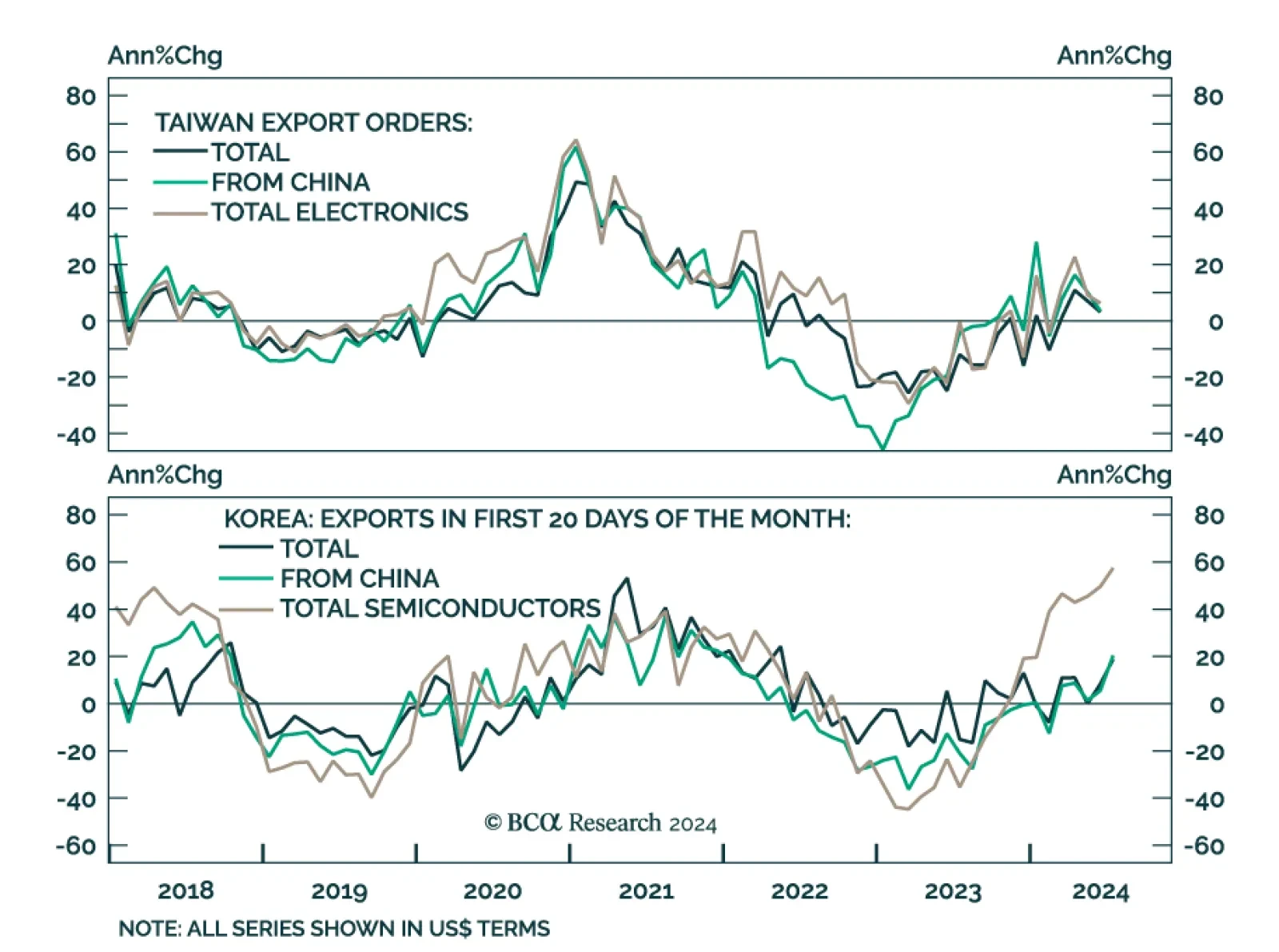

Export dynamics from small open economies are a good bellwether for global growth conditions. Taiwan export orders decelerated from 7.0% y/y to 3.1% in June, badly disappointing expectations of a double-digit growth rate and…

As Trump’s victory odds rise, the underperformance of European equities deepens. How negative would a global trade war be for European assets?

