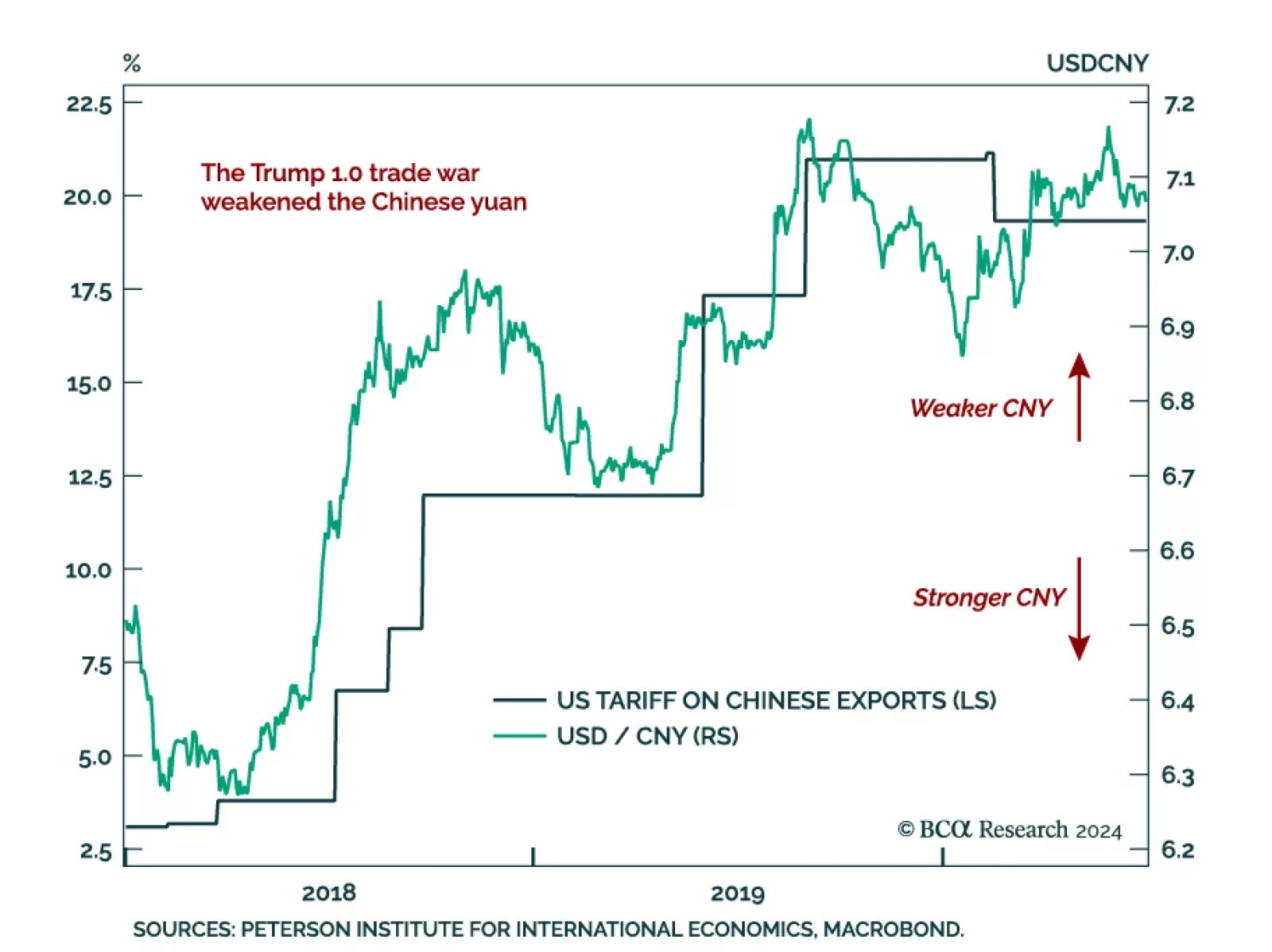

The USD has steamrolled both DM and EM currencies since the US election. Among the victims was the Chinese yuan, with USDCNY strengthening towards 7.3, a multi-year resistance level, from 7.11 on the day of the election. The CNY…

