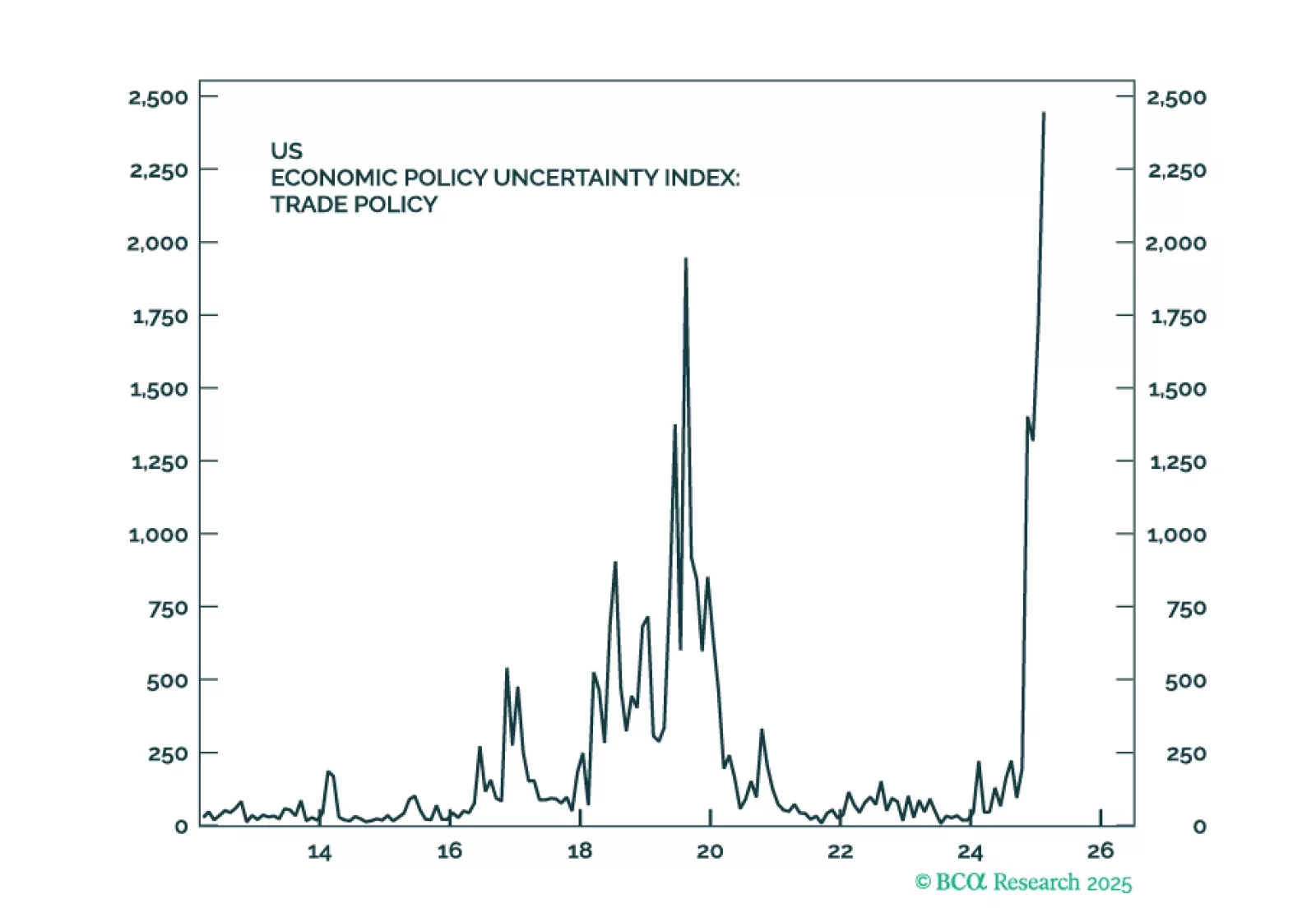

Stocks will continue to struggle in the second quarter as President Trump tries to implement tariffs. Tax cuts will only temporarily dispel growth fears, if at all. Middle Eastern instability will add oil price surprises to an…

