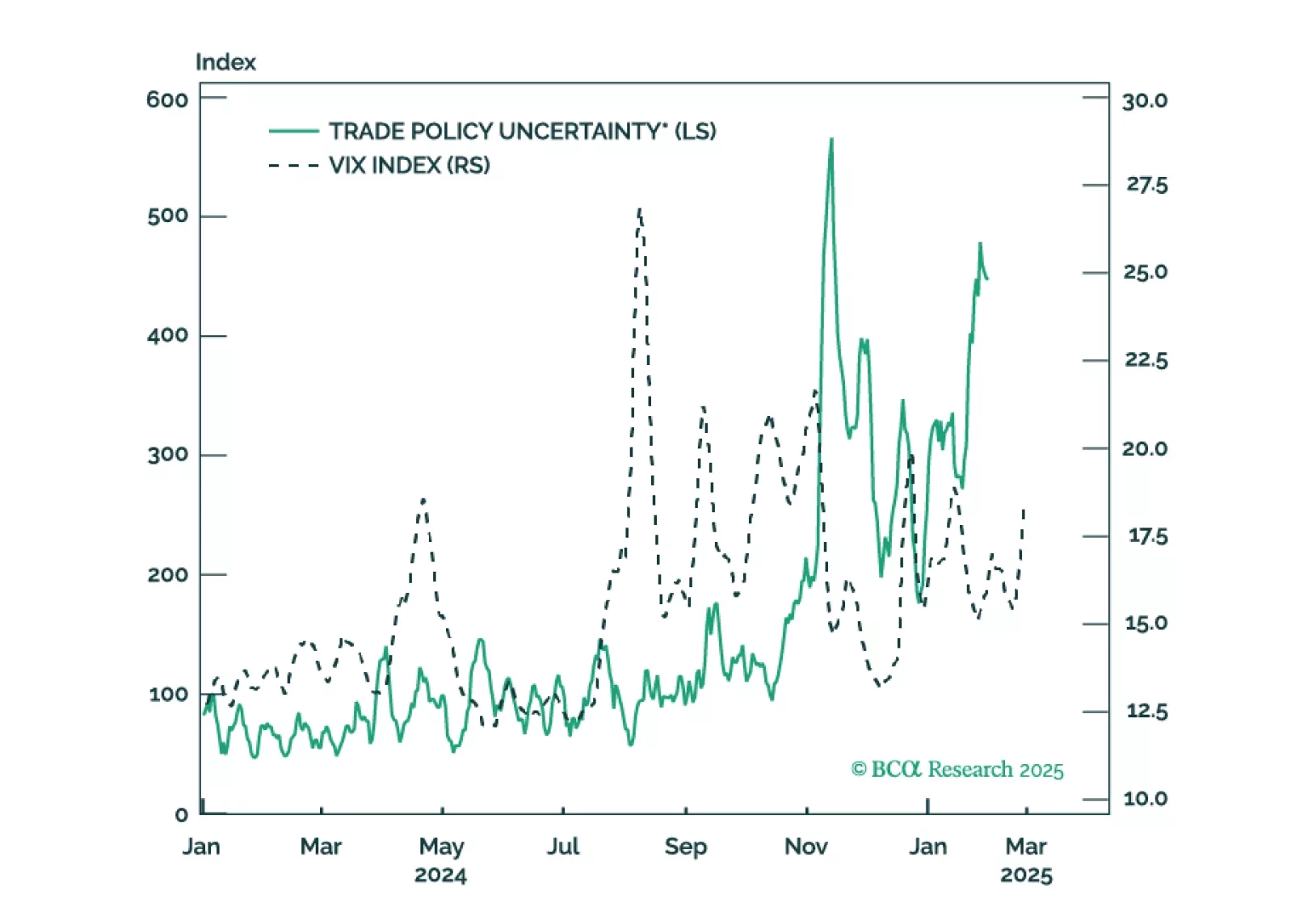

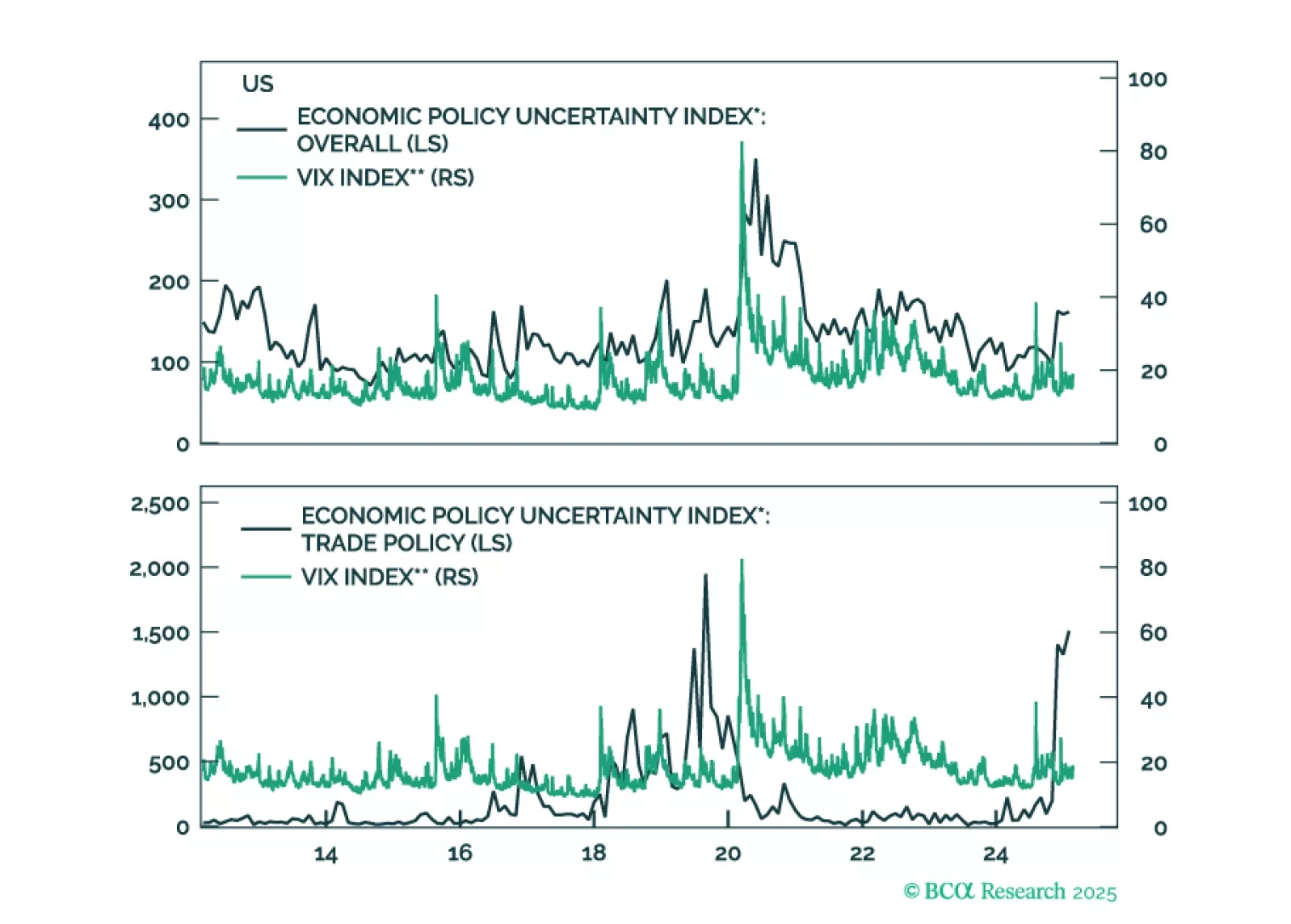

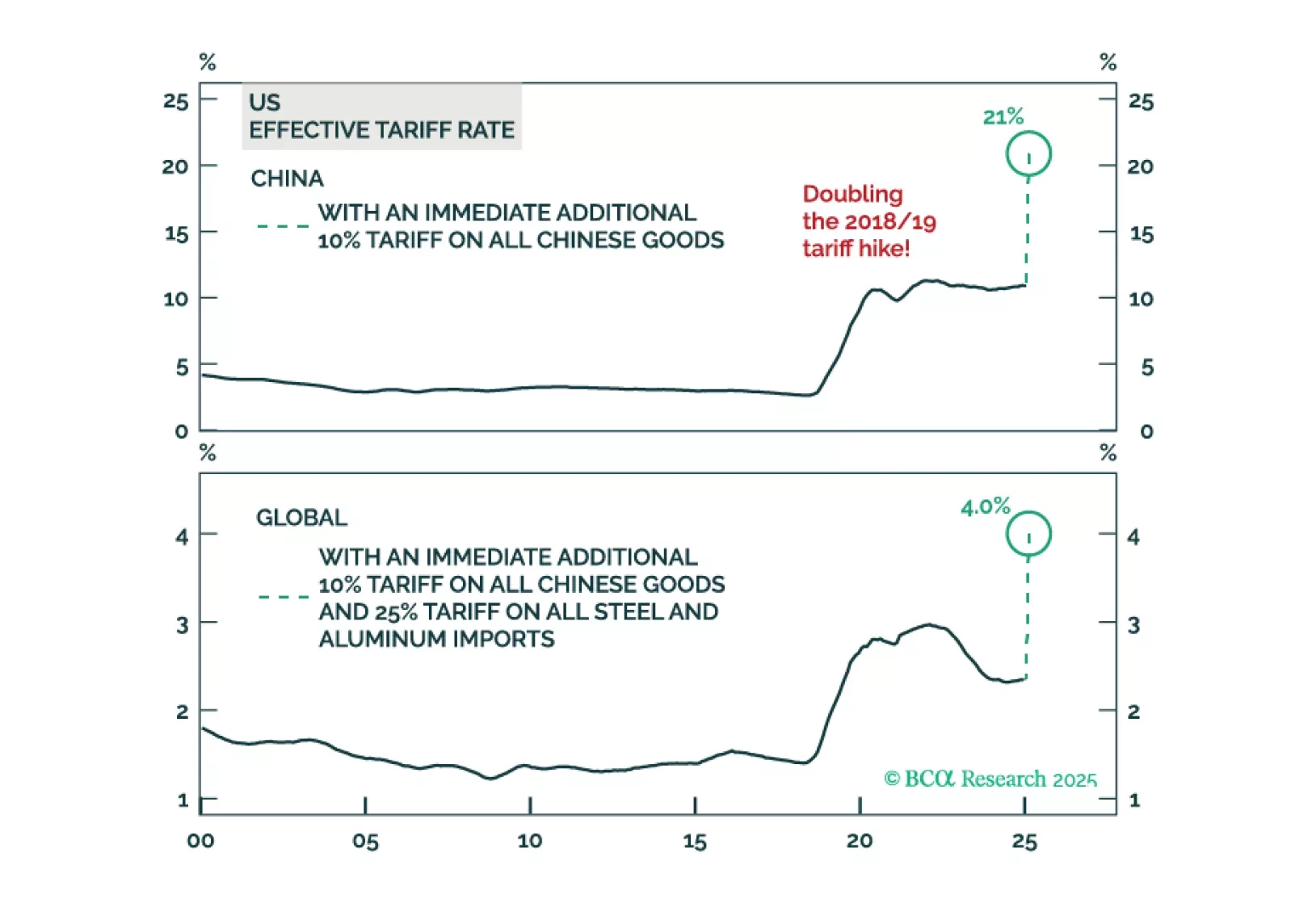

Our defensive strategy for 2025 is coming to fruition so we are re-initiating some of our defensive and risk-off trades. Tariff implementation, hurdles in the tax bill, and geopolitical shocks are materializing in the near term.

