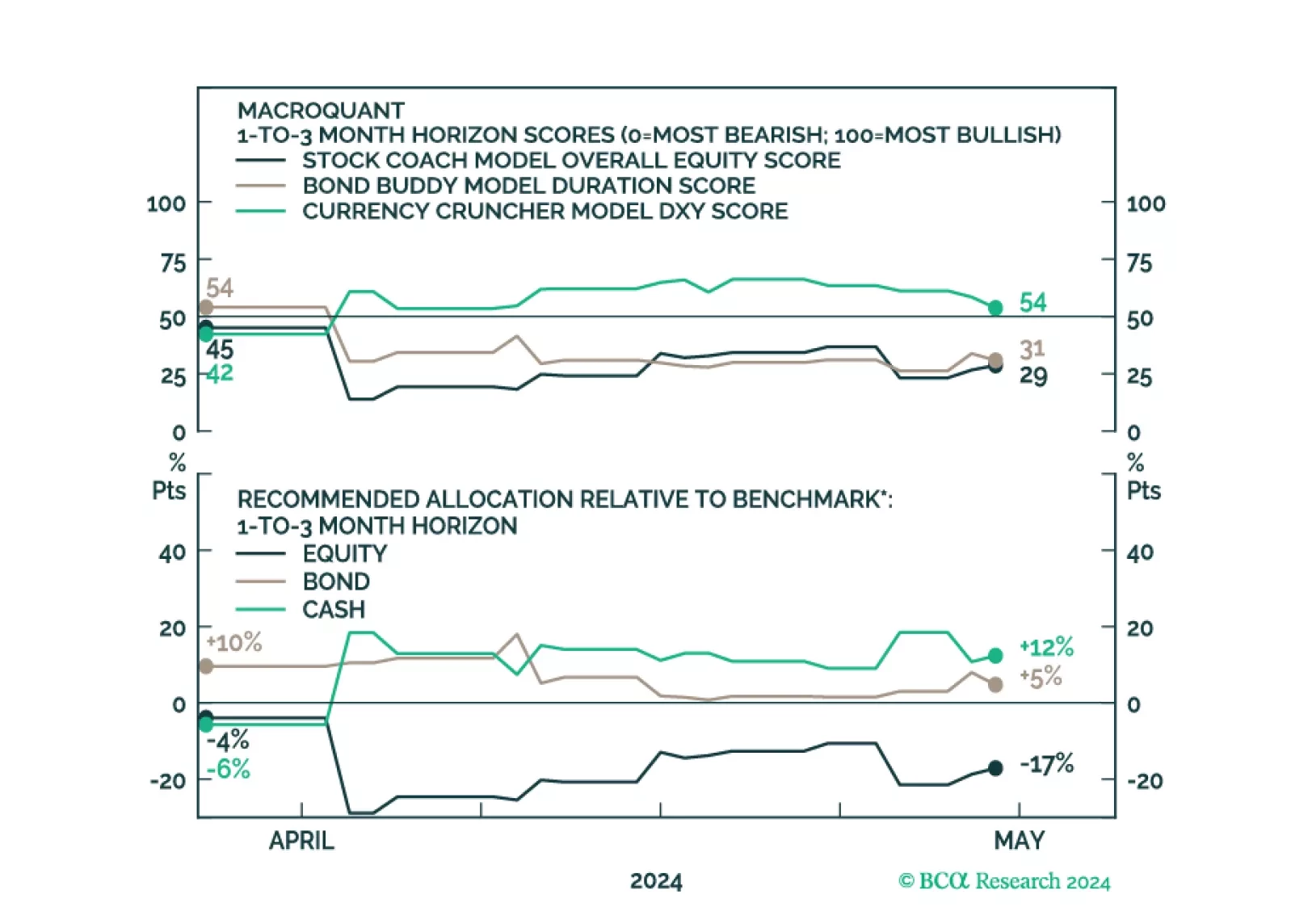

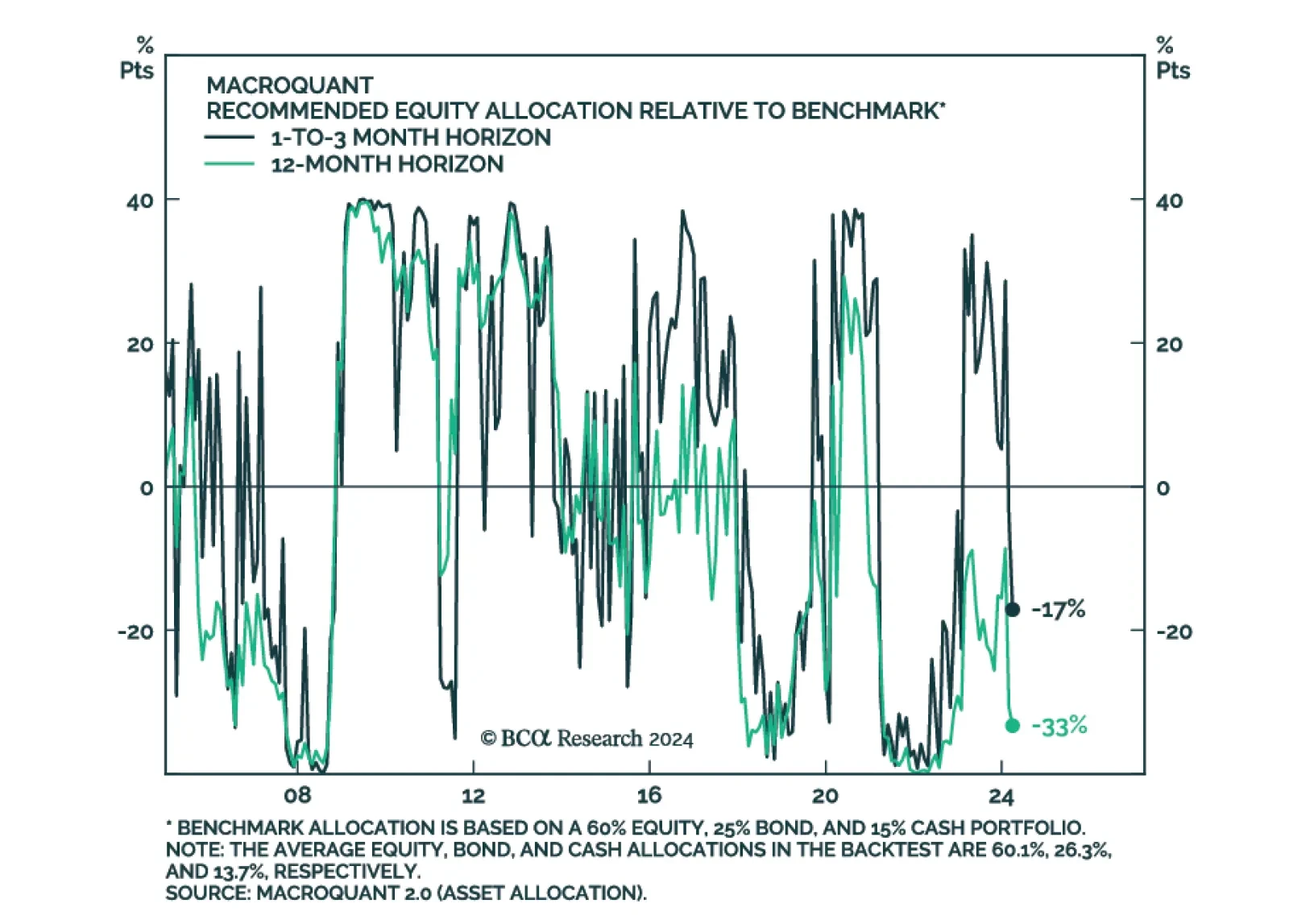

In its latest report, BCA Research’s Global Investment Strategy service provides an update on its MacroQuant model. The overall equity score declined in April, finishing the month at the 29th percentile, which is enough to…

MacroQuant downgraded equities from neutral to underweight on a 1-to-3 month horizon. The model suggests increasing exposure to cash.