China’s November trade balance increased to CNY 692.8 bln on the back of slowing-but-still-growing exports (down to 5.8% y/y from 11.2% in October), and a worsening imports contraction (-4.7% y/y vs. -3.7% in October). In…

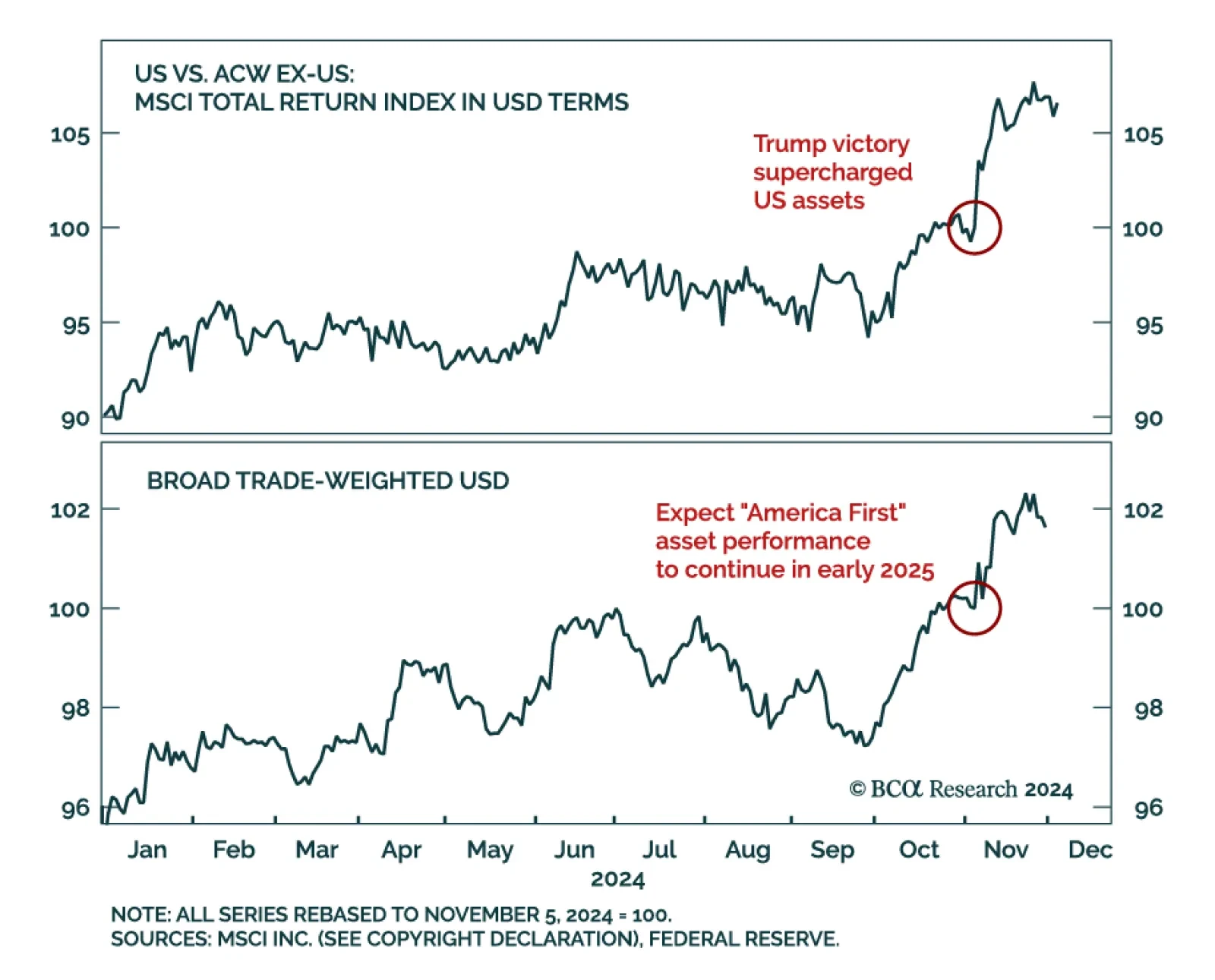

Our GeoMacro Strategy service published their 2025 outlook, and they see three peaks shaping the year: Peak fiscal, peak-deglobalization, and peak geopolitical risk. In 2024, our colleagues’ bullish economic outlook…

