Nvidia’s blowout Q4 2023 earnings results and bullish guidance catalyzed a rally in global stocks that pushed the S&P 500, Europe’s Stoxx 600, and Japanese Nikkei to record highs on Thursday. The S&P 500 is…

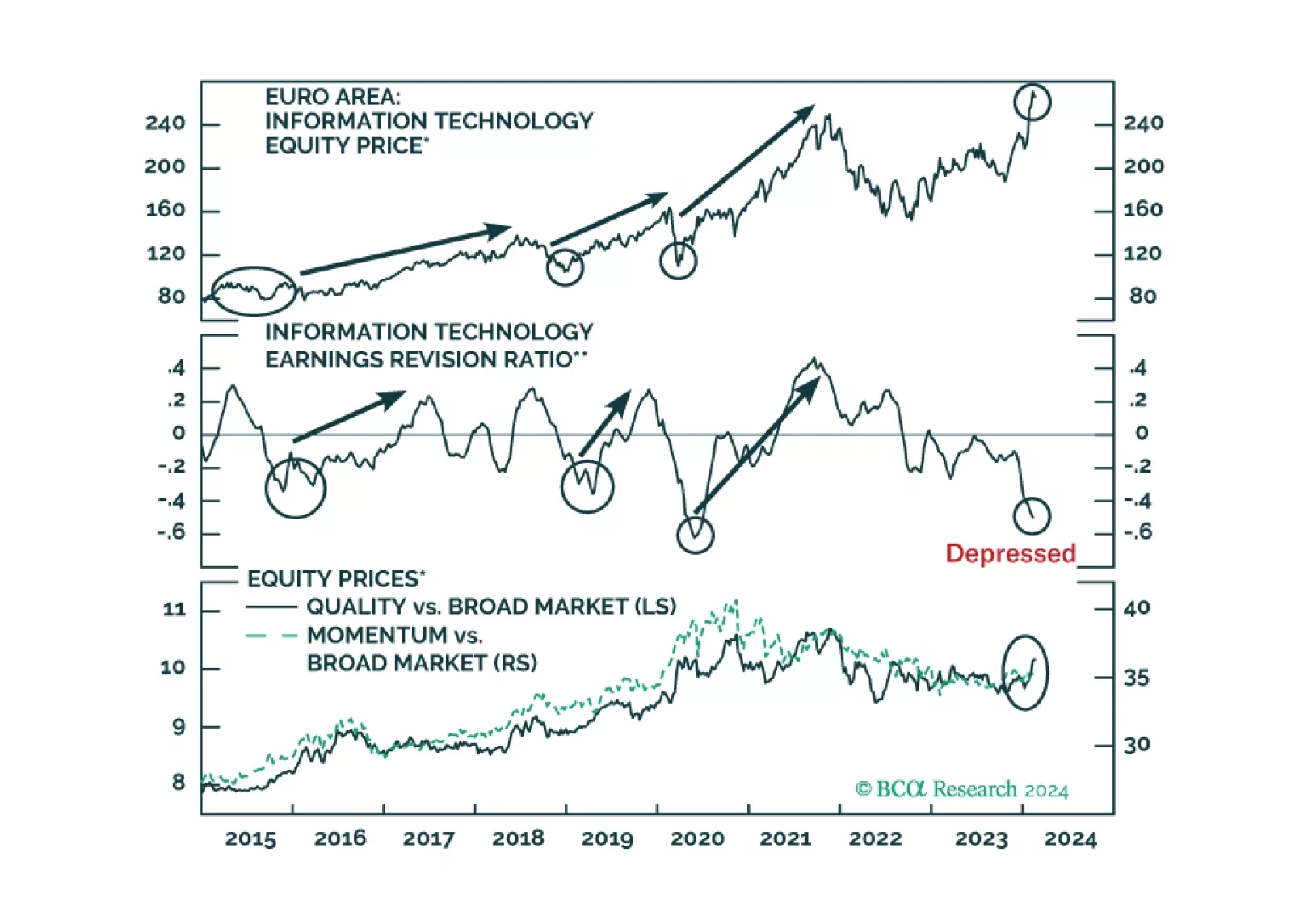

