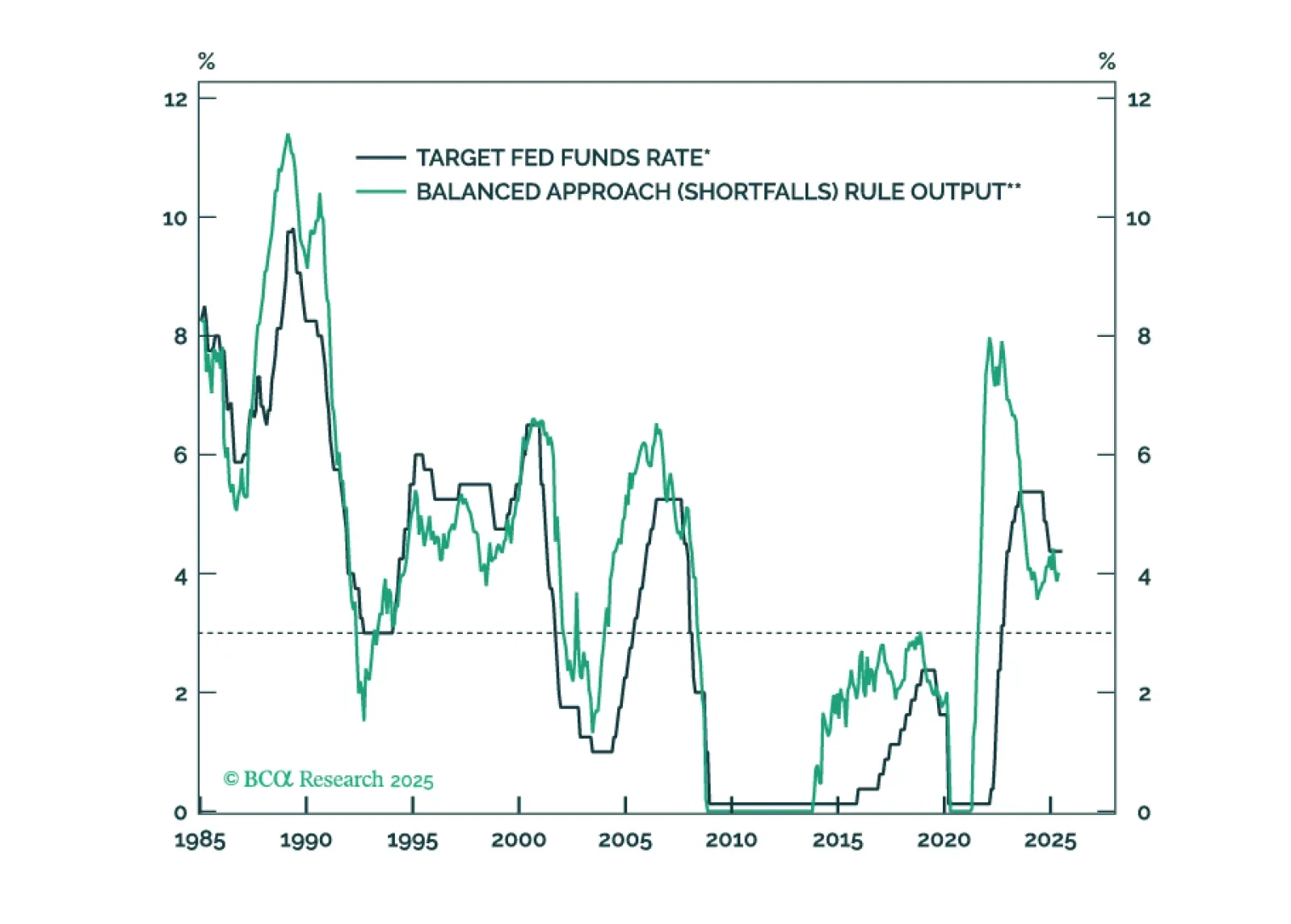

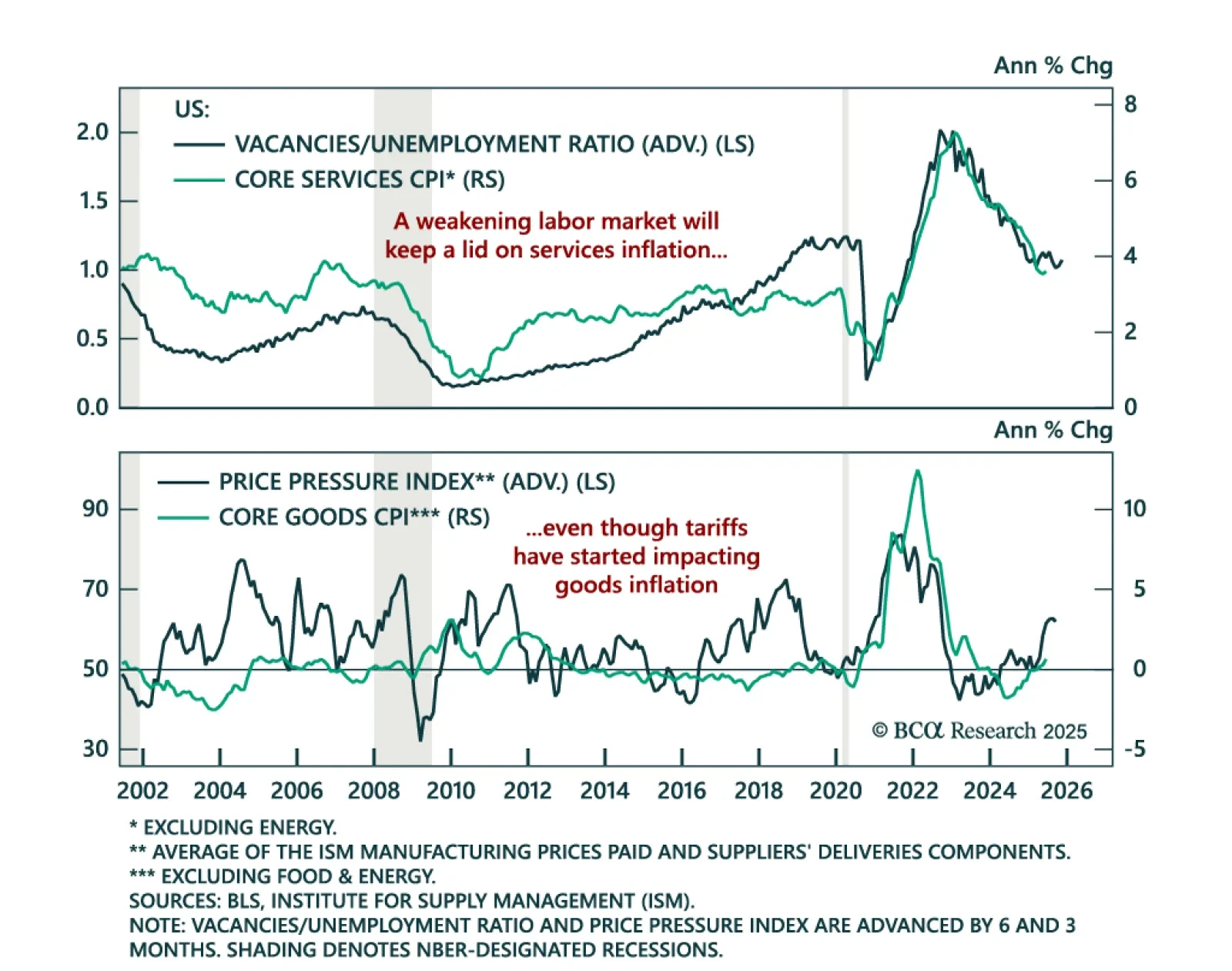

The Fed will keep rates on hold until the unemployment rate forces its hand.

