Five questions, five answers from the road. We unpack what Europe’s biggest investors are worried about right now, from trade‑war whiplash to bund‑versus‑Treasury positioning; and where the real opportunities still lie.

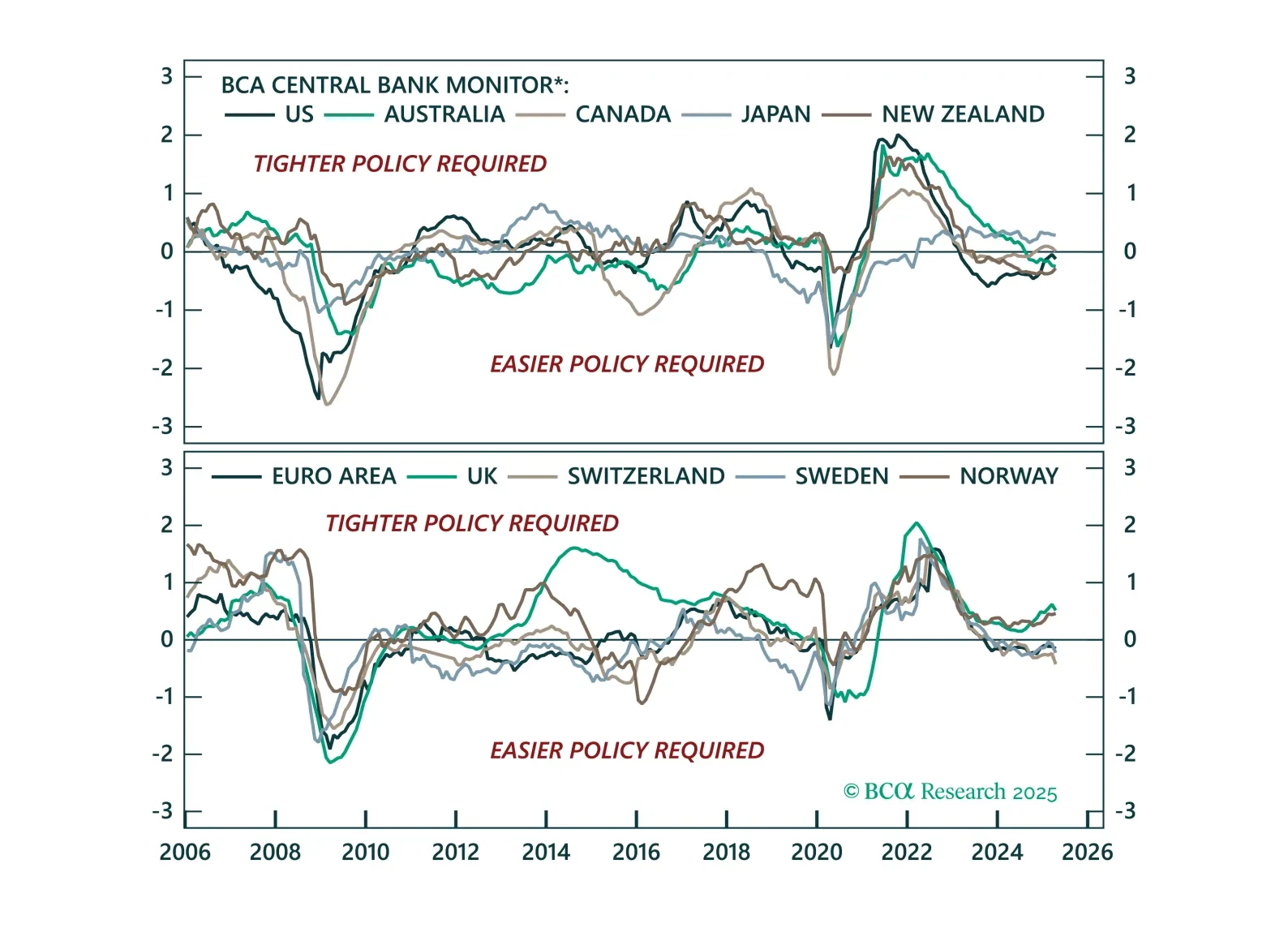