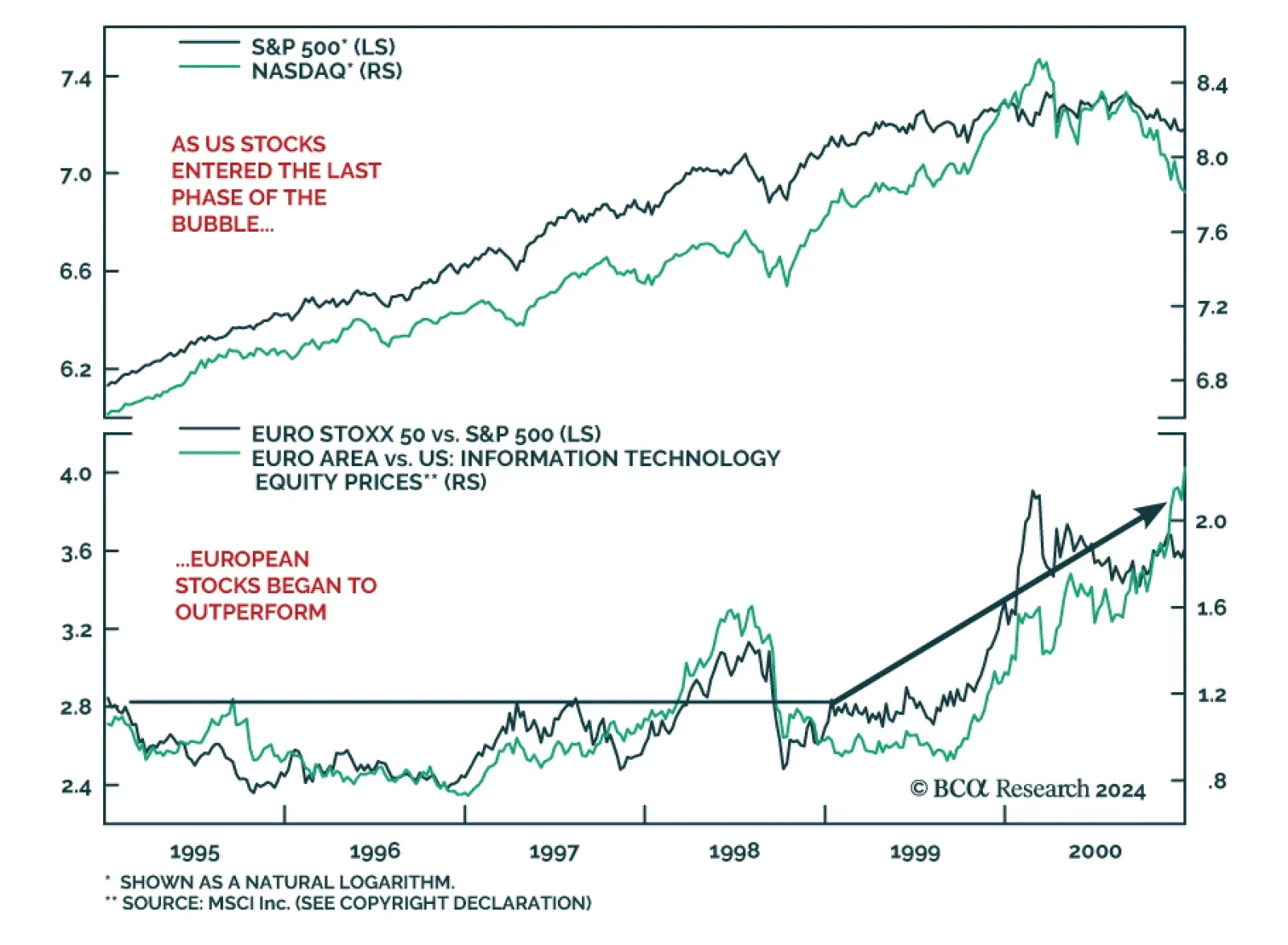

According to BCA Research’s European Investment Strategy service, European tech stocks could outperform their US counterparts in the last leg of the rally. The tech sector is in a bubble in advanced economies. While it…