The real threat to European equities is growth, not political risk. How low will Eurozone earnings fall during the coming recession and how much will equities decline in response?

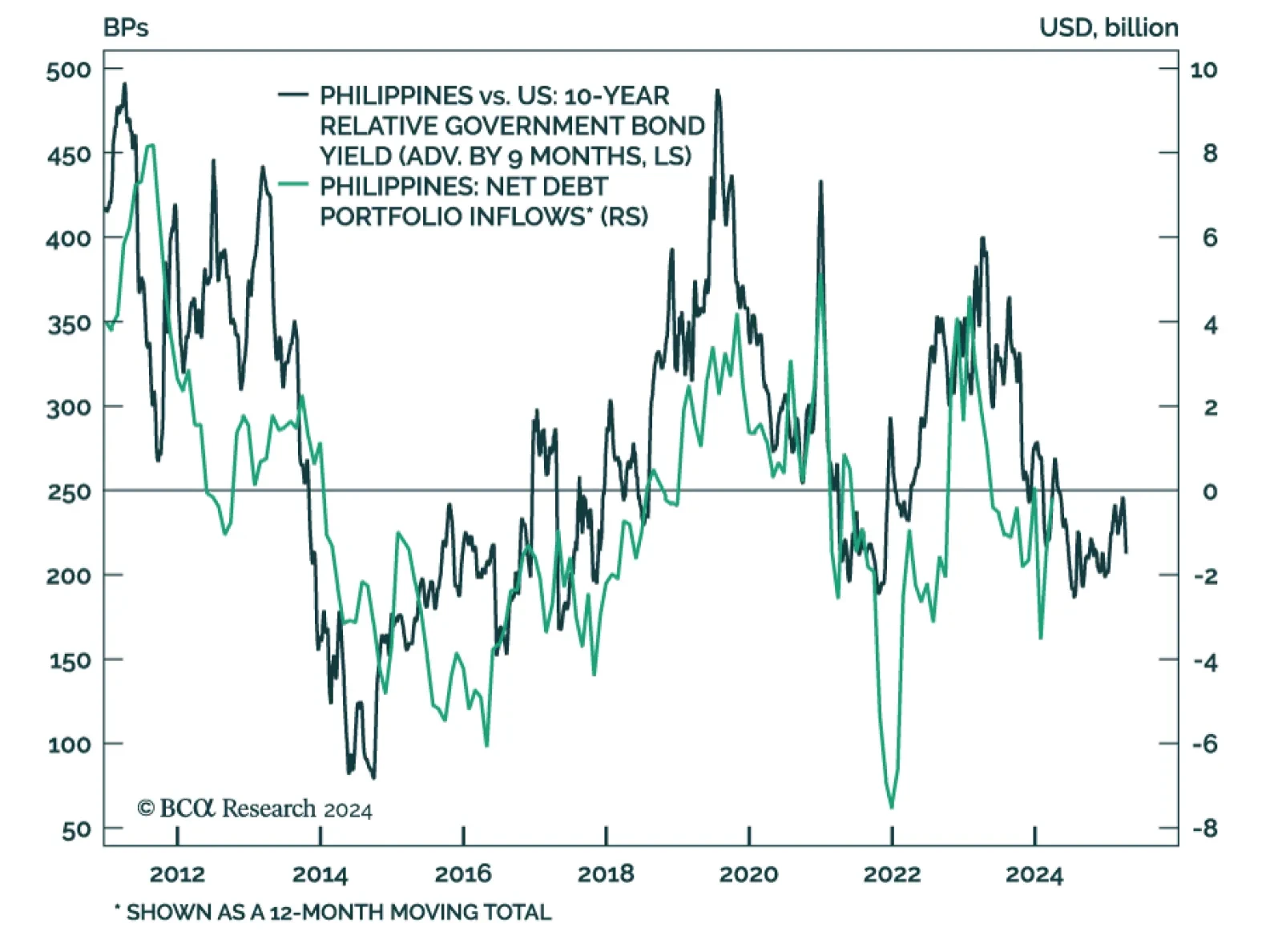

Since early 2023, the Philippine peso has depreciated by 8% versus the US dollar despite the country’s central bank pushing up real policy rates by 500 basis points. BCA’s Emerging Markets Strategy argues that raising…

Does the incipient slowdown in European data herald a soft landing and a goldilocks period for equities? We have our doubts.