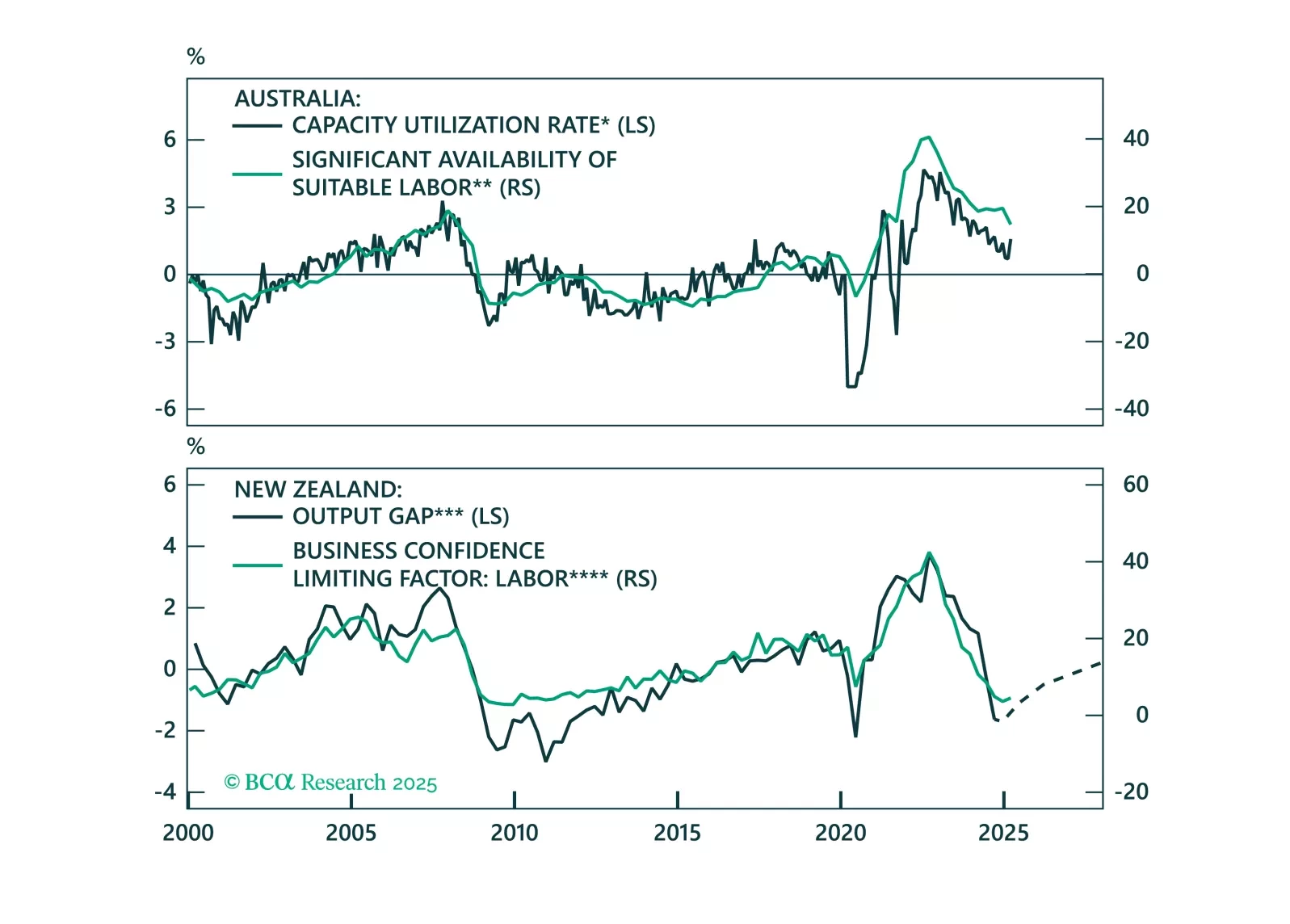

The easing bias remains, but not all central banks are equal. This Central Bank Monitor update reveals who is ready to cut more and who is still pretending not to.

Our Portfolio Allocation Summary for May 2025.