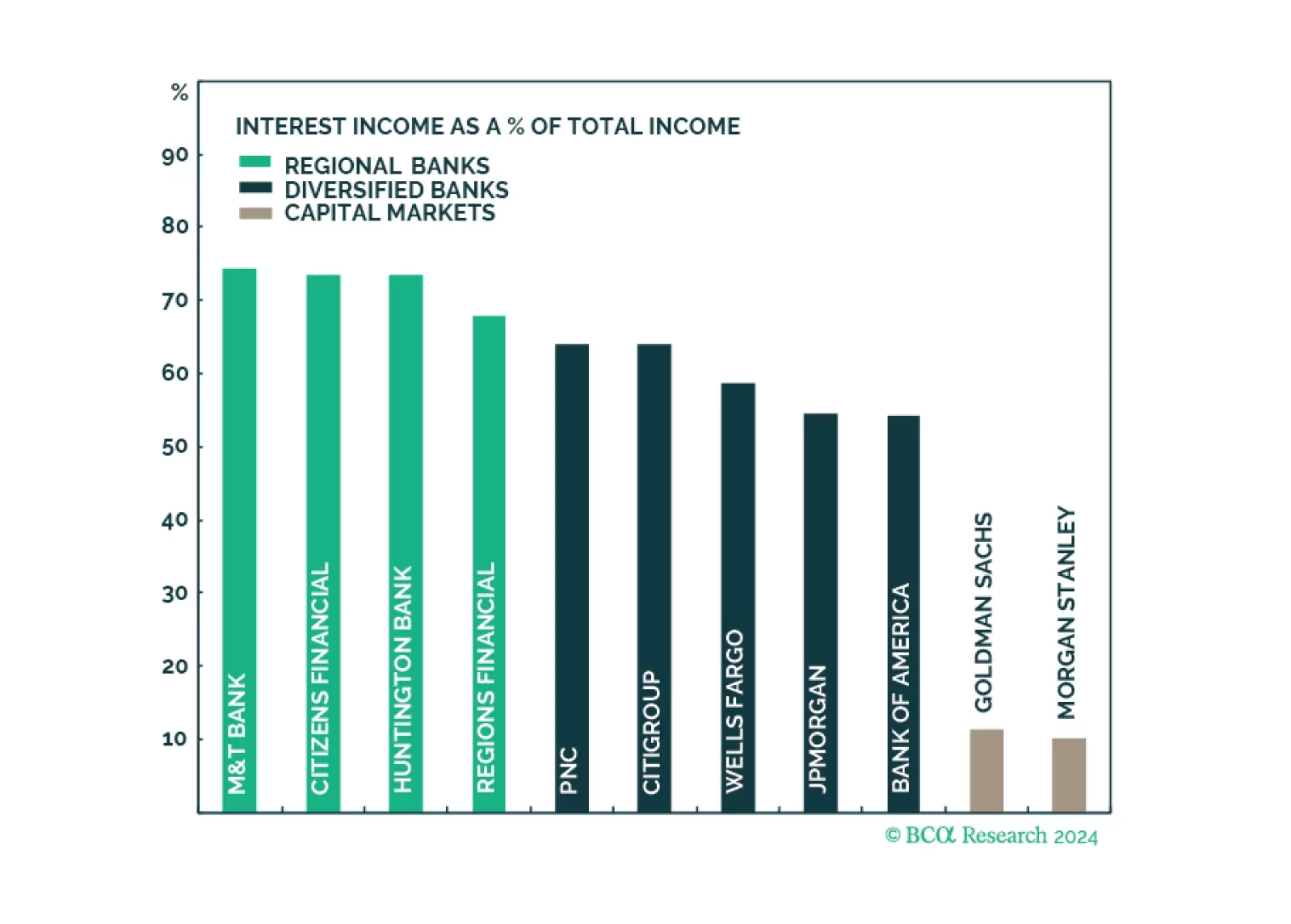

Q1 earnings results of the largest US banks have demonstrated that the engine of recent growth in profitability, NII, has faltered as funding costs are rising fast. However, the resurgence in non-NII thanks to a revival in corporate…

