In Section I, we examine some concerning signs of US economic weakness that emerged in June. We also discuss portfolio positioning in the face of falling interest rates and cross-check our recommended US equity overweight in the face…

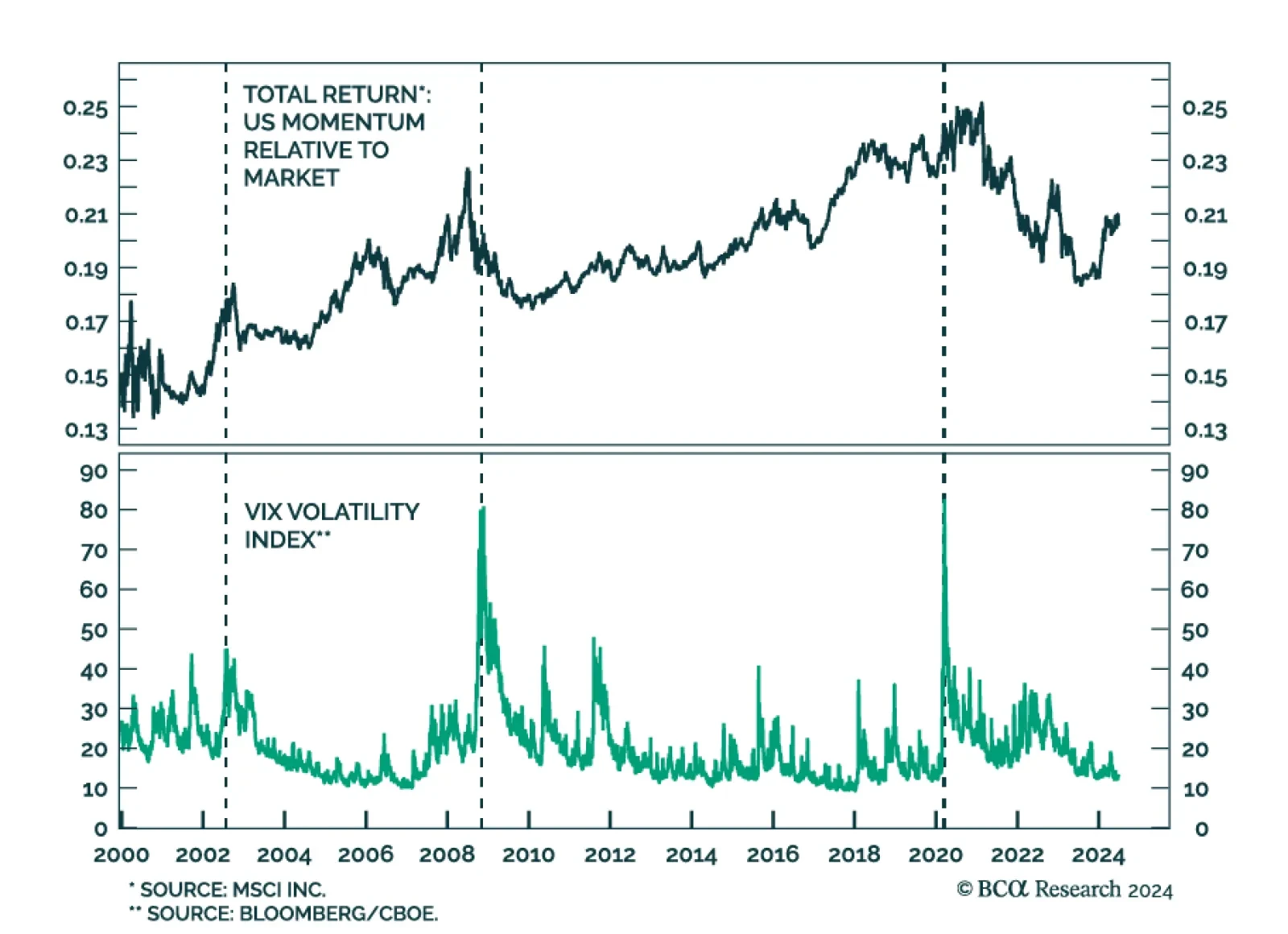

Volatility is usually a poor predictor of stock returns. It has no leading properties on the overall equity market. High volatility is contemporaneous with big drawdowns, while low volatility is contemporaneous with bull markets…

