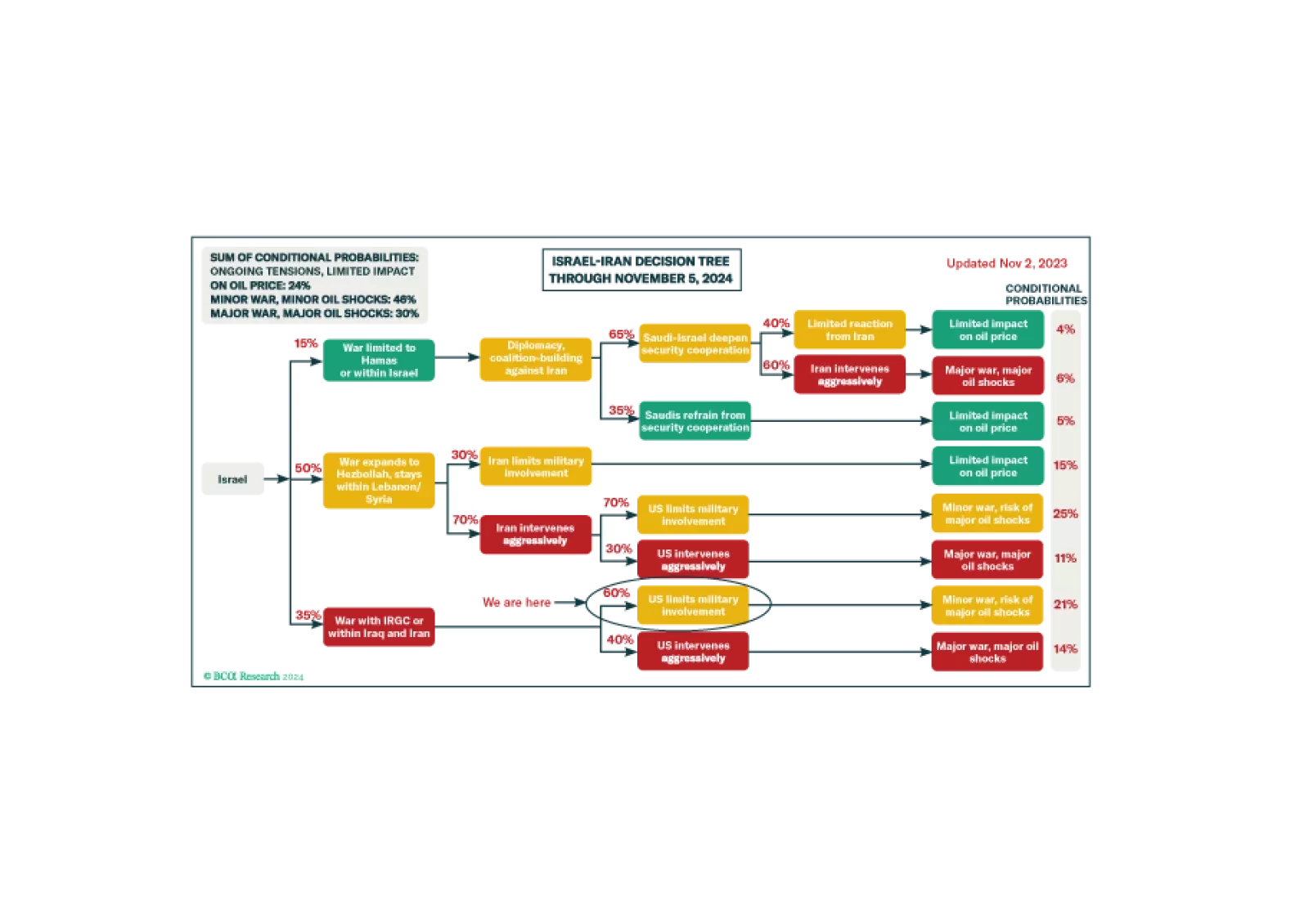

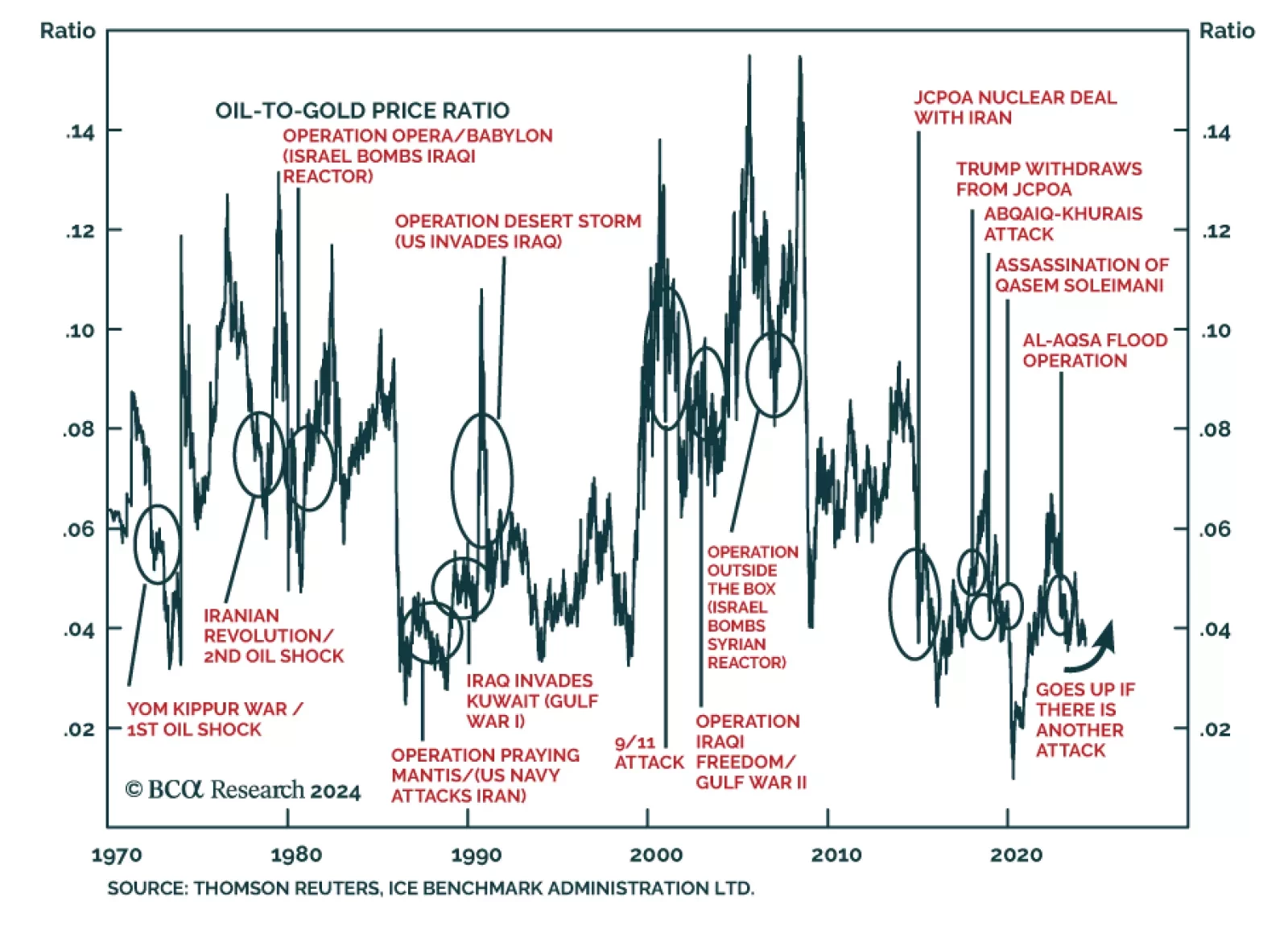

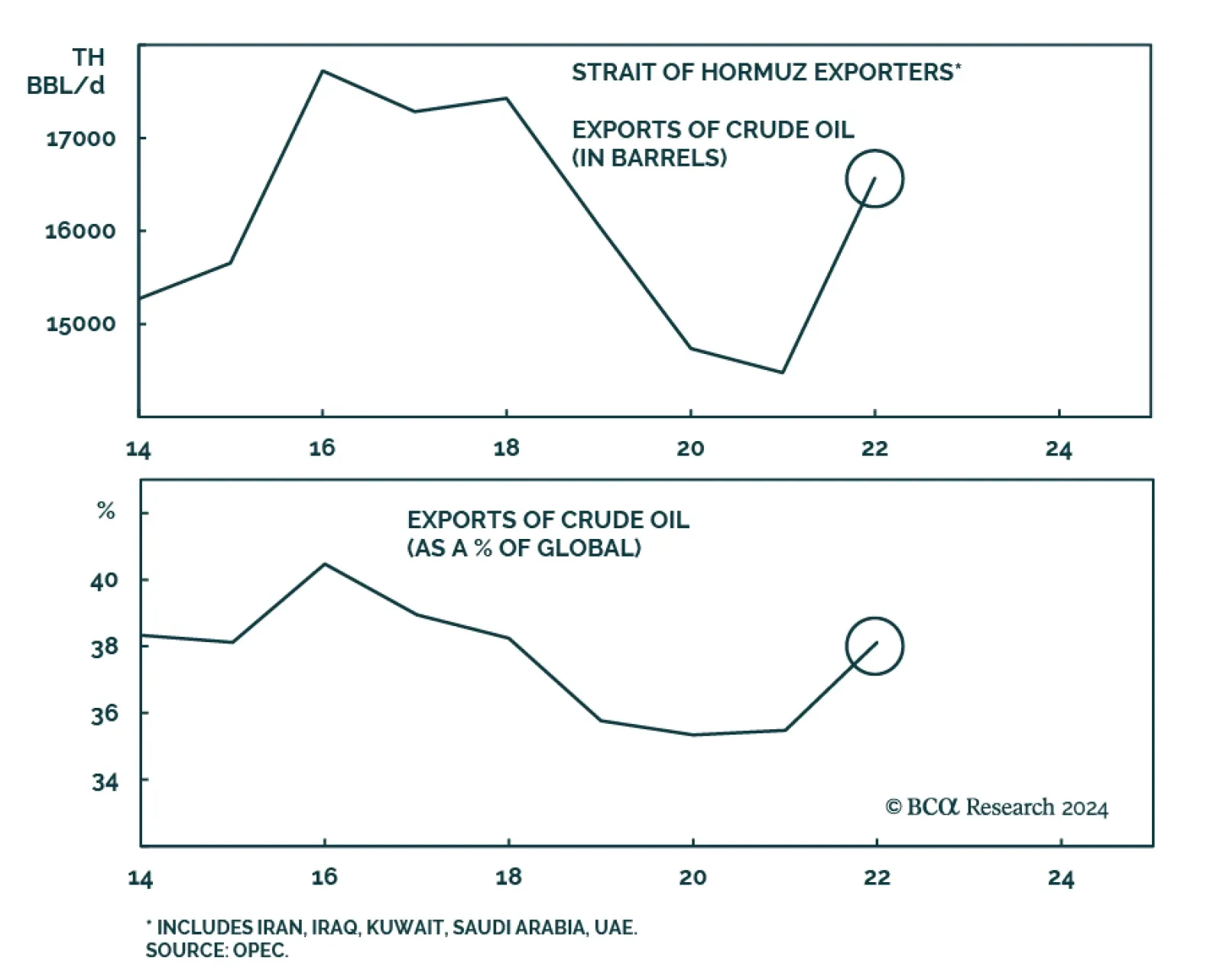

According to BCA Research’s Commodity & Energy Strategy and Geopolitical Strategy services, there are several avenues for tensions between Israel and Iran to escalate. Investors need to hedge against a 30% risk of a…

The implication is that Israel chose not to escalate the risk of direct war with Iran. Hence we remain in our base-case “Minor War, Minor Oil Shock” scenario.

In the near term, favor oil and oil producers outside the Gulf Arab states. Over a 12-month horizon, favor US and North American equities, defensive sectors over cyclicals, and safe-assets. Within cyclicals, stick to energy and…