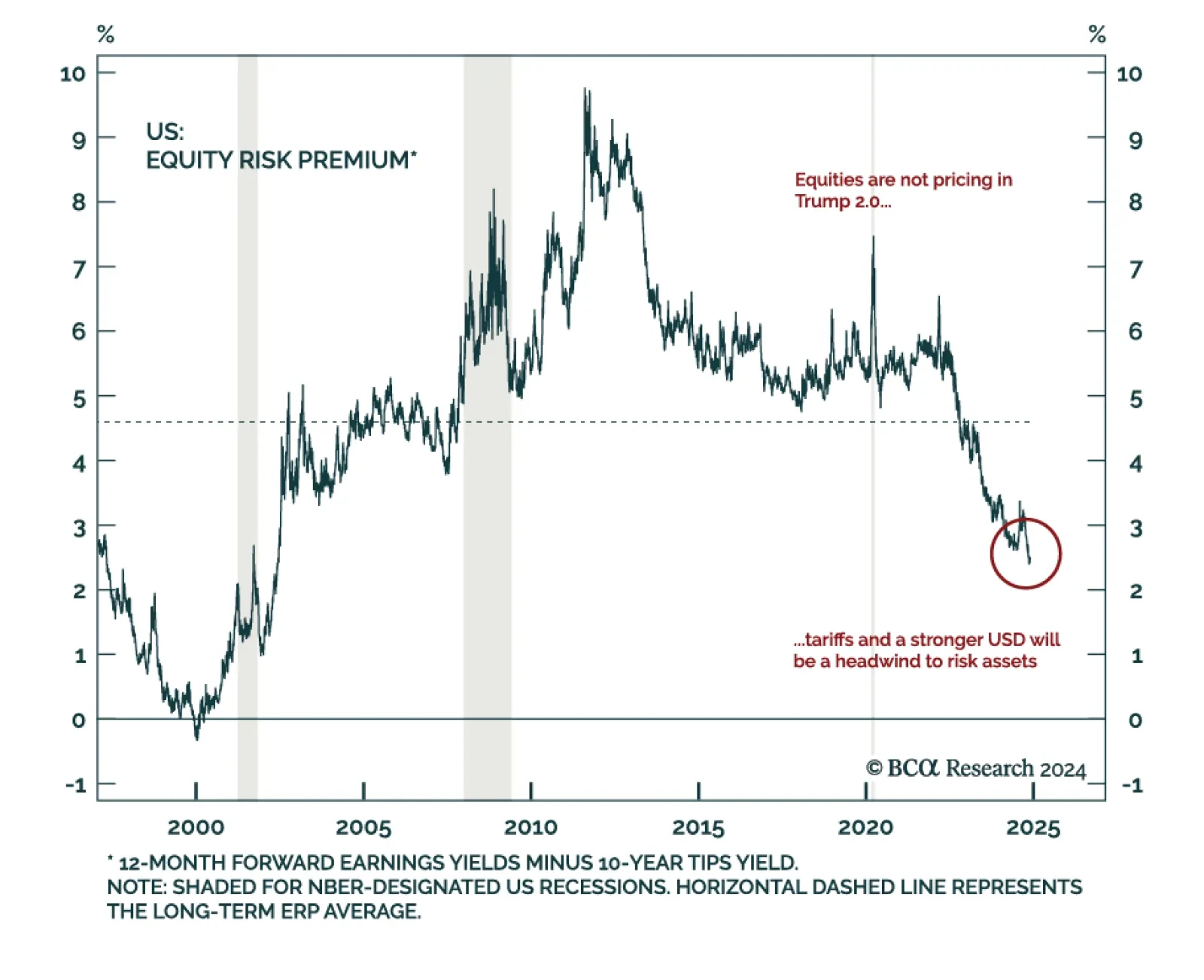

Investors have given up on European assets, which now suffer exceptional discounts to US ones. However, tighter US fiscal policy, the end of Europe’s austerity and deleveraging, the LNG Tsunami about to hit European shores, and the…