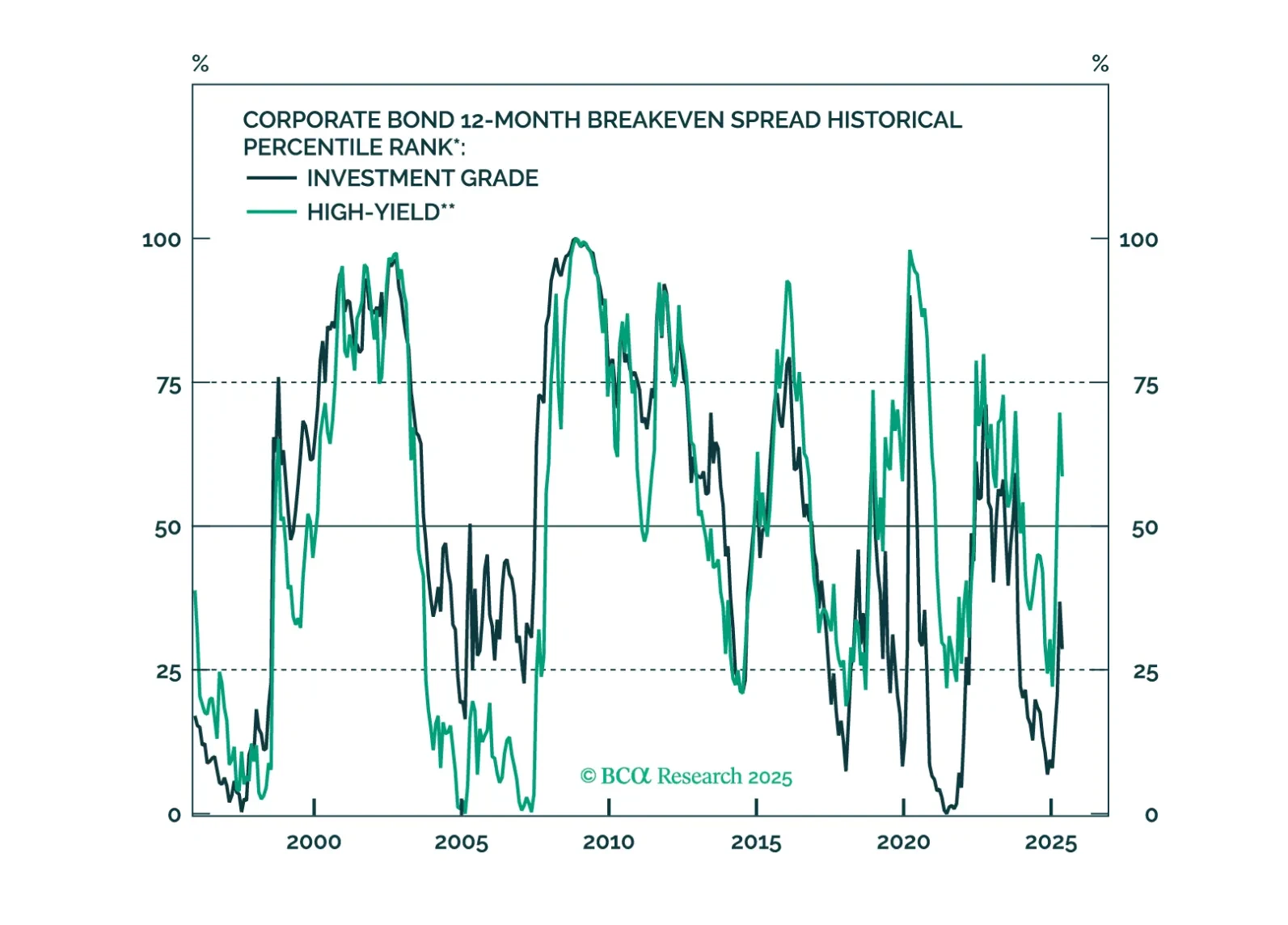

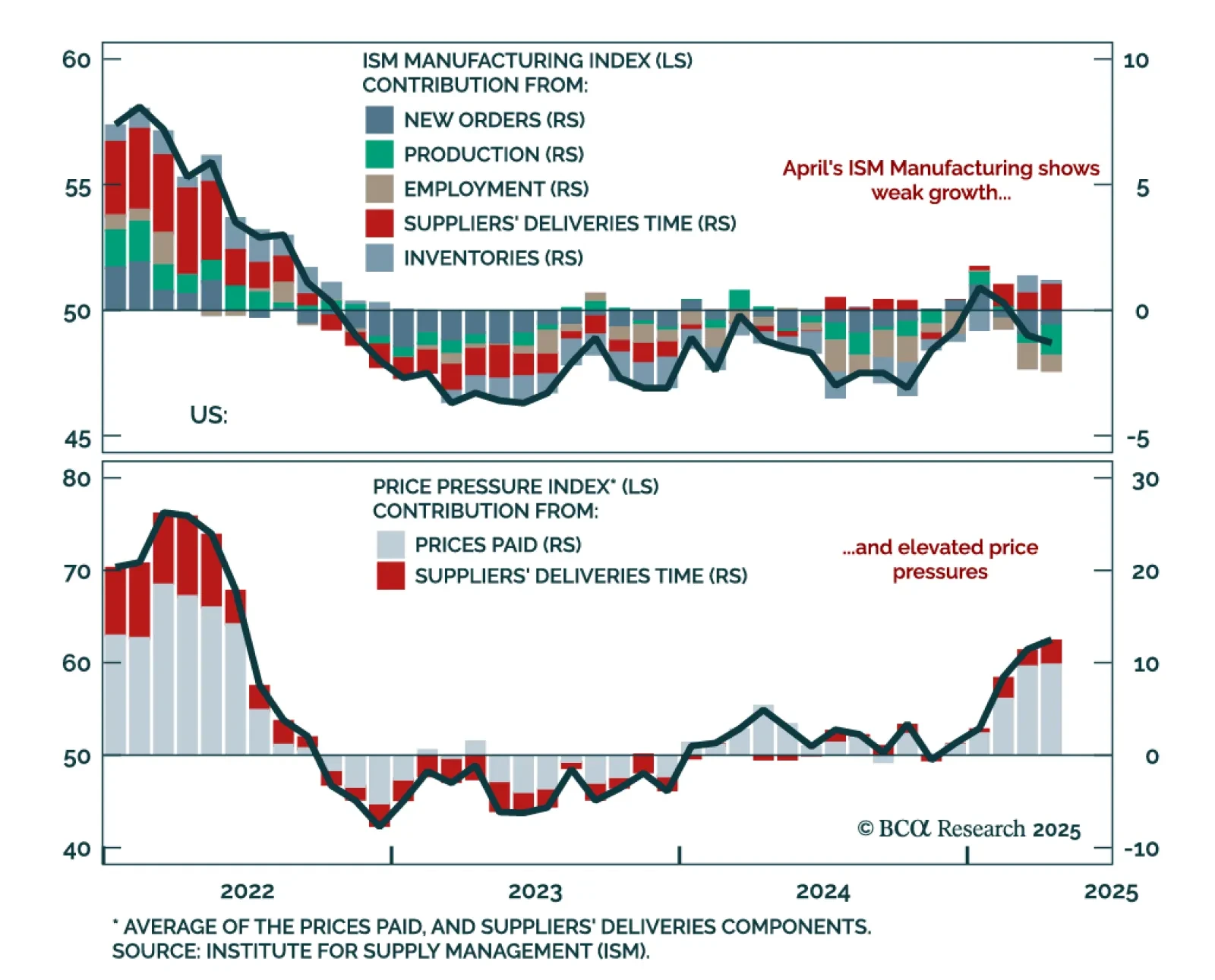

The April ISM Manufacturing adds to recession risks: Collapsing export orders