The latest news flow is mildly positive for the odds of getting a framework deal sometime this year. President Trump visited the Chinese negotiators in Washington, while President Xi reciprocated with the American negotiators in…

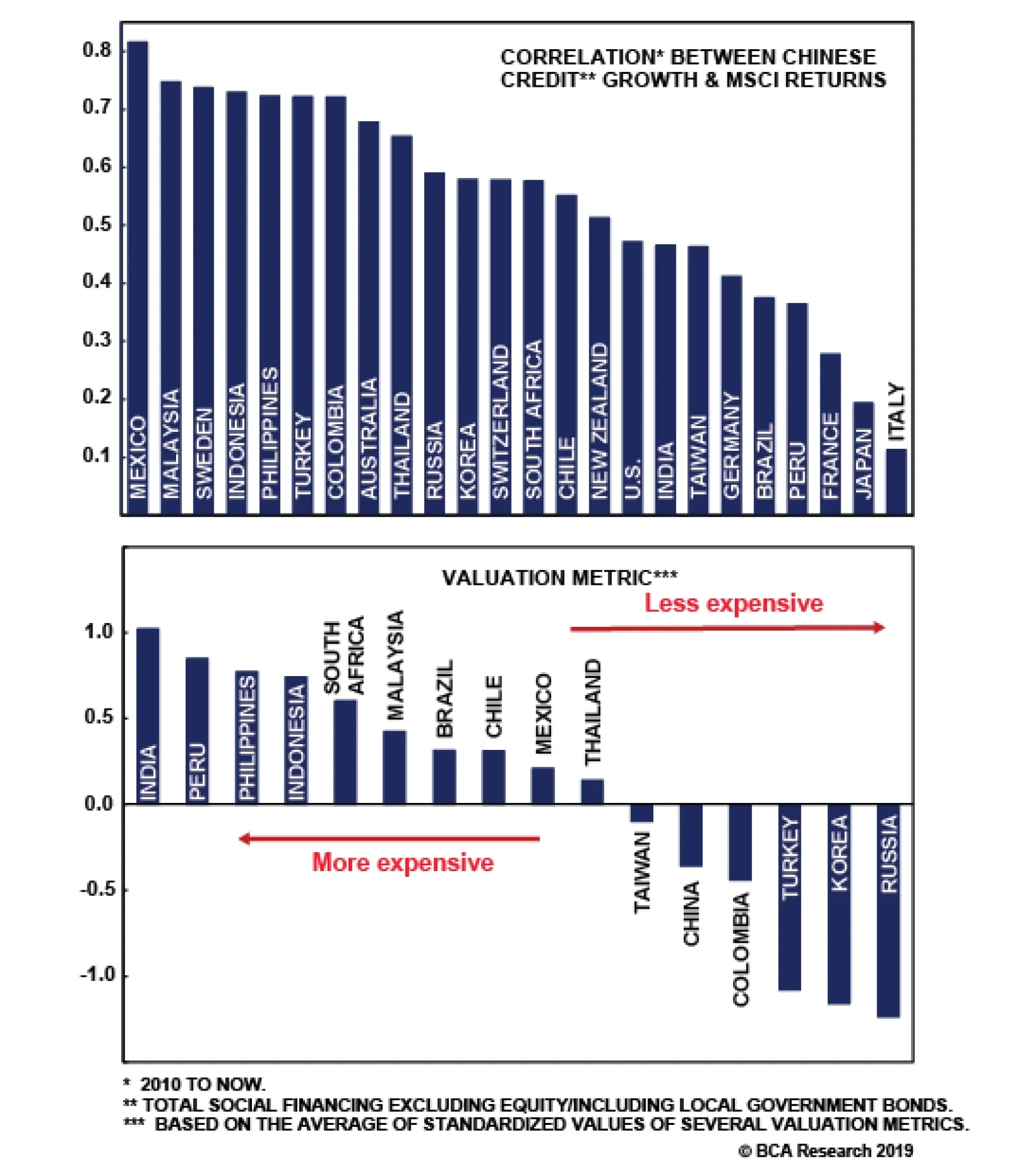

Our Geopolitical Strategy service examines the relationship between Chinese credit and MSCI equity returns of various countries. We find that Malaysian, Australian, South Korean, and Indonesian equities are the most highly…

