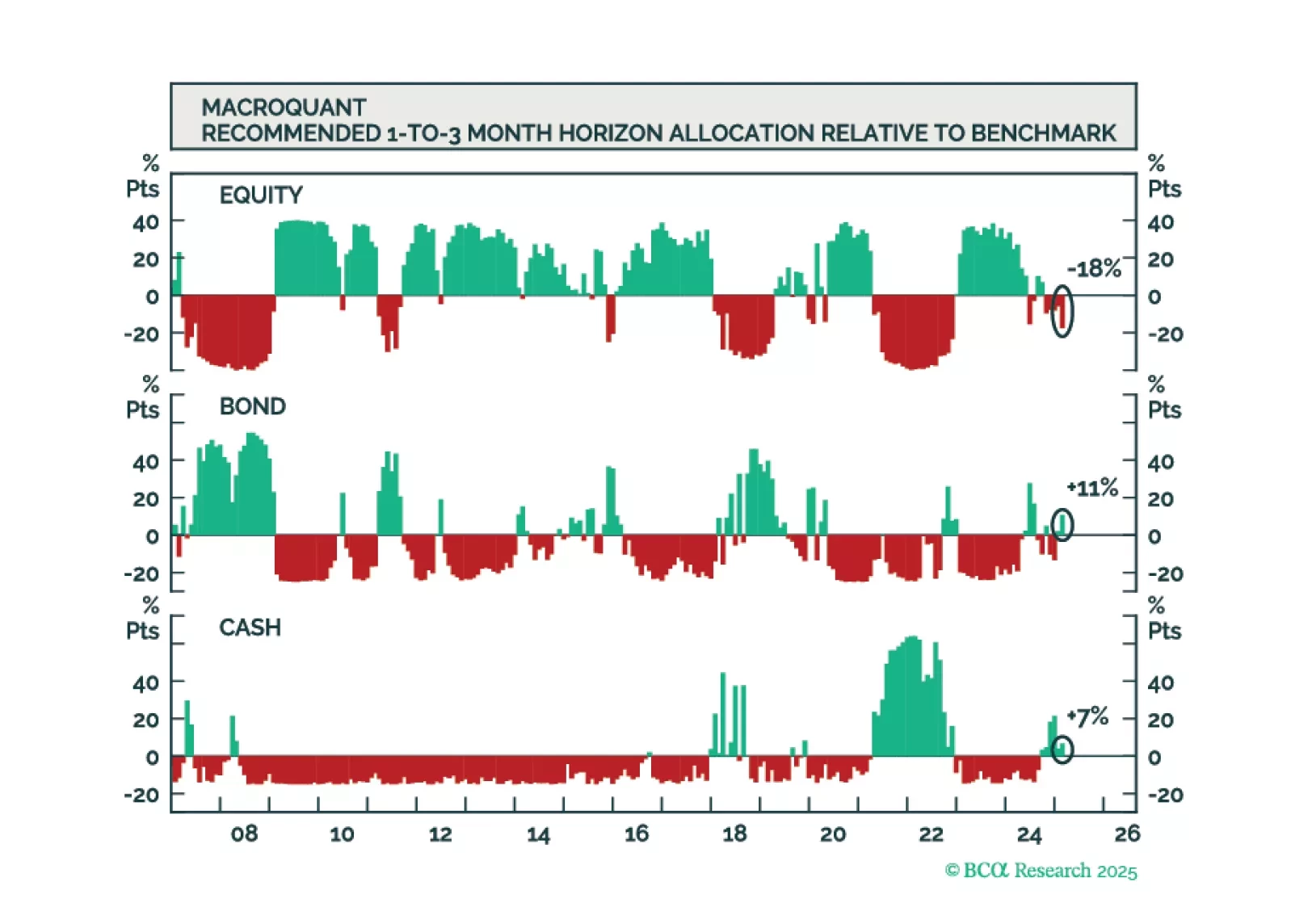

Going into April, MacroQuant recommends a modest underweight on stocks, offset by an overweight on bonds and cash. While MacroQuant is modestly bearish on stocks, we suspect that the downside risks to equities may be greater than…

