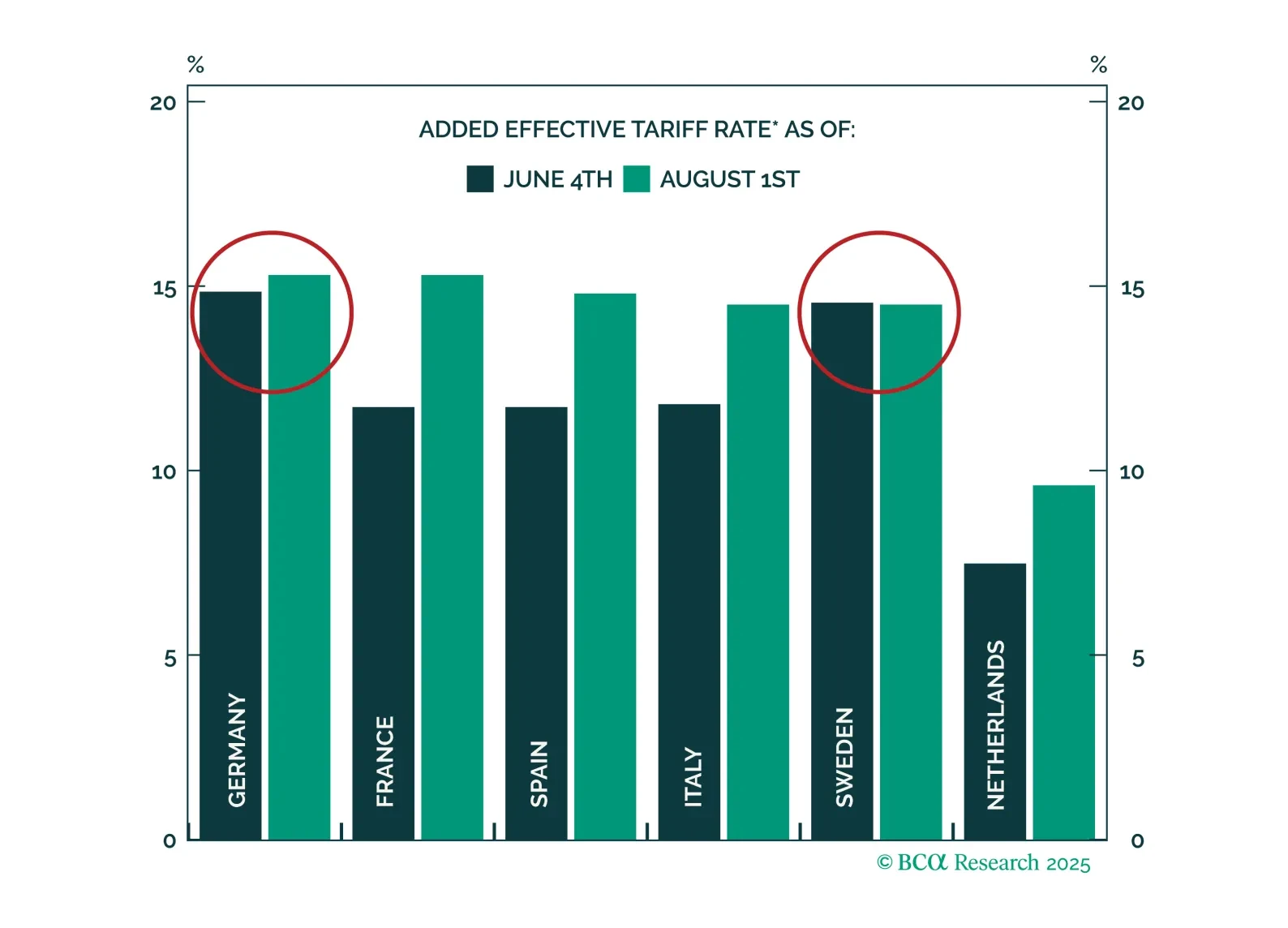

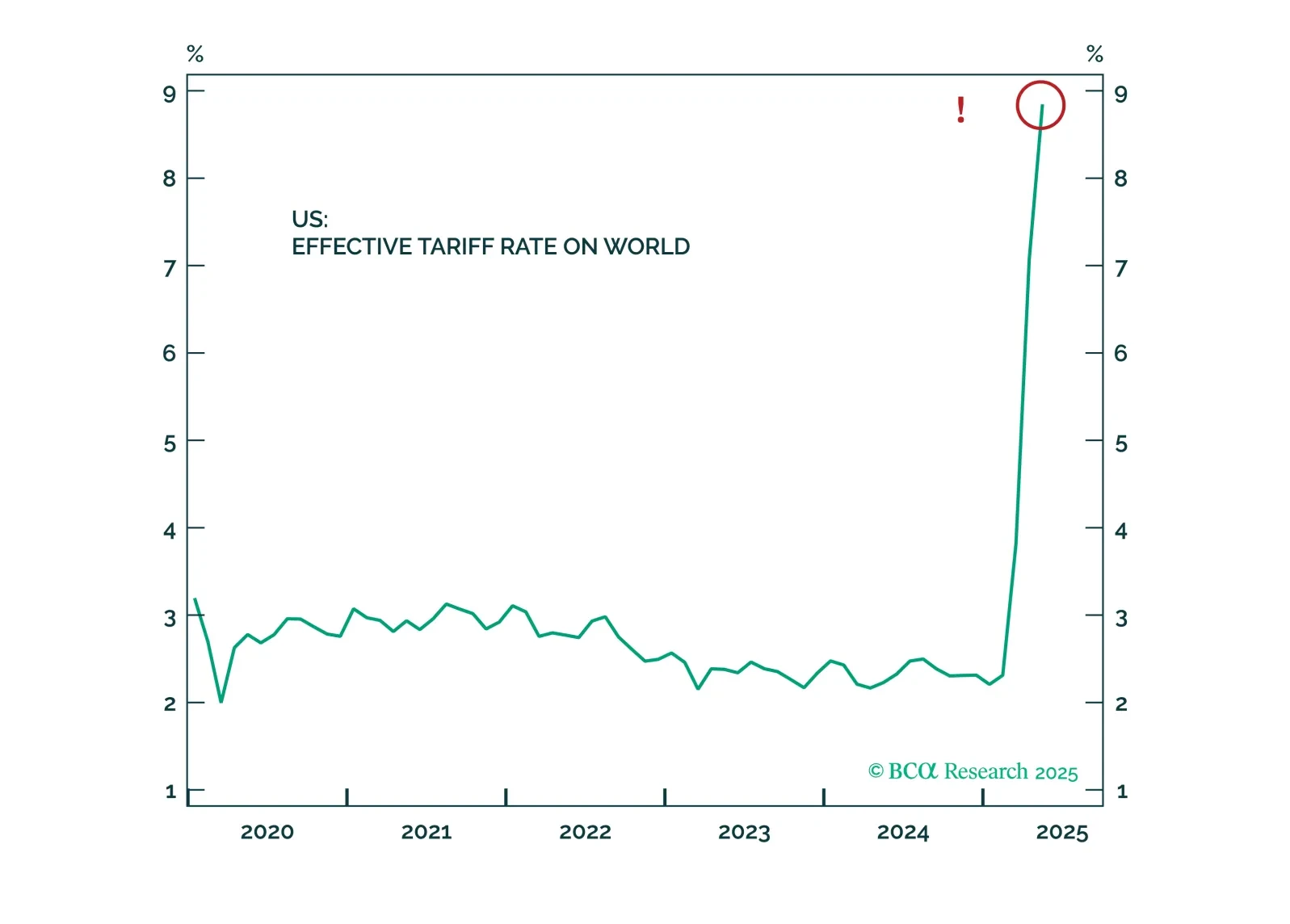

US tariffs will not derail the low-inflation economic recovery underway in the Euro Area. Investors should overweight European equities, focusing on parts of the market more insulated from tariffs.

