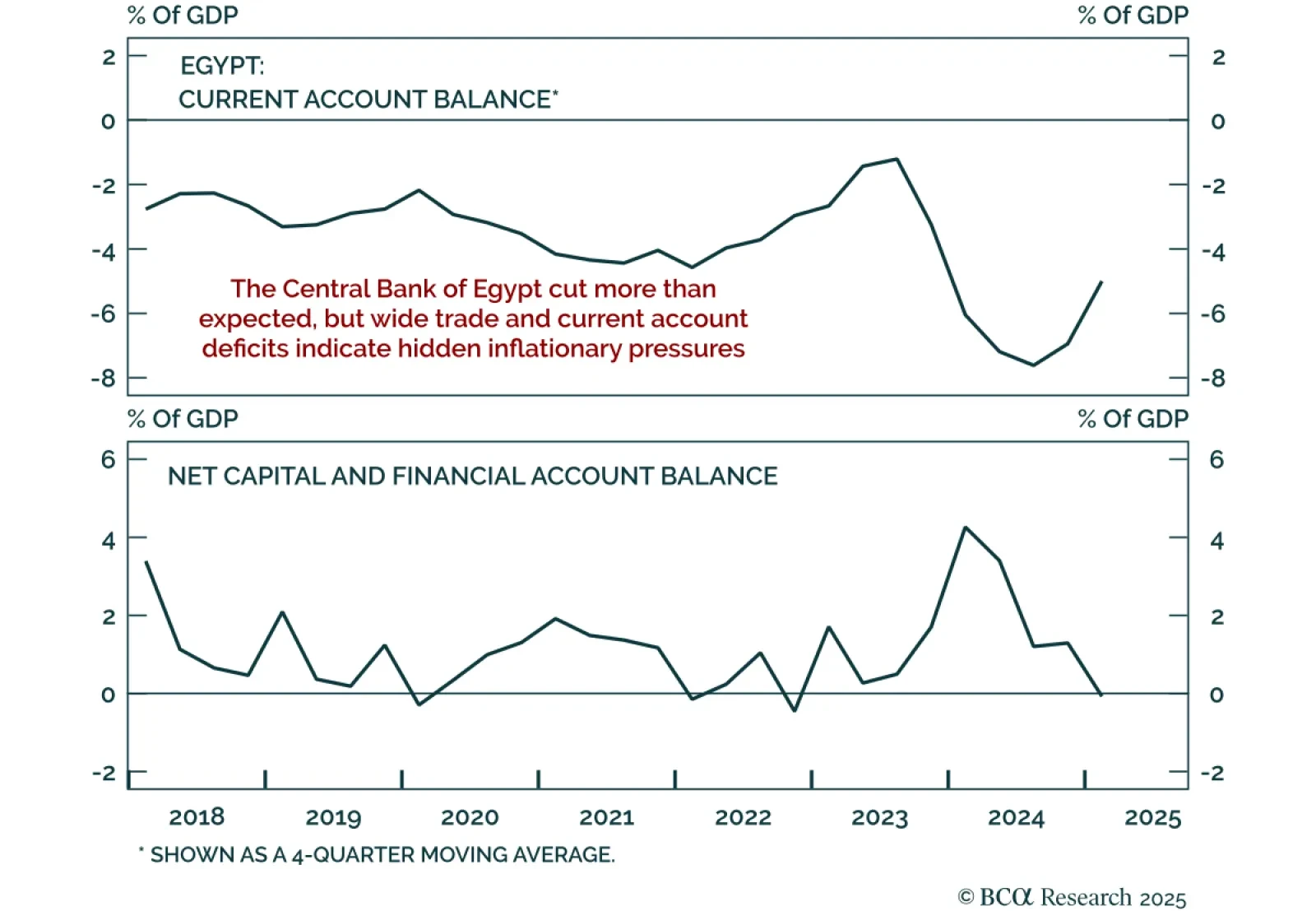

Egypt’s surprise 200 bps rate cut raises risks of re-accelerating inflation and currency pressure. The Central Bank of Egypt lowered the overnight lending rate to 23%, a larger-than-expected move. Our Emerging Markets strategists…