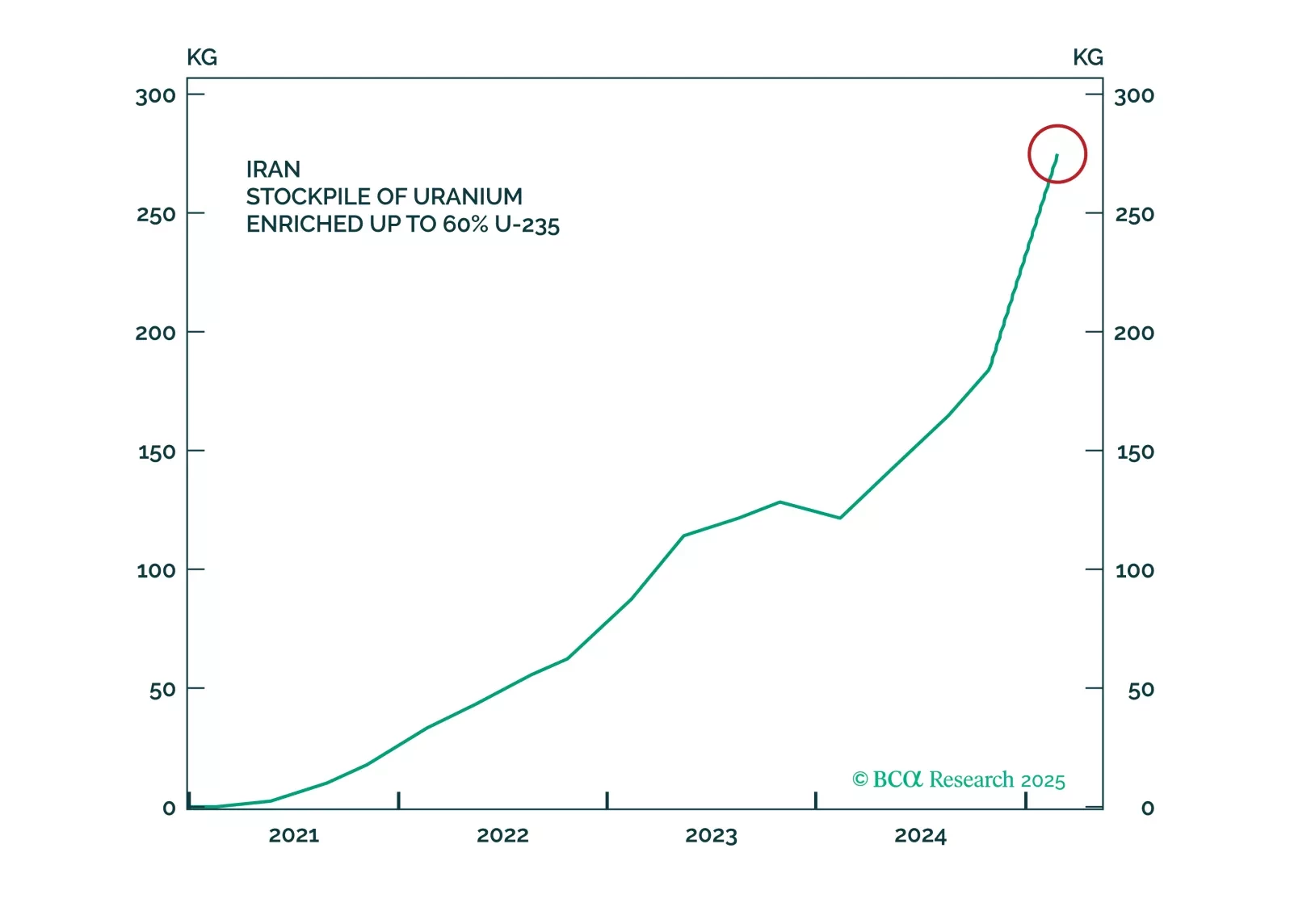

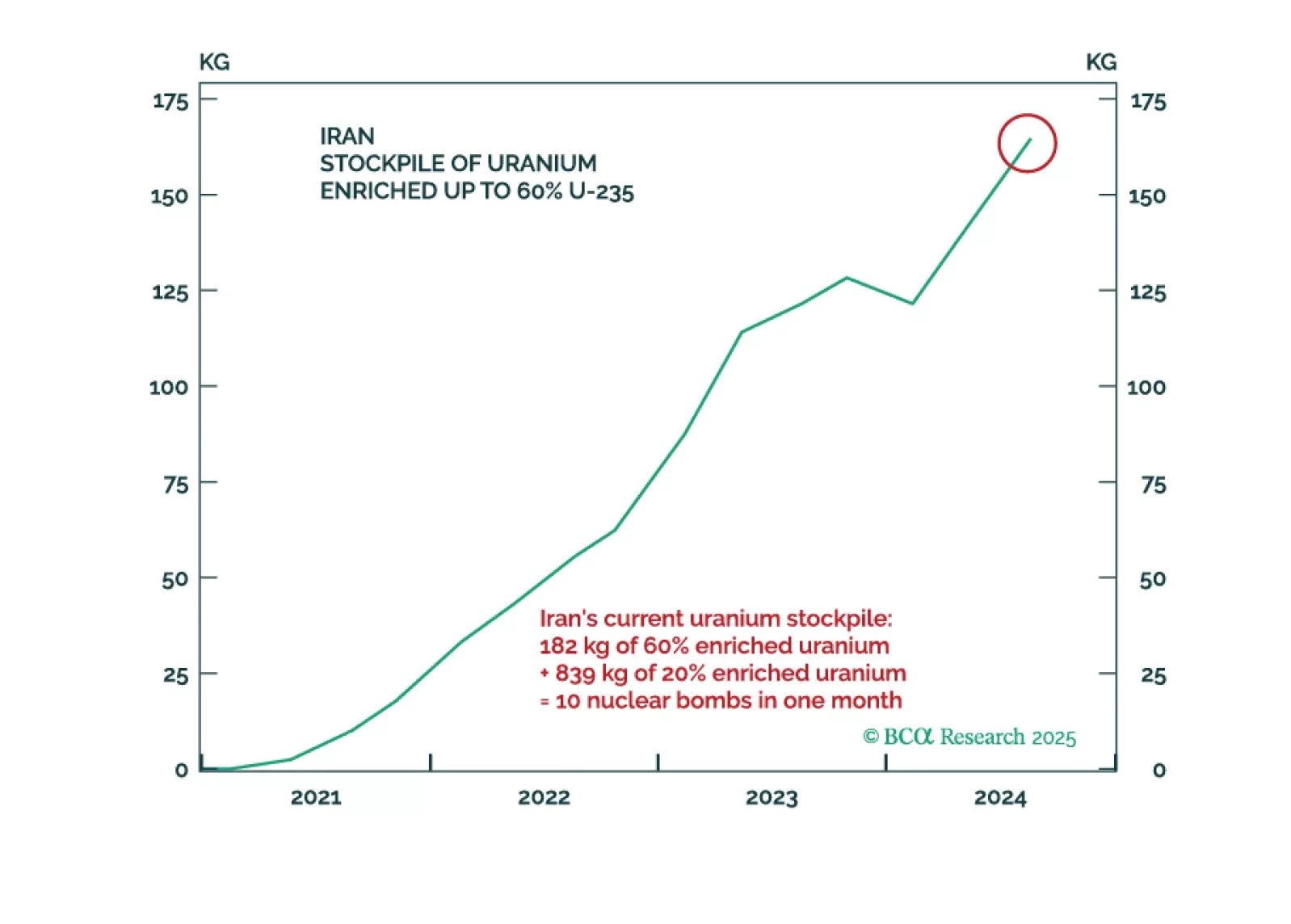

The tariffs on Canada and Mexico will come into effect as scheduled while the tariffs on China will be doubled. In the Middle East, Iranian response to any attack will threaten Middle Eastern oil supply. Meanwhile, Chinese fiscal…

