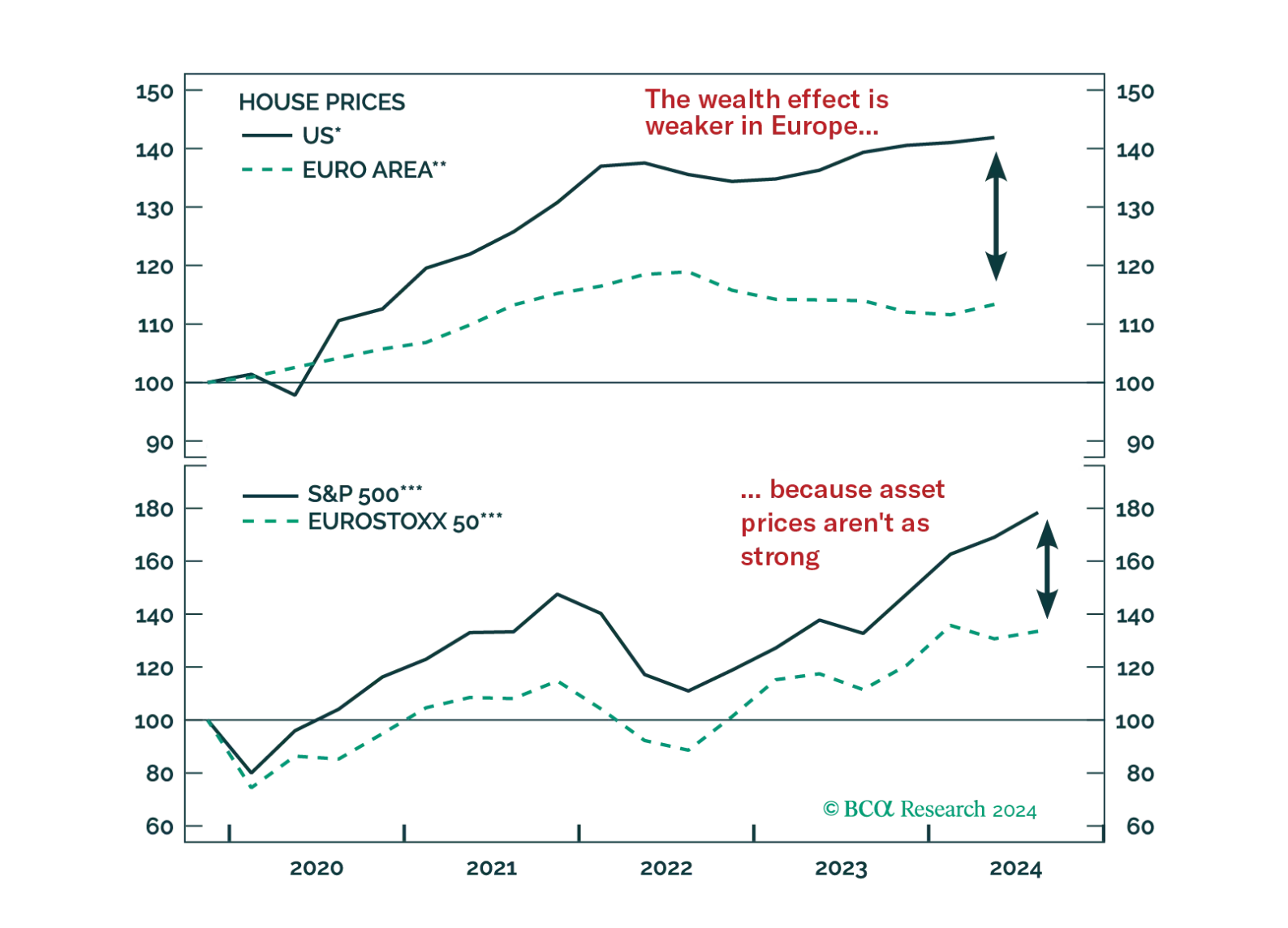

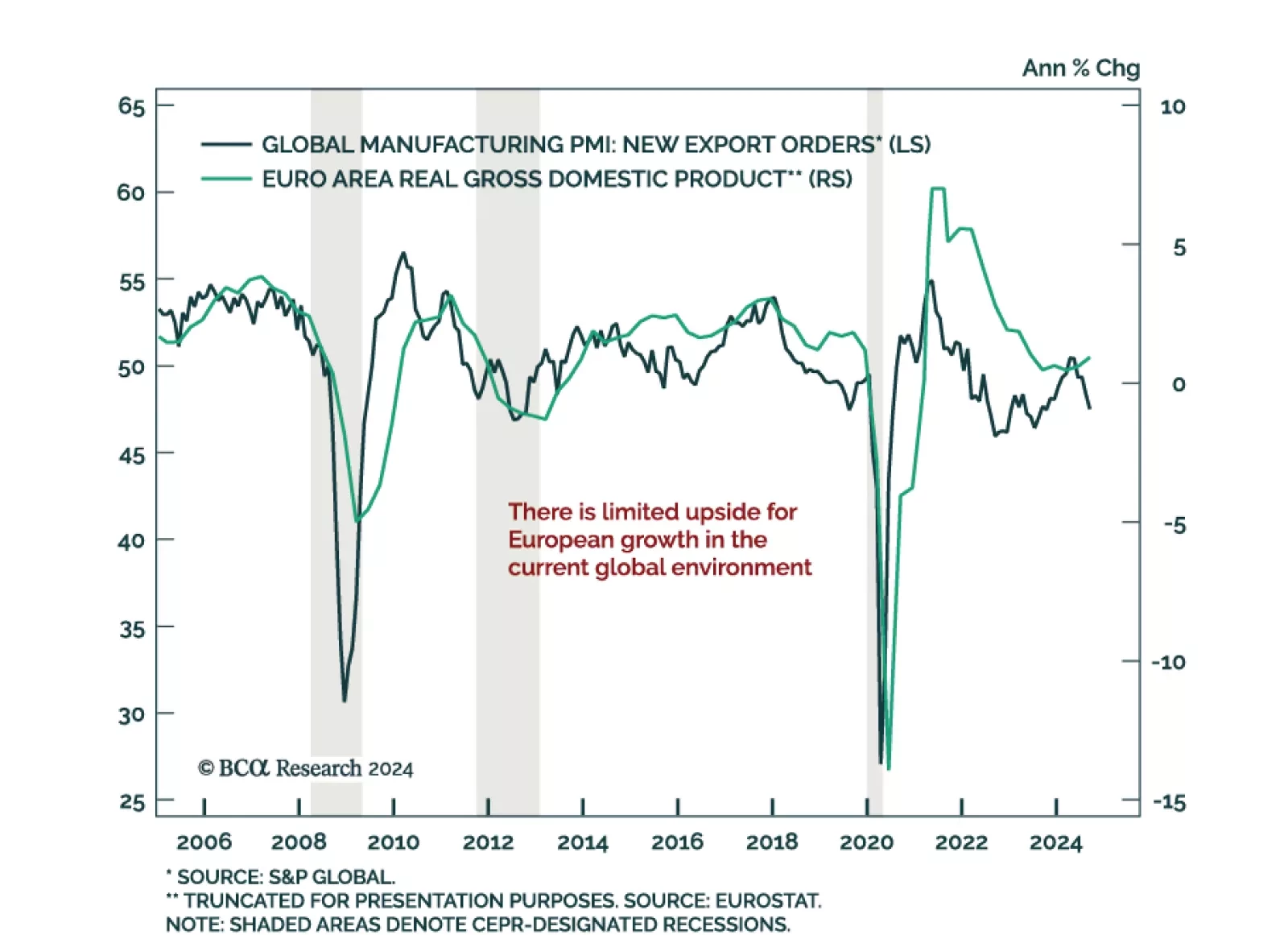

Flash Q3 GDP estimates for the Euro Area beat expectations, accelerating to 0.4% quarterly growth from 0.2% last quarter. The momentum was spread across major countries, except for Italy. Meanwhile, the European Commission’…

The global political system is destabilizing and the US will turn more hawkish in foreign policy, trade policy, or both, regardless of the election outcome. Tactically go long the dollar.