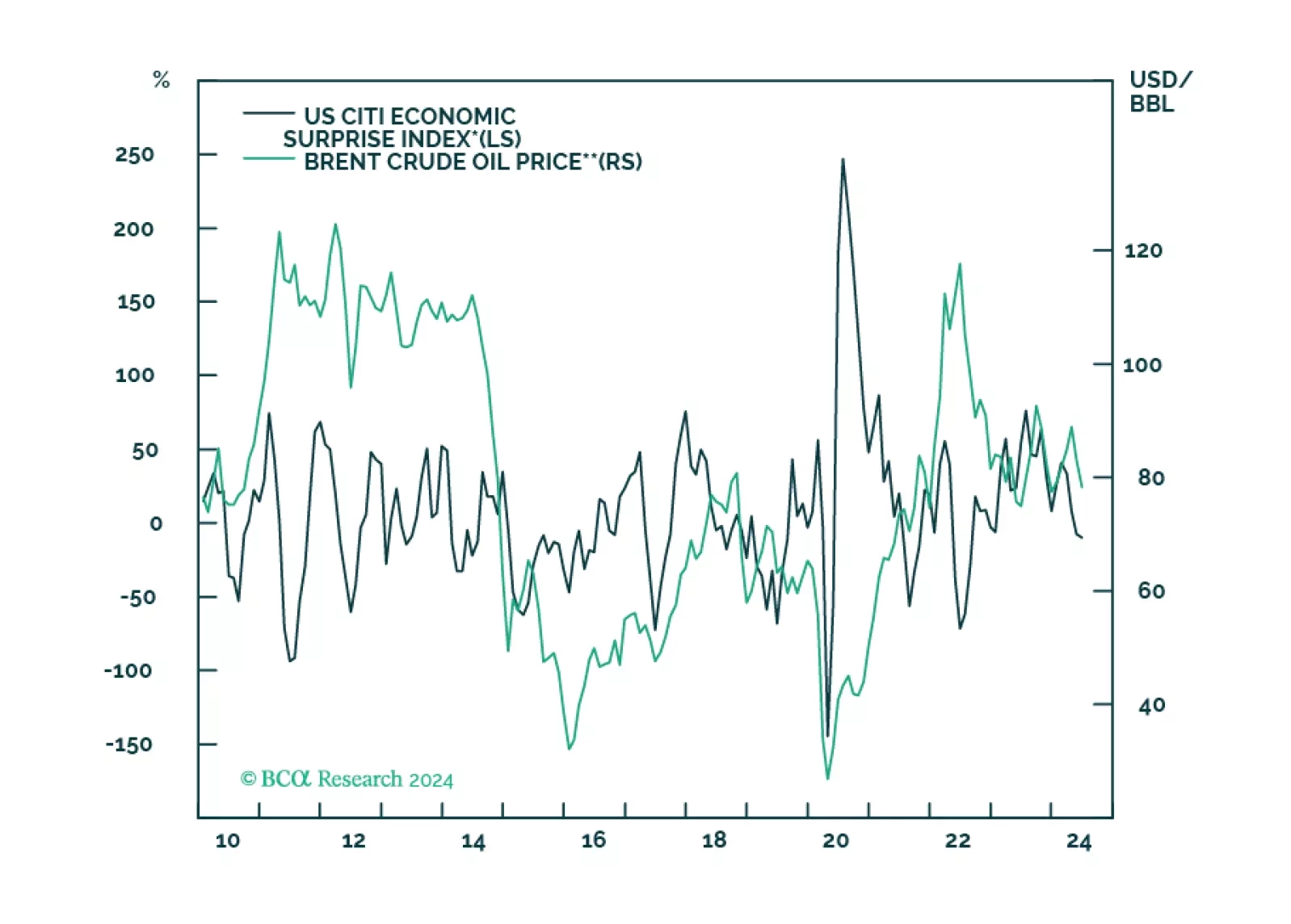

We close our overweights to Energy and Aerospace & Defense. The macroeconomic backdrop is deteriorating for Energy. As for A&D, the good news is already priced in.