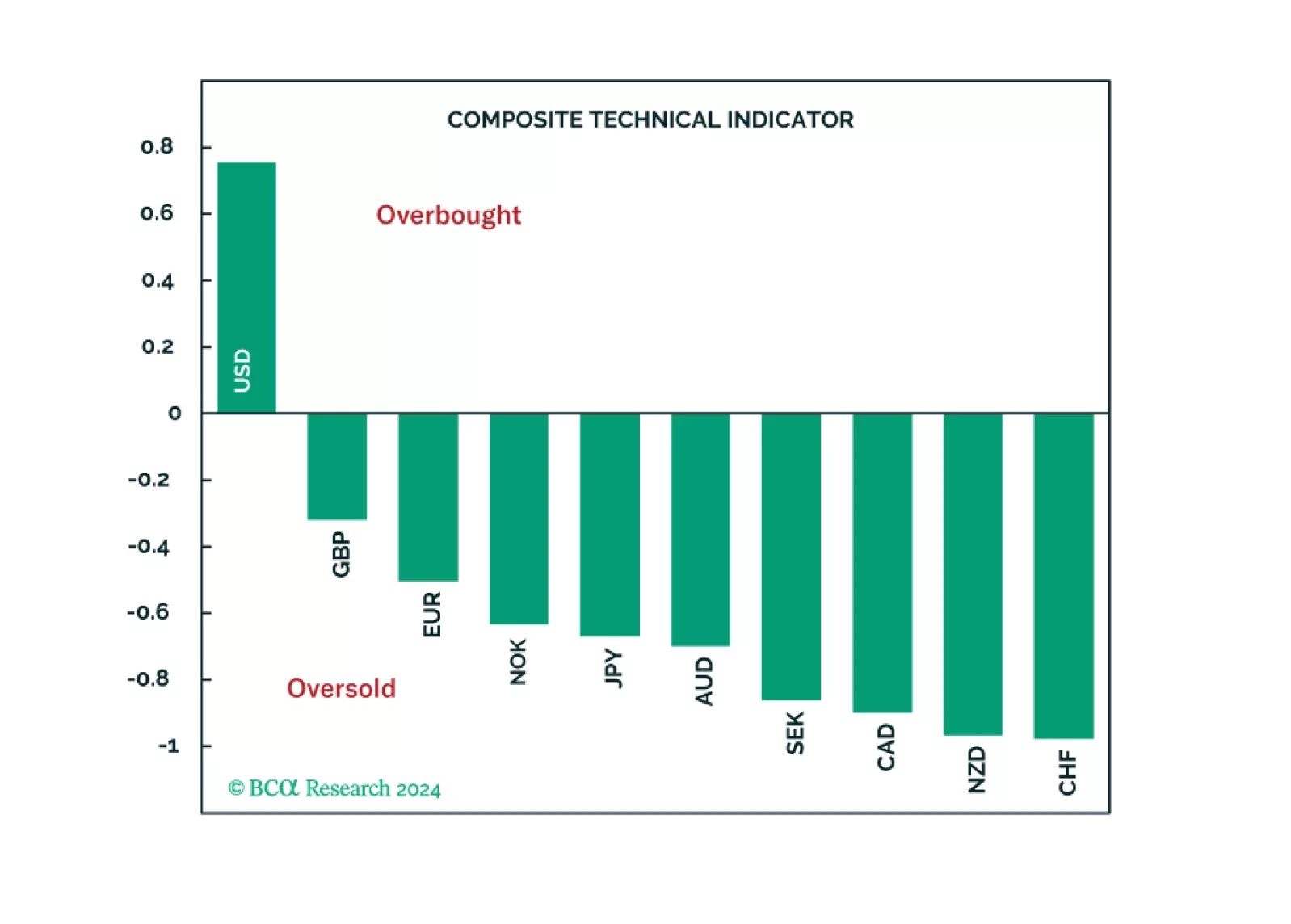

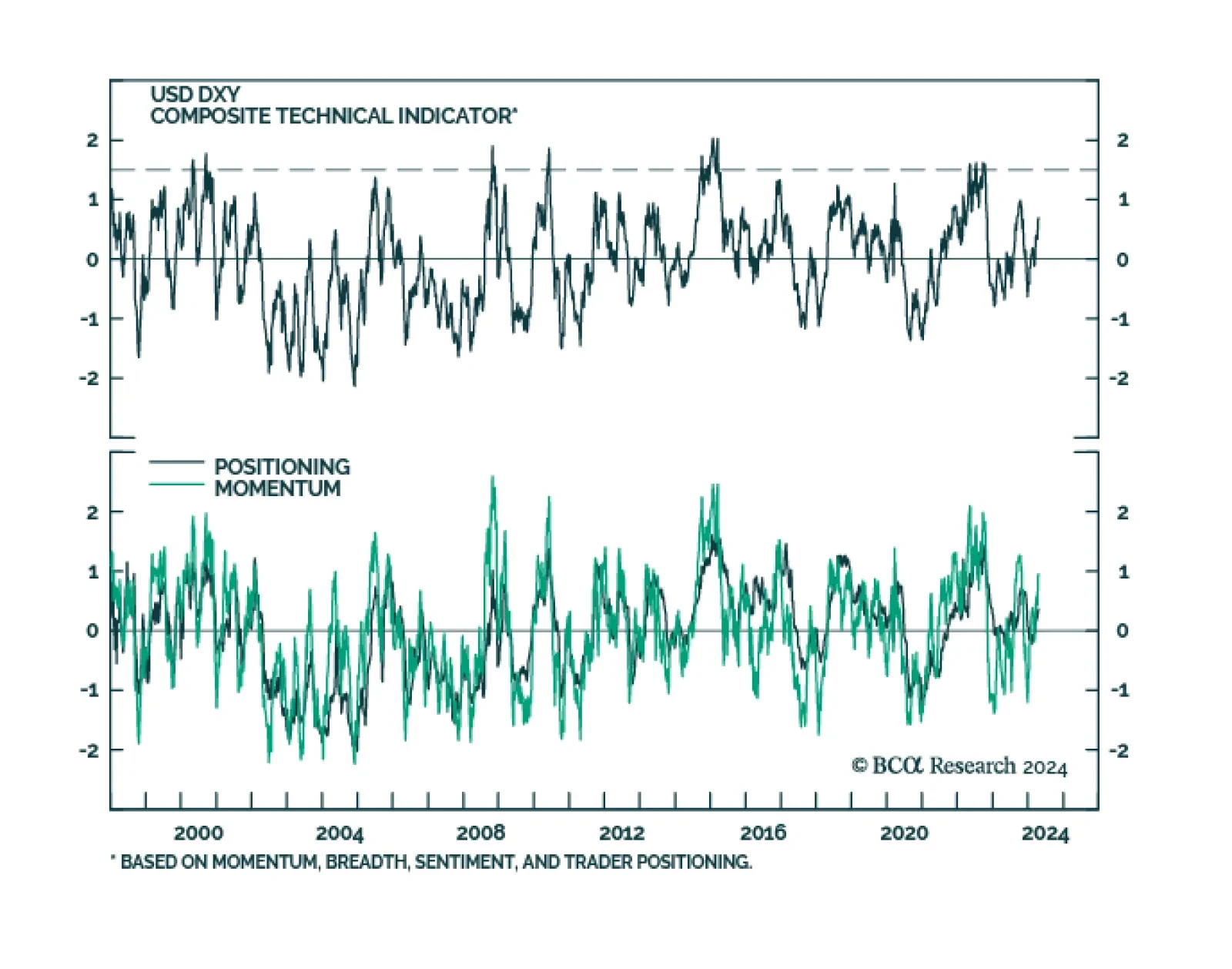

According to BCA Research’s Foreign Exchange Strategy service, an ensemble of technical indicators reveals that the dollar is overbought in the near term. The list of indicators they have compiled for this analysis is…

In this report, we review what our technical indicators are telling us about the G10 currencies.