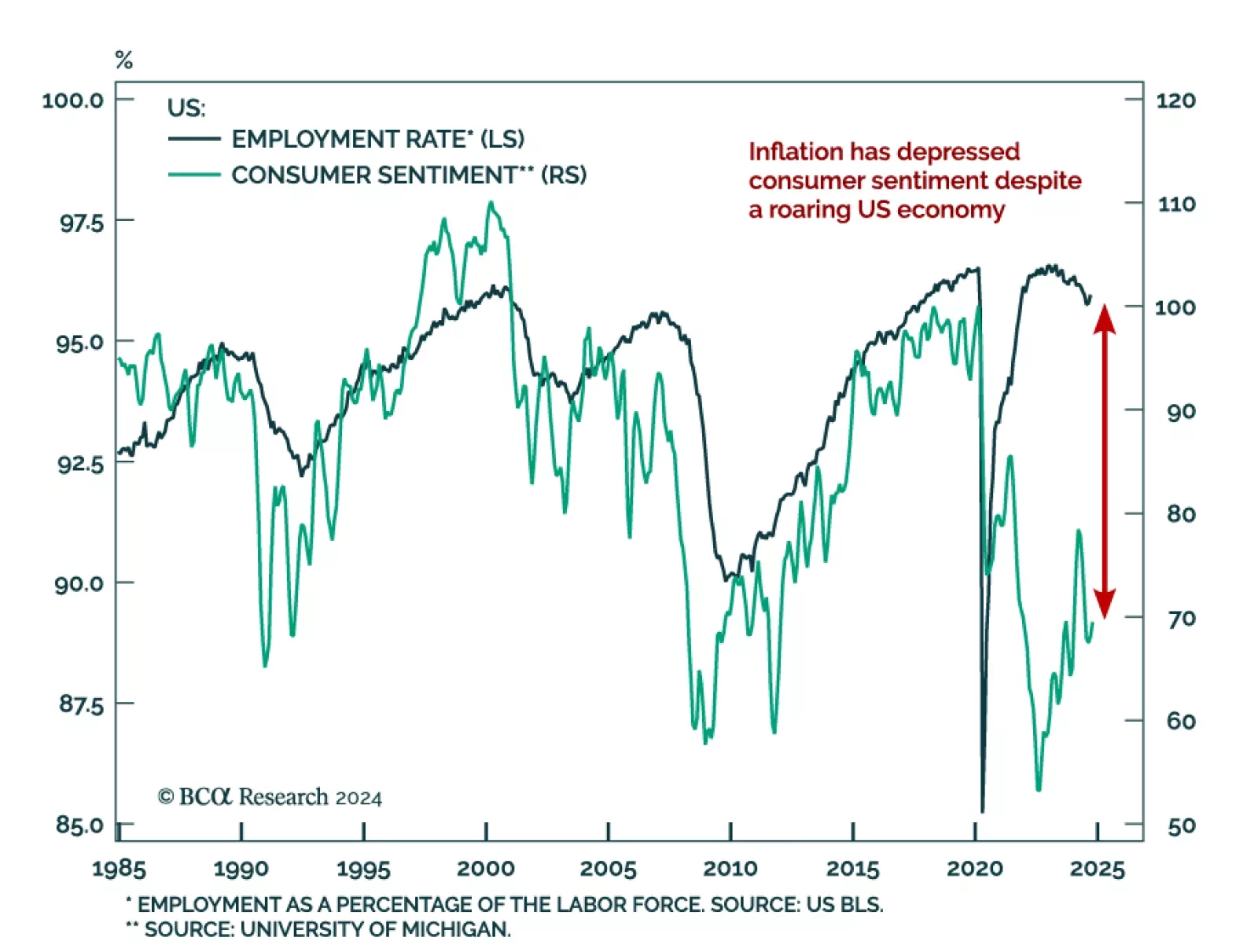

The main driver of global consumer sentiment in the past few years has been high inflation. Nowhere has this been the case more than in the US, where measures of animal spirits were depressed despite a roaring economy. Today,…

