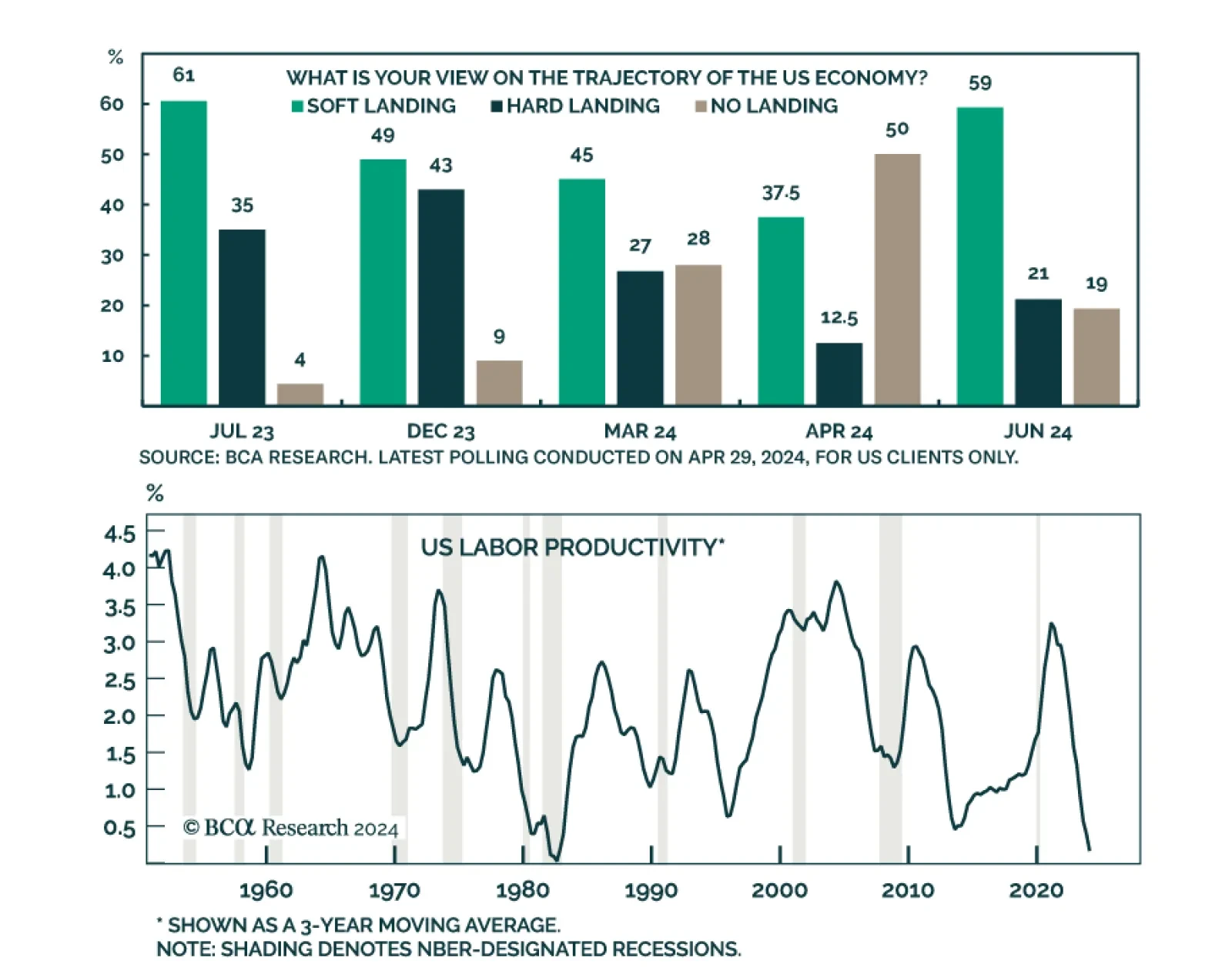

According to BCA Research’s US Equity Strategy service, the market is overestimating the odds of a soft landing. Our colleagues’ client polls have shown that 59% of respondents expect the US economy to achieve a…

