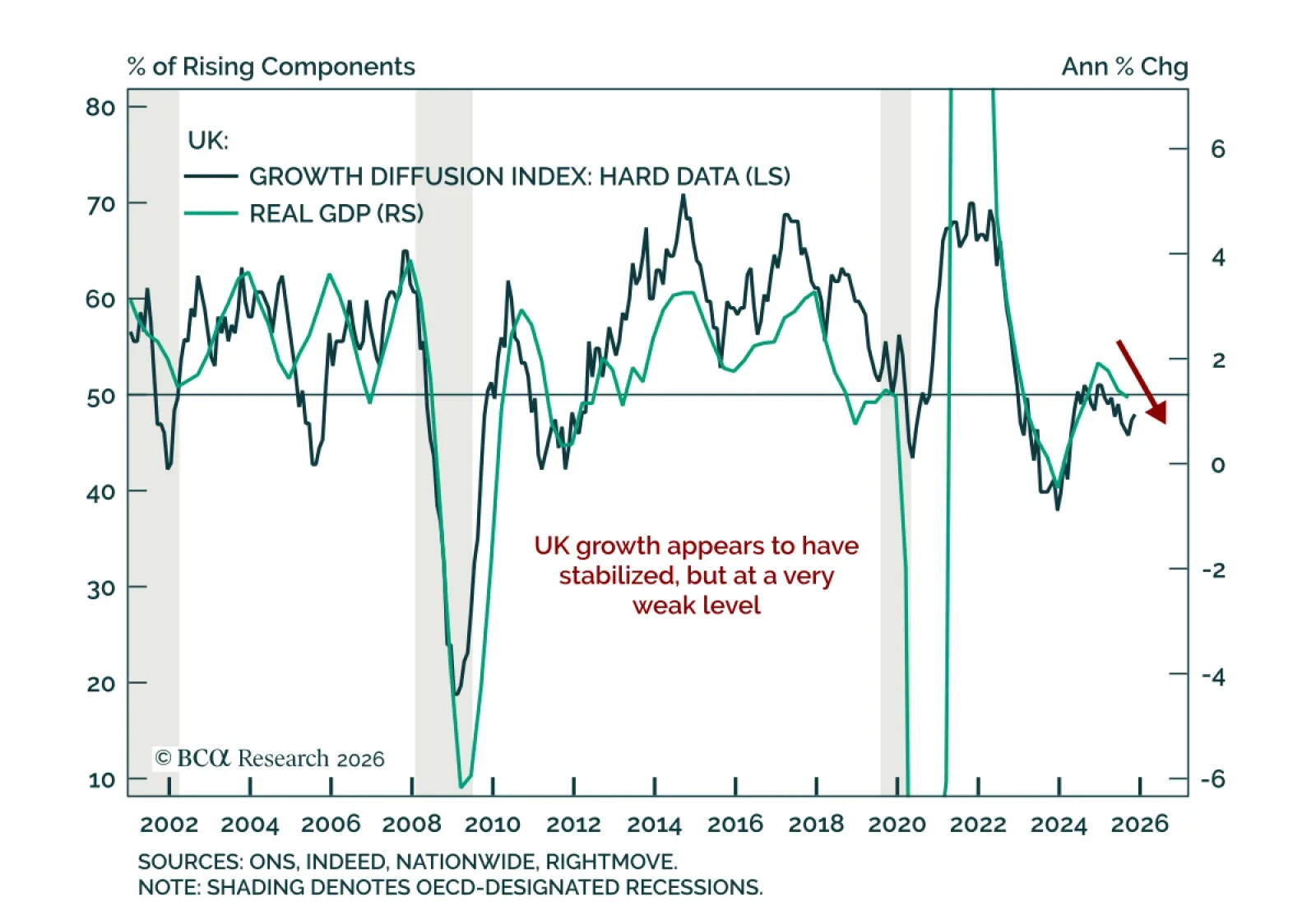

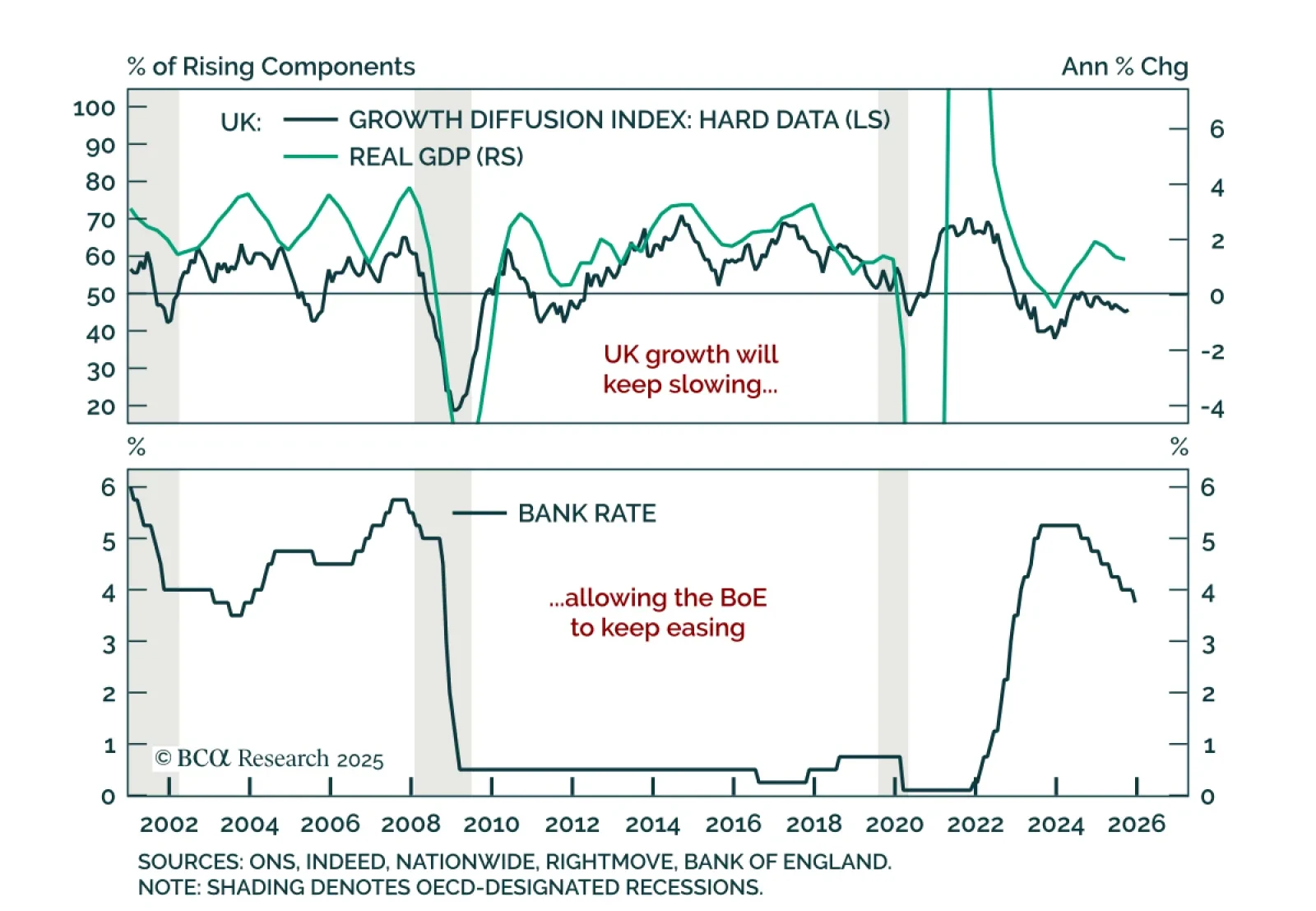

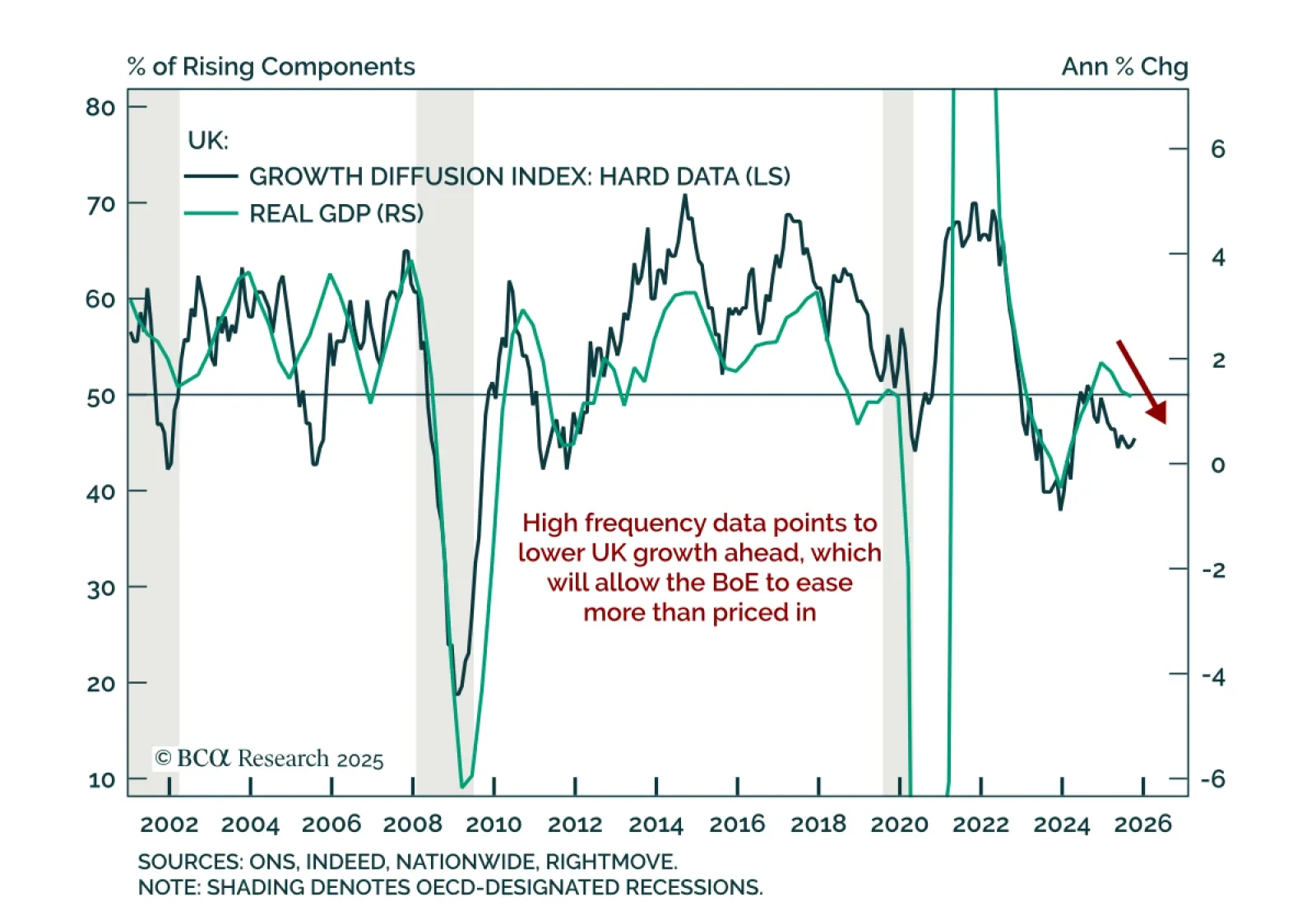

Stay overweight UK gilts and favor GBP 2-year/10-year steepeners as fundamentals remain weak and financial conditions restrictive. Recent strength in UK economic data reflects pent-up demand rather than underlying improvement.…