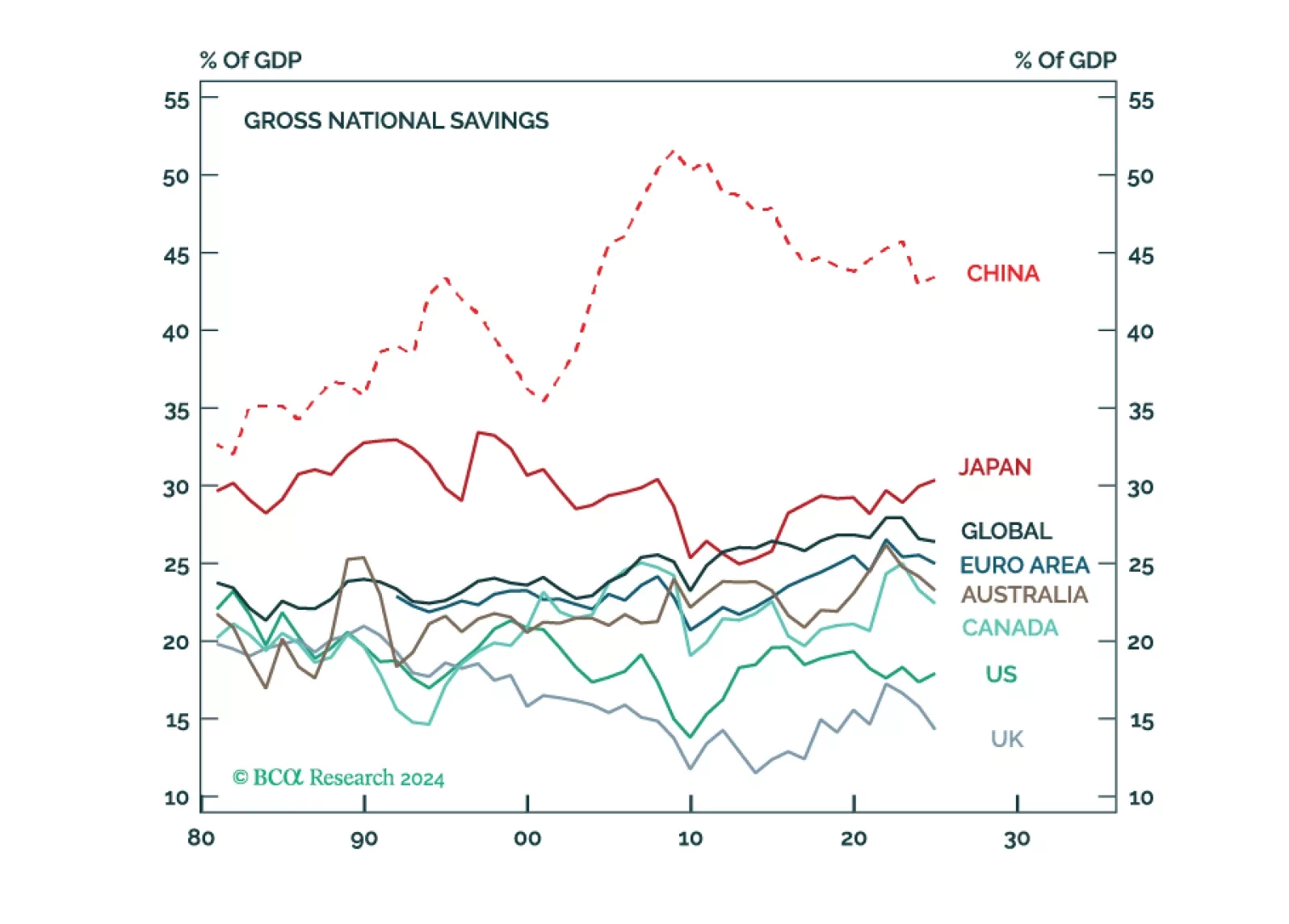

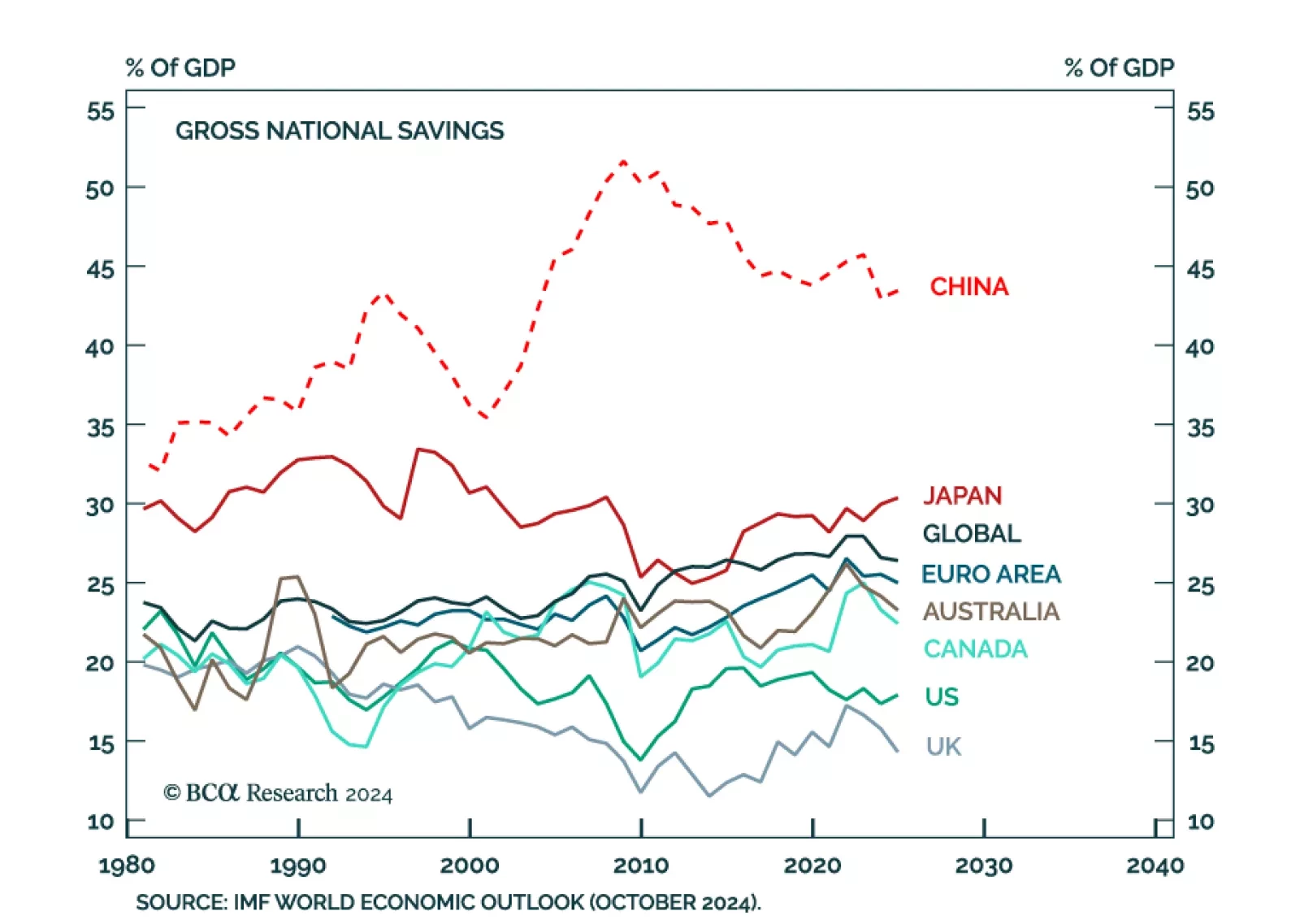

Savings must either flow into domestic investment, or abroad. Saving too much, with nowhere to funnel it, is breaking China’s economic model according to our Global Investment Strategy colleagues. As China's share of…

In this report, we discuss why we are lifting our US recession probability from 60% to 65% and explain why China’s latest stimulus announcements are welcome, but probably are “too little, too late.”