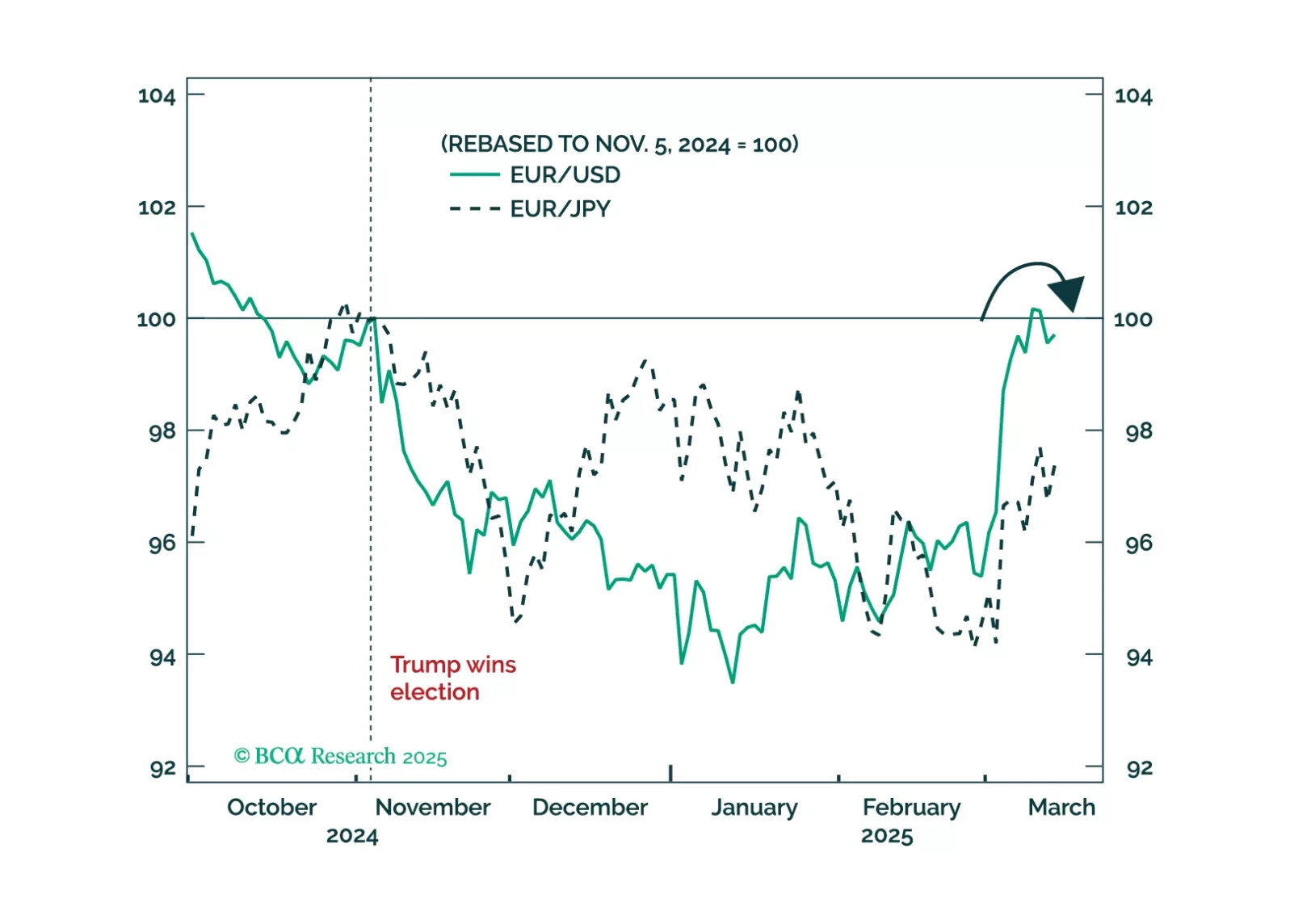

Trump’s foreign policy can be explained by rational US interests, but it requires settling the trade war with allies sooner rather than later. Book gains on EUR-USD for now.

Trump’s foreign policy can be explained by rational US interests, but it requires settling the trade war with allies sooner rather than later. Book gains on EUR-USD for now.