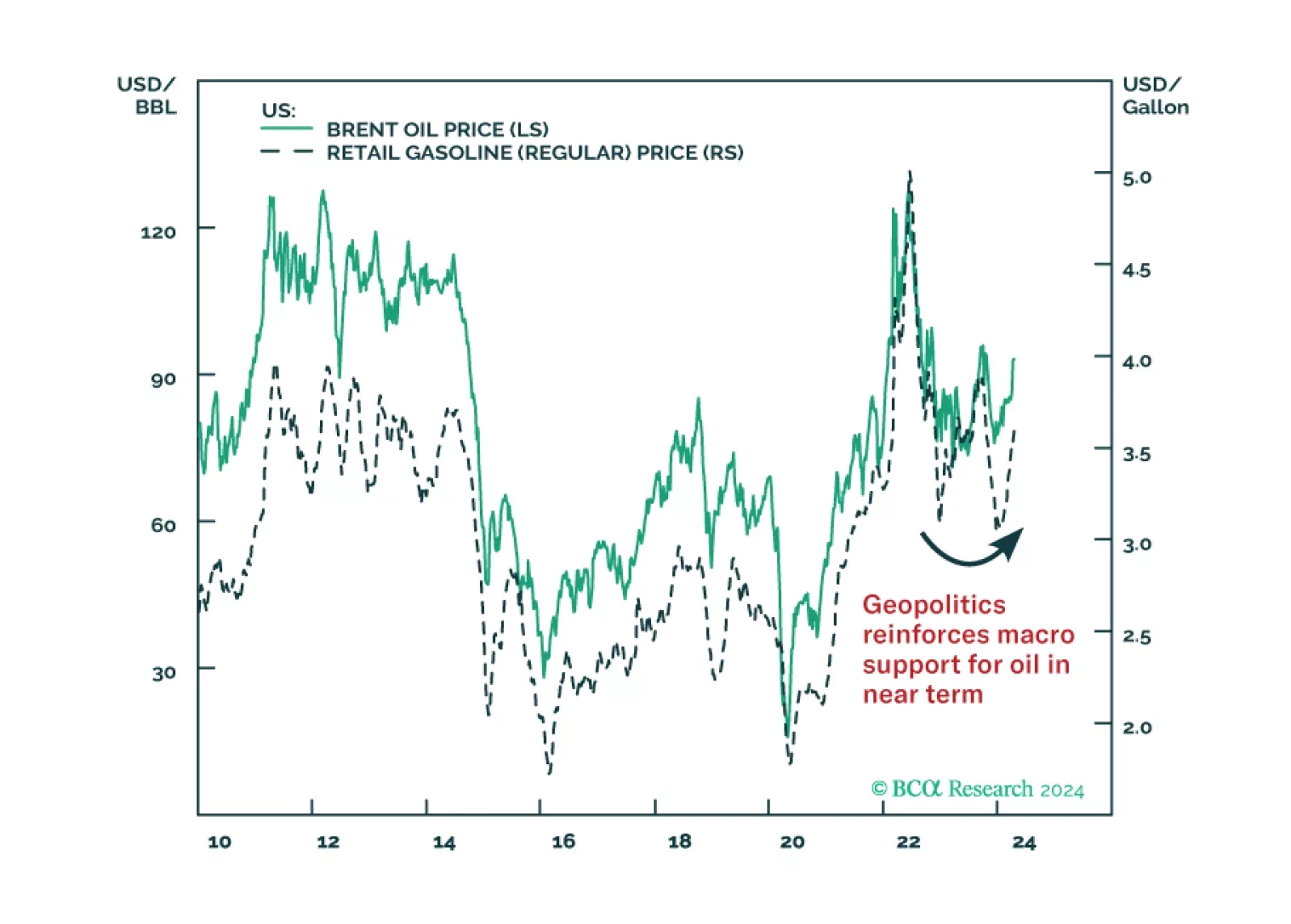

Financial markets appear unphased by the increase in Mideast tensions that occurred with Iran’s retaliatory attack on Israel over the weekend. Most notably, crude oil prices declined on Monday, suggesting that investors are…

Stay overweight US equities versus world, long US energy sector versus Middle East stocks, and long Canada and Mexico versus global-ex-US stocks.

Oil prices surged over the past two days on the back of heightened geopolitical risks to supply following increased tensions in the Middle East. Both Iran’s Supreme Leader Ayatollah Ali Khamenei and President Ebrahim Raisi…