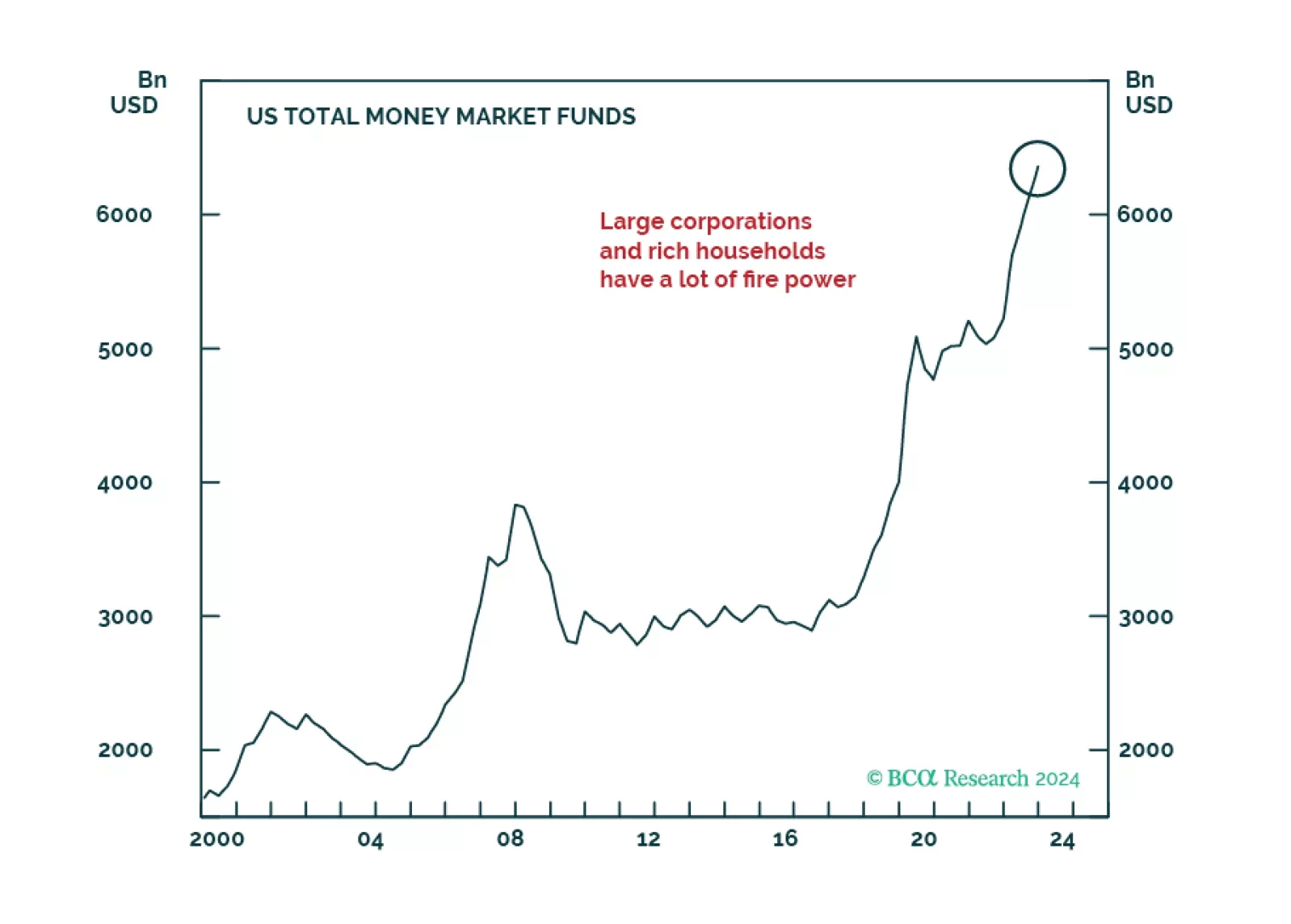

Generative AI-related rally resumed in May. Much of the recent market gains are down to excess liquidity that was begotten by the massive pandemic stimulus, creating a dichotomy between multiple economic challenges and exuberant…