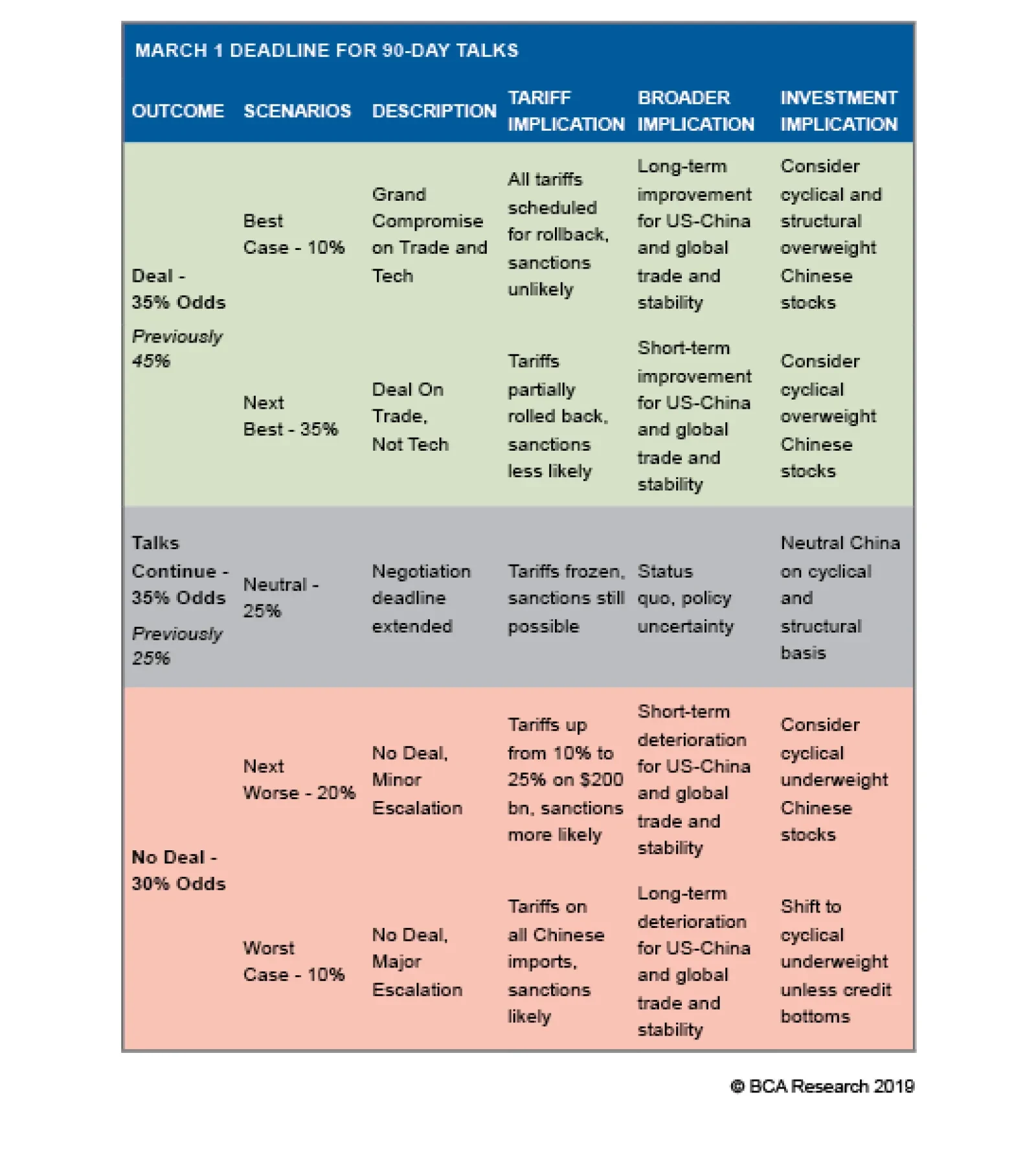

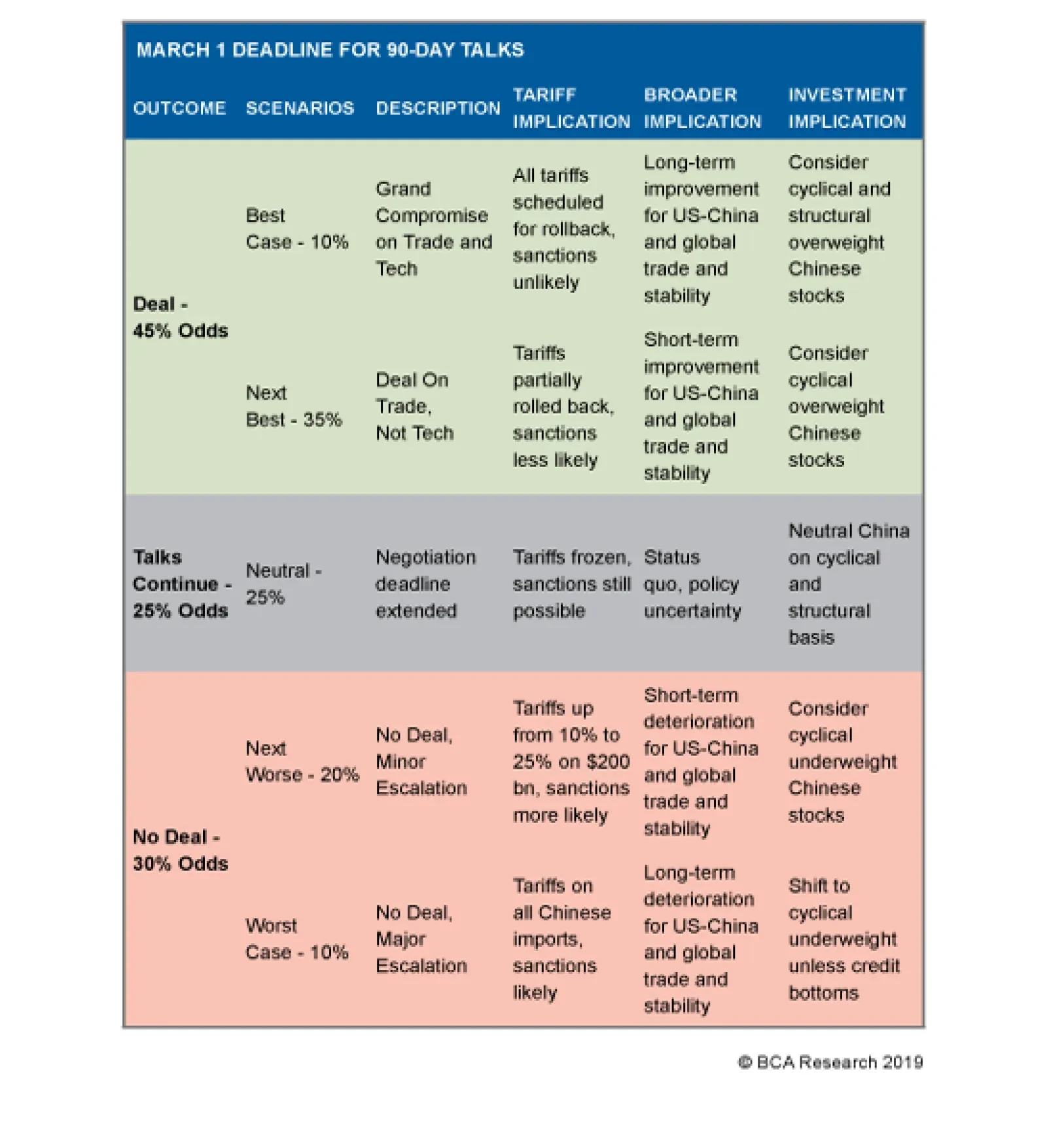

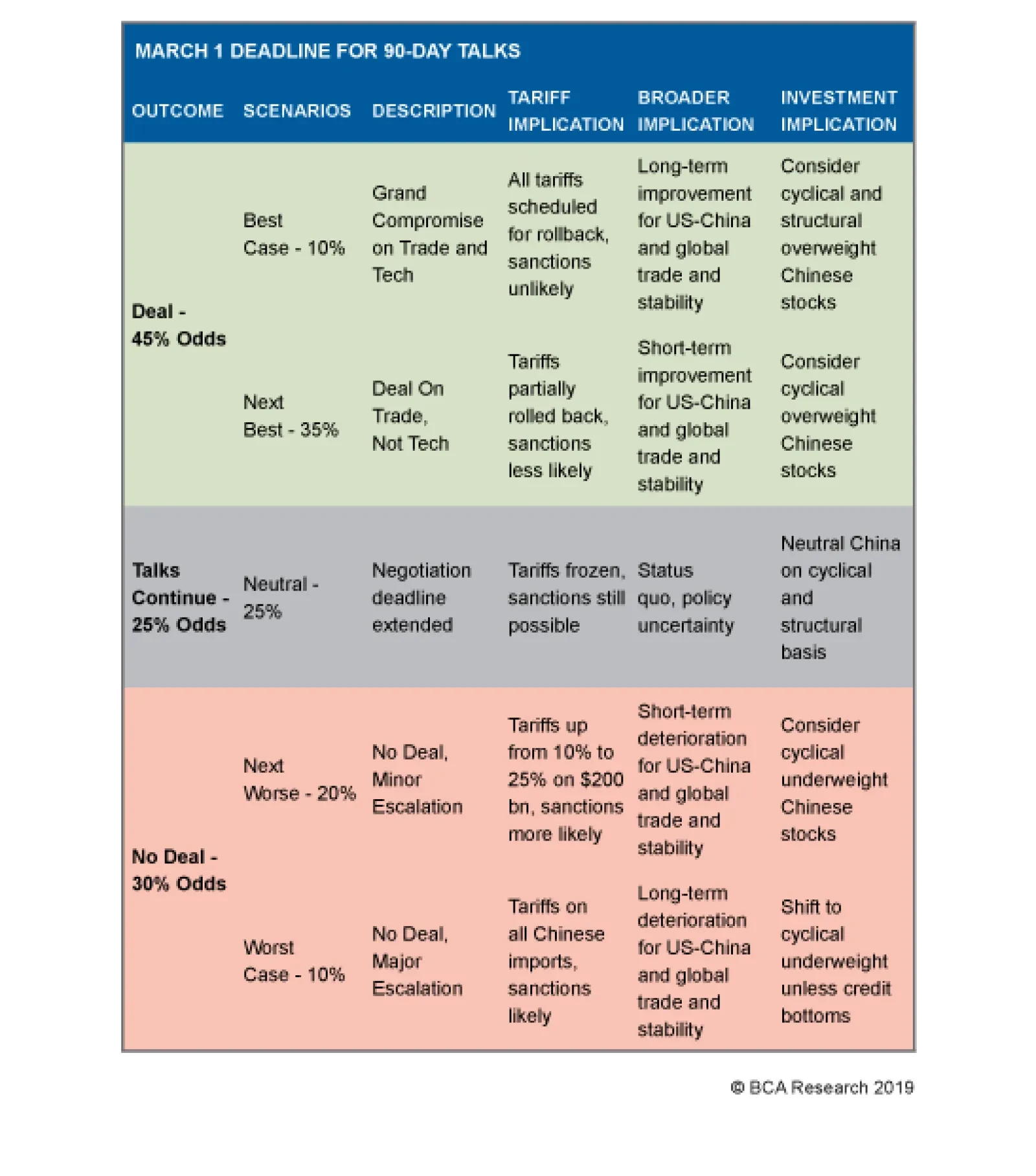

The above table presents our geopolitical strategists latest expectations of where the U.S. and China will be on March 1. We assign only 10% each to the “black and white” outcomes: a “Grand Compromise” or…

Highlights So What? The late-cycle rally faces non-trivial political hurdles. Why? The rally is based on a too-sanguine view of the Fed, China, and the trade war. Other issues – like Brexit and the U.S. border showdown…