In Section I, we examine some concerning signs of US economic weakness that emerged in June. We also discuss portfolio positioning in the face of falling interest rates and cross-check our recommended US equity overweight in the face…

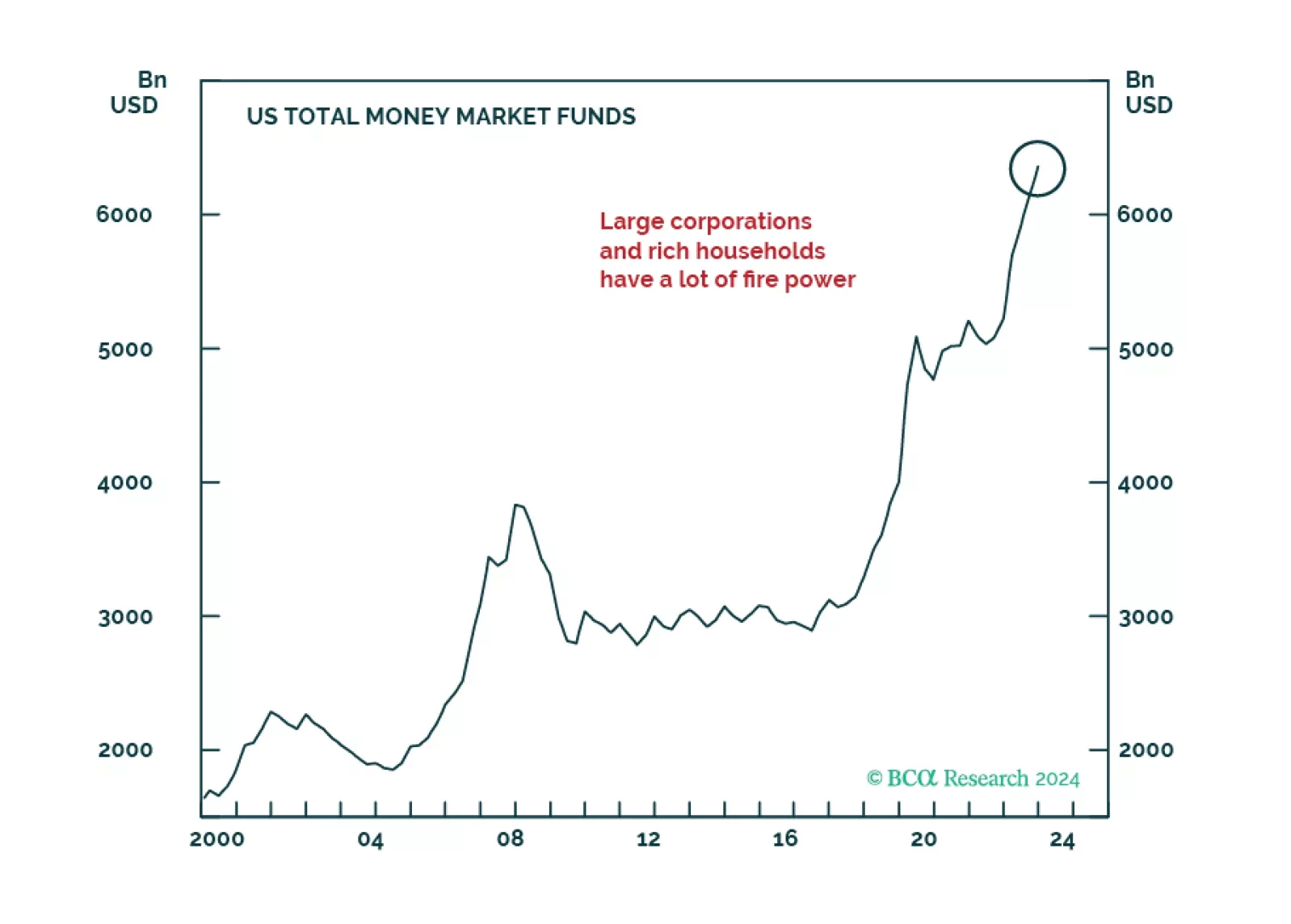