Going into April, MacroQuant recommends a modest underweight on stocks, offset by an overweight on bonds and cash. While MacroQuant is modestly bearish on stocks, we suspect that the downside risks to equities may be greater than…

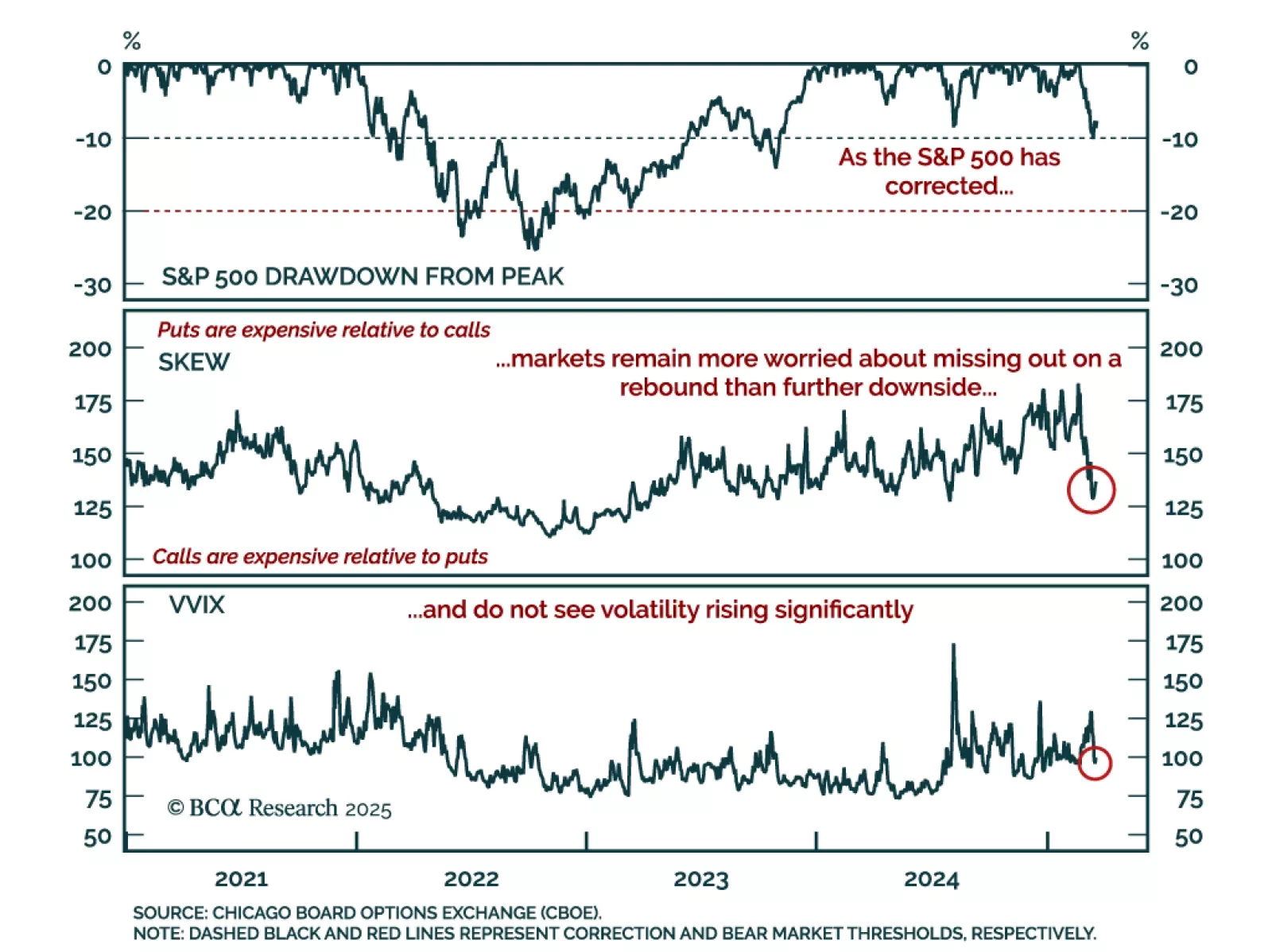

Recent years were marked by US equities rebounding from each drawdown to re-test all-time highs. The best absolute-return strategy has been to “buy the dip” and close your eyes. Is it still the case? The short answer is no, as…

