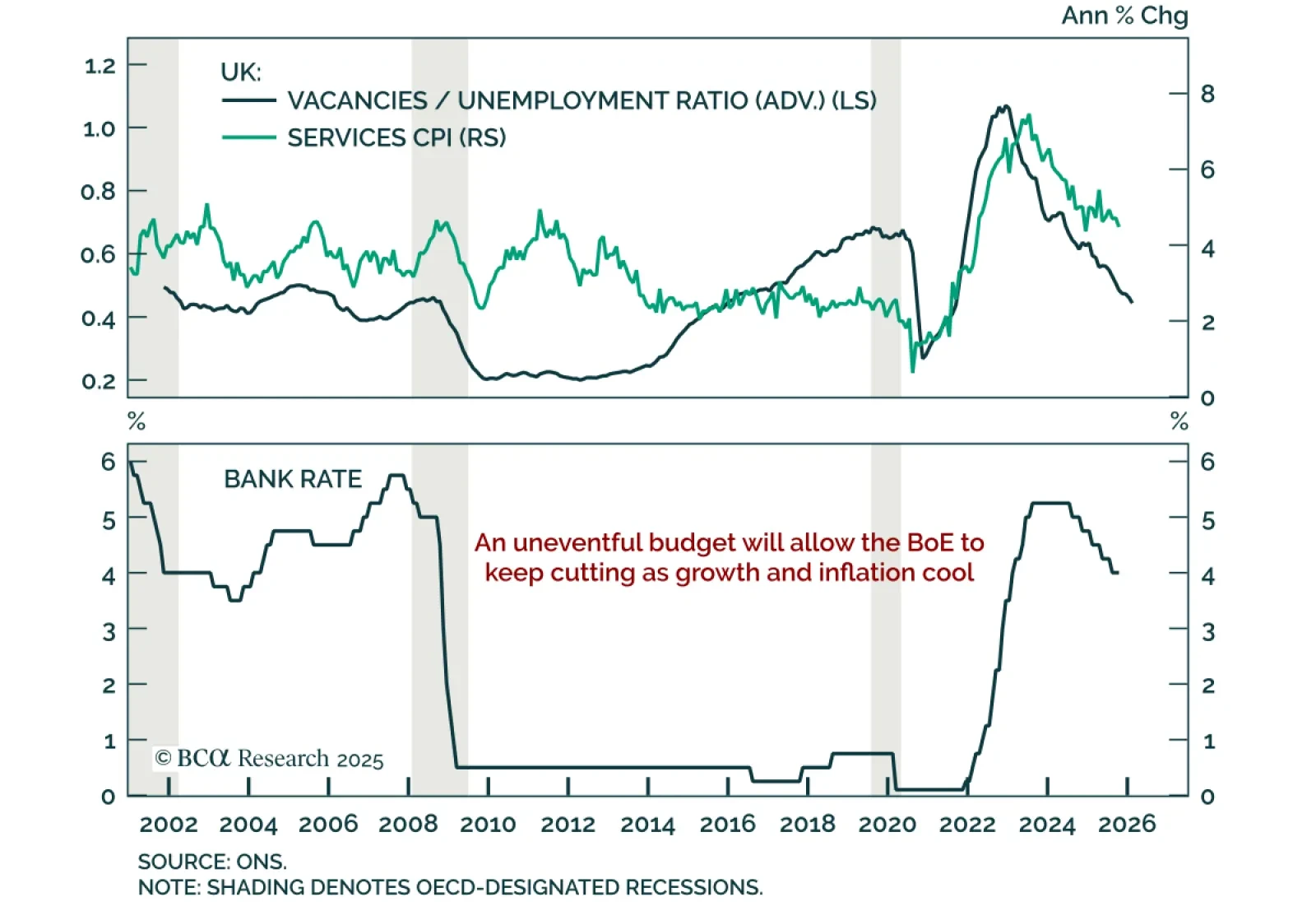

Stay overweight UK gilts and short GBP versus EUR as the budget supports a dovish BoE path. The UK unveiled a widely anticipated budget lifting taxes by GBP26bn, and adding GBP11.3bn in spending. Overall fiscal headroom rises from…