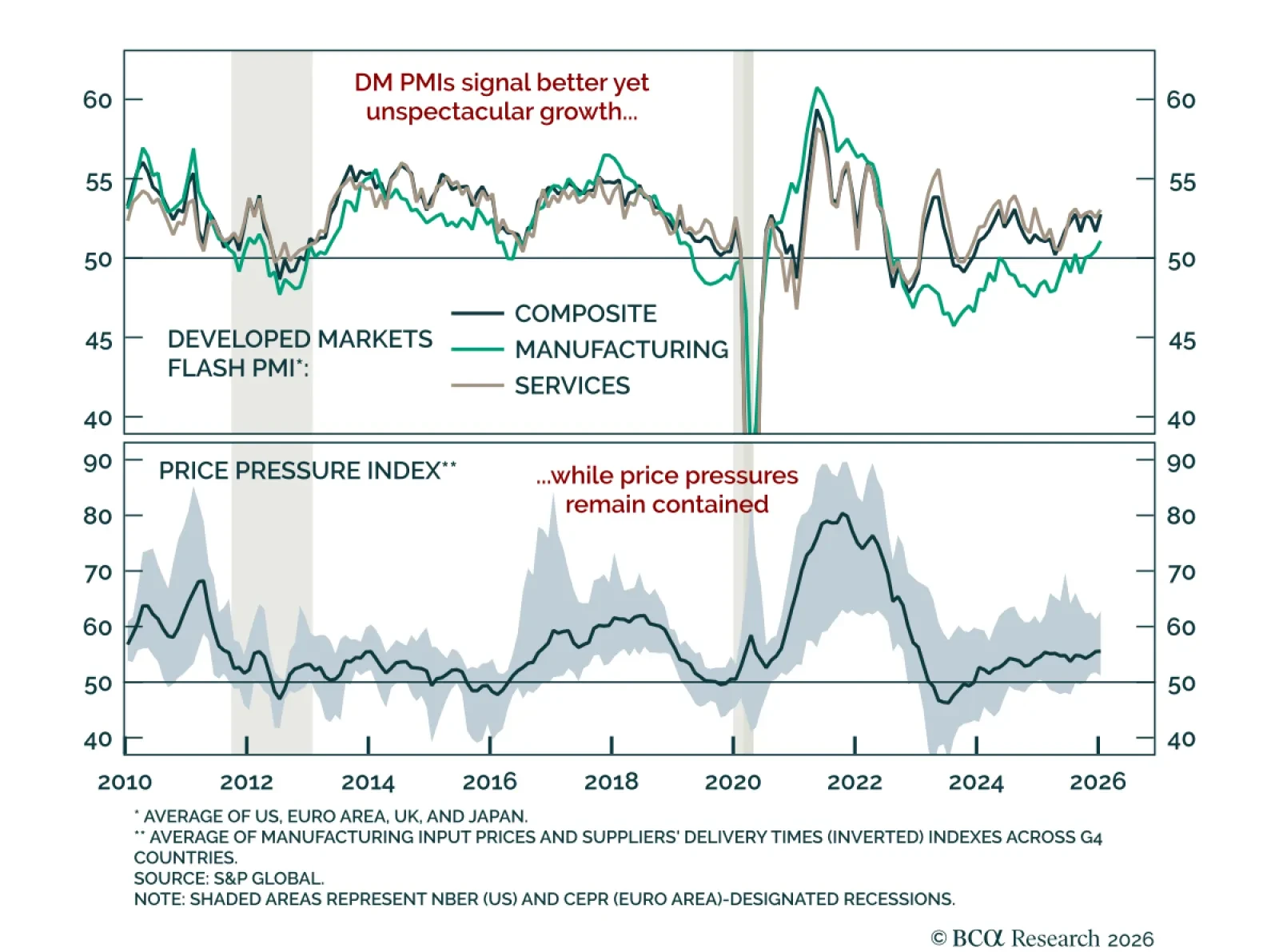

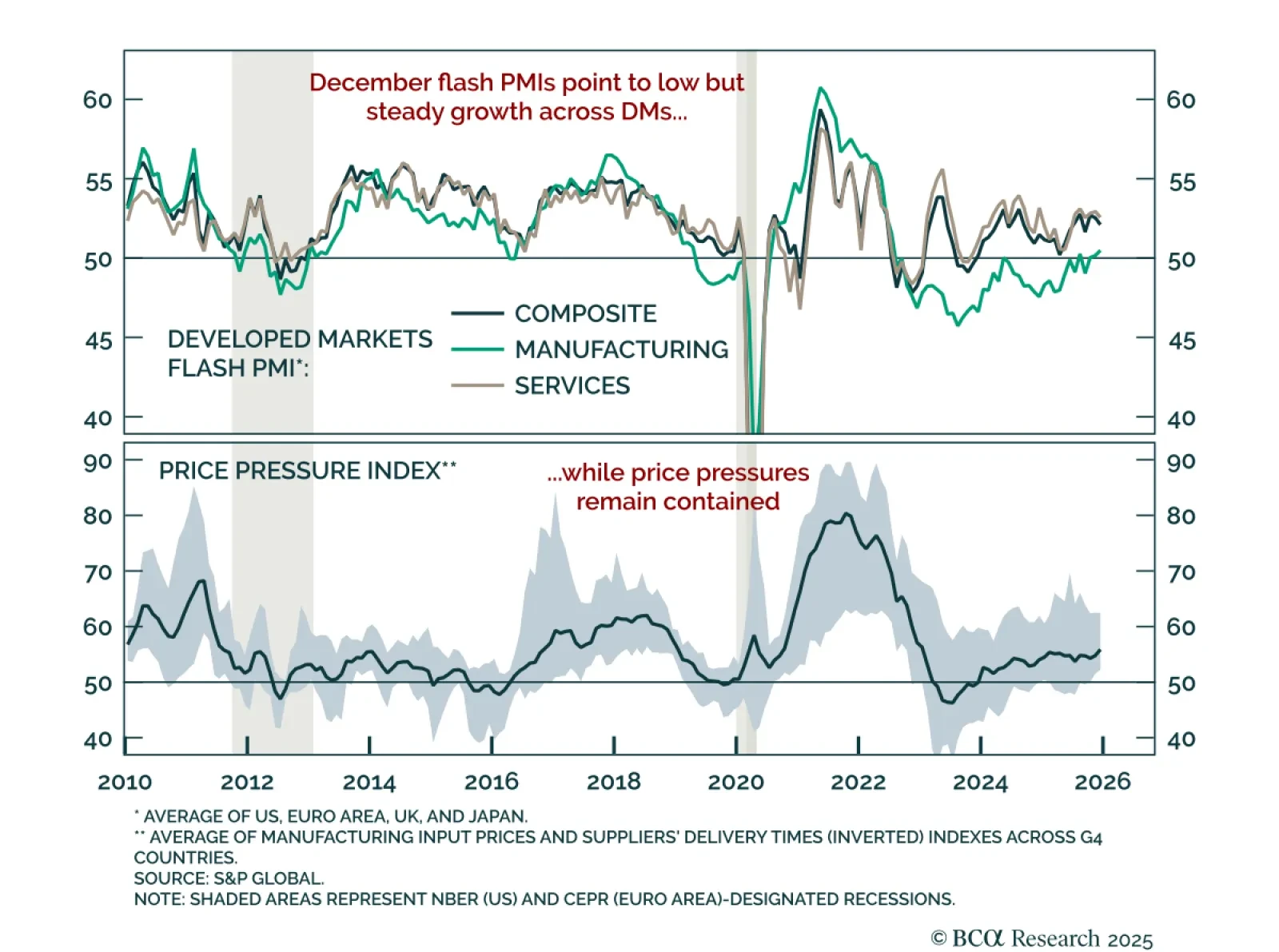

January flash PMIs point to better, though unspectacular, global growth momentum. Developed markets PMIs showed improvement in global growth momentum. PMIs have largely moved sideways through 2025, with manufacturing now recovering…