and weak domestic momentum reinforce our defensive positioning. The index slipped to 48.7 from 49.0, with new orders still contracting and new export…

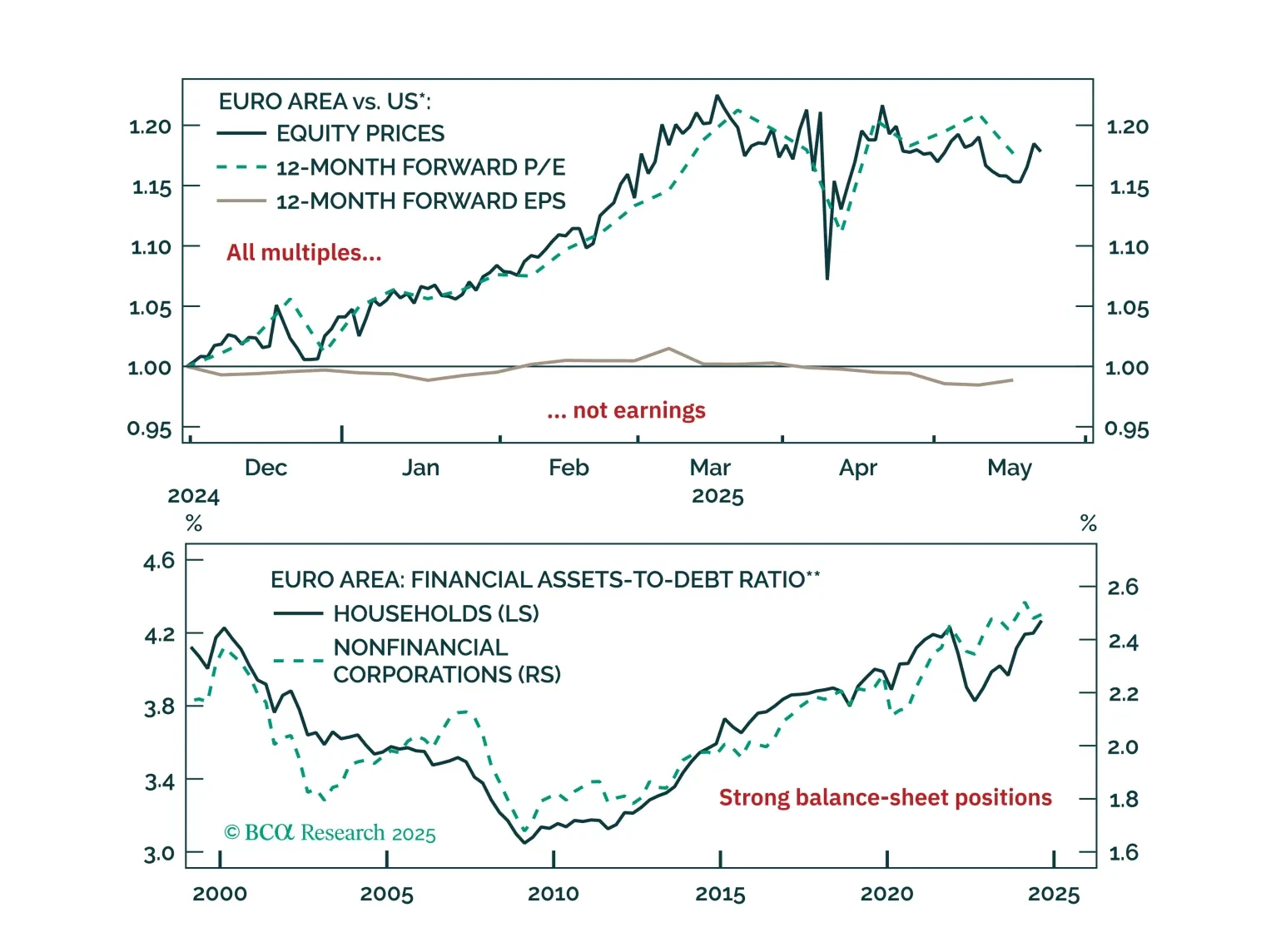

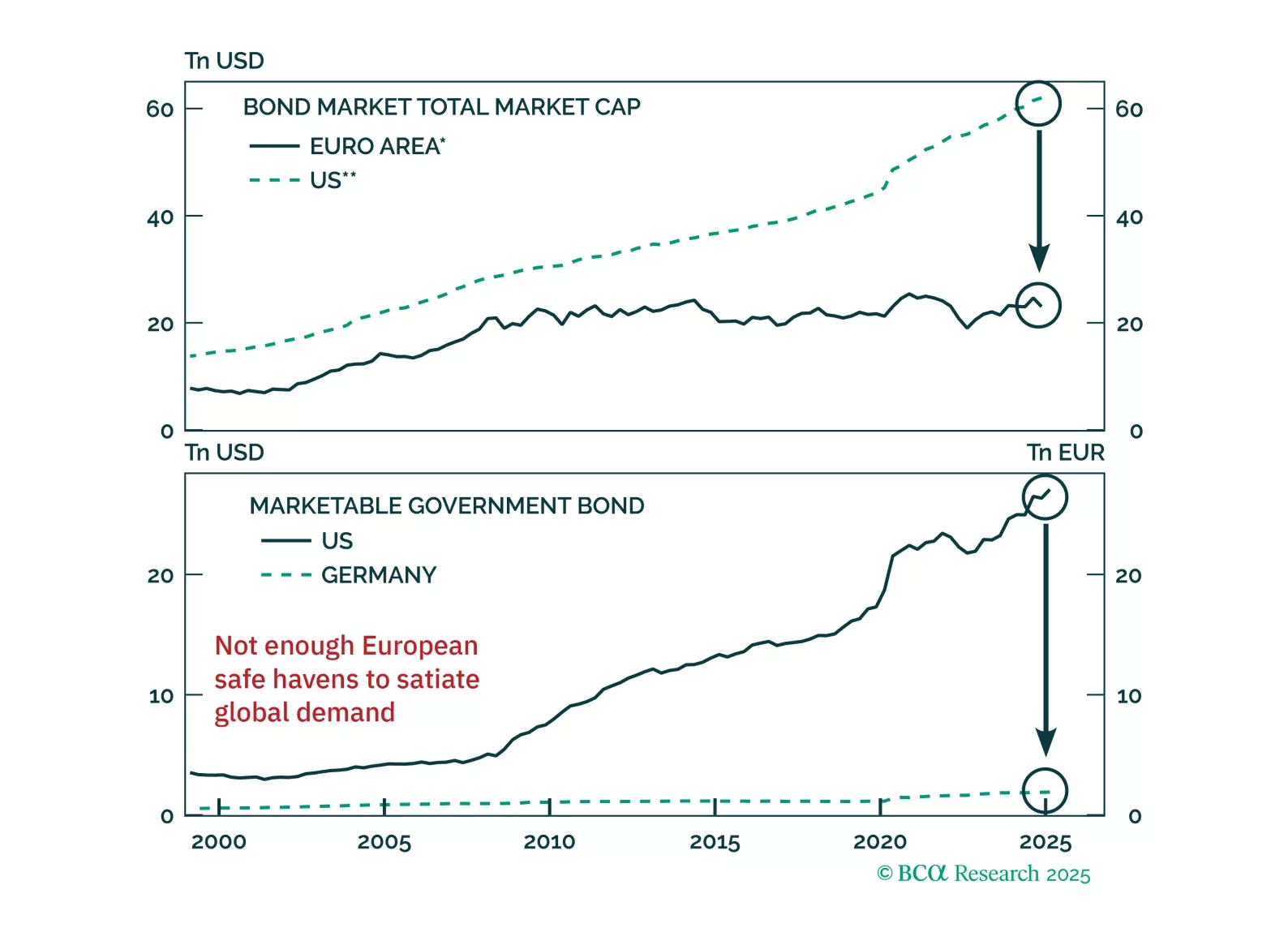

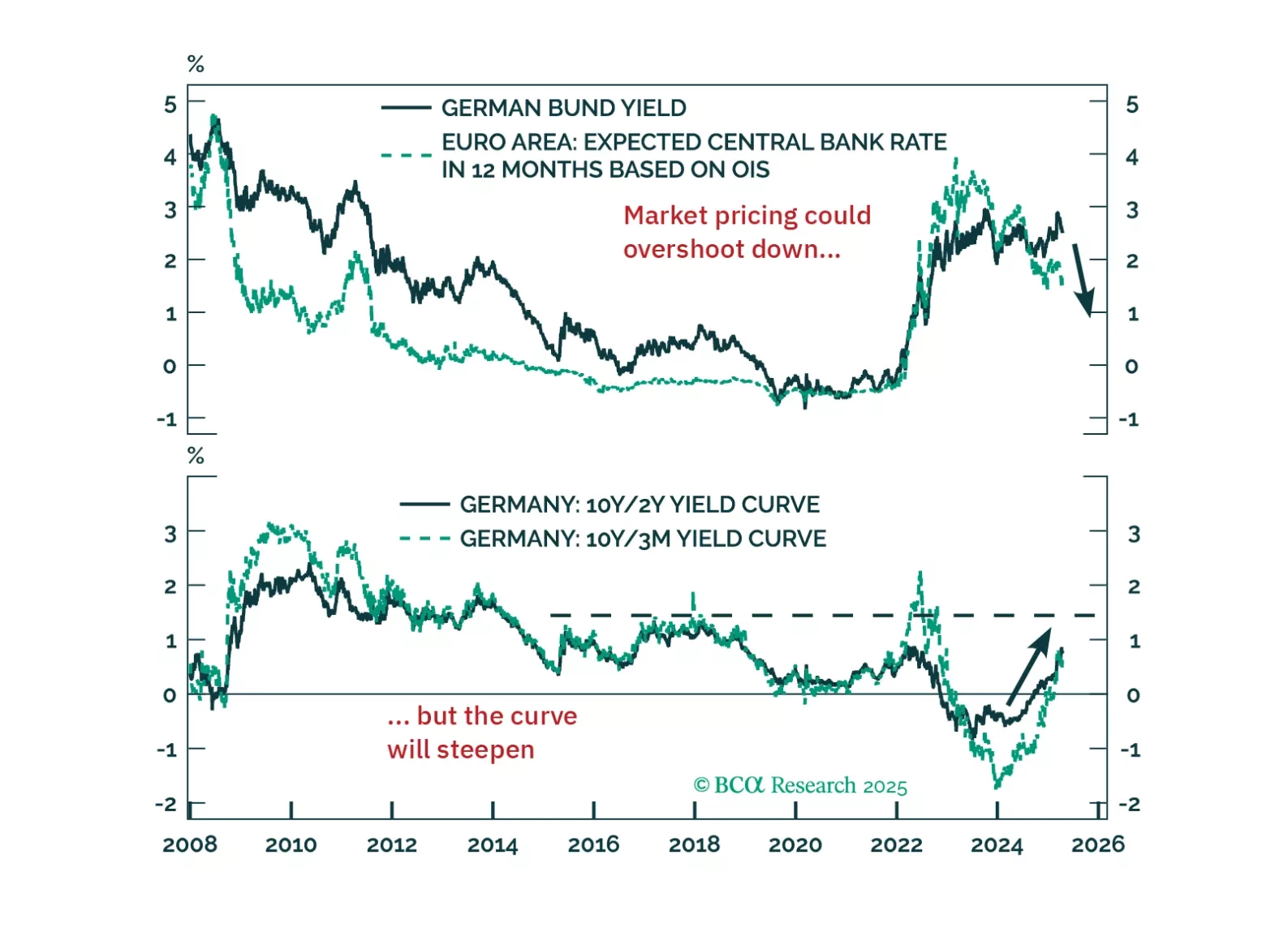

Are bunds the new Treasurys? The euro and German debt are gaining favor as safe havens, but markets may be overplaying the shift. Our latest report dissects what's durable, what's not, and how to trade the dislocation.