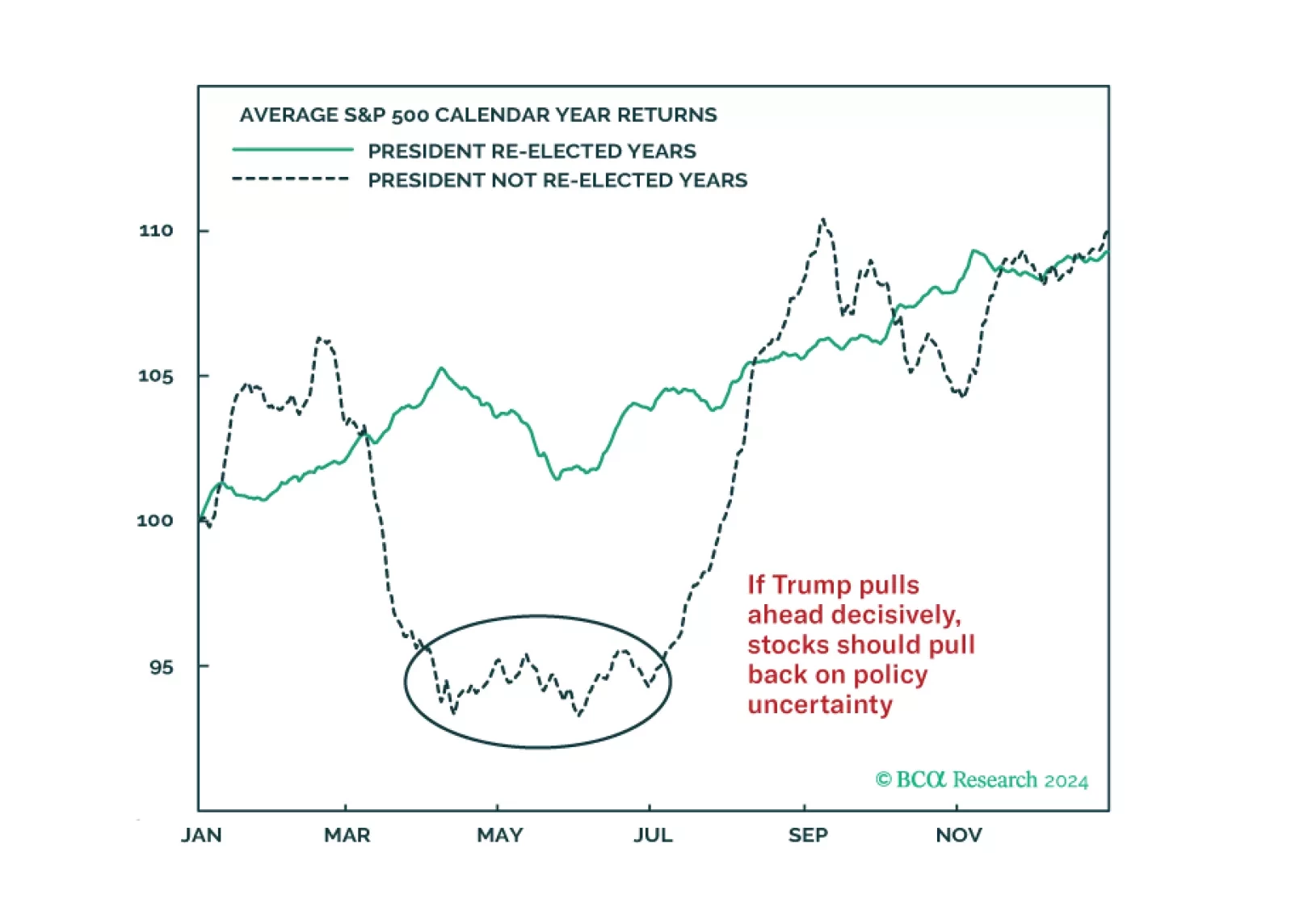

Investors around Europe and North America are concerned that the stock market is increasingly overbought and vulnerable to exogenous risks. We agree and have good reasons to fear that festering geopolitical risks and the US election…

