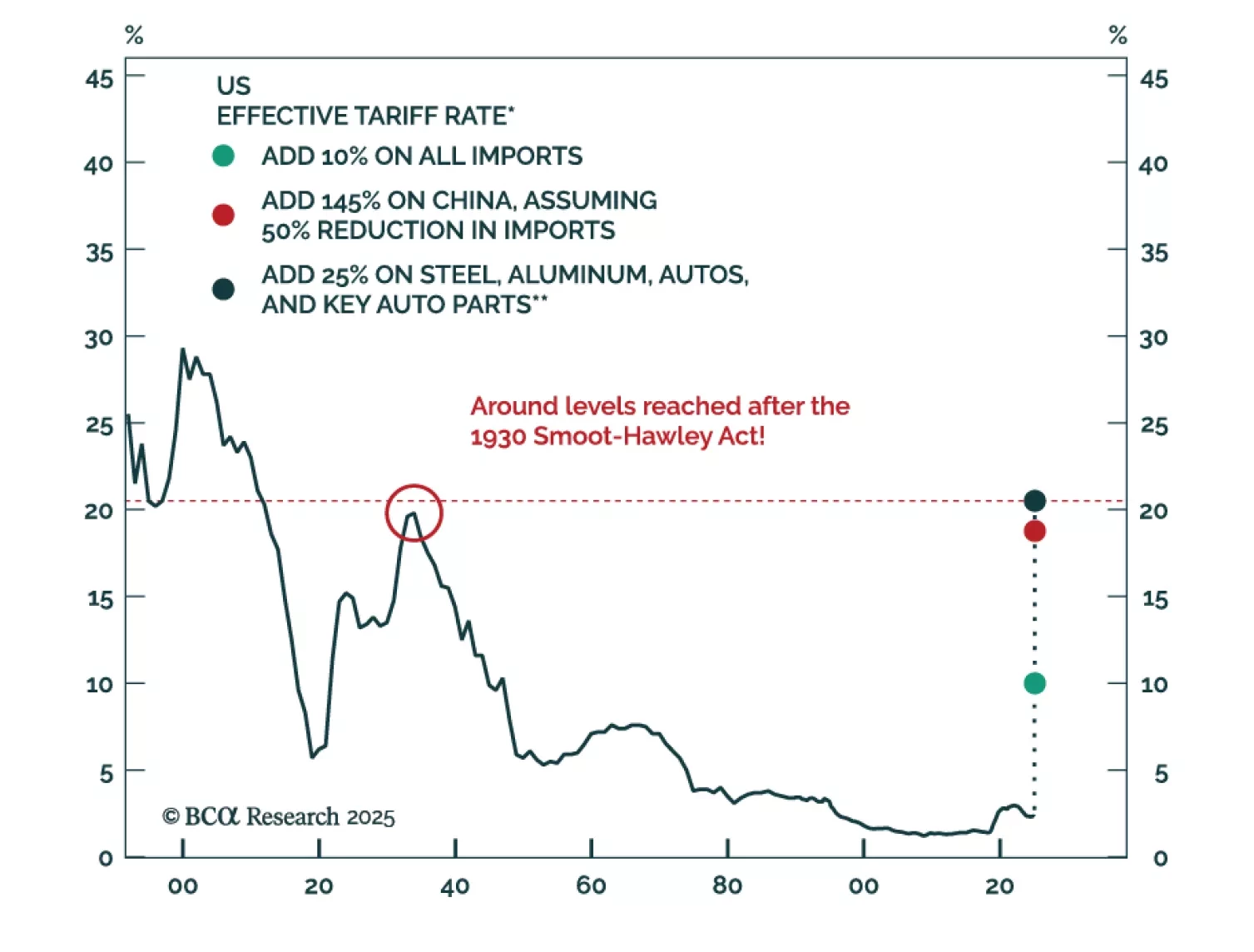

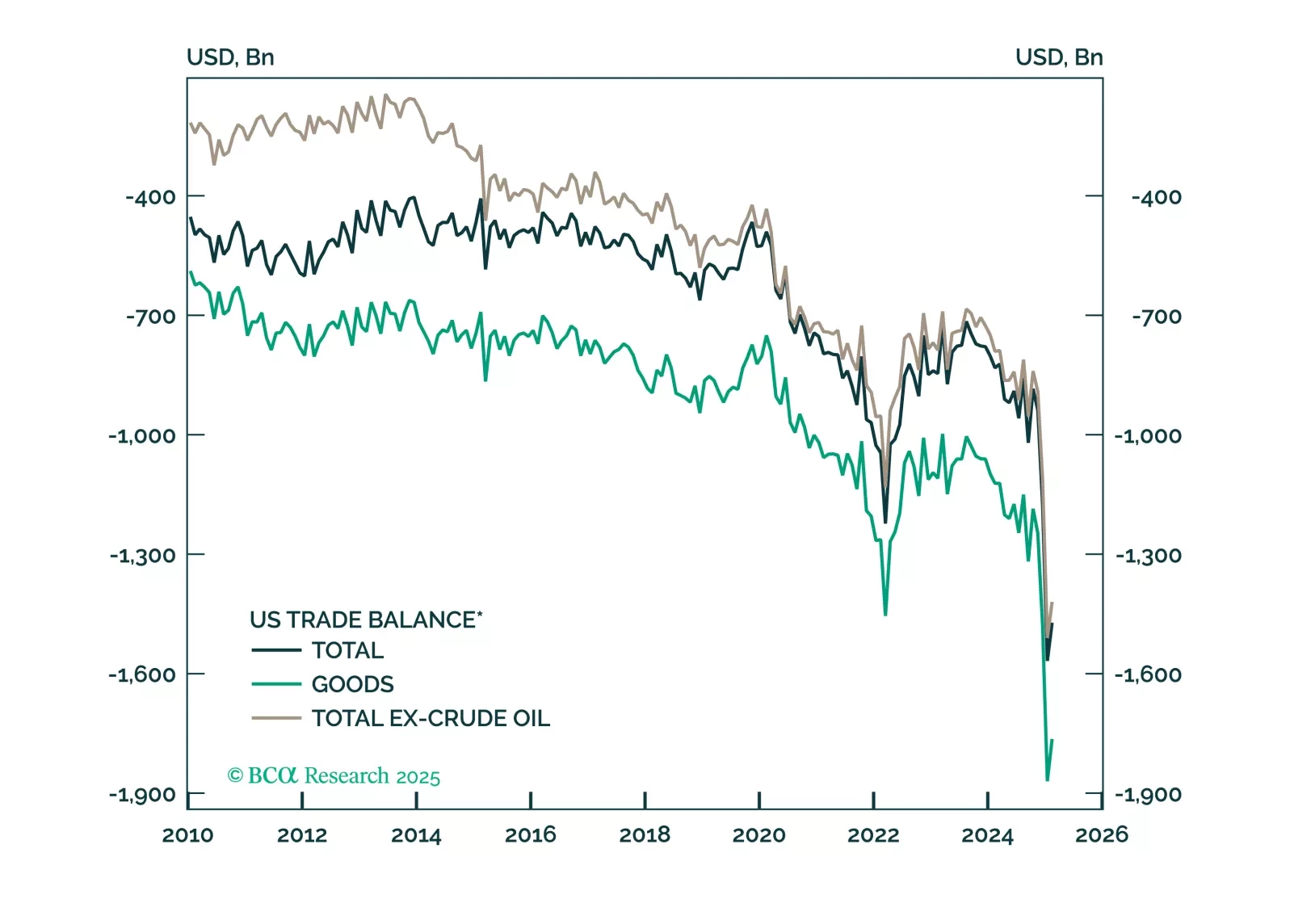

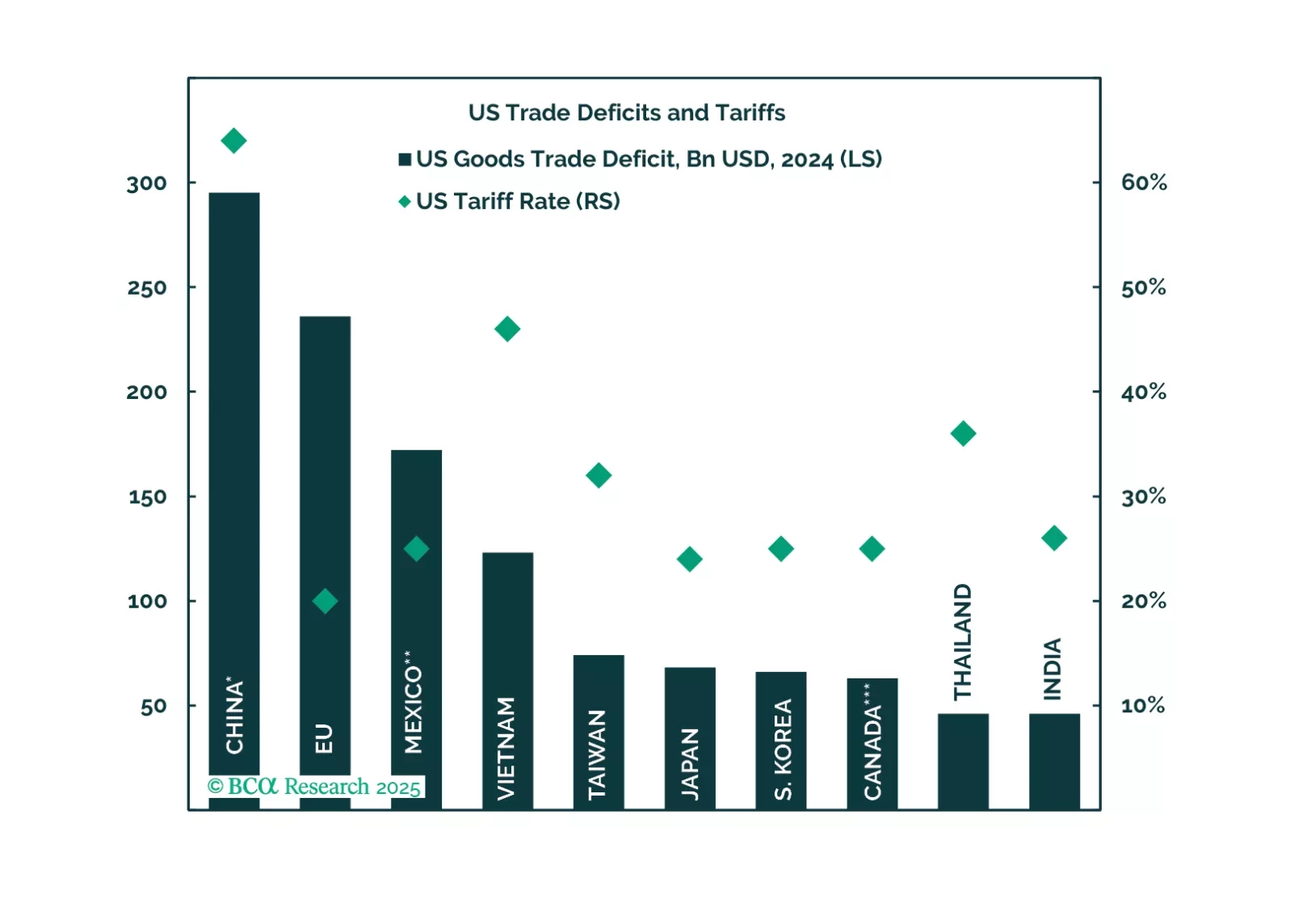

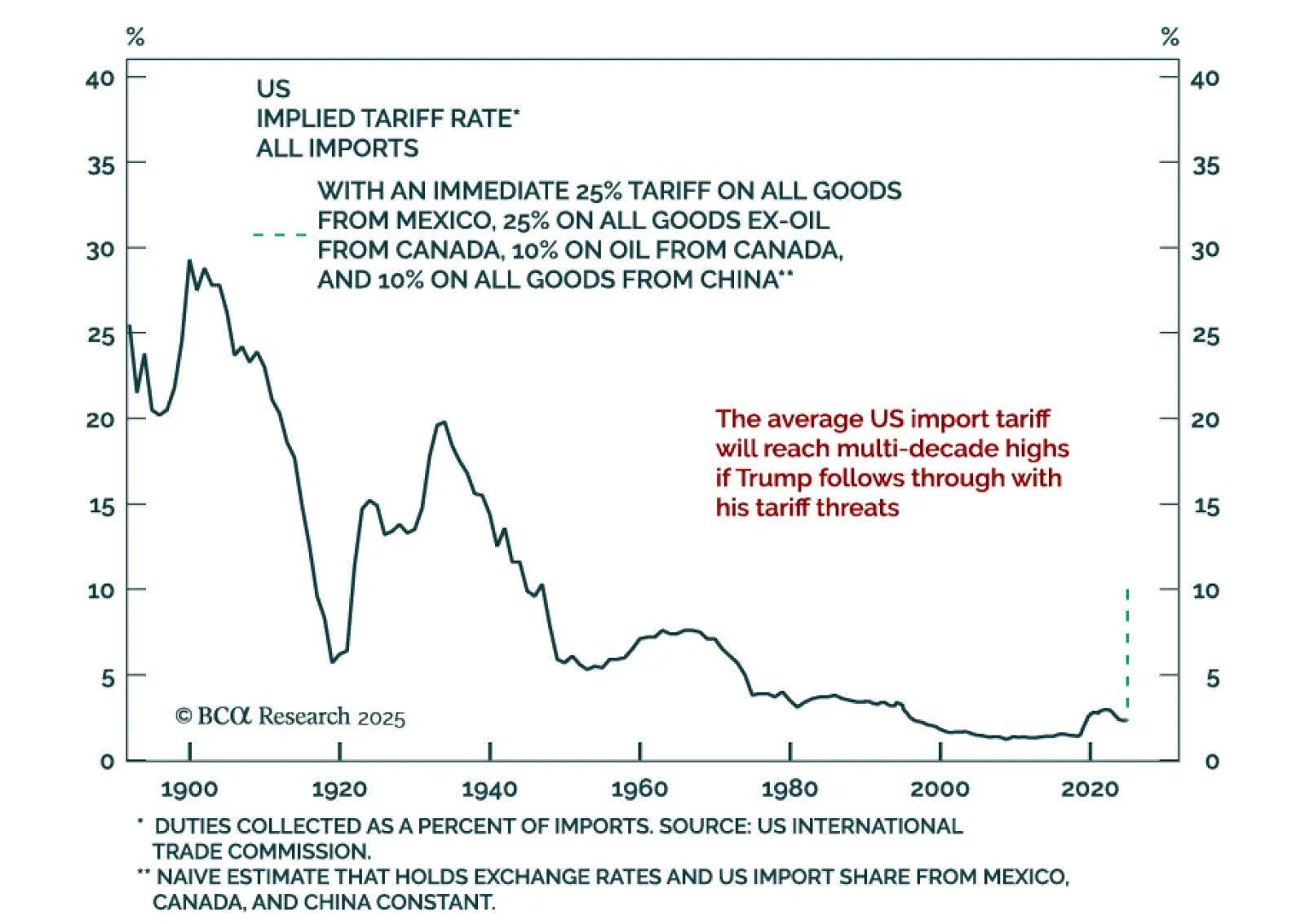

Barring a dramatic further de-escalation of the trade war, the US and much of the rest of the world will enter a recession over the next few months. Investors should remain defensively positioned for now.

This report looks at the FX implications of the Trump tariffs, and the review of our Q1 trades.

Trump's Tariff D-Day brings a negative surprise to financial markets already anxious over a declining US cyclical economy. Investors should sell risky assets, increase safe havens, and overweight US assets in the near term.

