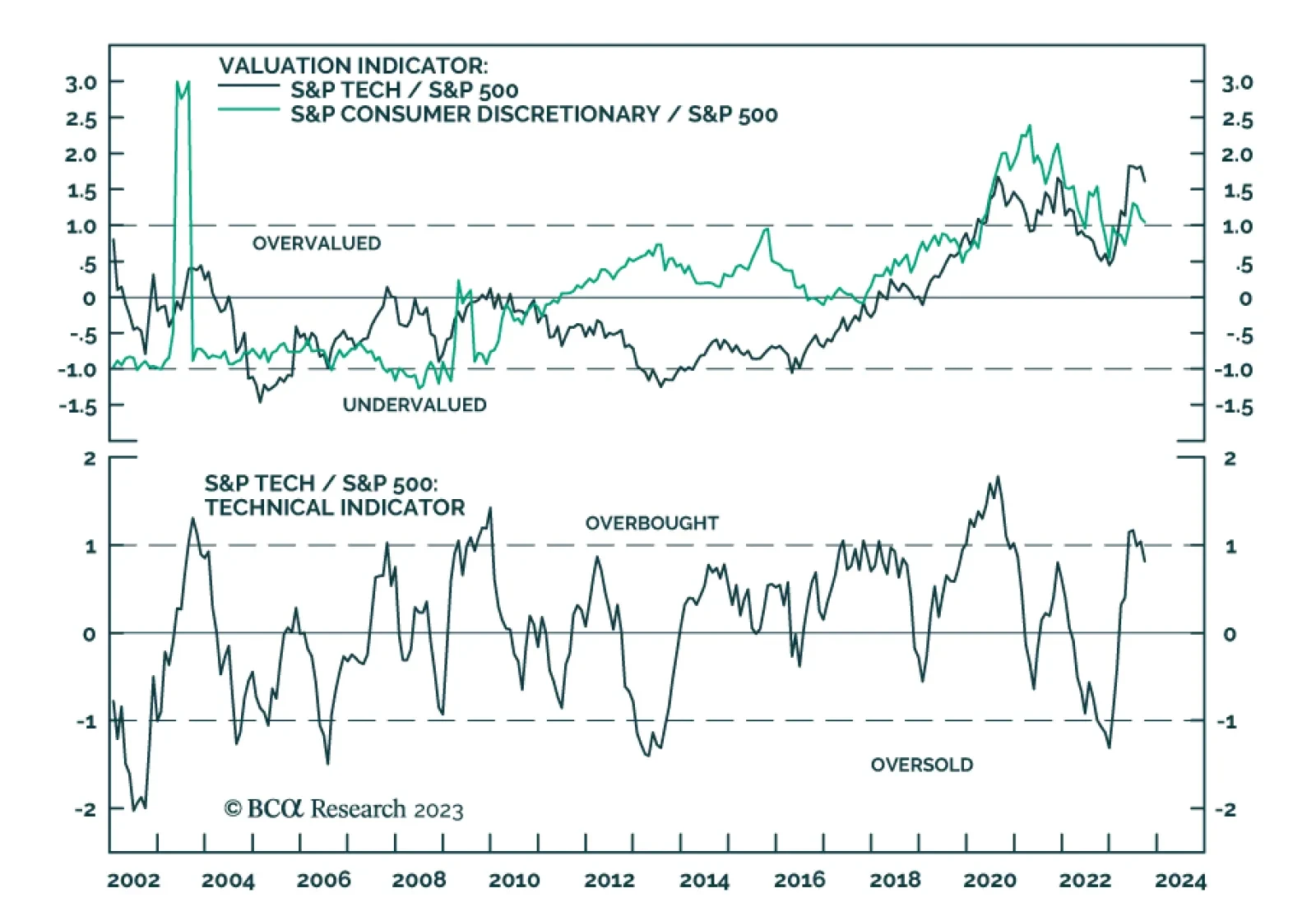

Tech stocks have recently been bearing the brunt of the US equity selloff. The Information Technology and Consumer Discretionary sectors – home to major H1 outperformers including Nvidia, Microsoft, Apple, Amazon, and Tesla…

Bulls and bears have capitulated, and the majority of the clients surveyed expect a rangebound market in the near term. Our fair value PE NTM indicates that the S&P 500 is only modestly overvalued. The continued outperformance…