Despite our bearish predisposition towards stocks, we are open-minded to anything that could challenge our thesis. As such, in this report, we review five upside scenarios for equities.

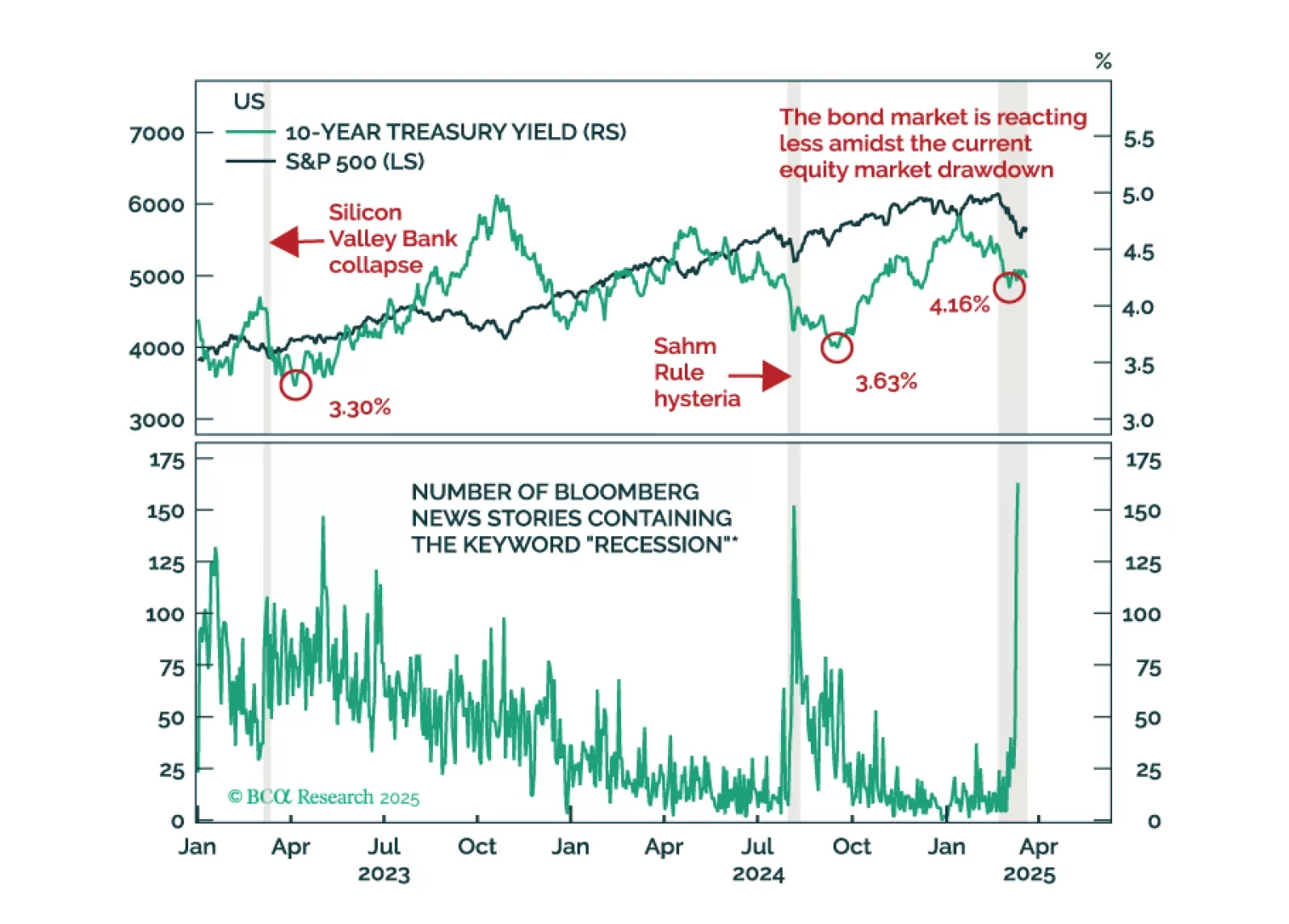

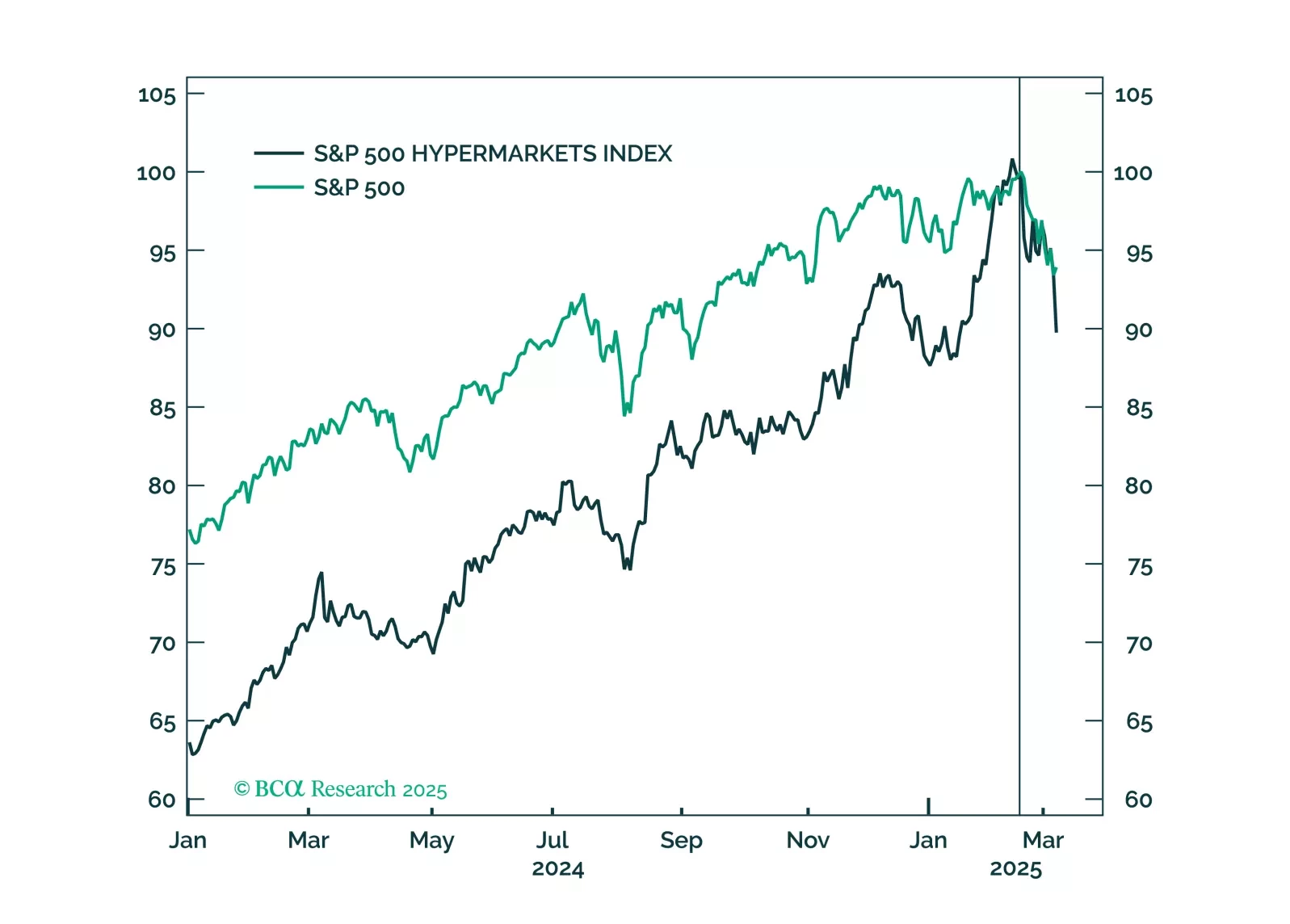

Although there may be a method to DOGE’s 100-mile-an-hour madness, we think the worries and uncertainty stoked by it and on-again, off-again tariff measures have increased the probability of a recession while bringing forward its…