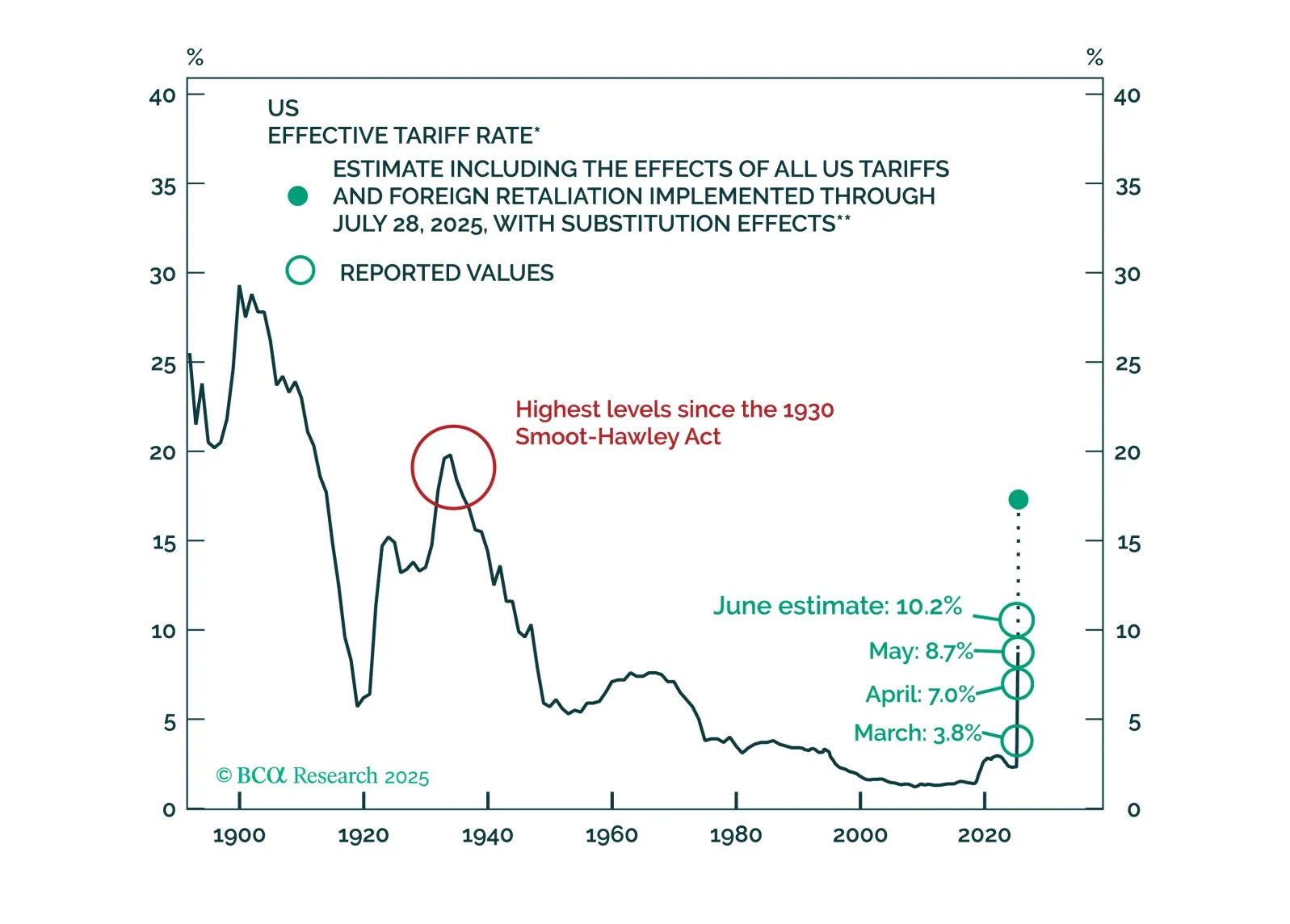

Russia poses an immediate risk to global financial markets, and then perhaps a buying opportunity. Trump is pivoting to ceasefires and trade deals, but Russia could trigger a new tariff shock first.