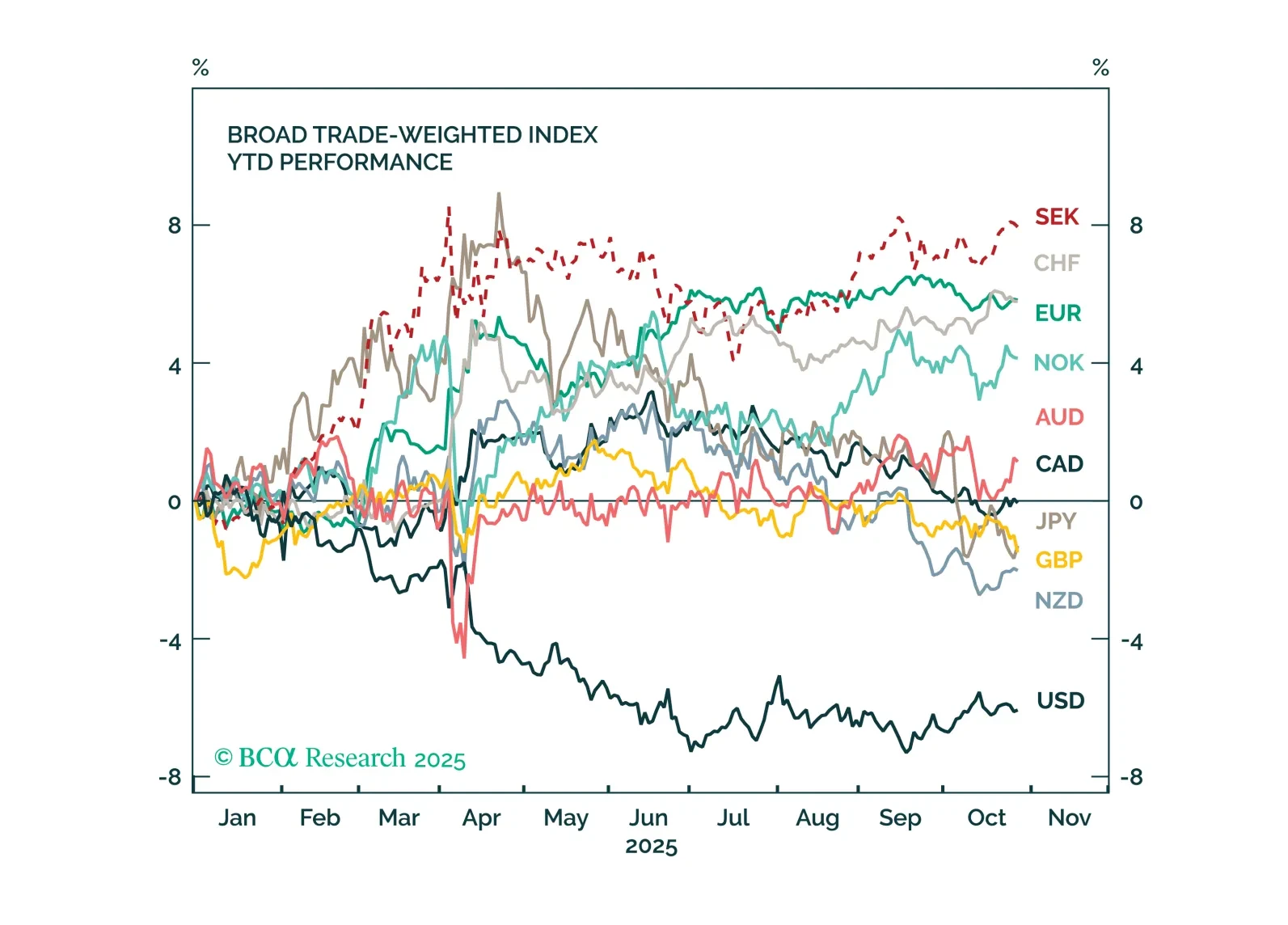

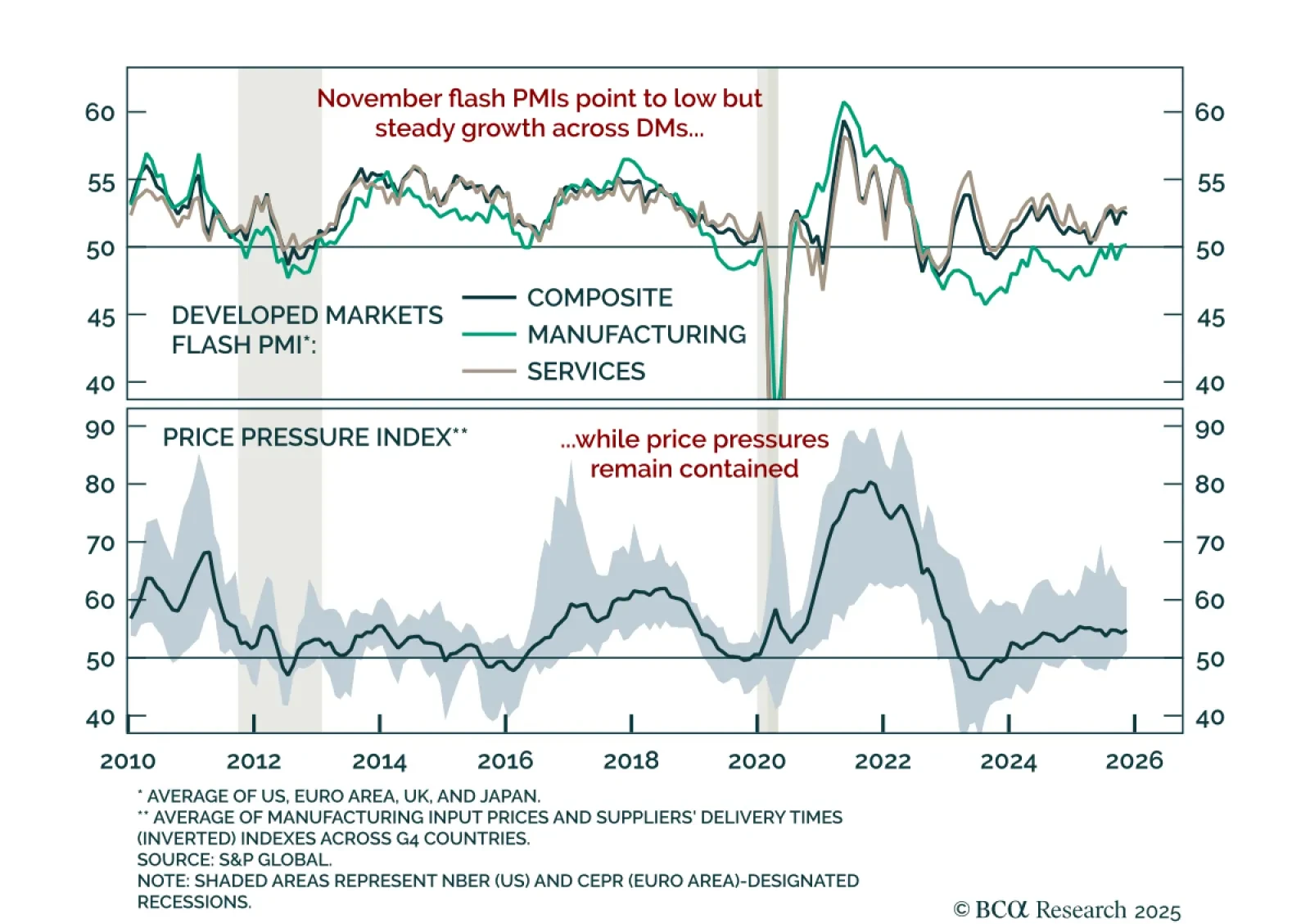

November flash PMIs confirmed sluggish global momentum, reinforcing a defensive stance with tactical support for the USD. The US composite PMI rose to 54.8, driven by stronger services but weaker manufacturing. The Euro area showed a…