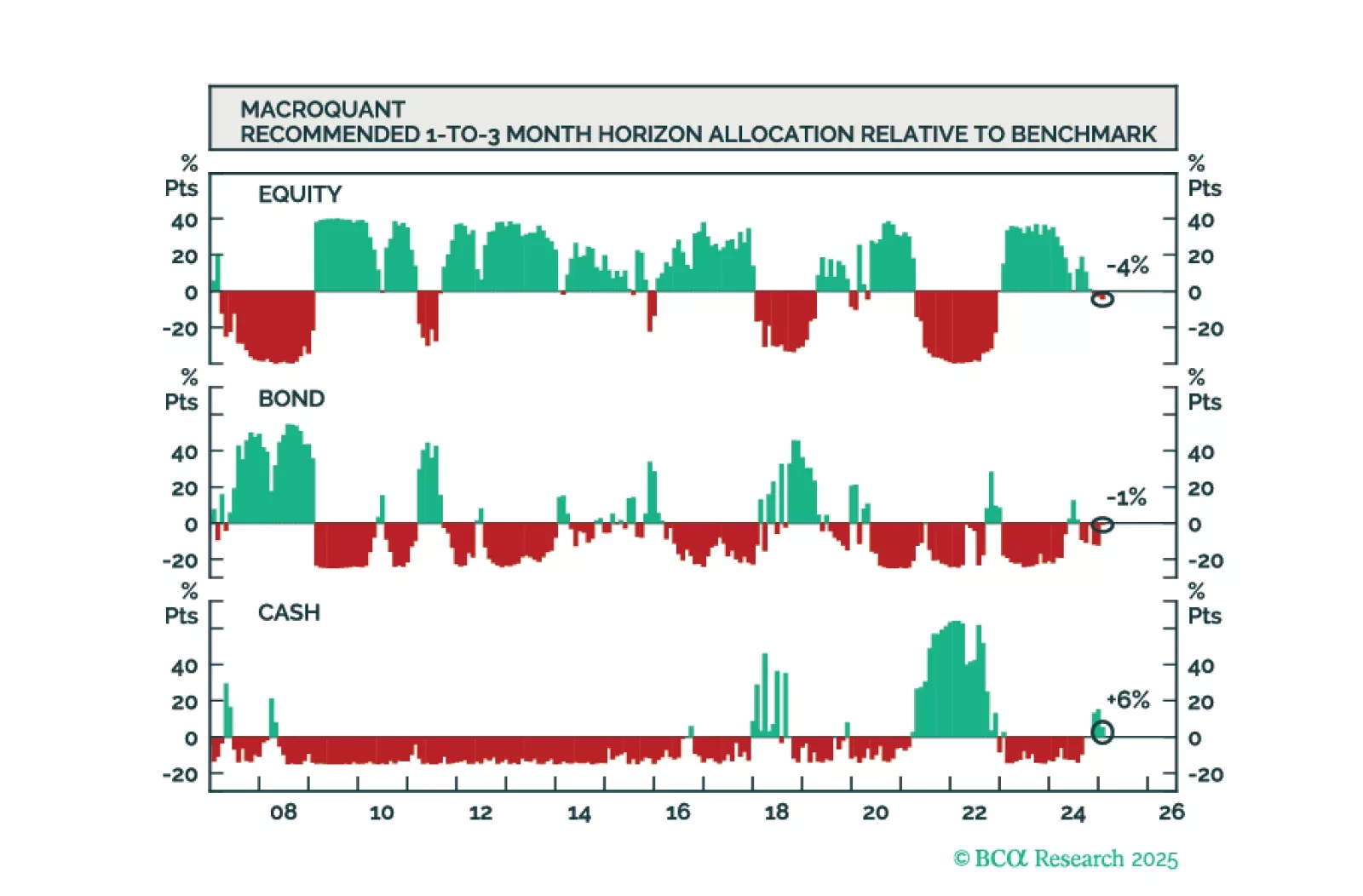

The MacroQuant model is no longer bullish on stocks but is not yet prepared to turn underweight. Subjectively, the Global Investment Strategy team is more bearish on equities than the model.