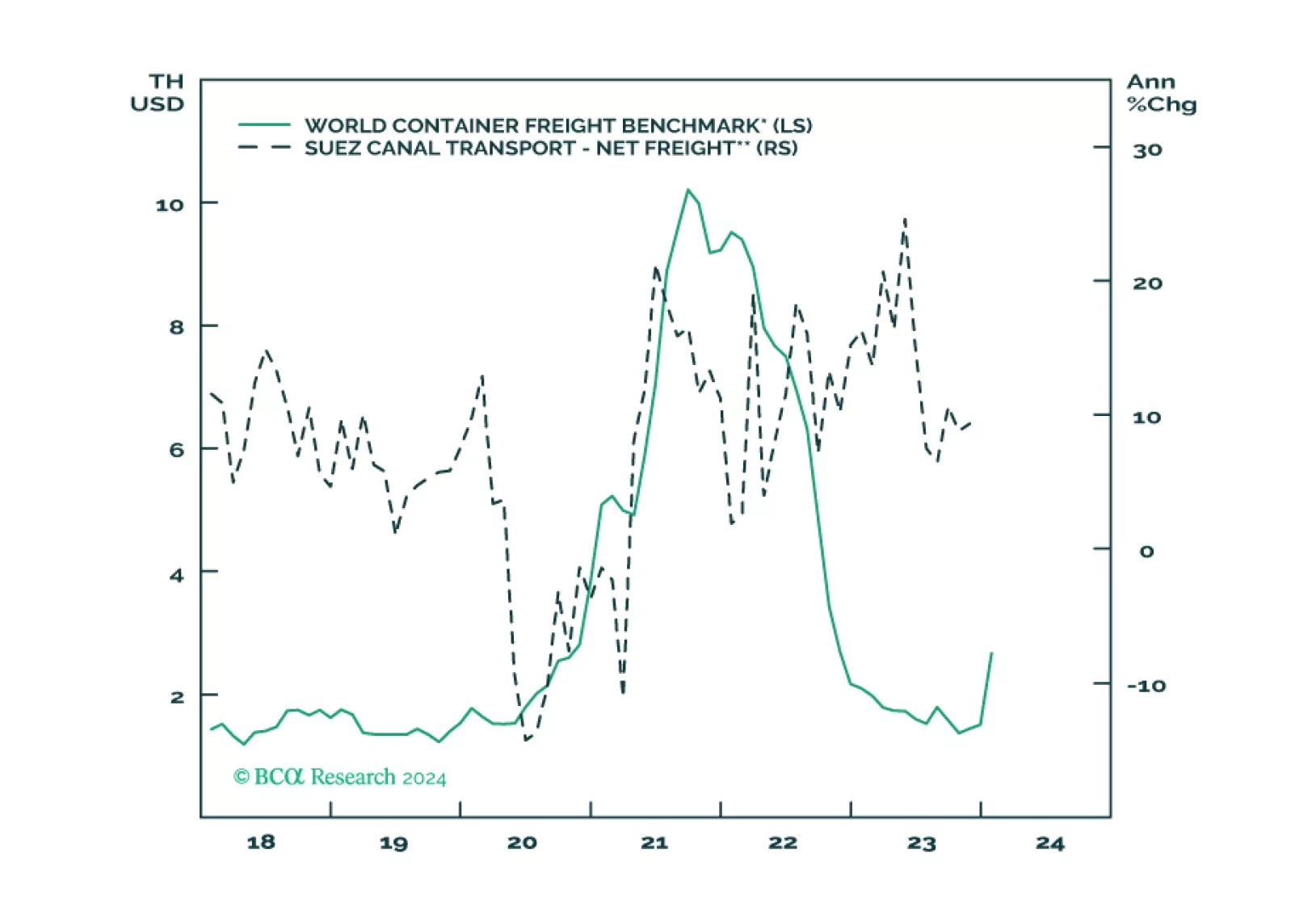

In this brief Insight we examine the expanding Middle East conflict and update the situation in the Taiwan Strait on the eve of elections. The Houthis are a distraction and China is not likely to invade Taiwan in the near term, but…