Stocks will continue to struggle in the second quarter as President Trump tries to implement tariffs. Tax cuts will only temporarily dispel growth fears, if at all. Middle Eastern instability will add oil price surprises to an…

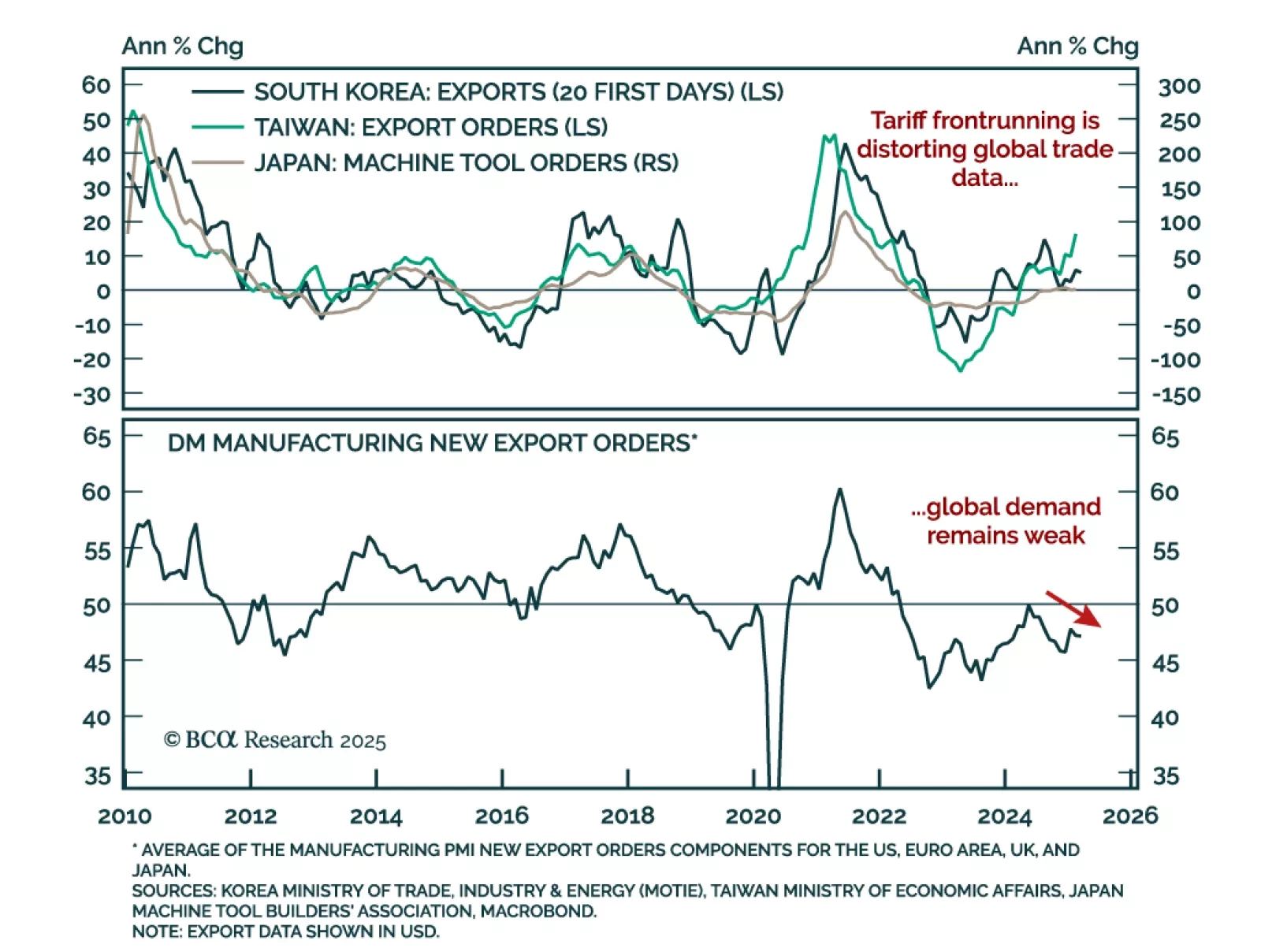

East Asian trade data has been disappointing. Preliminary February data for Japanese machine tool orders showed a slowdown to 3.5% y/y from 4.7% in January. Broader machinery orders were down 3.5% m/m in January. Taiwanese exports…