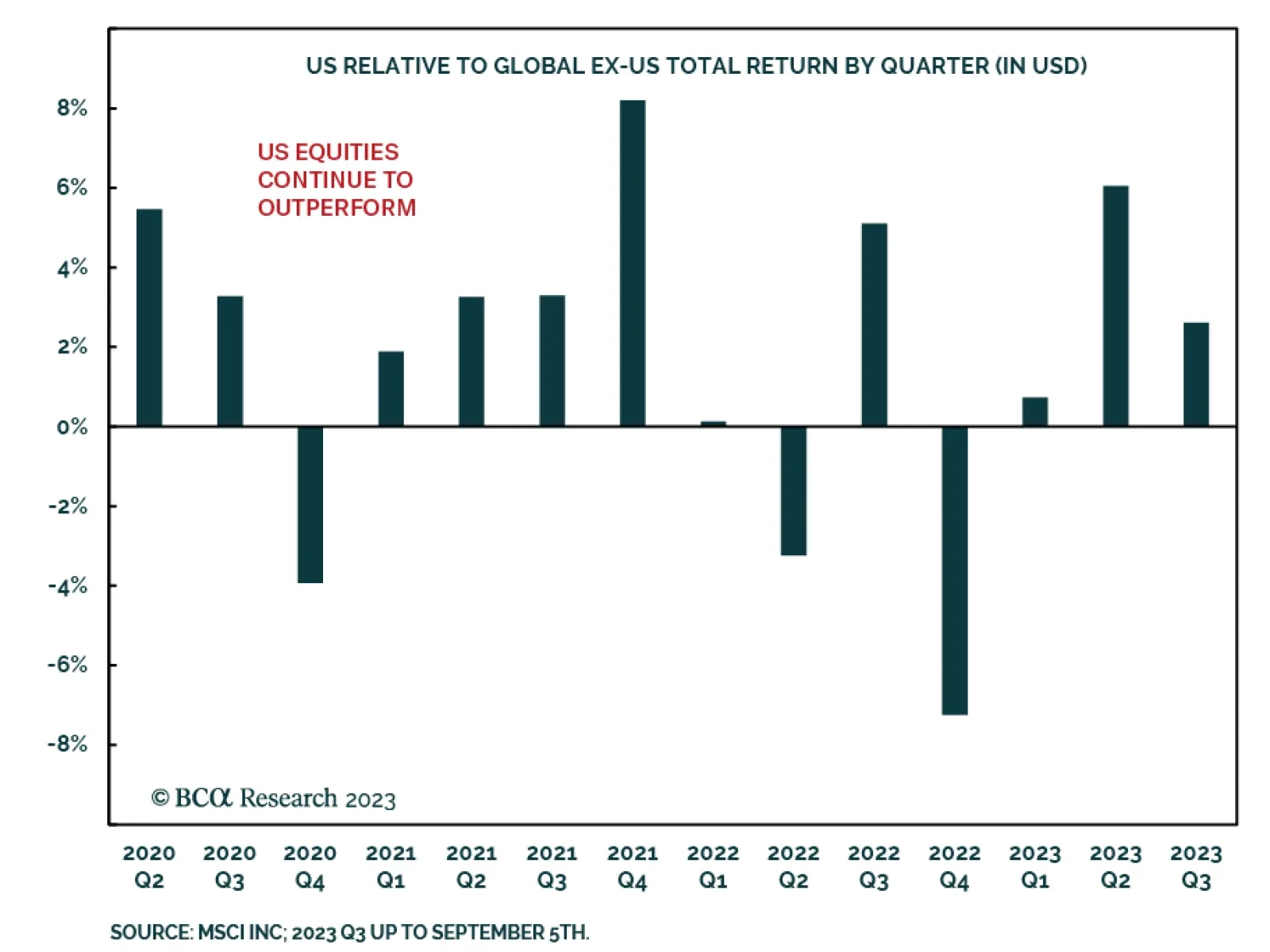

Strategists arguing for an end of the outperformance of US equities over international stocks have pointed to the lofty valuations of American stocks vis-à-vis their global counterparts. Moreover, they have highlighted…

