Overweight The inevitable economic reopening due to the population’s inoculation along with President Biden's freshly signed fiscal spending bill will pump fresh blood into the US economy that railroads –…

Highlights Portfolio Strategy Firming leading rail freight indicators signal that intermodal, coal and commodity (ex-coal) carloads are in high demand. Tack on the global economic reopening in the back half of the year and rising…

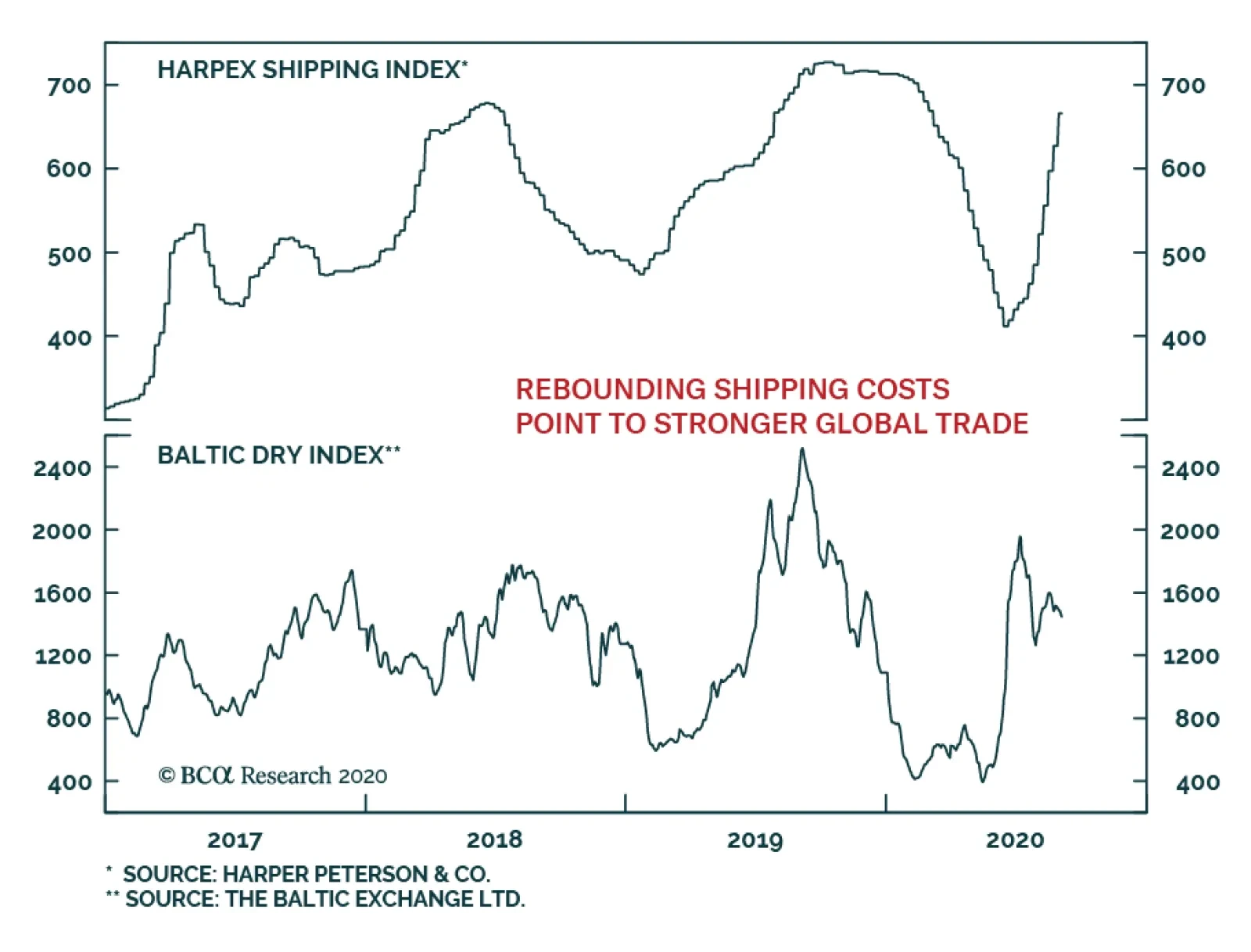

The sharp recovery in global shipping rates indicates that the recovery in the global trade cycle has legs. The Harpex Shipping Index, which measures the cost of chartering a container ship is now a stone-throw away from its…