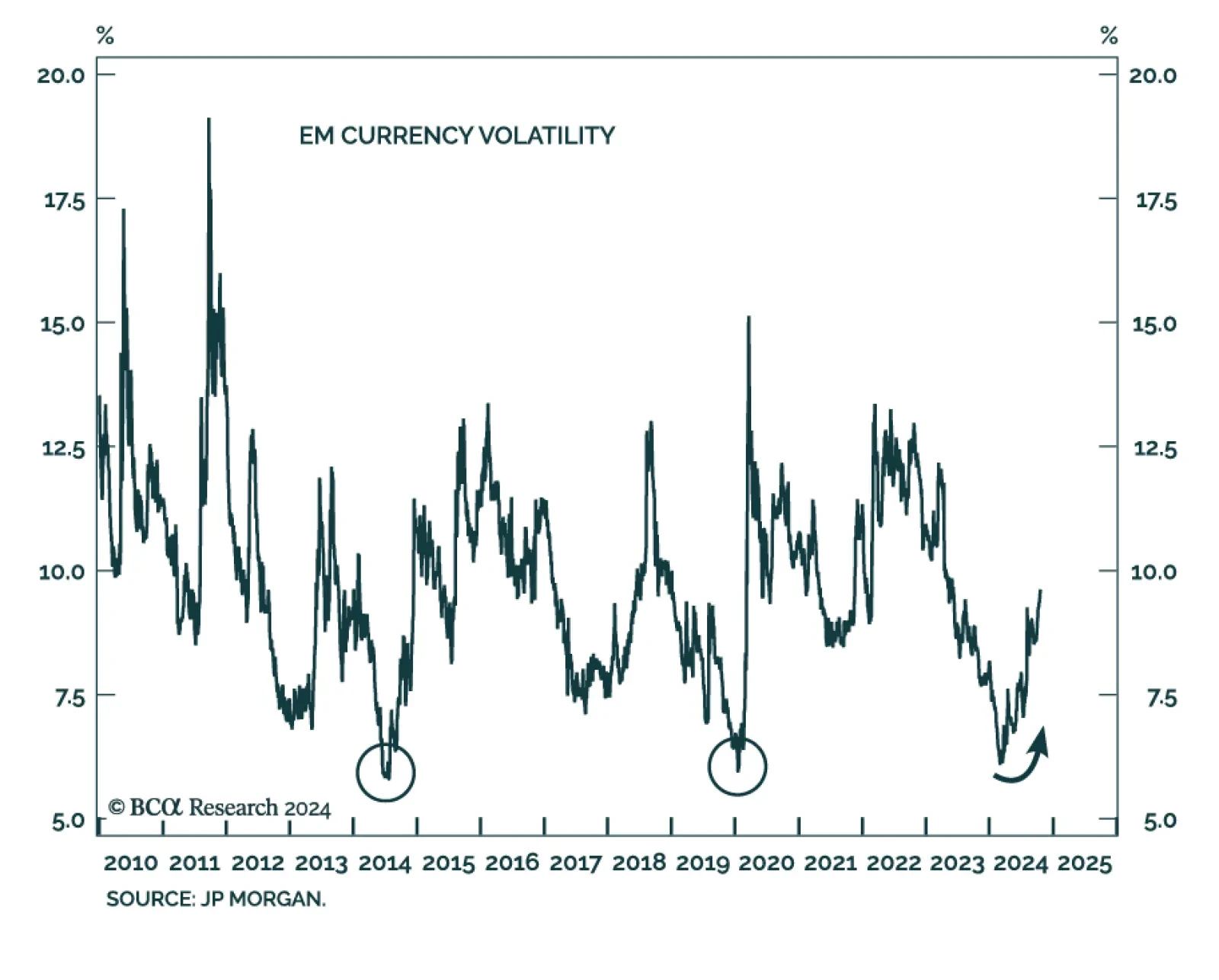

Our Emerging Markets Strategy team sees evidence of a “Trump trade” across markets, as the dollar strengthens, Treasury yields jump, and US small caps try to break out. However, the tactical and cyclical outcomes…