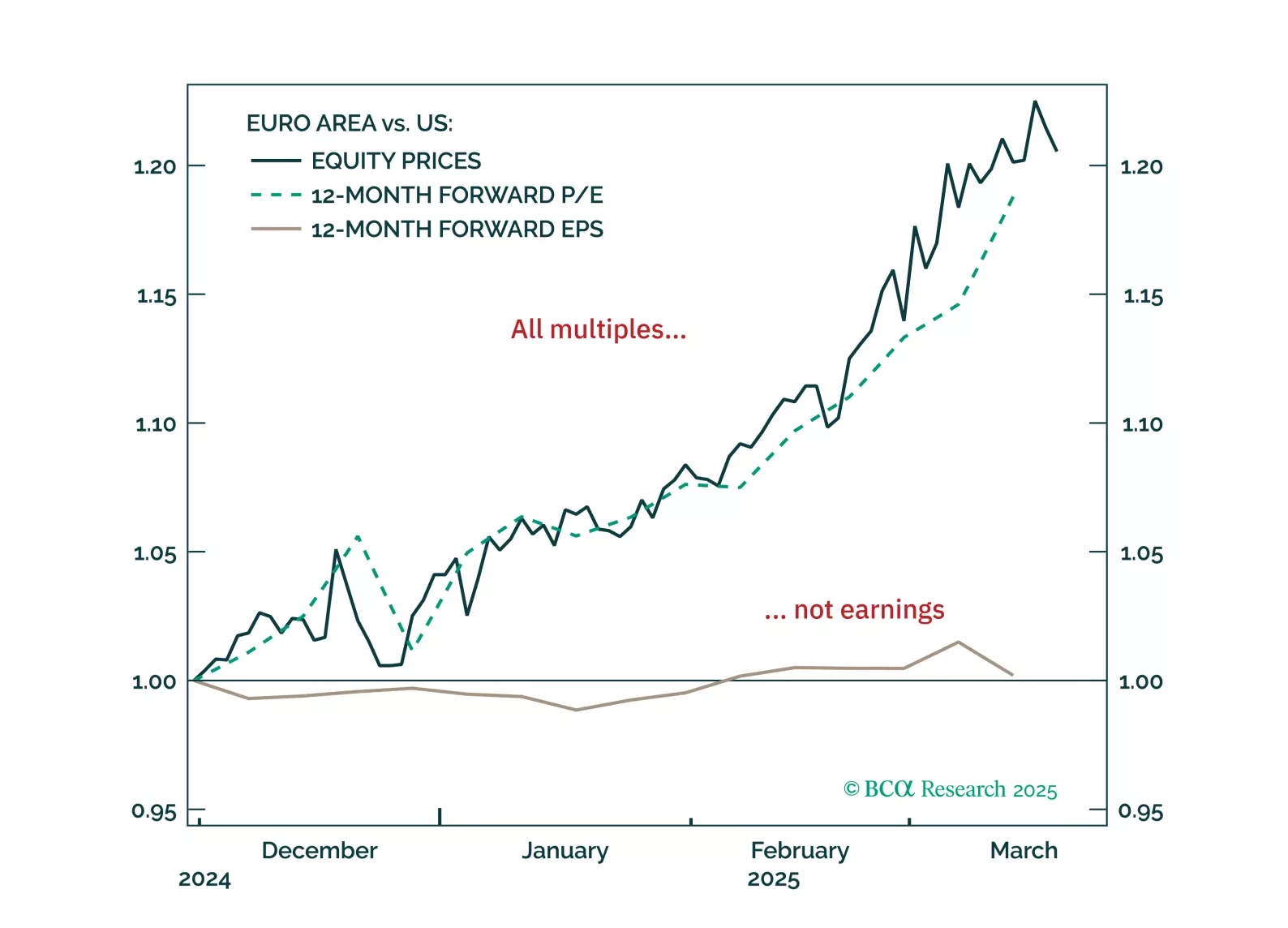

European equities have surged on hopes of a low-inflation boom—but the rally has likely gone too far, too fast. With a pullback now likely, how should investors position themselves over the next 3–6 months?