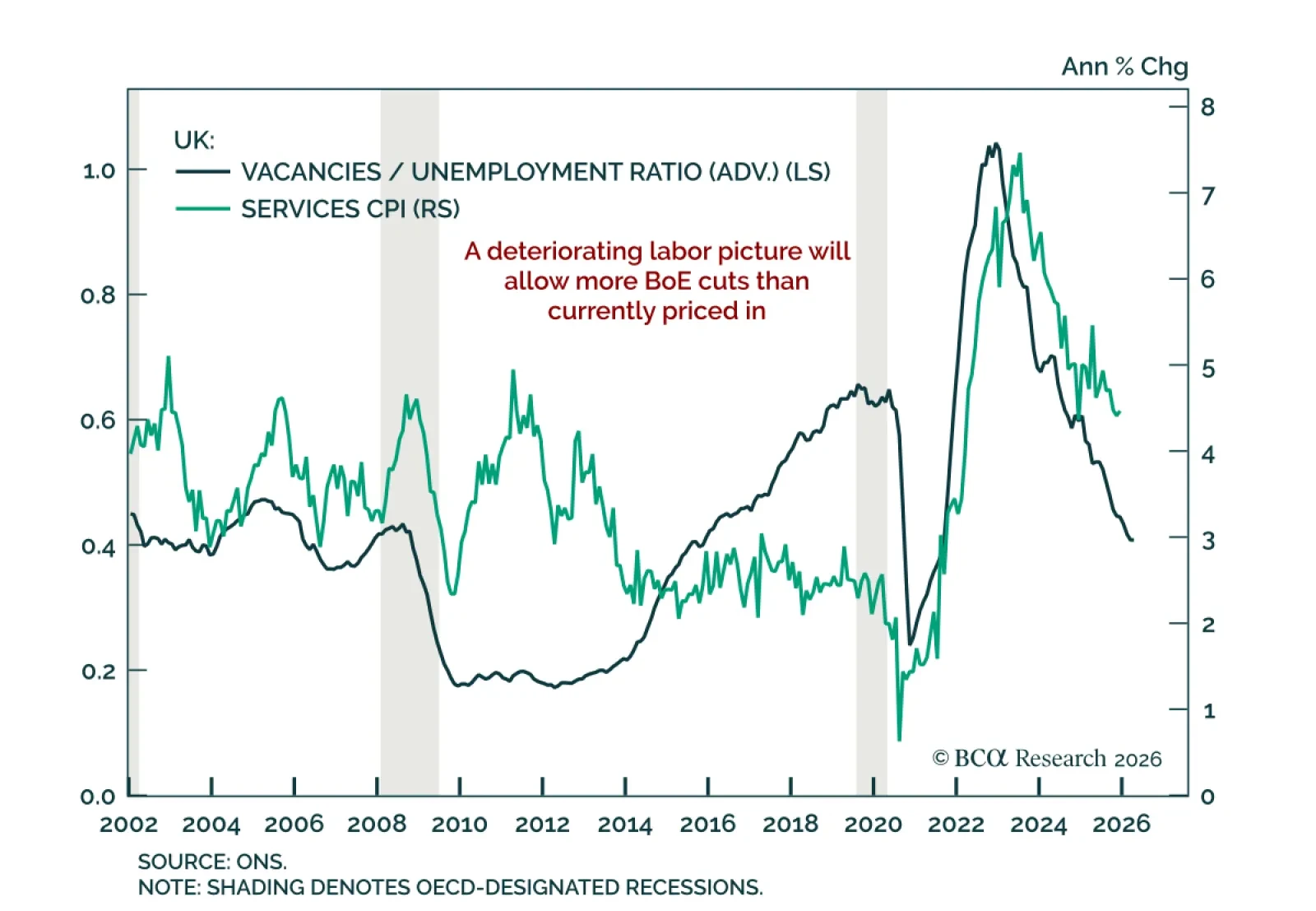

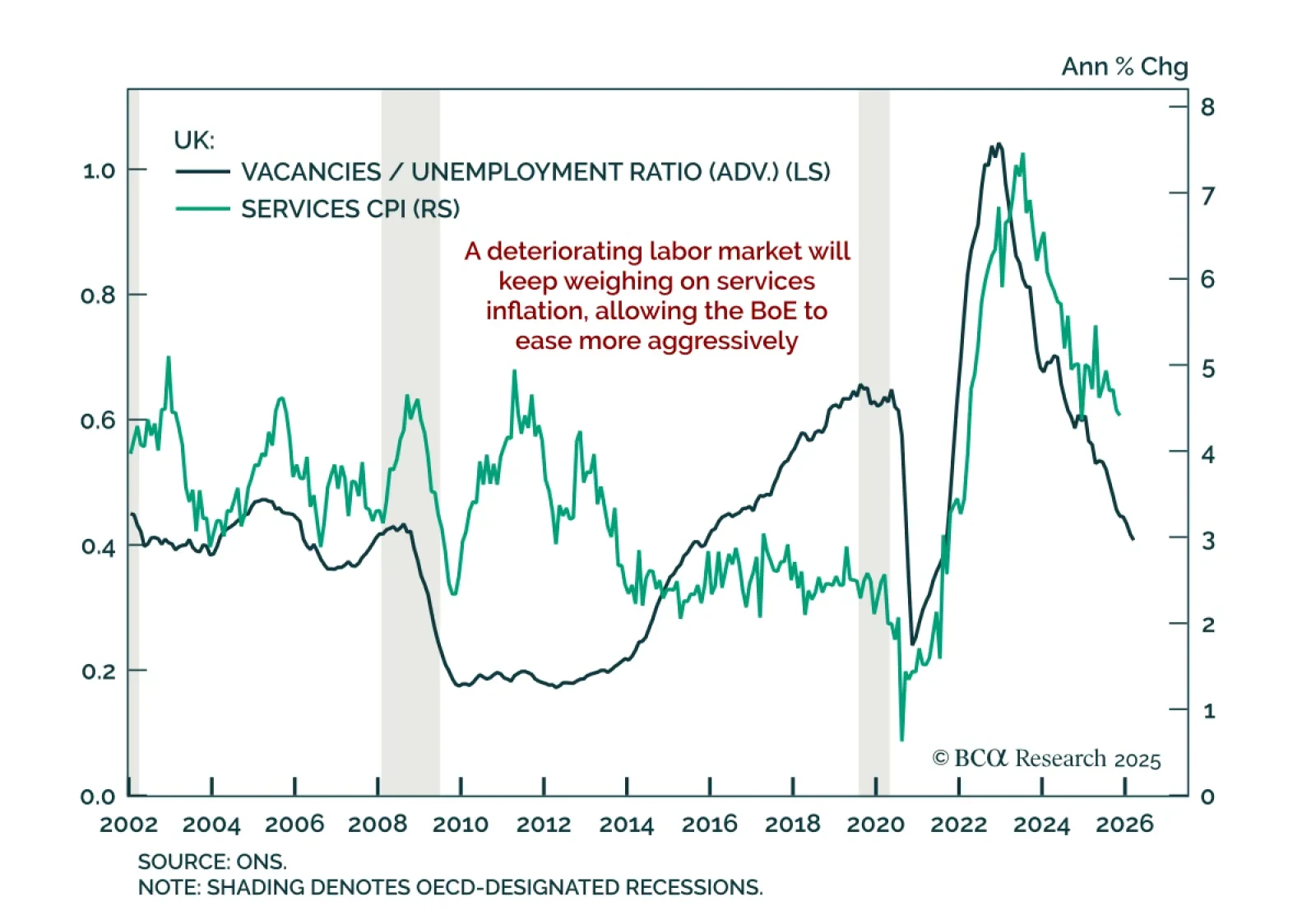

Stay overweight UK gilts and favor GBP 2-year/10-year steepeners as weak fundamentals keep the BoE on an easing path. UK employment data for November and December were weak, confirming the recent labor-market slowdown. Payrolls fell…