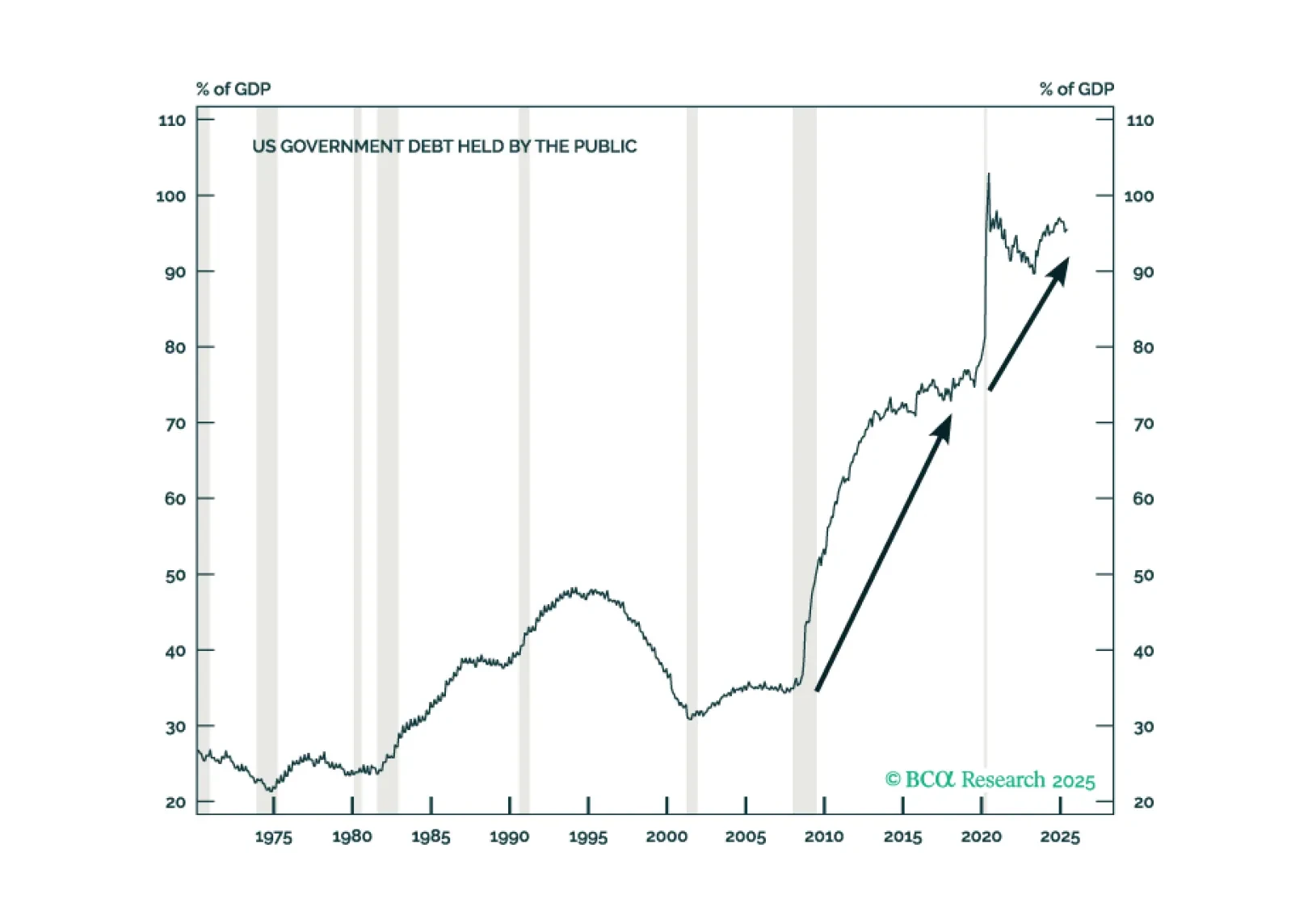

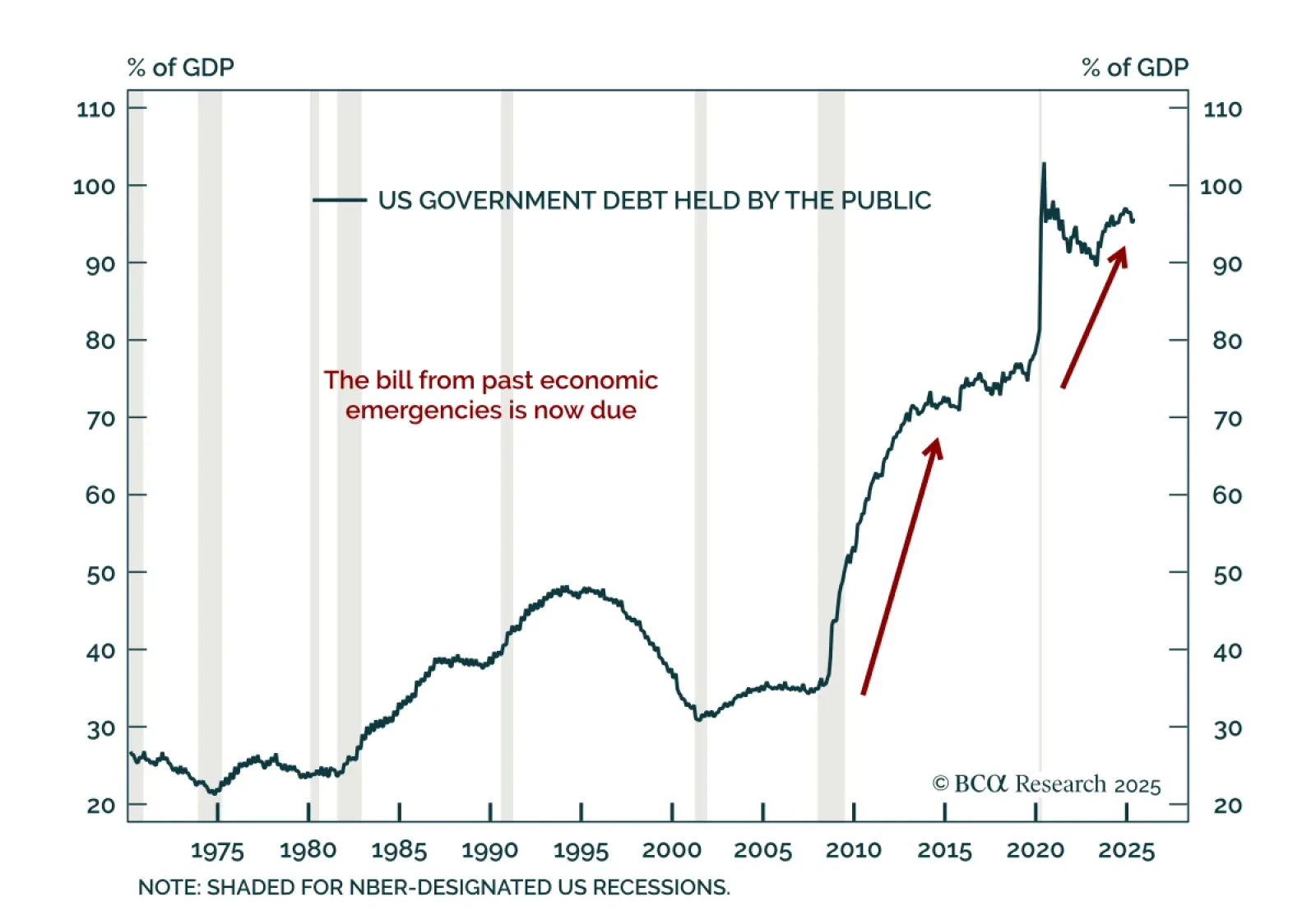

Our Bank Credit Analyst strategists argue that a US fiscal crisis should be treated as a base case over the next decade, not a tail risk. The ballooning US budget deficit reflects higher interest rates, demographic pressures, and the…