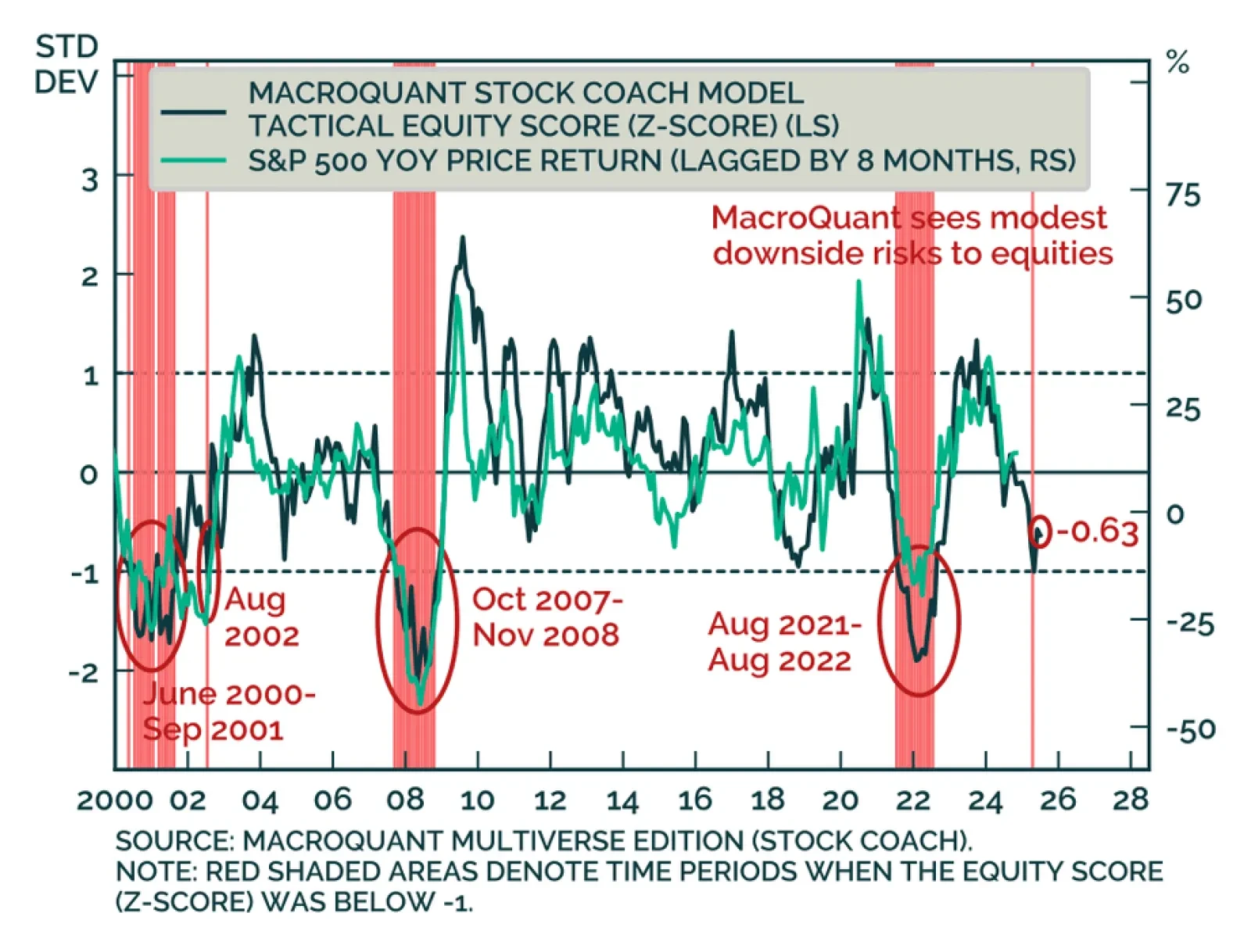

We will only move to a fully defensive stance if the “whites of the recession’s eyes” appear. So far, they have not. We will be increasingly looking to our MacroQuant model for guidance on when the next turning point in markets may…