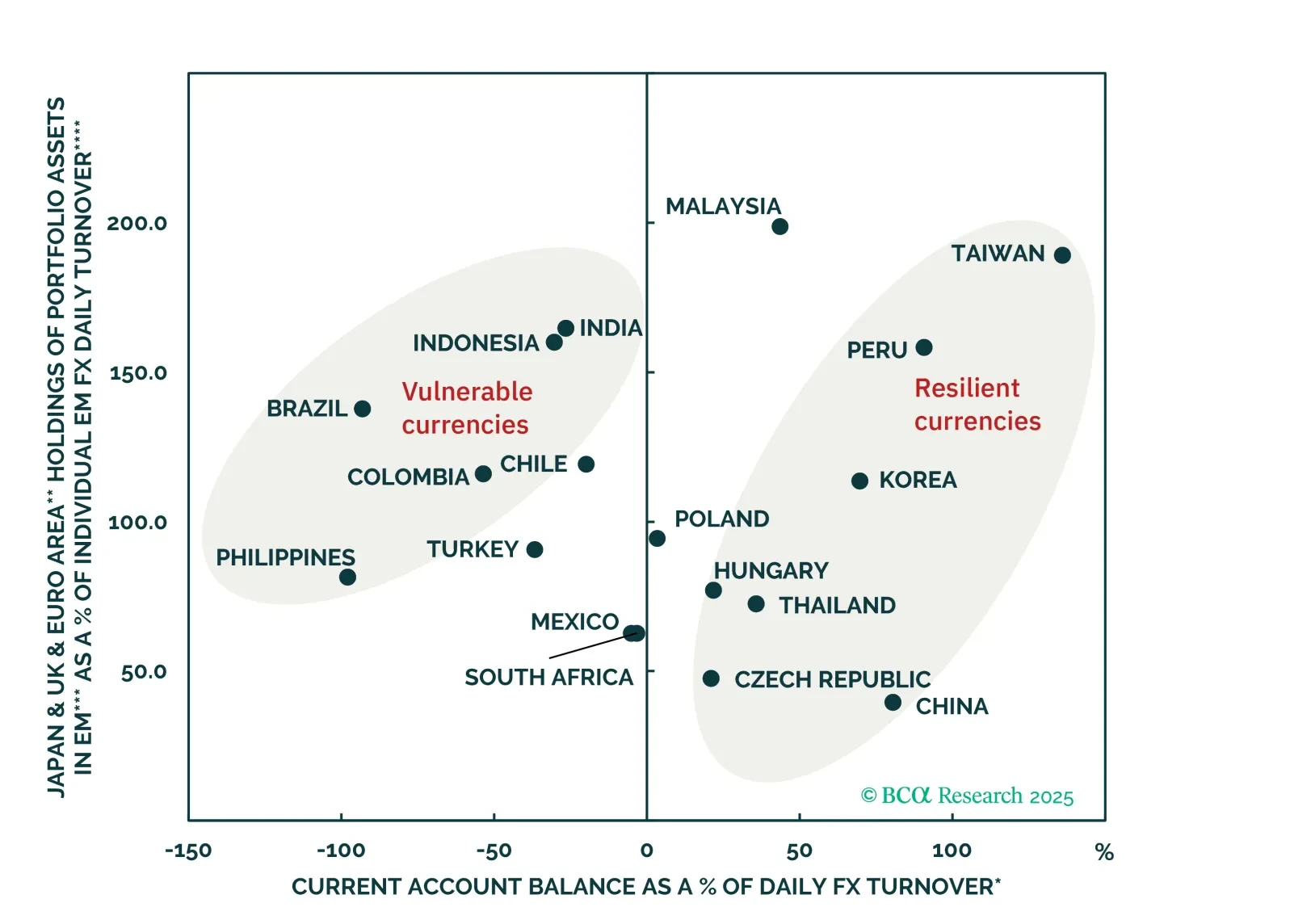

Despite widespread investor optimism Brazil’s currency outlook is challenged by a toxic mix of poor external, fiscal, and macro fundamentals. Expect BRL to underperform most EM peers.

