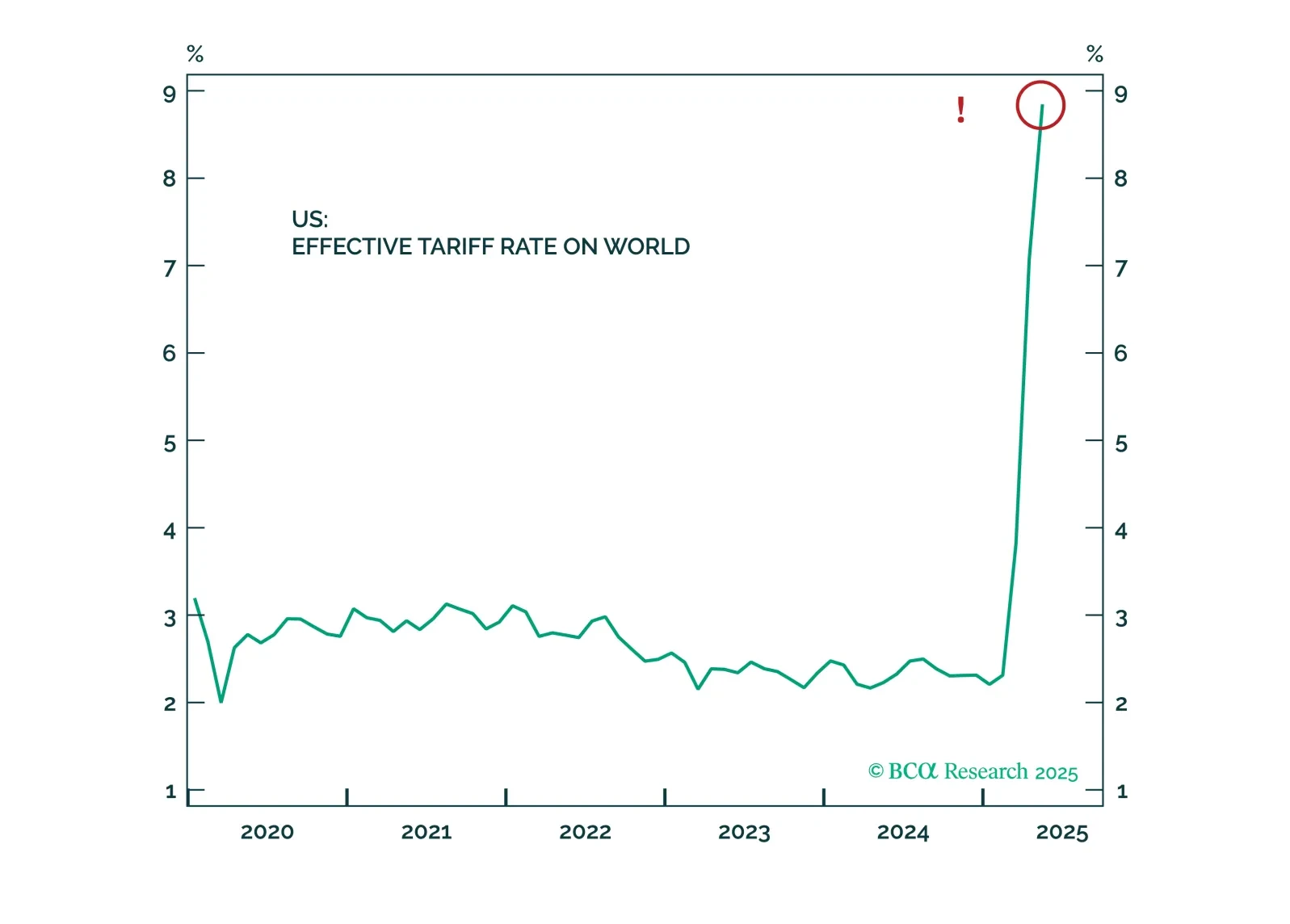

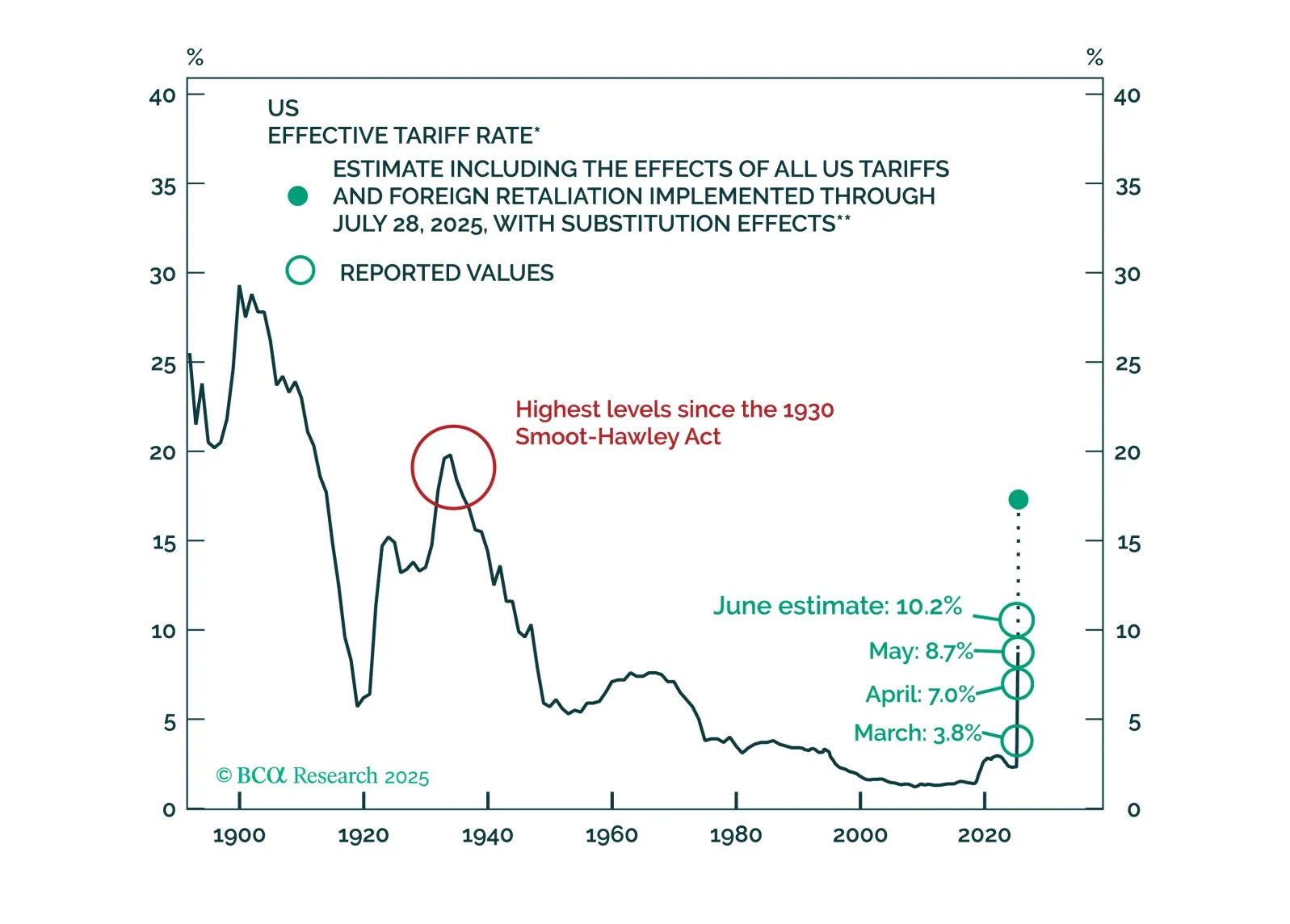

Recent economic data have been reasonably firm. We will cut our 12-month US recession probability to 40% from 50% if the Supreme Court strikes down President Trump’s tariffs. This would take our scenario-weighted year-end 2026…