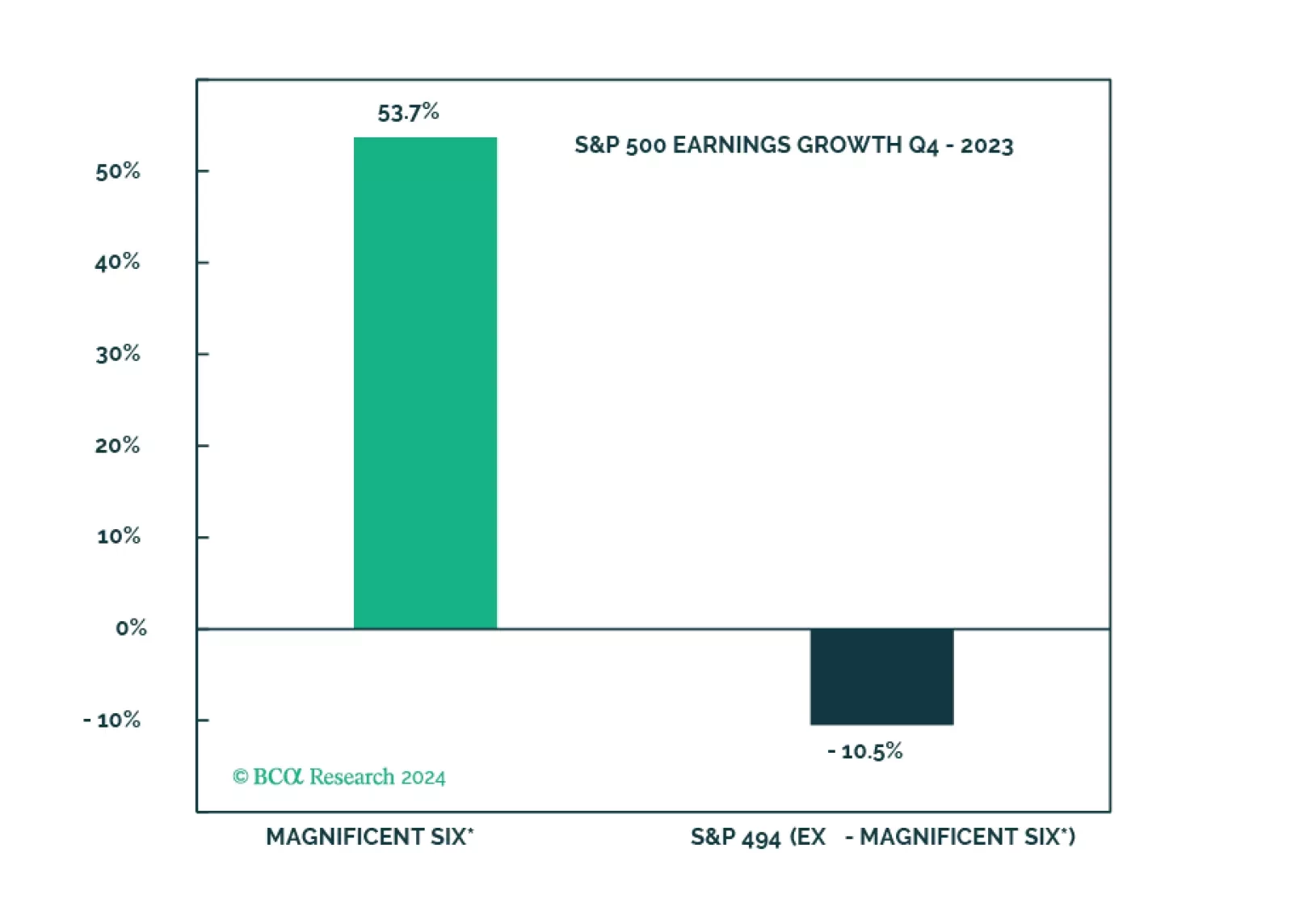

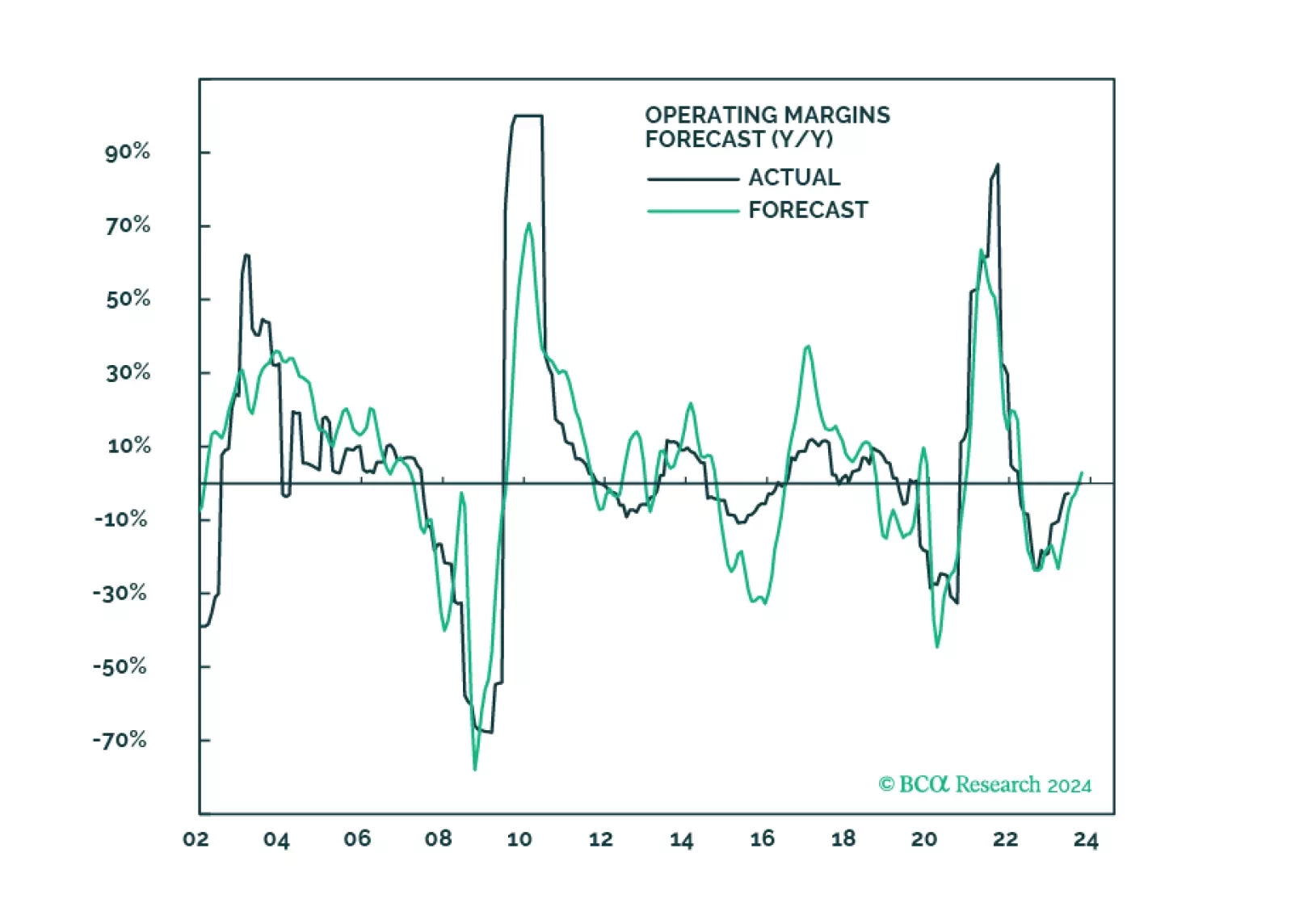

Reported earnings for Q4-2023 were rather underwhelming and prone to issues that we have identified over the past few months: Growth is concentrated in just a few sectors and companies, while the profitability of a broad swath of the…

Signs that we are entering the last phase of a bubble are building up. Can European equities benefit from a new tech mania?

