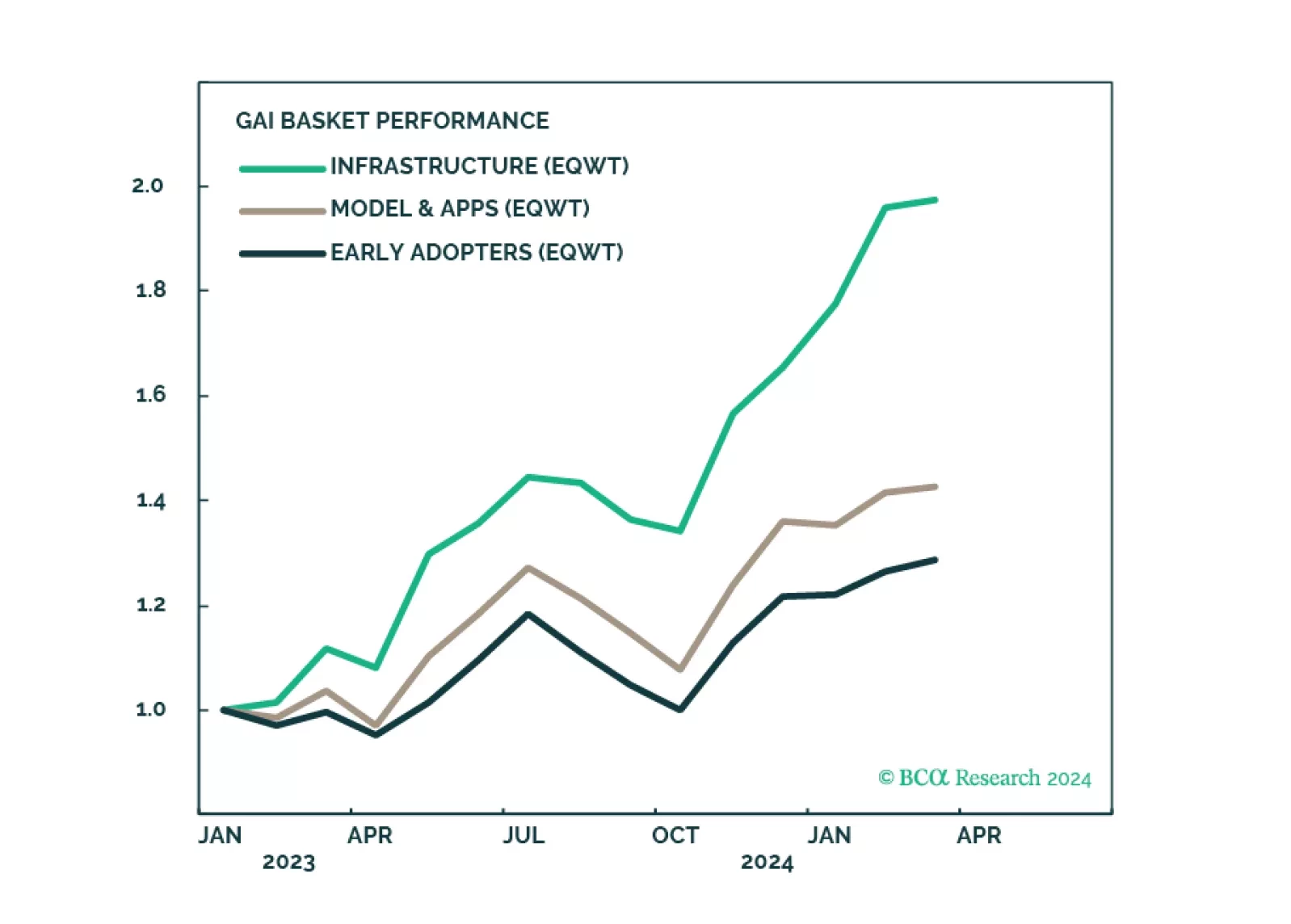

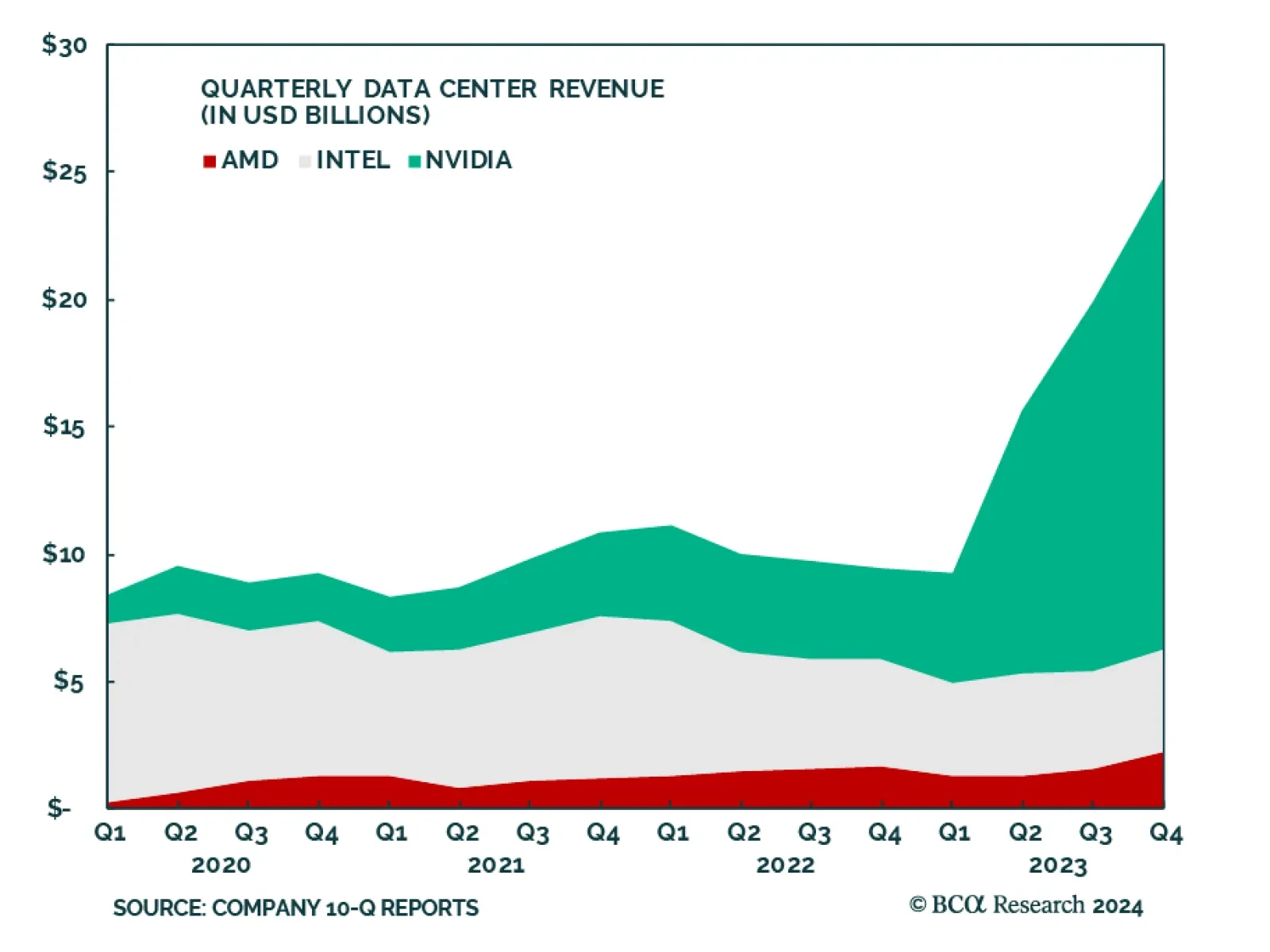

Nvidia has amassed staggering sales from AI. Last year its data center revenues exploded, going from just over $4 billion in 2023 Q1, to over $18 billion in 2023 Q4. That said, its competitors have not done as well. In the…

In this note, we preview the Q1-2024 earnings season, give our take on expectations and share what we will be watching.