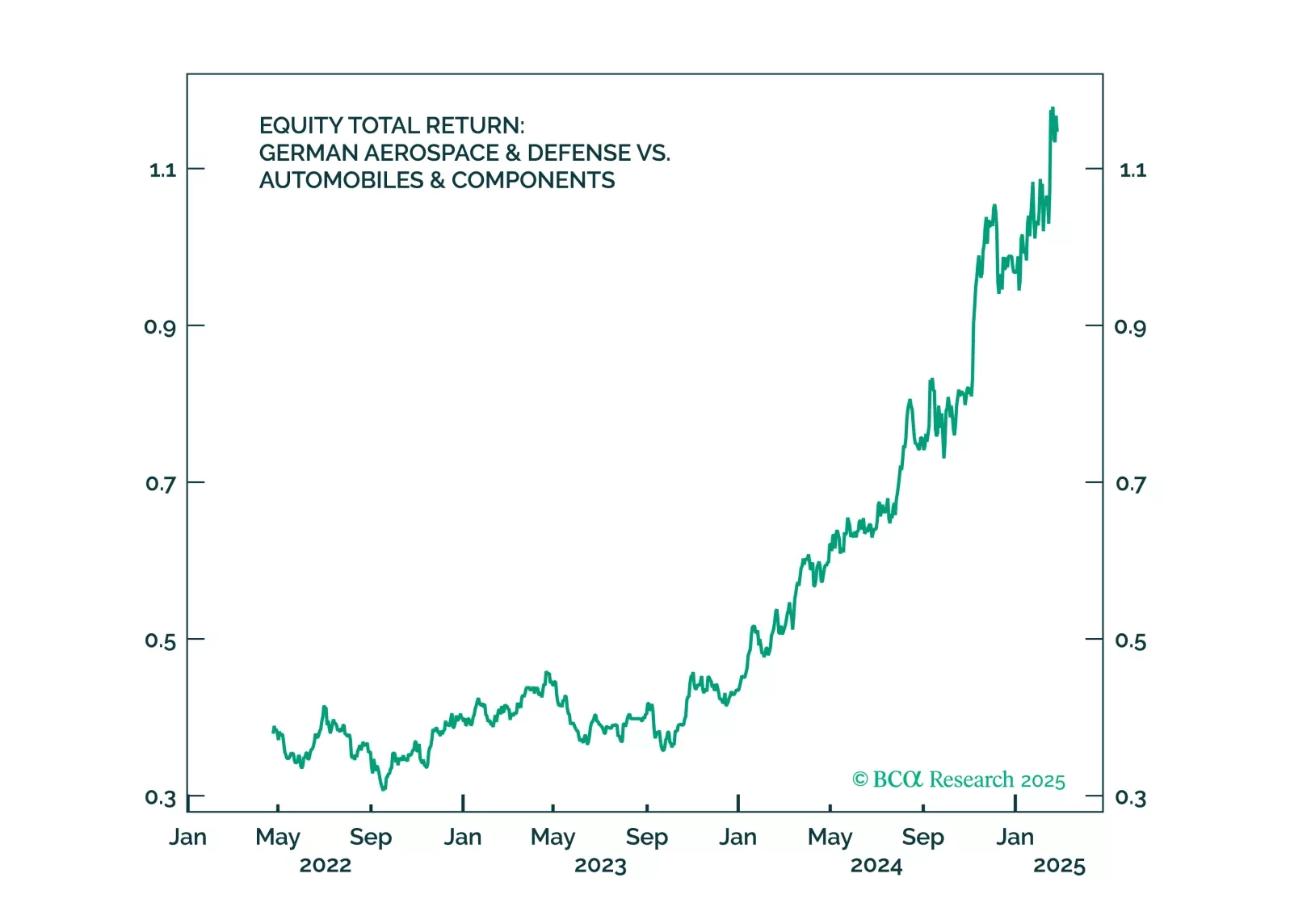

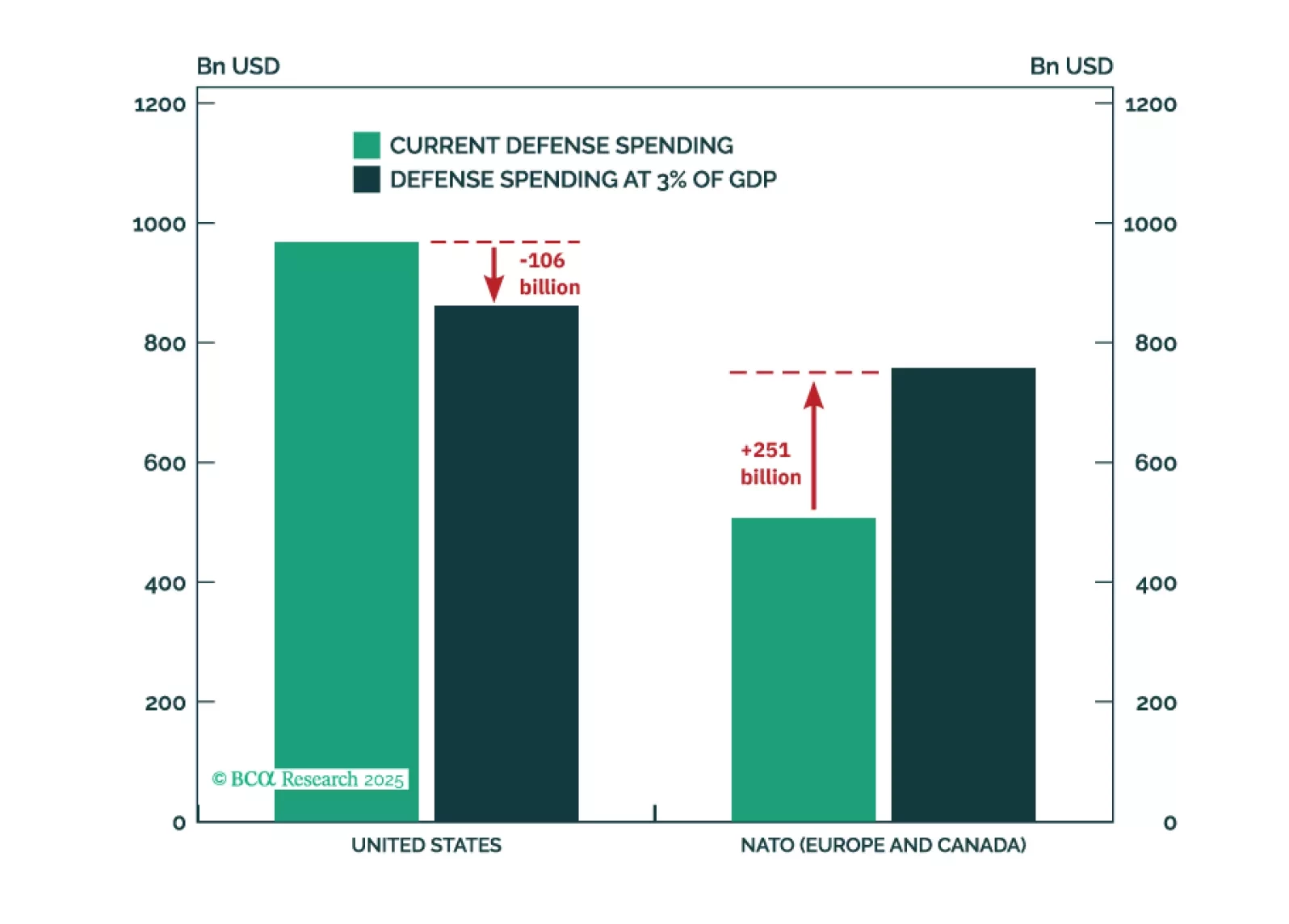

Trump’s ceasefire talks are positive for Germany – and so was the German election result. But Trump’s tariffs will hit Germany soon. Investors should use near-term volatility to increase exposure to Germany.

US growth has slowed in recent weeks. This can be seen in the weaker data on retail sales, consumer confidence, services PMIs, and a swath of housing releases (notably starts, existing home sales, homebuilder confidence, and stock…

