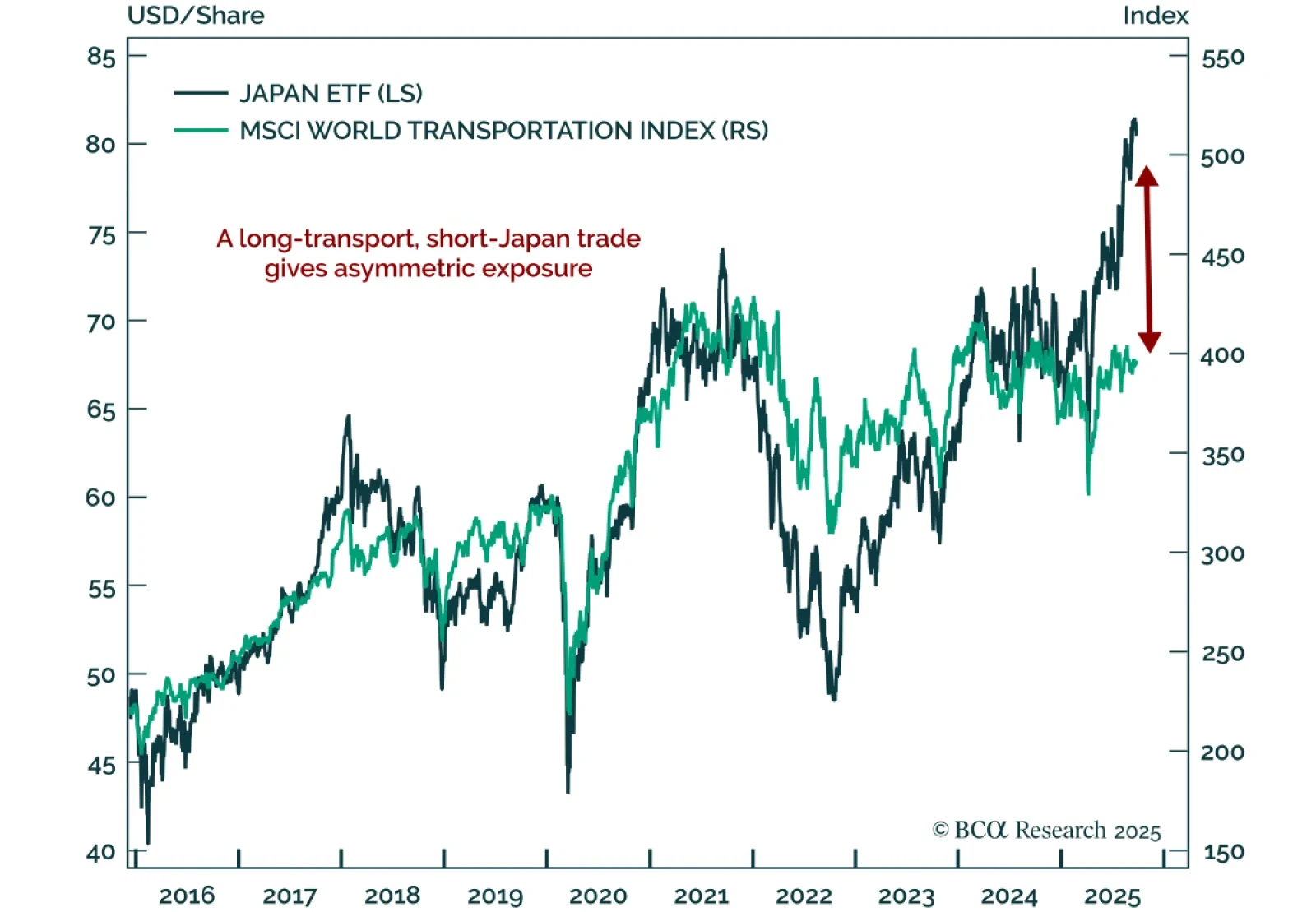

Sell Japanese equities and buy global transportation stocks to capture an overdue mean-reversion in trade-exposed assets. Our Chart Of The Week comes from Mathieu Savary, Chief DM ex. US Strategist. The post-Liberation Day…