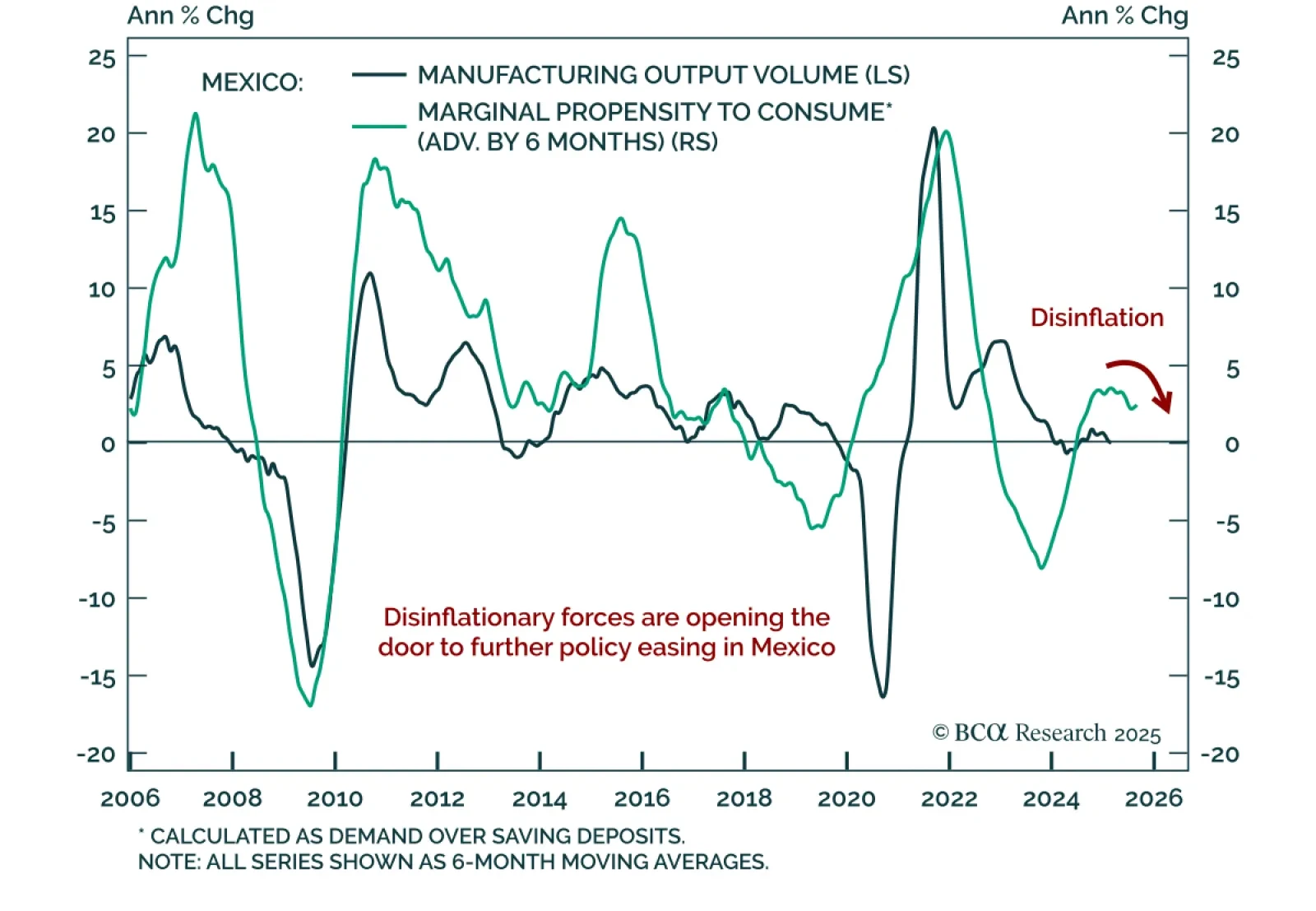

Banxico’s latest rate cut reinforces our bullish view on Mexican domestic bonds. Mexico’s central bank eased policy by another 25 basis points to 7.75%. Investors should bet on further easing. Inflation will continue…