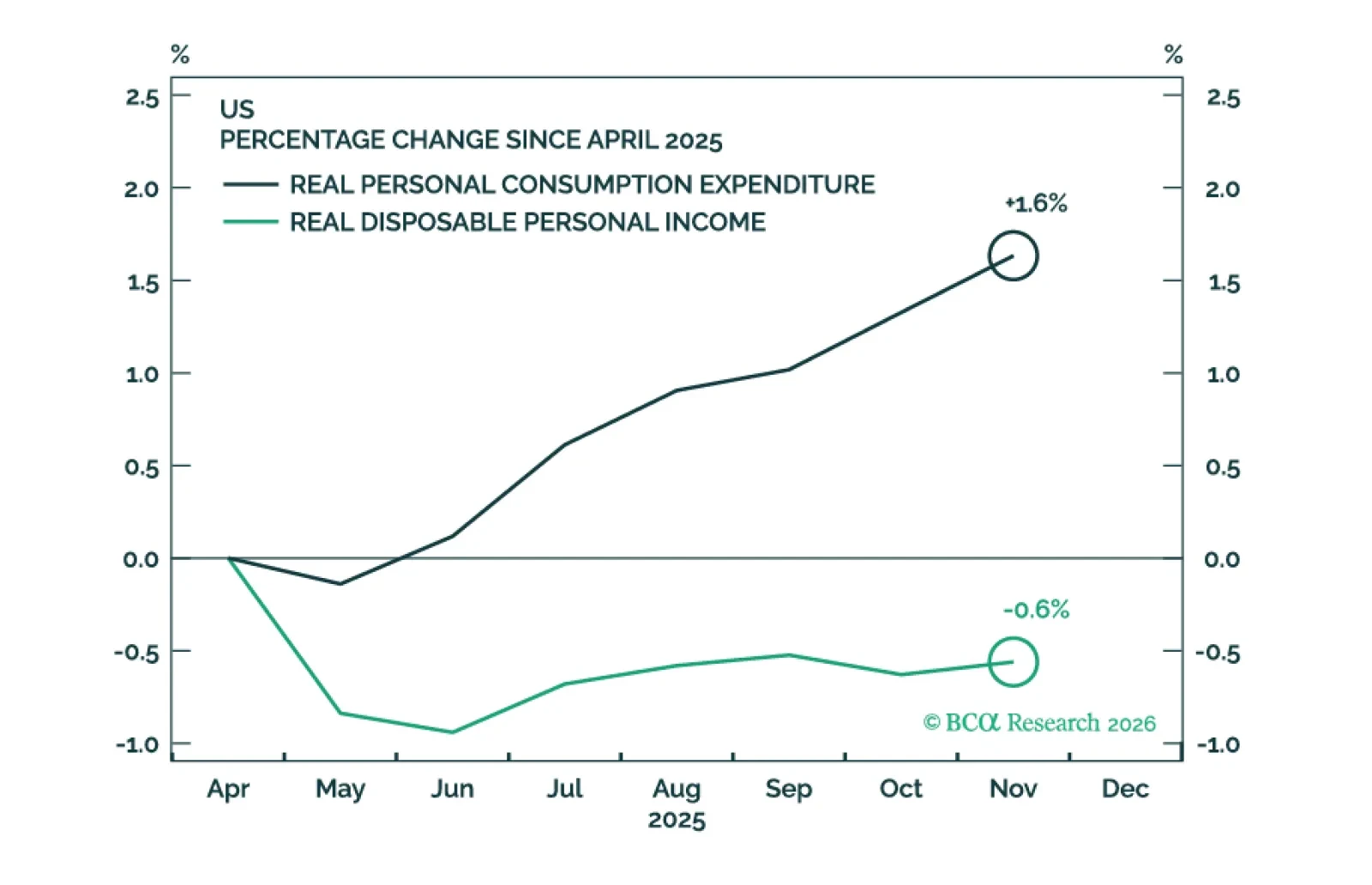

Markets have ripped in July, ignoring underwhelming payrolls and retail sales figures. This was our bet, so we don't think this is a mistake. The economy is transitioning from one catalyzed by cash to one led by lower borrowing rates…