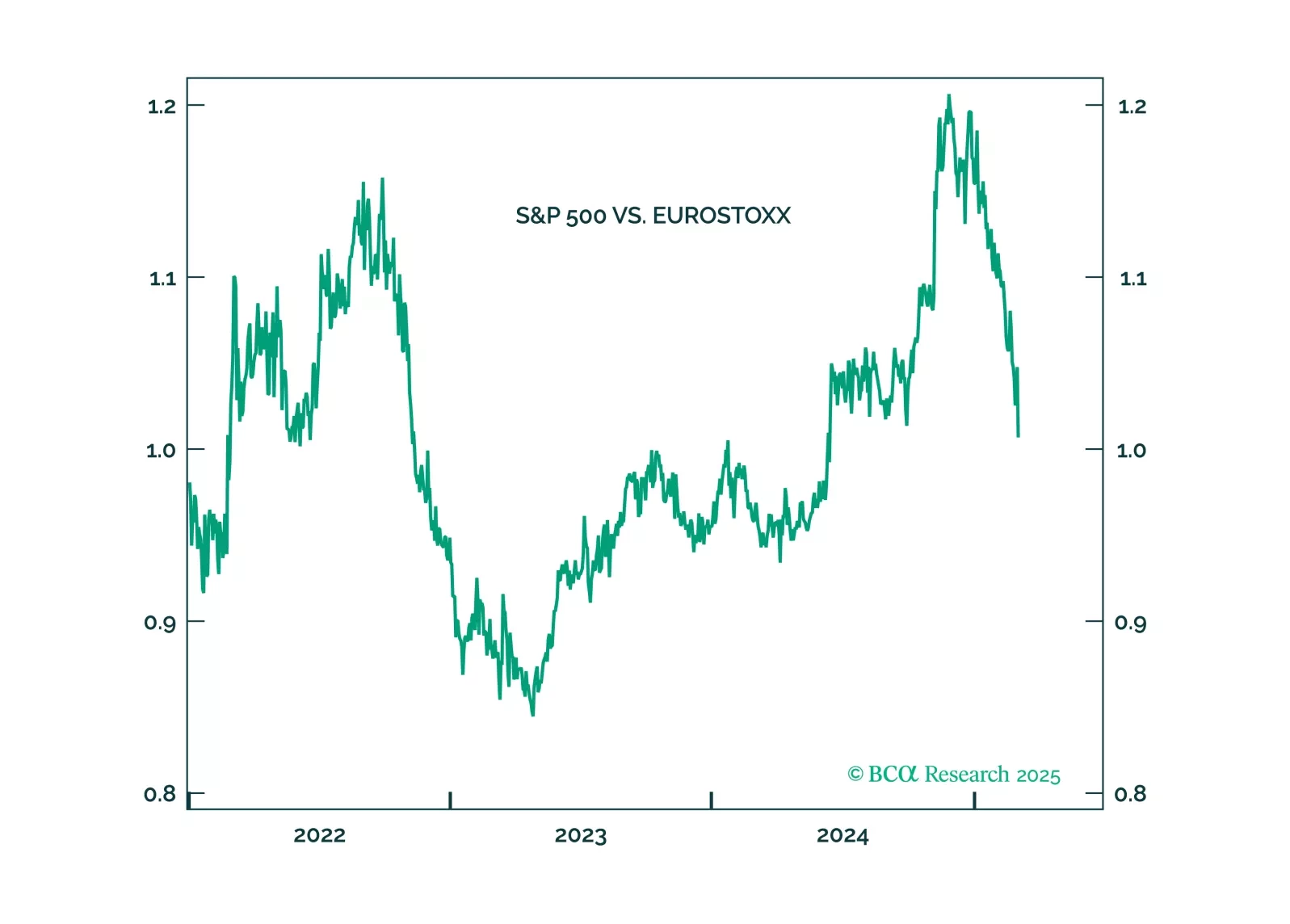

The US economy is set to enter a recession within the next few months. Stay underweight equities and overweight cash. Look to increase fixed-income duration exposure over the coming months. The euro is likely to strengthen and…

