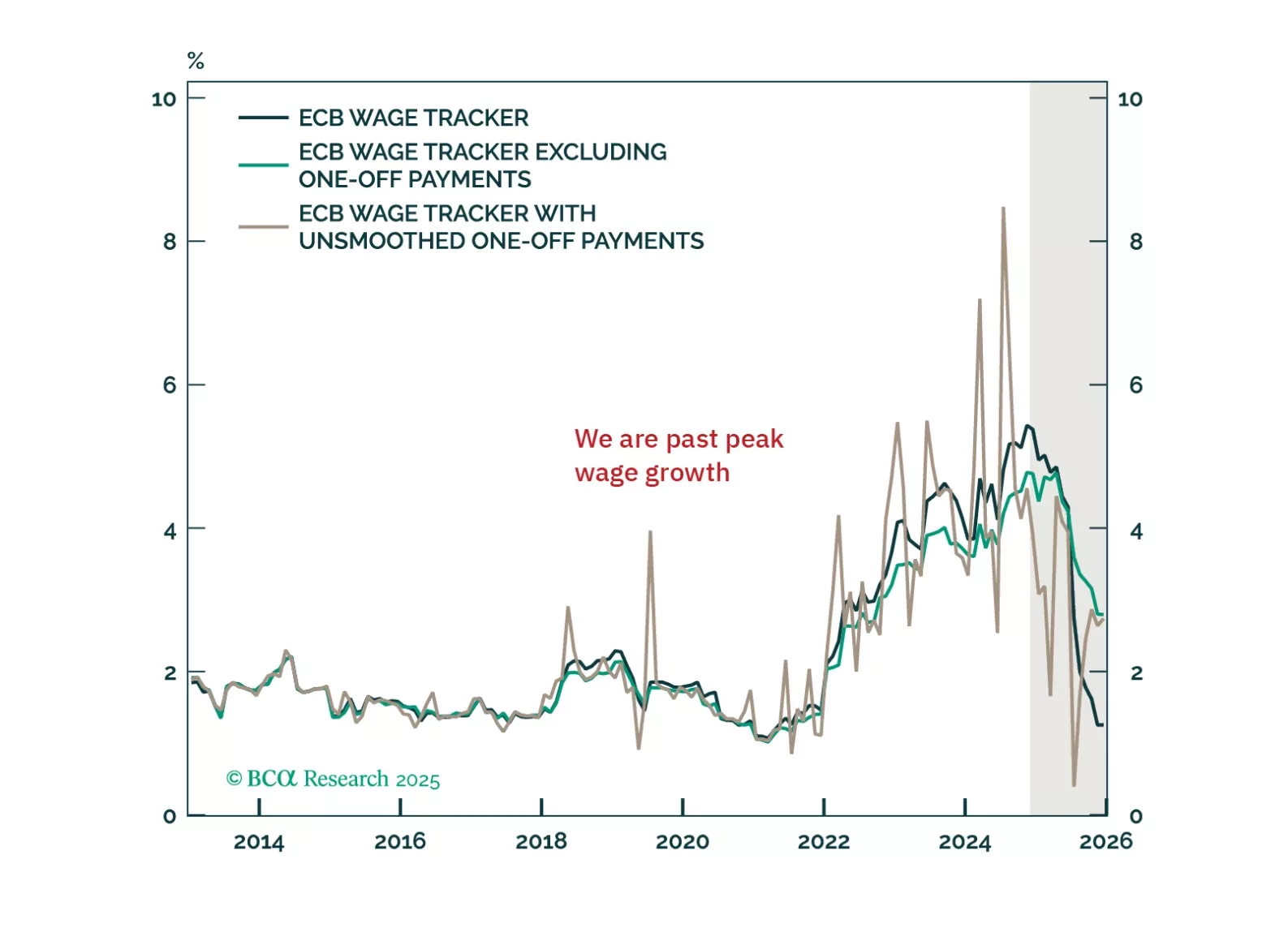

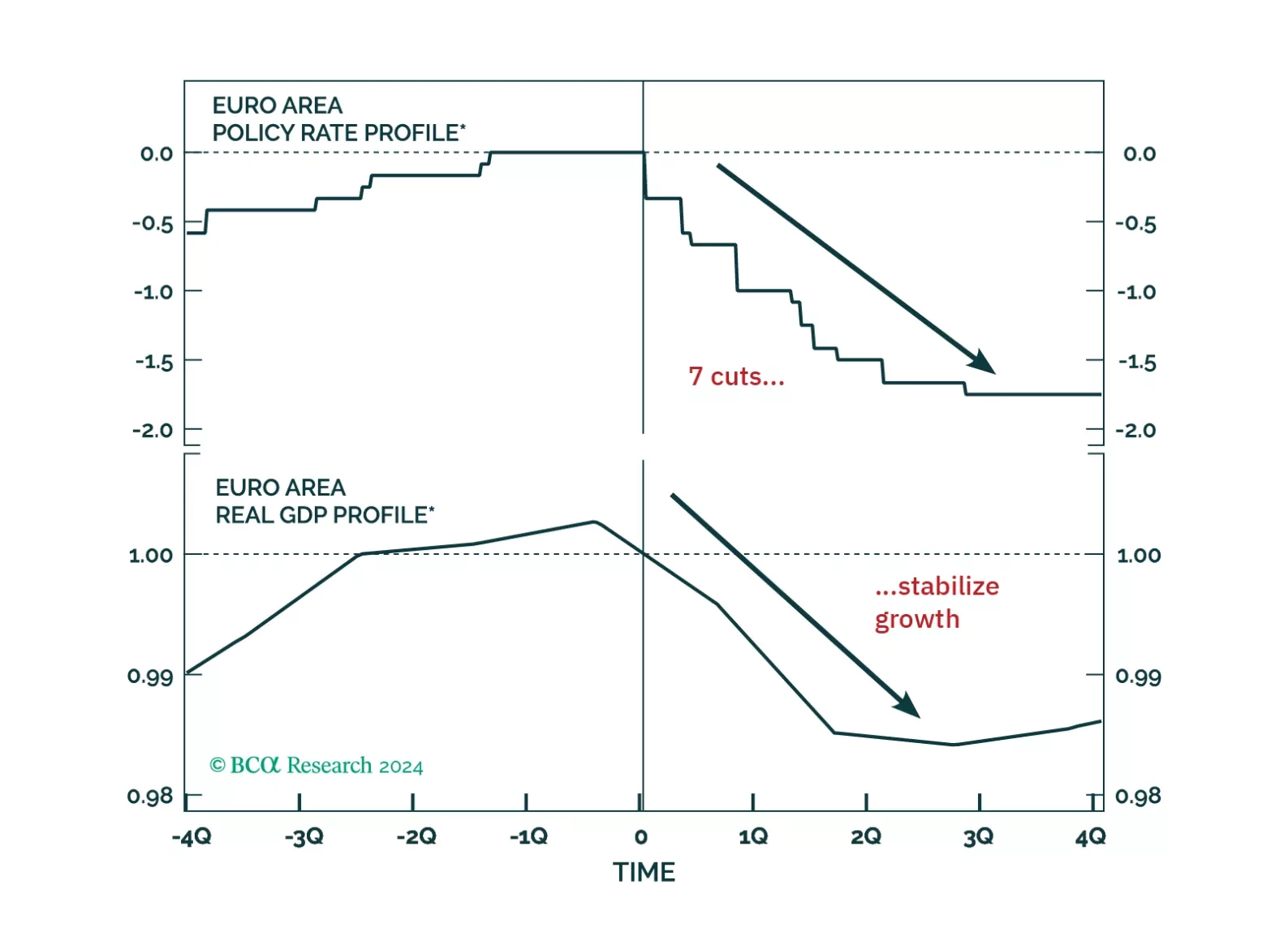

The ECB cut its deposit rate to 2.75%, as was widely anticipated. President Christine Lagarde did not provide any fireworks, but the Governing Council’s message was clear: Policy is restrictive, and inflation will fall further. As a…

Advanced Q4 US GDP missed estimates, slowing down to 2.3% quarterly annualized growth from 3.1%. The weakness was however driven by inventories. Consumer spending beat estimates and accelerated to 4.2% from 3.7% in Q3. Growth is…