The MacroQuant model is no longer bullish on stocks but is not yet prepared to turn underweight. Subjectively, the Global Investment Strategy team is more bearish on equities than the model.

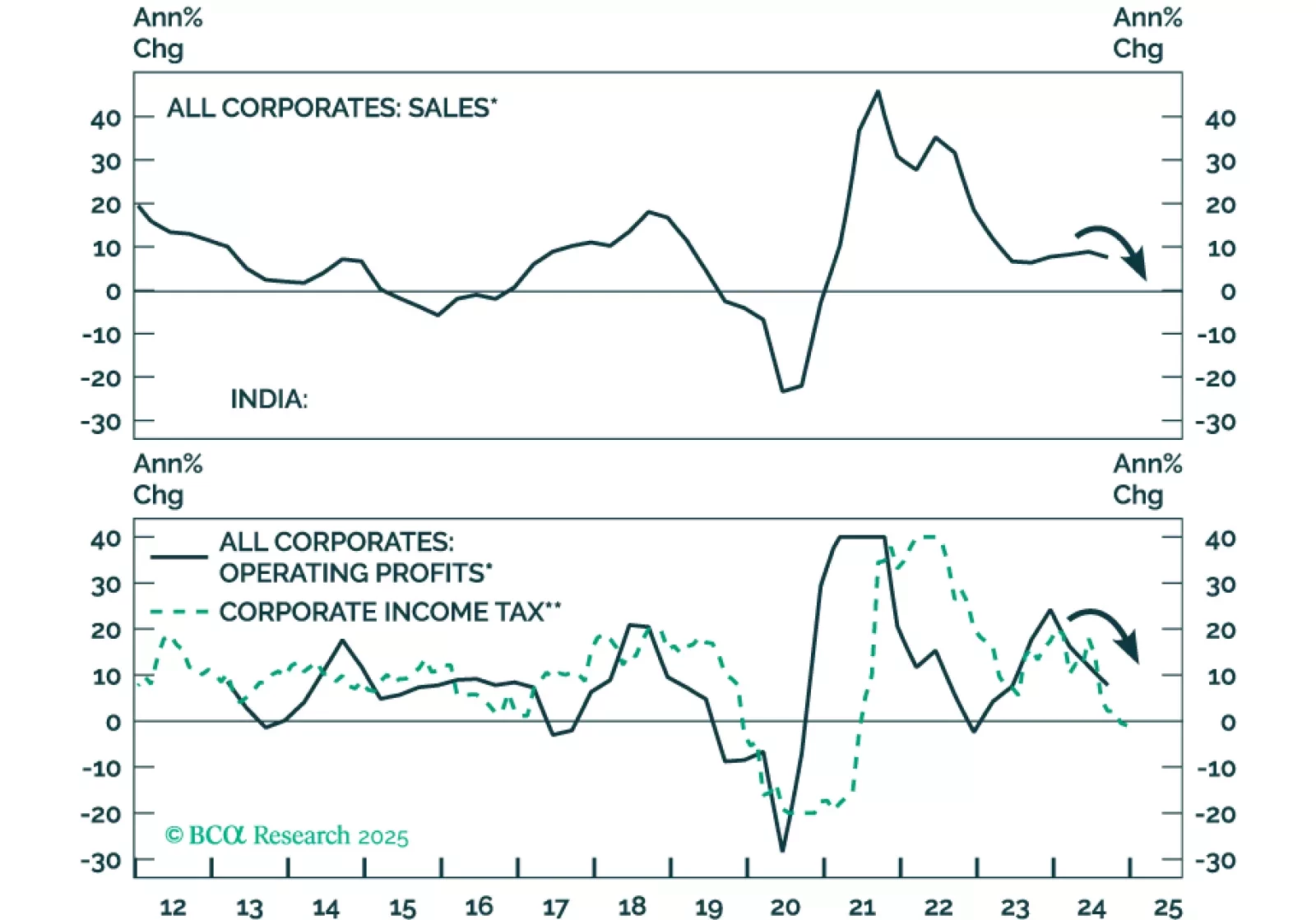

In its budget plans last week, the Indian fiscal authorities announced major tax cuts for households – the equivalent of about US$12 billion, 0.3% of GDP – to boost consumer spending. Soon thereafter, the central bank cut its policy rates…