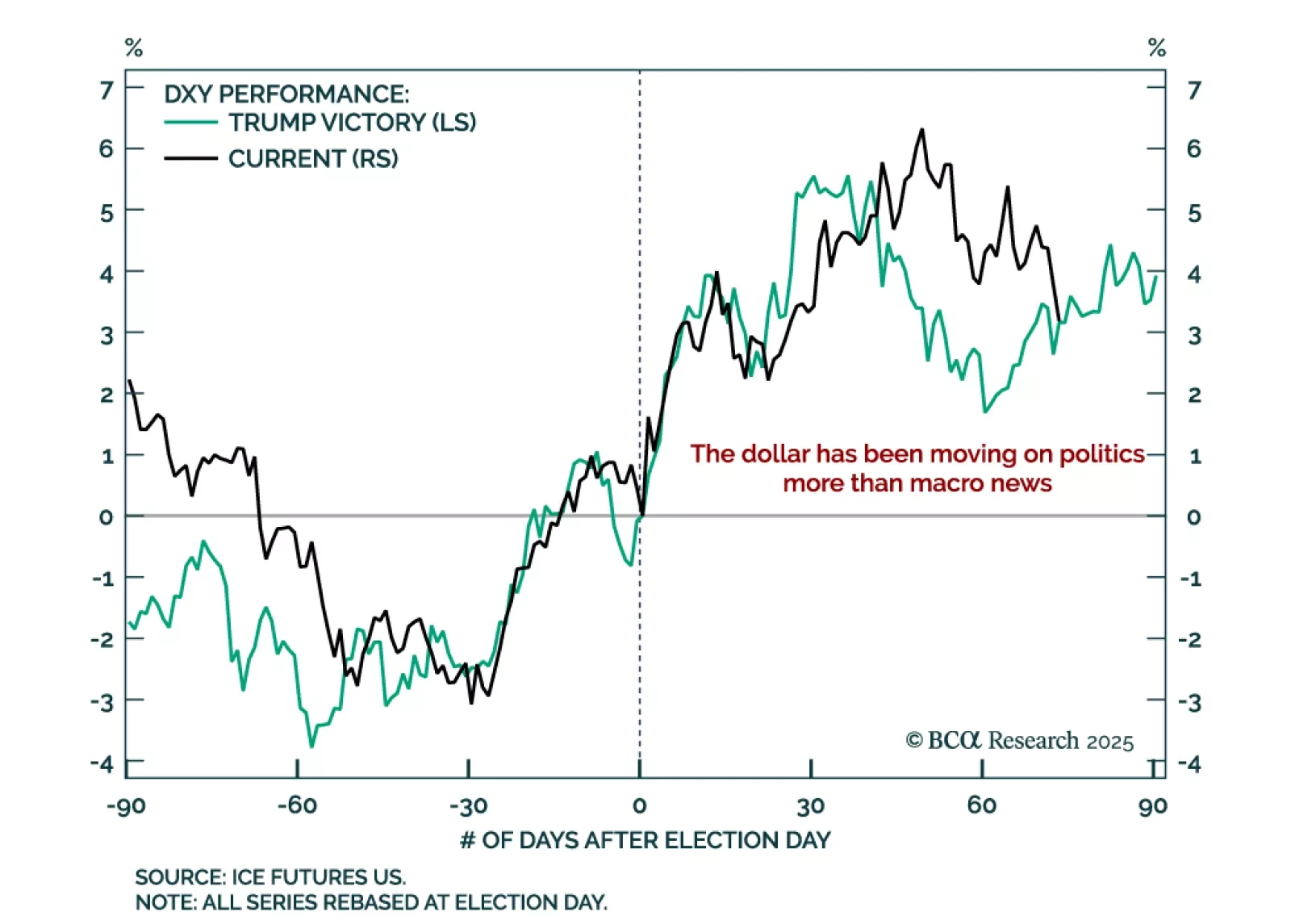

Our Foreign Exchange strategists reviewed the rationale to their short US dollar position as the DXY has been in a trading range with resistance near 110 and support around 100. The widening US budget deficit caps the dollar’s…