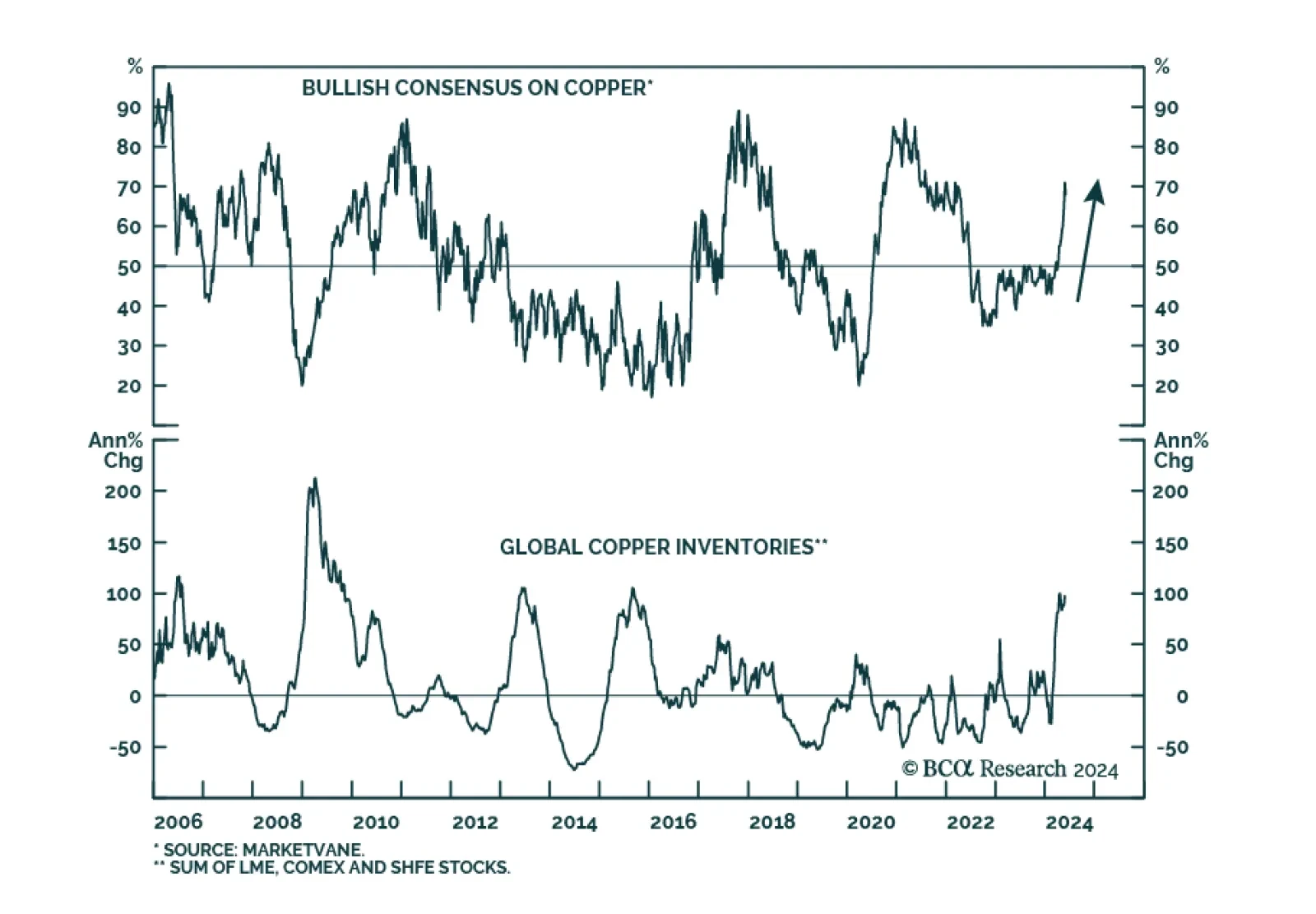

Copper prices have returned a whopping 25.6% YTD, briefly breaking above USD 5 earlier this month. The red metal accounts for a large share of industrial metals indices and it is being buoyed by the same late-cycle dynamics as…