Investors have given up on European assets, which now suffer exceptional discounts to US ones. However, tighter US fiscal policy, the end of Europe’s austerity and deleveraging, the LNG Tsunami about to hit European shores, and the…

A US recession remains our base case over a cyclical investment horizon. We expect the ongoing labor market deterioration to eventually tip the economy into a recession. We therefore continue to expect the disinflationary forces…

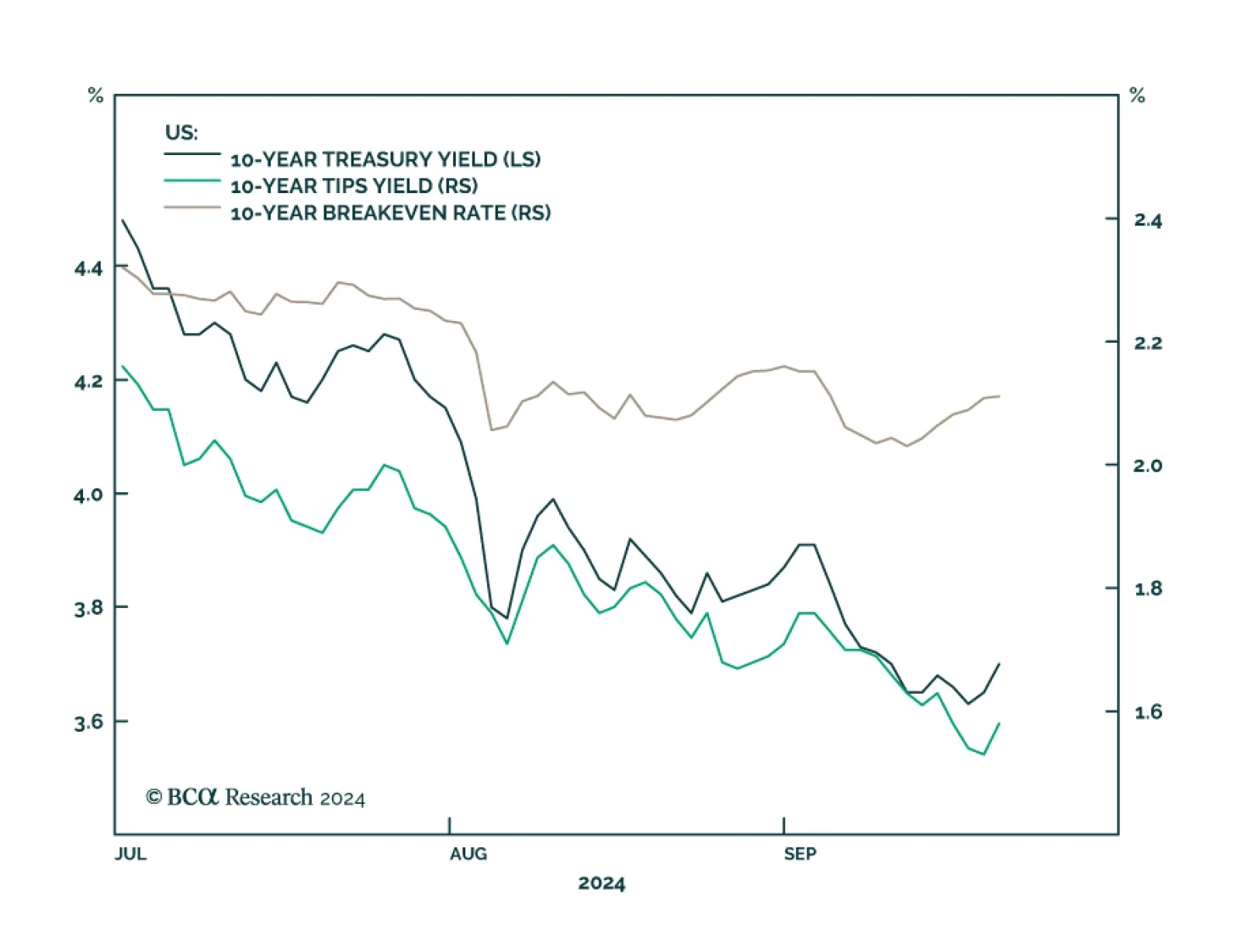

The 10-year Treasury yield rose in the aftermath of the Fed’s jumbo rate cut on Wednesday. Our US Bond strategists noted that this move reflects the fact that the downward revisions to the dots still fall short of the…