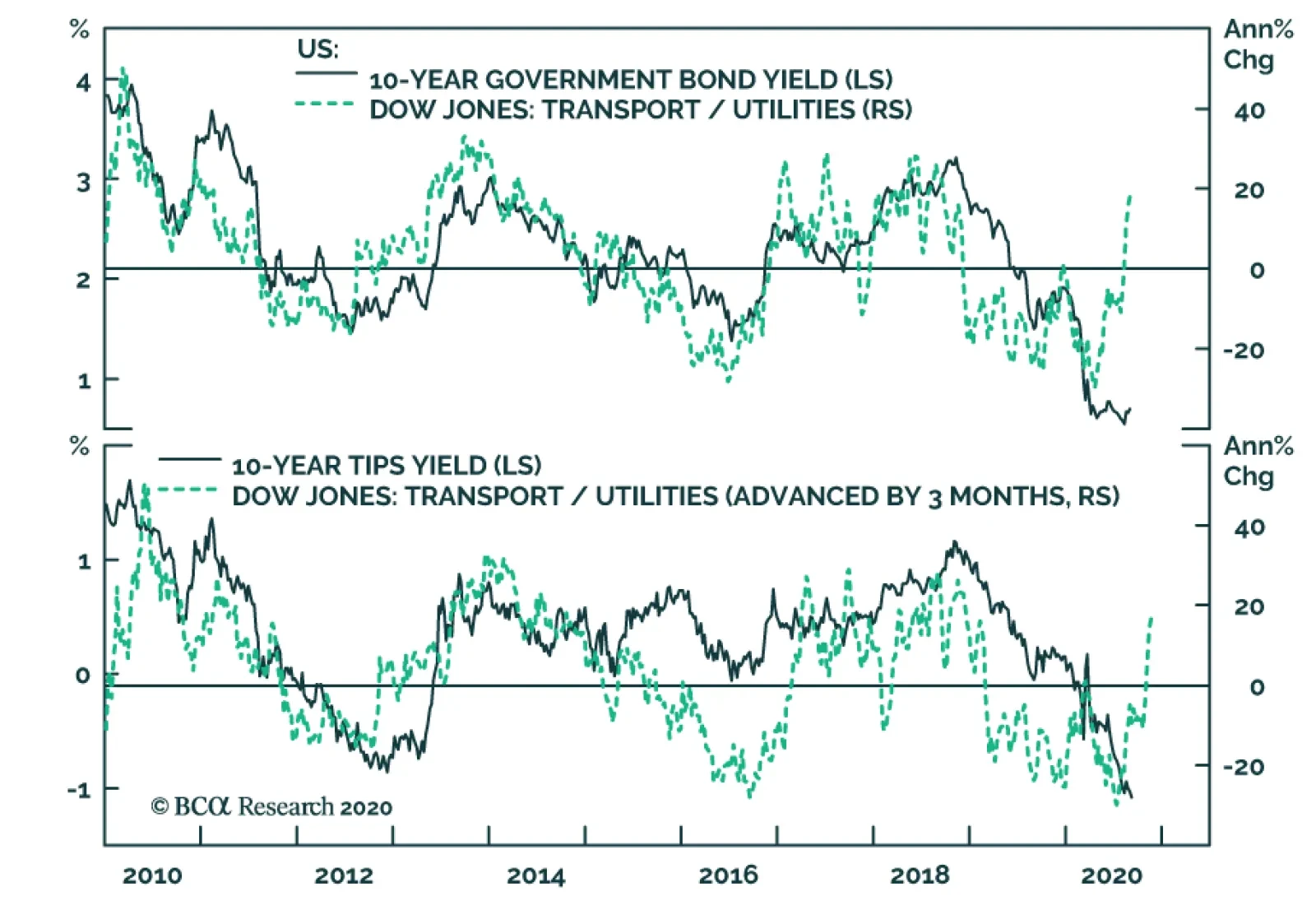

The outperformance of transportation stocks relative to utilities has gained pace in the month of August. This internal market dynamics is important because it confirms that the outlook for cyclical equities is improving relative…

While the S&P transports index has neither made new all-time highs nor outperformed the SPX year-to-date, one economically hypersensitive sub-group, trucking, has been revving its engines and is sending a bullish signal for…