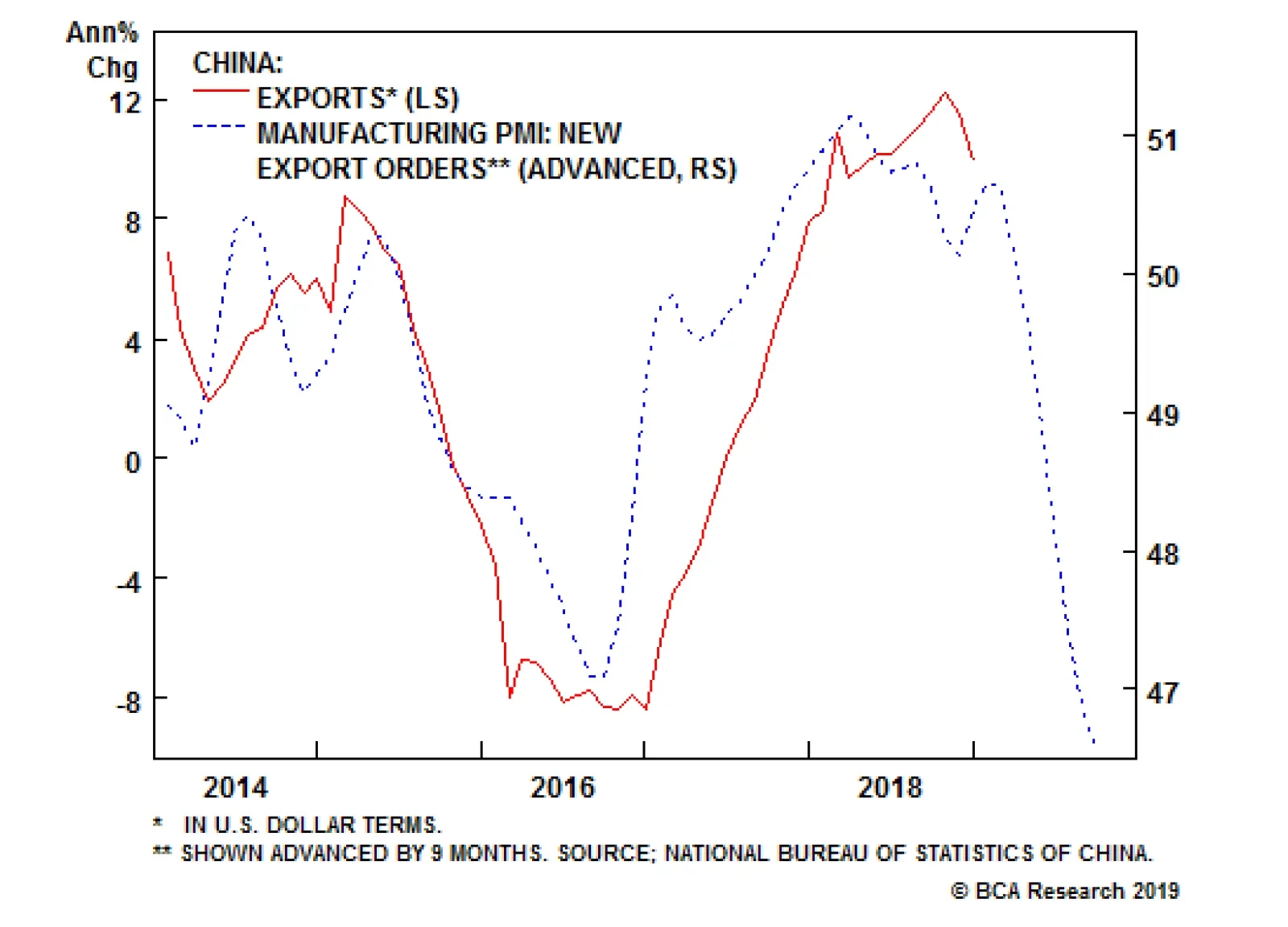

Highlights Our leading indicator for China’s “old economy” remains weak, and the beneficial trade front-running effect that has supported some of China’s macro data over the past year is beginning to wane. Our…

The most likely basis for a “whatever it takes” policy moment in China is either a sudden and sharp deterioration in the economy despite the various easing measures, or a renewed escalation of the trade war. Our…