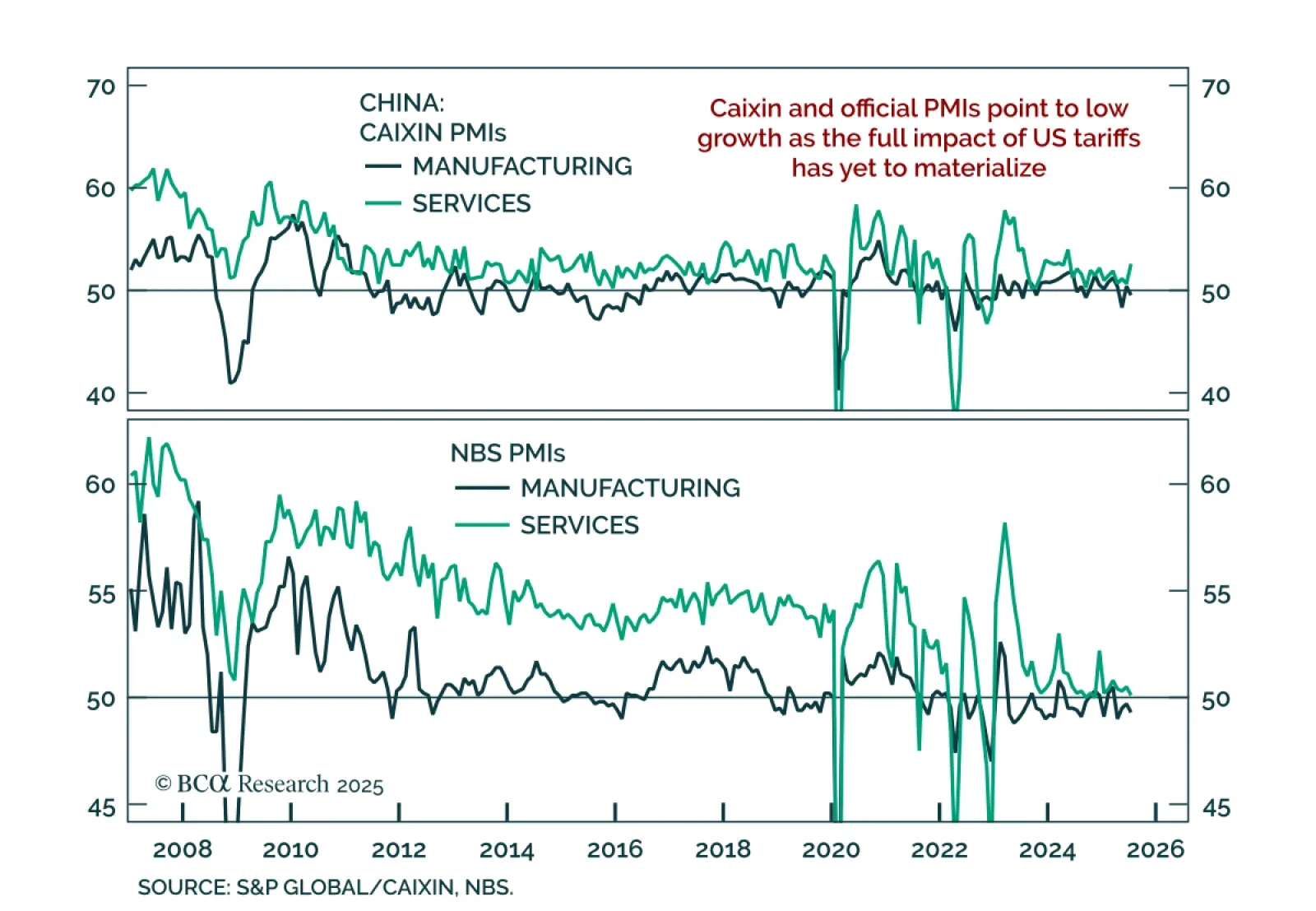

The July PMIs and inflation data confirm that China faces a persistent low-growth, deflationary backdrop, with weak demand and tariff risk warranting defensive equity positioning. The Caixin manufacturing PMI fell to 49.5, while…

