Highlights Investors ran for cover in December as they succumbed to a litany of worries regarding the outlook. The key question is whether the pessimism is overdone or an extended equity bear market is underway. Our outlook for the U.…

Highlights So What? Our best and worst calls of 2018 cast light on our methodology and 2019 forecasts. Why? Our clients took us to task for violating our own methodology on the Iranian oil sanctions. Sticking to our guns would…

The just-concluded midterm election saw no opposition to President Trump on trade. The Democratic Party candidates campaigned against the president on a range of issues, but not on his aggressive China policy. Polling from the…

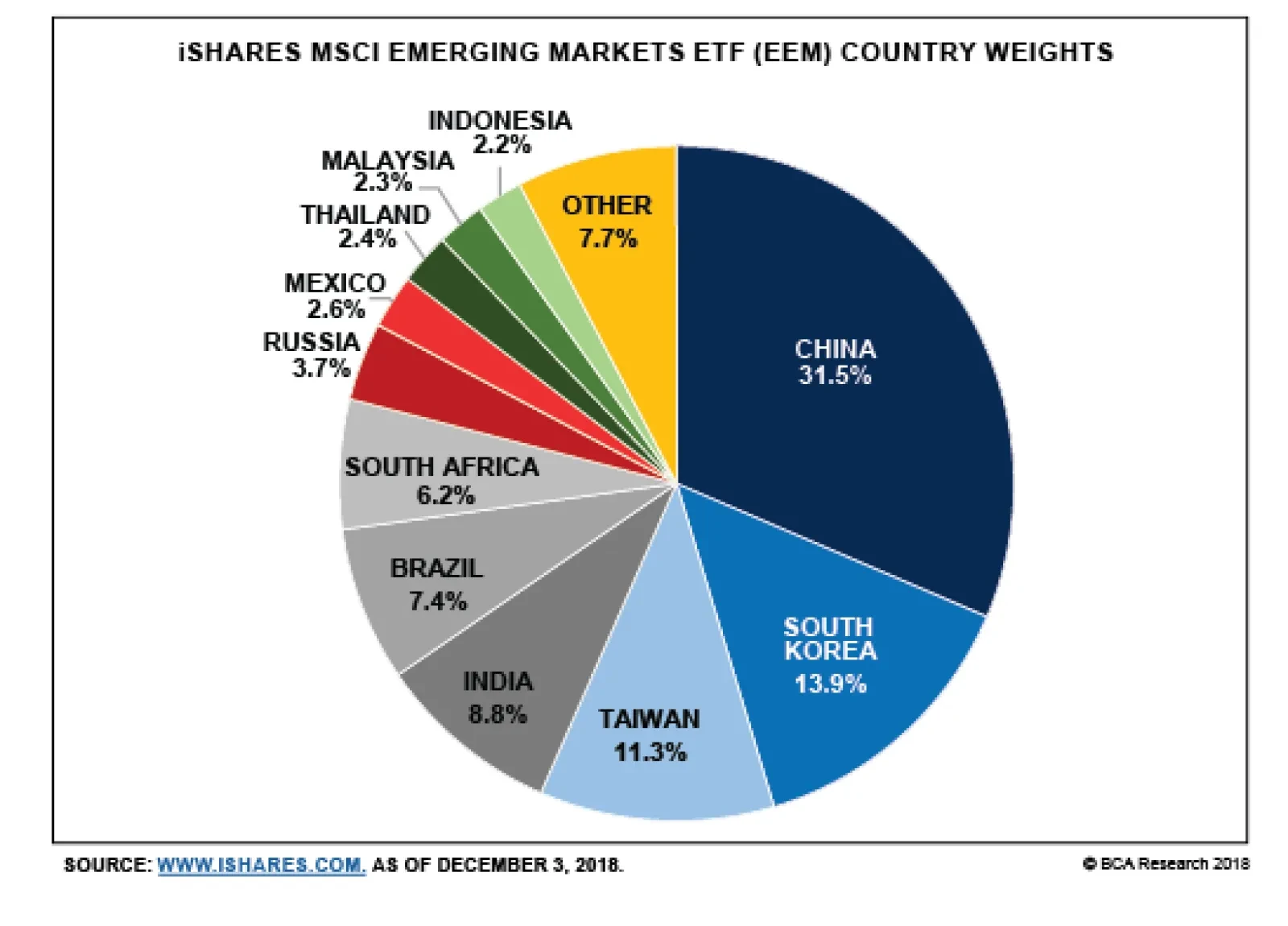

Highlights So What? Global divergence will persist beyond the near term. Why? China’s stimulus will be disappointing unless things get much worse. U.S.-China trade war will reignite and strategic tensions will continue.…