President-elect Trump jolted markets Monday night by declaring that tariffs will be implemented on imports from Mexico, Canada, and China. The US dollar strengthened while stocks fell, as did Treasury yields. Equities, however,…

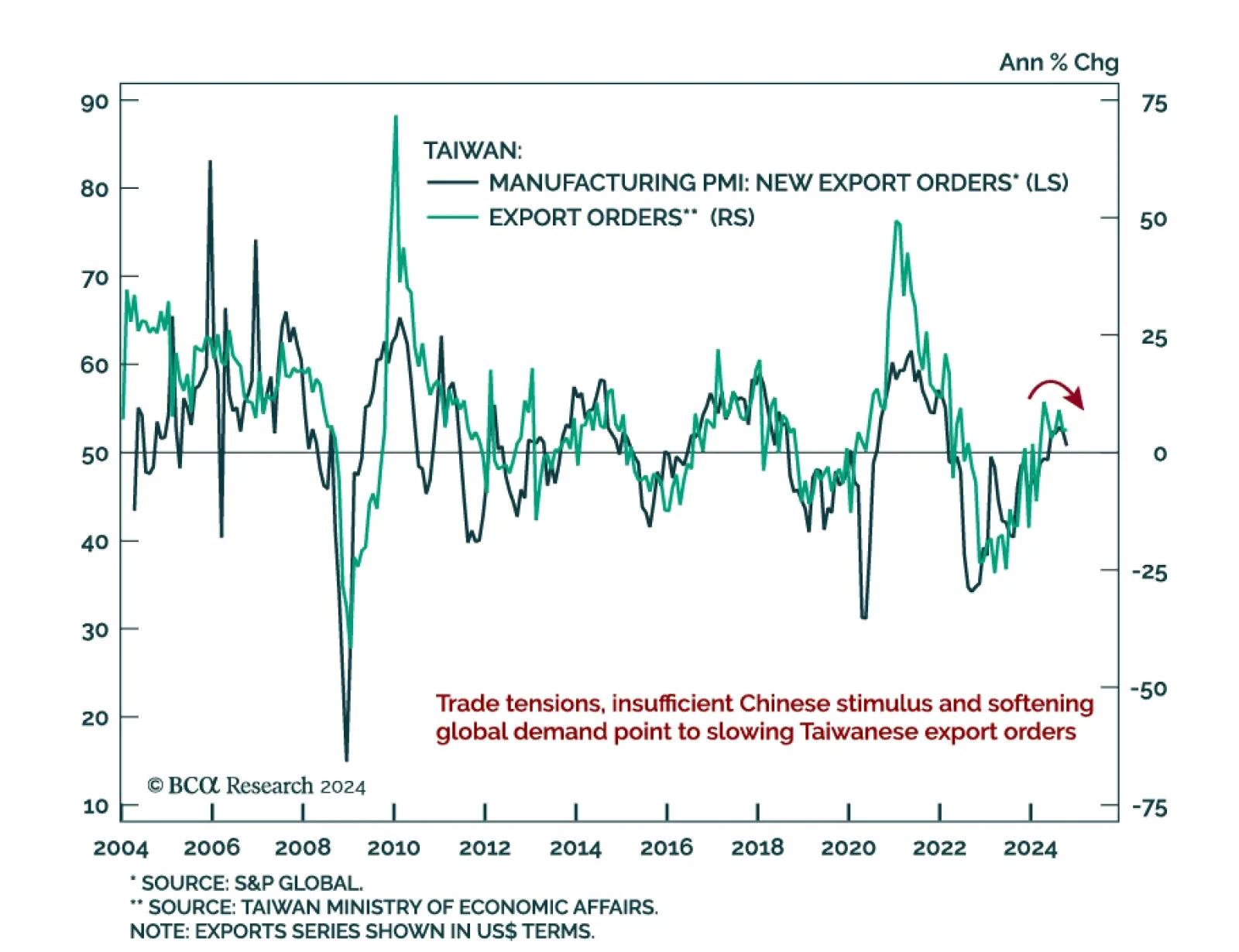

Taiwanese export orders surprised positively when a deceleration was expected, printing at 4.9% y/y, up from 4.6% in September. The increase was spread across most categories, with exports of electronic products accelerating to…

