Outperformance of Growth sectors most likely has run its course. It is time to shift Growth vs. Value allocation to neutral, downgrade Semis, and upgrade Energy to overweight.

Investors remain cautious about the US economy and still have significant cash that needs to be put to work which could extend the rally further. Earnings rebound later in the year will be supported by rising sales growth and surging…

Among the critical materials needed for the global energy transition, Li is expected to see the largest increase in demand from 2022 to 2050. Li supply is not constrained, but continued investment in mining and refining will be…

Both EV and Green Energy themes still hold strategic promise for investors, posing large upside, despite prevailing macro headwinds. While both themes have yet to claw back their pandemic peaks, a broadening of the rally supports a…

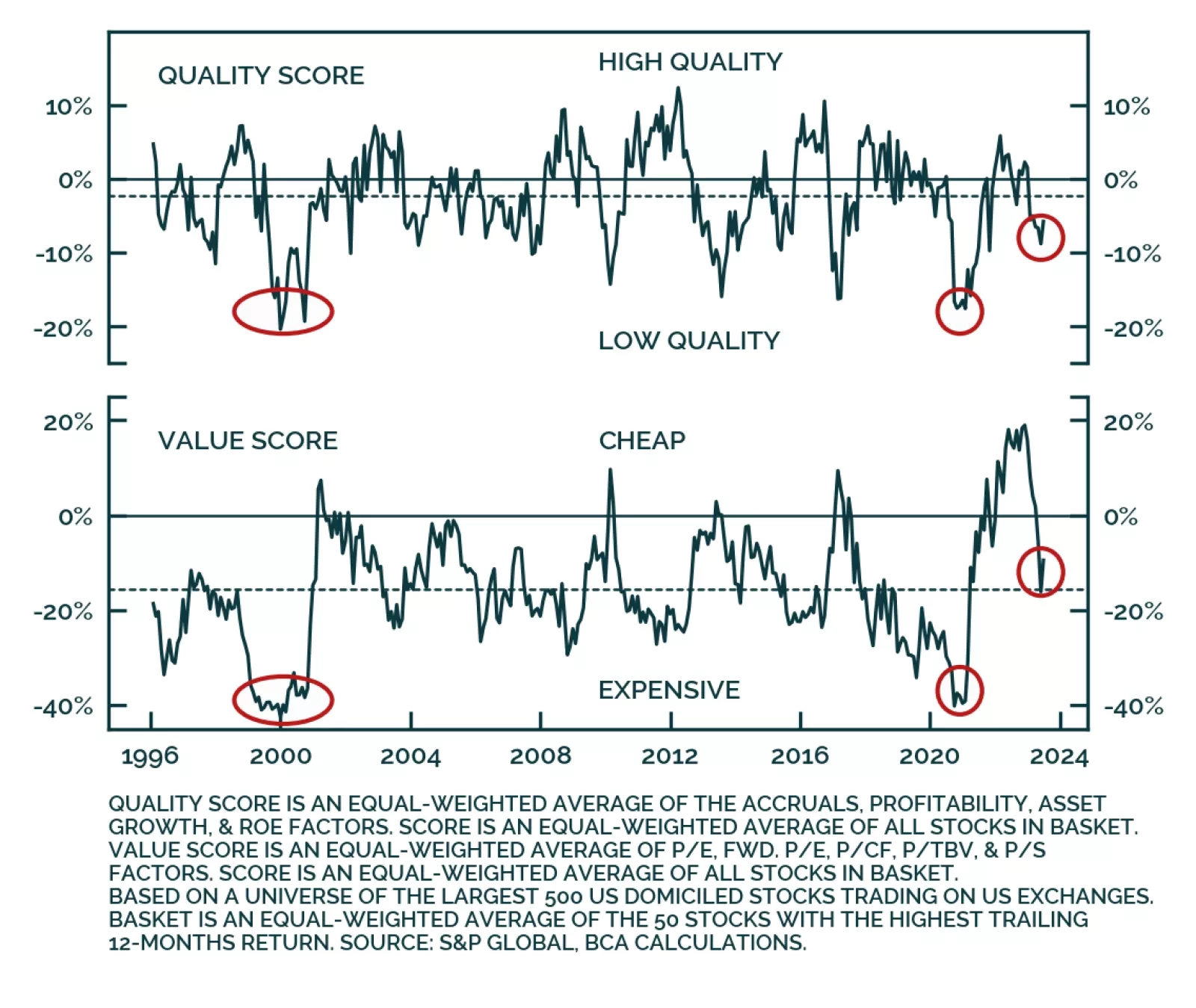

The stratospheric valuation of this year’s AI mania is likely to deflate, just as it did after the Web 1.0 mania of the late 90s. We go through some long-term and short-term investment implications.

