Highlights Portfolio Strategy Despite the Fed’s supra natural powers, the deep rooted global growth slowdown will likely win the tug of war versus flush liquidity, especially if the trade war spat stays unresolved and the U.S.…

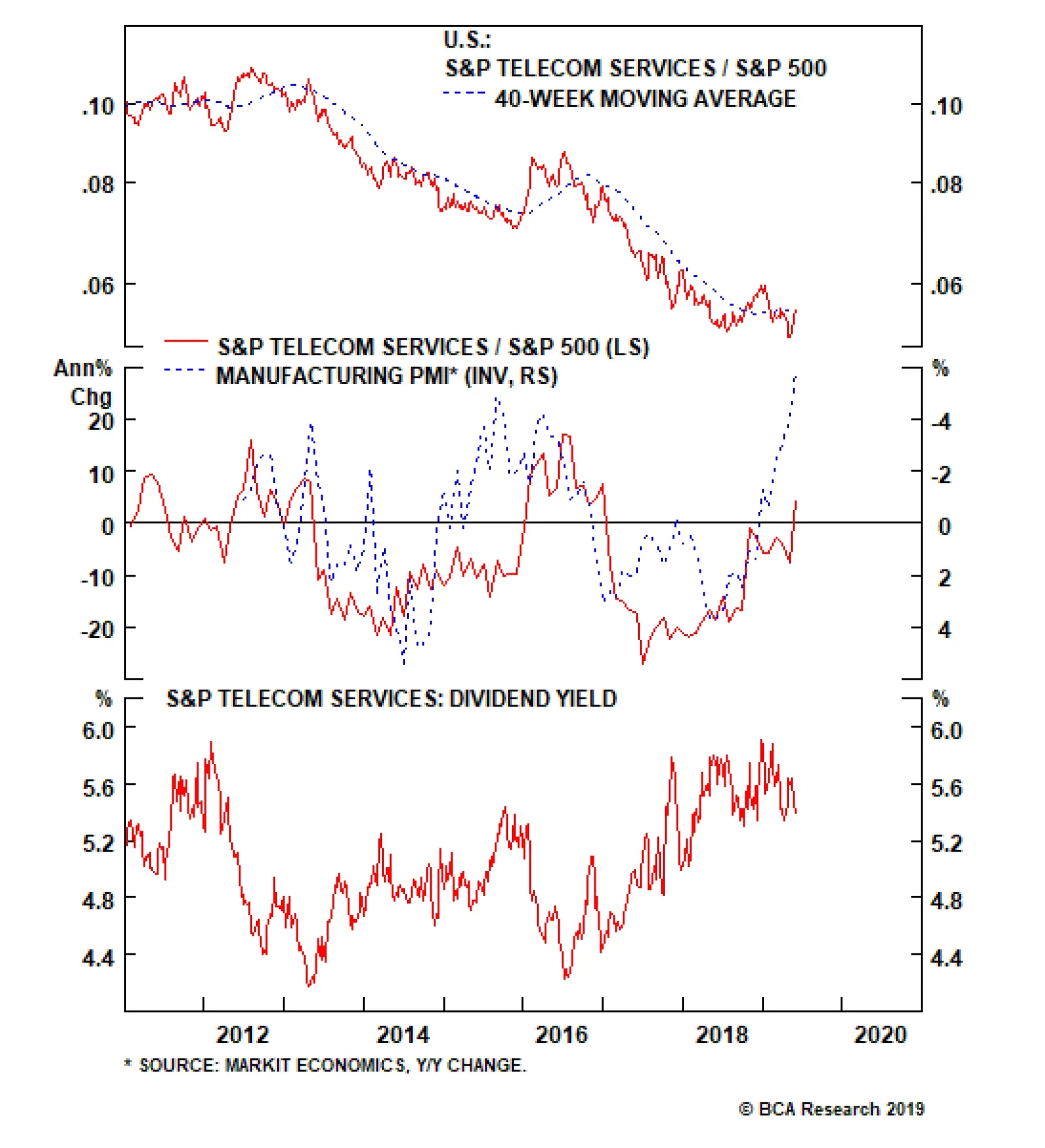

Neutral On Tuesday, we monetized gains of 6% in the S&P telecom services index. Gathering macro headwinds bode well for safe haven assets and it no longer pays to underweight high yielding telecom carriers. Specifically…