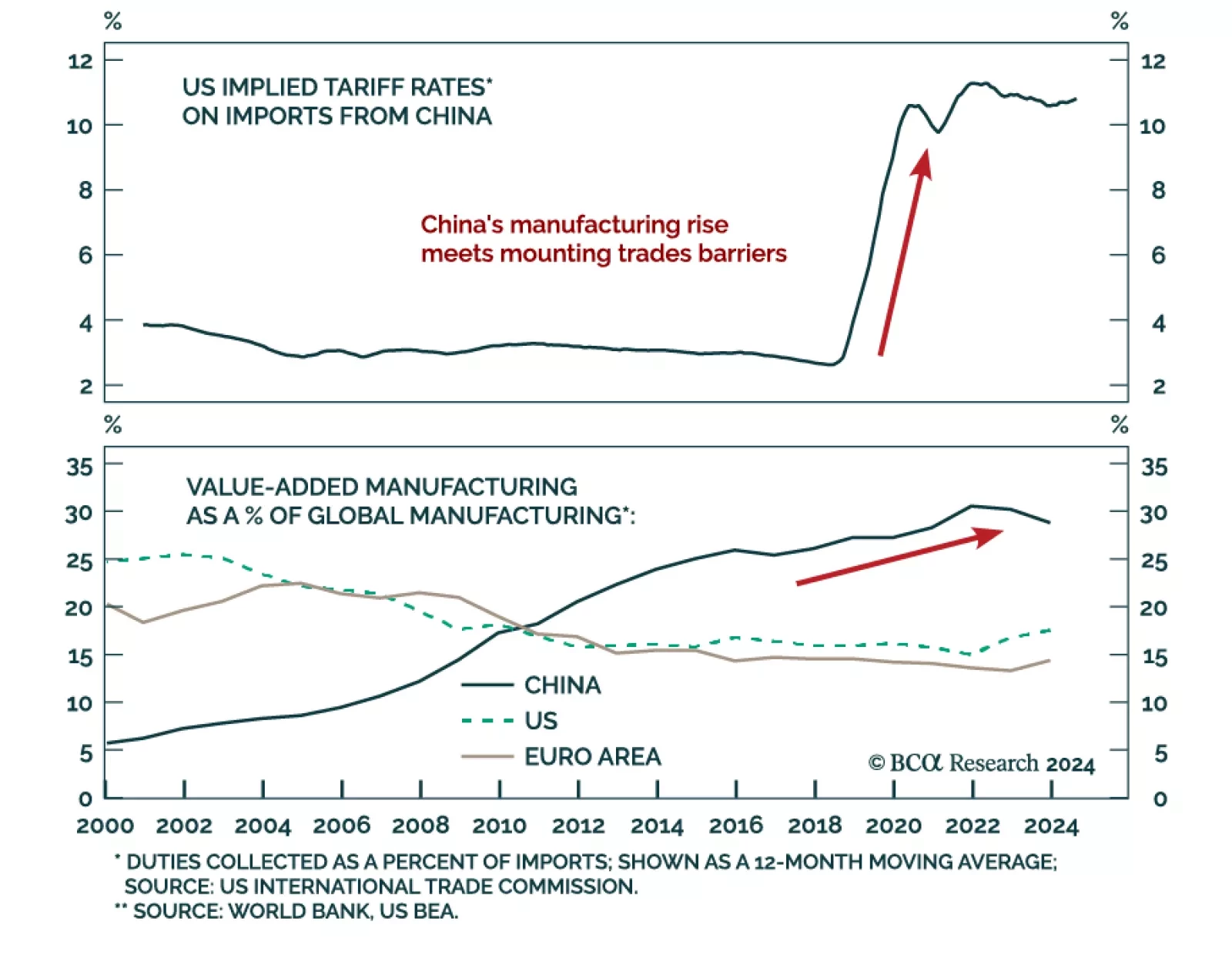

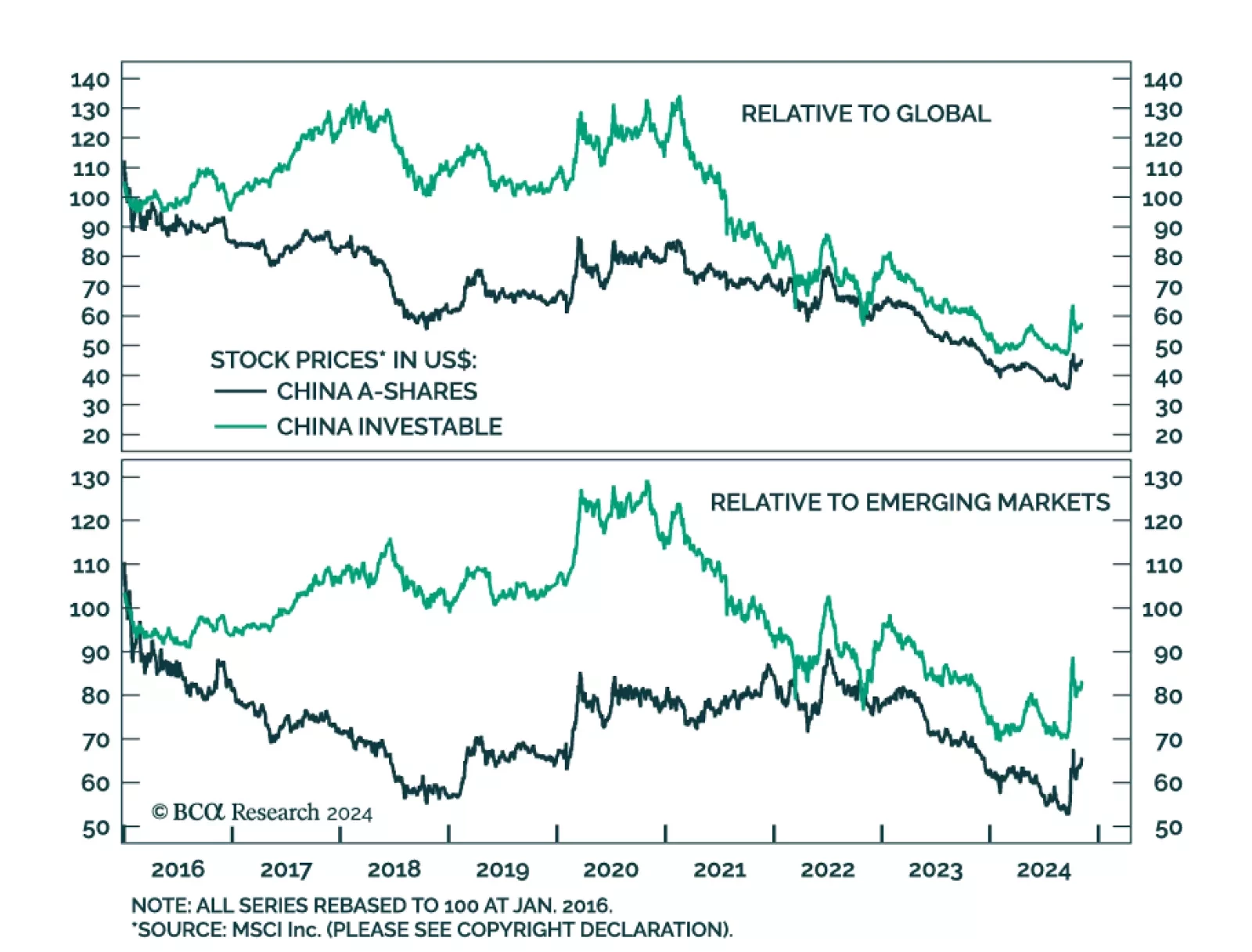

Our China Investment Strategy team assessed the country’s outlook in a context of underwhelming stimulus and rising trade tensions. Trump’s re-election raises the likelihood of tariff hikes on Chinese exports…