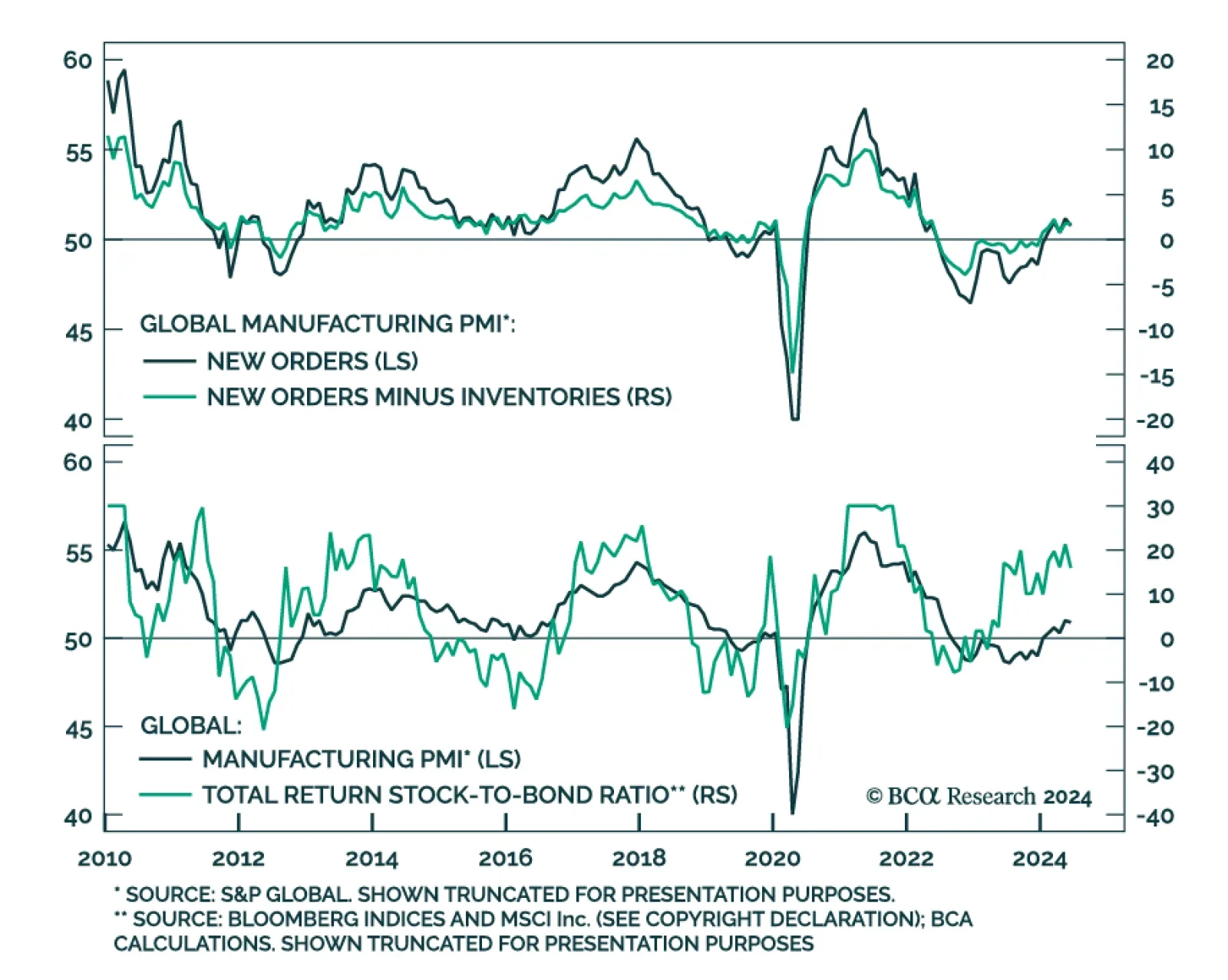

The stabilization in global growth continued in June. The JPM Global Manufacturing PMI came in at 50.9, nearly in line with May’s 22-month high. However, international trade flows deteriorated notably. The new export…