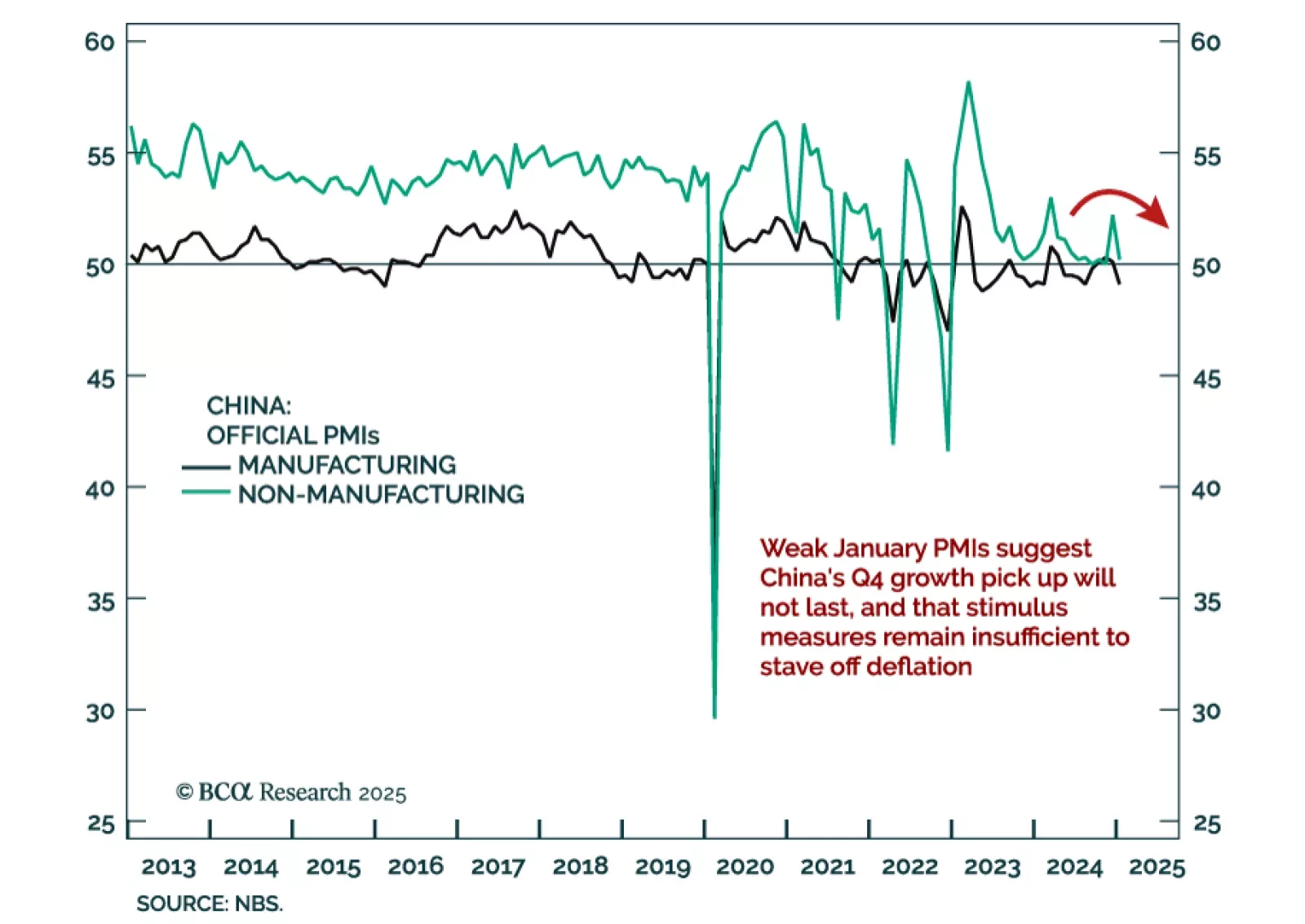

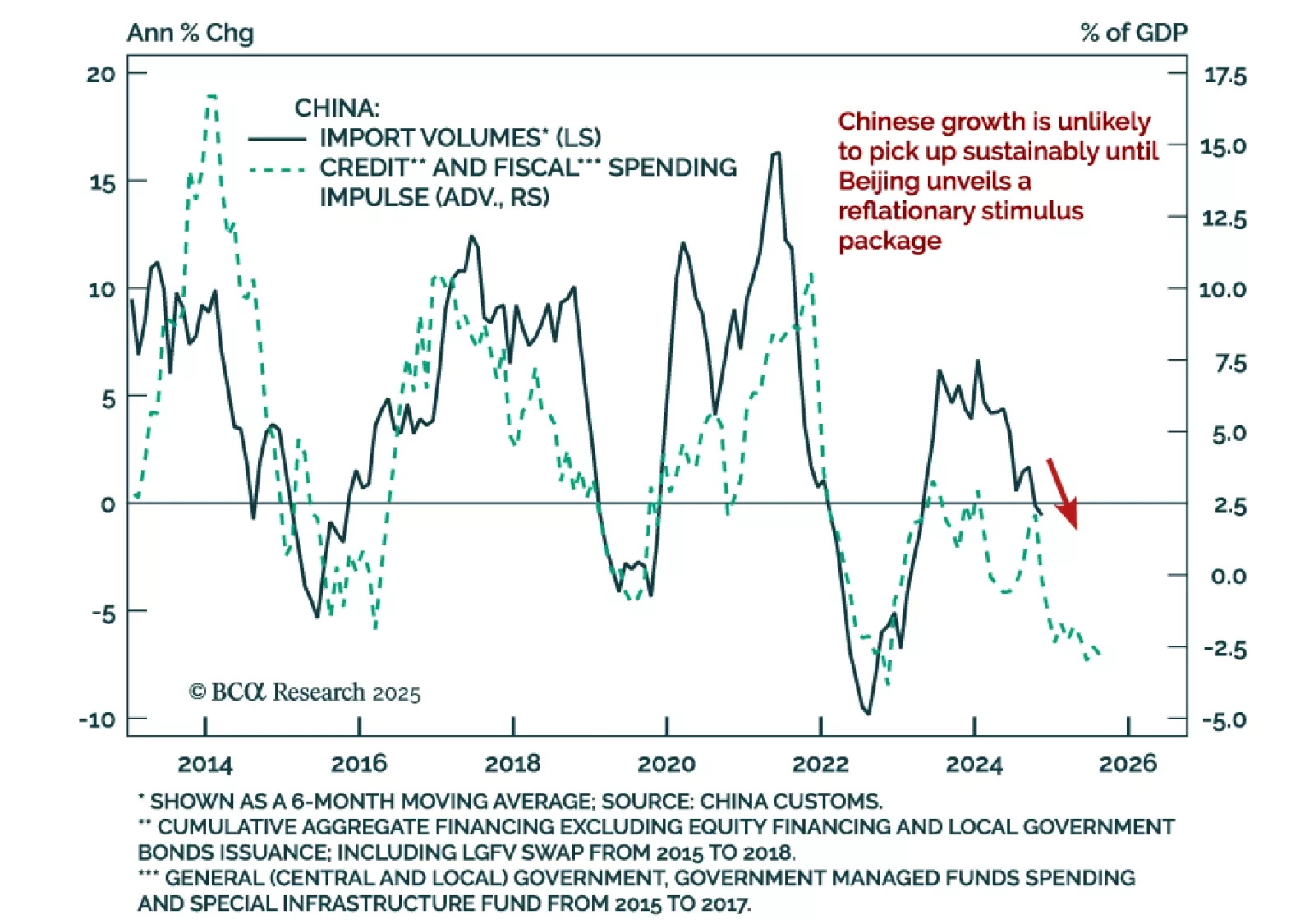

China’s official January PMIs disappointed, with the composite ticking down to 50.1 from 52.2. The decrease was driven by both the manufacturing and non-manufacturing components, with the former indicating contraction, and the latter…