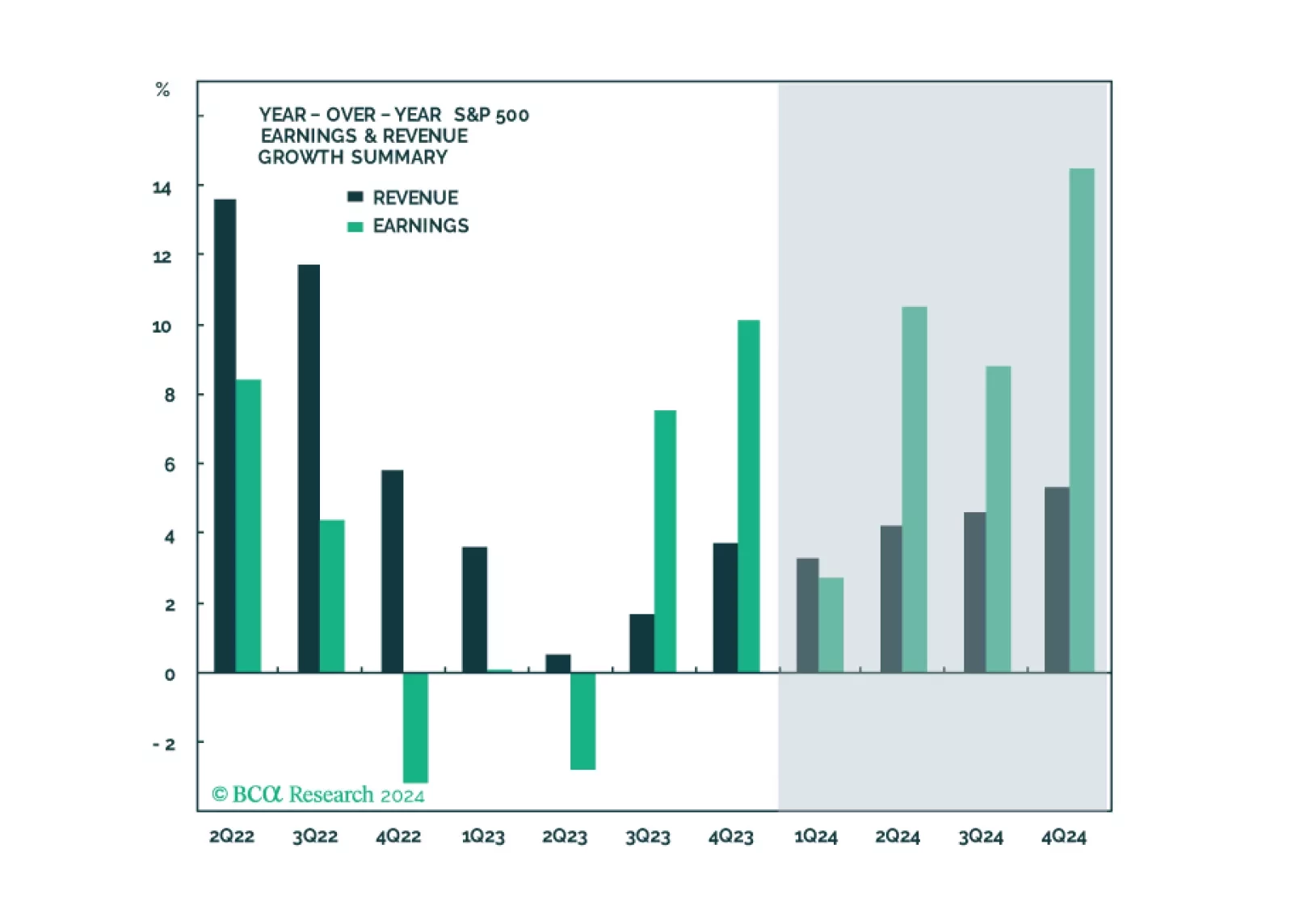

In this note, we preview the Q1-2024 earnings season, give our take on expectations and share what we will be watching.