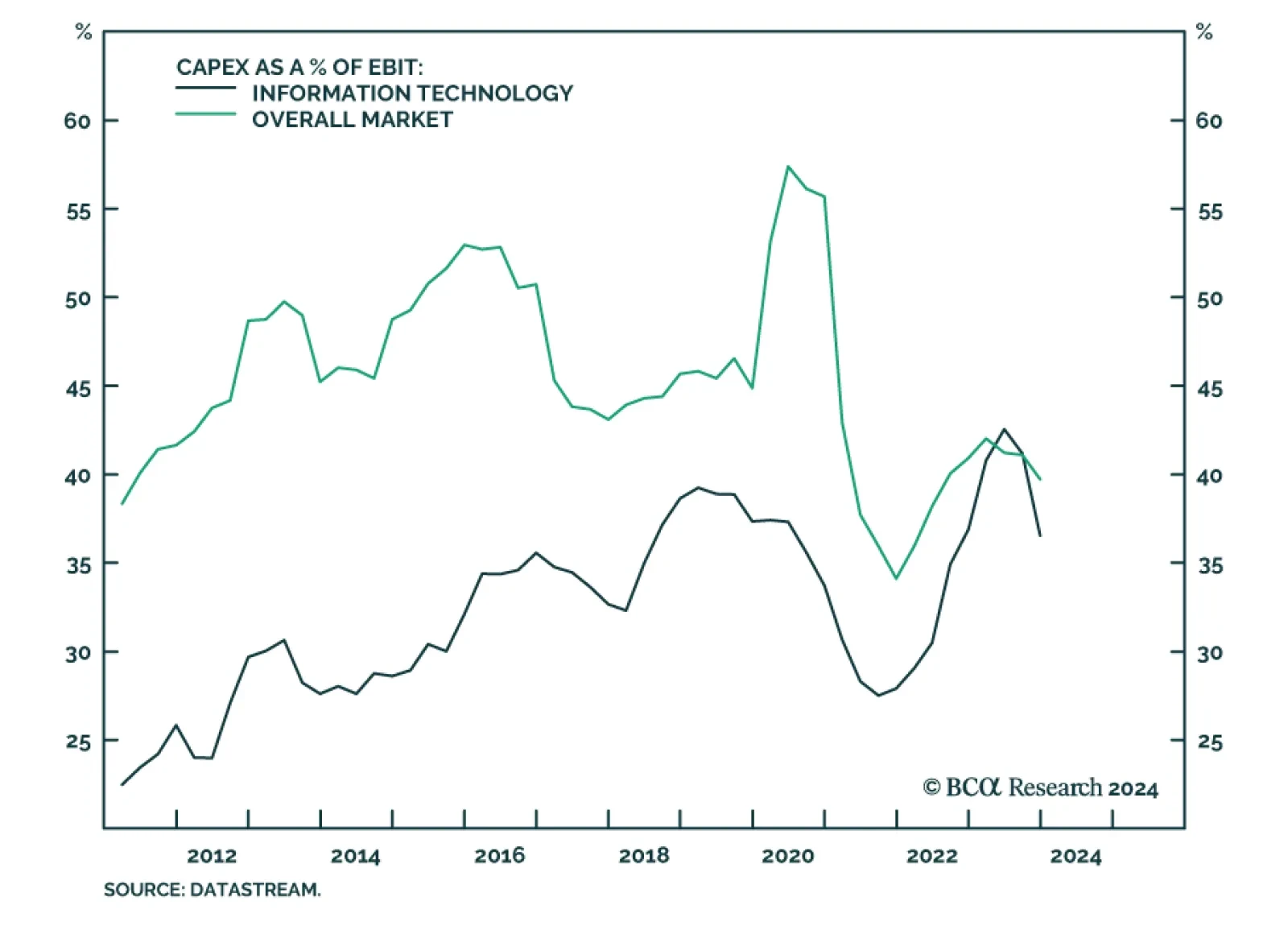

One of the most important factors for the success of tech stocks over the 2010s was monopoly power. Companies like Google, Facebook, Apple and Microsoft managed to develop entrenched moats in their own niches. This monopoly power…