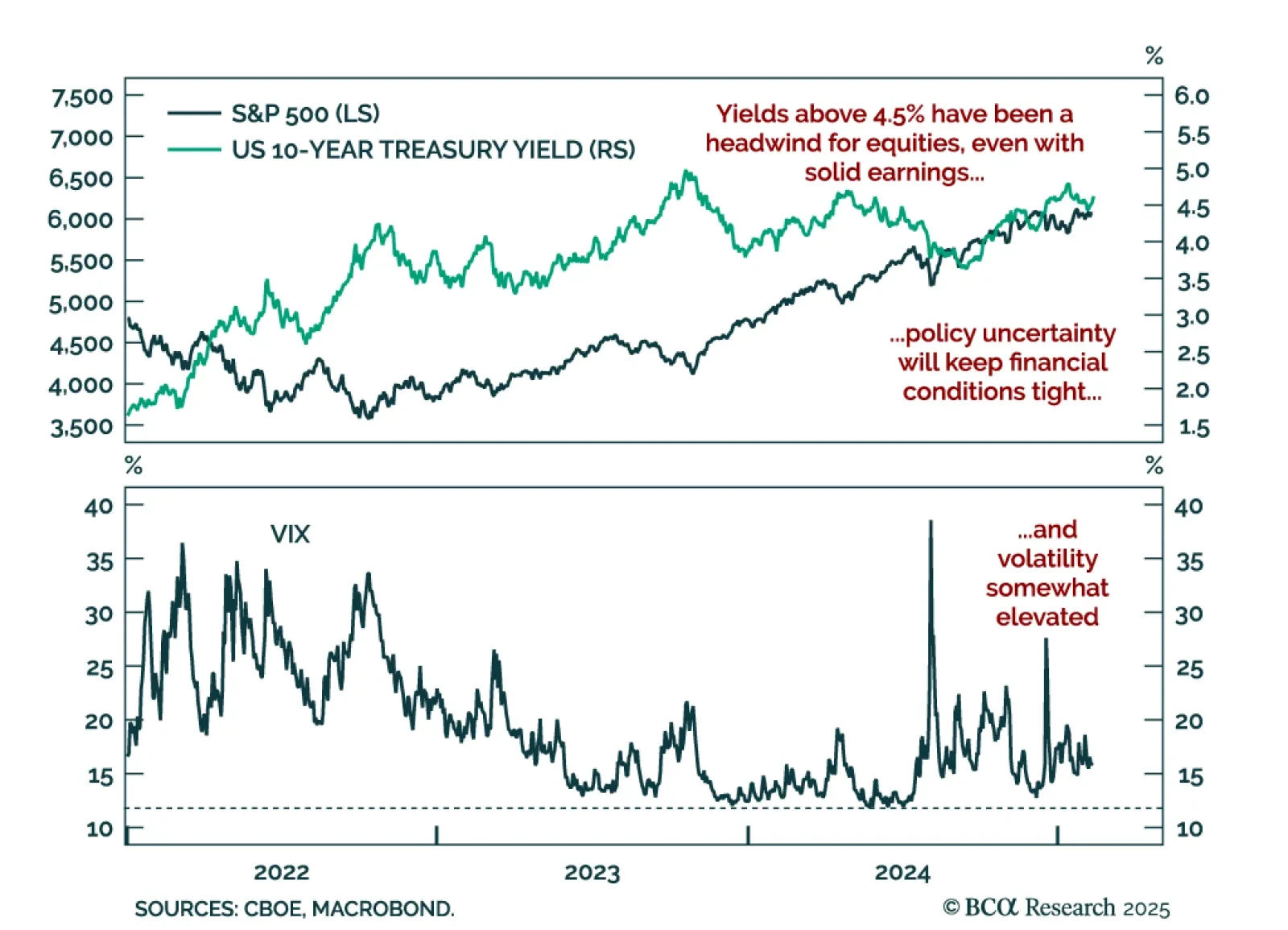

The S&P 500 has struggled to re-test all-time highs since the US 10-year Treasury yield has crossed the 4.50% mark. Stocks have moved sideways since December, and January’s hot CPI print confirmed that equities remain averse to…