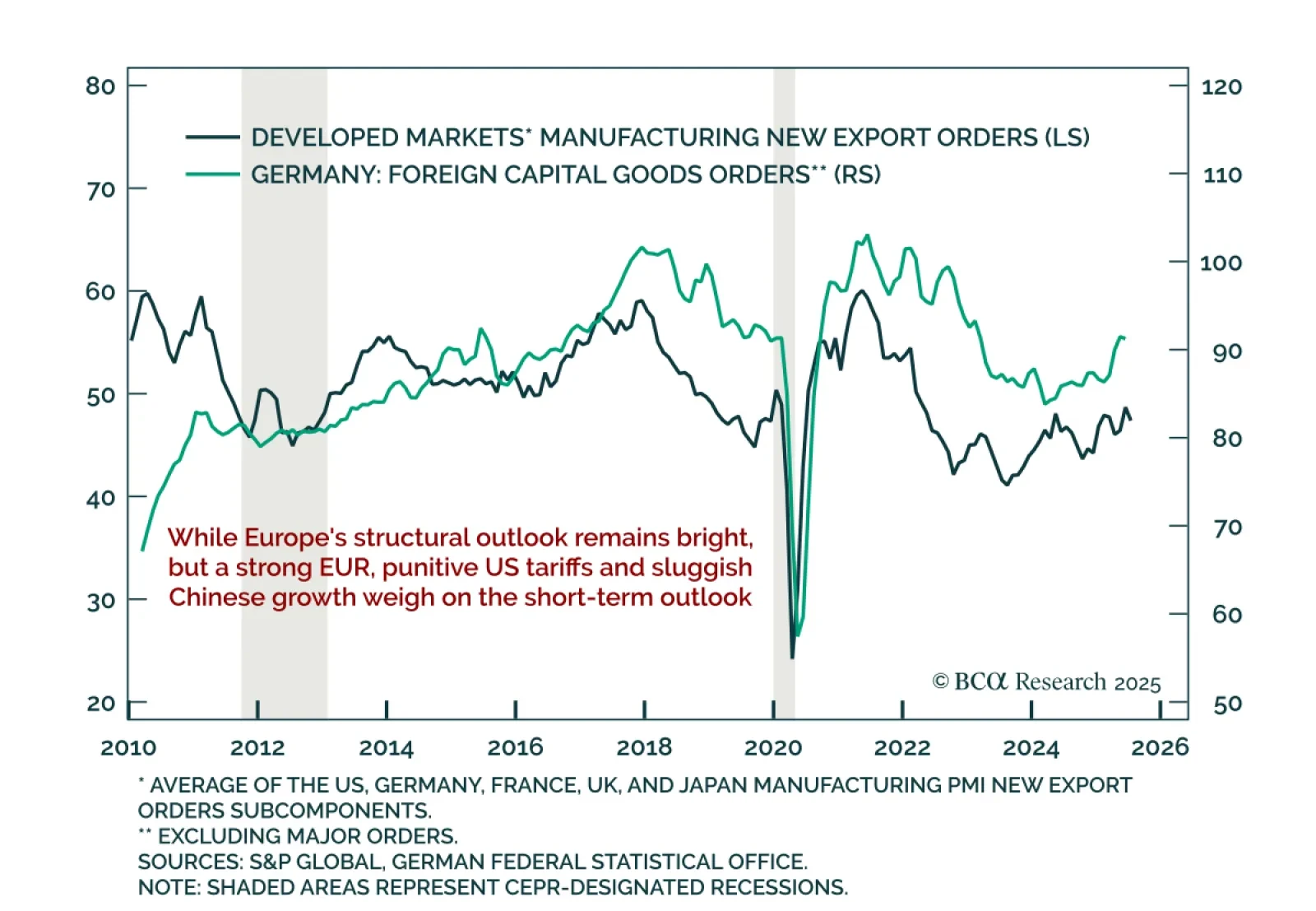

Germany’s June factory orders missed expectations, highlighting persistent headwinds reinforcing the case for a cautious tactical outlook on European assets. Orders fell 1.0% m/m, slowing to 0.8% y/y on a calendar-adjusted basis…

Our Commodity strategists recommend staying short LME copper outright and long gold/short LME copper on a cyclical basis. The unwind in copper, set off by the US tariff exemption on refined metal, is not yet complete. An inventory…