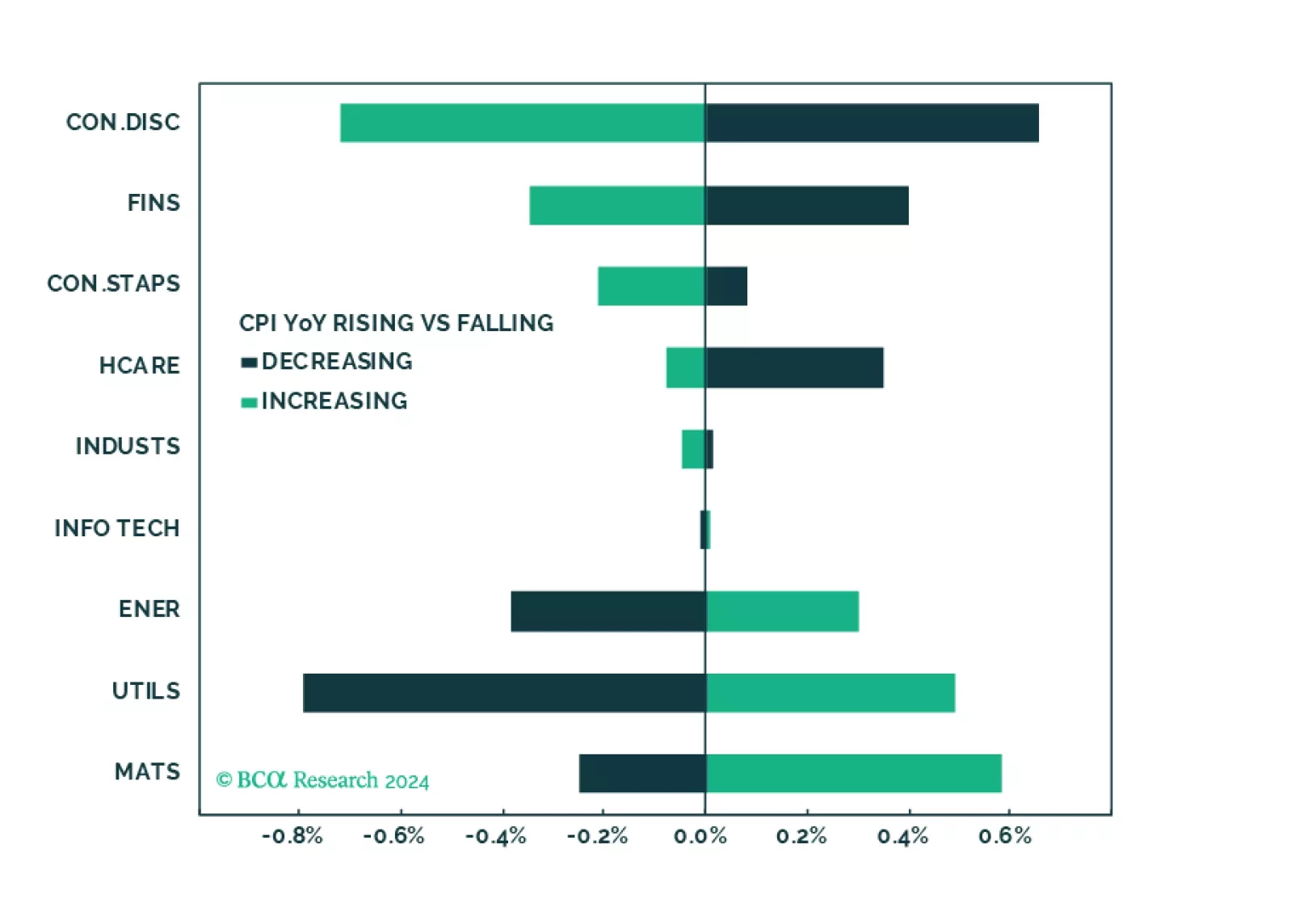

Fears of a hard landing are abating as growth has been surprising to the upside. New worries are emerging, such as the trajectory of disinflation, and the pace and timing of rate cuts. In this environment, it is important to build a…