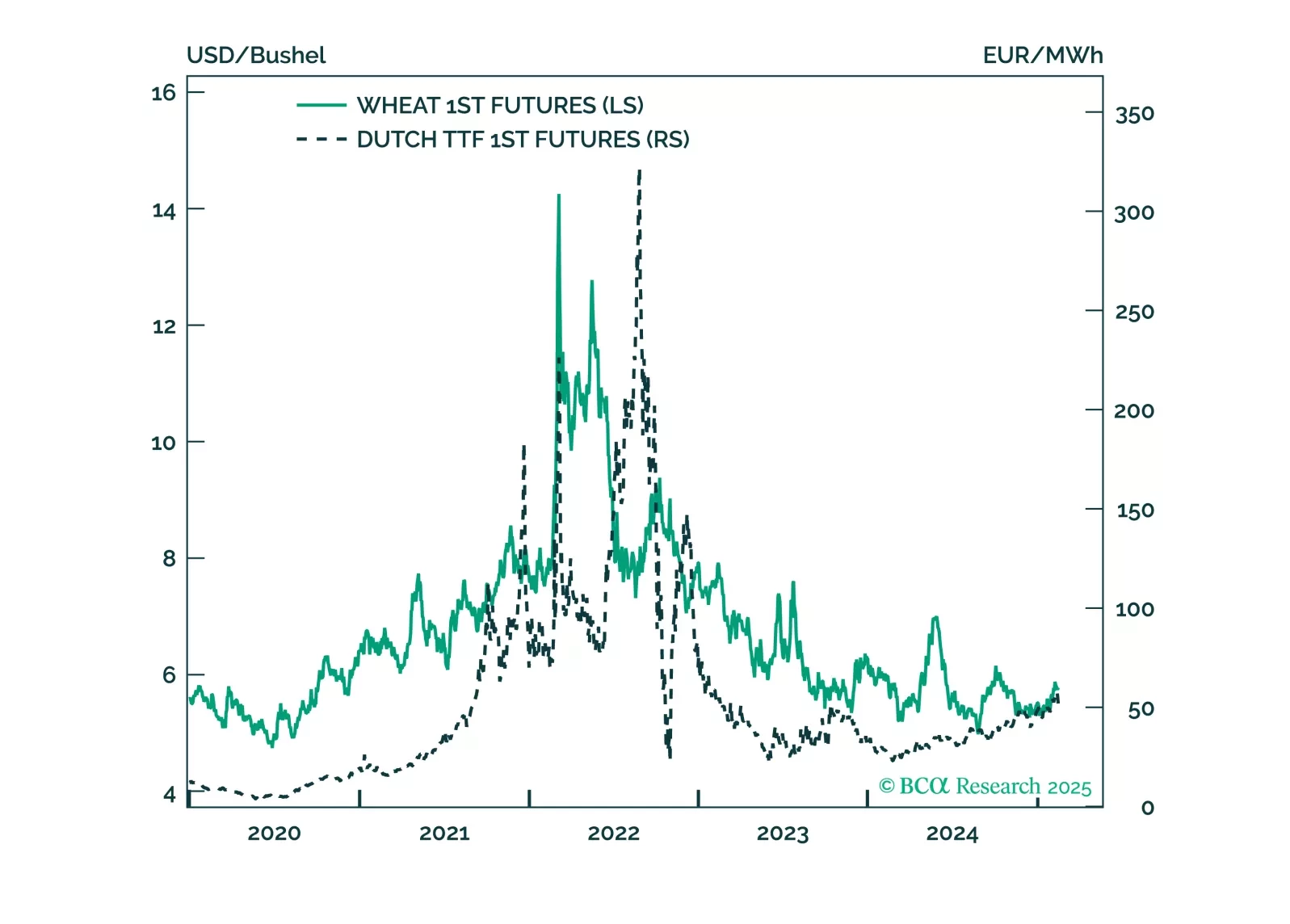

President Trump is negotiating a ceasefire in Ukraine. This will be a marginal headwind to some commodities which benefitted from the conflict like natural gas and wheat, and will be a marginal tailwind for European assets,…