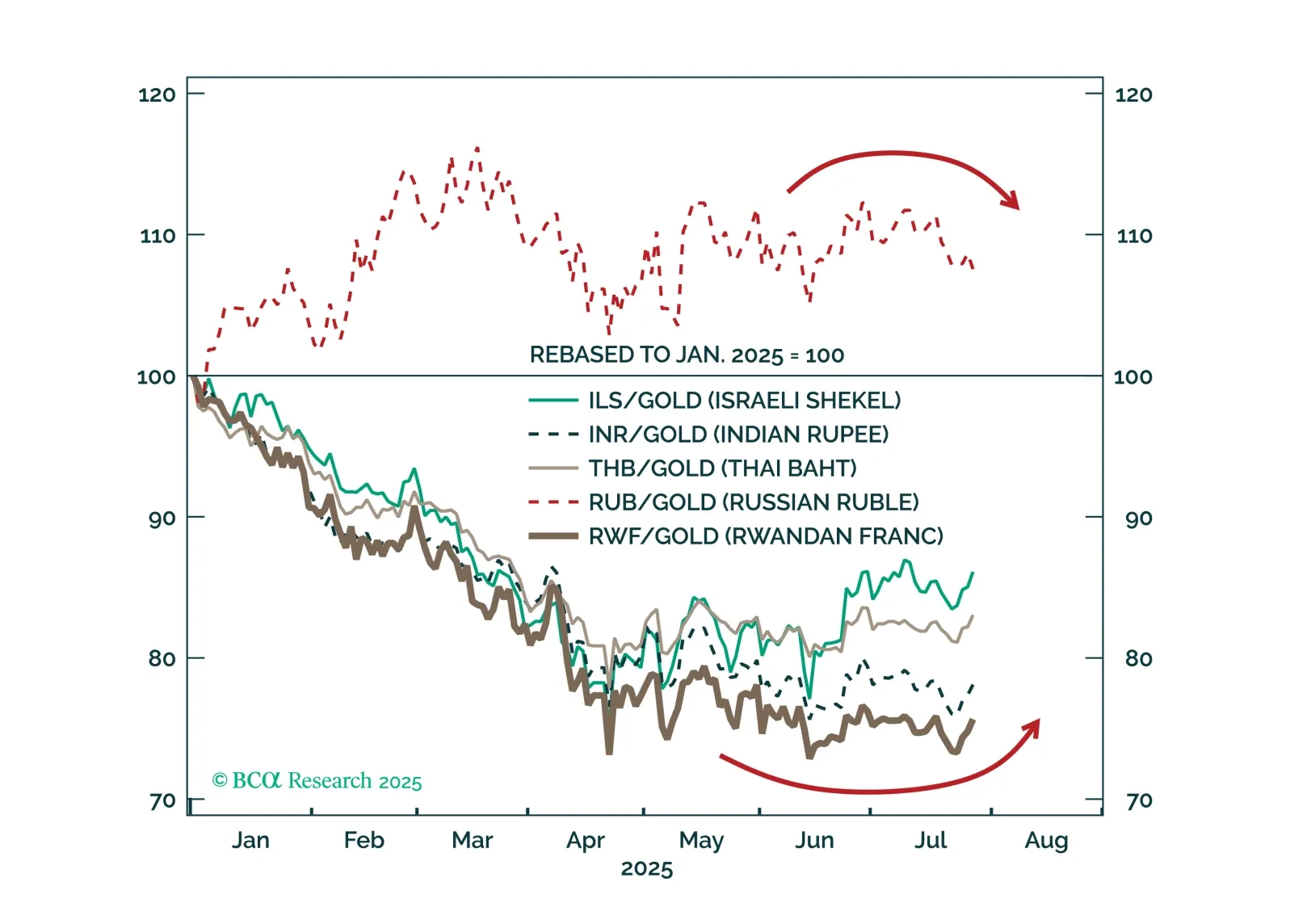

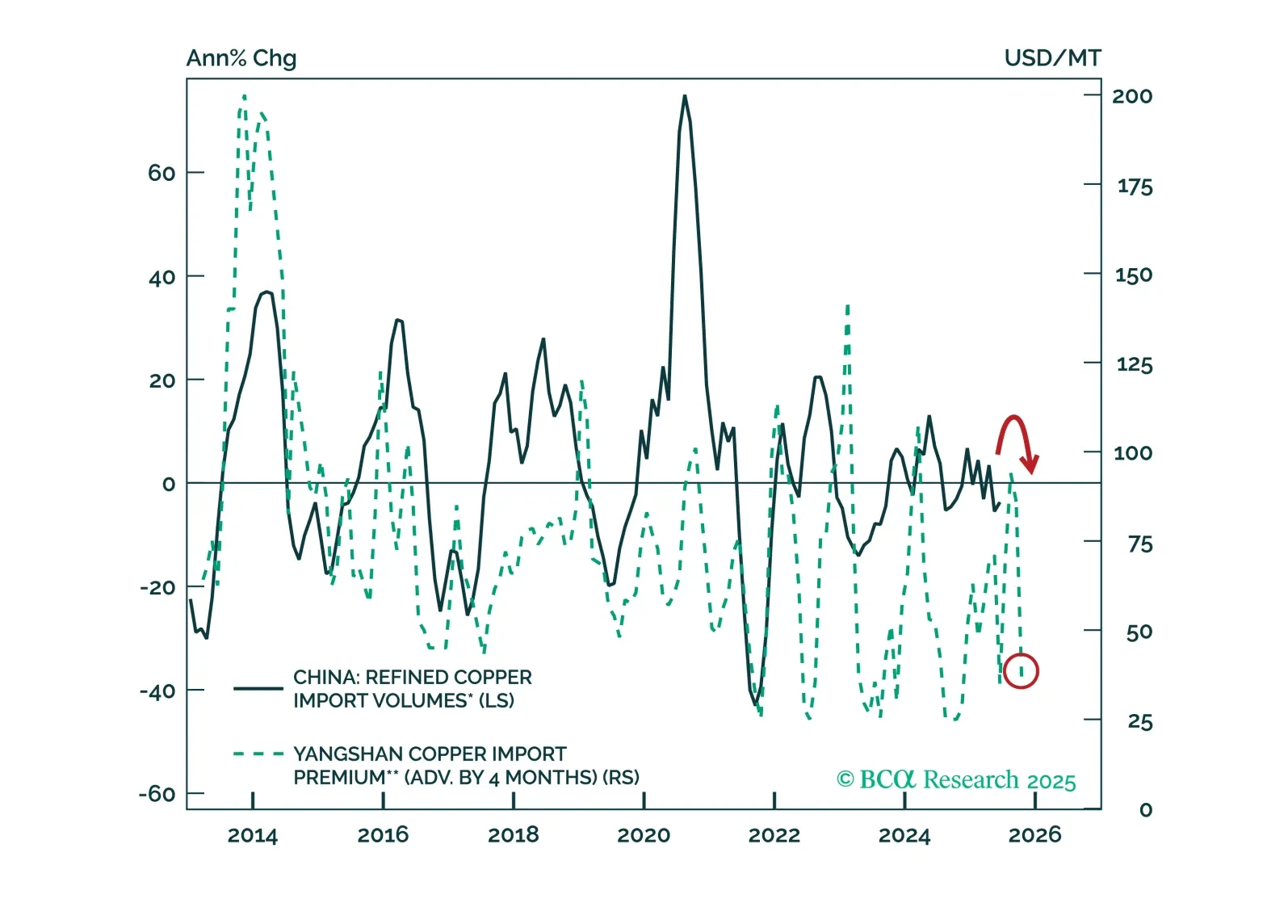

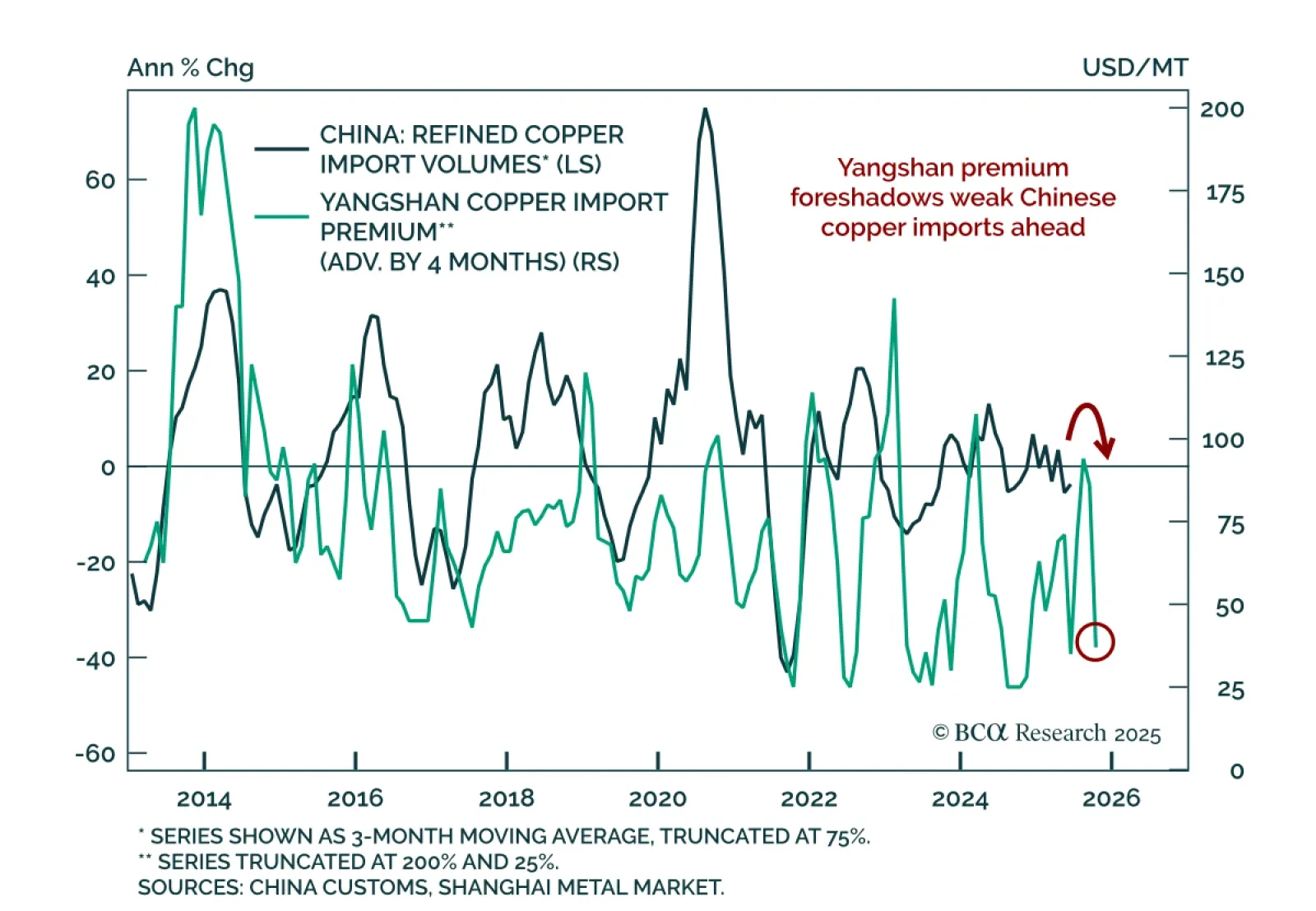

BCA’s Commodity strategists remain long gold/short LME copper and have initiated an outright short in LME copper as a cyclical trade. The US copper tariff will redirect supply away from the US, replenishing depleted inventories…