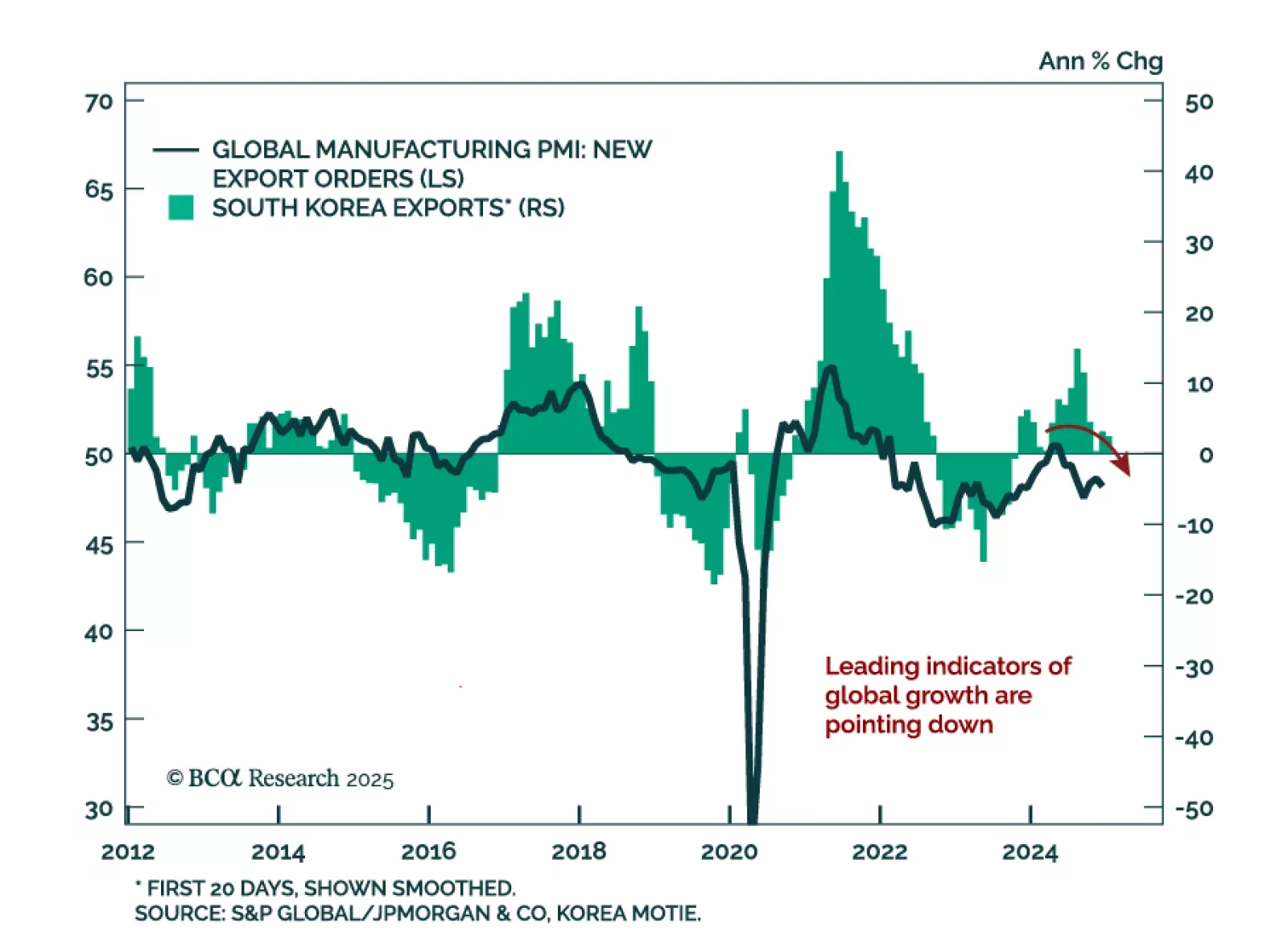

East Asian trade data was mixed in December and January. Taiwanese export orders for December were stronger than expected, rebounding to 20.8% y/y from 3.3% in November. On the other hand, Korean exports for the first 20 days of…