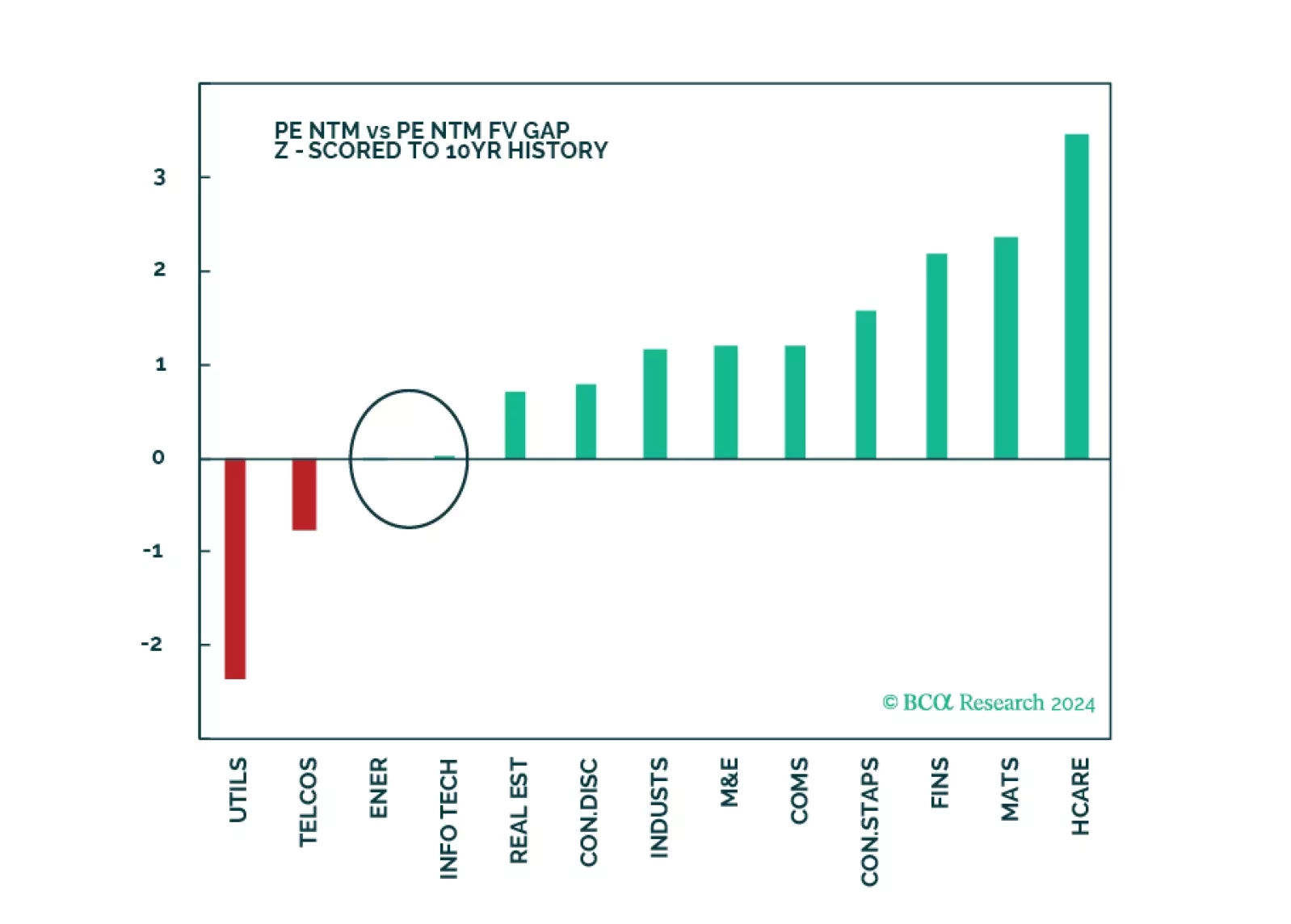

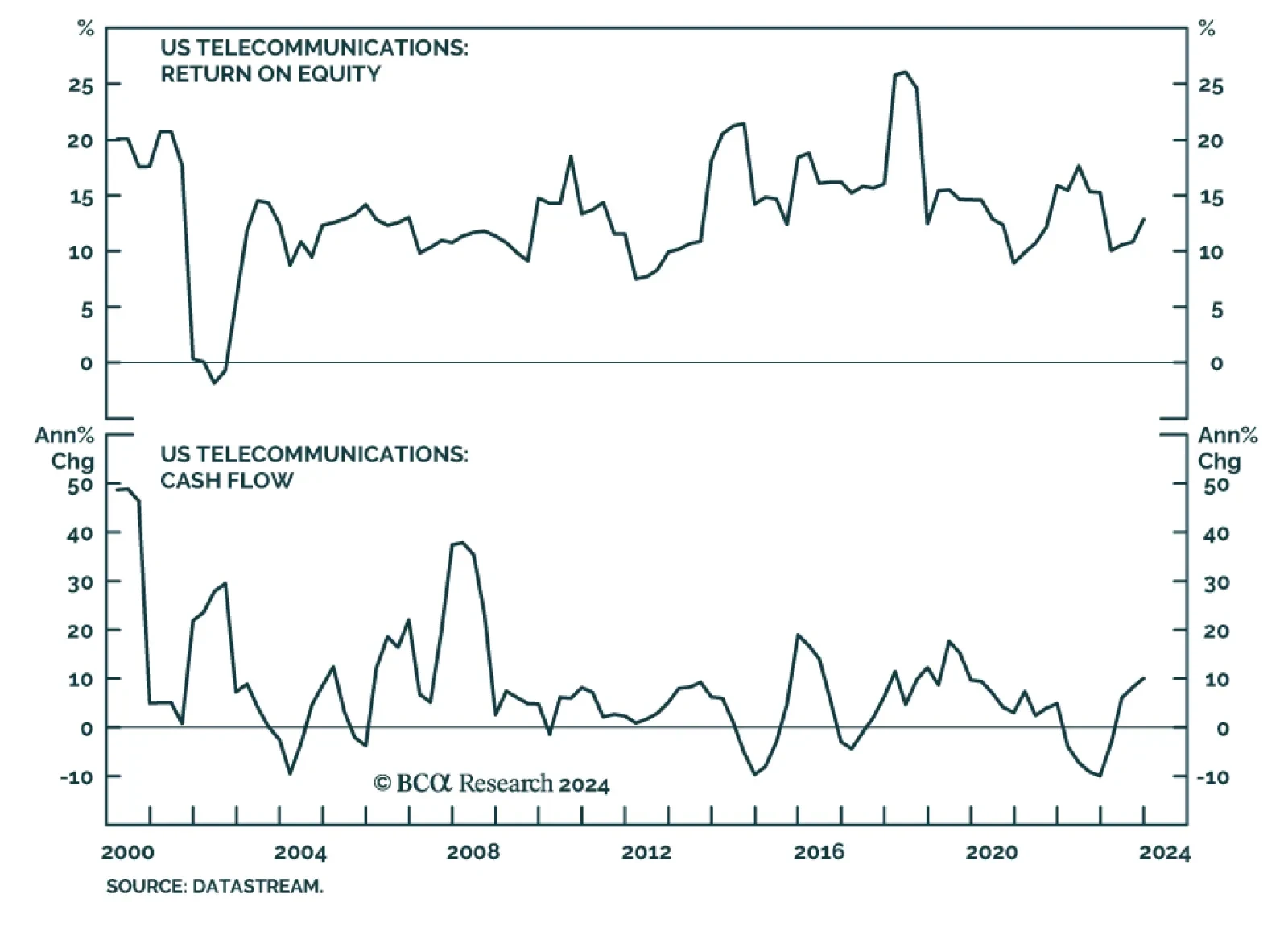

According to BCA Research’s US Equity Strategy service while Telecoms are not attractive on a strategic investment horizon, as a low-beta defensive sector they offer excellent downside protection for a portfolio. The…