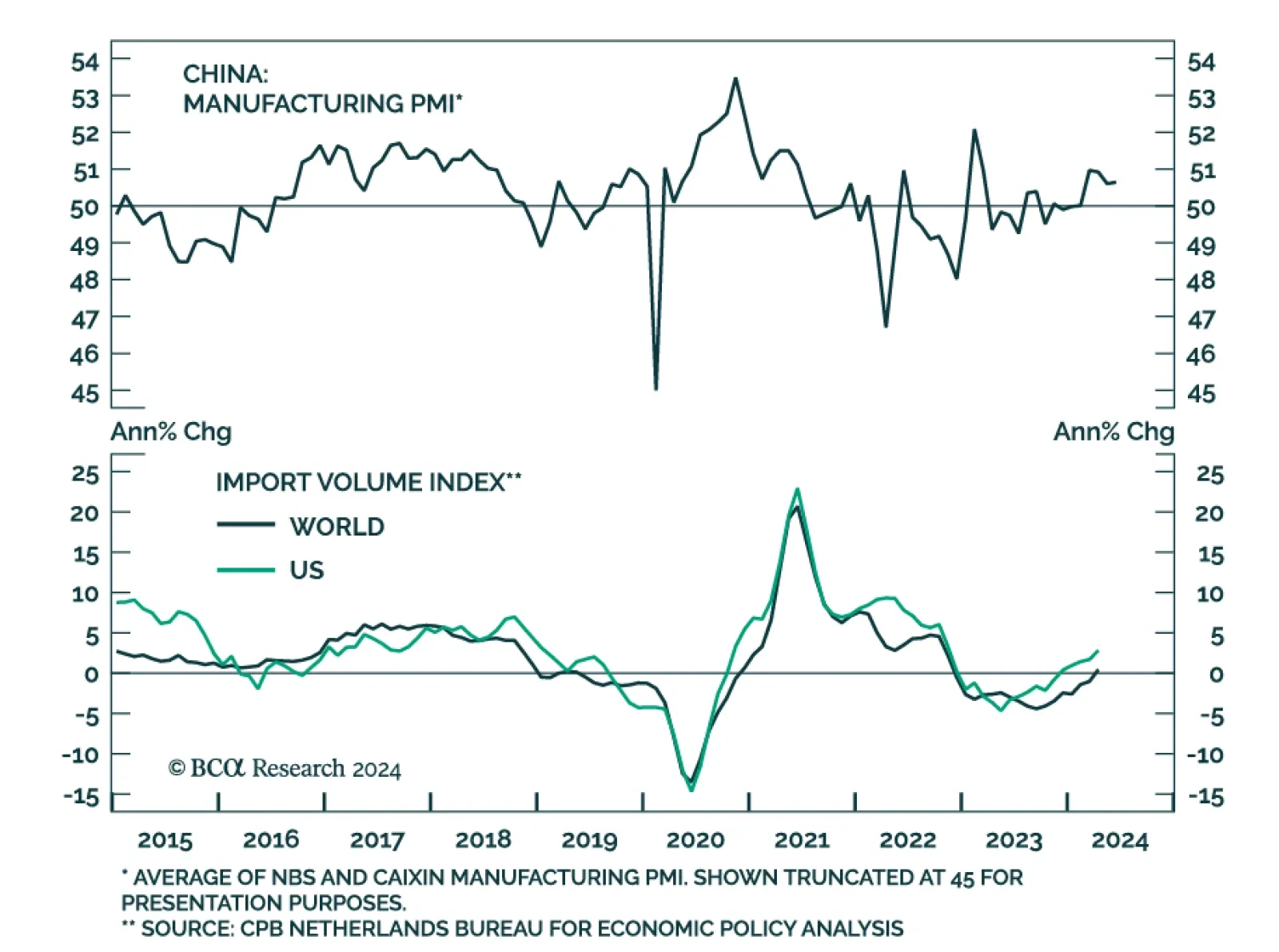

Chinese manufacturing PMIs remained mostly stable in June. The Caixin PMI ticked 0.1 point higher to 51.8 while the NBS measure remained at 49.5. Both leading gauges of Chinese manufacturing activity are thus sending seemingly…

