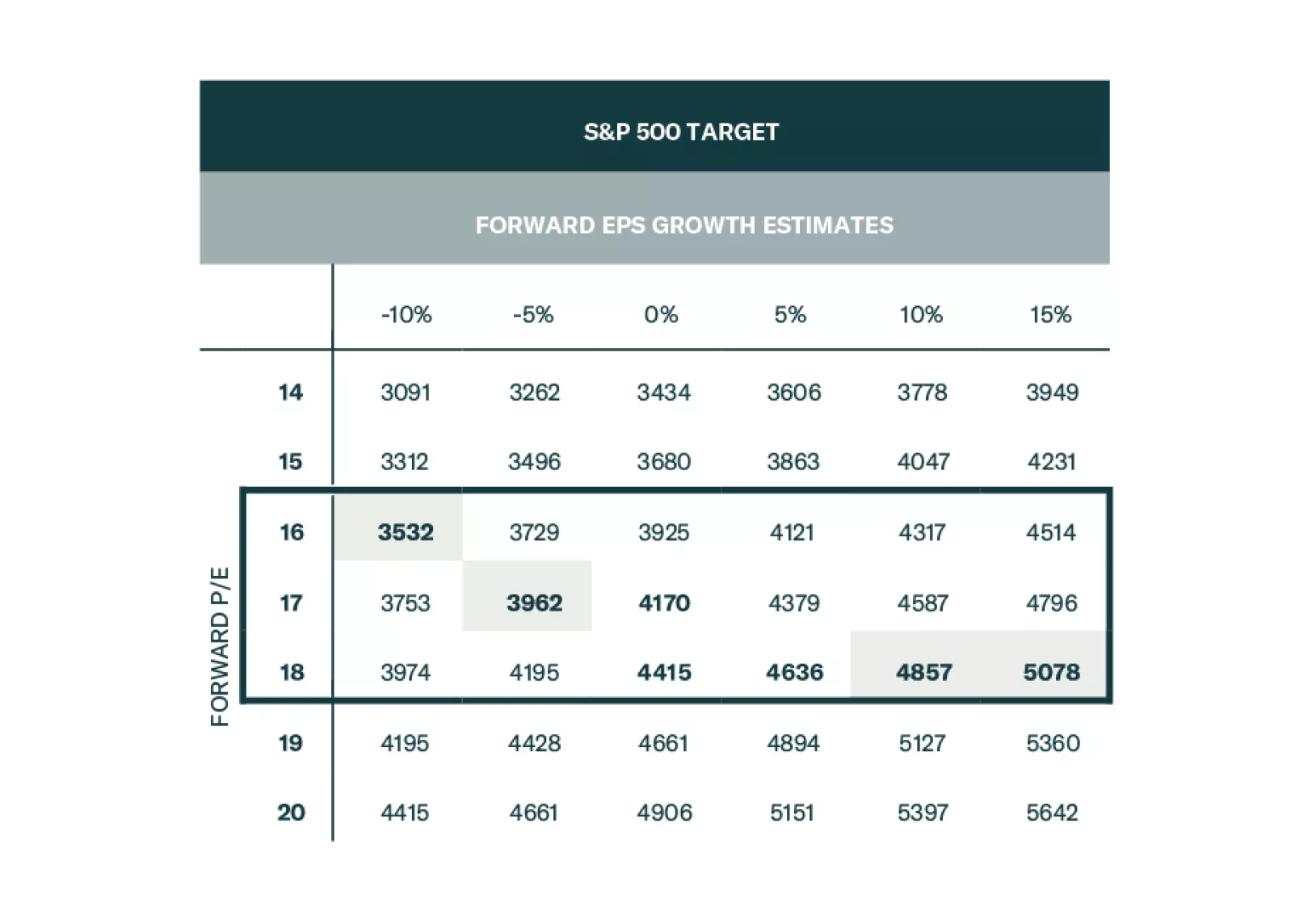

The S&P 500 closed at a fresh year-to-date high on Friday, breaking slightly above its late-July top. The brisk rally since late-October erased all the losses of the prior three months. However, the sector performance has…