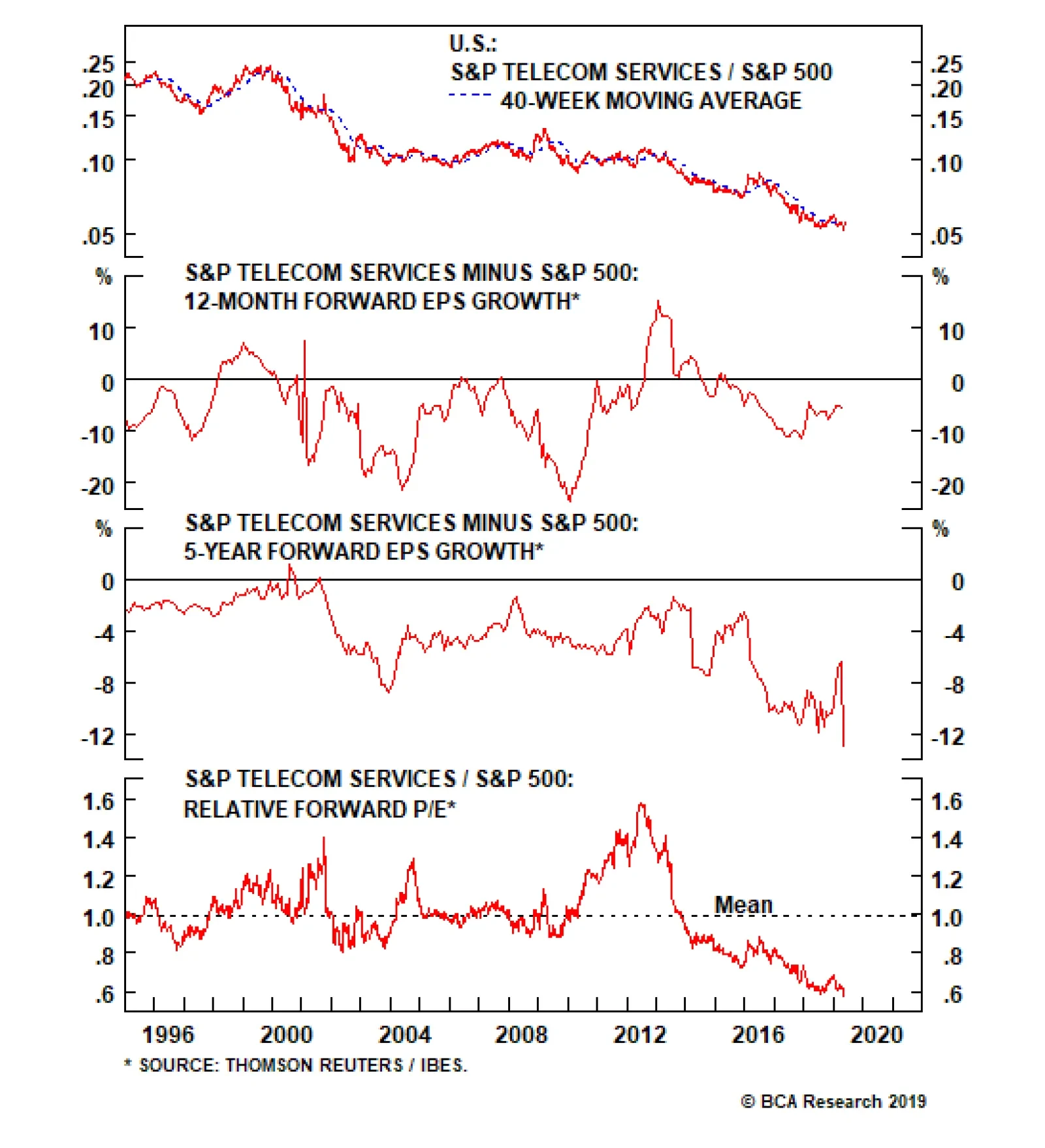

Bombed out profit expectations, suggest that the bar is set extremely low for incumbents, creating a fertile ground for them to generate positive earnings surprises. In fact, the pessimism embedded in 5-year relative profit…

Not only have bond yields plunged, raising the allure of fixed income equity proxies, but also, the recent escalation of the trade spat is worrying U.S. manufacturers. Markit’s flash manufacturing PMI survey that took place…

Highlights Portfolio Strategy The risk/reward equity market tradeoff is to the downside and we remain tactically cautious. The trade war re-escalation risks pushing out the global growth recovery to early-2020 and has shaken our…