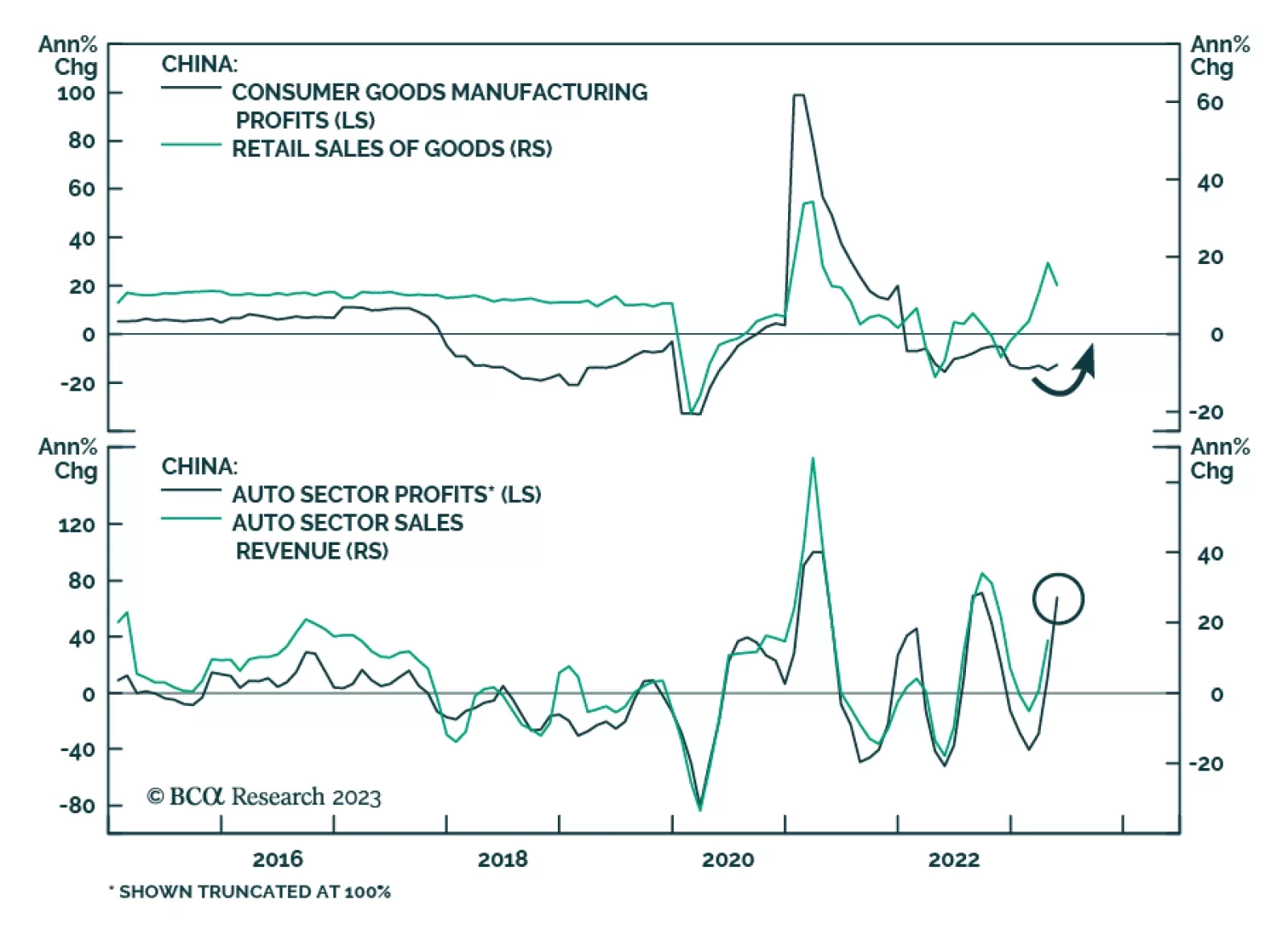

According to BCA Research’s China Investment Strategy service, although the recovery in overall Chinese industrial profits will be subdued, there will be a silver lining among China’s consumer goods producers, autos…

This chart breaks down the factor exposure of the top performers in the US large cap space relative to the largest 500 stocks in the US to see how the current market leaders compare to history relative to their peers. The values…

Momentum, high cash balances, FOMO, and expectations of soft landing drive the market higher. This rally may continue for a while, but macroeconomic headwinds are intensifying and will eventually derail the rally. It is too early to…