Recessions often begin seemingly out of the blue when the economy’s temperature falls enough to set in motion adverse feedback loops that cause unemployment to rise. We expect the US economy to suddenly freeze over towards the end of…

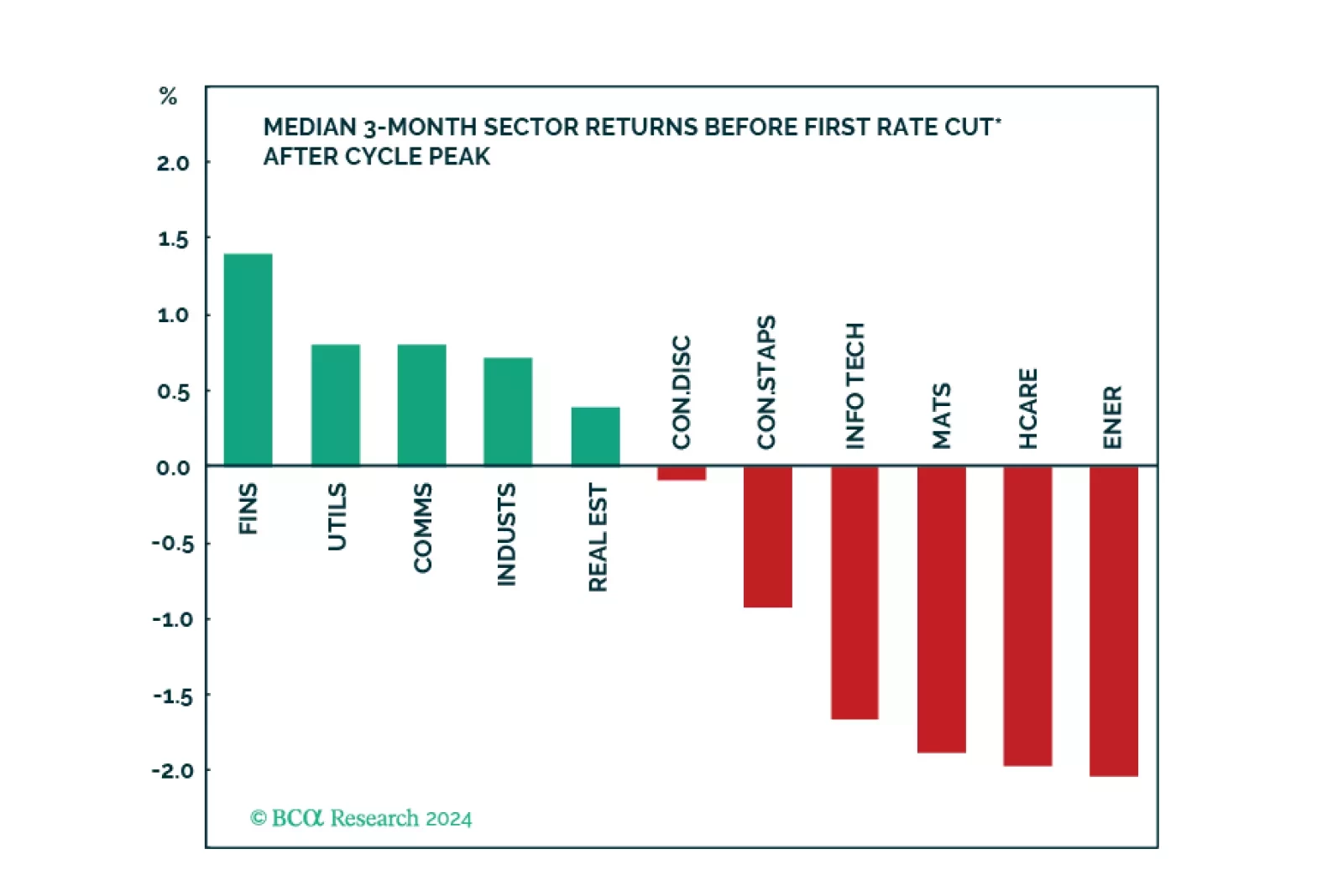

We created a sector selection scorecard based on performance of sectors under various macroeconomic regimes while taking into consideration revisions to expected earnings growth and valuations in a historical context. Our total…