Overweight UK gilts and favor GBP 2-year/10-year steepeners as stronger November data reflect pent-up demand, not a shift in the weak UK outlook. UK hard activity data for November surprised to the upside. Industrial production rose…

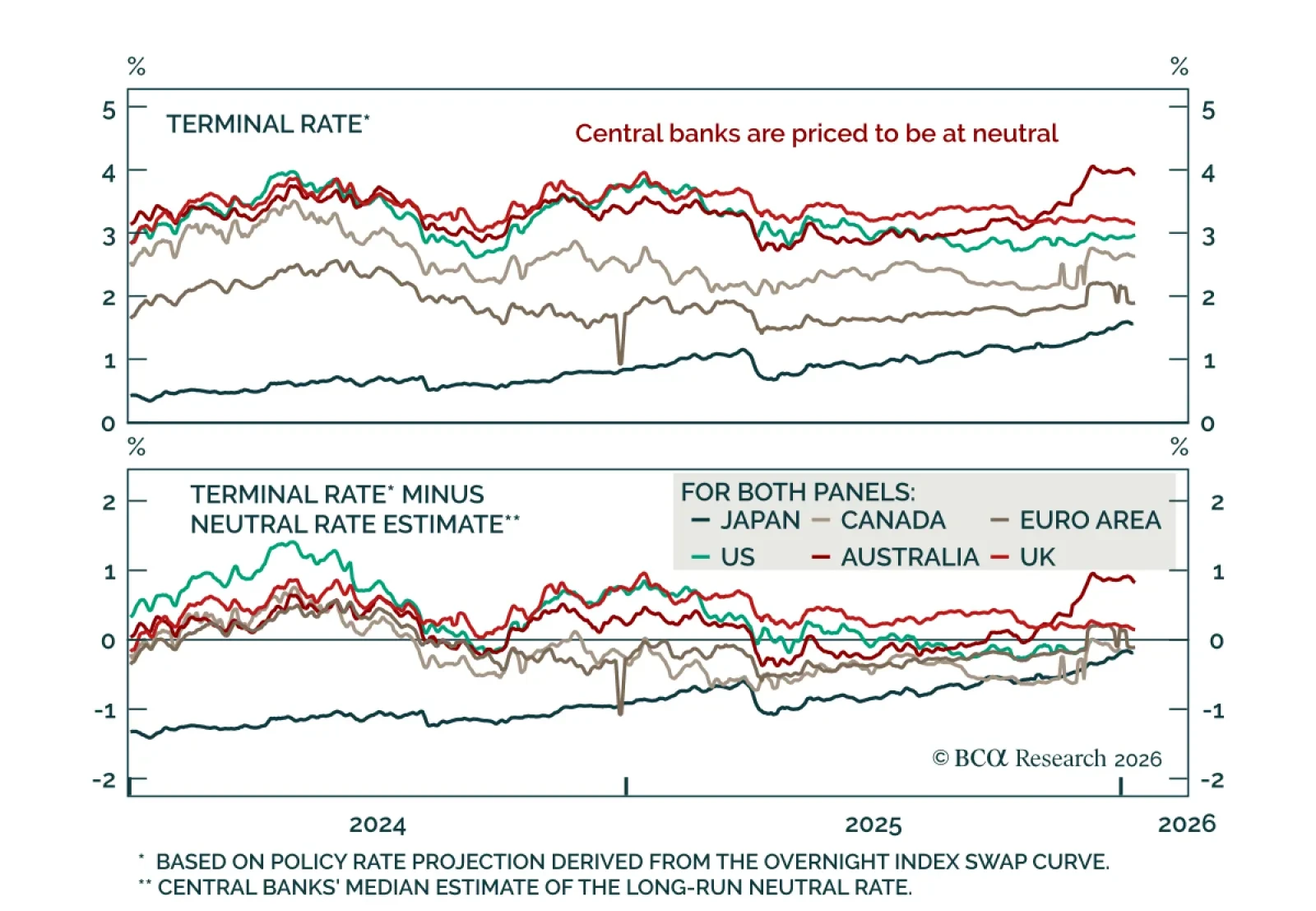

Our Global Fixed Income strategists maintain an above-benchmark duration stance as labor market risks continue to support downside yield potential, even as the global easing cycle winds down. With policy normalization largely…

Stay long September 2026 Euribor futures and overweight UK gilts, as Europe could see reflationary cuts while the UK slowdown argues for deeper easing. The ECB left rates unchanged at 2% in a routine meeting and revised its growth…