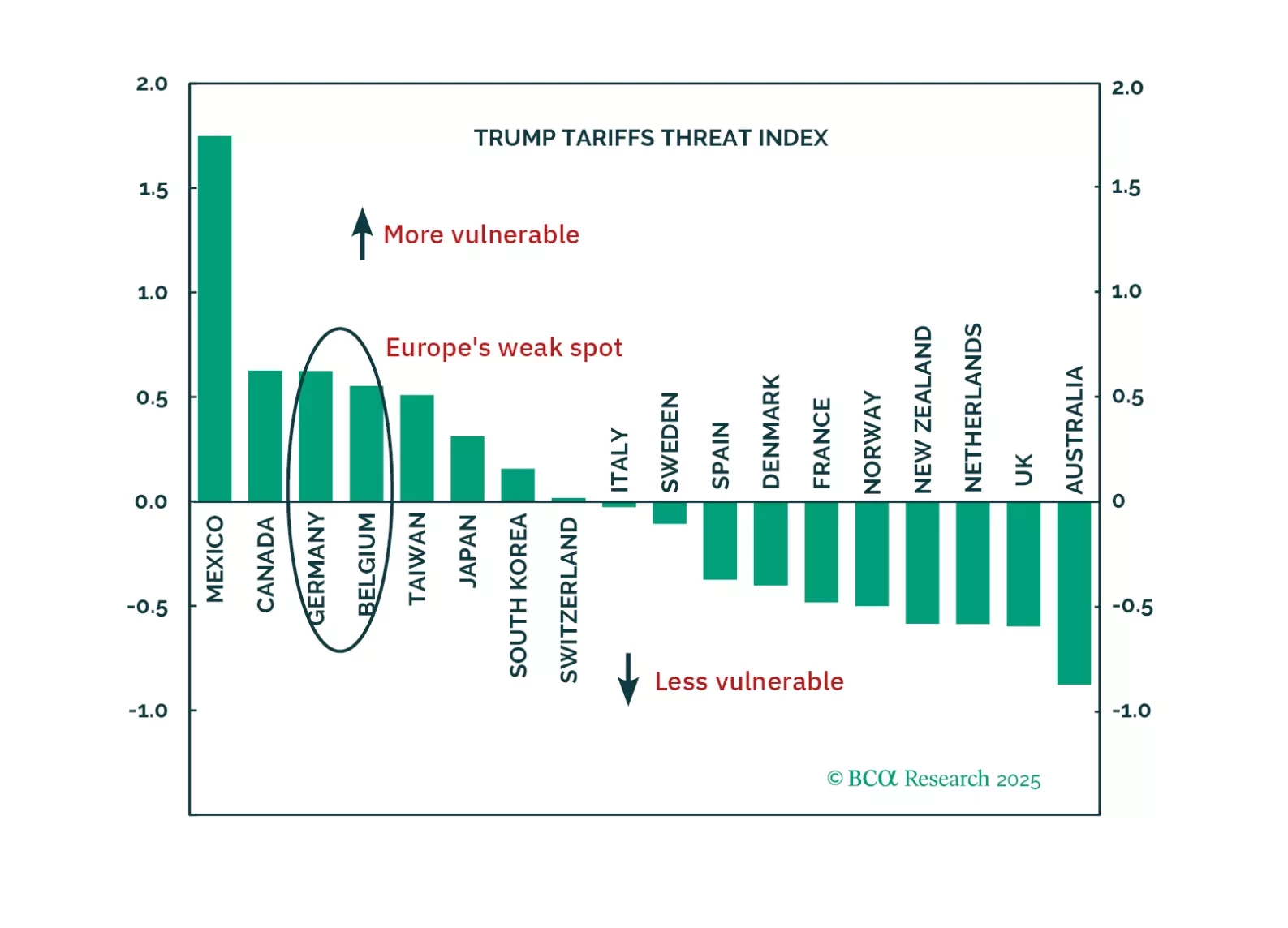

President Trump is about to be inaugurated. Investors often assume all his policies will hurt Europe, but the reality is more nuanced.