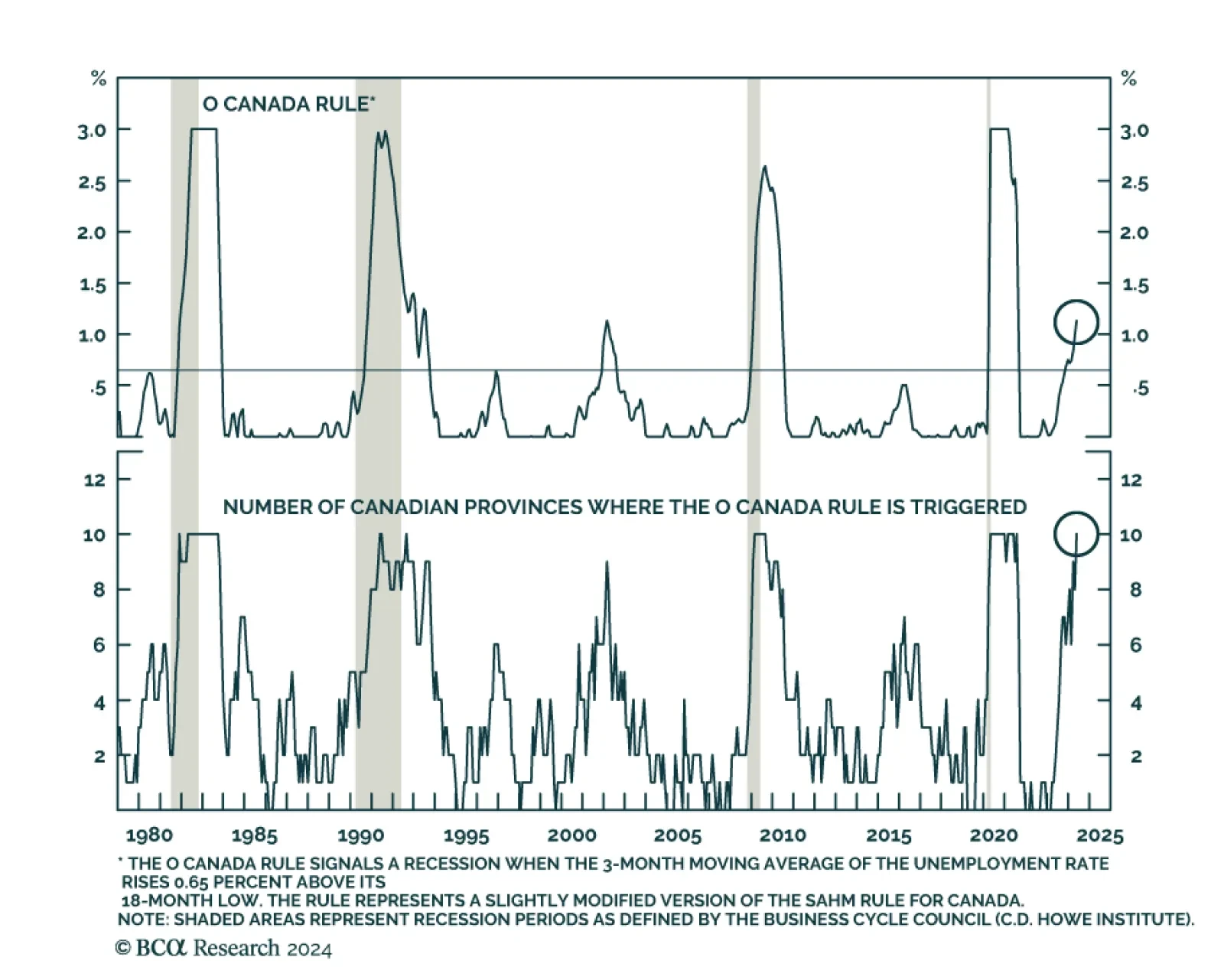

The Bank of Canada (BoC) cut interest rates from 5% to 4.75% in June and another rate cut in July would be warranted. Tight monetary policy is impacting the labor market. The unemployment rate (6.1%) has been on an uptrend…

