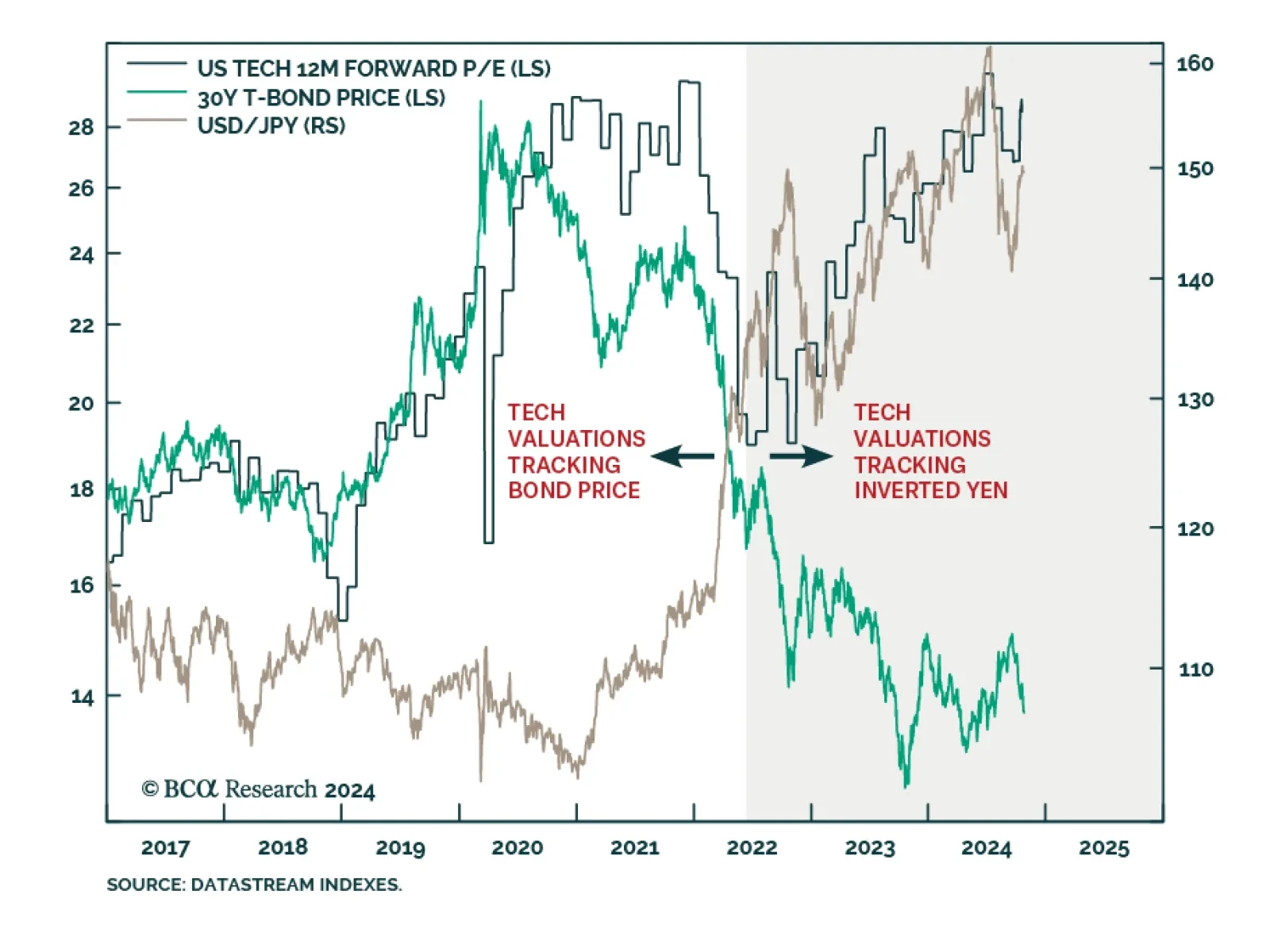

Our Counterpoint Strategy team believes the equity bull market’s biggest risk is the reversal of the divergence between Japanese and US real yields. Japan’s real policy interest rate differential versus the US…