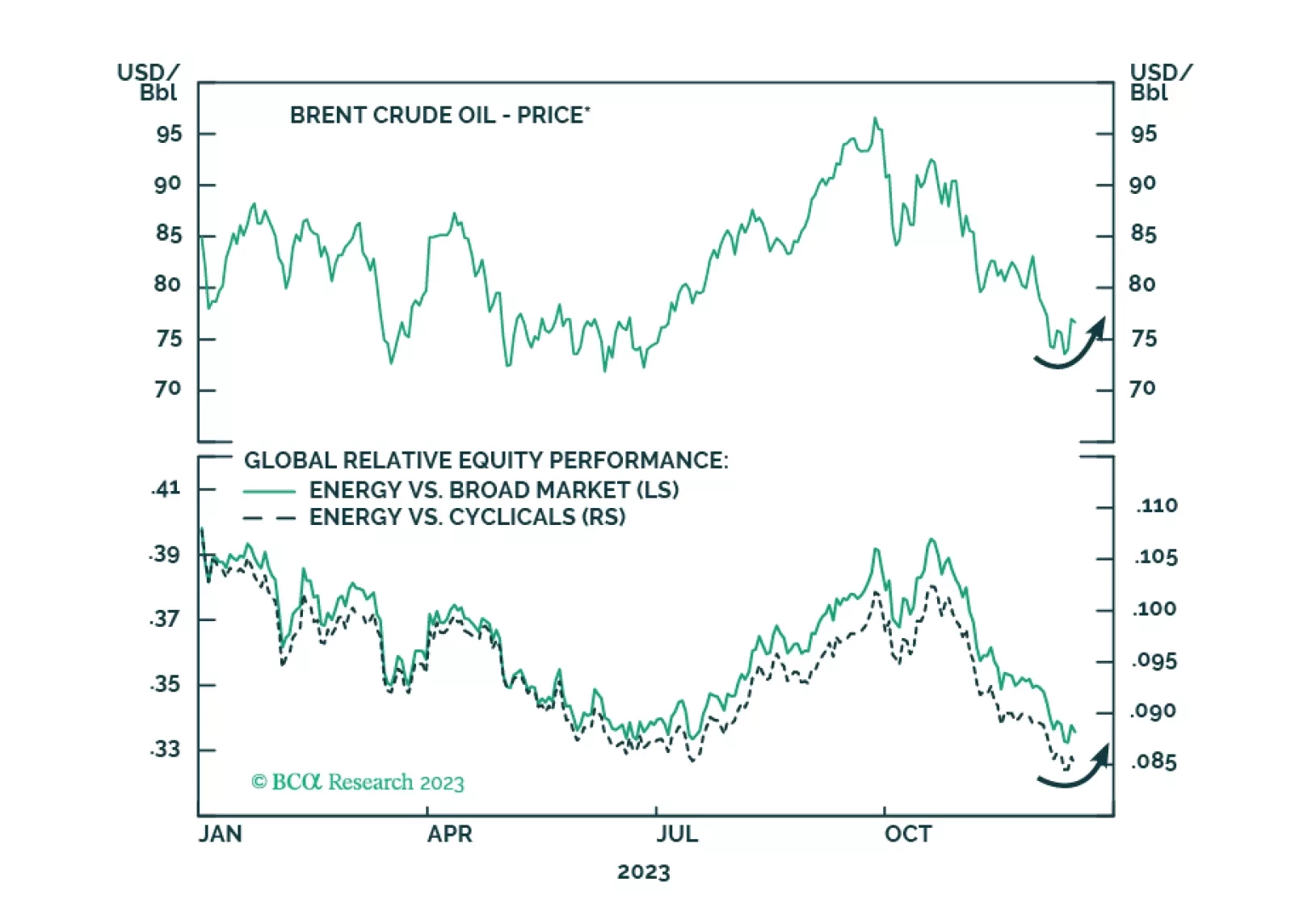

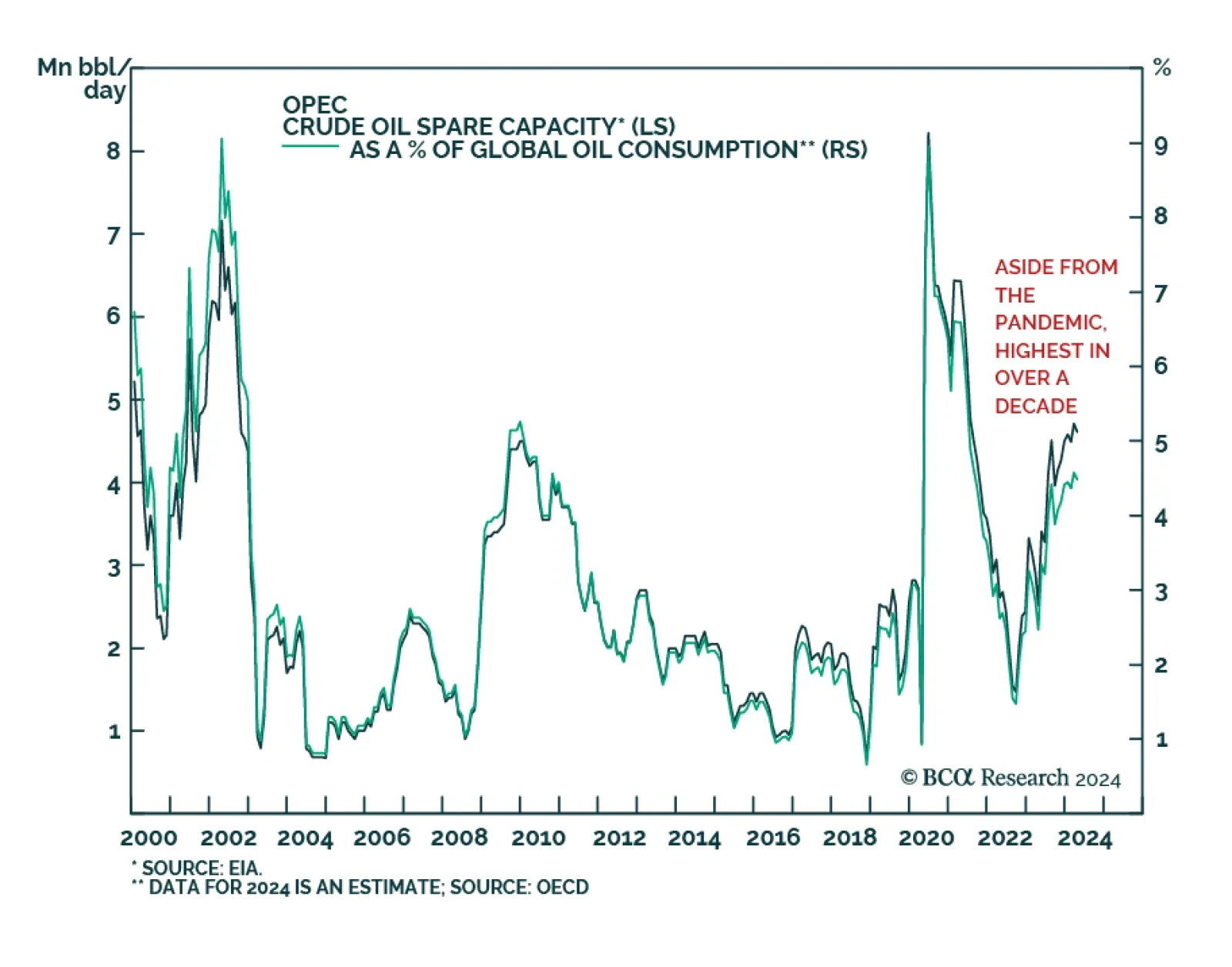

Oil prices will rise tactically due to supply risks. Recent developments indicate escalation of the conflict with Iran in the Middle East and confirm our expectation of energy supply disruptions and oil price spikes in the short run…