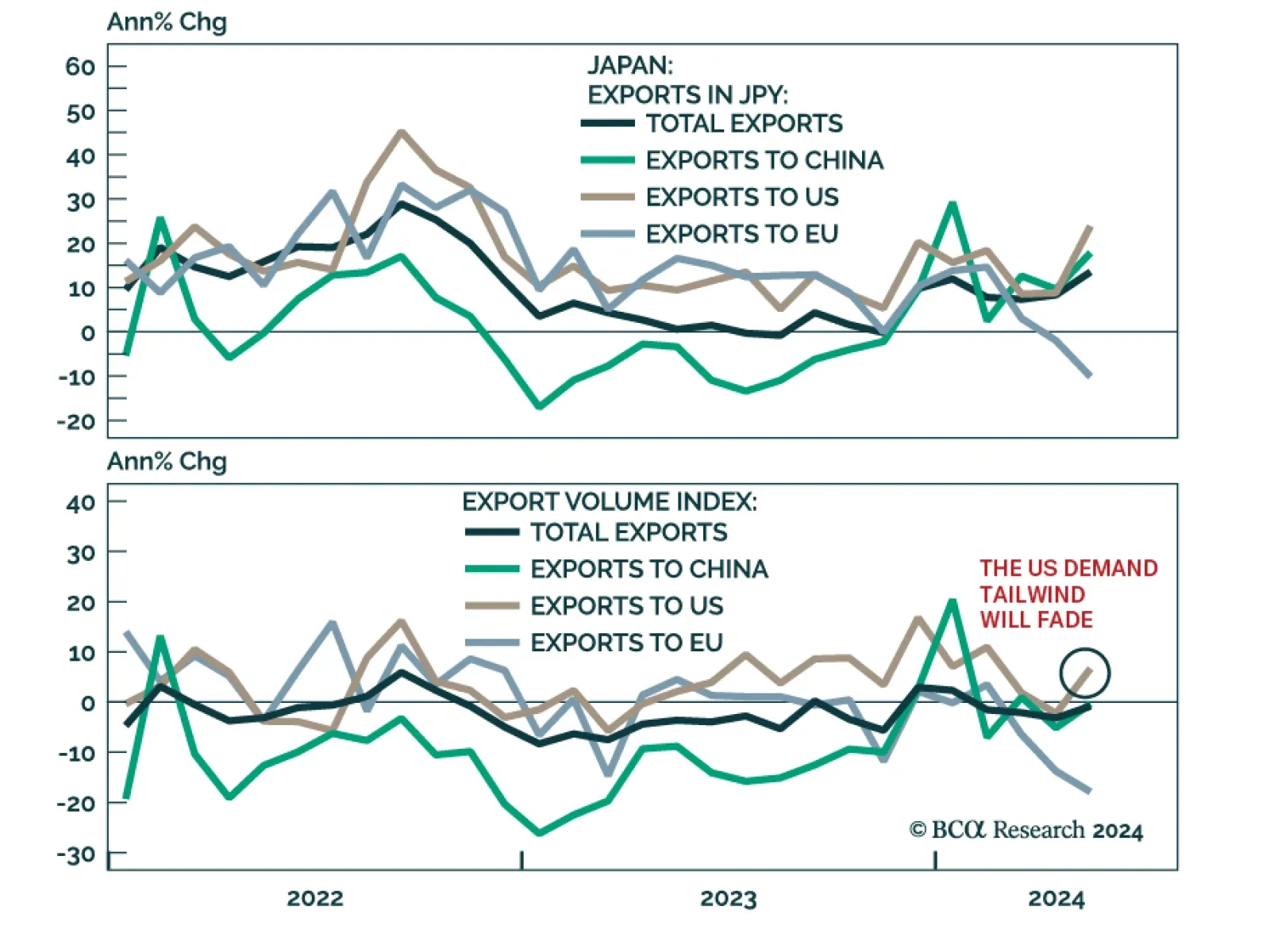

Japanese exports in JPY increased from 8.3% y/y to 13.5% in May, surpassing expectations of 12.7%. 23.9% and 17.8% y/y growth in exports to the US and China, respectively, led the overall surge. Trade data from Asian export-…