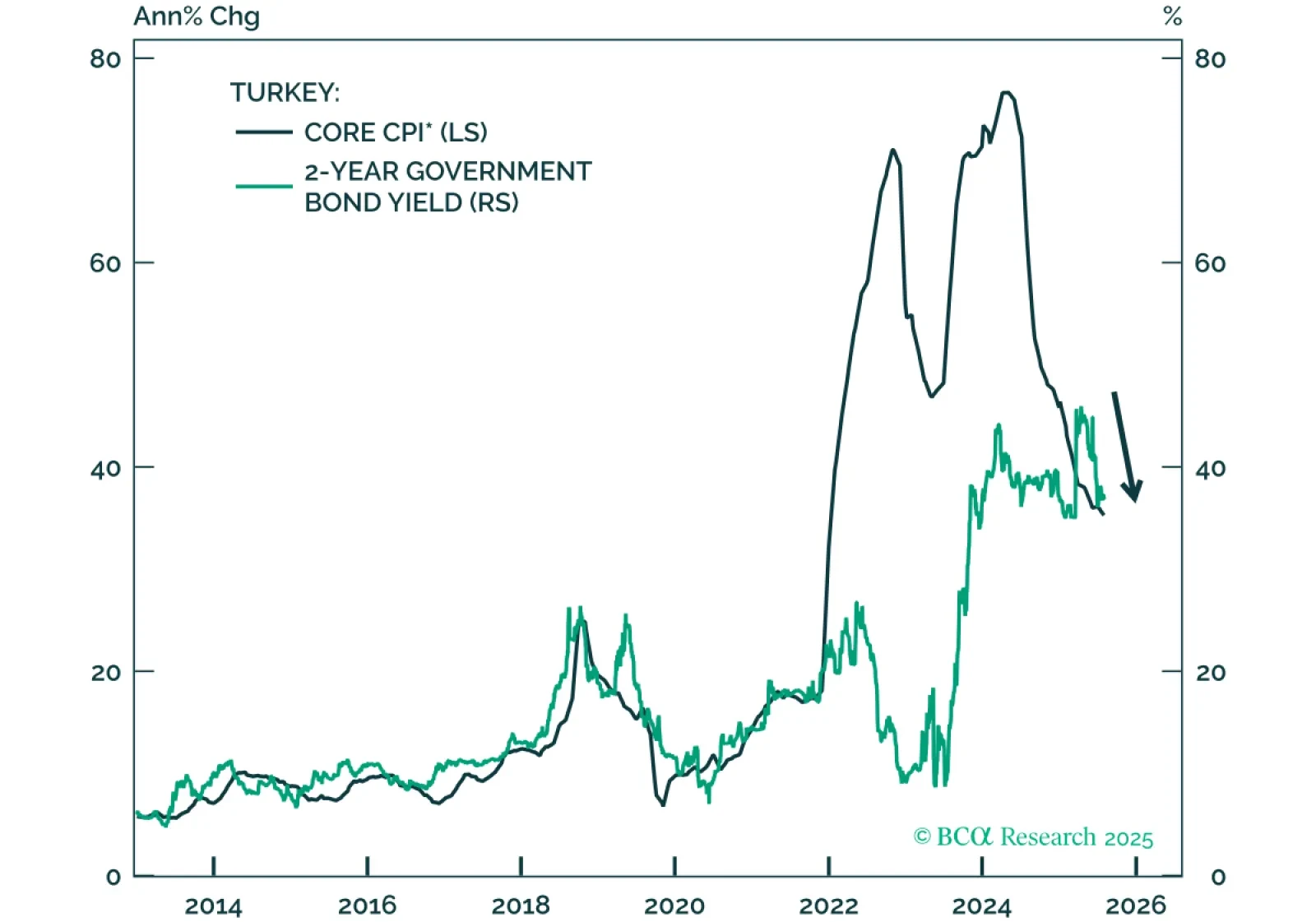

Turkey’s financial policymakers have pursued a disciplined and restrictive policy mix so far, delivering high real interest rates and curbing fiscal expansion even as the economy slows. This commitment to inflation control has paved the…