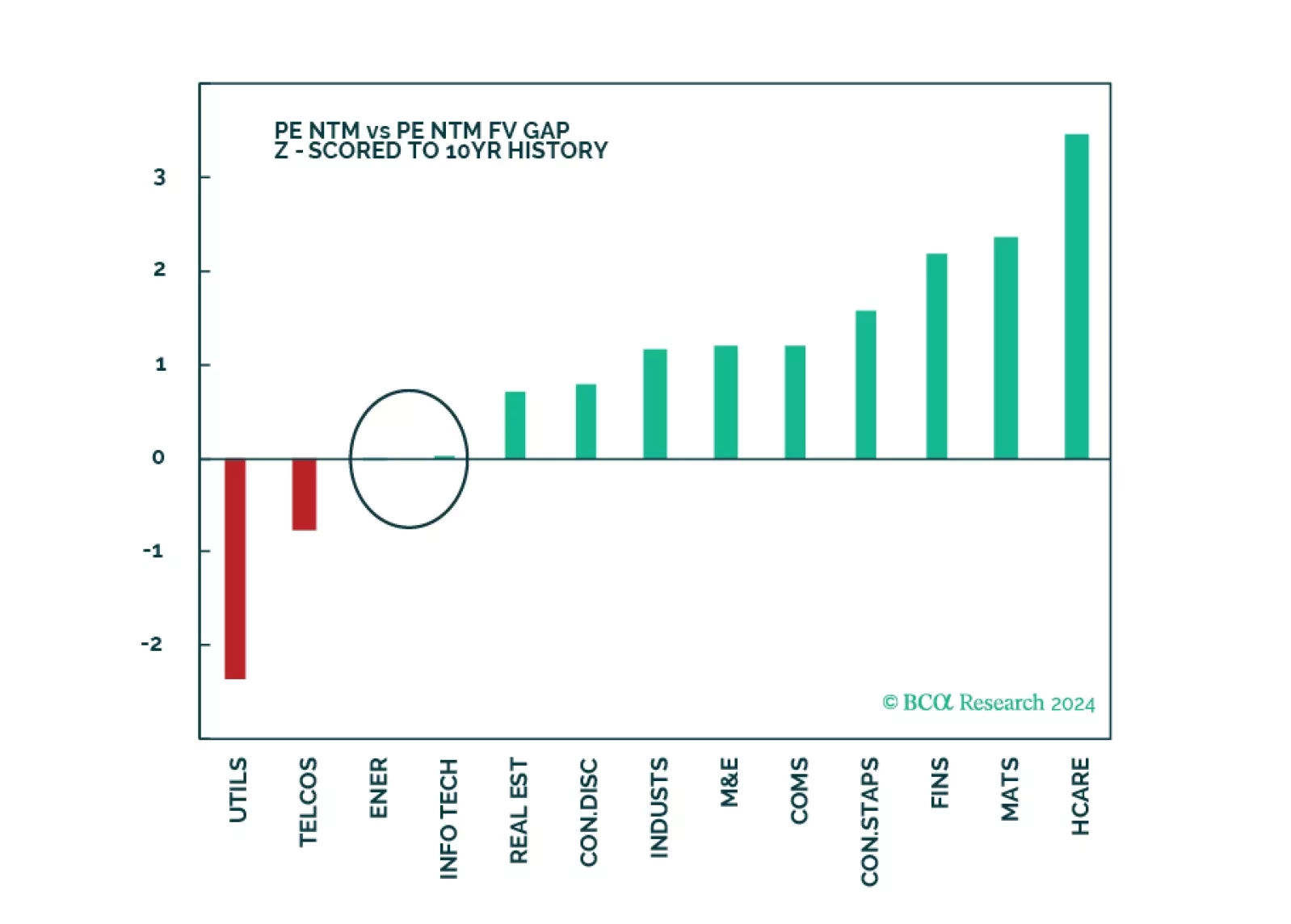

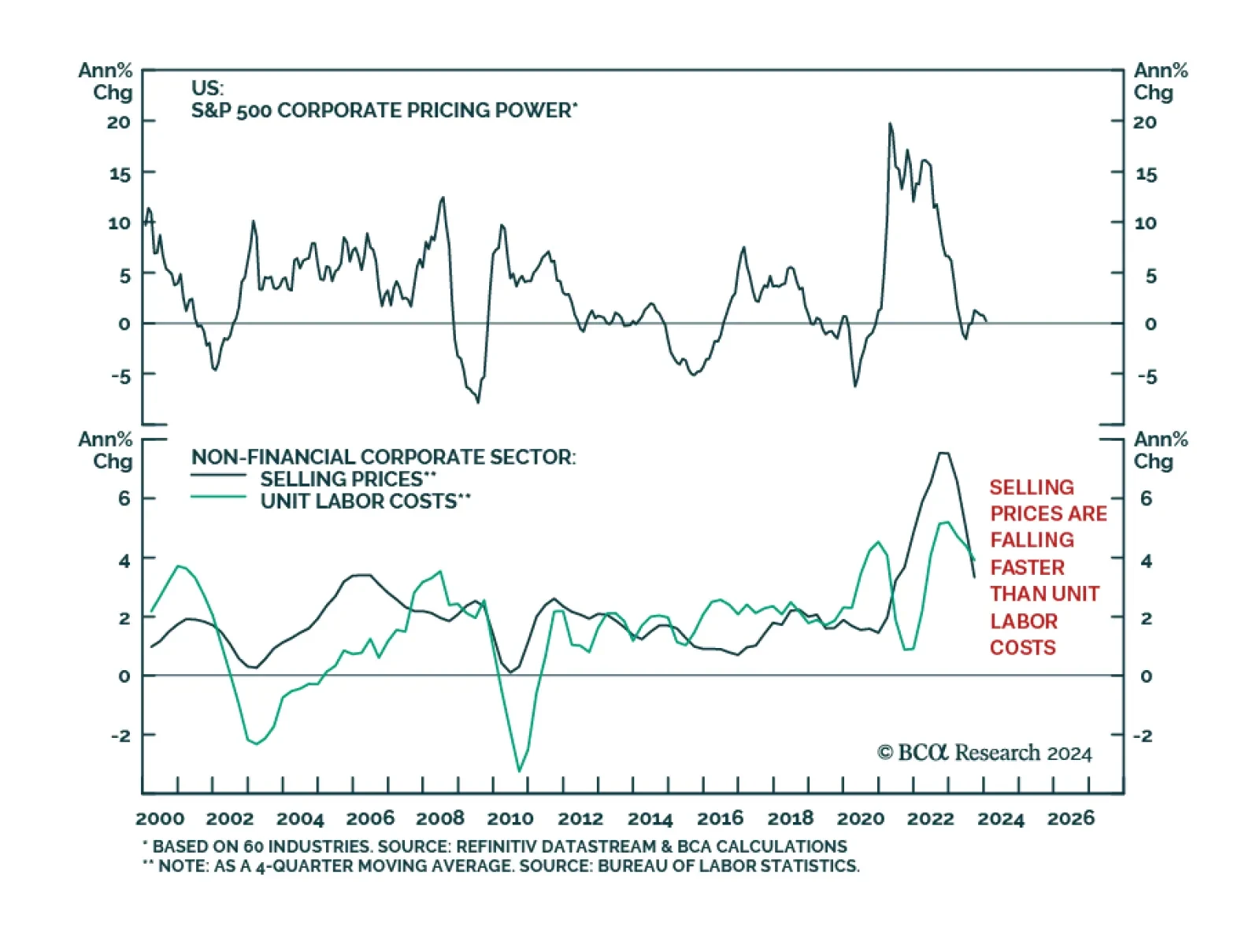

The equity rally extended into March as hard landing outcome was priced out. It has broadened, as money flowed into less over-loved pockets of the market. Our models signal that margins are about to stabilize, and earnings growth…