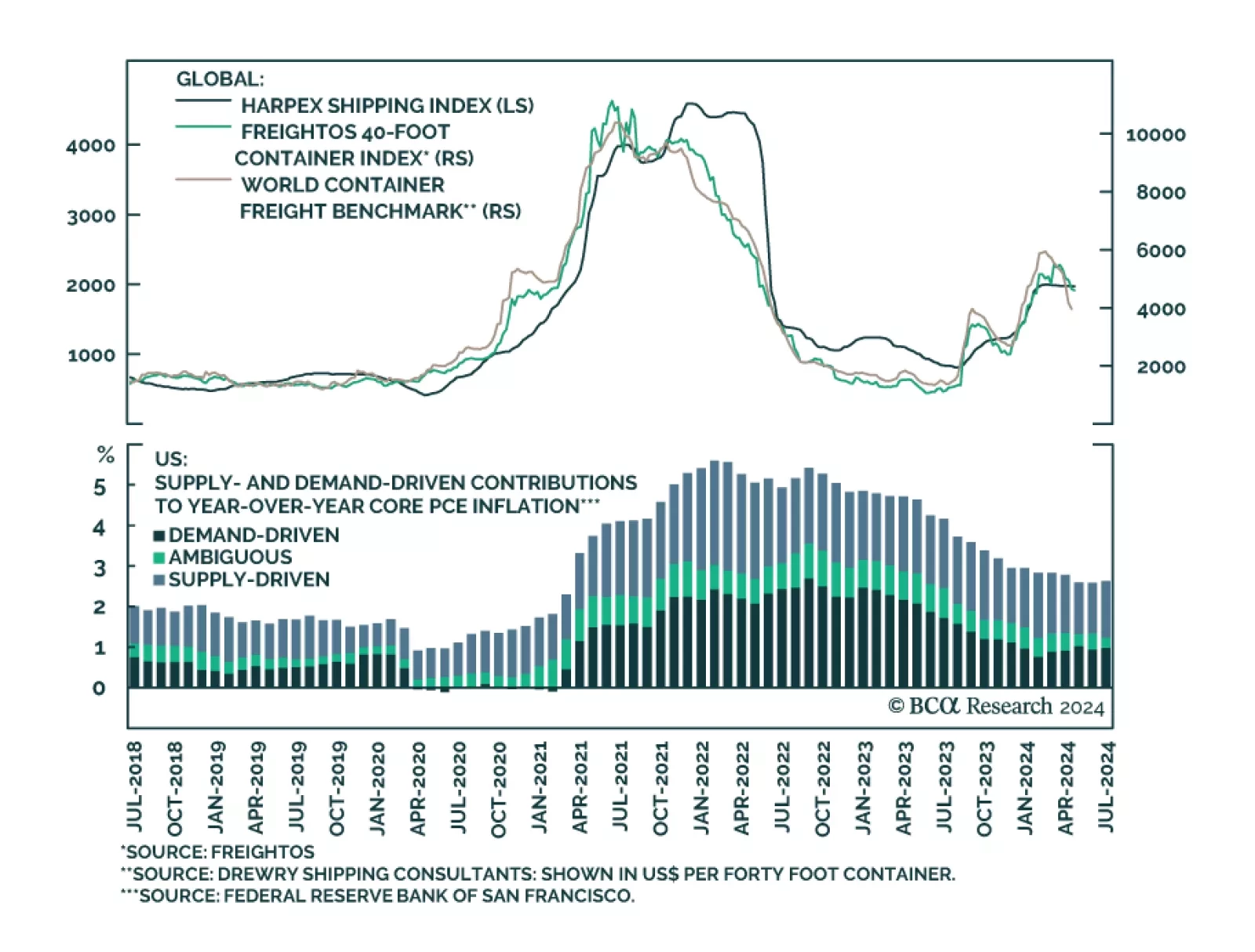

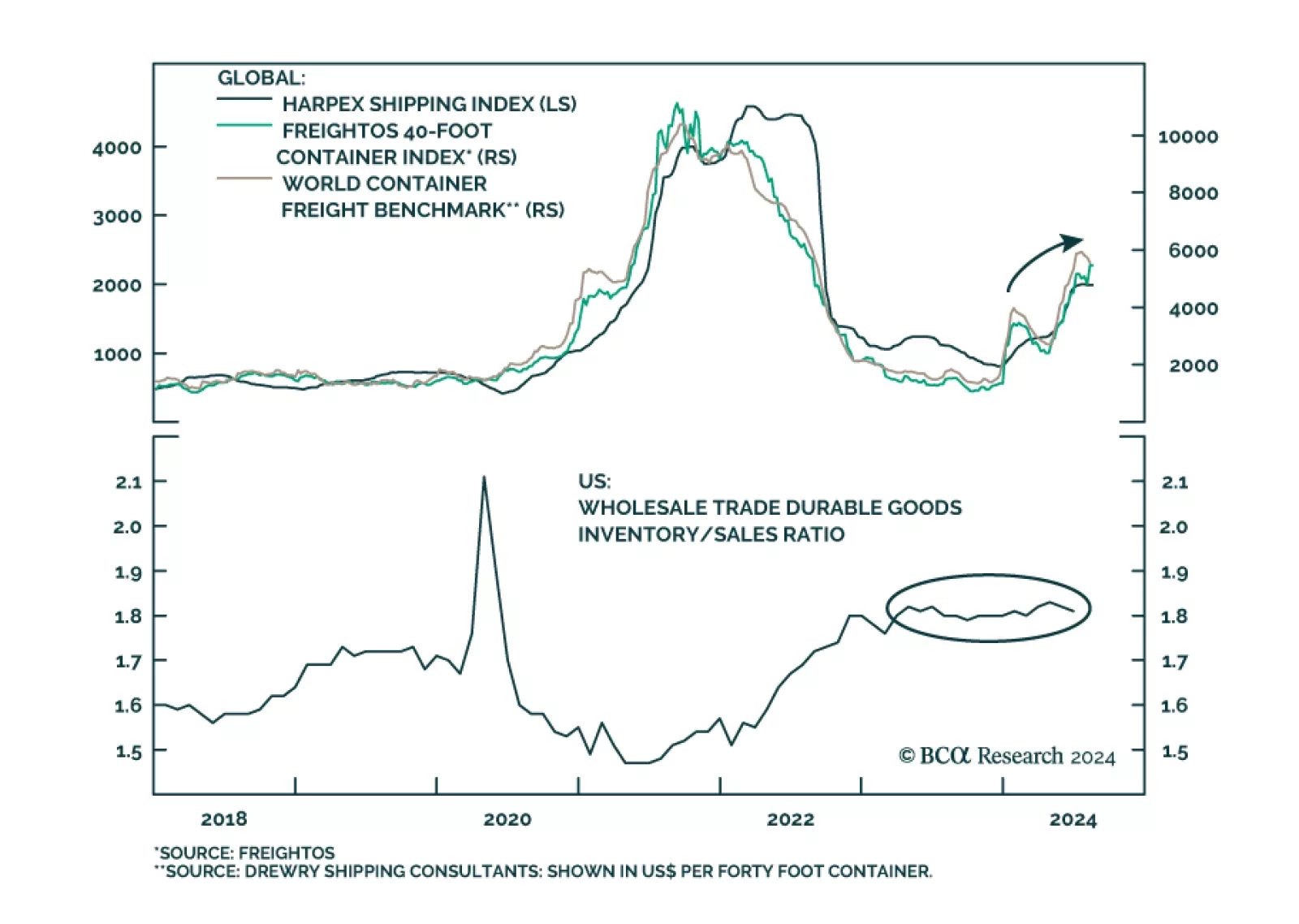

Goods prices have normalized following the pandemic binge on goods spending and have contributed to easing price pressures overall. A large drop in vehicle prices largely drove the decrease in July’s CPI and we have…

