Underweight In our downgrade of the S&P railroads index late last year to a benchmark allocation, we highlighted that two of our key industry Indicators, the Railroad Indicator and our Rail Shipment Diffusion Indicator,…

The S&P transports index’s recovery rally has stalled recently and is a cause for concern for the overall market. In more detail, the recent gulf between relative share prices and the SPX has widened and warns that the overall…

Highlights The global shipping-fuels market will tighten as UN-mandated fuel standards kick in next year. This will keep ship fuels, known as bunkers, and other distillate prices – e.g., diesel and jet fuel – elevated…

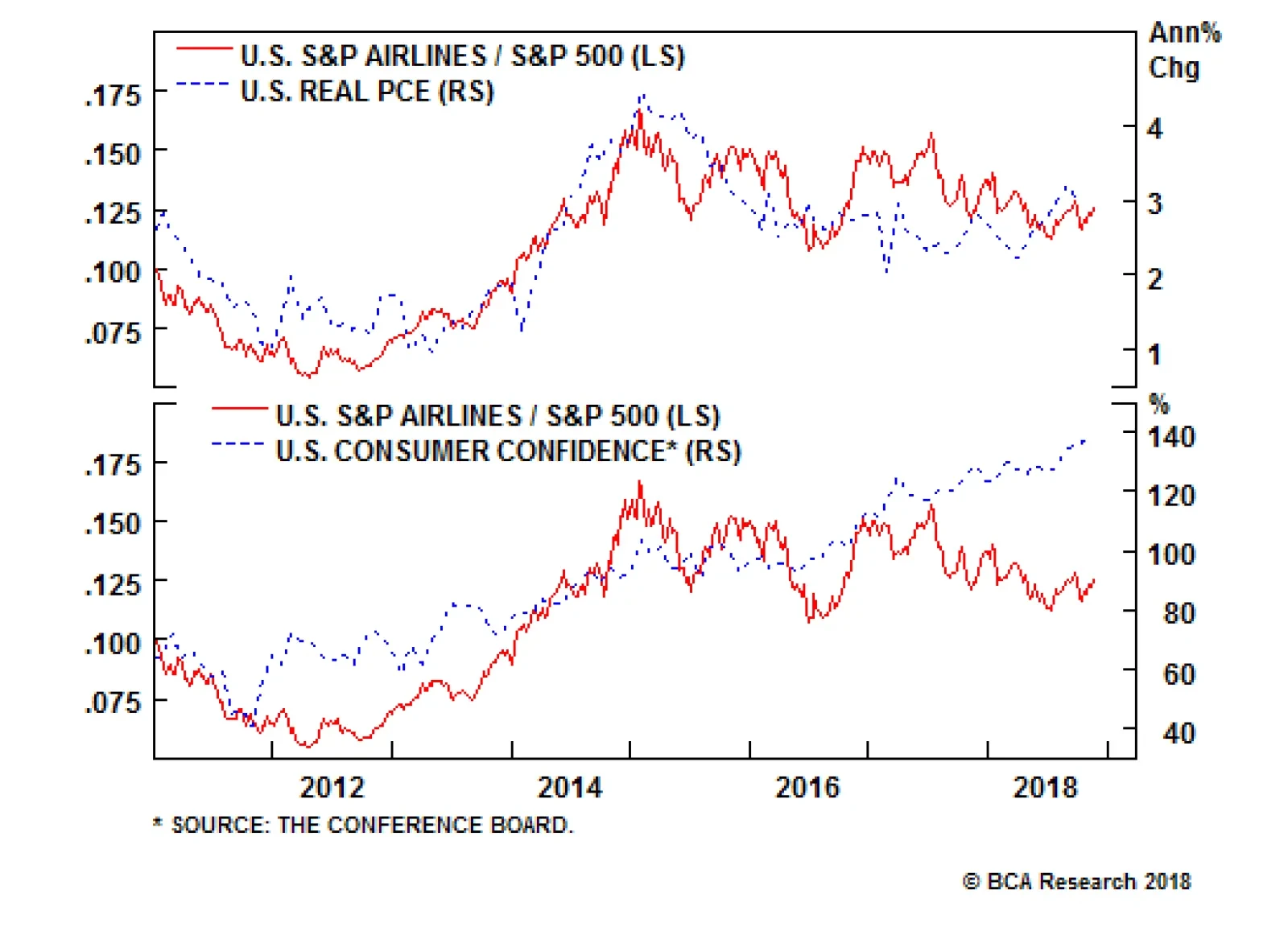

Overweight The Q4 earnings season has become dramatic in the airlines sector as the S&P airlines index is fairly evenly split with positivity and negativity. On the positive front, both LUV and AAL delivered guidance ahead…

Highlights Portfolio Strategy Higher interest rates, with the Federal Reserve tightening monetary policy three more times in the next seven months, will be the dominant theme next year. All four of our high-conviction underweight…

