The CCP is poised to roll out a re-boot of China’s economy that will focus on its comparative advantage in the processing of base metals – particularly copper – and the export of metals-intensive products like EVs. The re-boot will…

The Q1-2023 earnings season has surprised as companies’ results point to the end of the earnings recession. However, the good news is already priced in – the market has barely budged over the past six weeks. Earnings rebound may…

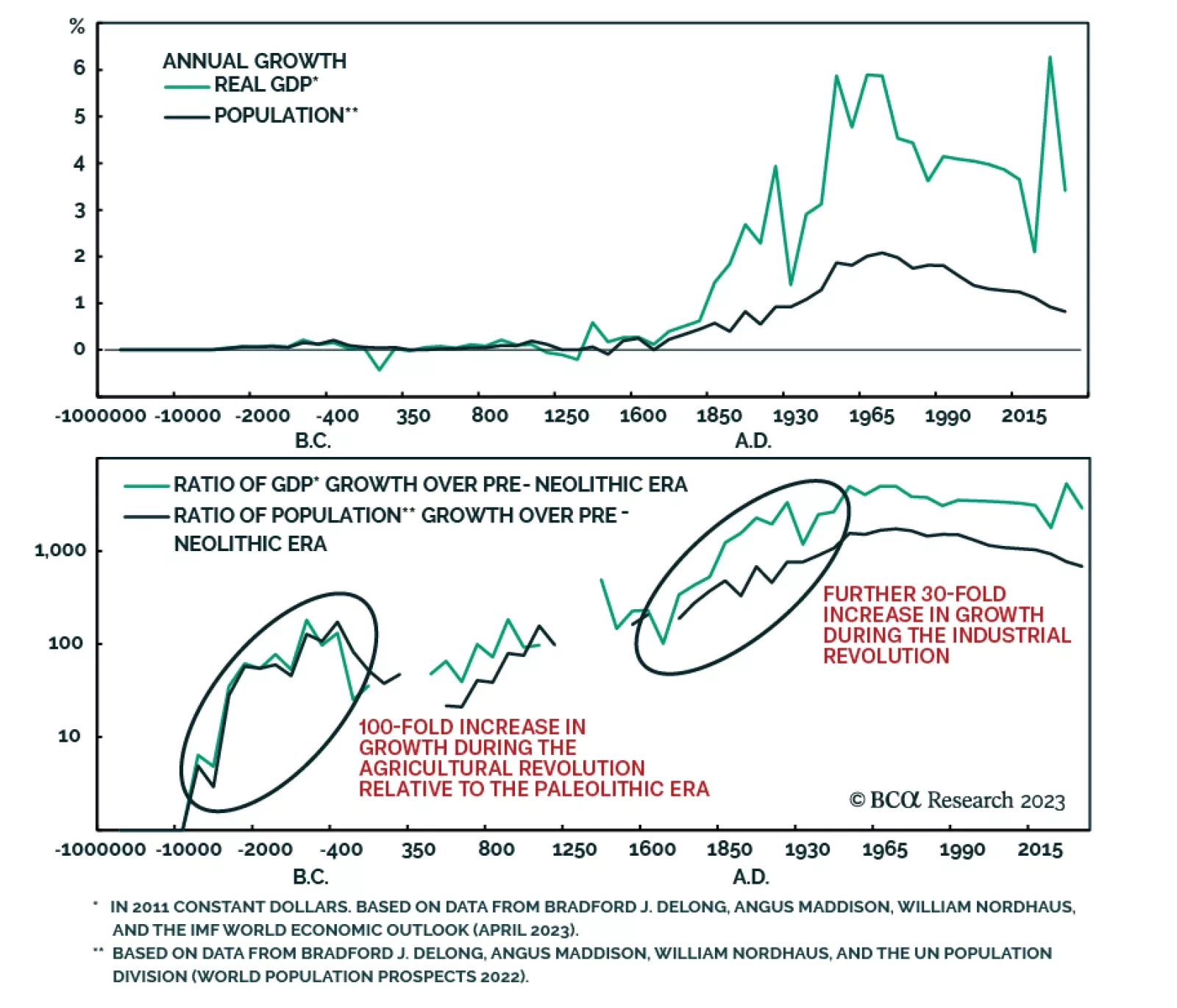

According to BCA Research’s Global Investment Strategy service, AI’s progression is following an exponential curve, not a linear one, meaning that advances could come much faster than expected. If humanity survives…

According to BCA Research’s Counterpoint service, on a timeframe of two years, investors should shock-proof their portfolios by holding some combination of cheap insurance assets. All shocks end up with both deflationary…

There is a 50:50 chance of experiencing a major deflationary shock in the next two years, and an even greater likelihood on a longer timeframe. The good news is that several assets provide a good insurance against this risk, and that…

Innovative Tech will face macroeconomic headwinds in a new “higher for longer” interest regime. Yet, the long-term opportunity of the cohort is tremendous. Investors need to be judicious with the timing of adding new capital to…