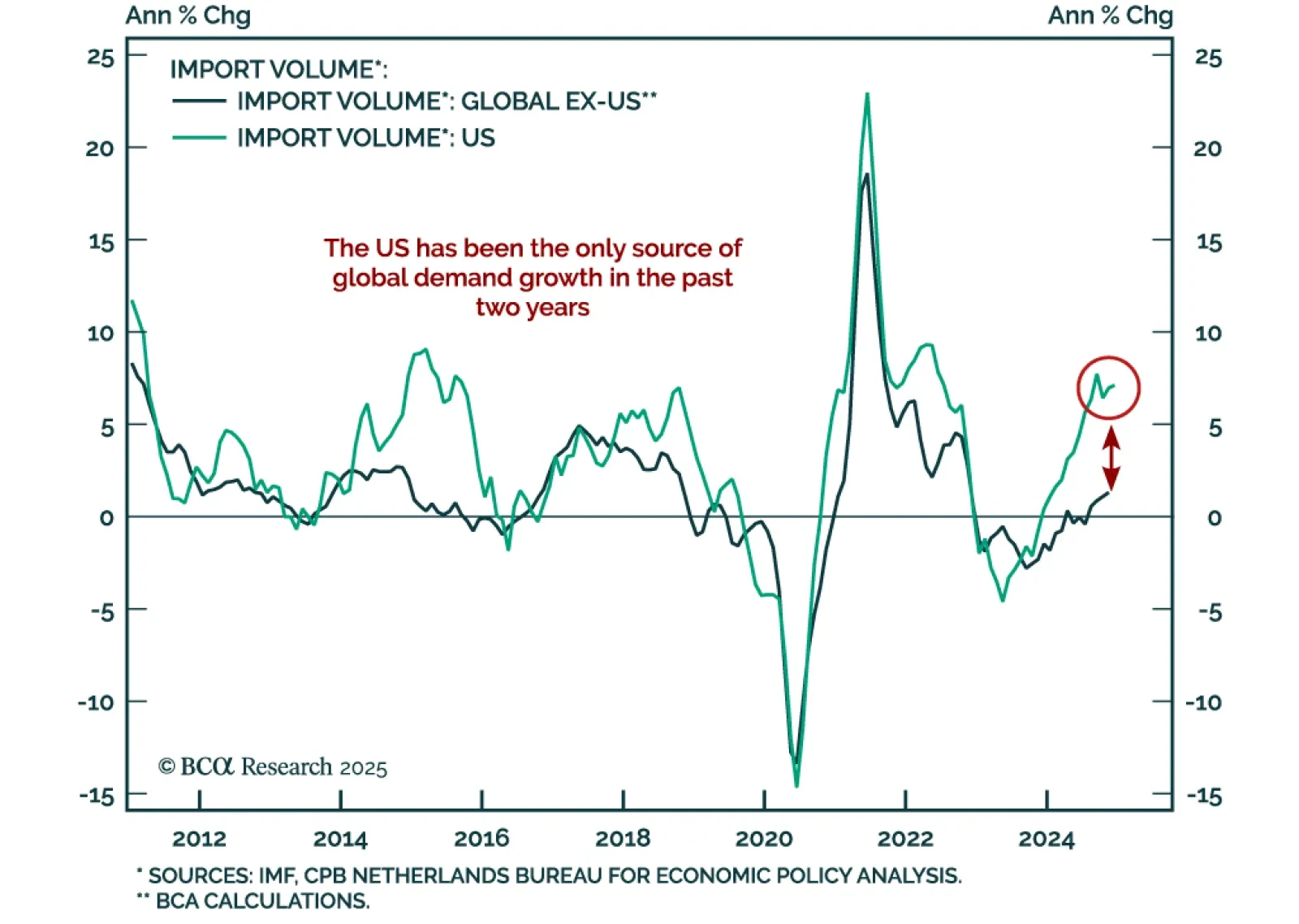

Our Chart Of The Week comes from Arthur Budaghyan, Chief Emerging Markets/China strategist. Arthur highlights a key risk for the global economy, and its implication for the US dollar. By and large, the US economy has been…

