Underweight In early-2018, some green shoots appeared for telecom services that an end was in sight for the nearly two years of pricing deflation hitting industry profits as some year-on-year pricing gains were eked out. However, as…

Underweight In our previous Insight, we highlighted the S&P REITs index’s tight inverse correlation with UST yields, but it is far from the only group with this trait. The S&P telecom services index (now a subsector within…

The reshuffling dilutes what until recently was a pure-play safe haven index. Previously, telecommunications services was an ultra-low beta, high-dividend, zero currency-exposure prototypical defensive index. Communication…

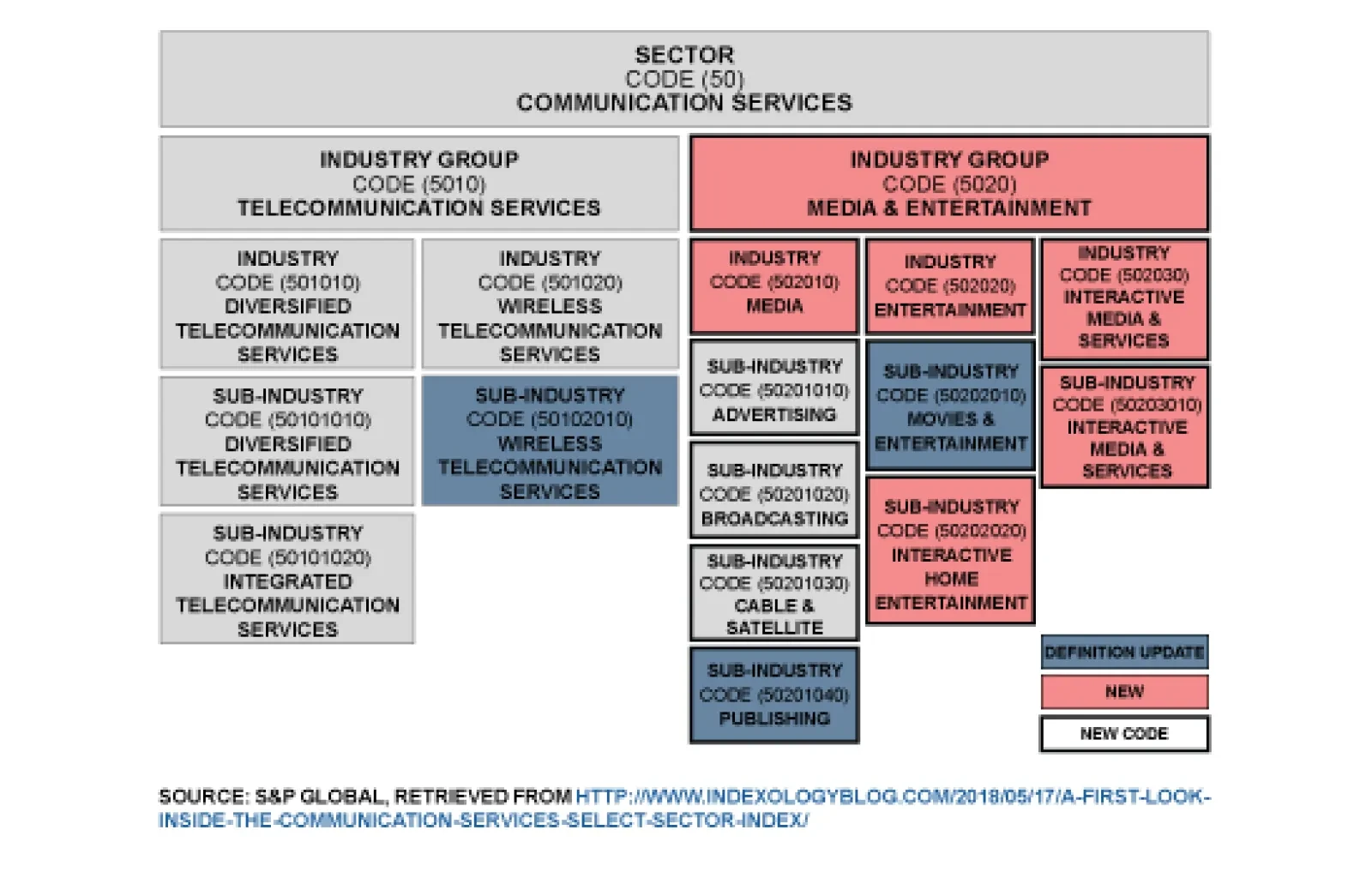

Underweight At the market's close last Friday, investors welcomed a new (rather, a renamed) GICS1 sector to the industry taxonomy: the S&P communication services sector. The change had long been overdue as the progenitor…

Highlights Recommended Allocation We don't see any change over the next six to 12 months to the current trends of strong U.S. growth, continuing Fed hikes, rising long-term interest rates, and an appreciating dollar. We…

Please note that our next publication will be a joint special report with BCA’s Geopolitical Service that will be published on Wednesday, August 1st instead of our usual Monday publishing schedule. Further, there will be no…

Telecom services stocks rallied Tuesday, following positive news coming out of VZ's sellside analyst presentation. The mood was generous enough that our high-conviction underweight recommendation was stopped out at a 10% relative…

Underweight (High Conviction) News of a renewed attempt at a merger between Sprint and T-Mobile has weighed heavily on shares in the S&P telecom services index. Shares sold off on fears that a mightier competitor with the heft to…