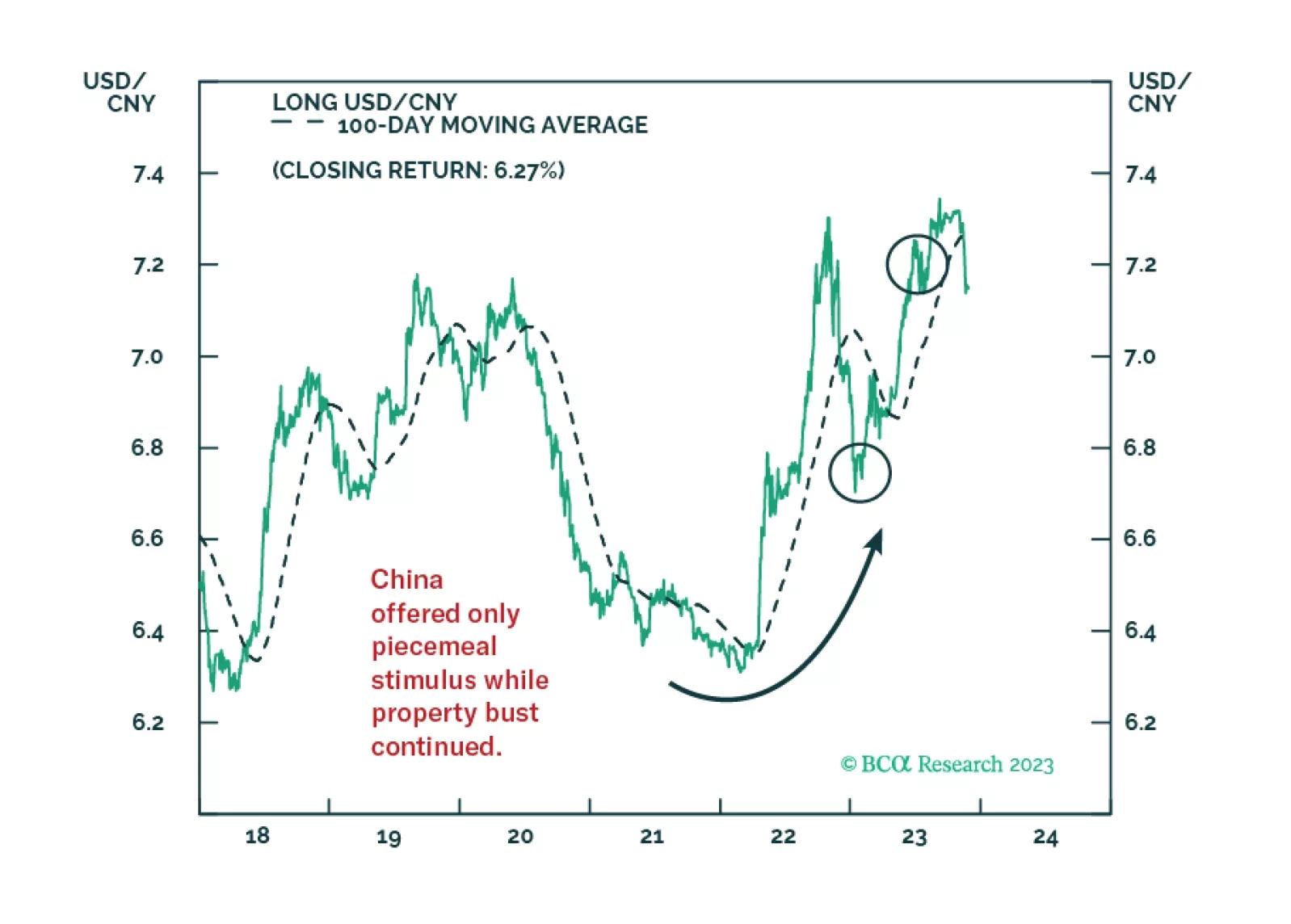

Our political forecasting scored wins in 2023 but we failed to capitalize on it adequately in our trade recommendations.