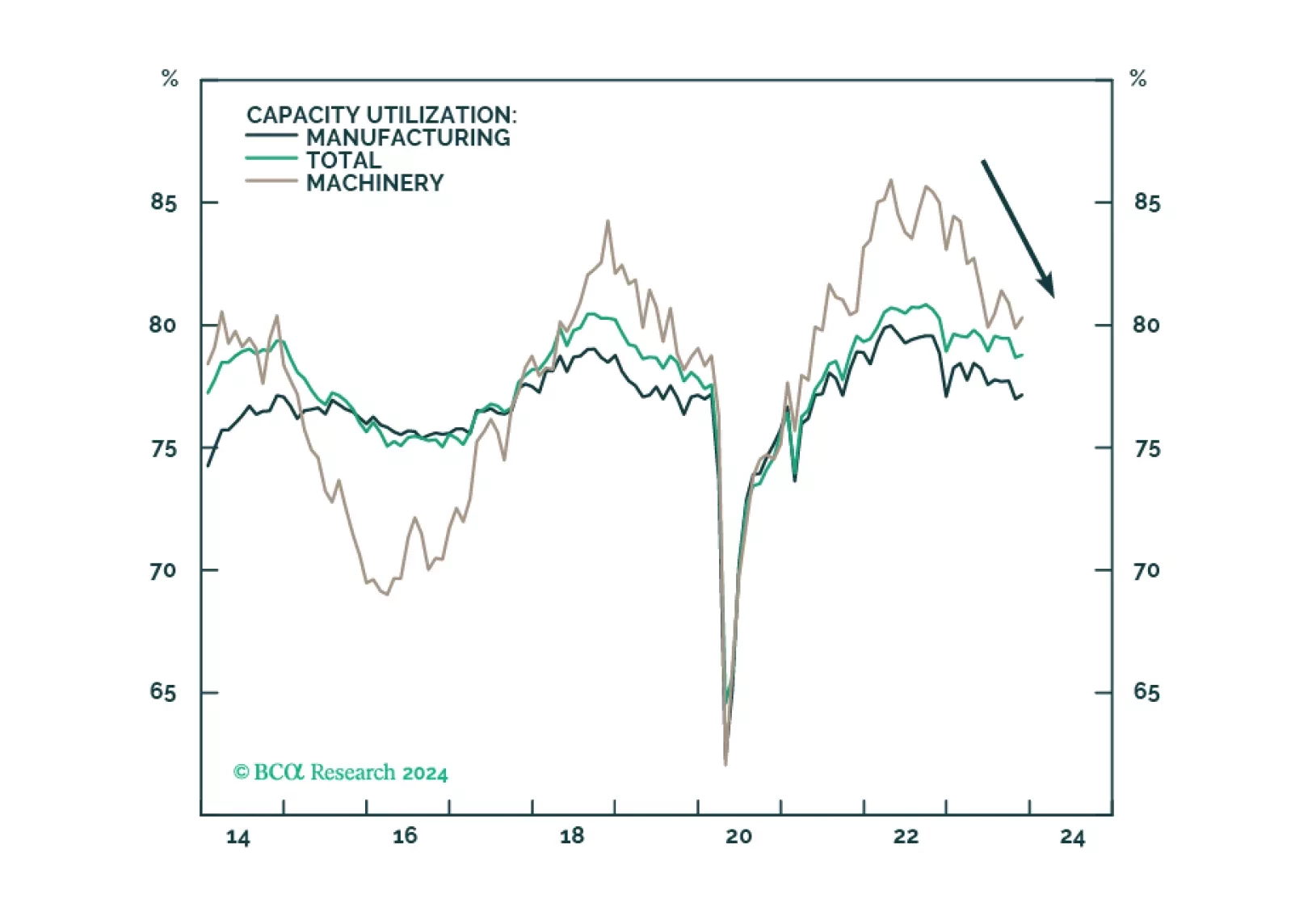

The US manufacturing renaissance, spurred on by reshoring, automation, and government spending, is running its course but progress has slowed on the back of tight monetary conditions and the manufacturing recession. The deceleration…