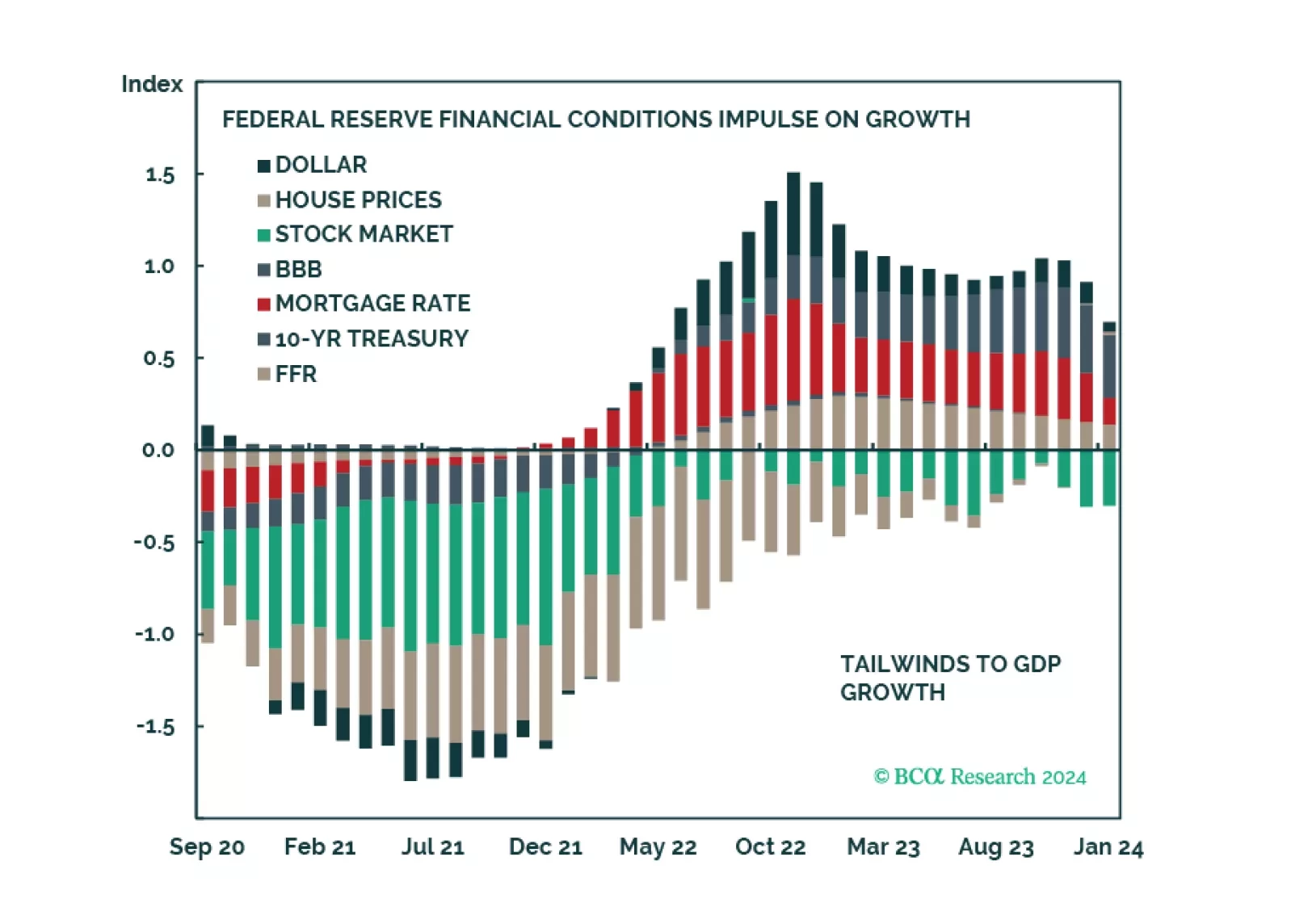

Clients are increasingly more positive about the US economy, but there are no signs of exuberance. The rally could continue as the majority is not fully invested. Financial conditions have already eased, and the Fed is unlikely to…