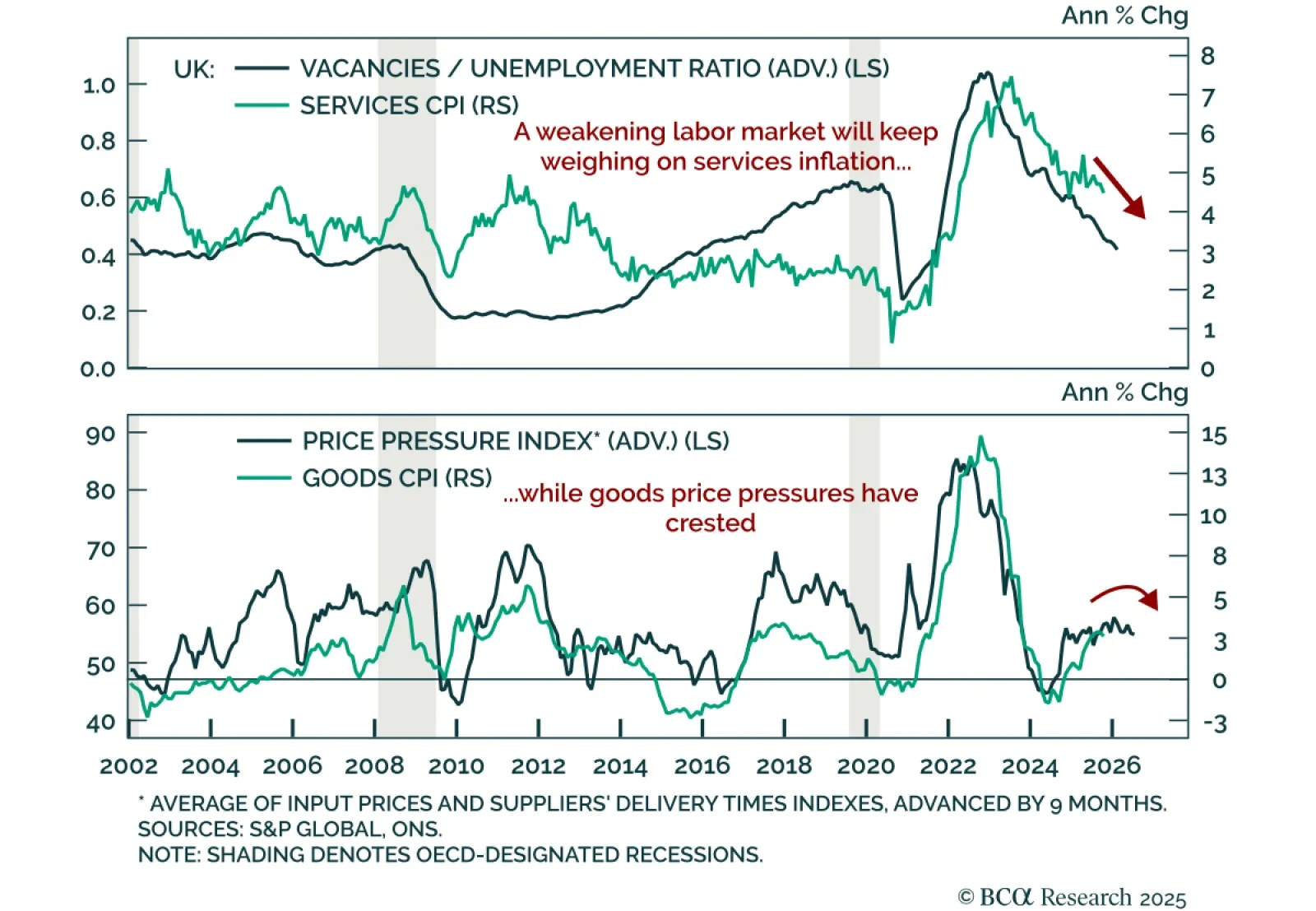

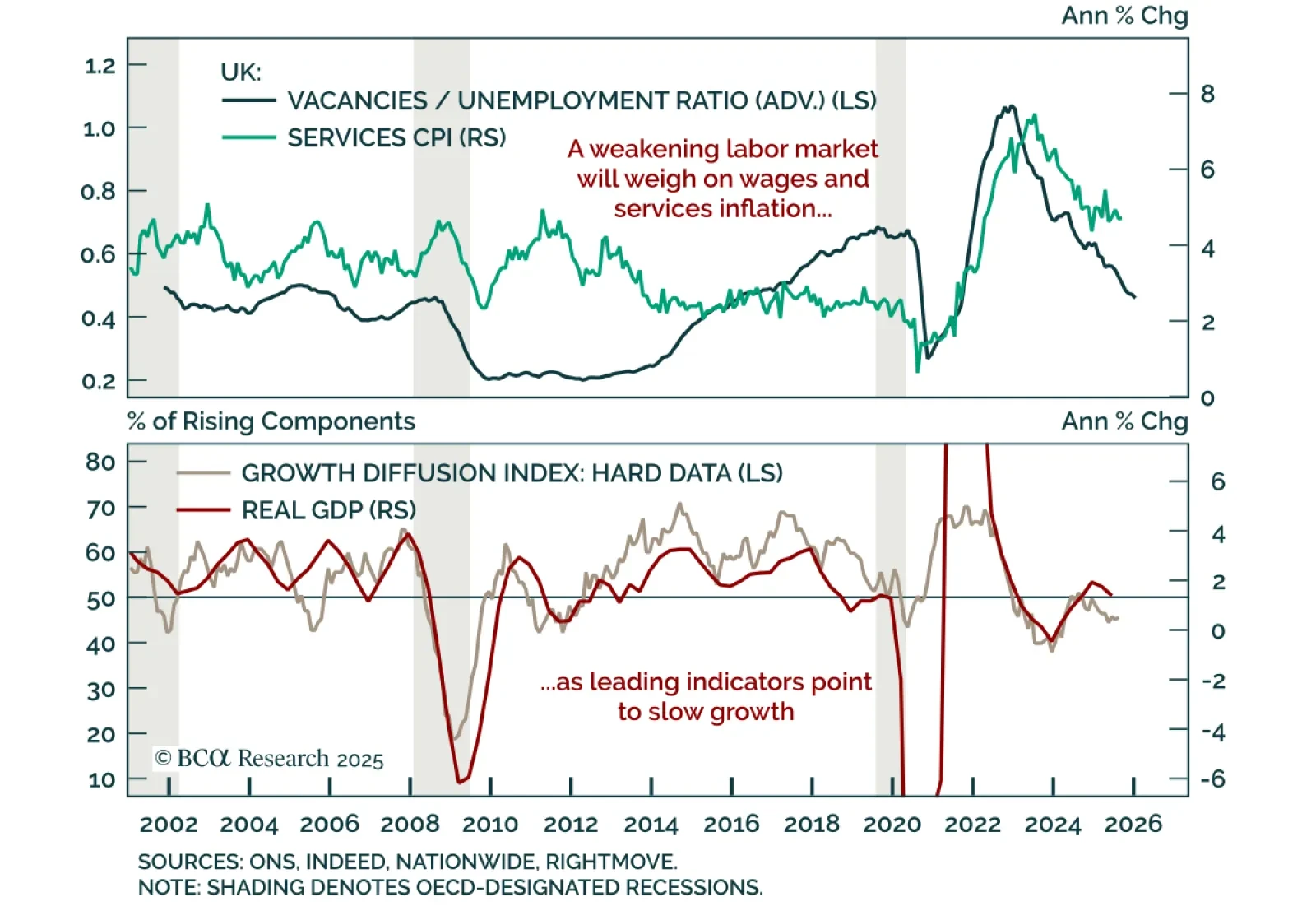

UK inflation data supports a December BoE cut, reinforcing the case for staying long gilts and short GBP versus EUR. October CPI inflation came broadly in line with expectations but showed broad deceleration. Headline CPI slowed to 3…