Stay overweight UK gilts as weakening labor data and cooling inflation give the BoE room to cut beyond what markets price. UK employment data continued to disappoint, with November payrolls falling 38k after a revised 22k decline in…

Maintain an underweight in industrial commodities as flash PMIs confirm weak global growth momentum. December flash PMIs for developed markets pointed to subdued activity. The US composite slowed to 53 from 54.2, a six-month low,…

Stay overweight UK gilts and short GBP versus EUR as weak UK data and a softening labor market point to a more dovish BoE. Monthly UK GDP missed estimates and contracted 0.1% m/m in October after a 0.1% decline in September. The…

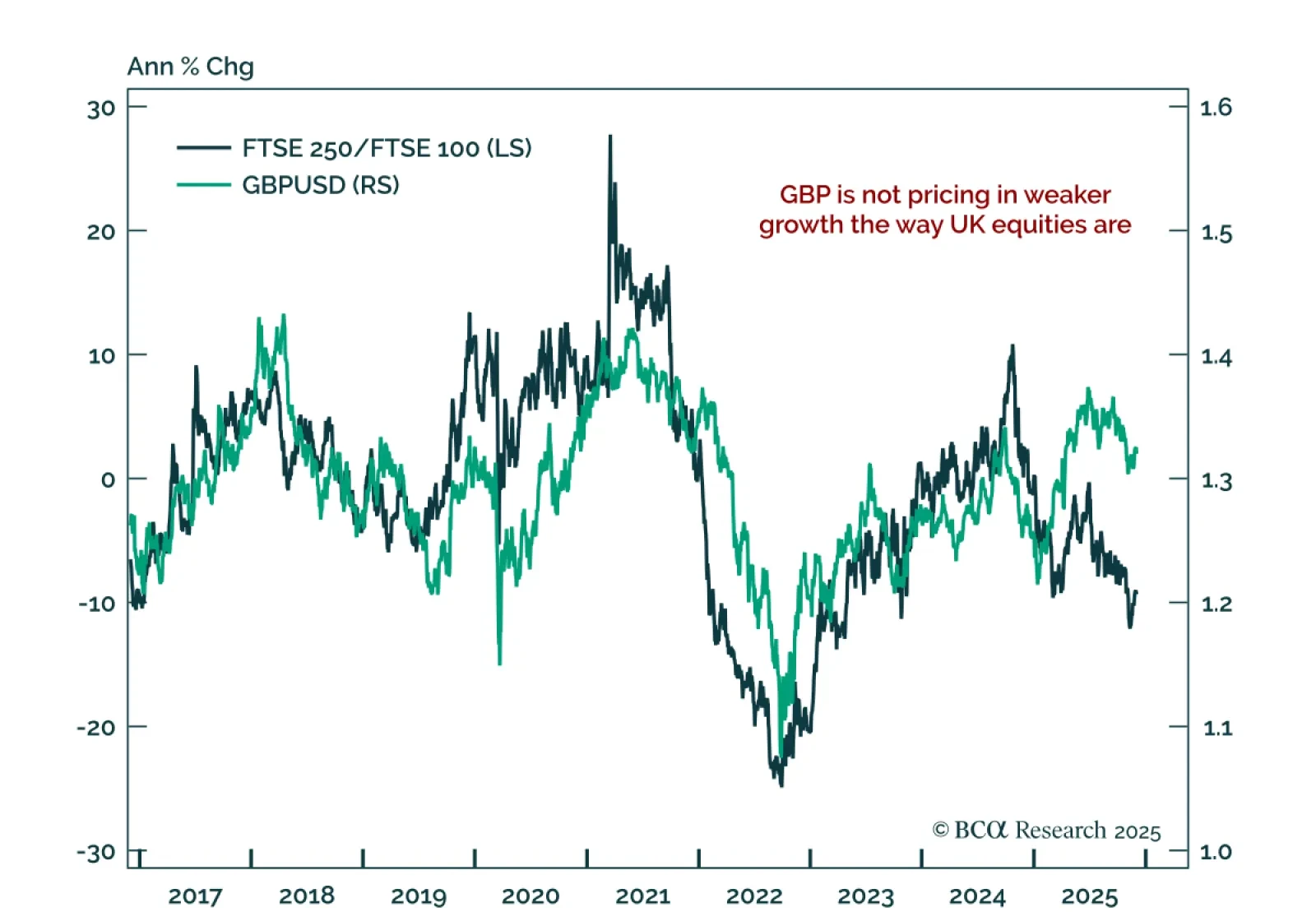

Stay tactically long USD as UK macro weakness remains underpriced in GBP but fully reflected in equities. One of our key themes has been that UK macro disappointment is in the pipeline. Being long UK gilts is our Global Fixed Income…