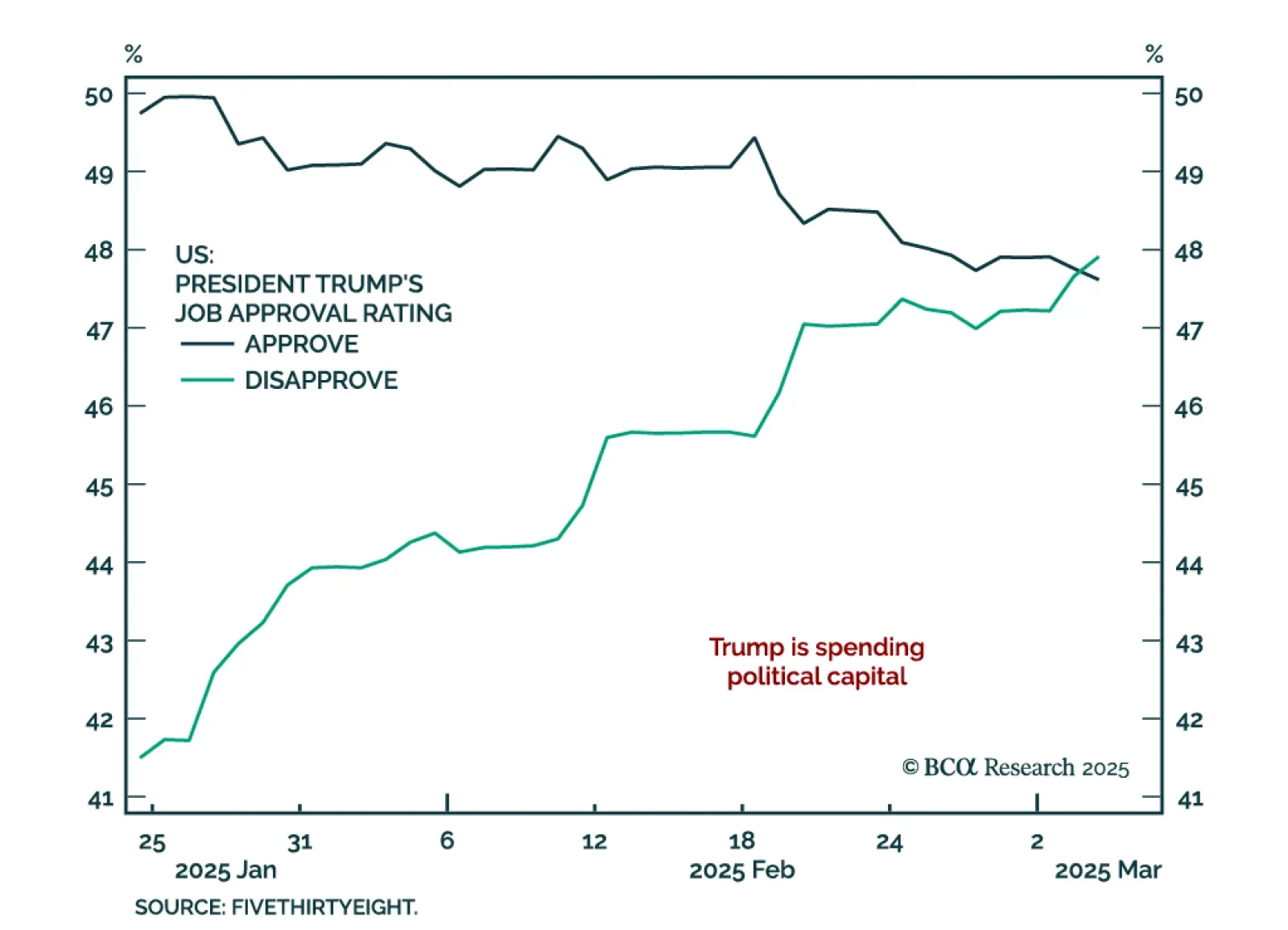

In light of President Trump’s address to Congress and the ebb-and-flow of tariff announcements, our Geopolitical strategists assessed the constraints on the administration’s disruptive agenda. Trump’s ability to implement his…

