Highlights The surge in energy prices going into the Northern Hemisphere winter – particularly coal and natgas prices in China and Europe – will push inflation and inflation expectations higher into the end of 1Q22 (Chart of…

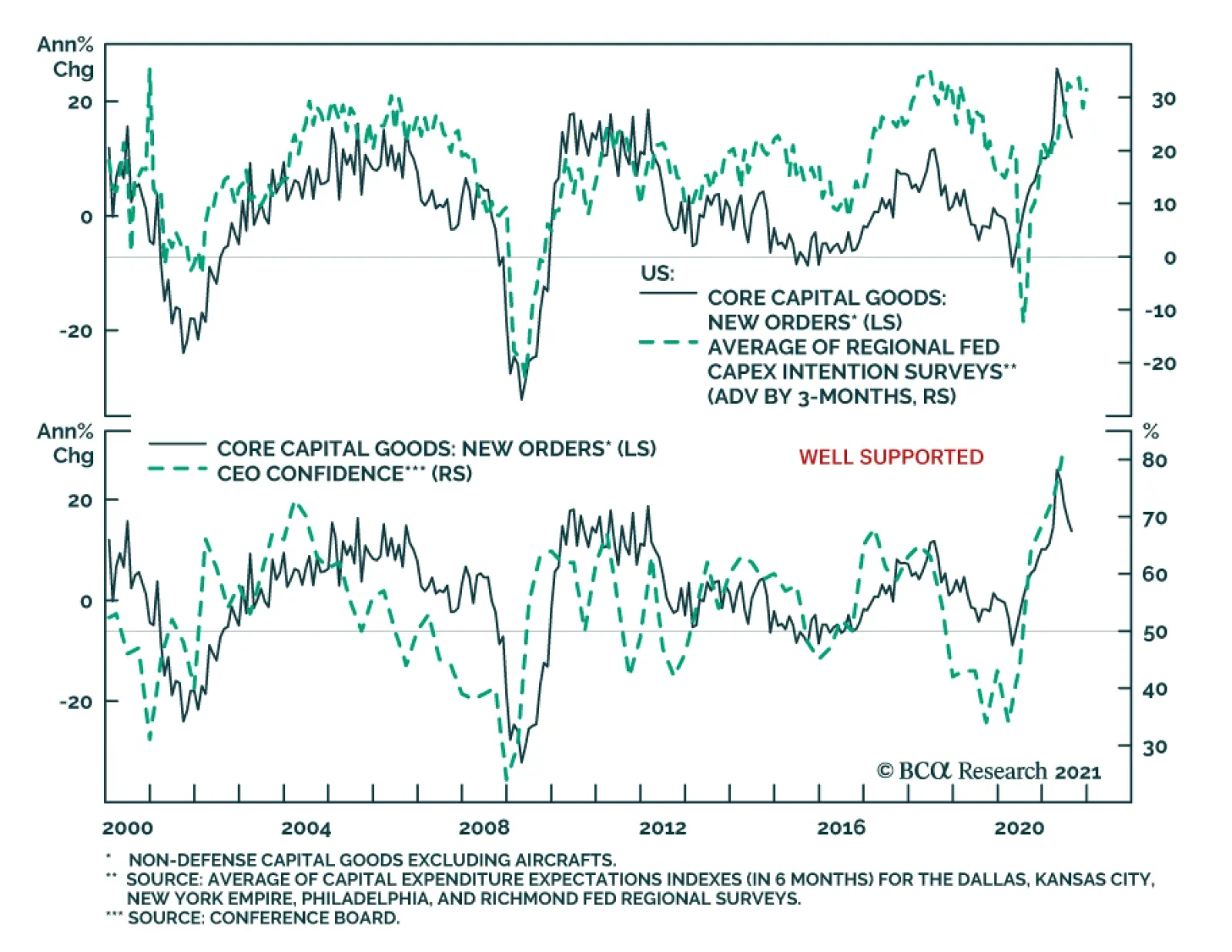

New orders for US durable goods grew 1.8% month-on-month to a record $263.5 billion in August. The increase follows an upwardly revised 0.5% and is more than double expectations of a 0.7% rise. However, a 5.5% month-on-month…

Highlights Asian and European natural gas prices will remain well bid as the Northern Hemisphere winter approaches. An upgraded probability of a second La Niña event this winter will keep gas buyers scouring markets for supplies…

Highlights An Iran crisis is imminent. We still think a US-Iran détente is possible but our conviction is lower until Biden makes a successful show of force. Oil prices will be volatile. Fiscal drag is a risk to the cyclical…

Highlights China’s new plan for “common prosperity” is a long-term strategic plan to bulk up the middle class that will strengthen China – if it is implemented successfully. The record on implementing reforms…

Highlights Going into the new crop year, we expect the course of the broad trade-weighted USD to dictate the path taken by grain and bean prices (Chart of the Week). Higher corn stocks in the coming crop year, flat wheat stocks and…

Highlights The DXY index appears to be following the seasonal pattern of strengthening in the summer and weakening towards year-end. In this context, the most attractive vehicles to play a decline in the dollar are the Scandinavian…

Highlights China’s July Politburo meeting signaled that policy is unlikely to be overtightened. The Biden administration is likely to pass a bipartisan infrastructure deal – as well as a large spending bill by Christmas.…