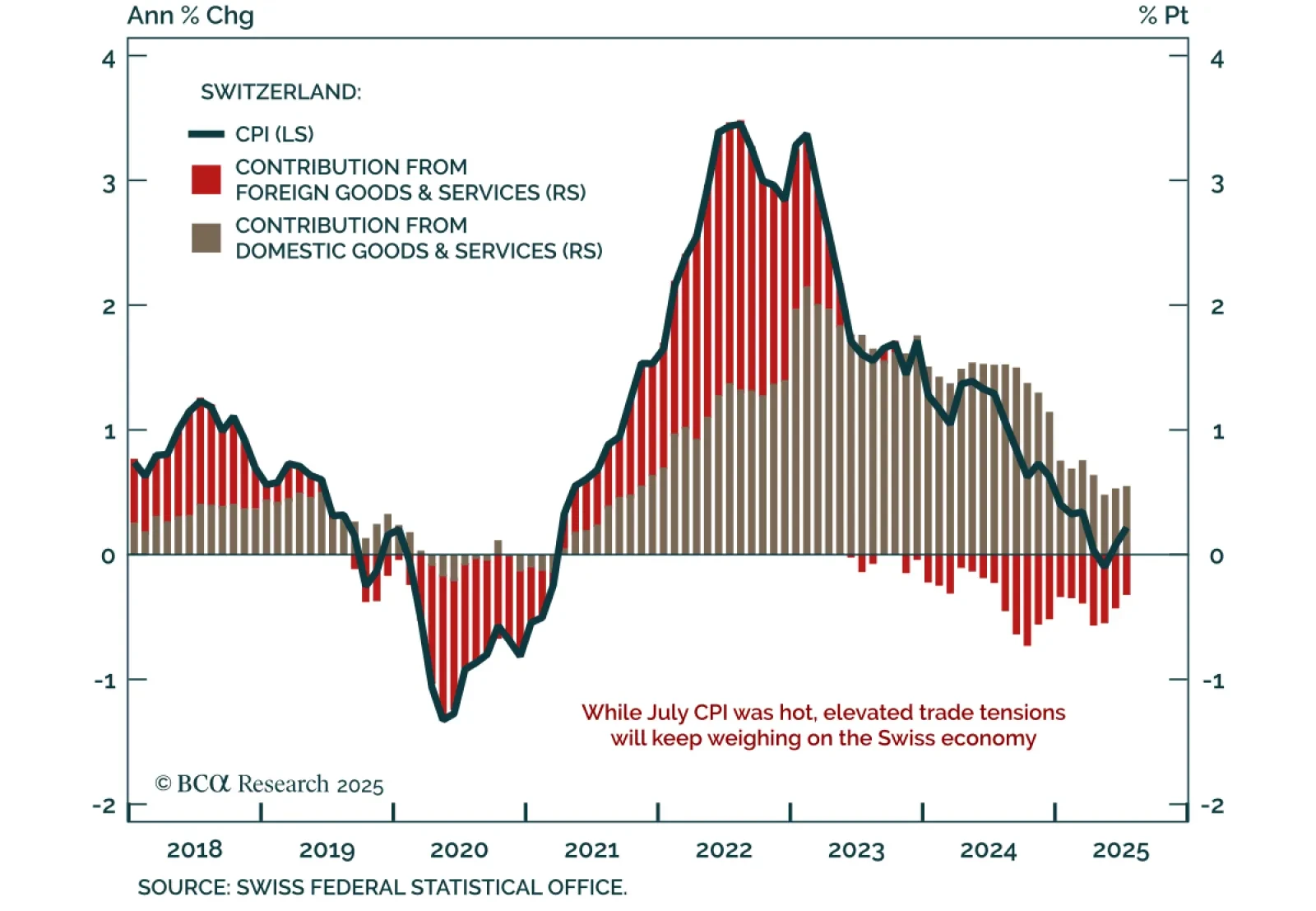

Hot July inflation does little to alter Switzerland’s near-term deflationary outlook, as soft data and trade risks support a defensive stance and preference for bonds over equities. CPI ticked up to 0.2% y/y from 0.1%, with core…