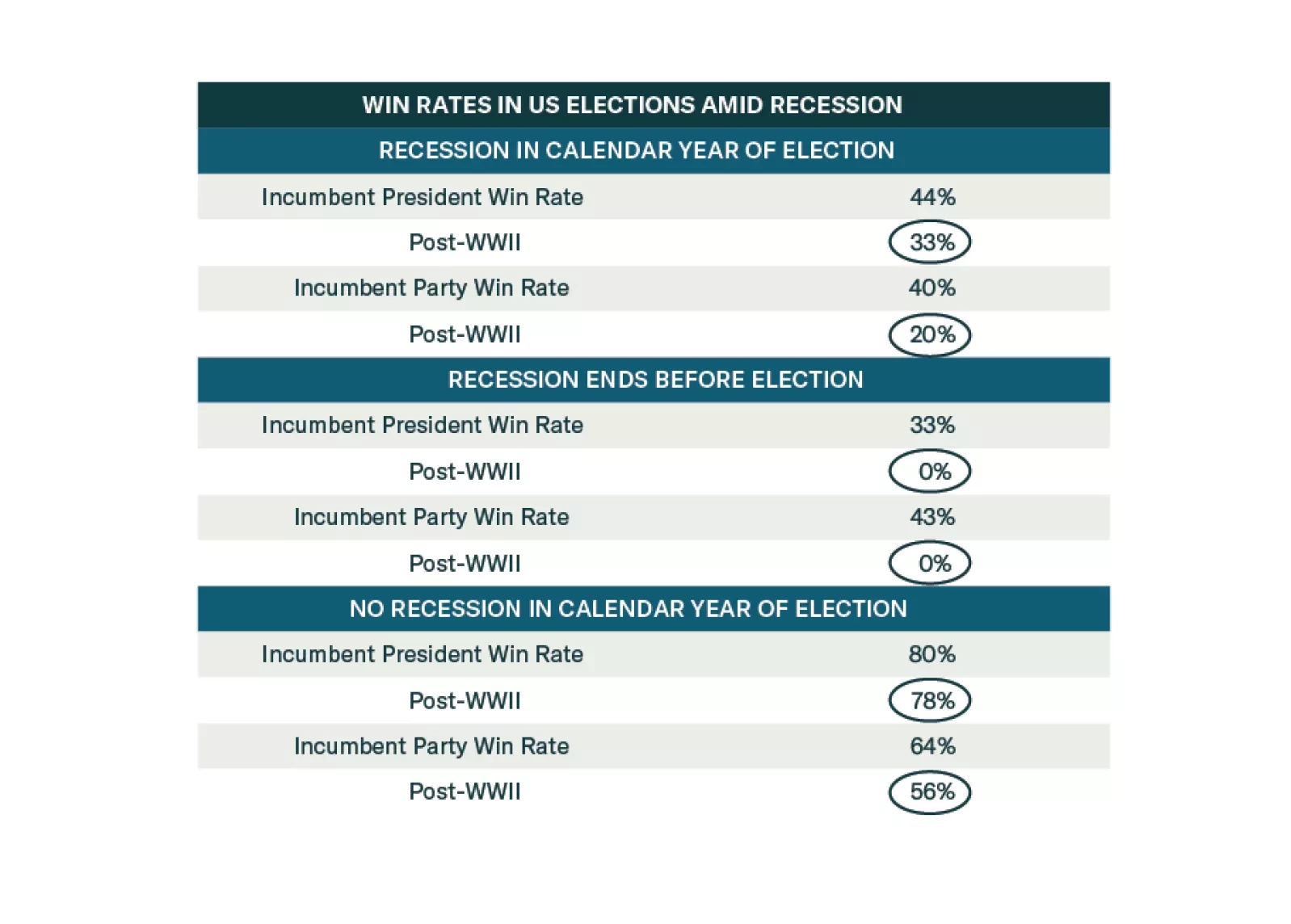

Democrats are favored to win the election until recession materializes. But recession risks are high. Investors should adopt a defensive and conservative strategy in 2024 amid extreme US policy uncertainty.