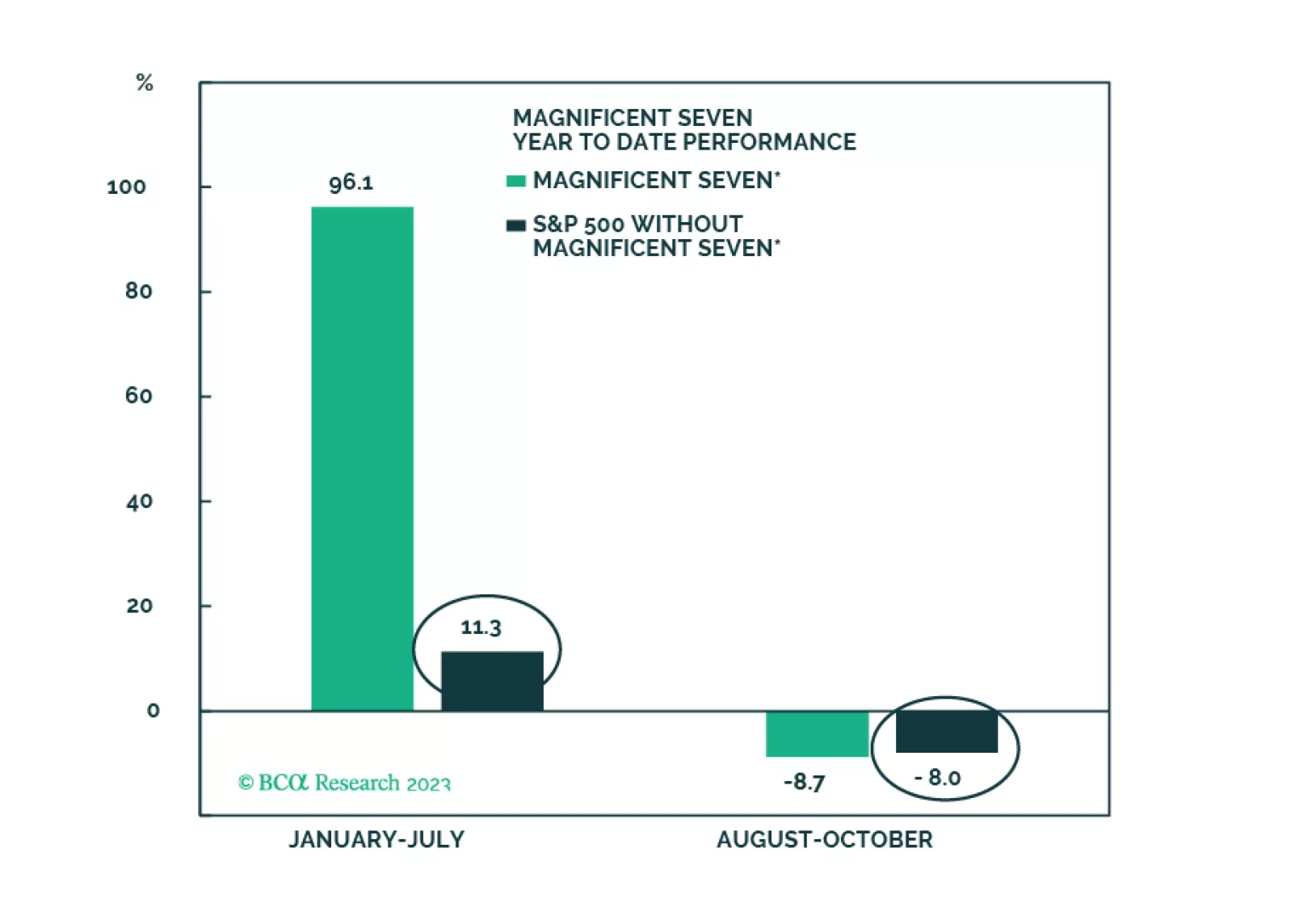

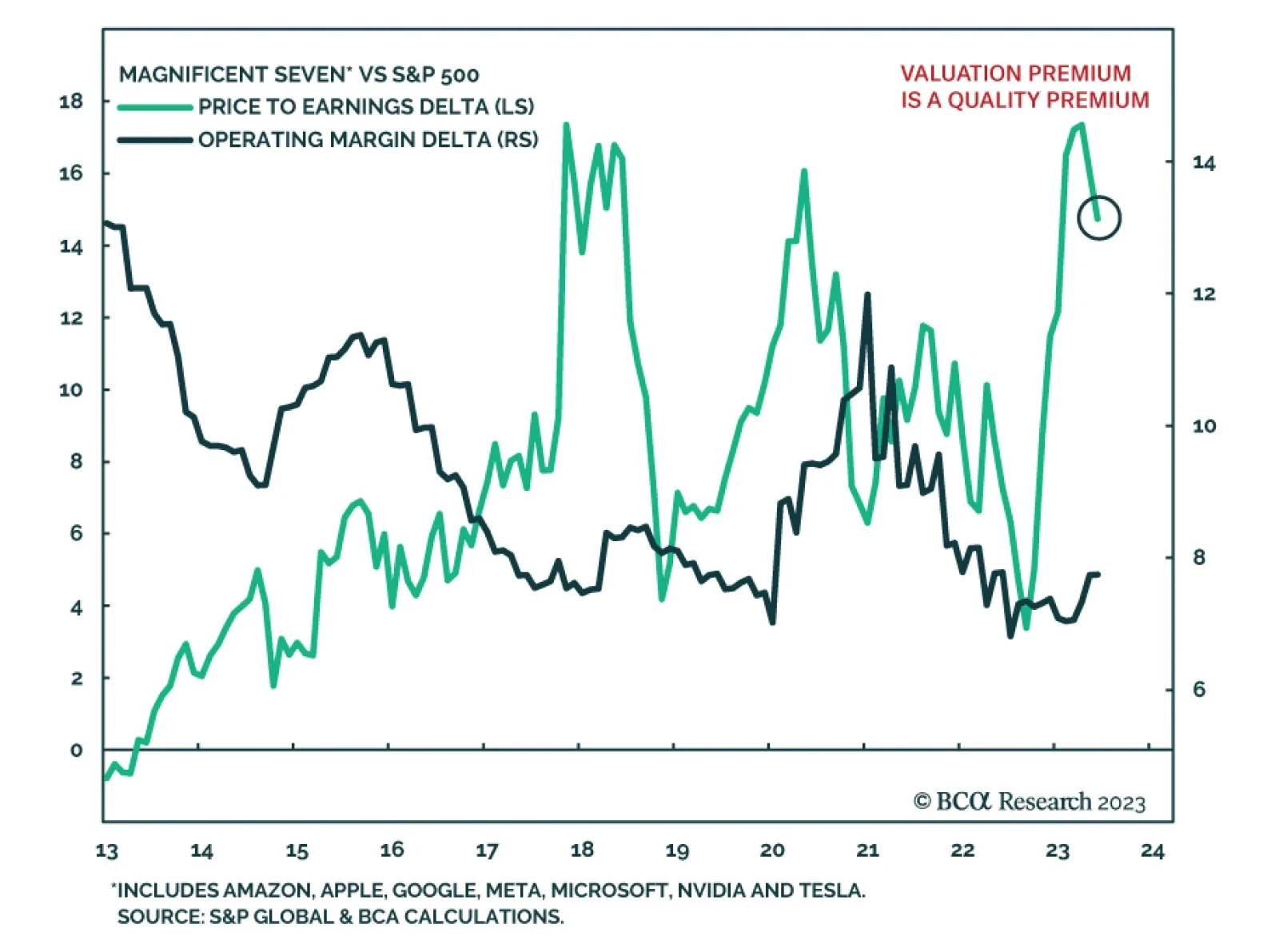

The Magnificent Seven constitute 26.7% of the S&P 500 and are the cohort responsible for the majority of S&P 500 returns this year. Fundamentals, and, specifically, the profitability of the group are behind the strong…