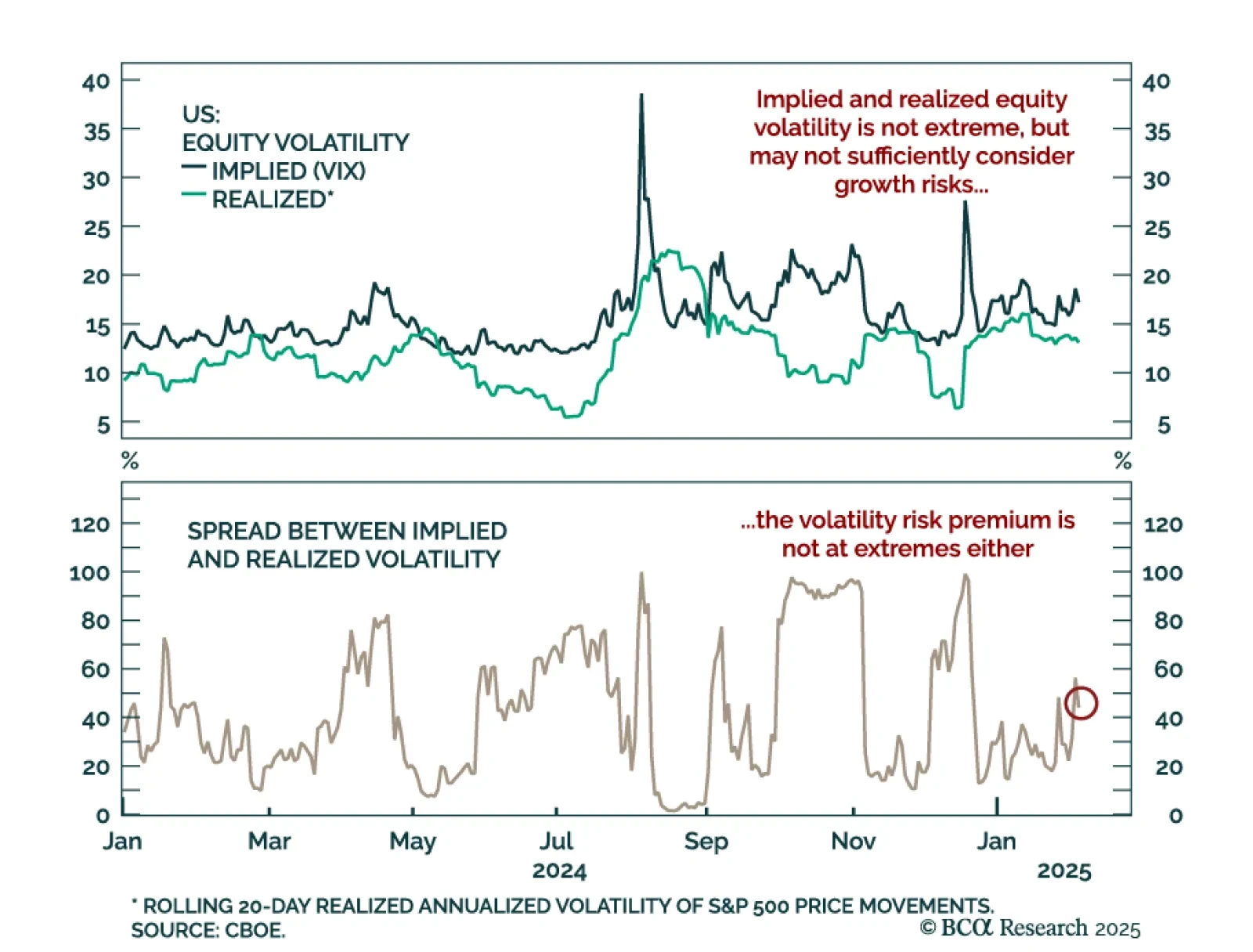

Despite disruptive headlines, equity market volatility remains contained. The S&P 500 has been in a tight range since the last VIX spike, and news of a disruptive, cheaper AI technology has not sustainably brought down US tech…