Overweight An axiom we have noted numerous times is that, as oil prices decline, the share prices of airlines rise and vice versa. As such, the recent spike in airlines share prices (our upgrade of the S&P airlines index a…

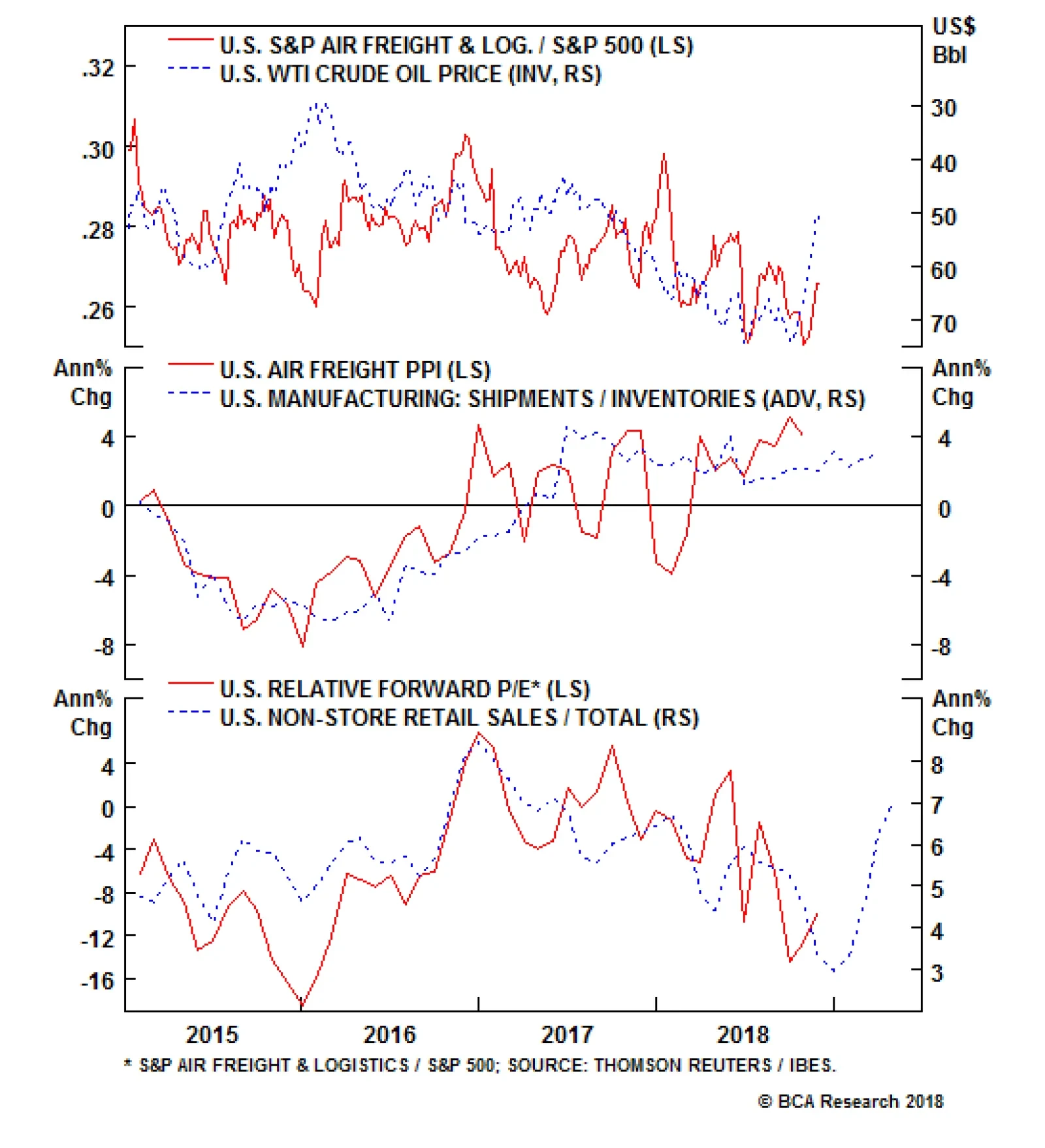

Energy costs comprise a large chunk of the input costs for freight service firms. The recent drubbing oil suffered will boost margins for airfreight & logistics companies, especially as it materialized on the eve of the…

Overweight (High-conviction) Air freight & logistics stocks have been bouncing along the bottom for the better part of the past year and have formed a base that should serve as a launch board higher in the coming months. Energy…

Given the downward pressure on input costs facing airline profits, our U.S. equity strategists have put airlines on upgrade alert and are cementing their gains of 18% from their underweight position. They have also increased…

Overweight The recent carnage in oil markets has breathed a huge sigh of relief into the S&P airlines index (most of which do not hedge fuels costs) as the collapse in WTI crude oil prices has also taken down kerosene…