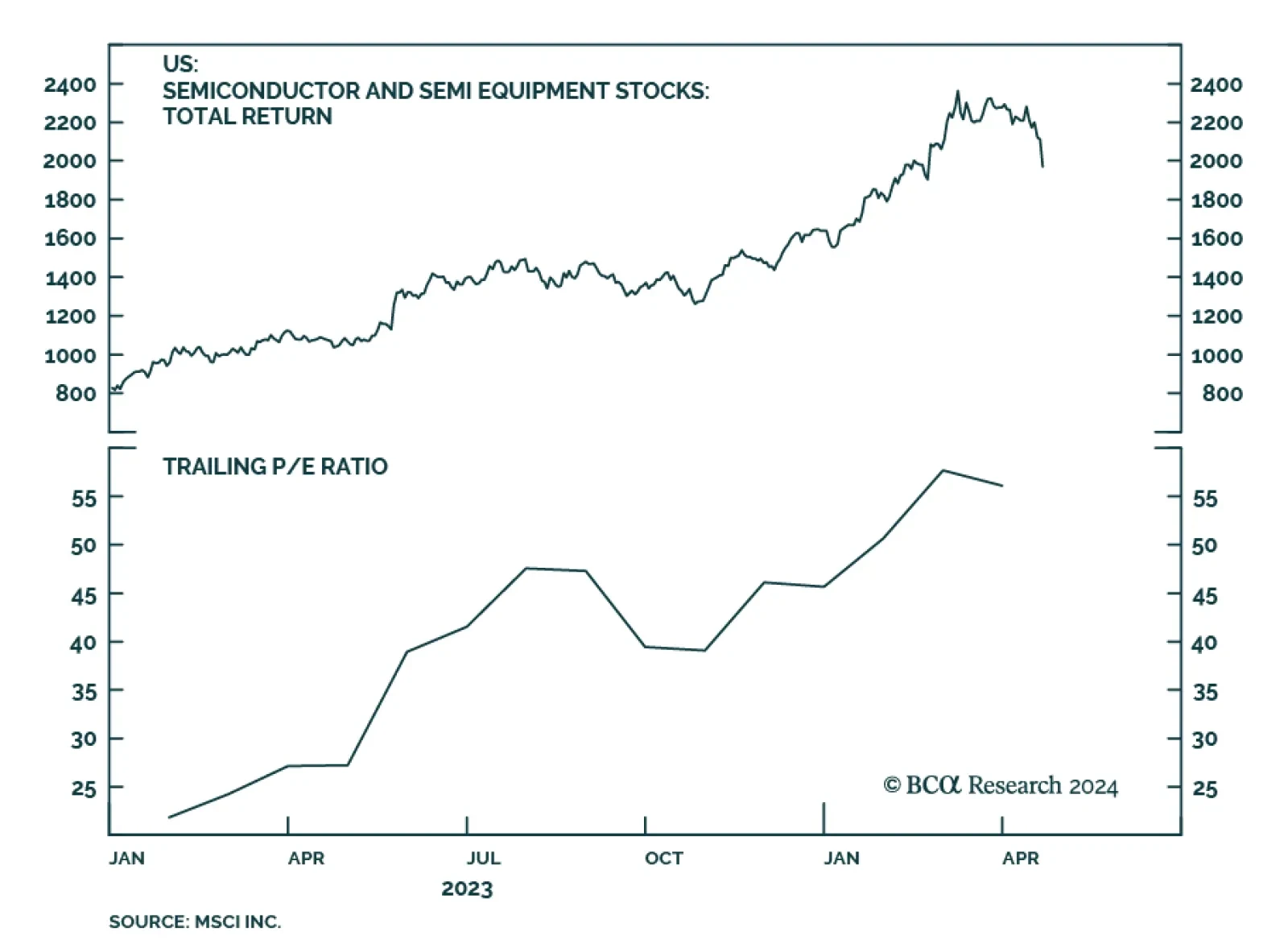

Generative AI-related rally resumed in May. Much of the recent market gains are down to excess liquidity that was begotten by the massive pandemic stimulus, creating a dichotomy between multiple economic challenges and exuberant…