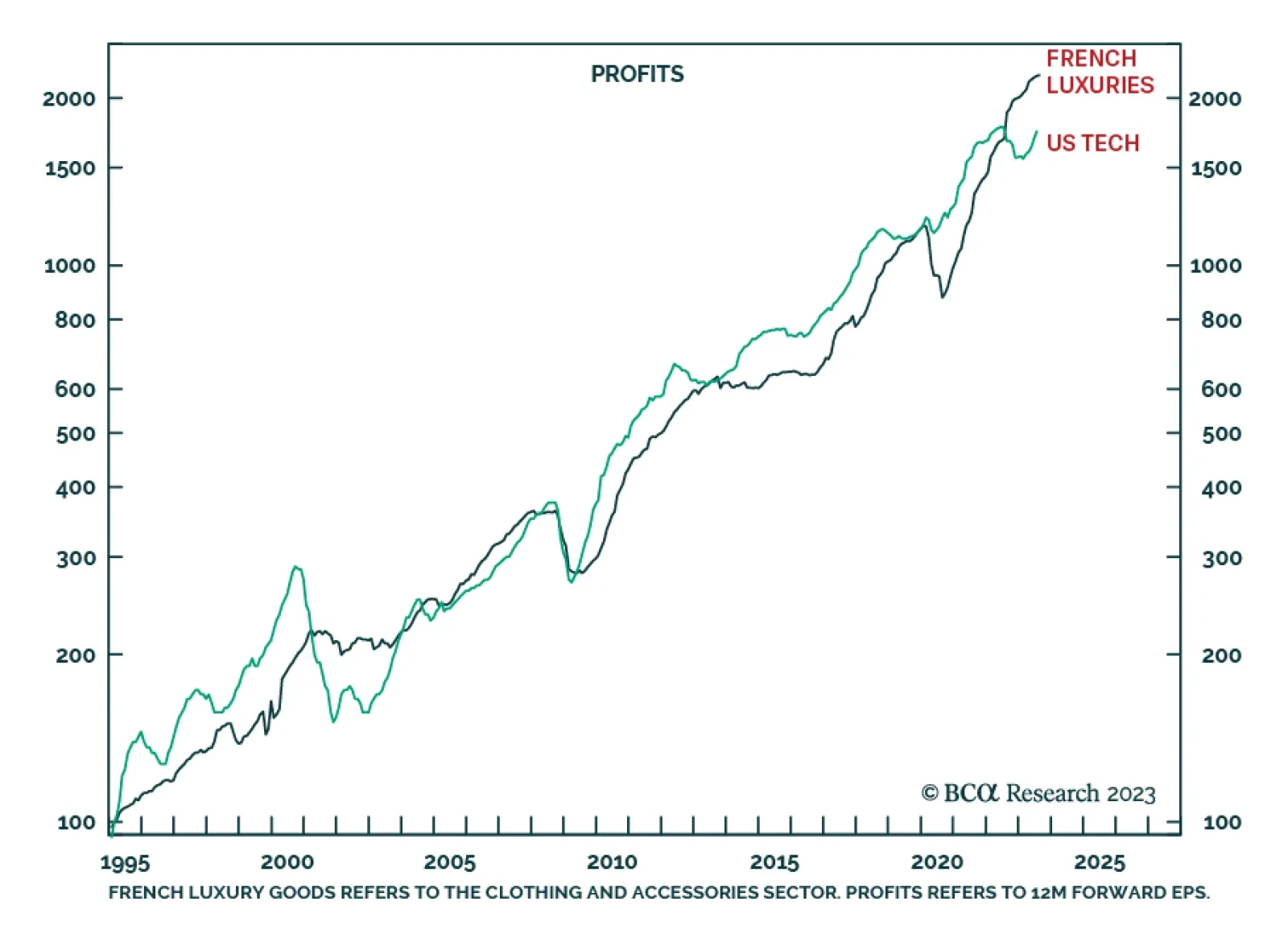

The stock market’s pre-eminent growth sector is not US technology, it is French luxury goods. On most time horizons over the past decades, French luxuries have trumped US technology on profit growth, price performance and…

BCA Research's US Equity Strategy service downgraded Semiconductors to underweight for the following reasons: Weakening global growth: Global semiconductor sales move in lockstep with economic growth. Global growth…

Outperformance of Growth sectors most likely has run its course. It is time to shift Growth vs. Value allocation to neutral, downgrade Semis, and upgrade Energy to overweight.