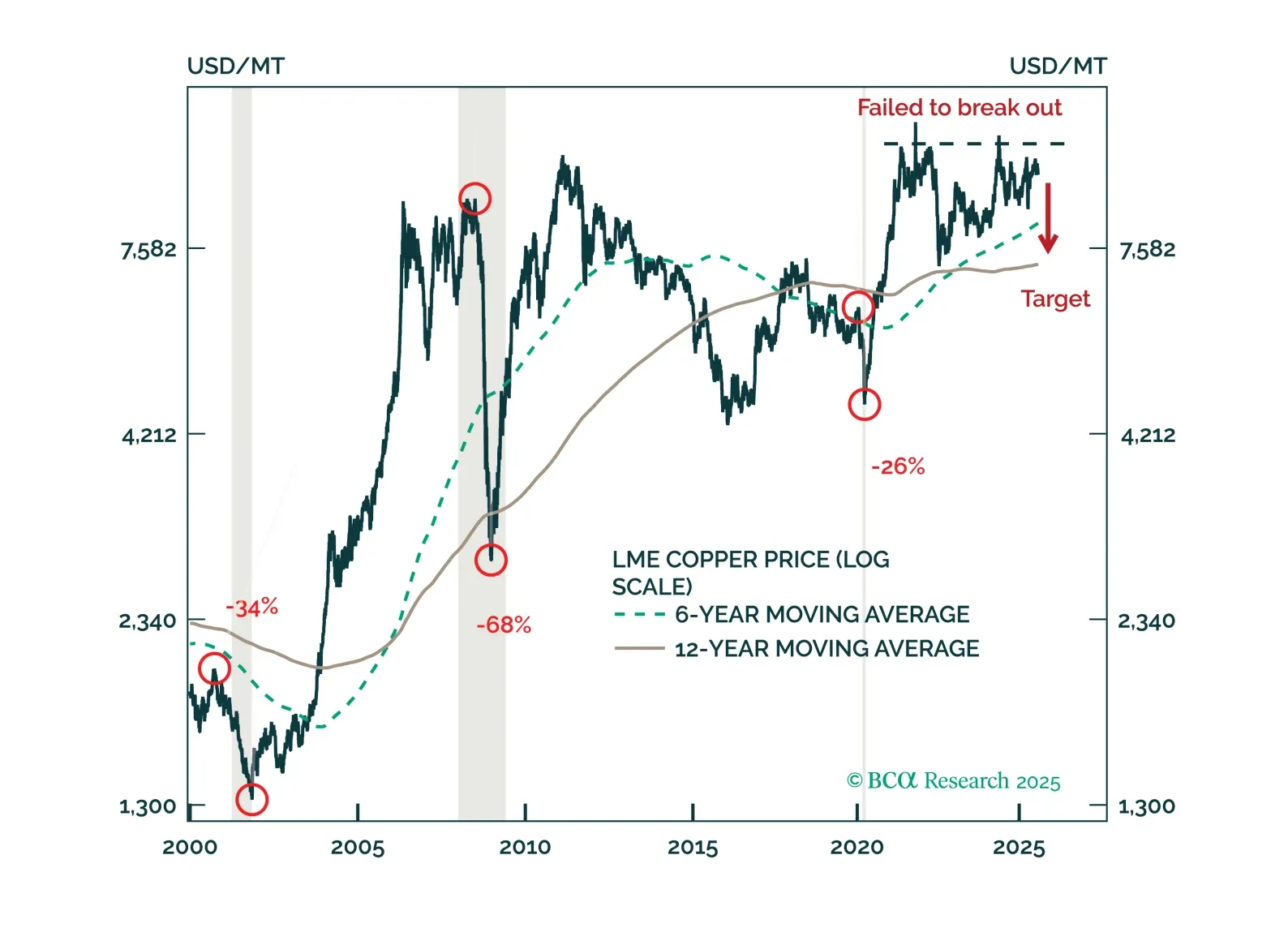

Copper’s unwind – triggered by the refined metal’s US tariff exemption – isn’t over yet. We remain short the red metal on an absolute basis and relative to gold.