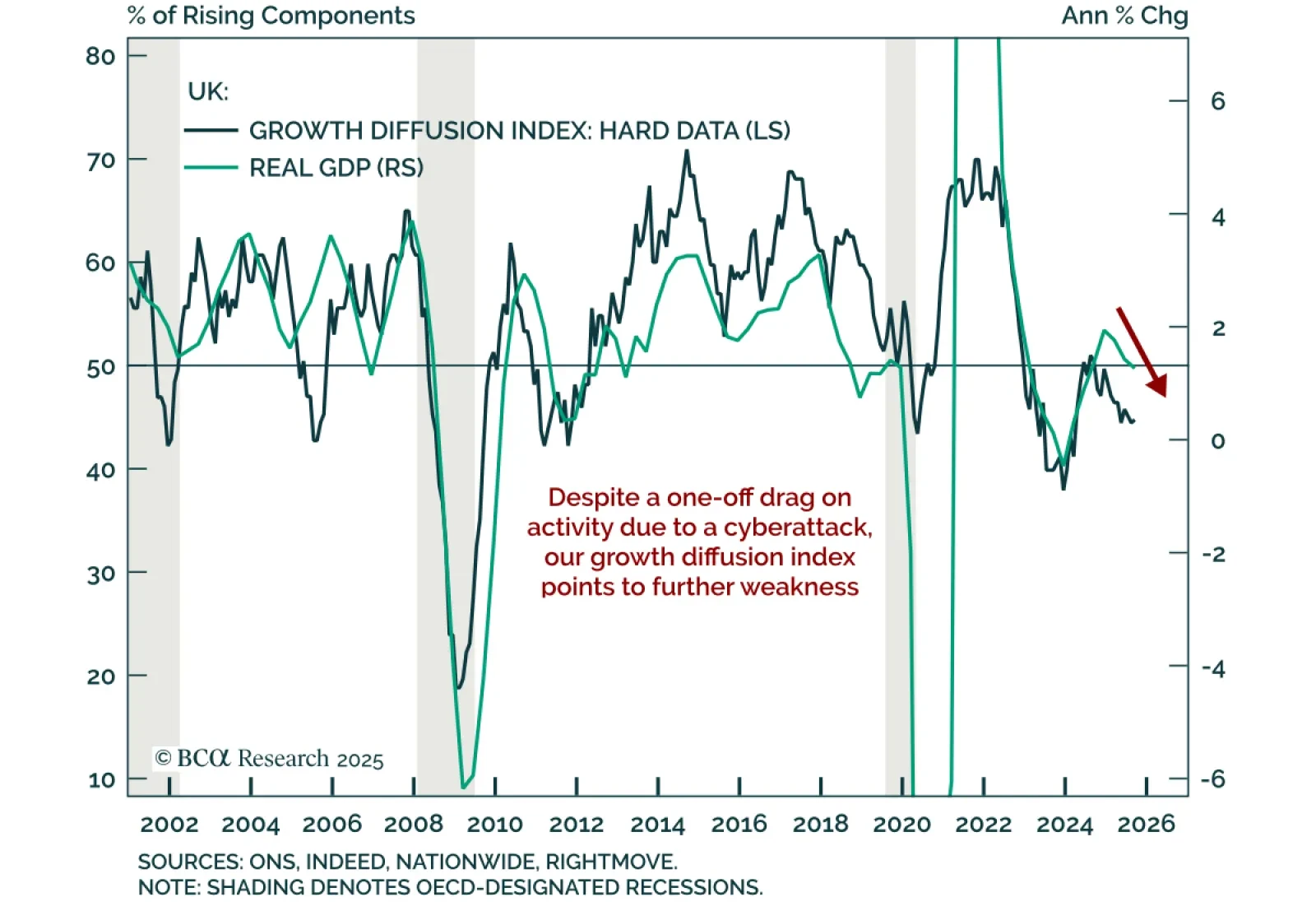

UK growth data weakened in September and Q3, reinforcing expectations of a more dovish BoE and bolstering the case for gilts. Monthly GDP contracted 0.1% m/m in September after a flat August, while preliminary Q3 growth slowed to 0.1…