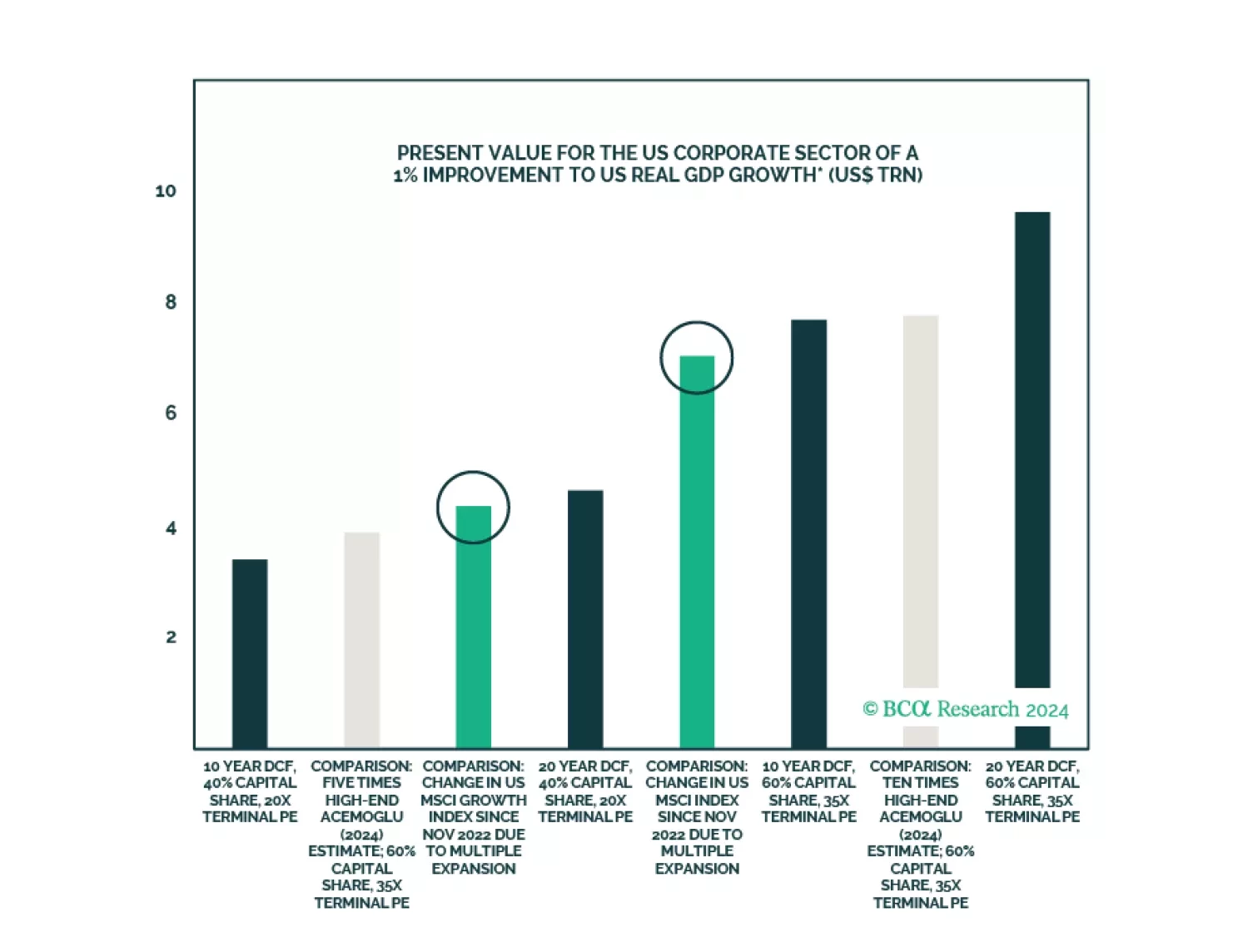

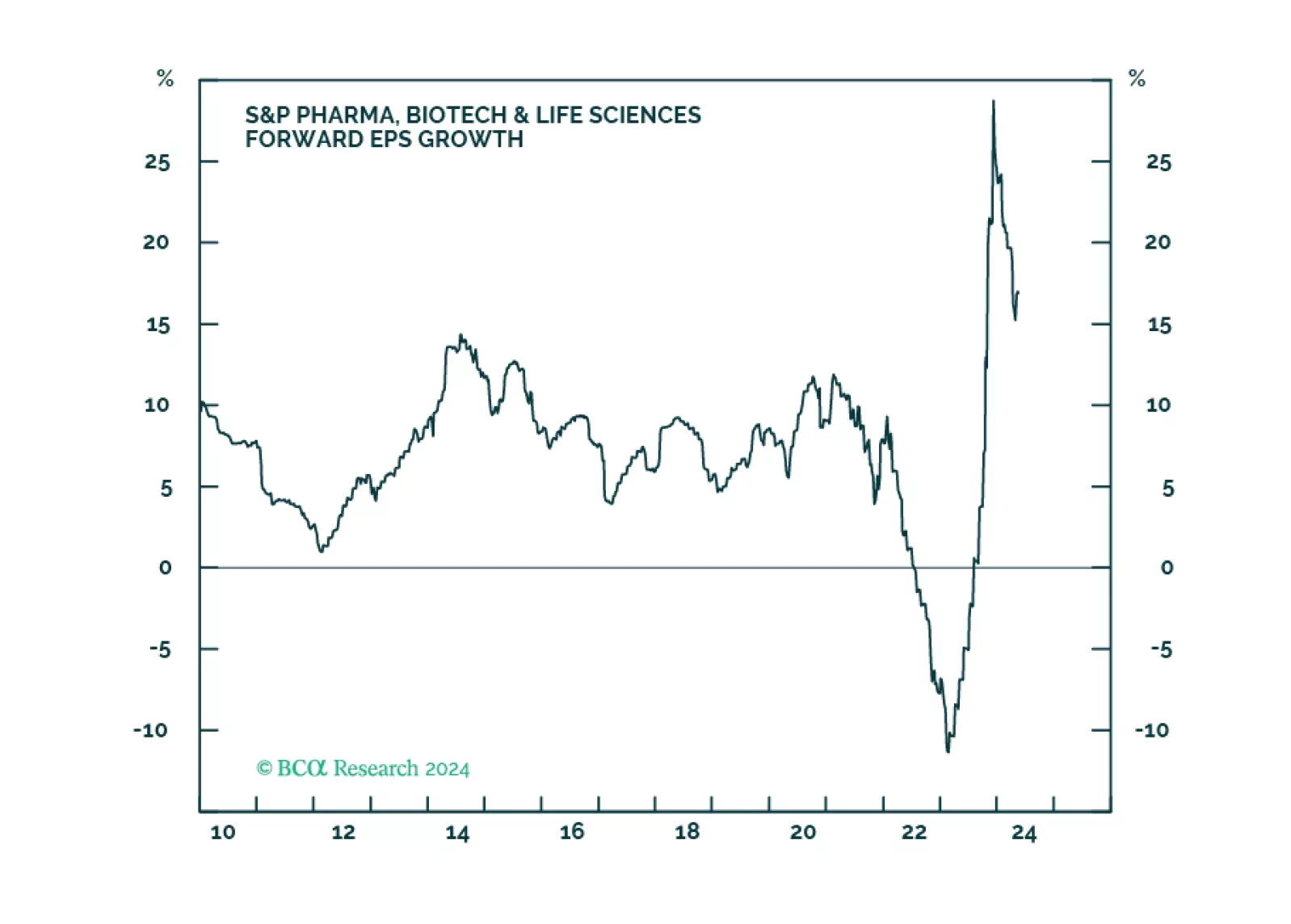

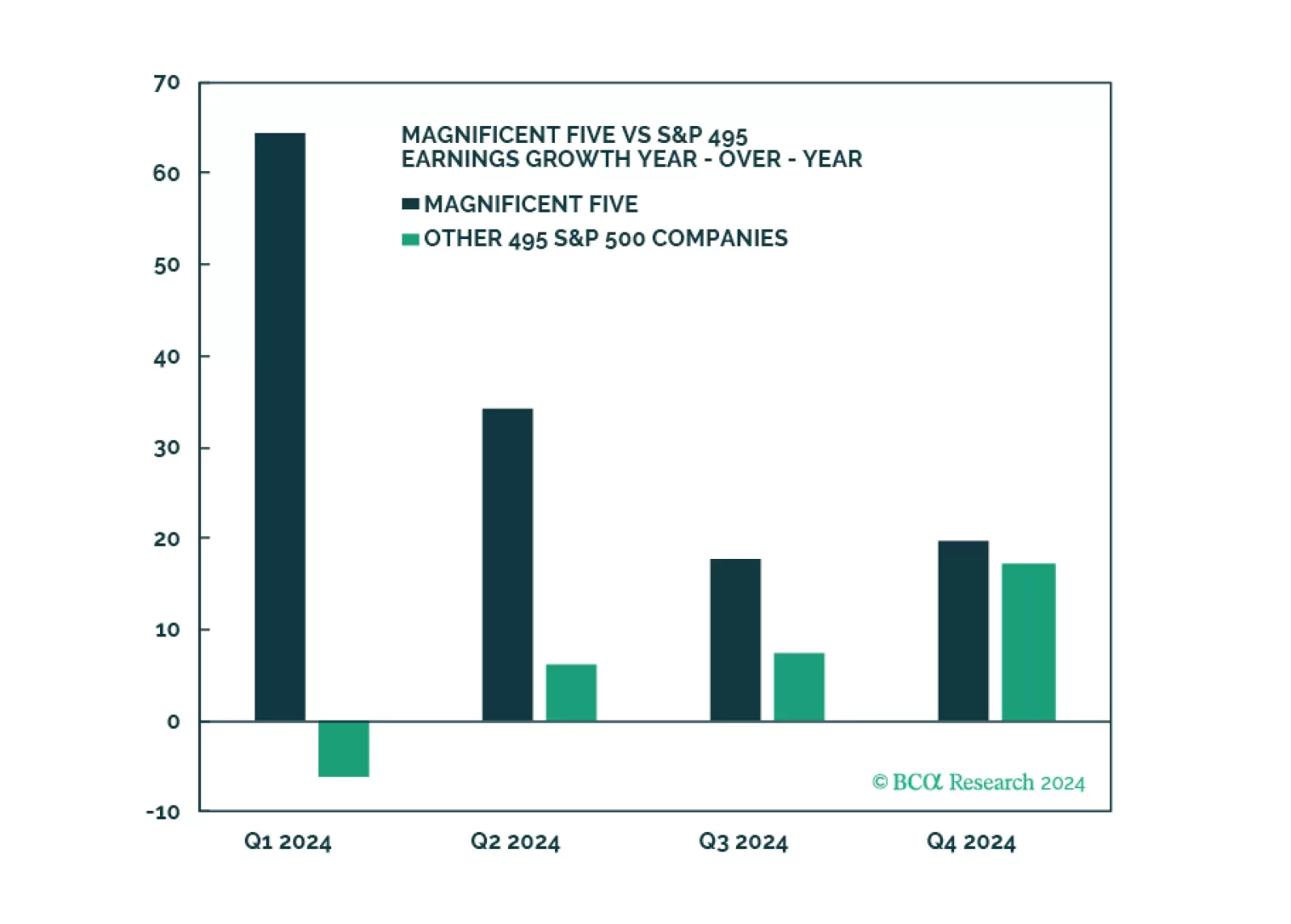

Q1 Earnings and sales growth were strong, but the devil is in the details: Without the Magnificent Five, earnings growth for the index would have been negative. On a positive note, margins have stabilized, and earnings growth is…