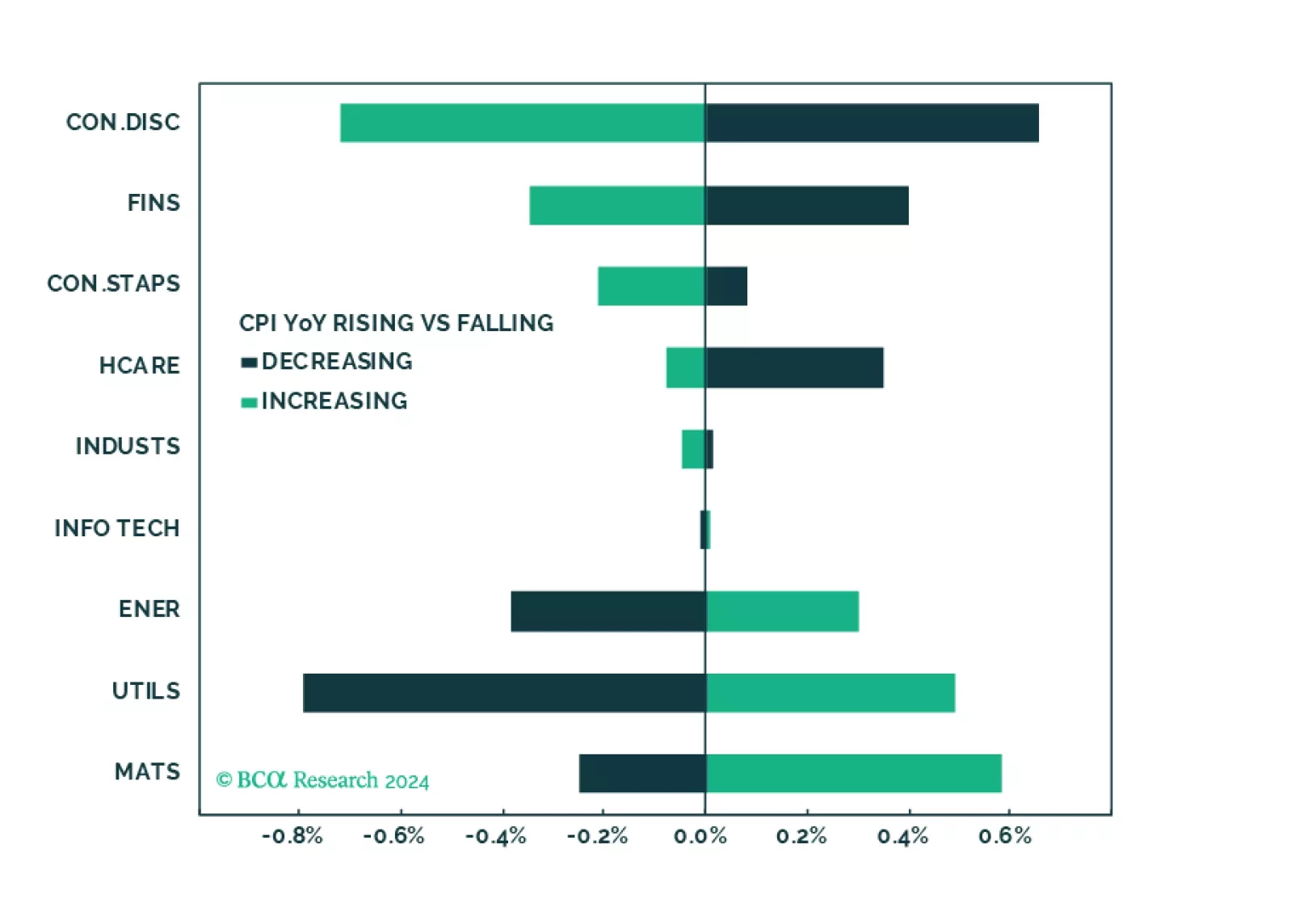

Fears of a hard landing are abating as growth has been surprising to the upside. New worries are emerging, such as the trajectory of disinflation, and the pace and timing of rate cuts. In this environment, it is important to build a…