Will the prospect of expanding trade tensions lead to more Chinese stimulus, and create an opportunity for Chinese equities? Not necessarily, as the election results were already factored in our EM and China strategists’…

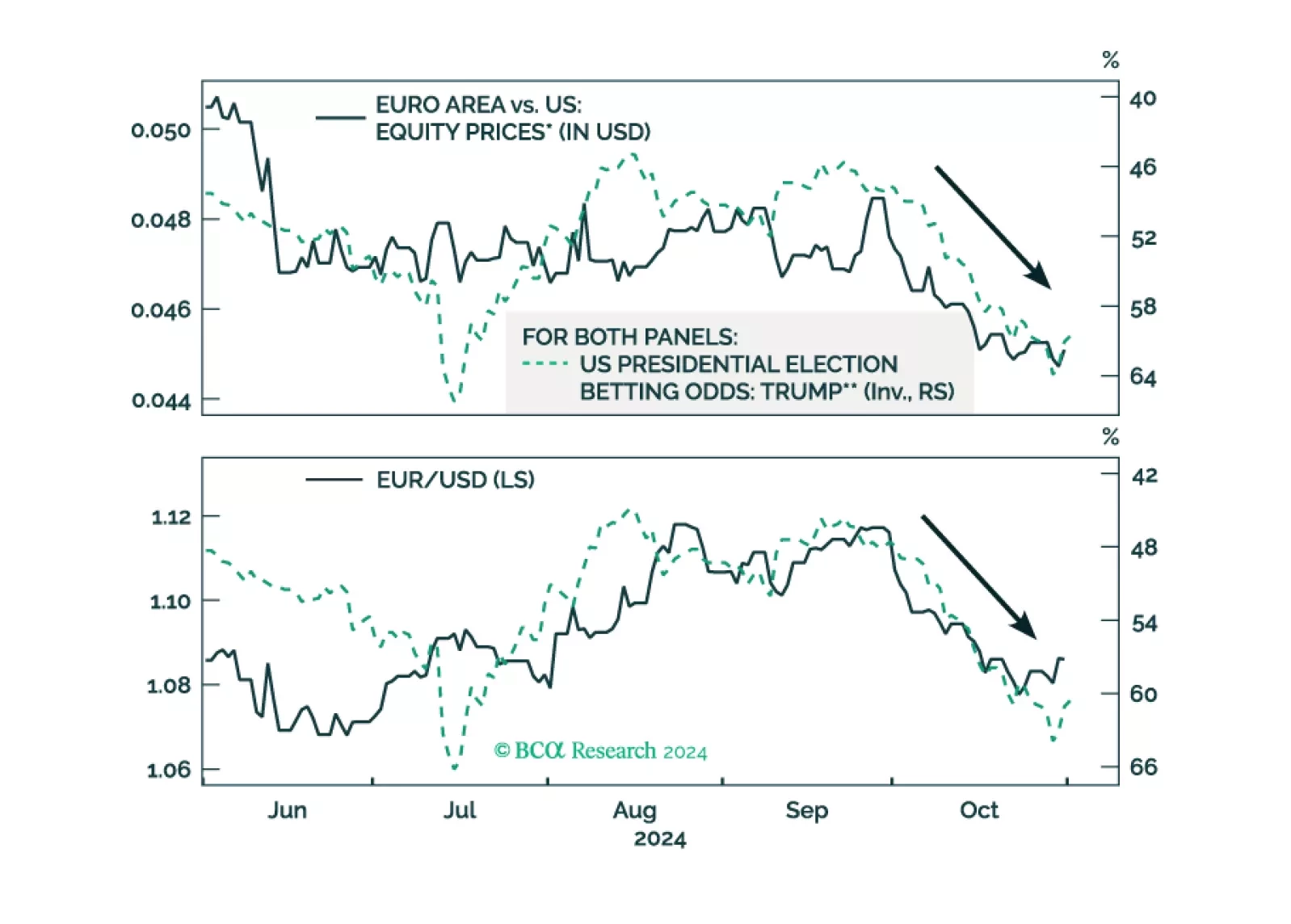

As the odds of a Trump victory rise, European assets underperform US ones. What would be the immediate impact of a Trump victory on European stocks?