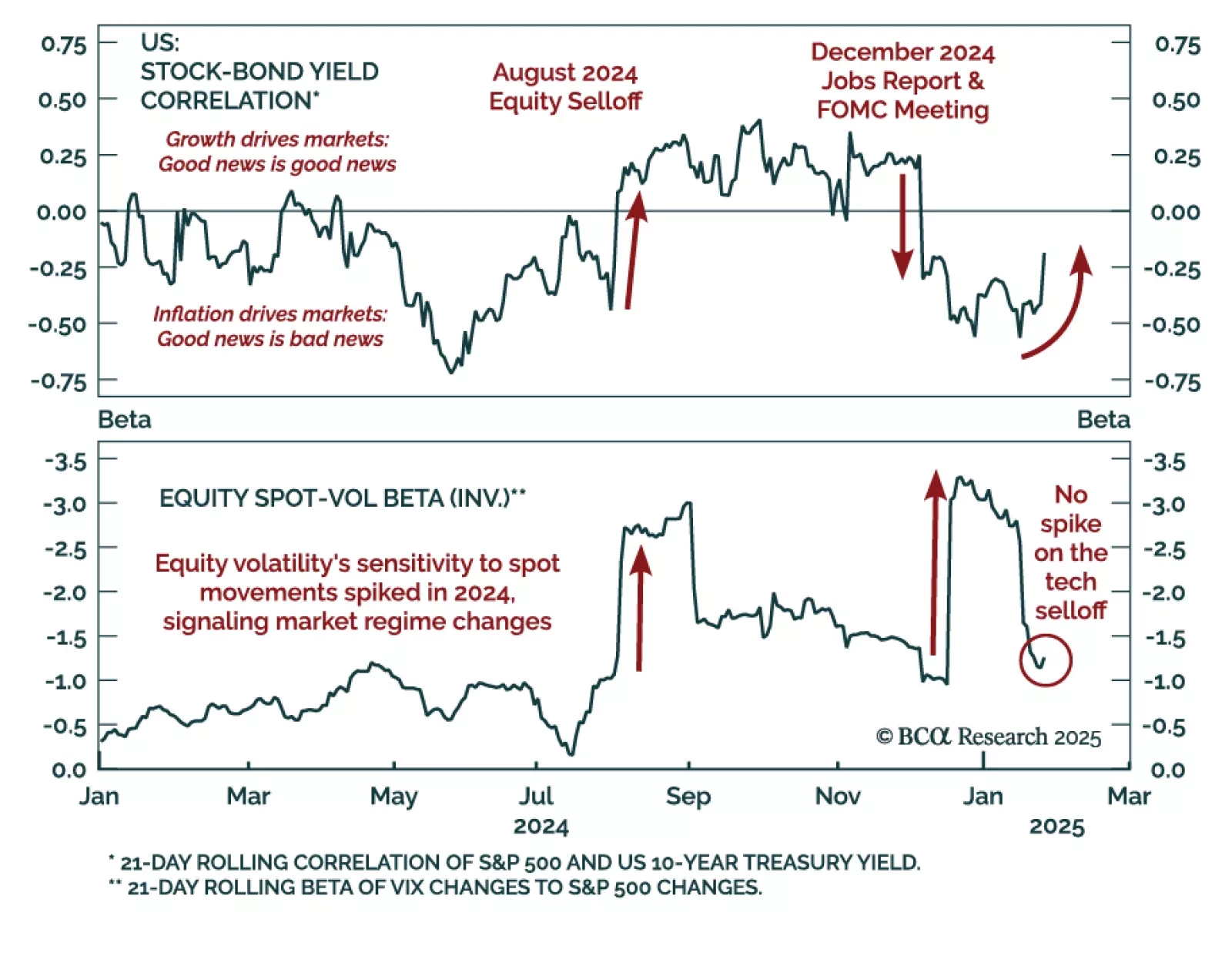

Monday’s selloff was orderly and concentrated in the tech sector. The price action was a classic risk-off response, where both stock prices and bond yields decreased. While the VIX increased, the equity spot-vol beta, volatility’s…