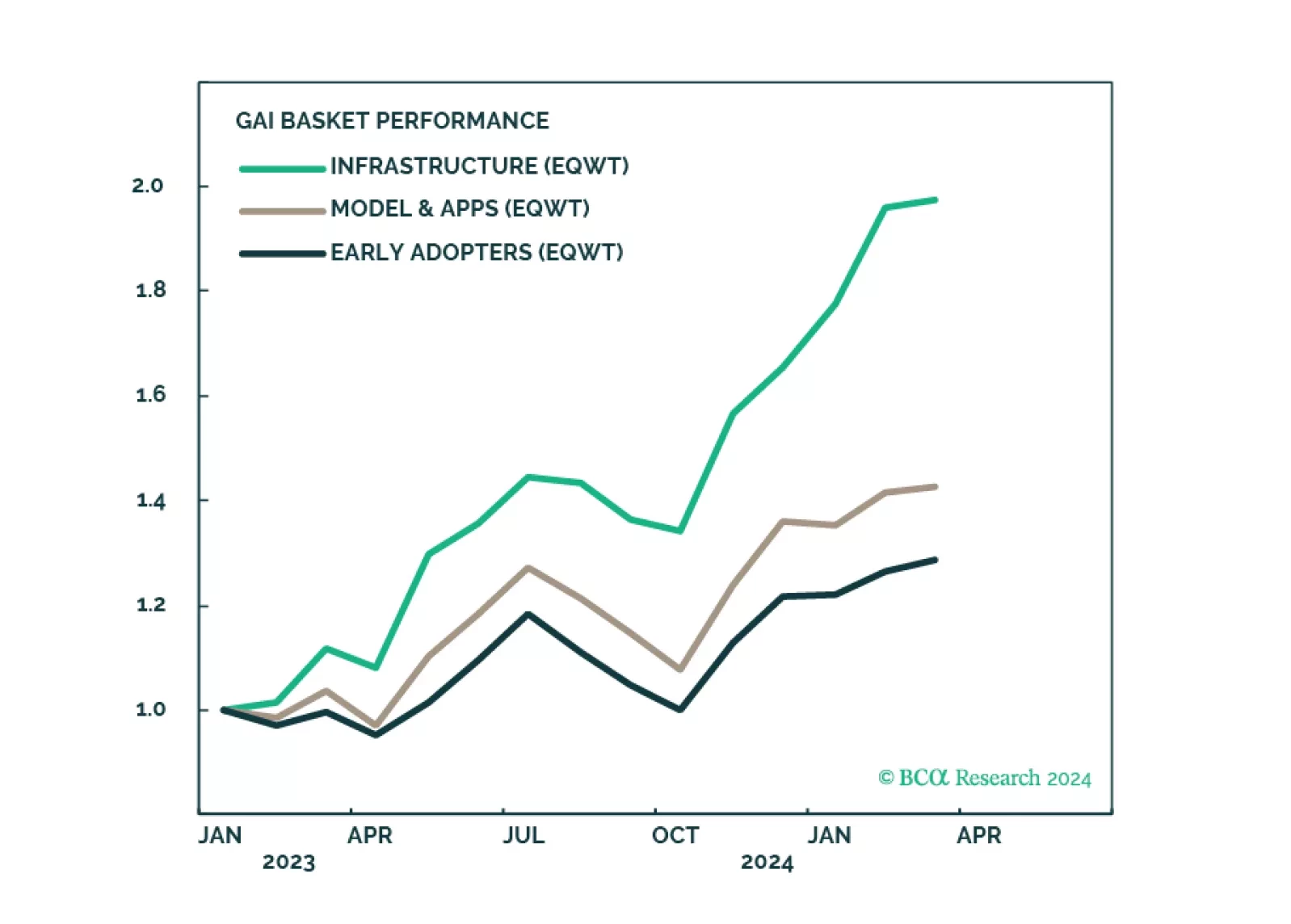

The equity rally extended into March as hard landing outcome was priced out. It has broadened, as money flowed into less over-loved pockets of the market. Our models signal that margins are about to stabilize, and earnings growth…