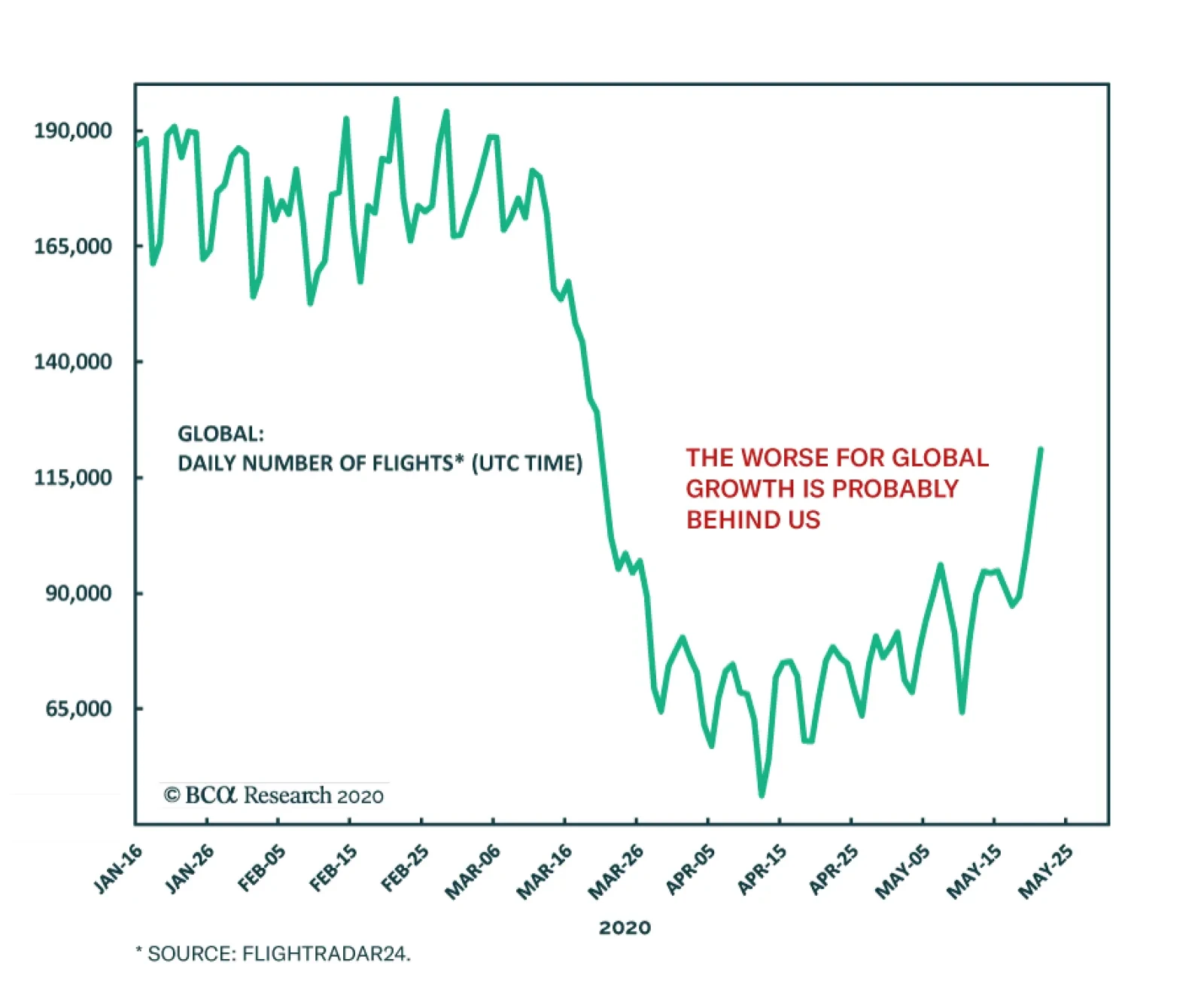

After collapsing by 71% between mid-February and early April, global flight numbers are once again increasing, rising 162% between April 12 and May 21. This improvement overstates the pick-up in the number of passengers as flights…

This week we upgraded the S&P railroads index to neutral locking in 6.4% in relative gains since inception. The defensive nature of rails is most evident in industry pricing power (third panel). Railroad selling prices are holding…

Highlights Portfolio Strategy The Fed’s unorthodox monetary policy is aimed at quashing volatility, lifting asset prices and debasing the currency, all of which are equity market bullish. Grim, but backward looking, macro data…

Highlights US Corporates: The Fed continues to expand the reach of its extraordinary monetary policies designed to combat the COVID-19 recession, now giving itself the ability to hold BB-rated US high-yield bonds within its corporate…