Poor trade numbers out of China contributed to a wave of selling in the markets on Monday. While China’s trade balance improved in December, rising from CNY306 billion to CNY395 billion, beating expectations in the process…

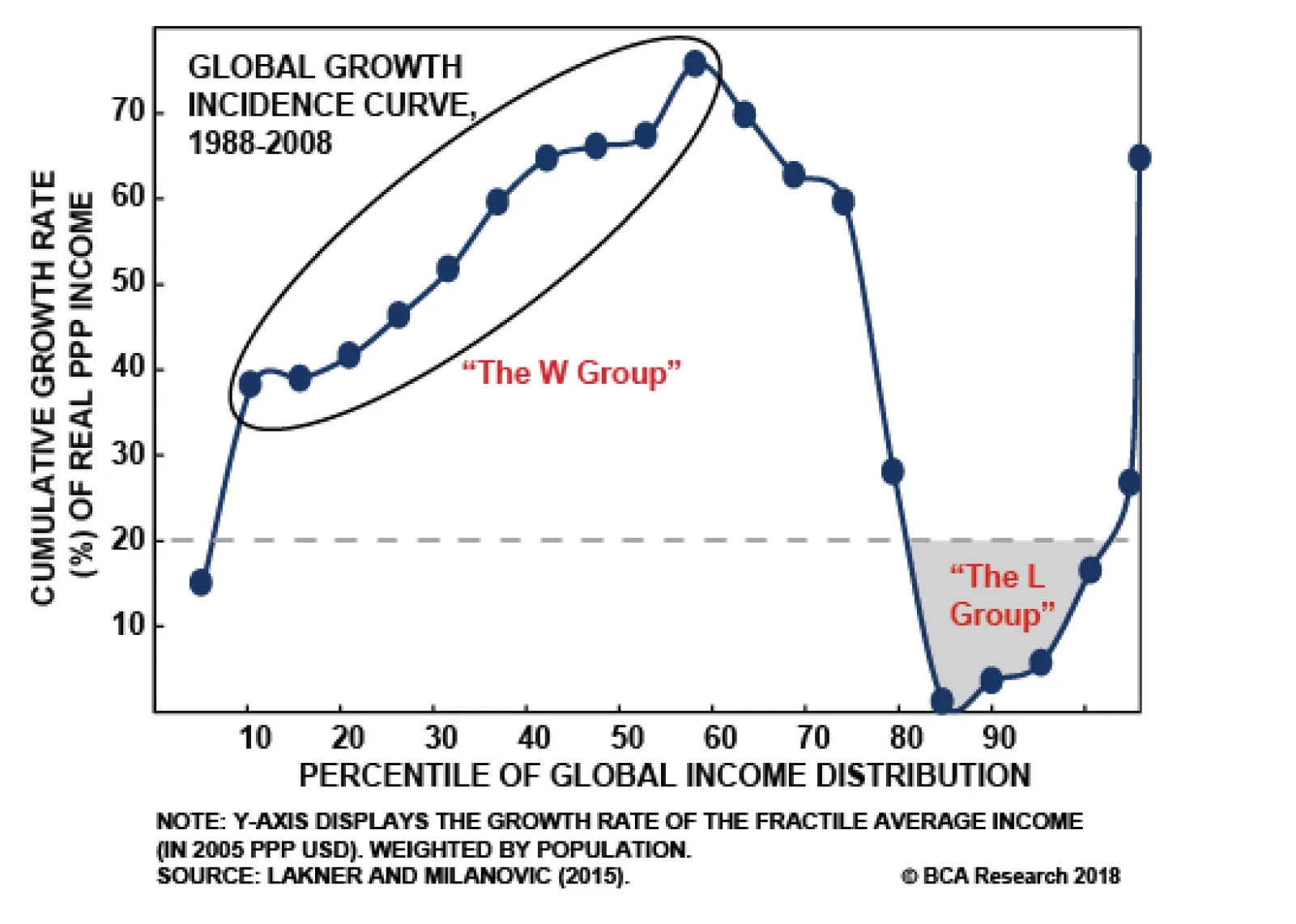

There are three levels of inequality that investors need to be familiar with in the context of populism: global, national, labor. The first level starts big, on the international stage, where economic outcomes are examined on a…