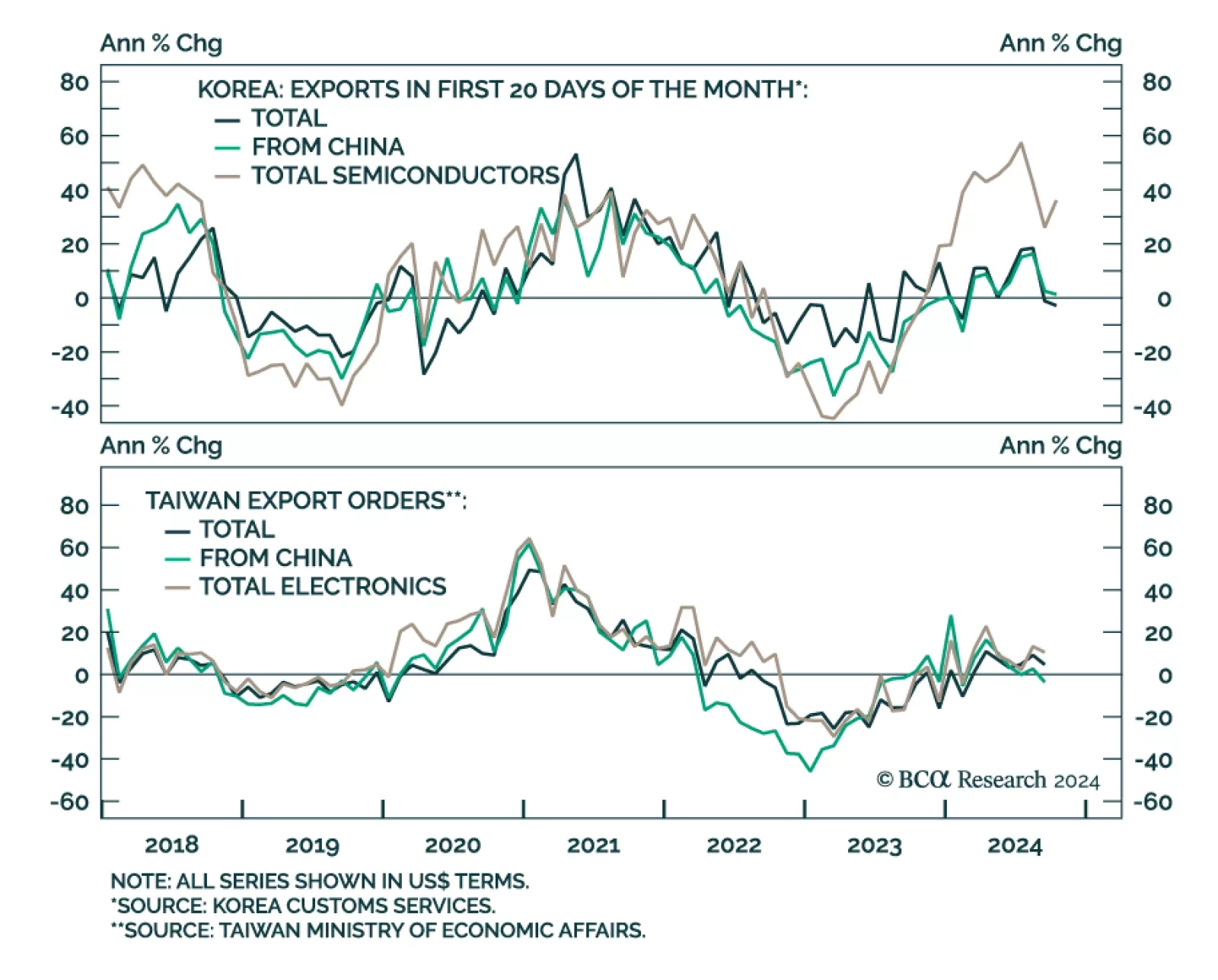

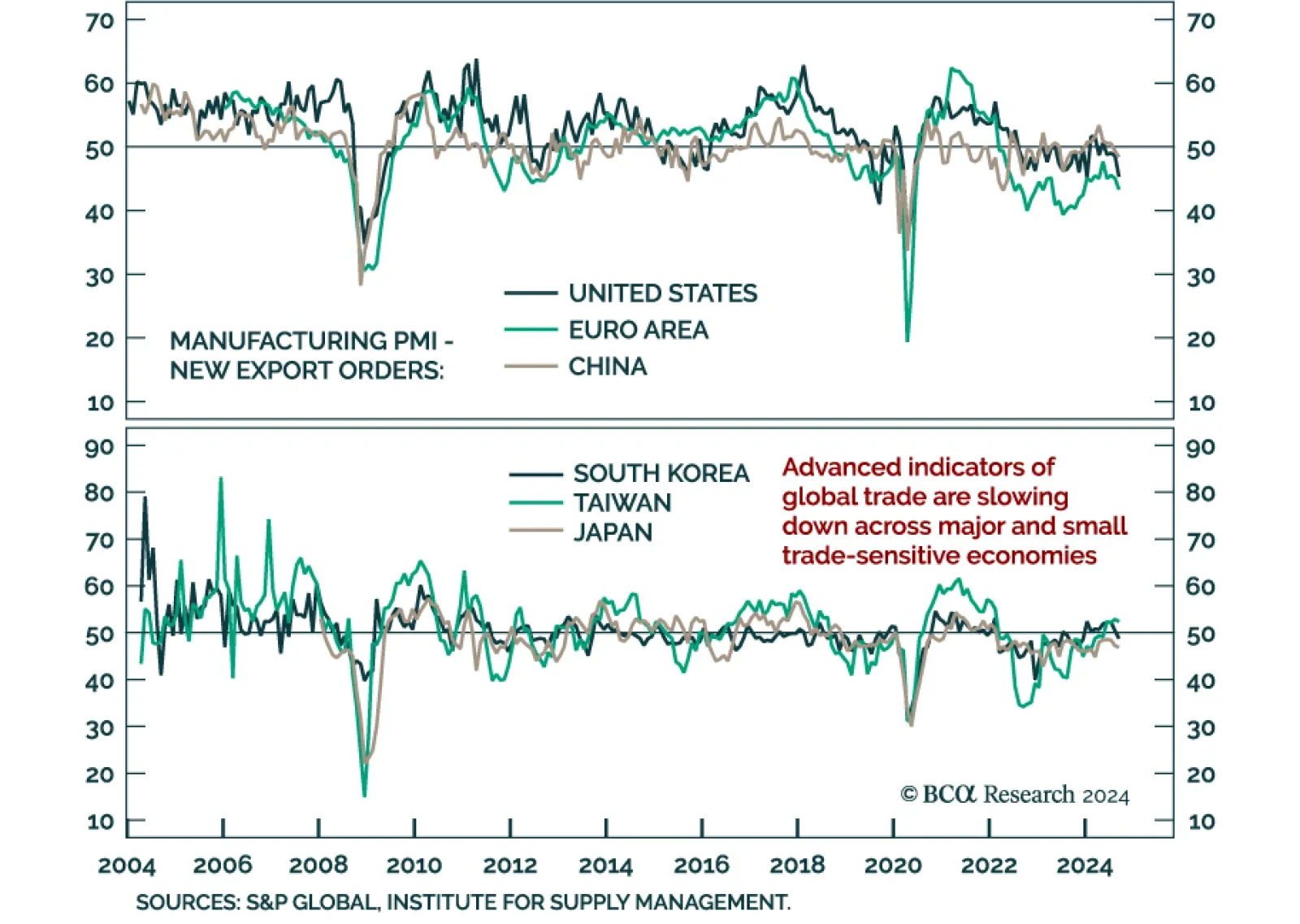

The recent slump in globally- and tech-sensitive East Asian trade shows no respite, with advanced October Korean exports and September Taiwanese export orders data disappointing. Korean exports for the first 20 days of October…

September numbers for East Asian trade disappointed across the board. Japanese exports dropped 1.7% year-on-year (YoY) after rising 5.5% in August, and Singapore’s non-oil domestic exports decelerated to 2.7%YoY after…

This week, we cover the main questions we fielded during our latest client trip in Europe. Among the many topics broached are Europe’s recession odds, the impact of China’s stimulus, and the outlook for European markets.