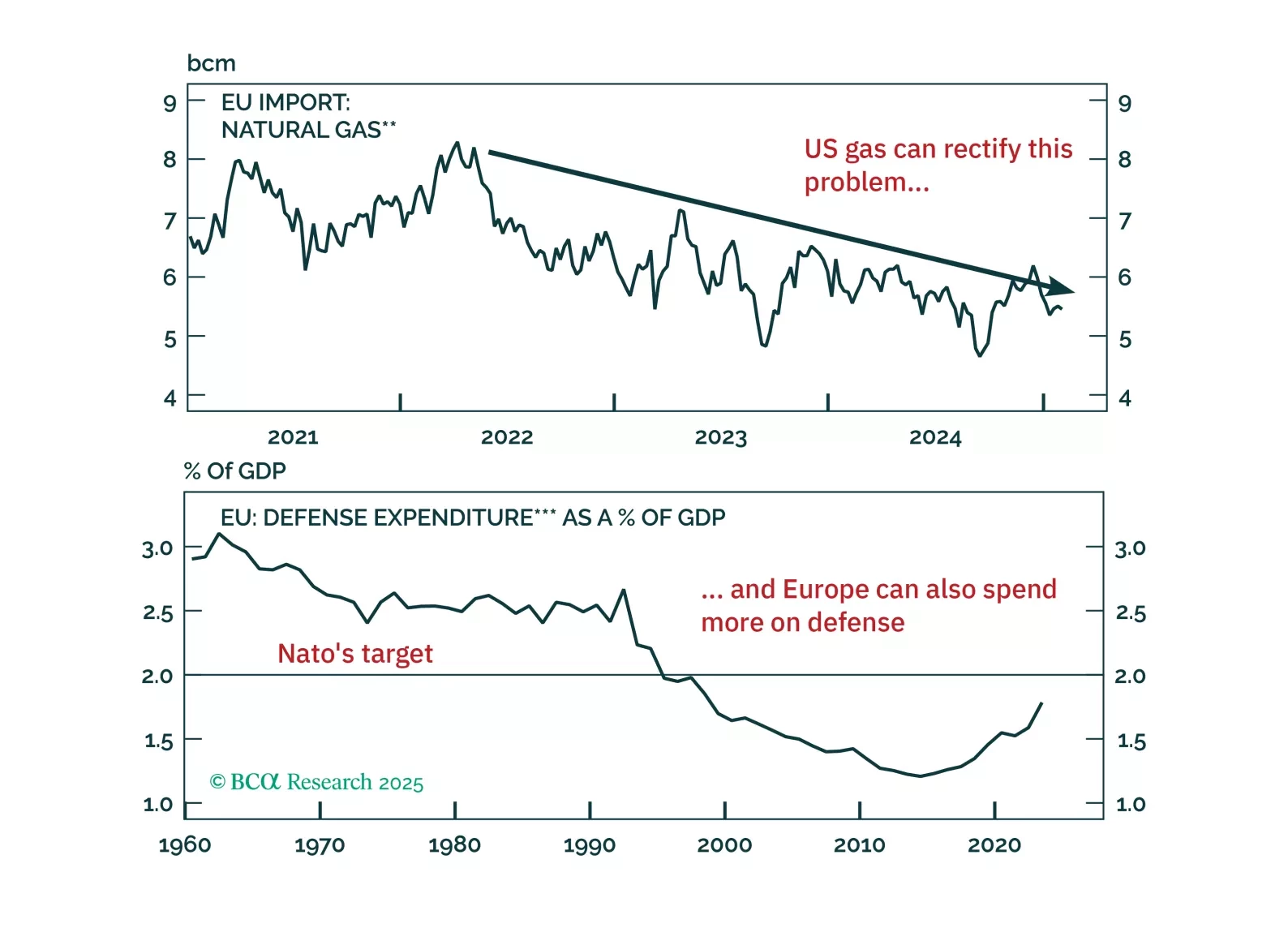

Europe is about to become President Trump’s next target. The good news: a US/EU trade war will be short as common ground to achieve a deal exists. The bad news: European assets remain at the mercy of heightened uncertainty. How…

Our Global Investment strategists offered their initial thoughts on the nascent US trade war with its allies, with a few longer-term takeaways. President Trump’s decision to delay Mexico tariffs on Monday highlights the…