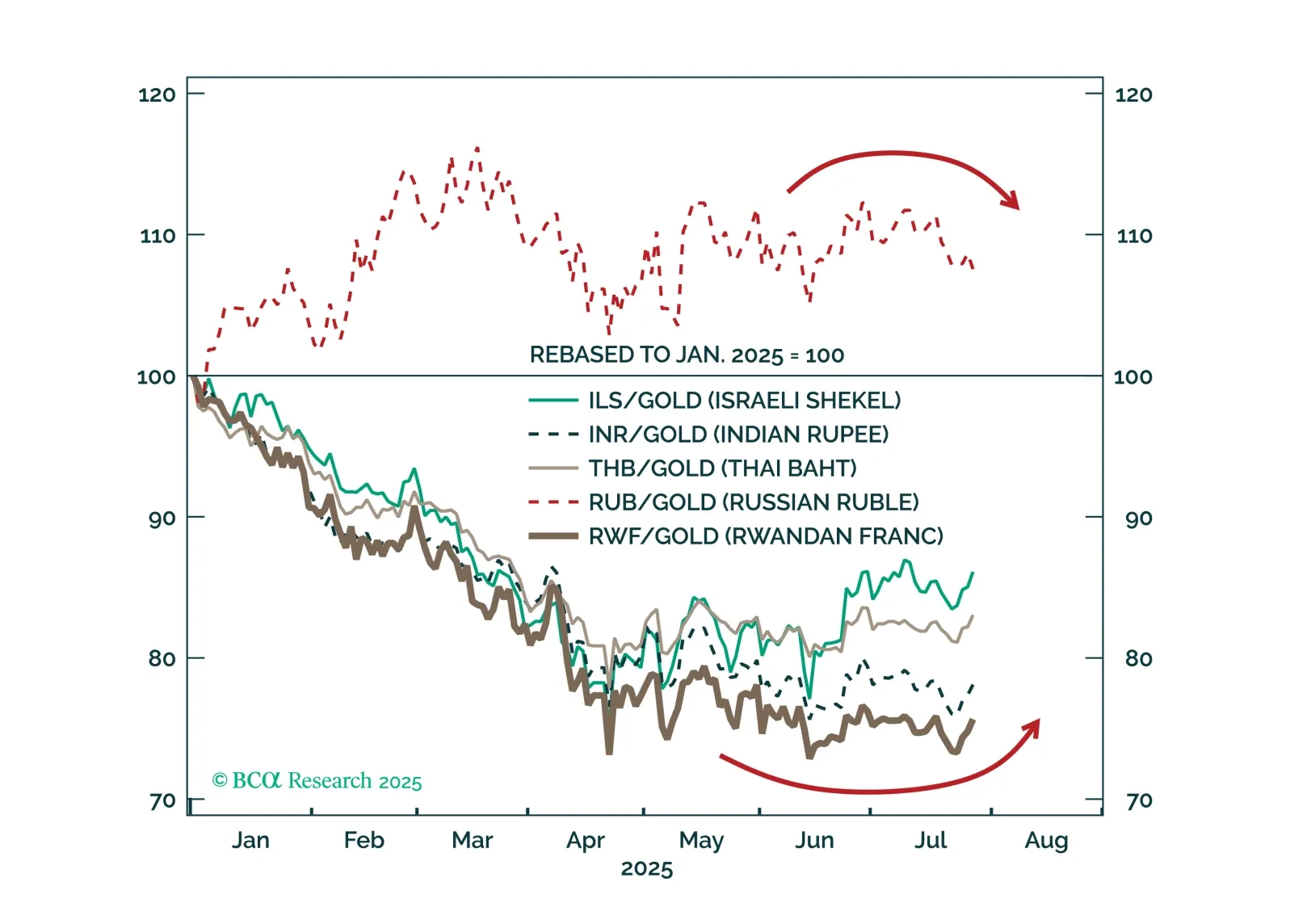

Investors should stick to a defensive stance in the very near term as the Russia-Ukraine conflict and persistent trade tensions cause market volatility.