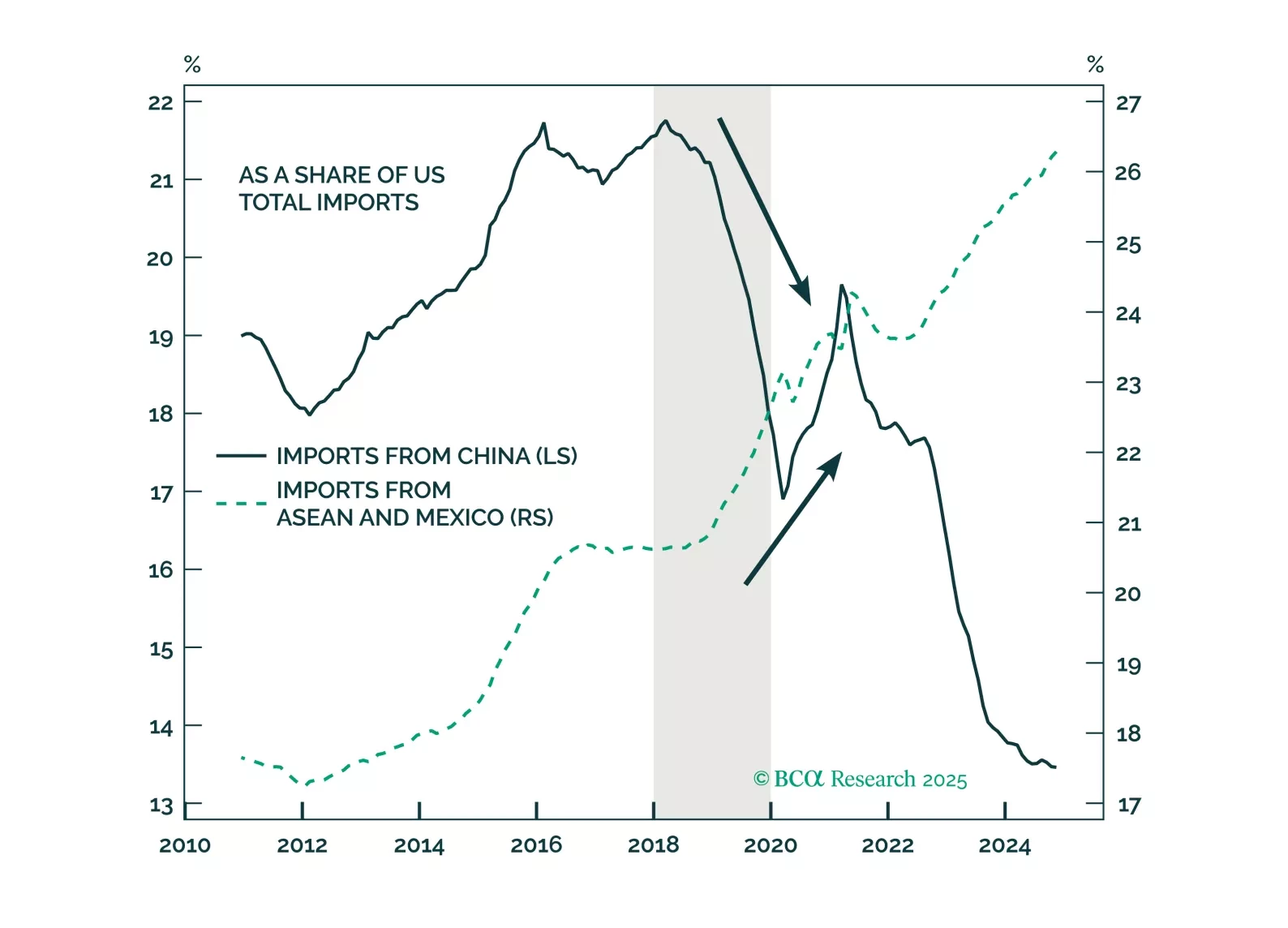

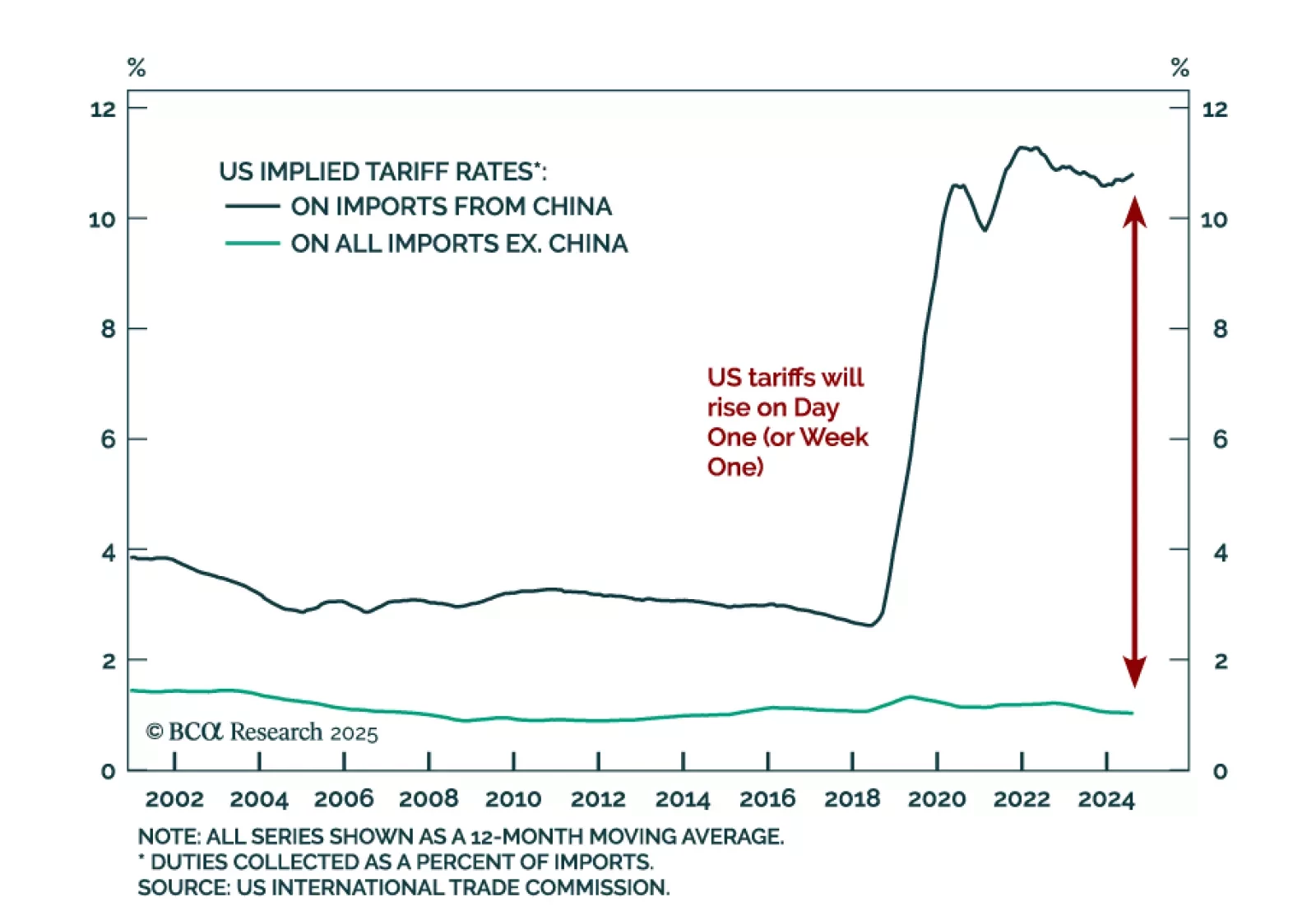

Our US Political strategists published a Special Report on the trade and fiscal policies likely to be implemented on Day One as the Trump administration takes over Washington. Trump is likely to implement significant tariffs…