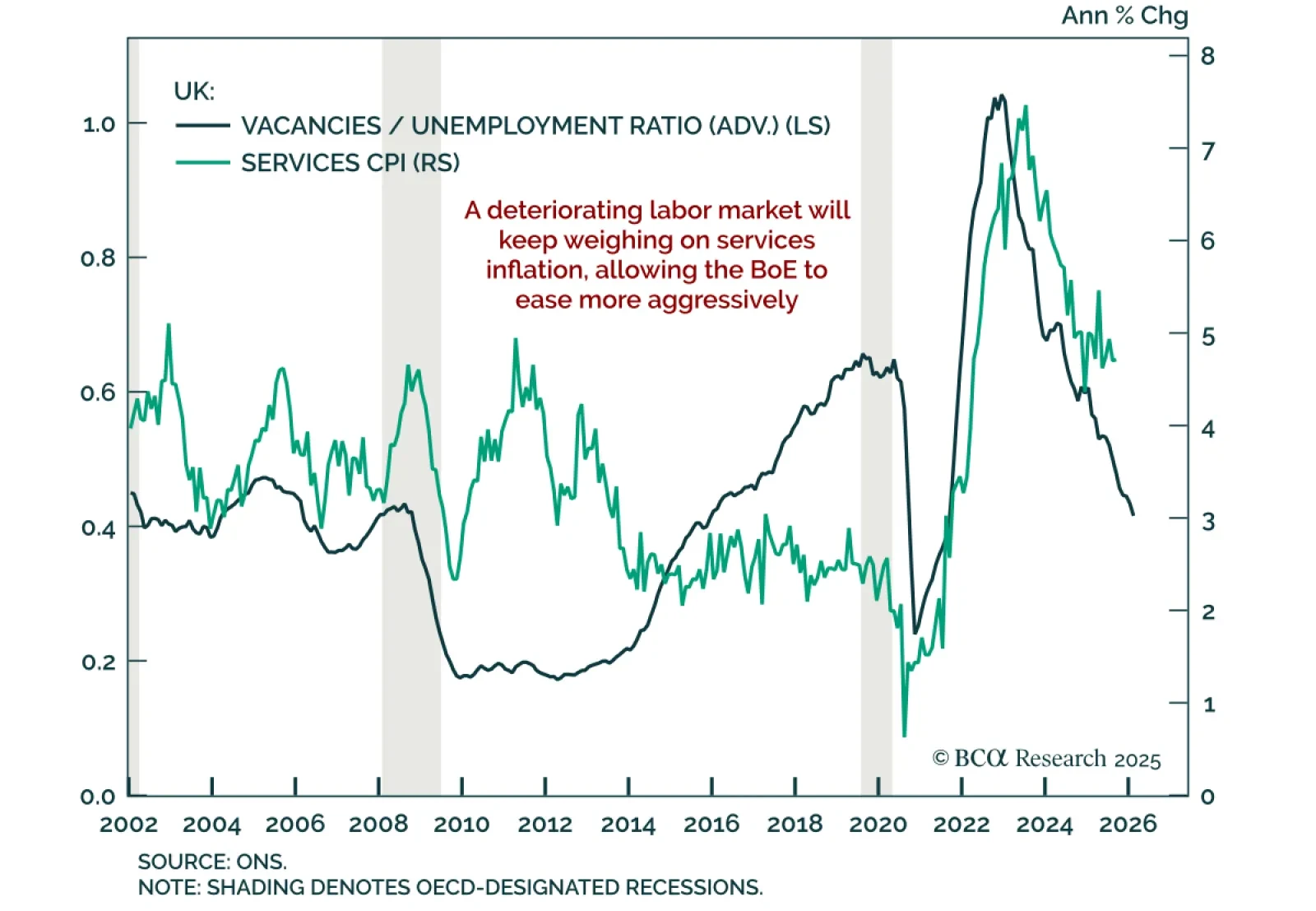

UK labor data weakened further in October and September, reinforcing the case for continued BoE easing. Payrolls fell by 32k in October, matching a downwardly revised 32k decline in September. Unemployment rose to 5.0% from 4.8%,…