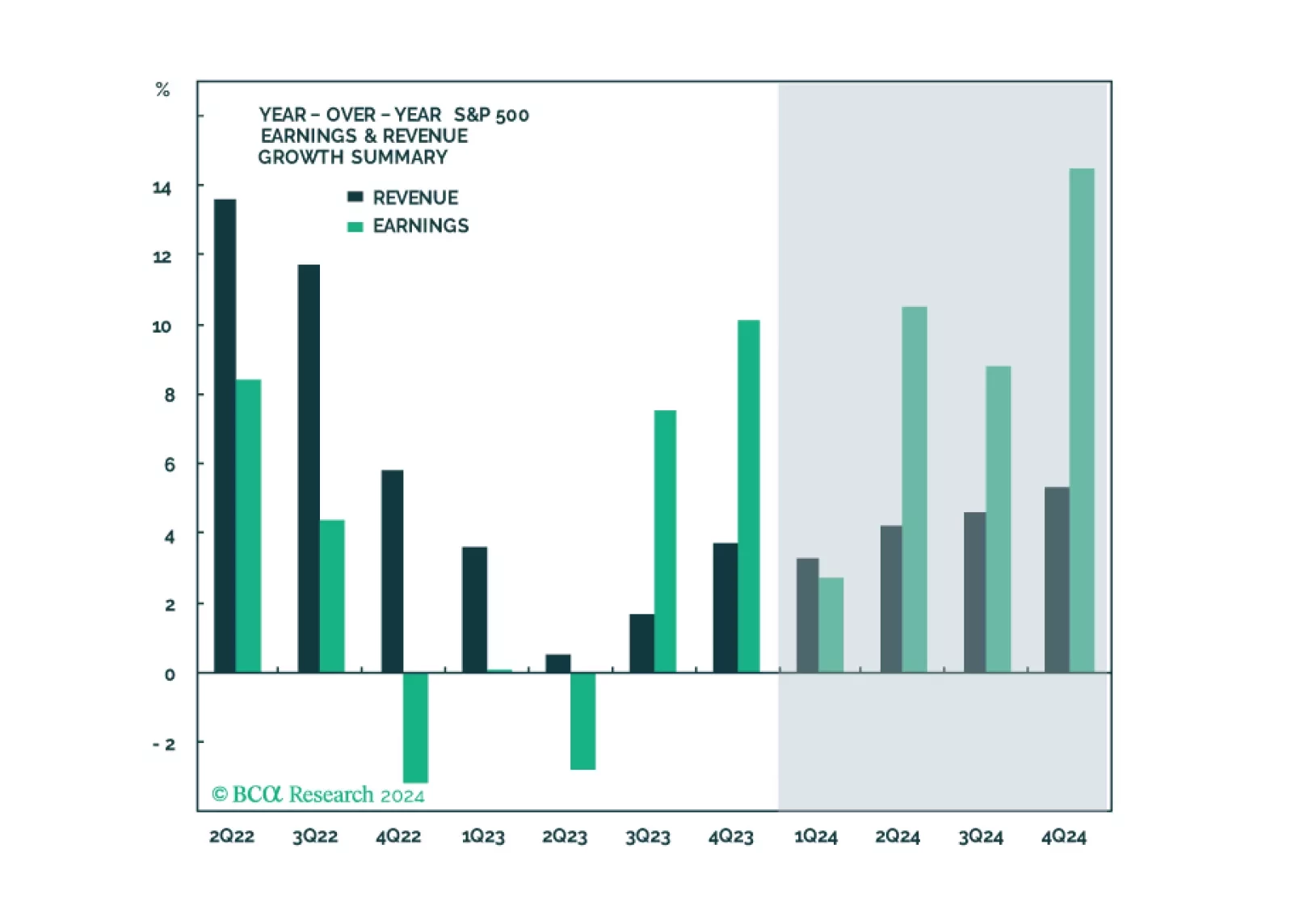

According to Factset, analysts are forecasting S&P 500 earnings and revenues to grow by 11.0% y/y and 5.0% y/y respectively in 2024 (an acceleration from 0.9% and 2.8% in 2023). Information technology and communications…