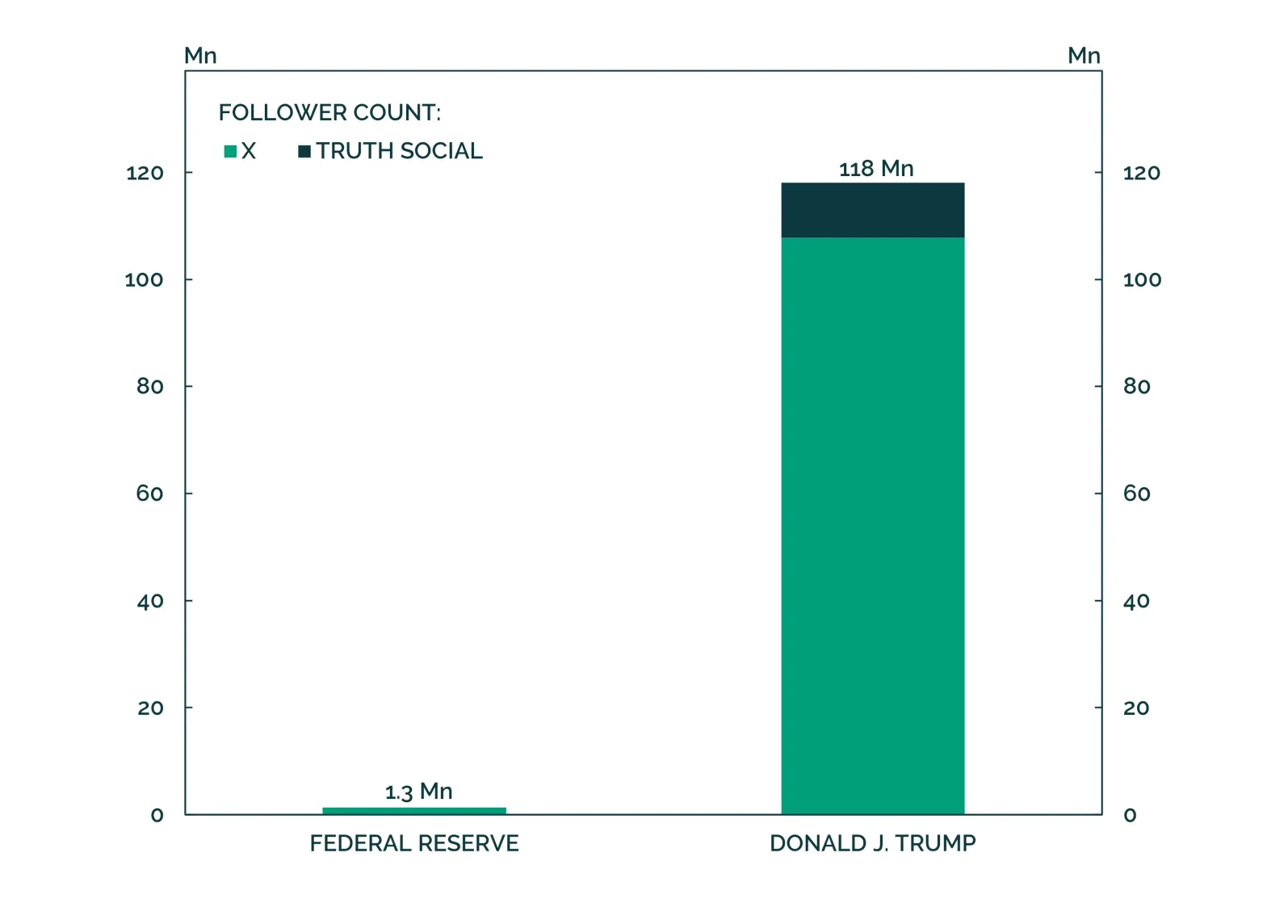

Russia poses an immediate risk to global financial markets, and then perhaps a buying opportunity. Trump is pivoting to ceasefires and trade deals, but Russia could trigger a new tariff shock first.

We will only move to a fully defensive stance if the “whites of the recession’s eyes” appear. So far, they have not. We will be increasingly looking to our MacroQuant model for guidance on when the next turning point in markets may…

We will abandon our recession call if US economic data show clear signs of stabilization over the summer months. For now, that has not happened. Maintain a modest underweight to stocks but look to get more defensive if MacroQuant’s…

Acute geopolitical risks, like a massive oil shock, may be abating. But structural geopolitical risk remains high and could upset a blithe market. Cyclical economic risks are underrated as the US slows down and China continues to…

Investors should modestly underweight equities in their portfolios and look to turn more aggressively defensive once the whites of the recession’s eyes are visible. We think that will happen within the next few months.