The BoE held rates at 4% in a narrow 5–4 vote but signaled readiness to resume easing in December as disinflation and labor weakness deepen. The removal of the word “careful” from its guidance on further easing signals bias toward…

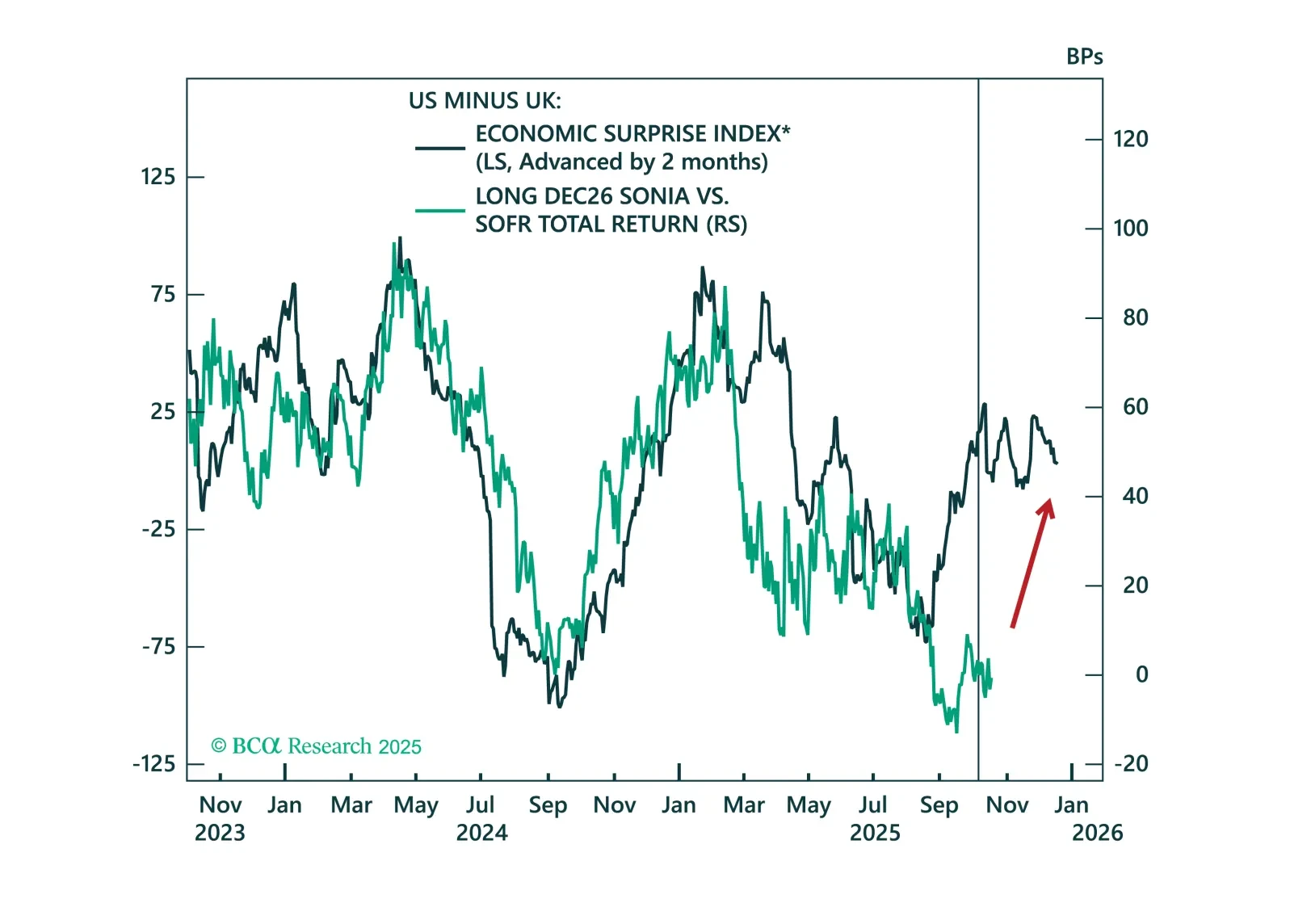

The Bank of England will resume rate cuts in December after the autumn budget is passed. Today’s Strategy Insight discusses what this means for UK gilts and the pound.