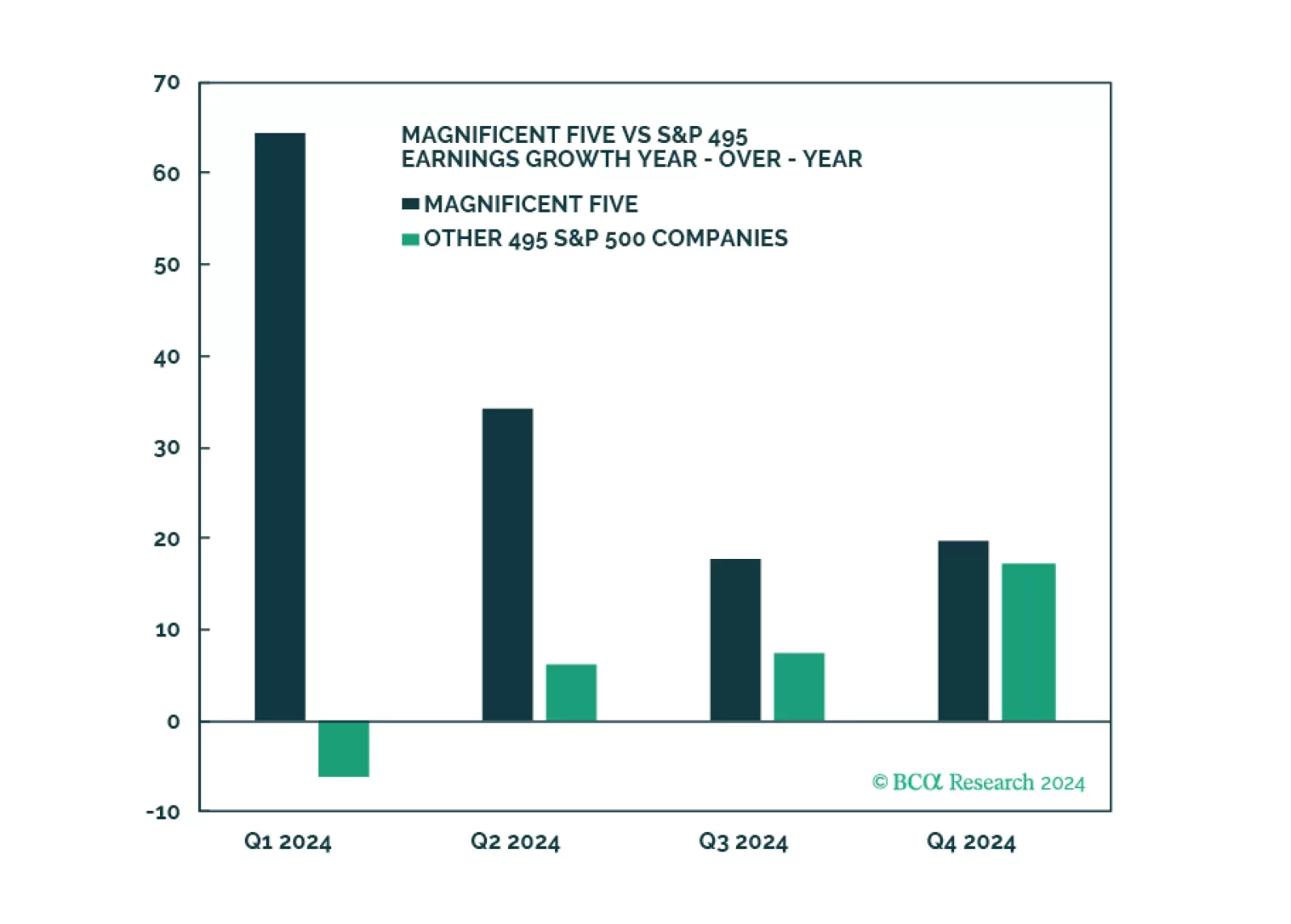

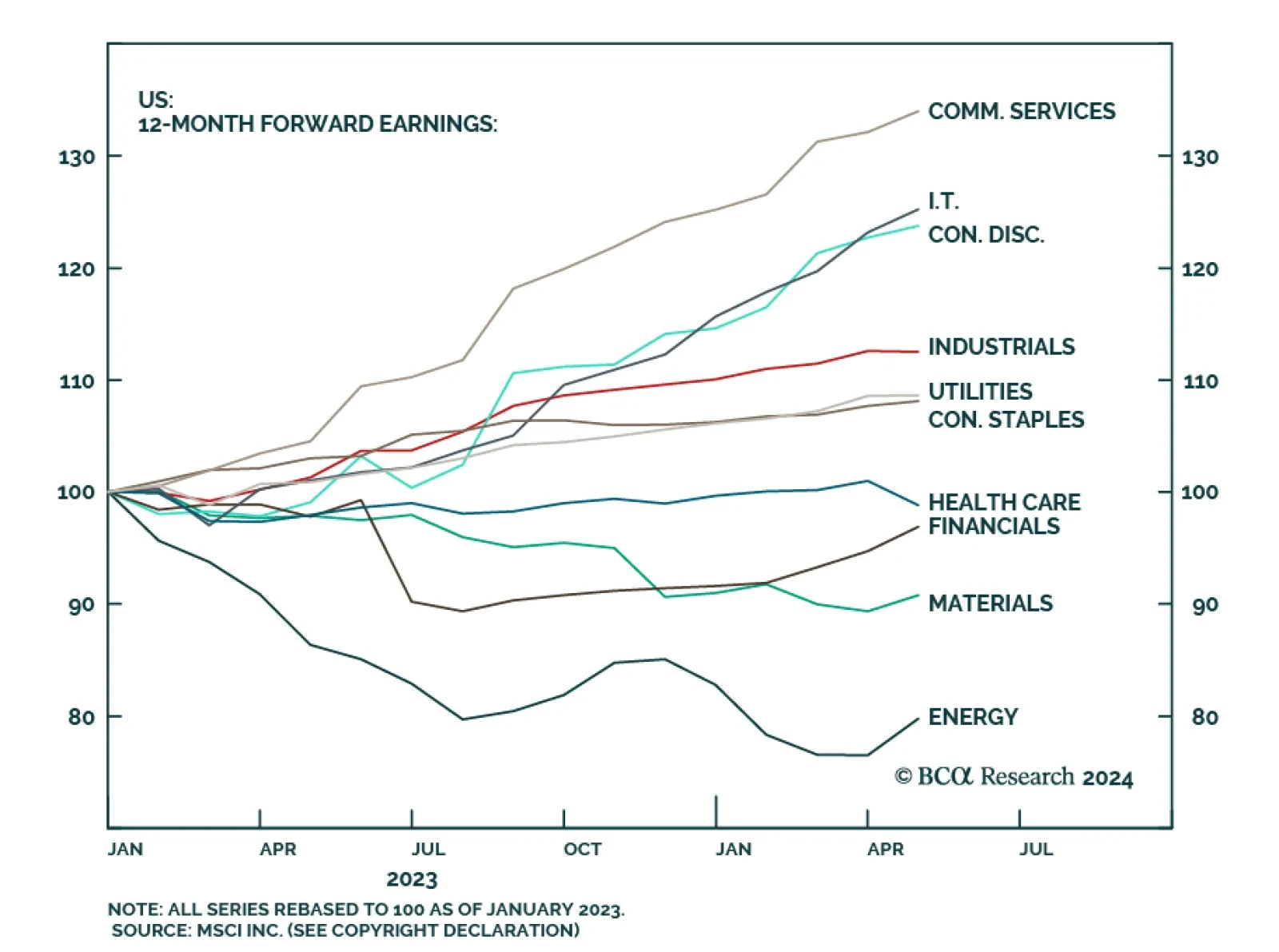

Q1 Earnings and sales growth were strong, but the devil is in the details: Without the Magnificent Five, earnings growth for the index would have been negative. On a positive note, margins have stabilized, and earnings growth is…