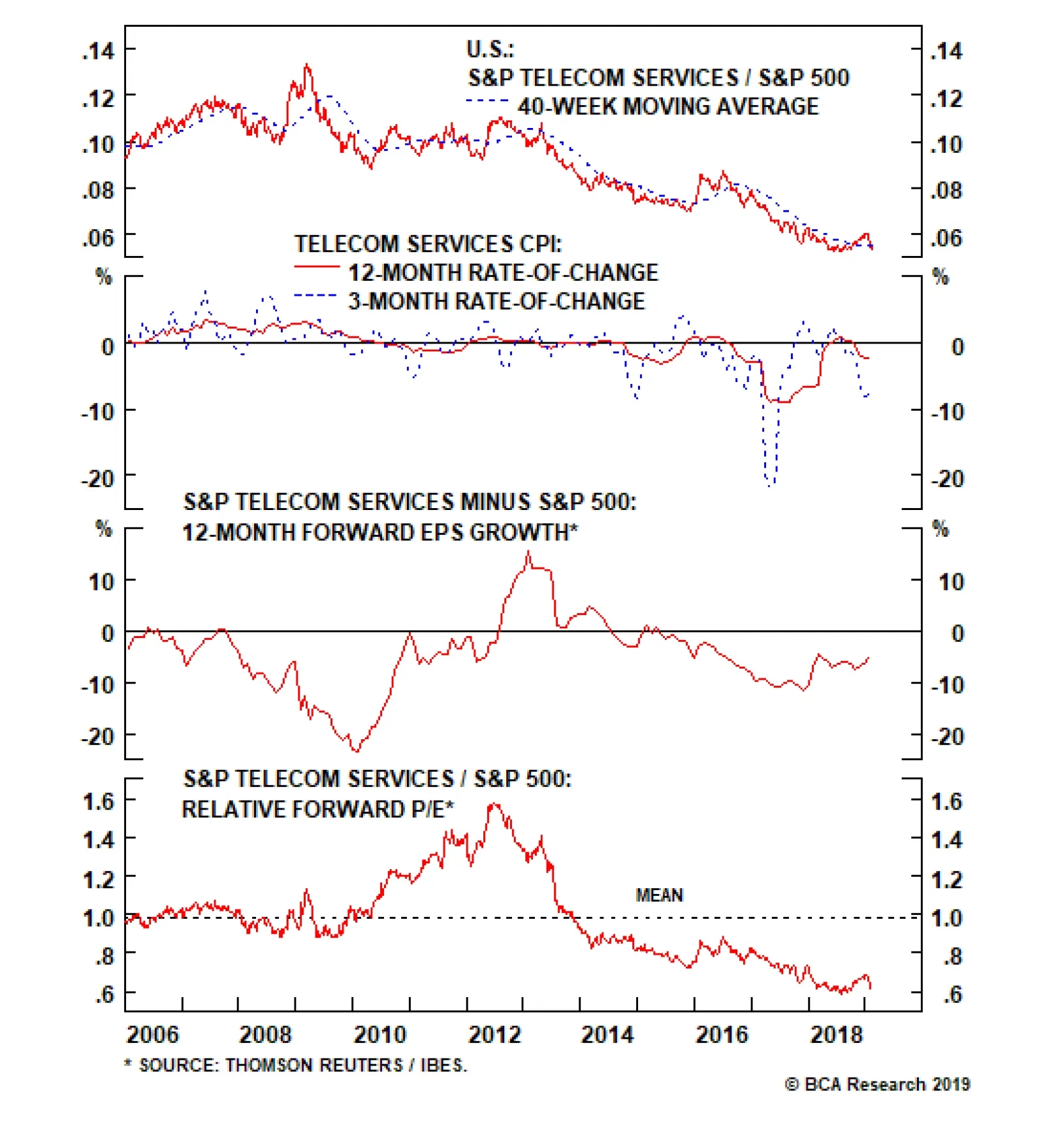

Underweight When we last updated the S&P telecom services index, it had been enjoying a modicum of relative outperformance against the broad market. However, this rally has faltered as pricing power, an excellent predictor…

As this winter’s fall in bond yields boosted high dividend yielding stocks, the S&P telecom services index enjoyed a brief respite from its decade long more-or-less steady underperformance. Furthermore, the massive…

Tough Times For Telco Top Lines Underweight The S&P telecom services index had recently been enjoying a brief respite from their mostly steady relative performance decline over the past decade, as a fall in yields boosted…