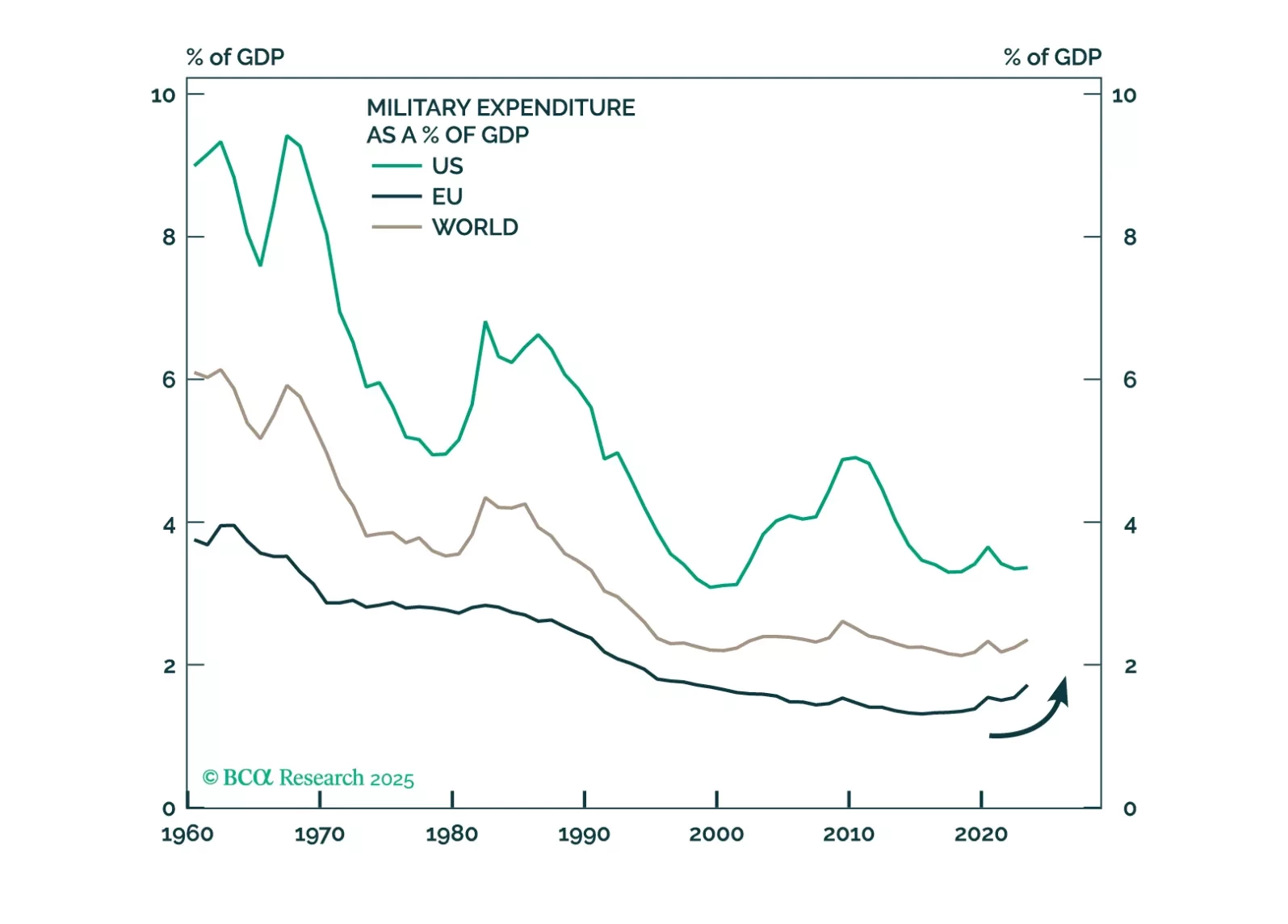

Fears of Europe’s decline due to Russian aggression and shifting US policy are overblown. President Trump’s tough stance on Ukraine is a strategic move to consolidate domestic support, not an abandonment of Europe, while Russia’s…

Trump will pull back from the trade war when stocks approach bear market territory. He will not withdraw from NATO. Favor European stocks on fiscal policy.