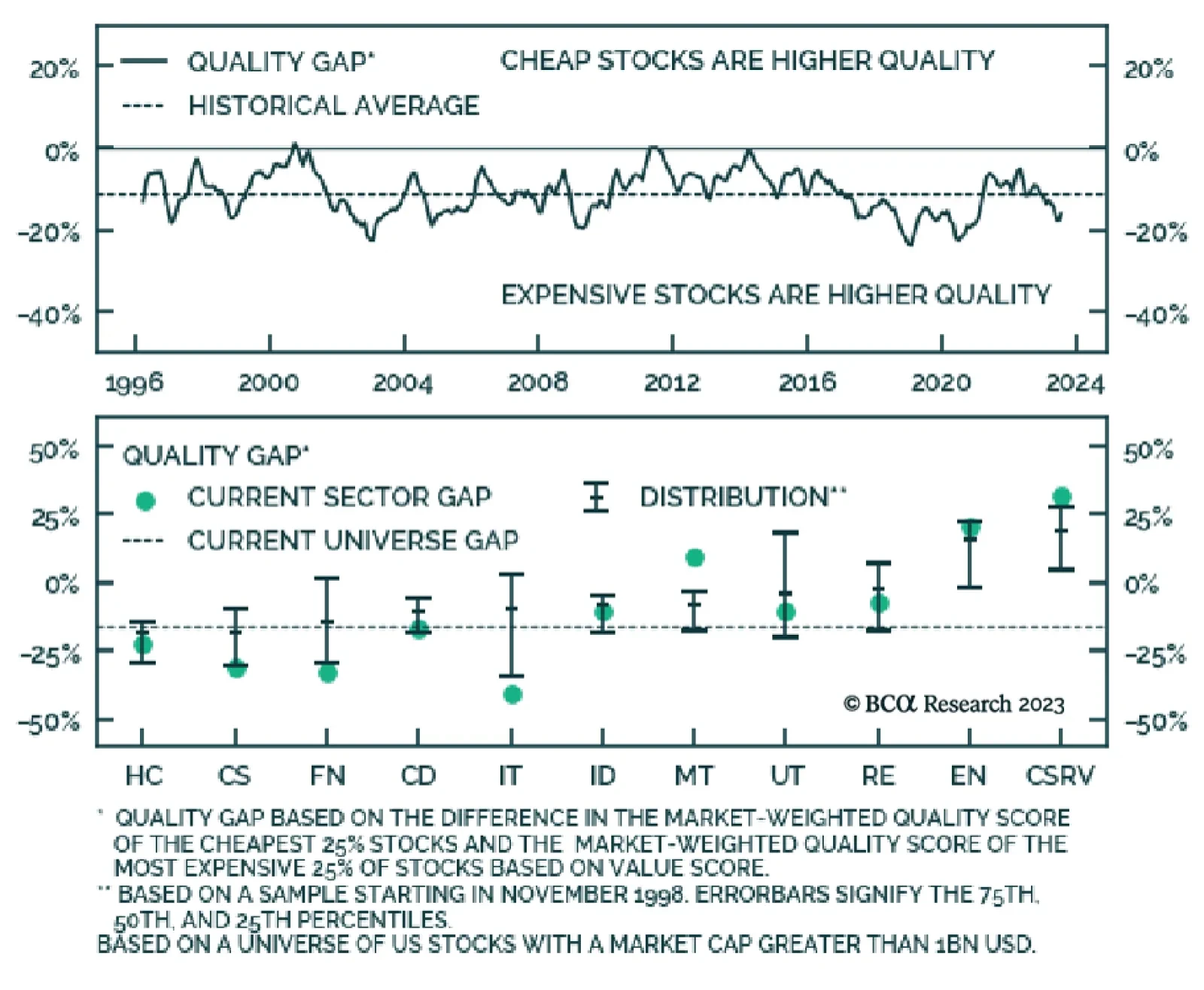

The Equity Analyzer Platform uses a 30-factor model called the BCA Score to help our clients build robust portfolios. Multi-factor models are constructed to avoid the common pitfalls of focusing on one factor dimension, such as…

The stratospheric valuation of this year’s AI mania is likely to deflate, just as it did after the Web 1.0 mania of the late 90s. We go through some long-term and short-term investment implications.