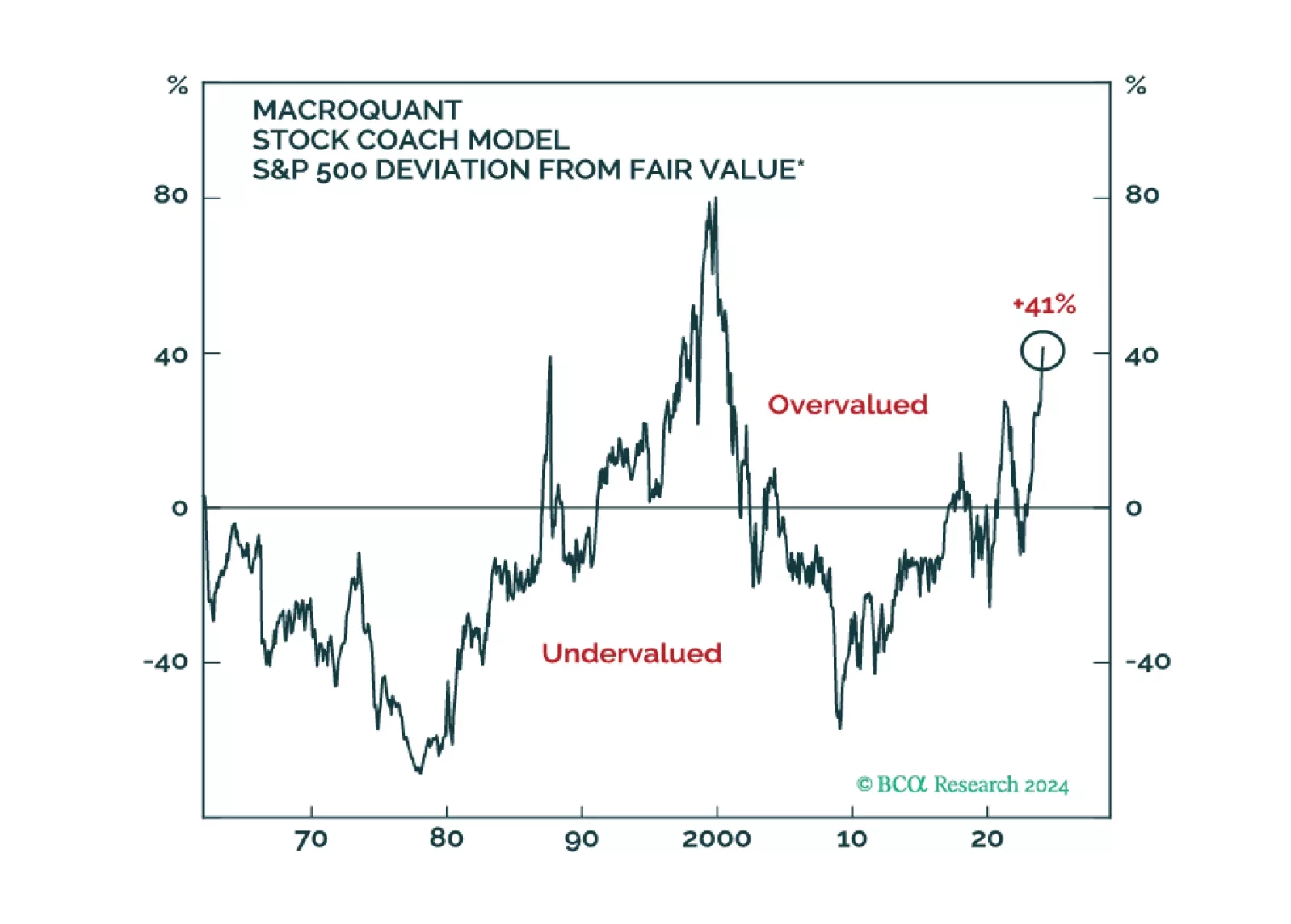

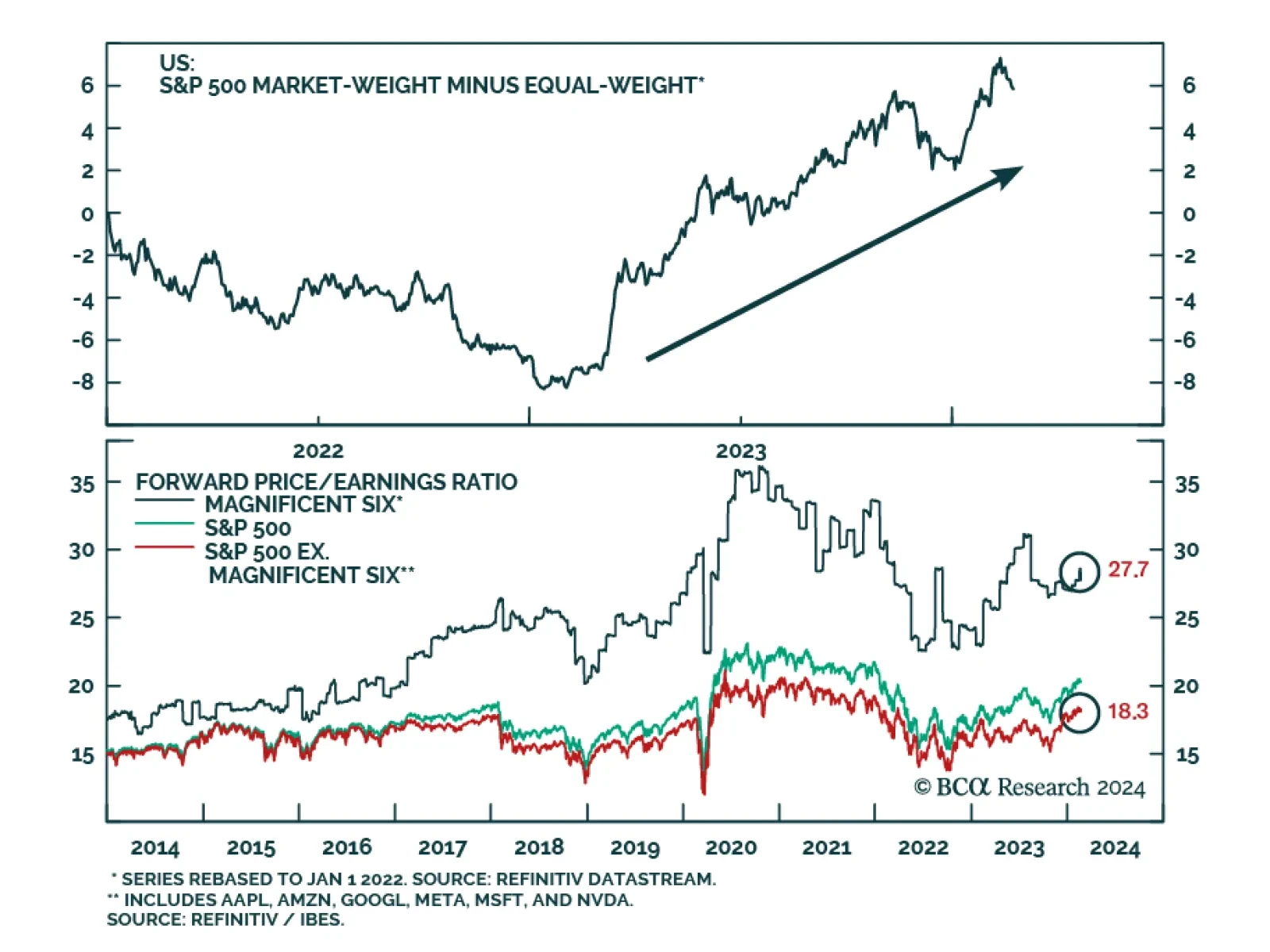

The soft landing and rate cuts narrative is being priced out, and the S&P 500 is overvalued and getting overbought. The Magnificent Seven are about to get a new moniker on the back of performance dispersion. However, without the…

A recent slew of macroeconomic data has reassured us that the runway to a recession is longer than many thought. However, that positive realization comes with two caveats. First, the Fed pivot is not imminent, and the magnitude of…

Disinflation coupled with sticky wage growth is likely to result in either a second wave of inflation or layoffs and a recession. In the meantime, market expectations for sales, growth, and margins are overly optimistic and are…

The AI craze was the dominant force driving difference in equity sector returns in 2023. Broadly-defined technology sectors were the top three outperformers last year with IT, Communication Services, and Consumer Discretionary…