U.S. copper tariffs will redirect the metal’s trade flows from the US to the rest of the world, replenishing depleted inventories abroad. With global copper demand set to soften in H2, the red metal will likely face downward price…

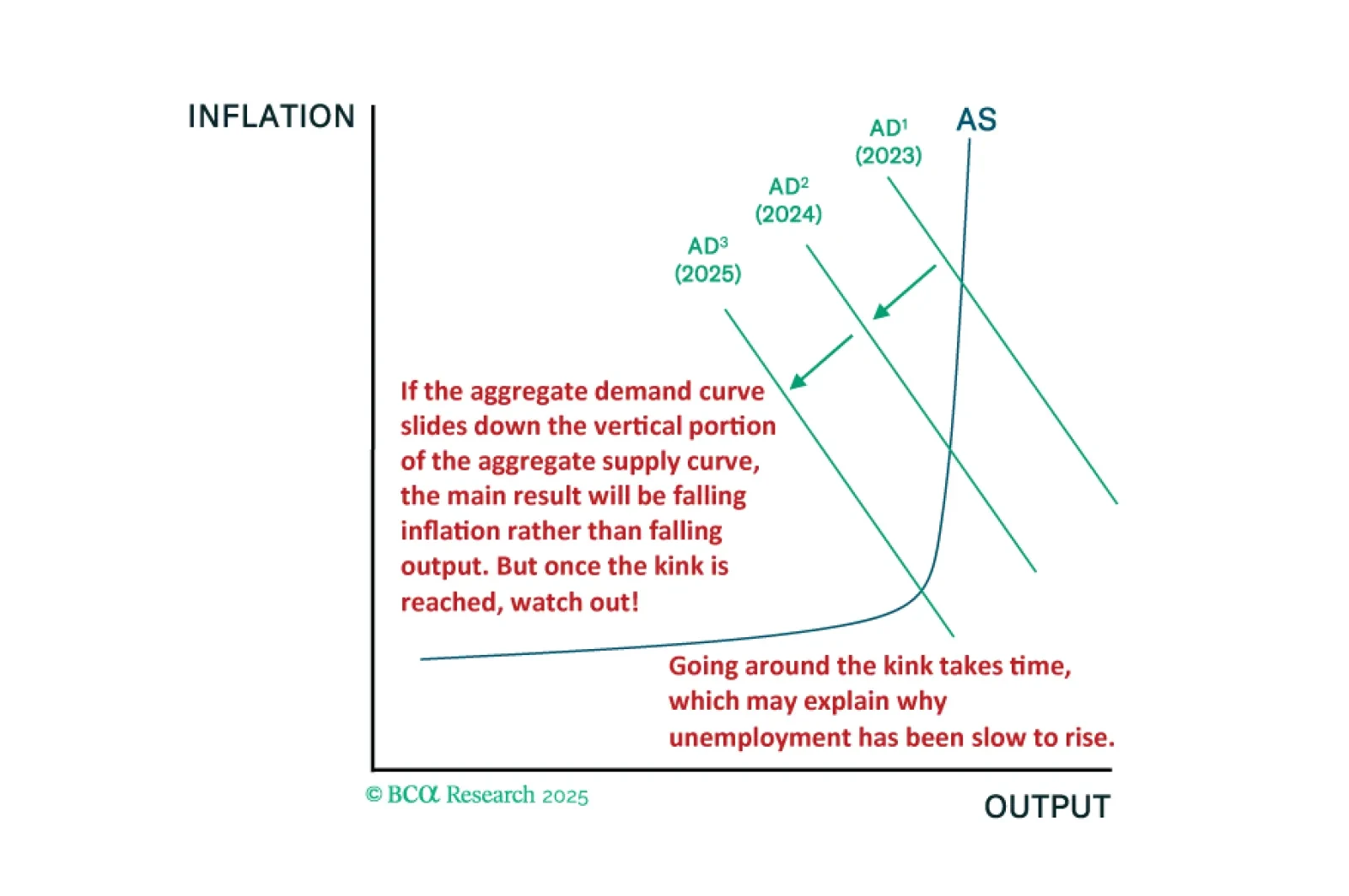

The fact that the US economy has been slower to deteriorate than in past cycles is entirely consistent with our kinked Phillips curve framework. We will be looking to our MacroQuant model for guidance on when to turn fully defensive…