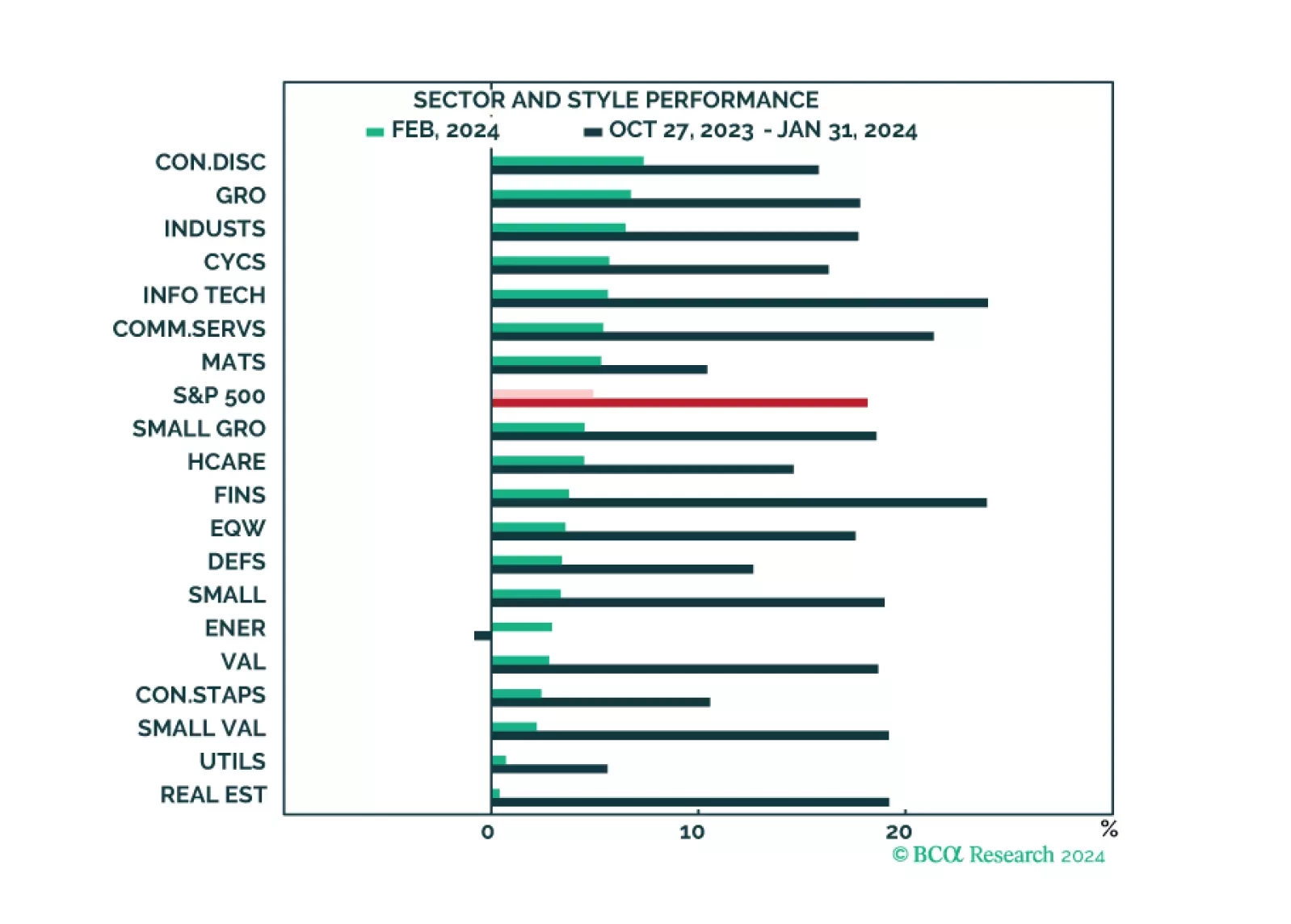

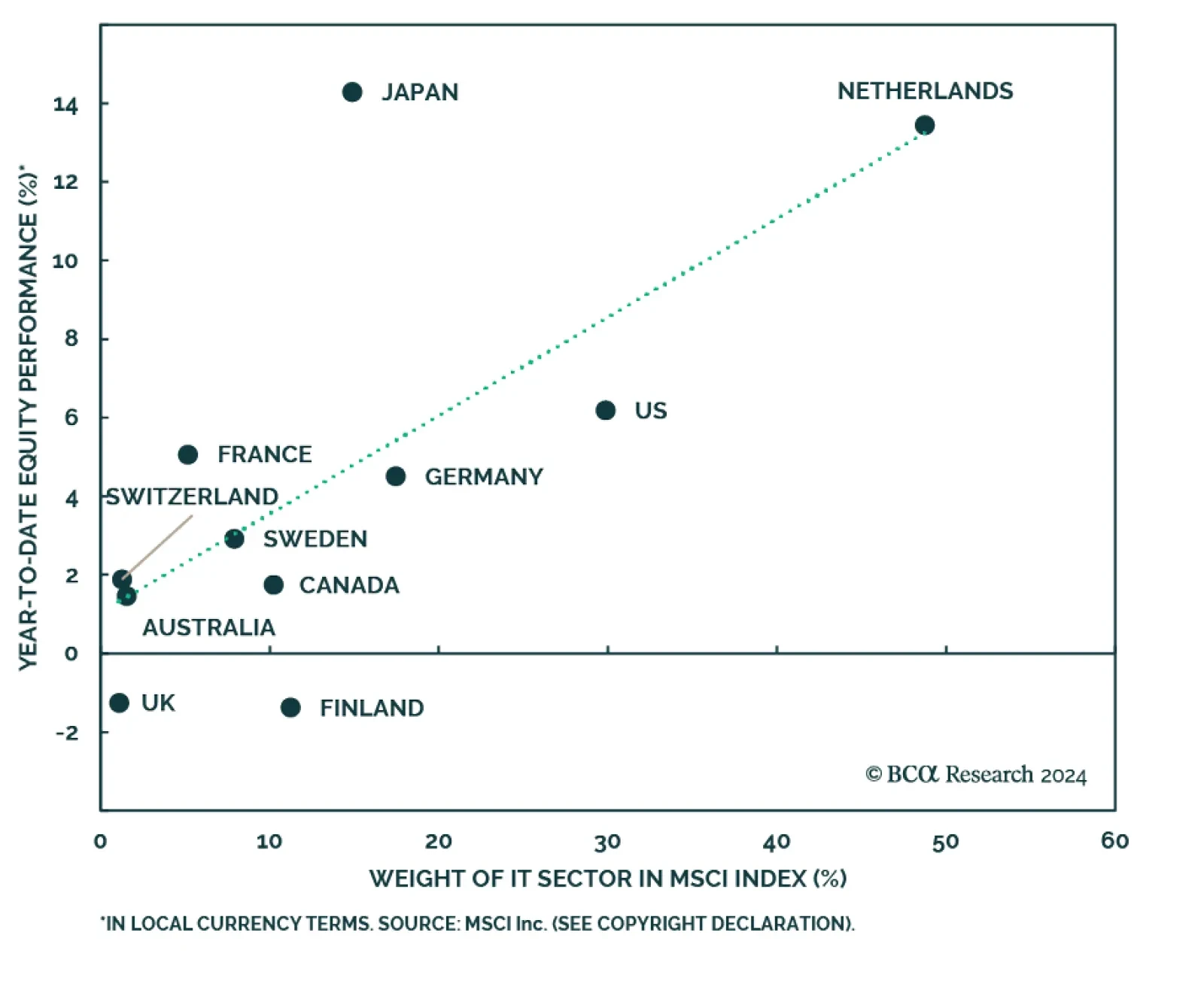

The market narrative continues to be dominated by the Magnificent Six, which drove both market performance and strong Q4 earnings results. While all sectors and styles have recently turned green, the rally is still mostly narrow.…

As we highlighted in a previous Insight, the breadth of the US equity rally has been relatively narrow, led by extremely strong gains among Big Tech stocks. Tech is still the best performing sector, with the S&P IT price…