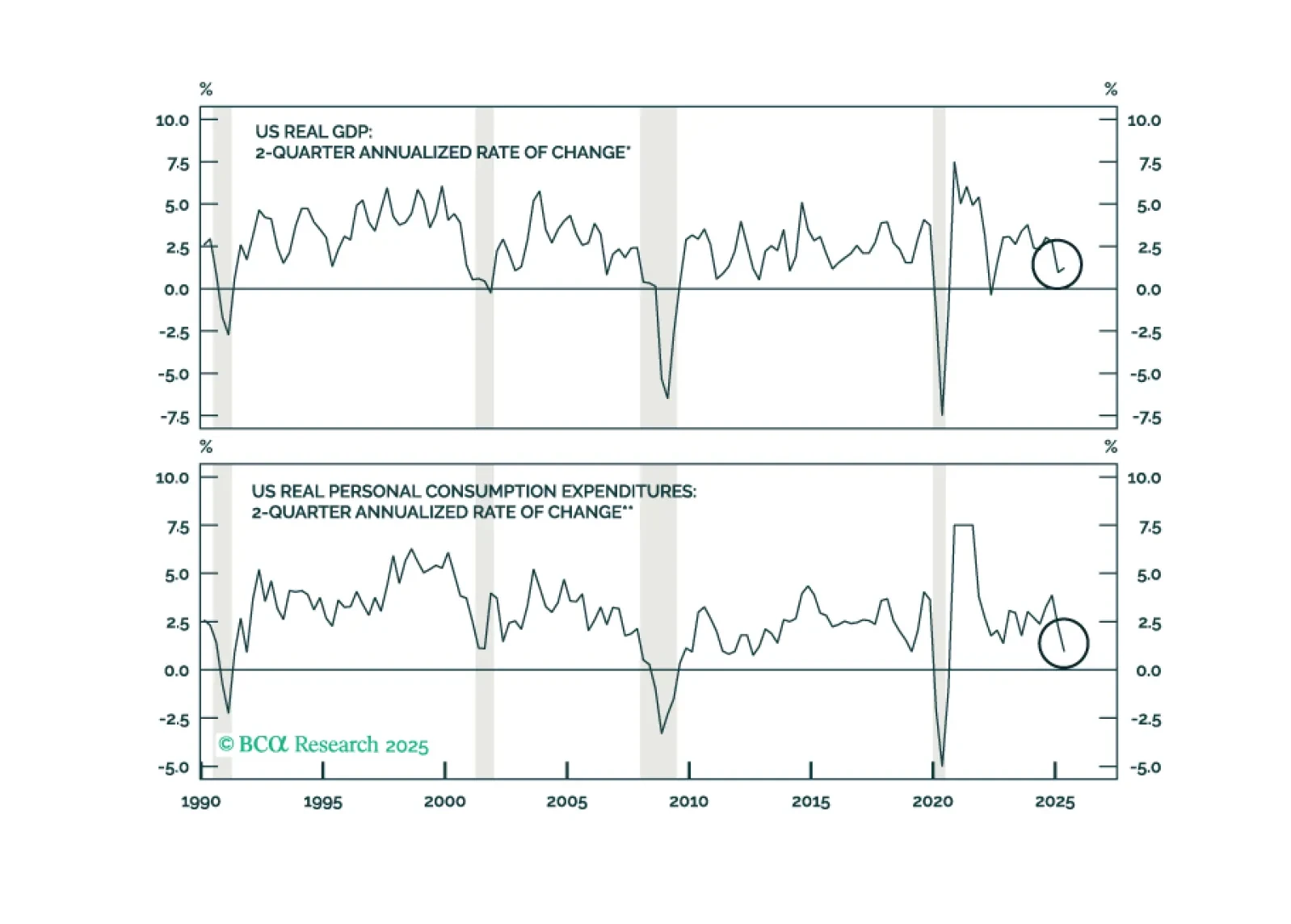

We maintain our 12-month US recession probability at 60%. However, until the “whites of the recession’s eyes” are more clearly visible, we would refrain from moving to a fully defensive stance.

Investors should stick to a defensive stance in the very near term as the Russia-Ukraine conflict and persistent trade tensions cause market volatility.

In Section I, Doug weighs the recent reduction in trade uncertainty against the clear signs of labor market and consumer weakness. In Section II, Jonathan reviews the US fiscal outlook in the wake of the passage of the OBBBA.