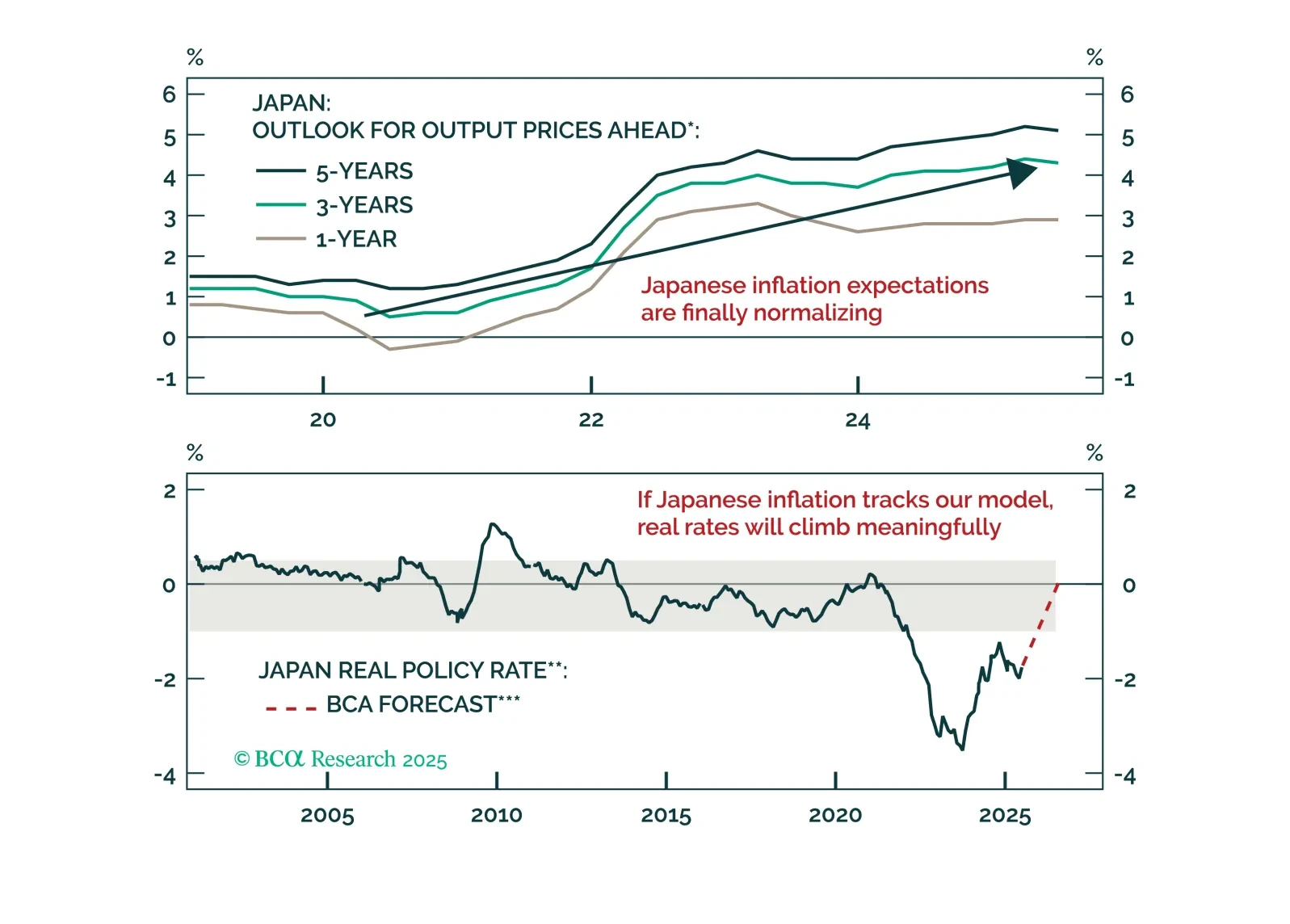

The yen’s discount, surplus, and rising real rates line up for a multi-quarter surge. Find out why EUR/JPY is the first short and when USD/JPY follows.