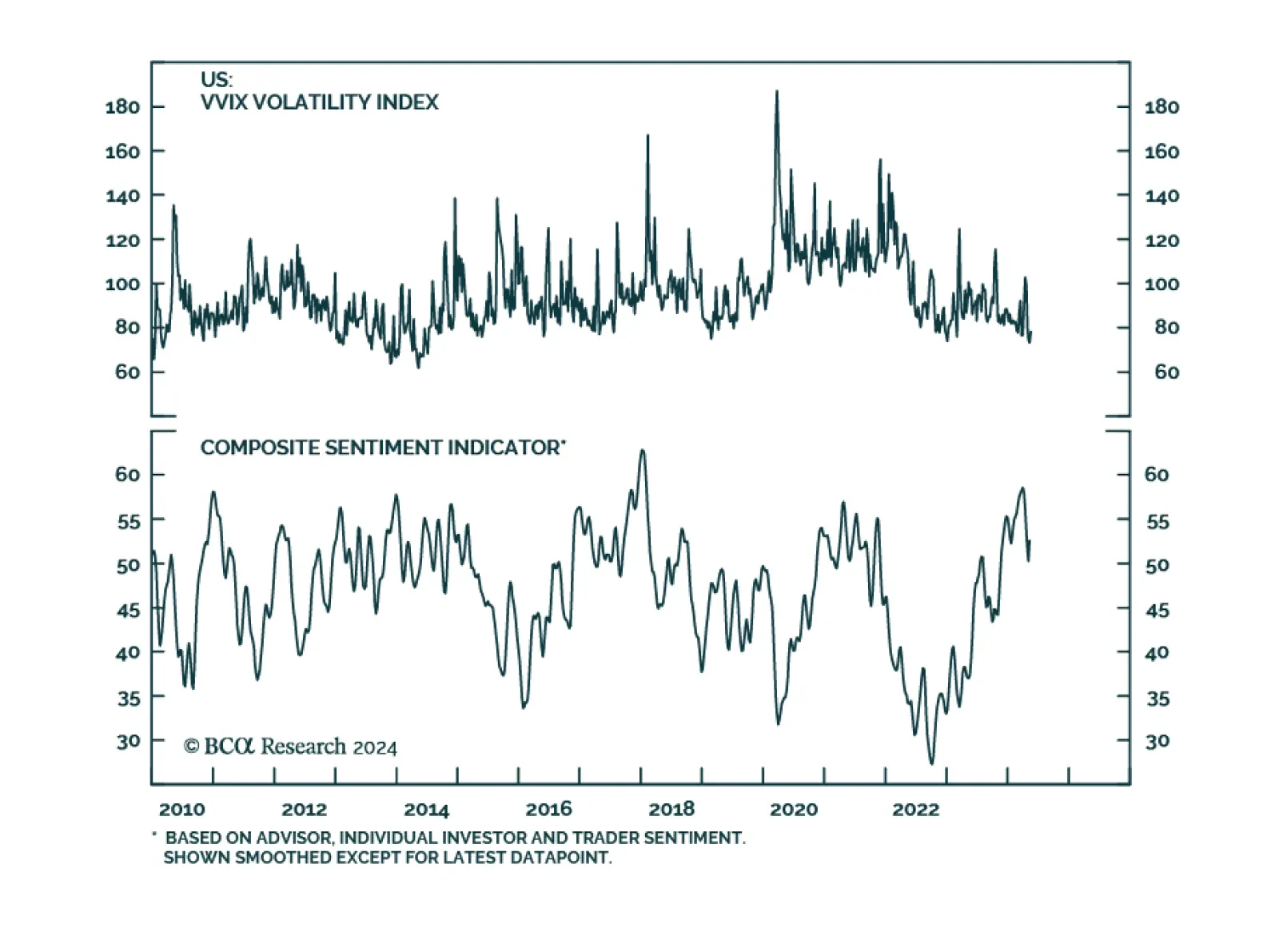

The CBOE VVIX index (expected volatility of the VIX) dropped to a nine-year low of 73.26. A low VVIX index suggests subdued demand for VIX call options which are typically used to bet against significant market declines.…

The broad market took a significant step backward in April, as market jitters gripped investors, stoking fears of higher for longer monetary policy. However, our roundtable investor poll has demonstrated that the majority remain…