BCA’s US Political strategists warn that Russia presents an immediate market risk, with near-term pullbacks offering potential buying opportunities. President Trump is pivoting toward ceasefires and trade deals, supported by approval…

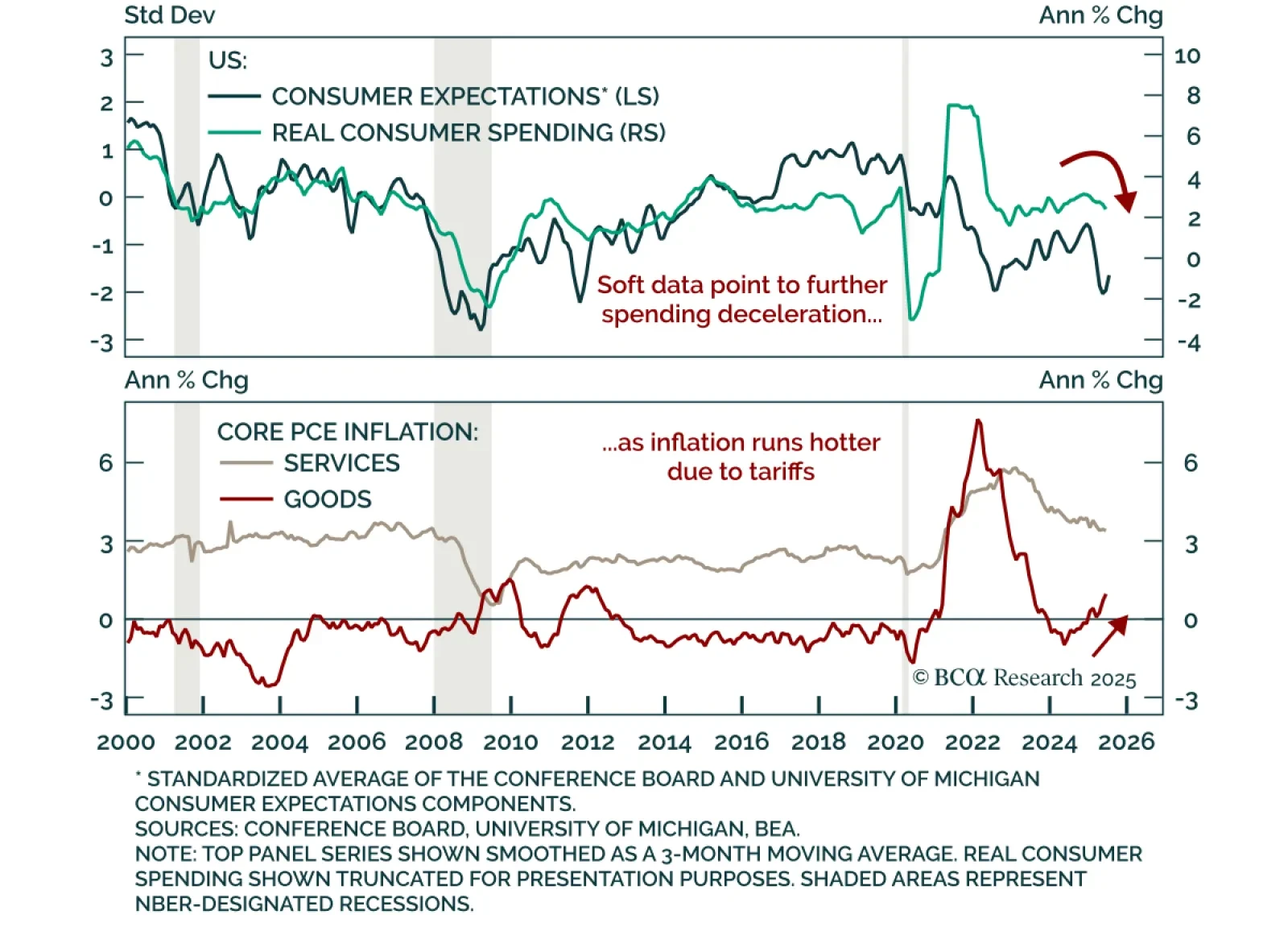

June US income and spending shows softening demand and rising goods inflation pressure, reinforcing our long-duration stance. Real personal spending only rose 0.1% m/m, in line with expectations. Personal income increased 0.3% m…