The budget process and debt ceiling will cause stock and bond market volatility. US trade policies will provoke foreign pushback at a time of stretched valuations. Hence US politics and geopolitics will be bullish for US energy, but…

In his latest Thoughts Of The Day, Peter Berezin discusses the different moving parts of the global economy today and the potential impact of Trump's policies.

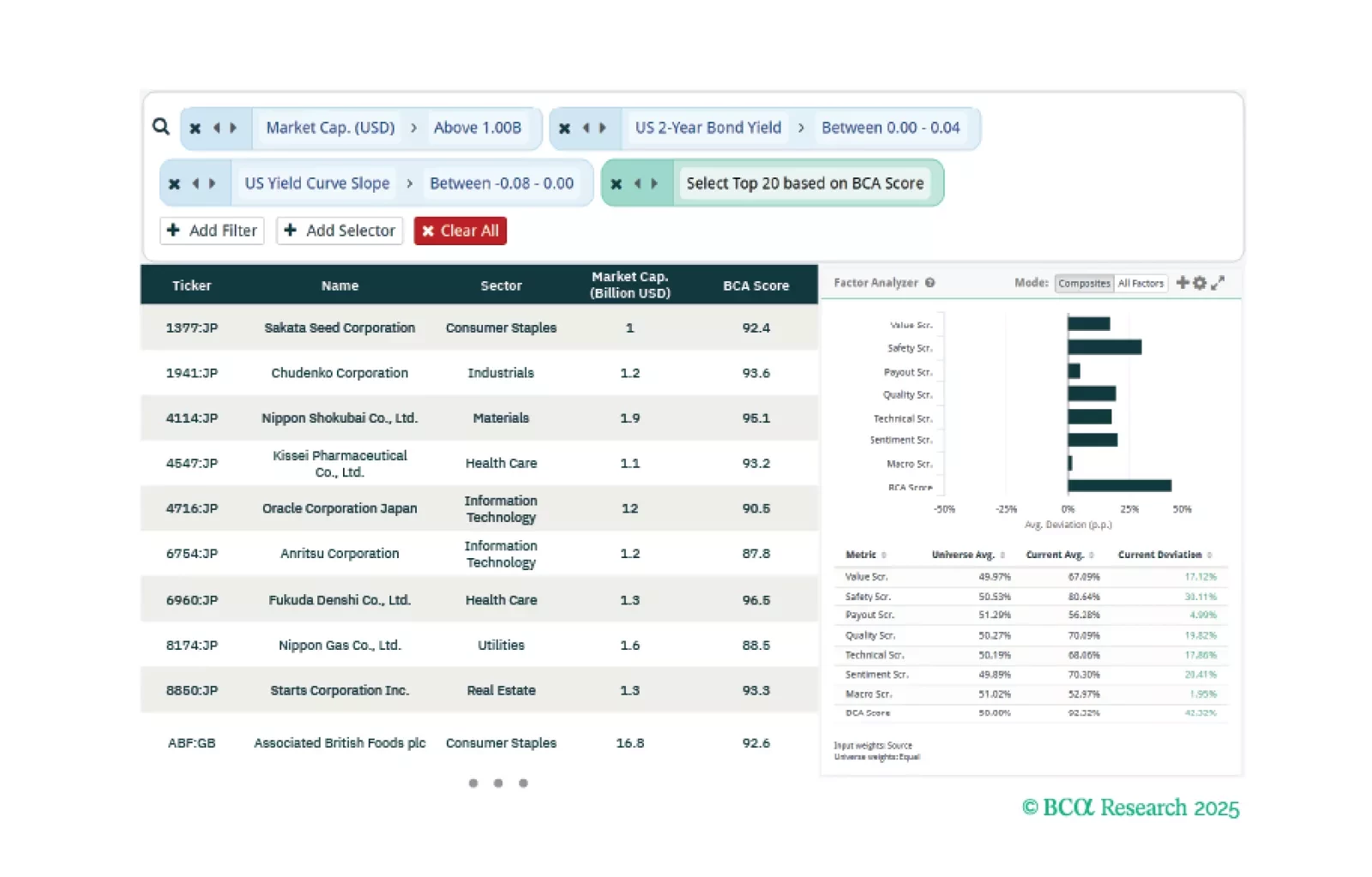

This week, our three screeners focus on providing equity insights based on the impact of tariffs, and trade policy uncertainty in general, helping clients identify stocks exposed to these shocks.