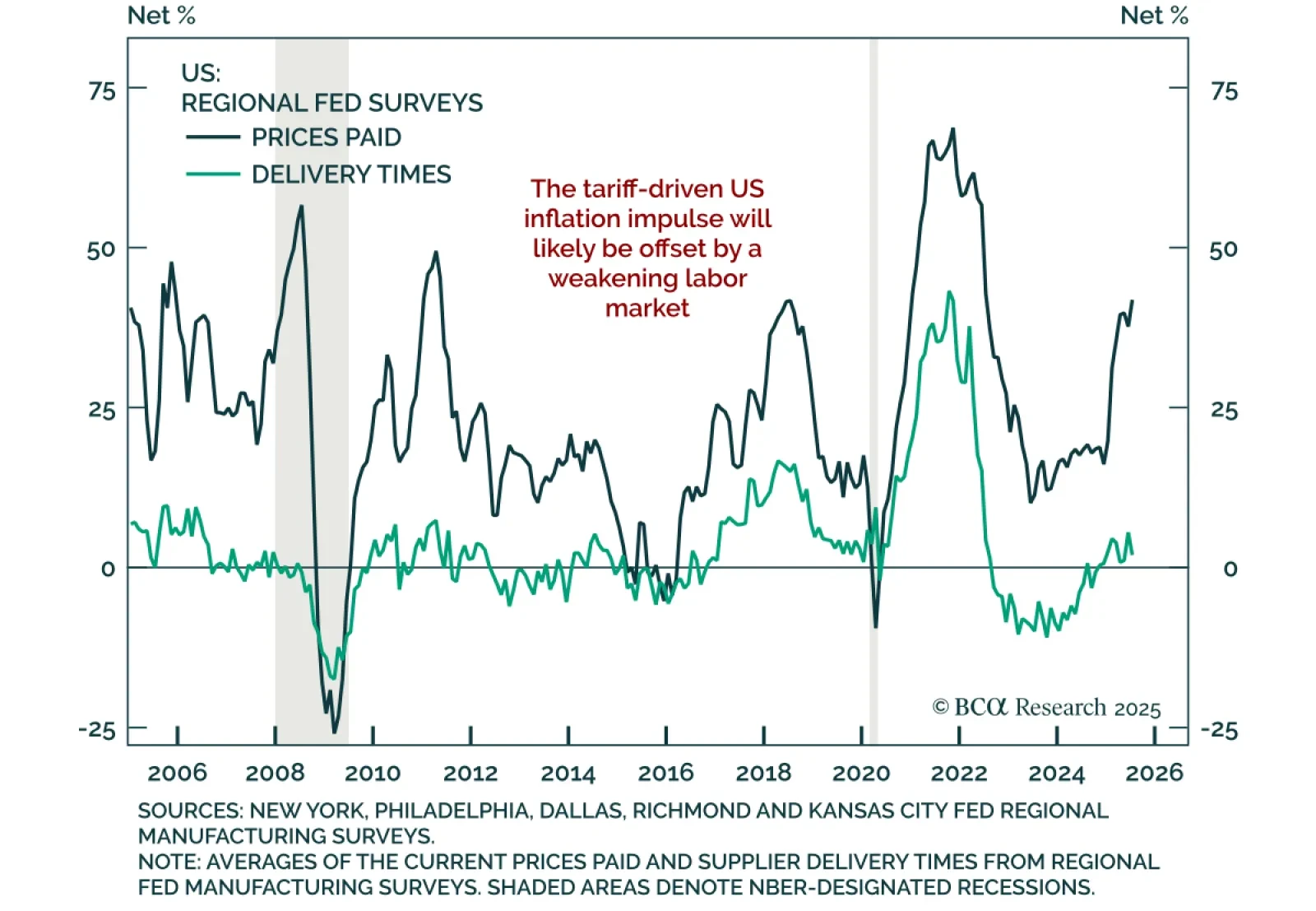

The July Dallas Fed survey beat expectations, pointing to a rebound in current activity, but the outlook remains subdued, supporting our modestly defensive asset allocation. The headline index rose to 0.9 from -12.7 in June, with…

The Japan-US trade deal removes short-term uncertainty but leaves in place high tariffs. The deal imposes a 15% tariff on most Japanese exports, lower than the previously threatened 25% on autos, and includes Japanese commitments to…