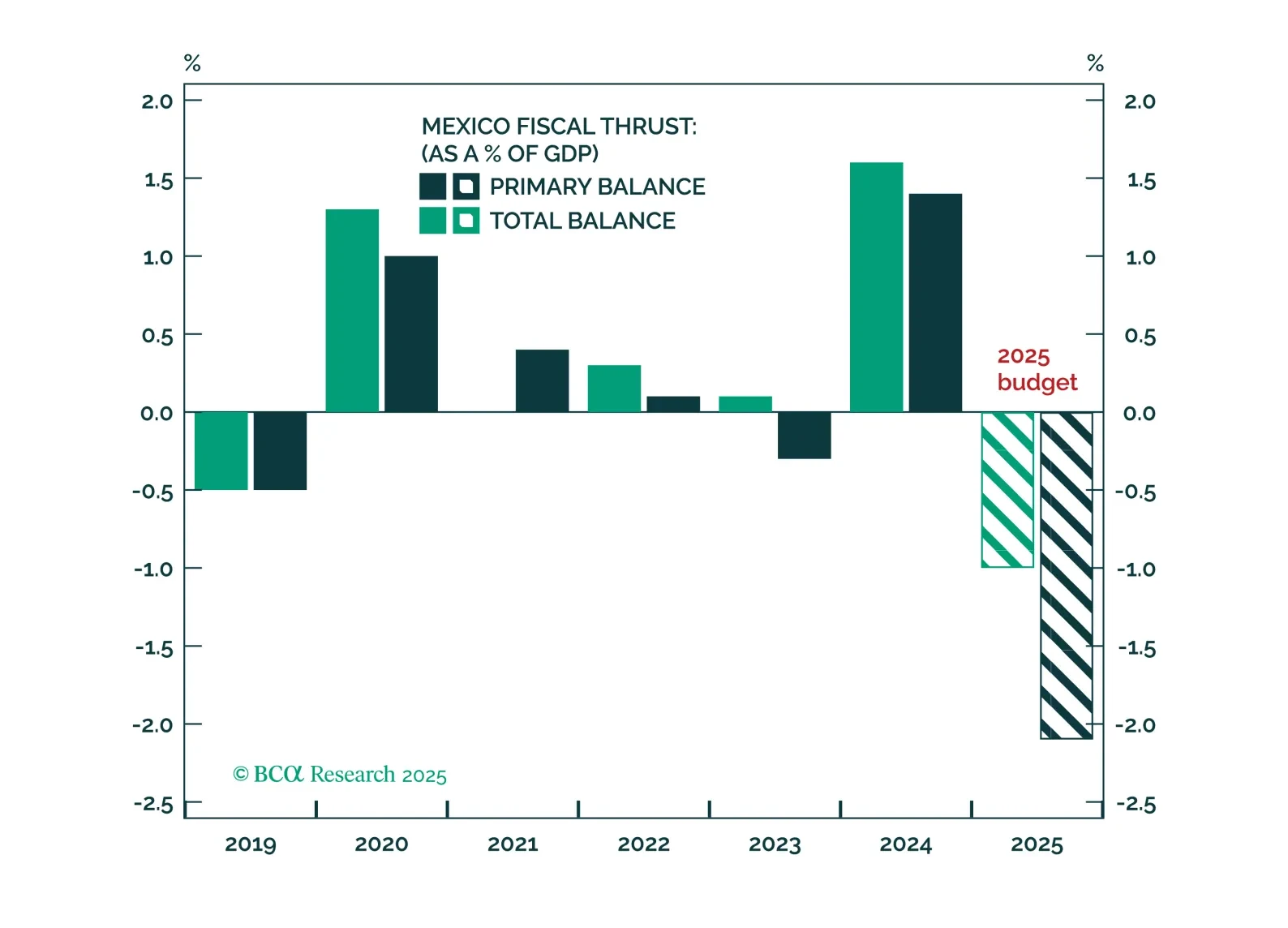

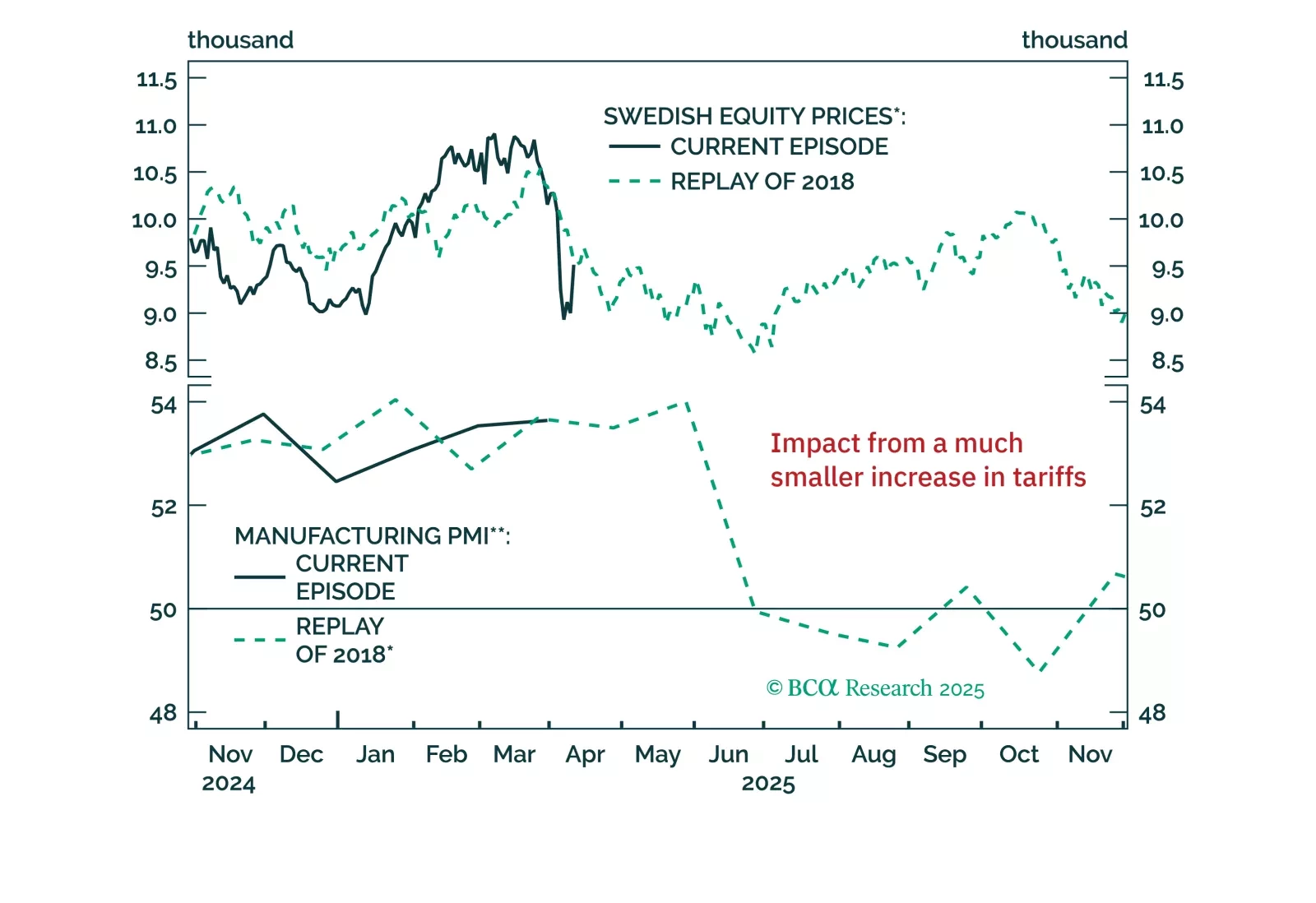

Europe’s deflation problem is getting harder to ignore. This week’s ECB cut is just the beginning — tariffs, the euro’s rally, and softening demand all point to more easing ahead. We explain what it means for yields, equities, and…