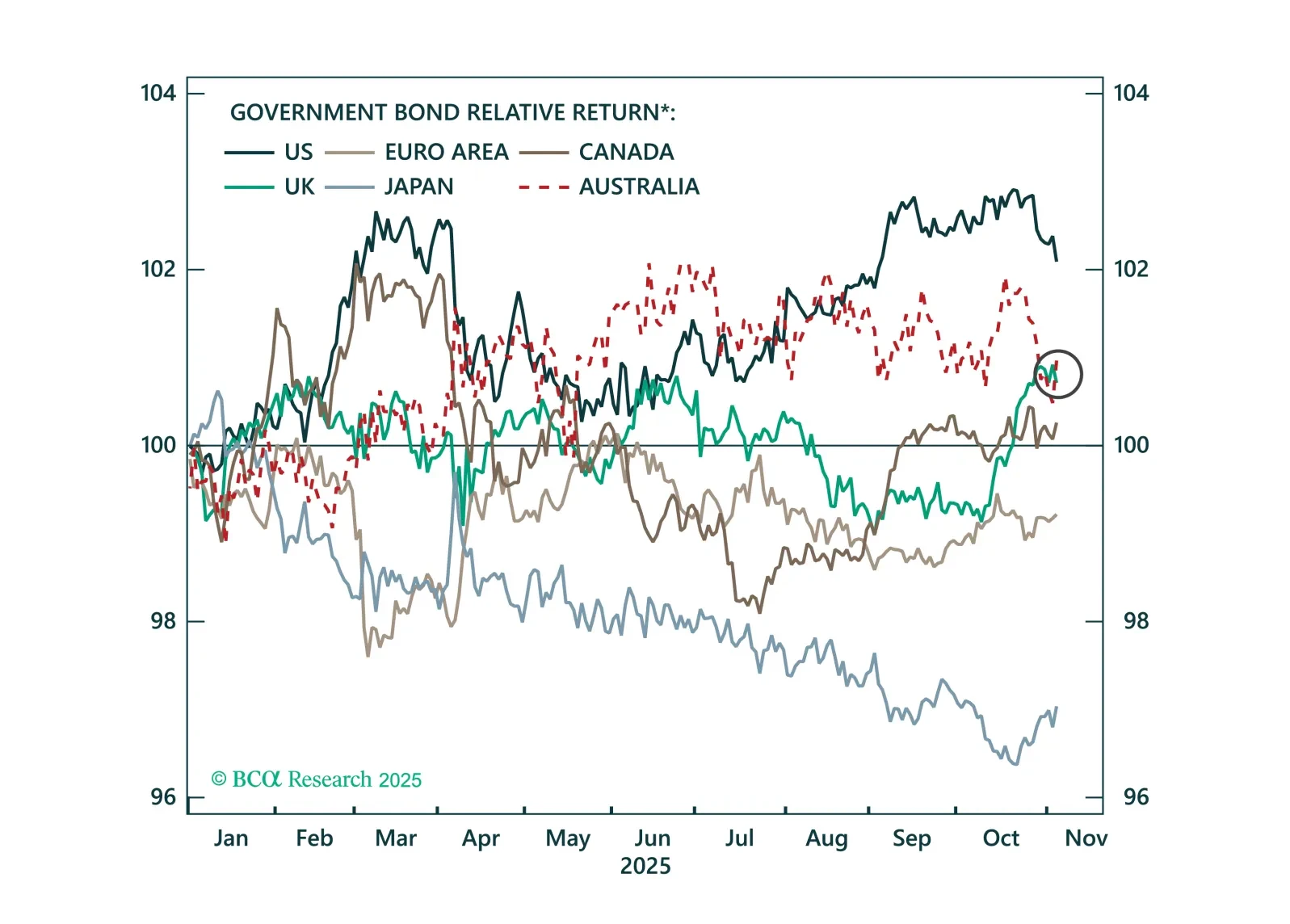

Markets are increasingly pricing an end to the global easing cycle, with many central banks expected to remain on hold. But uncertainty remains high, and policy surprises are likely going into 2026. This Strategy Report breaks down…

Markets are increasingly pricing an end to the global easing cycle, with many central banks expected to remain on hold. But uncertainty remains high, and policy surprises are likely going into 2026. This Strategy Report breaks down…

Same policy rate, very different expectations. We break down why policy convergence between the Fed and BoE is THE fixed income trade for year-end.