… quick’s the word and sharp’s the action. Jack Aubrey1 Idiosyncratic supply-demand adjustments – some induced by head-spinning reversals of policy (e.g., the U.S. about-face on Iran oil export sanctions)…

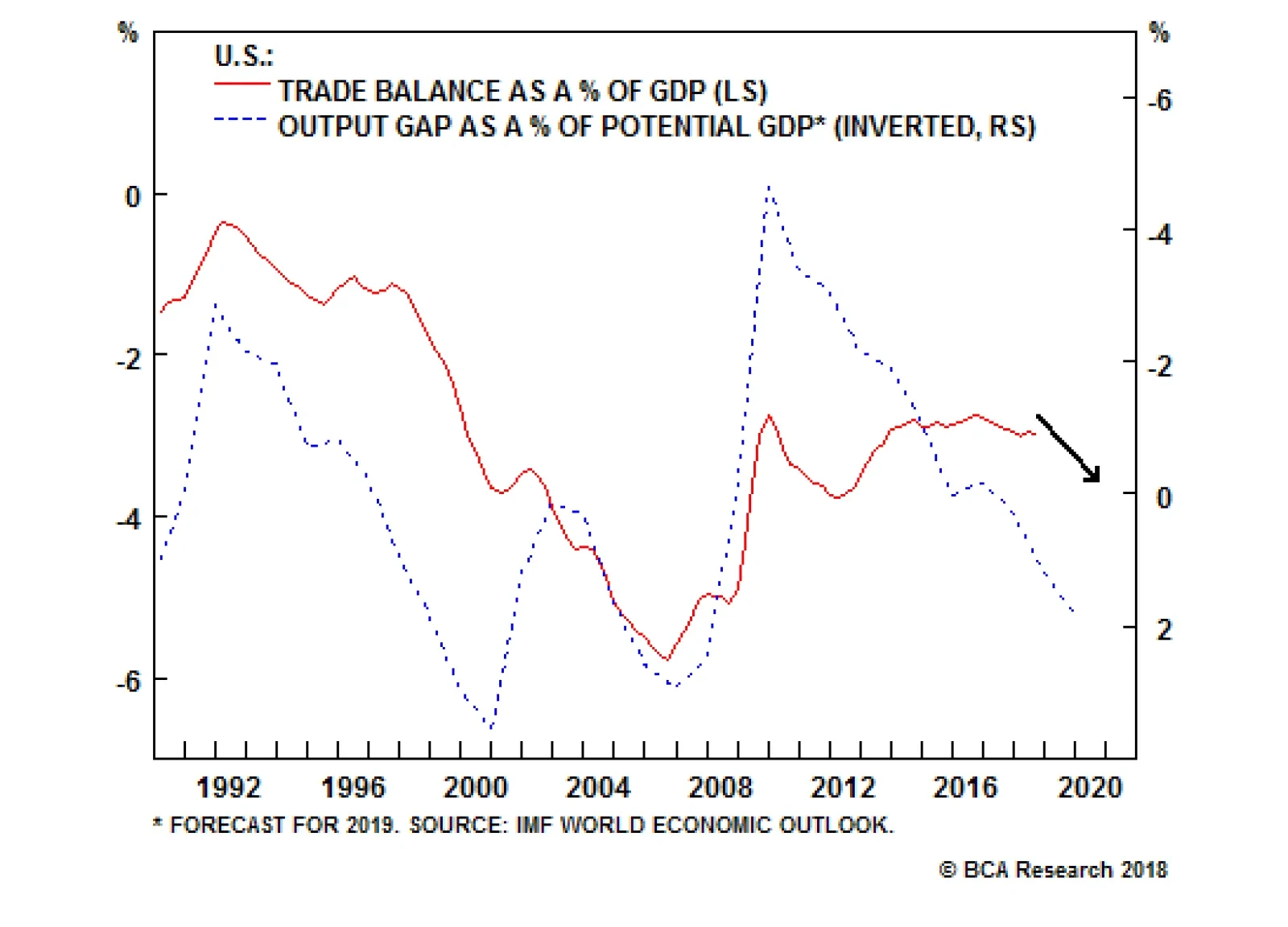

There are various drivers of the U.S.-China trade war. Geopolitics is a big one. From a structural perspective, the redistribution of power from the U.S. to China is creating ‘fat geopolitical tails’. This implies…

Highlights The dollar will continue to rally despite the trade truce agreed upon last weekend between U.S. President Donald Trump and China President Xi Jinping. Not only is this truce far from a permanent deal, but global growth…