China’s December trade data was positive, with exports in USD terms rebounding to 10.7% y/y from 6.7% in November, and imports rebounding to 1.0% from -3.9%. Taken at face value, the numbers are positive for both the Chinese and…

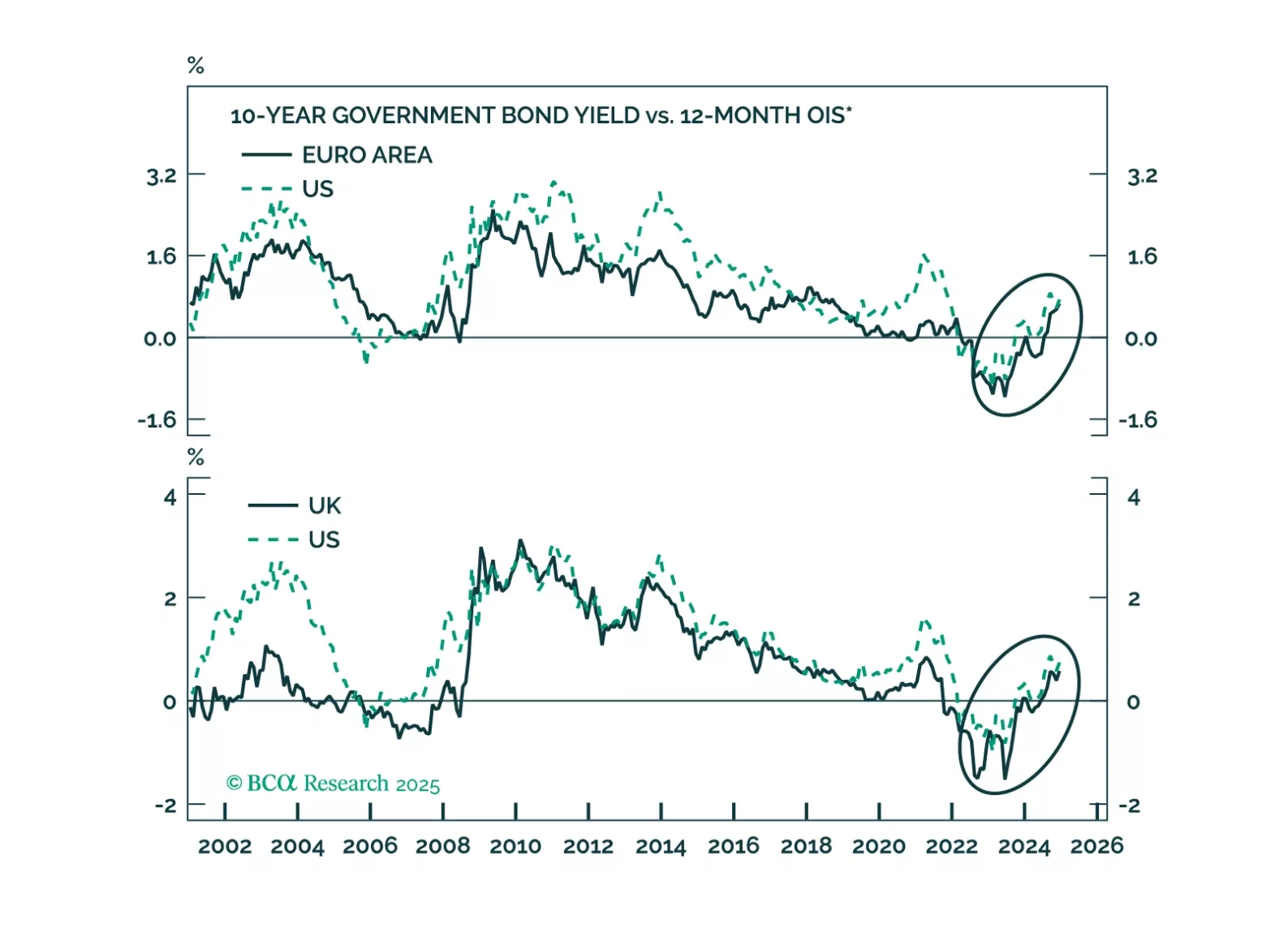

UK and German bonds are victims of the global bond market riots. Will European yields continue to move higher and will the euro and the pound find a floor anytime soon?