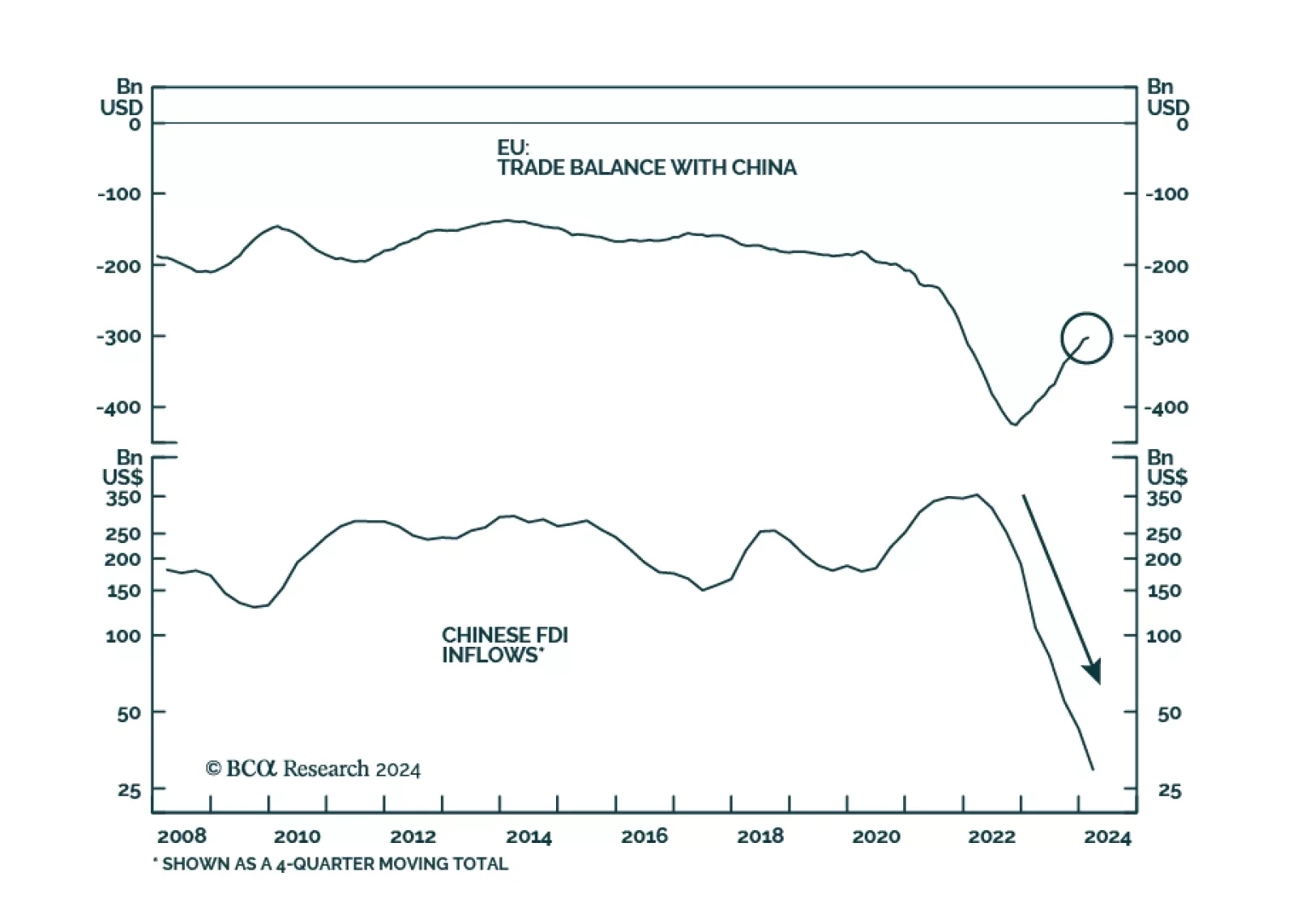

According to BCA Research’s China Investment Strategy service, Beijing will engage in ongoing negotiations with the EU regarding its import tax decision rather than impose meaningful retaliatory measures. The EU and…