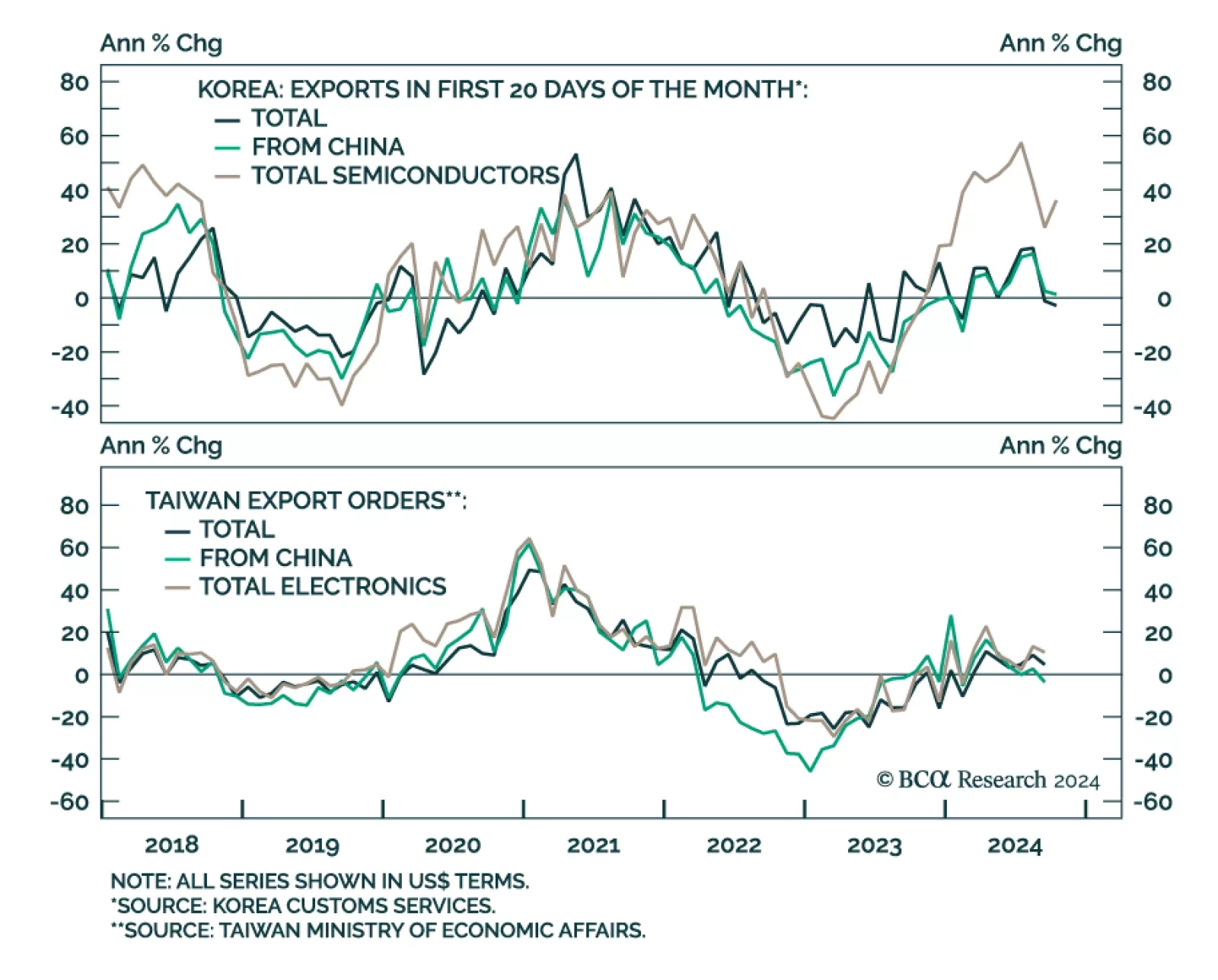

The recent slump in globally- and tech-sensitive East Asian trade shows no respite, with advanced October Korean exports and September Taiwanese export orders data disappointing. Korean exports for the first 20 days of October…

Innovative Tech will face macroeconomic headwinds in a new “higher for longer” interest regime. Yet, the long-term opportunity of the cohort is tremendous. Investors need to be judicious with the timing of adding new capital to…

Macroeconomic and business conditions are gradually becoming more favorable for Tech as the bottoming of demand is in sight. Yet, we don’t believe that now is an attractive entry point - the good news is fully priced in, and…

Initiating a long S&P semis/short S&P technology hardware storage & peripherals (THS&P) pair trade is the ultimate reflationary play given its tight positive correlation with the 10-year US Treasury yield (top panel). Not…

While the Fed’s dots dovishly surprised, the FOMC’s output and inflation projections were on the hawkish side. Adding the committee’s core PCE price inflation estimate for 2021 to their real GDP forecast results in a…

Highlights The economic performance of Sweden, which did not have a lockdown, has been almost as bad as Denmark, which did have a lockdown. This proves that the current recession is not ‘man-made’, it is ‘pandemic-…

Underweight Our intra-sector positioning shifts with the recent S&P tech hardware storage & peripherals downgrade to underweight1 and this Monday’s trimming of the S&P software index to neutral, reduce the S…

Highlights Chinese stocks made a comeback as soon as the speed of COVID-19 transmitting outside of the epicenter somewhat moderated. Inside the epicenter, the pandemic has not shown clear signs of easing, and could significantly…