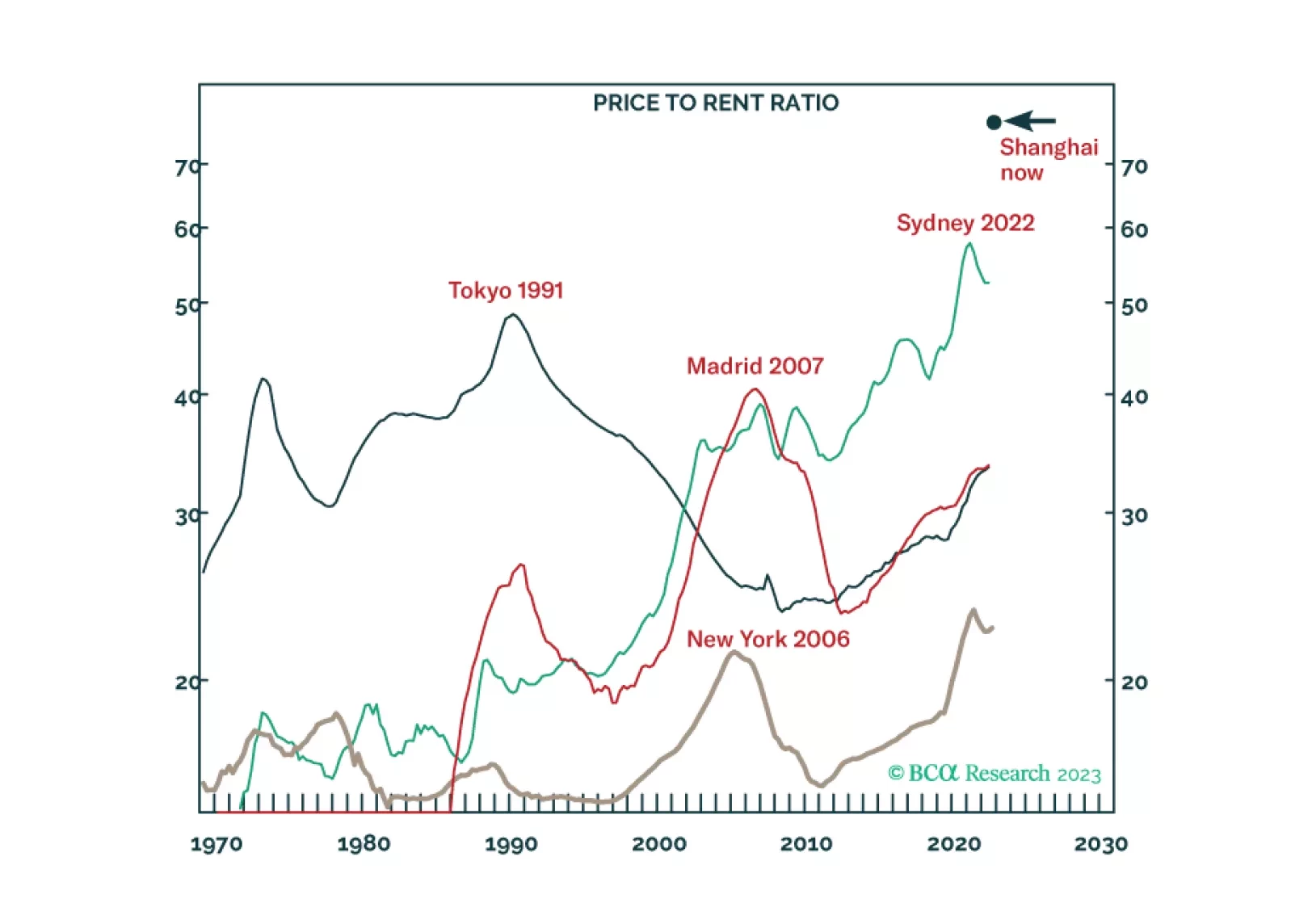

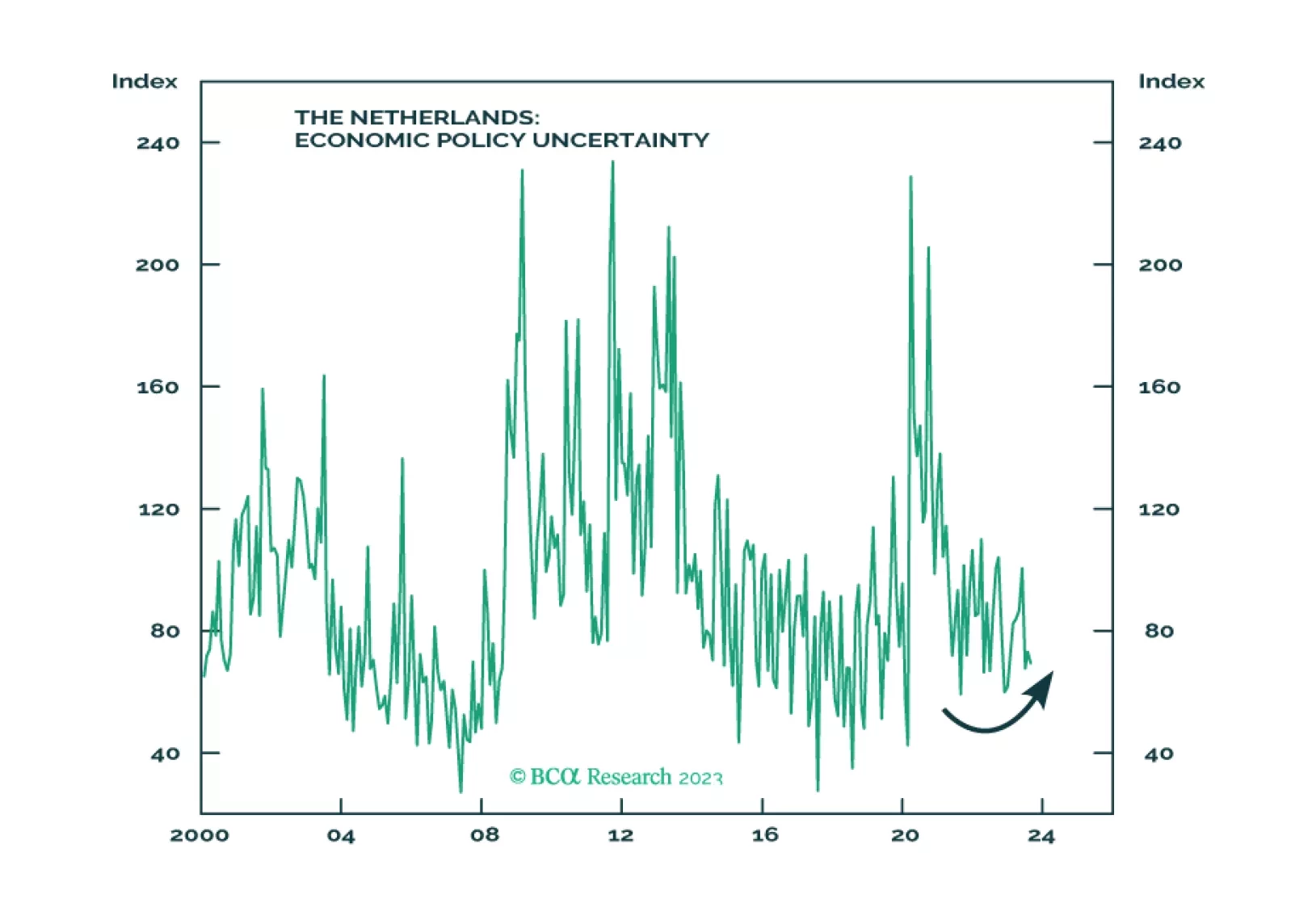

The Vicious Troika remains a long-term threat, but over the short term, rates will likely have another leg down on growth concerns, offering support to equities, which are now fairly valued and are no longer overbought. Longer-term…

Q3-2023 is expected to mark the end of the earnings recession for the past three quarters, opening the door to positive earnings growth. Whether that would be sustainable or will sputter once the recession settles in as expected in…

Aggressive monetary tightening has always led to recession, although the timing is uncertain. The effects of high interest rates are starting to be felt. Investors should stay risk off and buy government bonds as a safe haven…