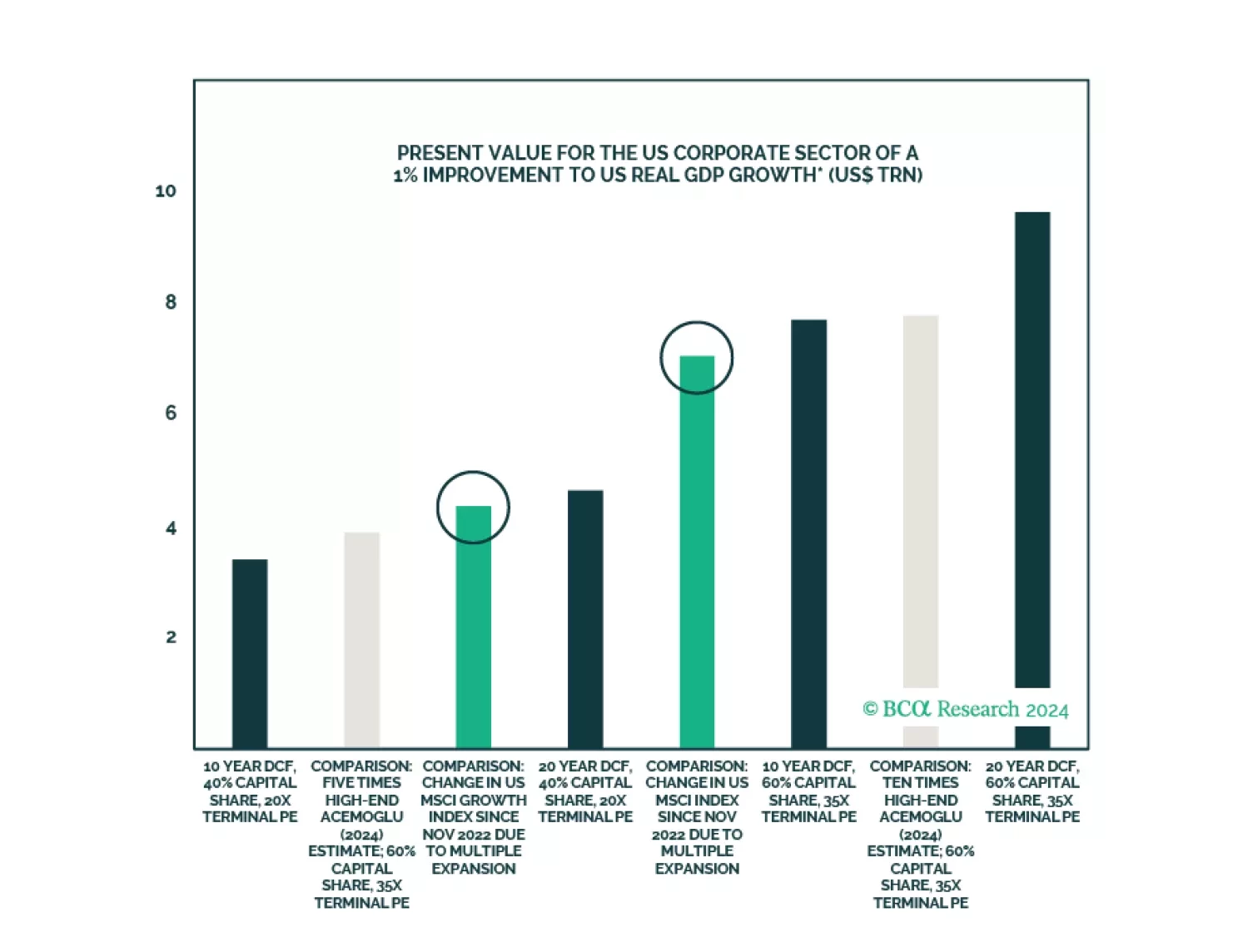

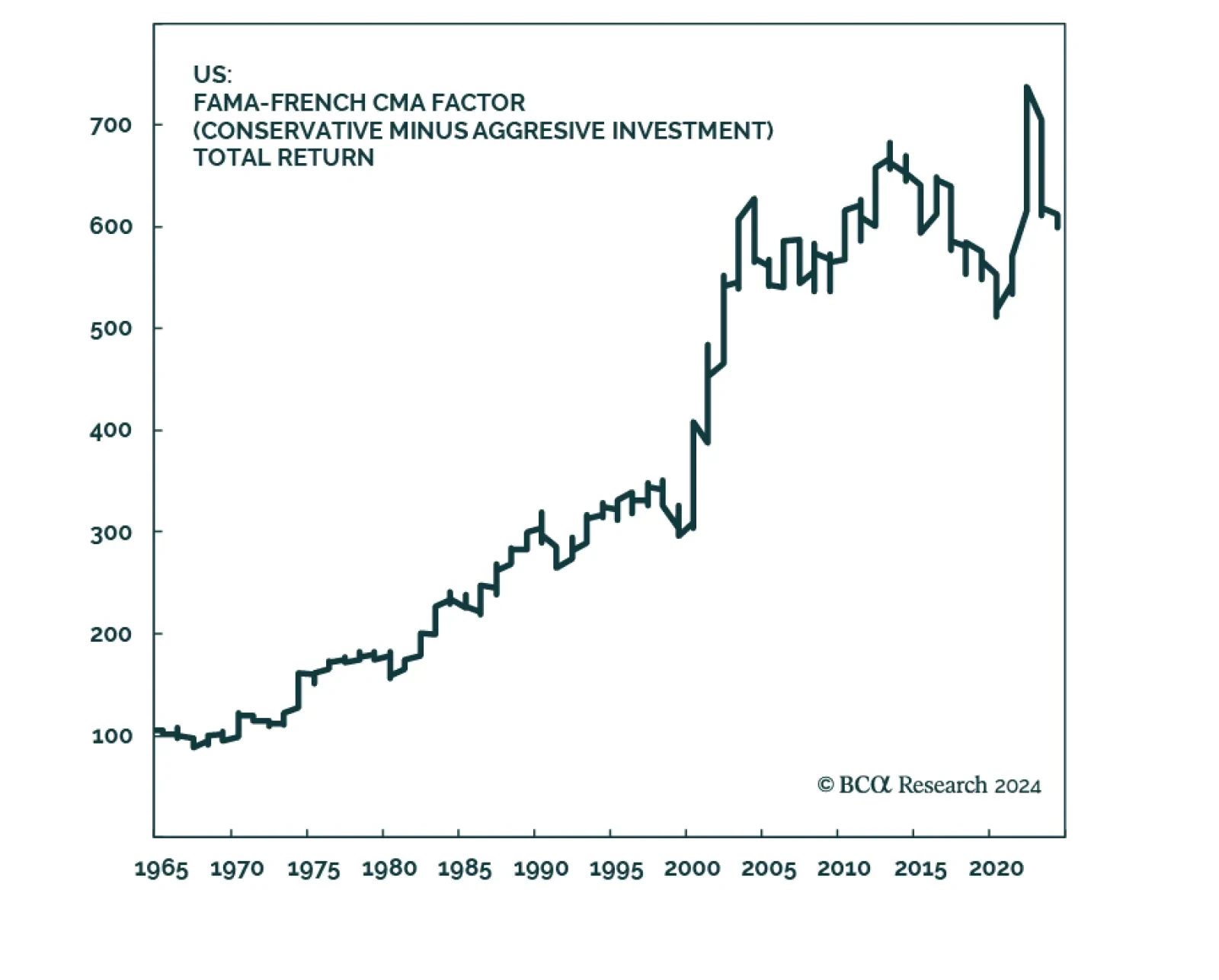

Investors generally associate higher investment rates with higher rates of growth. Indeed, companies at the beginning of their life cycle with a lot of high ROI opportunities will generally be more willing to invest their capital…

The broad market took a significant step backward in April, as market jitters gripped investors, stoking fears of higher for longer monetary policy. However, our roundtable investor poll has demonstrated that the majority remain…

After underperforming in 2022, I.T., Consumer Discretionary and Communication Services – the three sectors encompassing America’s largest tech companies – have rallied by 61.3%, 41.4% and 73.7%, respectively,…

Over the last weeks, US semiconductor stocks have plunged by over 17%. In a way, this correction should be expected. Semiconductor stocks had skyrocketed this year. Even after the recent pullback, semi stocks…