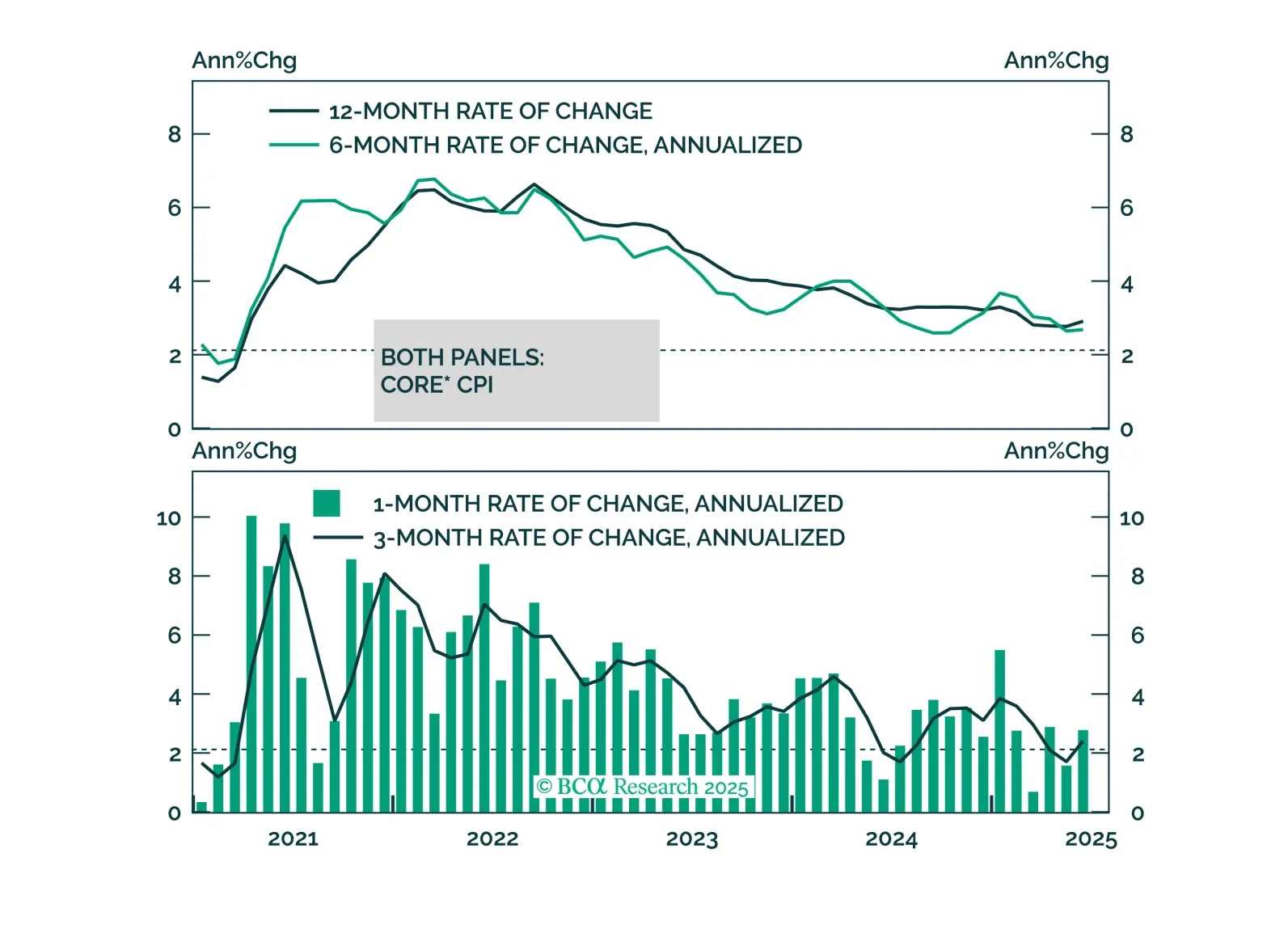

June CPI was broadly in line with expectations, with tariff passthrough building in goods but broader inflation pressures likely to remain contained. Headline inflation came in slightly above expectations at 2.7% y/y (0.3% m/m),…

We discuss the implications of this morning’s CPI report and the relative attractiveness of 2/5 Treasury curve steepeners.

MacroQuant’s equity model points to mild downside risks for the S&P 500, supporting a modest equity underweight. Our Chart Of The Week comes from Chanhyuck Lee, from our Global Investment Strategy team. MacroQuant’s Stock…